- Home

- »

- Medical Devices

- »

-

Radiofrequency Electrosurgery Generators Market, 2030GVR Report cover

![Radiofrequency Electrosurgery Generators Market Size, Share & Trends Report]()

Radiofrequency Electrosurgery Generators Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Monopolar, Bipolar, Hybrid), By Application (Cardiovascular Surgery, Orthopedic Surgery, Neurological Surgery), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-606-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Radiofrequency Electrosurgery Generators Market Summary

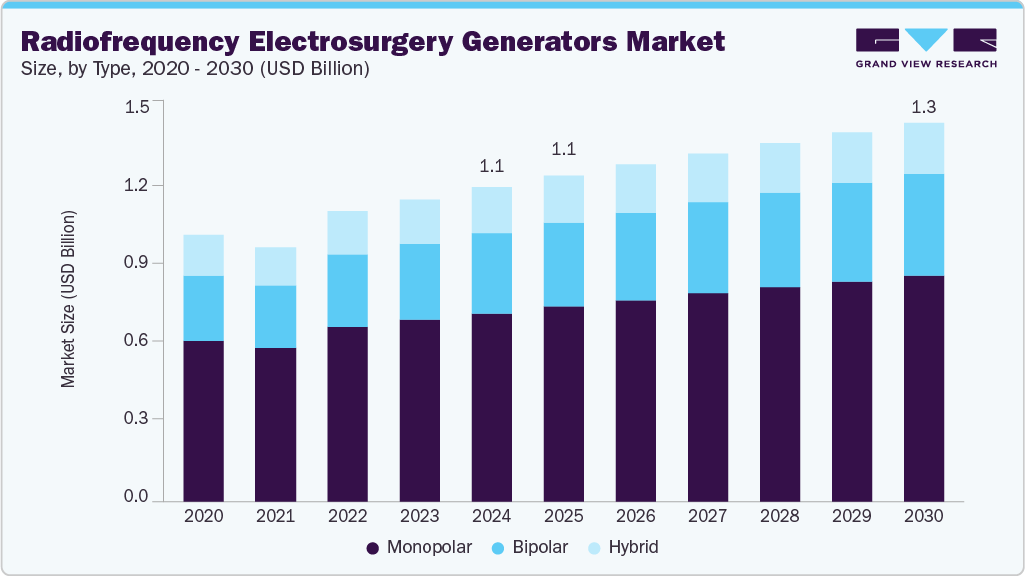

The global radiofrequency electrosurgery generators market size was estimated at USD 1.07 billion in 2024 and is projected to reach USD 1.29 billion by 2030, growing at a CAGR of 3.08% from 2025 to 2030. This growth is attributed to the rising number of surgical procedures, increasing preference for minimally invasive techniques, and continuous technological advancements.

Key Market Trends & Insights

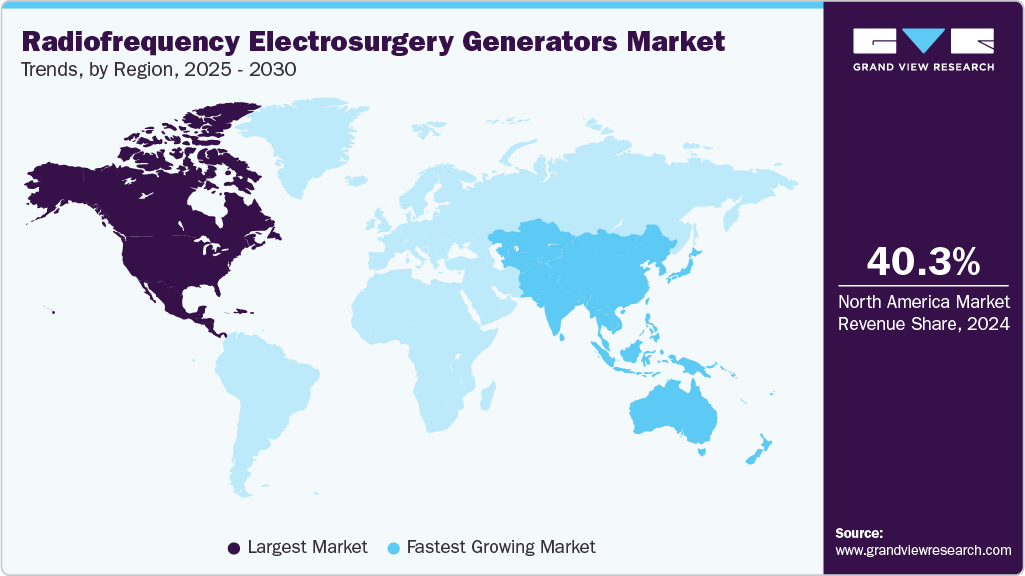

- North America radiofrequency electrosurgery generators market dominated the global industry with a revenue share of 40.31% in 2024.

- The radiofrequency electrosurgery generators market in the U.S. led the region in 2024.

- By end use, the hospital segment dominated the market with a 33.36% share in 2024.

- By type, the monopolar segment dominated the market in 2024.

- By application, the general surgery segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.07 Billion

- 2030 Projected Market Size: USD 1.29 Billion

- CAGR (2025-2030): 3.08%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Expanding healthcare infrastructure in emerging economies and integrating with digital health platforms contribute to market expansion. For instance, in July 2024, Stryker introduced its MultiGen 2 Radiofrequency (RF) Generator in India, aiming to enhance chronic pain management, particularly for facet joint pain, a prevalent issue affecting over 180 million Indians. This advanced device offers physicians improved efficiency, control, and reliability in performing RF ablation procedures, which are minimally invasive and provide long-lasting pain relief. The MultiGen 2 enables integration into digital health ecosystems, including customizable settings and streamlined workflows, such as electronic health records and remote procedural monitoring.

The growing number of cosmetic surgical procedures significantly drives the industry. As demand for aesthetic enhancements such as facelifts, liposuction, breast augmentation, and rhinoplasty continues to rise, so does the need for surgical tools that offer precision, safety, and minimal tissue trauma. Radiofrequency electrosurgical generators are increasingly favored in these procedures due to their ability to deliver controlled cutting and coagulation with reduced blood loss and faster healing times. Additionally, the shift toward minimally invasive cosmetic techniques further boosts the adoption of radiofrequency (RF) generators, as they enhance procedural efficiency while ensuring optimal aesthetic outcomes. This trend underscores the crucial role of advanced electrosurgical devices in meeting the evolving expectations of both patients and surgeons in the cosmetic surgery space.

The table below shows the global rise in cosmetic surgical procedures in the 2023 data, with over 15.8 million surgeries performed-an increase of 5.5% from 2022 and 39.2% from 2019. This surge highlights a growing global focus on aesthetic enhancement and body contouring, which in turn fuels demand for advanced surgical technologies. Radiofrequency electrosurgery generators play a critical role in this trend, offering precision, reduced blood loss, and faster recovery-key requirements for modern cosmetic surgeries. As patients seek minimally invasive, effective procedures, the adoption of RF-based tools is expected to grow with the expanding cosmetic surgery market.

Number of worldwide surgical procedures performed by plastic surgeons

Rank

Surgical Procedure

Total Procedures (2023)

% of Total Surgical Procedures

Total Procedures (2022)

Total Procedures (2019)

% Change 2023 vs. 2022

% Change 2023 vs. 2019

1

Liposuction

2,237,966

14.2%

2,303,929

1,704,786

-2.9%

31.3%

2

Breast Augmentation

1,892,777

12.0%

2,174,616

1,795,551

-13.0%

5.4%

3

Eyelid Surgery

1,746,946

11.0%

1,409,103

1,259,839

24.0%

38.7%

4

Abdominoplasty

1,153,539

7.3%

1,180,623

924,031

-2.3%

24.8%

5

Rhinoplasty

1,148,559

7.3%

944,468

821,890

21.6%

39.7%

6

Breast Lift

903,266

5.7%

955,026

741,284

-5.4%

21.9%

7

Lip Enhancement/Perioral Procedure

901,991

5.7%

699,264

N/A

29.0%

N/A

8

Buttock Augmentation

771,333

4.9%

820,762

479,451

-6.0%

60.9%

9

Fat Grafting - Face

741,061

4.7%

648,894

598,823

14.2%

23.8%

10

Breast Reduction

686,125

4.3%

632,860

600,219

8.4%

14.3%

11

Face Lift

646,482

4.1%

541,491

448,485

19.4%

44.1%

12

Neck Lift

452,639

2.9%

400,593

260,747

13.0%

73.6%

13

Brow Lift

386,427

2.4%

352,324

270,917

9.7%

42.6%

14

Gynecomastia

352,302

2.2%

305,340

273,344

15.4%

28.9%

15

Breast Implant Removal

335,939

2.1%

320,765

229,680

4.7%

46.3%

16

Ear Surgery

327,990

2.1%

303,906

288,905

7.9%

13.5%

17

Upper Arm Lift

244,977

1.5%

204,011

168,289

20.1%

45.6%

18

Labiaplasty

189,058

1.2%

194,086

164,667

-2.6%

14.8%

19

Facial Bone Contouring

153,749

1.0%

138,115

108,536

11.3%

41.7%

20

Thigh Lift

146,264

0.9%

113,746

93,334

28.6%

56.7%

21

Lower Body Lift

128,998

0.8%

123,123

75,895

4.8%

70.0%

22

Buttock Lift

110,167

0.7%

95,174

54,894

15.8%

100.7%

23

Vaginal Rejuvenation

84,495

0.5%

70,645

N/A

19.6%

N/A

24

Upper Body Lift

70,306

0.4%

54,120

N/A

29.9%

N/A

Total Surgical Procedures

15,813,353

-

14,986,982

11,363,569

5.5%

39.2%

Source: International Society of Aesthetic Plastic Surgery, Grand View Research

The rising prevalence of diabetes is a significant driver for the radiofrequency electrosurgery generators market. Diabetic patients require surgical interventions for complications such as chronic wounds, diabetic foot ulcers, cardiovascular issues, and ophthalmic conditions. Radiofrequency electrosurgical generators are widely used in these procedures because they minimize blood loss, reduce infection risk, and promote faster healing, critical for patients with impaired wound healing and compromised immunity. Additionally, RF technology is beneficial in minimally invasive procedures, which are preferred for diabetic patients to lower surgical risks and enhance recovery outcomes. As diabetes continues to impact global health, the demand for safe, efficient surgical tools such as RF generators is expected to grow steadily.

The table below highlights a significant projected increase in the prevalence of diabetes and prediabetes between 2024 and 2034 in Canada. In 2024, approximately 5.8 million individuals-or 15% of the population-are expected to be living with diabetes, including Type 1, diagnosed Type 2, and undiagnosed Type 2 diabetes. By 2034, this number is projected to rise to 7.3 million, accounting for 16% of the population. The number of diagnosed cases (Type 1 and Type 2) is expected to grow from 4 million (10%) in 2024 to 5.3 million (12%) in 2034, indicating both improved detection and a rising disease burden.

Estimated Diabetes Prevalence - Canada 2024 and 2034

Category

2024

2034

Diabetes (Type 1 + Type 2 diagnosed + Type 2 undiagnosed)

5,804,740 (15%)

7,303,620 (16%)

Diabetes (Type 1 and Type 2 diagnosed)

4,006,850 (10%)

5,300,670 (12%)

Diabetes (Type 1)

5-10% of total diabetes

5-10% of total diabetes

Diabetes (all types incl. undiagnosed) + Prediabetes (incl. undiagnosed)

11,918,090 (30%)

14,122,660 (32%)

Source: Diabetes Canada

Technological advancements are pivotal in driving the growth of the radiofrequency electrosurgery generators market by enhancing the precision, safety, and versatility of surgical procedures. Modern RF electrosurgery generators are equipped with smart features such as real-time feedback systems, tissue impedance monitoring, and automatic power modulation, significantly reducing the risk of collateral tissue damage and improving surgical outcomes. These innovations allow more accurate cutting and coagulation, mainly in delicate and complex surgeries. Additionally, integrating digital interfaces and programmable settings has enhanced ease of use for surgeons, enabling customizable energy delivery based on tissue type and surgical requirements. The advent of bipolar and advanced monopolar technologies further contributes to safer, more controlled energy transmission, minimizing thermal spread and reducing intraoperative blood loss. Technological advancement has also facilitated the miniaturization and portability of these devices, making them ideal for outpatient and ambulatory surgical settings.

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of growth is accelerating, driven by increasing demand for minimally invasive surgical procedures, improvements in healthcare infrastructure, and rapid technological advancements in electrosurgical devices.

The industry is characterized by a significant degree of innovation, driven by the growing demand for minimally invasive procedures and rapid technological advancements. Key trends include the integration of multiple energy modalities (RF, ultrasonic, laser) into single platforms, enhancing surgical precision and reducing thermal damage to surrounding tissues. Enhanced safety features, such as automated energy control and tissue recognition, are also becoming standard.

The radiofrequency (RF) electrosurgery generators industry has witnessed significant mergers and acquisitions (M&A) activities, reflecting the industry's drive for technological advancement, market expansion, and competitive positioning. Major players have actively pursued strategic acquisitions to strengthen their portfolios. For instance, in October 2022, Aspen Surgical Products, Inc., an Audax Private Equity portfolio company, acquired Symmetry Surgical from RoundTable Healthcare Partners. The acquisition augments Aspen's broad portfolio with additional clinically preferred brands, diversifies into attractive adjacent categories, and adds new commercial competencies and routes to market with a national direct-sales infrastructure across both acute and non-acute care settings.

Regulations significantly impact product development, approval timelines, market entry, and overall innovation. Regulatory bodies such as the U.S. FDA, European Medicines Agency (EMA), and other national authorities enforce strict standards to ensure the safety, efficacy, and quality of electrosurgical devices. Compliance with medical device directives like the EU MDR (Medical Device Regulation) and the U.S. FDA’s 510(k) or PMA pathways increases the complexity and cost of bringing new products to market.

Product expansion in the industry is driven by increasing demand for minimally invasive procedures, technological advancements, and the need for greater precision and safety in surgical interventions. Manufacturers are broadening their portfolios by introducing multifunctional generators that integrate multiple energy delivery modes, allowing surgeons to perform various procedures with a single device.

Regional expansion in the industry is a strategic focus for manufacturers aiming to tap into high-growth areas and diversify their revenue streams. While North America and Europe remain mature markets due to established healthcare infrastructure and strict regulatory frameworks, companies target emerging economies in Asia-Pacific, Latin America, and the Middle East & Africa.

Type Insights

The monopolar segment dominated the market in 2024 due to its widespread use across a broad spectrum of surgical procedures, including general surgery, gynecology, urology, and gastrointestinal operations. Monopolar systems are favored for their versatility, ease of use, and cost-effectiveness, making them a standard in both large hospitals and smaller healthcare facilities. They are particularly well-suited for cutting and coagulating large tissue areas, which makes them indispensable in high-volume surgical settings. Their long-standing clinical familiarity among surgeons and the lower cost of consumables and equipment also contribute to their dominant market share.

The bipolar RF electrosurgery generator segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by increasing demand for procedures that require greater precision and safety, especially in delicate or confined surgical fields such as neurosurgery, ophthalmology, ENT, and gynecology. Bipolar systems offer reduced thermal spread and eliminate the need for a grounding pad, making them ideal for minimally invasive and sensitive tissue applications. As surgical practices shift toward safer, more controlled energy delivery and technological advancements enhance bipolar performance, their adoption is rising significantly, particularly in advanced and specialty care environments.

Application Insights

The general surgery segment dominated the market in 2024 due to the high volume and broad range of procedures performed globally. General surgeons routinely use RF electrosurgical generators for tissue dissection, hemostasis, and coagulation across operations involving the abdomen, gastrointestinal tract, skin, and soft tissues. Monopolar RF devices, which are commonly used in general surgery, are cost-effective, efficient, and widely available, contributing to their broad adoption in inpatient and outpatient settings. The essential role of RF electrosurgery in routine surgeries and its compatibility with both open and laparoscopic techniques reinforce general surgery’s leading market position.

The neurological surgery segment is expected to grow at the fastest CAGR due to the increasing number of delicate and complex brain and spinal procedures. Neurosurgeons adopt advanced bipolar RF generators for their precision, minimal thermal spread, and safety-critical factors when operating near sensitive neural structures. The rise in neurological disorders, aging populations, and technological advancements in neurosurgical tools are further fueling this trend. Additionally, the growing integration of RF systems with neuronavigation and robotic-assisted platforms enhances their appeal in specialized neurosurgical centers, driving rapid growth in this segment.

End Use Insights

The hospital segment dominated the market with a 33.36% share in 2024, due to its extensive surgical capacity, large patient volume, and access to advanced surgical infrastructure. Hospitals perform a wide range of complex and high-risk surgeries, such as general, oncologic, gynecologic, neurosurgical, and emergency procedures, where RF electrosurgery generators are essential for precise cutting and effective coagulation. Their ability to invest in high-end, integrated operating room technologies and to maintain multiple RF systems across departments further strengthens their market dominance. Additionally, hospitals benefit from public funding, insurance reimbursements, and centralized procurement systems, which support the adoption and long-term utilization of advanced surgical equipment.

The specialty clinics segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by the rising demand for minimally invasive and outpatient procedures in dermatology, dentistry, cosmetic surgery, ENT, and gynecology. These clinics increasingly favor RF electrosurgery for its precision, reduced recovery time, and minimal thermal damage-critical factors in aesthetic and soft tissue procedures. The shift toward ambulatory care, expanding private healthcare providers, and the increasing affordability of compact, user-friendly RF systems further accelerate adoption in this segment. As a result, specialty clinics are emerging as a key growth area for RF electrosurgery device manufacturers.

Regional Insights

North America radiofrequency electrosurgery generators market dominated the global industry with a revenue share of 40.31% in 2024, driven by the region’s advanced healthcare infrastructure, high adoption of minimally invasive surgical procedures, and strong presence of key medical device manufacturers. The U.S., in particular, leads the market due to its well-established regulatory framework, growing geriatric population, and increasing incidence of chronic diseases requiring surgical intervention. Hospitals and ambulatory surgical centers are investing in technologically advanced electrosurgical systems that offer greater precision, safety, and efficiency. Additionally, continuous R&D efforts, favorable reimbursement policies, and increasing surgical volumes are propelling market expansion.

U.S. Radiofrequency Electrosurgery Generators Market Trends

The radiofrequency electrosurgery generators market in the U.S. led the region in 2024. One of the most significant drivers is the country’s advanced healthcare infrastructure, which includes a high number of accredited hospitals, ambulatory surgical centers, and specialized surgical suites equipped with state-of-the-art medical technologies. This enables widespread adoption of advanced surgical tools, including electrosurgical generators. Additionally, the rising demand for minimally invasive surgical procedures plays a crucial role. Radiofrequency electrosurgery generators are particularly suited for such procedures due to their precision, reduced intraoperative bleeding, faster recovery times, and minimal post-operative complications. The aging population in the U.S. further contributes to market growth, as older adults require surgical interventions for chronic conditions such as cardiovascular diseases, cancer, and orthopedic issues-all of which involve electrosurgical techniques.

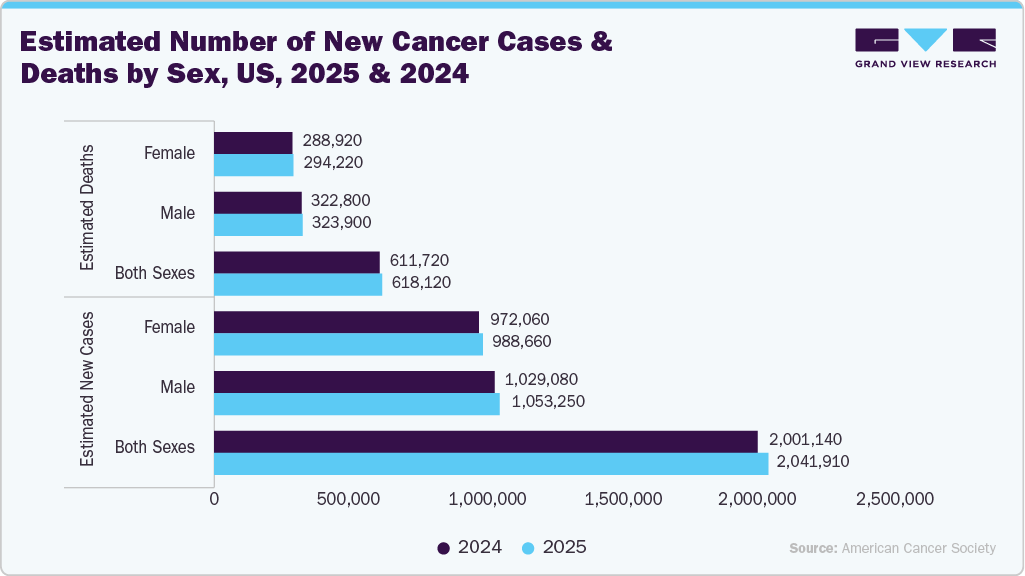

The below figure shows that the year-on-year rise in cancer incidence and mortality in the U.S. is a significant factor expected to drive the demand for radiofrequency electrosurgery generators. According to the American Cancer Society, new cancer cases are projected to increase from 2,001,140 in 2024 to 2,041,910 in 2025, while cancer-related deaths will rise from 611,720 to 618,120. This upward trend reflects population growth, aging, and improved diagnostic capabilities that enable earlier detection and intervention. As cancer treatment involves surgical procedures, particularly for solid tumors, there is an increasing need for advanced surgical tools that offer precision, safety, and efficiency.

Europe Radiofrequency Electrosurgery Generators Market Trends

The radiofrequency electrosurgery generators market in Europe held a substantial share in 2024. The region’s well-established healthcare infrastructure, high volume of surgical procedures, and strong focus on technological innovation have contributed to the widespread adoption of advanced electrosurgical devices. Additionally, the growing prevalence of chronic diseases such as cancer, cardiovascular conditions, and gastrointestinal disorders has increased the demand for effective surgical interventions, where radiofrequency electrosurgery generators play a critical role. European countries also benefit from favorable reimbursement policies and regulatory frameworks that support the introduction and use of advanced medical technologies. Moreover, the rising preference for minimally invasive and day-case surgeries across Europe, supported by an aging population and the need to reduce hospital stays, continues to drive the precision-based surgical tools like radiofrequency generators. These factors position Europe as a key contributor to the global electrosurgical devices market.

As per the European Union 2023, Cardiovascular diseases (CVDs) remain the leading cause of death in both the European Union and globally. Each year, over 6 million people in the EU suffer from heart-related conditions, with approximately 1.7 million deaths attributed to circulatory diseases. These conditions significantly reduce healthy life expectancy and account for 77% of the disease burden in Europe. Cancer is the second leading cause of death in the EU, with a new case diagnosed every 12 seconds in 2022. If current incidence and mortality rates continue, cancer diagnoses are projected to rise by 18% and deaths by 26% by 2040, primarily driven by an aging population.

The UK radiofrequency electrosurgery generators market is expected to grow significantly over the forecast period. The rising prevalence of chronic conditions such as cancer and cardiovascular diseases, both of which require surgical intervention. As the UK population ages, the demand for surgical procedures is increasing, particularly in areas such as oncology, cardiology, and general surgery segments where radiofrequency electrosurgery is commonly used due to its precision, reduced blood loss, and faster recovery times. The UK’s National Health Service (NHS) has been actively modernizing surgical infrastructure and promoting minimally invasive techniques, further supporting the adoption of advanced electrosurgical technologies. In addition, the growing number of outpatient surgical centers and the push for day-case surgeries to reduce hospital burden also contribute to market expansion. Furthermore, the UK’s well-established regulatory and reimbursement framework provides a conducive environment for adopting and commercializing high-tech surgical equipment, supporting sustained growth in the radiofrequency electrosurgery generators market.

The table below highlights the significant impact of cardiovascular diseases across the UK and its constituent nations. England accounts for the highest number of CVD-related deaths and people living with CVD, followed by Scotland, Wales, and Northern Ireland.

Data on deaths from and numbers living with heart and circulatory diseases (CVD) for the UK

Nation

No. of People Dying from CVD (2023)

No. of People Under 75 Years Old Dying from CVD (2023)

Estimated Number of People Living with CVD (Latest Estimate)

England

142,460

38,996

6.4 million +

Scotland

17,787

5,313

730,000

Wales

9,701

2,918

340,000

Northern Ireland

4,227

1,133

225,000

UK Total

174,693

48,697

7.6 million +

Source: British Heart Foundation 2025

"While it is good news that the incidence of coronary heart disease and stroke has decreased overall, the lack of decline in younger people, the rise in other serious conditions such as heart failure, and the persistent socioeconomic gradient in cardiovascular problems means much still has to be done to improve the most important cause of ill health in the UK."-John McMurray, Professor of medical cardiology at the University of Glasgow.

The radiofrequency electrosurgery generators market in Germany is growing. A significant contributor to this growth is the rising preference for minimally invasive procedures, which offer benefits like reduced recovery times and lower infection risks. Electrosurgical generators, particularly radiofrequency-based devices, are integral to these procedures due to their precision and efficiency. Germany's advanced healthcare infrastructure and adoption of advanced medical technologies further support the market's growth. Hospitals and surgical centers are increasingly integrating electrosurgical generators into their operating rooms to enhance surgical outcomes and patient safety. Additionally, the country's focus on innovation and sustainability is leading to the development of more efficient and environmentally friendly surgical devices.

Asia Pacific Radiofrequency Electrosurgery Generators Market Trends

The radiofrequency electrosurgery generators market in Asia Pacific is experiencing the fastest growth. This growth is fueled by the increasing demand for minimally invasive surgical procedures, advancements in healthcare infrastructure, and rising healthcare expenditures across the region. The region's focus on healthcare modernization, the growing prevalence of chronic diseases, and an aging population contribute to the increased adoption of electrosurgical devices. The integration of advanced technologies and the expansion of medical tourism further bolster market growth, making Asia Pacific the fastest-growing regional market in the electrosurgical generators sector.

India radiofrequency electrosurgery generators market is anticipated to witness significant growth over the forecast period. According to a 2023 report by the American College of Cardiology, cardiovascular diseases are responsible for approximately 30% of deaths in India, with ischemic heart disease being the leading cause. The report highlights that the high prevalence of diabetes and hypertension, combined with urban lifestyle factors like poor diet and pollution, are significant contributors to this alarming trend. In addition, the central government has noted a rise in heart attack-related deaths over the past three years, potentially exacerbated by the remaining effects of the COVID-19 pandemic. This growing burden of CVDs is driving the demand for radiofrequency electrosurgery generators.

The radiofrequency electrosurgery generators market in China is growing. The market is driven by increasing demand for minimally invasive surgical procedures, advancements in healthcare infrastructure, and a rising prevalence of chronic diseases. This growth is further supported by China's significant investments in healthcare modernization and the adoption of advanced medical technologies. The country's focus on enhancing surgical outcomes and patient safety has led to increased integration of electrosurgical generators in hospitals and surgical centers. Additionally, the expanding medical tourism industry and the government's initiatives to improve healthcare accessibility contribute to the market's growth.

Middle East & Africa Radiofrequency Electrosurgery Generators Market Trends

The radiofrequency electrosurgery generators market in the Middle East and Africa (MEA) is experiencing significant growth. This growth is fueled by the increasing demand for minimally invasive surgical procedures, advancements in healthcare infrastructure, and rising healthcare expenditures across the region. Countries like South Africa and the Gulf Cooperation Council (GCC) nations are at the forefront, with South Africa projected to lead the regional market in revenue by 2030. The region's focus on healthcare modernization, the growing prevalence of chronic diseases, and an aging population contribute to the increased adoption of electrosurgical devices. The integration of advanced technologies and the expansion of medical tourism further bolster market growth, making the Middle East and Africa a significant regional market in the electrosurgical generators sector.

Key Radiofrequency Electrosurgery Generators Companies Insights

Key players operating in the radiofrequency electrosurgery generators market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Radiofrequency Electrosurgery Generators Companies:

The following are the leading companies in the radiofrequency electrosurgery generators market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Olympus

- XcelLance Medical Technologies Pvt. Ltd.

- Sutter Medizintechnik GmbH

- elliquence

- Medtronic

- Boston Scientific Corporation

- Aspen Surgical Products, Inc.

Recent Developments

-

In February 2025, Medtronic and Philips announced a partnership to upskill over 300 clinicians in India in advanced structural heart imaging techniques. This initiative aims to enhance the capabilities of cardiologists and radiologists, particularly in multi-modality imaging methods such as echocardiography (echo) and Magnetic Resonance Imaging (MRI), with a special focus on patients with End-Stage Renal Disease (ESRD).

-

In January 2025, Medtronic entered a U.S. distribution agreement with Contego Medical, enhancing its presence in the carotid and peripheral vascular disease markets. This partnership could contribute to the market expansion of electrosurgical generators, particularly in vascular and minimally invasive surgeries.

-

In January 2025, Olympus Latin America (OLA), a subsidiary of Olympus Corporation, announced the acquisition of its long-standing Chilean distributor, Sur Medical SpA. This strategic move led to the establishment of Olympus Corporation Chile, granting Olympus direct control over its sales, distribution, and service operations in the country.

Radiofrequency Electrosurgery Generators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.29 billion

Growth rate

CAGR of 3.08% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Olympus; XcelLance Medical Technologies Pvt. Ltd.; Sutter Medizintechnik GmbH; elliquence; Medtronic; Boston Scientific Corporation; Aspen Surgical Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Radiofrequency Electrosurgery Generators Market Report Segmentation

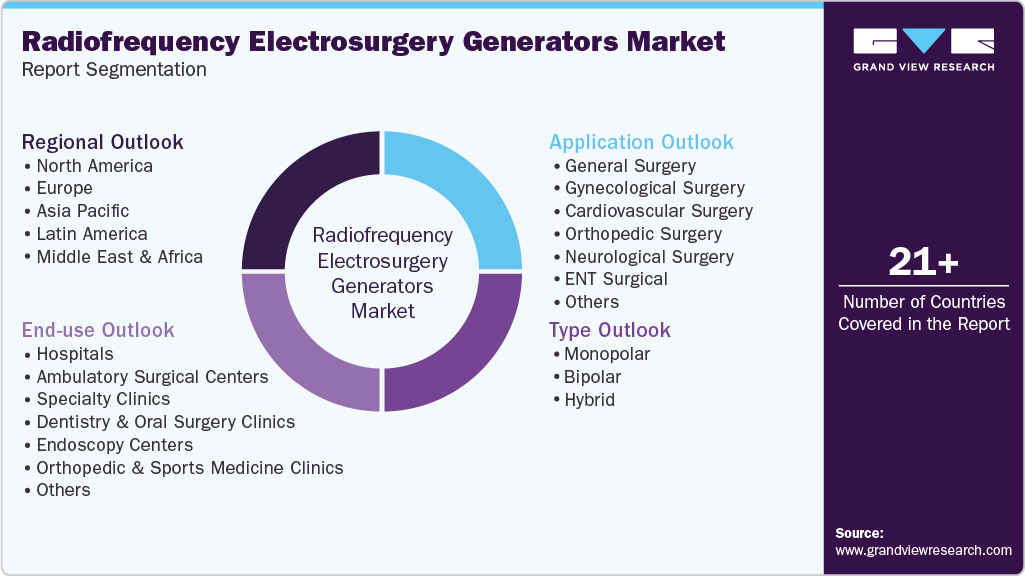

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global radiofrequency electrosurgery generators market report based on type, application, end use, and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Monopolar

-

Bipolar

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Gynecological Surgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Neurological Surgery

-

ENT Surgical

-

Urological Surgery

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Dermatology Clinics

-

Urology Clinics

-

Gynecology Clinics

-

ENT (Ear, Nose, and Throat) Clinics

-

Plastic Surgery Clinics

-

-

Dentistry & Oral Surgery Clinics

-

Oral Surgery Practices

-

Periodontics Clinics

-

-

Endoscopy Centers

-

Orthopedic & Sports Medicine Clinics

-

Pain Management Clinics

-

Burn & Trauma Centers

-

Research & Clinical Trial Centers

-

Others (e.g., Veterinary Clinics, Hospices)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global radiofrequency electrosurgery generators market size was estimated at USD 1.07 billion in 2024.

b. The global radiofrequency electrosurgery generators market is expected to grow at a compound annual growth rate of 3.08% from 2025 to 2030 to reach USD 1.29 billion by 2030.

b. North America dominated the radiofrequency electrosurgery generators market with a share of 40.31% in 2024. This dominance is attributable to the region’s advanced healthcare infrastructure, which supports the widespread adoption of advanced surgical technologies. The high volume of surgical procedures, particularly minimally invasive surgeries, further fuels demand for electrosurgical devices.

b. Some key players operating in the radiofrequency electrosurgery generators market include Abbott, Olympus, XcelLance Medical Technologies Pvt. Ltd., Sutter Medizintechnik GmbH, elliquence, Medtronic, Boston Scientific Corporation, and Aspen Surgical Products, Inc.

b. Key factors driving the market growth include increasing demand for minimally invasive surgical procedures, which offer reduced recovery times and lower risk of complications than traditional surgery. Technological advancements in radiofrequency electrosurgery generators, such as improved precision, safety features, and energy control, also contribute to their growing adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.