- Home

- »

- Advanced Interior Materials

- »

-

Rainscreen Cladding Market Size And Share Report, 2030GVR Report cover

![Rainscreen Cladding Market Size, Share & Trends Report]()

Rainscreen Cladding Market Size, Share & Trends Analysis Report By Raw Material (Fiber Cement, Terracotta, Composite Material), By Application (Residential, Official, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-517-5

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Rainscreen Cladding Market Size & Trends

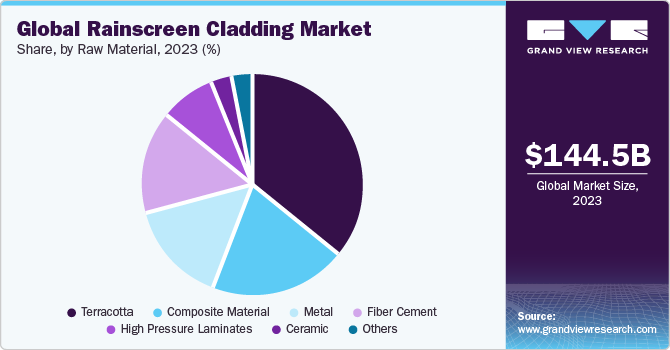

The global rainscreen cladding market size was estimated at USD 144.53 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The market is expected to be driven by increasing demand for enhanced moisture management properties and energy efficiency of the product. In addition, a shift in the trend toward protecting exterior walls and the growth in the construction of non-residential buildings, which include offices and institutions, in both developed and developing economies.

The industry has experienced limited growth as a consequence of the economic recession caused by the COVID-19 crisis, which has resulted in low investor confidence and a decline in industrial activities.

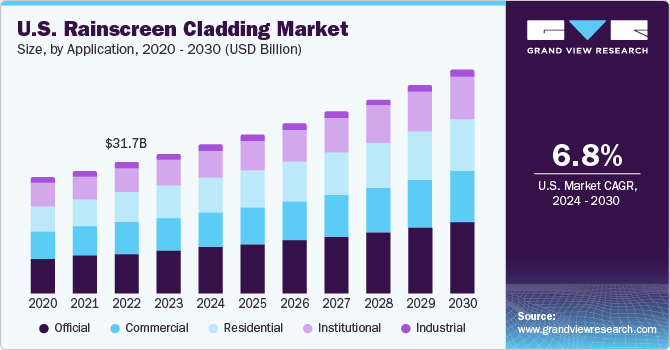

The U.S. market is primarily driven by increasing construction activities in residential, commercial, official, institutional, and industrial constructions. The rapid development of infrastructures, increasing investments, and the need for expansion are expected to increase construction practices across the country; which is likely to drive the product demand.

The market is expected to observe moderate competition, as the rainscreen claddings need a variety of raw materials and an efficient workforce for production & installation. Industry players face challenges from new entrants for raw material supply and technology used for the process, thus, integrating throughout the chain to sustain in the highly competitive market.

Product quality is an essential element for rainscreen structures, as numerous applications need panels of different raw materials. Manufacturers are focusing on innovative techniques for producing claddings complying with industry standards. Building standards are also followed while designing the rainscreen structures for building applications.

Industry players are focusing on structural framework designs for rainscreen claddings owing to the un-uniform shape of buildings. Requirements for thermal insulation and rainwater drain vents of buildings may hamper the framework design as other components are added to the rainscreen cladding structures. Ready-to-install frames and claddings are produced to save construction time.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Furthermore, the market is fragmented in nature owing to the presence of a significant number of panel manufacturers and suppliers. A large number of players are present at domestic and international levels owing to the wide availability of raw material in natural and synthetic forms.

Technical innovations in the Rainscreen Claddings have influenced the market on a positive note. For instance, Trespa International B.V. introduced enhanced products using its Electron Beam Curing (EBC) technology. These are suitable for color stability, weather resistance, chemical resistance, and scratch resistance. The same trend is being followed by the industry participants to gain market share in the global market.

Mergers & acquisitions and joint ventures are undertaken by the players to extend their business portfolio and reduce overall costing of the product. For instance, MF Murray Companies is integrated across the value chain from raw material production to installation of the rainscreen cladding structuresto sustain in the competitive market.

The market is subject to regulatory scrutiny for instance regulations by approved document B of the Building Regulations (Part B) states fire resistance performance of rainscreen cladding panels. Similarly, Building Regulations 2004 8 (1) (2) states regulations for fitness of material components used in rainscreen cladding.

Substitutes for panels including composite panels, acoustic panels and non-combustible panels are other insulation types. However, rainscreen claddings are preferred owing to their properties of UV protection, weather and aesthetic protection. These panels are preferred by medical, industrial, commercial for weather protection and energy efficiency. Hence, the product substitutes are expected to remain low in forecast period.

A large number of buyers are present in the end use industries including residential, commercial, infrastructure and industrial. Increasing infrastructure spending in emerging economies is expected to increase the levels of end-user concentration.

Raw Material Insights

Based on raw material, the terracotta segment led the market with the largest revenue share of 35.9% in 2023. These materials are widely used for manufacturing panels for rainscreen cladding structures owing to their high durability, low maintenance cost, and fire & weatherproof properties. These panels can be glazed or unglazed and are available in different colors, shapes, and sizes.

Composite materials are gaining popularity in the construction industry owing to their flexibility which allows the claddings to be molded into complex shapes. Copper, zinc, and aluminum composite materials are 100% recyclable and help enhance the aesthetic appearance of buildings with panels of different colors and sizes.

Metals are used for the construction of panels and the framework that is attached to the building wall and supports the entire cladding structure. Stainless steel and aluminum are widely used for framework design owing to their high tensile strength, durability, corrosion resistance, superior flatness, rigidity & stability under changing thermal conditions, and low maintenance.

The fiber cement segment is expected to grow at a steady CAGR during the forecast period, owing to its high durability, fire & weatherproof properties, low maintenance cost, and resistance to the growth of fungi, mold, and bacteria. These panels are commercially available in various colors and shapes, which helps improve the aesthetic appeal of the construction structure.

Application Insights

Based on application, the offices segment led the market with the largest revenue share of 33.0% in 2023. Rapid industrialization and expansion of companies are expected to drive the demand for new construction, which is likely to fuel the product demand in new office buildings and for the renovation of existing buildings.

Commercial construction segment includes buildings for hypermarkets, supermarkets, departmental stores, shopping malls, hospitals & clinics, restaurants & hotels, resorts, and others. These are generally large buildings or clusters of buildings that require rainscreen cladding made from rigid and durable material for protection against extreme weather conditions.

The residential segment is classified into single-family houses (standalone homes), and multi-family houses (apartment buildings, clusters, and complexes). The rainscreen cladding structure for these buildings requires fewer components as the structures are small as compared to other segments.

The institutional and industrial segments provide aesthetic appeal and thermal insulation to the construction including government buildings, factories, warehouses, and schools & other educational institutes. Construction of healthcare facilities and growing medical tourism, particularly in the Asia Pacific region, are expected to increase the product demand.

Regional Insights

The market growth in North America is due to factors such as energy efficiency, building code requirements, architectural trends favoring modern designs, durability, minimal maintenance, moisture management awareness, green building efforts, and product innovation rainscreen cladding market is expanding in North America. Rainscreen systems provide thermal performance, conform to standards, improve aesthetics, need little maintenance, efficiently manage moisture, contribute to sustainability goals, and survive harsh weather, resulting in their widespread use in building projects around the area.

U.S. Rainscreen Cladding Market Trends

The Rainscreen cladding market in the U.S. is expected to grow at the sustainable CAGR over the forecast period, owing to the growth in the construction sector in the country. The growth in demand for energy-efficient construction solutions is one of the primary factors driving the product growth. In addition, recurring occurrences of natural calamities, such as hurricanes and wildfires, in the U.S. is anticipated to positively impact the construction sector in the country.

Europe Rainscreen Cladding Market Trends

Europe dominated the market with the revenue share of over 30.0% in 2023. The region is expected to grow owing to the significant demand from the construction industry. Ongoing residential and non-residential constructions in the region are expected to further propel market growth.

The rainscreen cladding market in Germany is anticipated to grow at the fastest CAGR during the forecast period, as the construction industry is thriving. High demand for housing is being driven by population increase, demographic shifts, and a good economic environment. Interesting niches include those for multigenerational homes, micro-apartments, and prefabricated structures.

France rainscreen cladding market is expected to grow at the significant CAGR during the forecast period, in the residential construction sector, which is driven by long-standing favorable demographic and sociological factors, including a high birth rate, a growing aging population, and a high divorce rate. The increased number of households owing to the rise in divorce rate, increased life expectancy, and population growth, driven by high birth rate & net migration, is further expected to boost residential construction, thereby bolstering product demand.

Asia Pacific Rainscreen Cladding Market Trends

The rainscreen cladding market in Asia Pacific accounted for a substantial market share in 2023. This growth is attributedto factors such as rapid urbanization, increasing construction activities, demand for energy-efficient buildings, and stringent building regulations. Architectural trends favoring modern designs and the need for durable, low-maintenance solutions further drive the market growth. In addition, rising awareness of moisture management, especially in humid climates, boosts the appeal of rainscreen systems. Furthermore, green building initiatives and advancements in materials and technology contribute to market expansion. As the region faces climate challenges, the resilience of rainscreen cladding to extreme weather conditions becomes increasingly valued, fueling its growth across Asia Pacific.

The China rainscreen cladding market is expected to grow at the significant CAGR over the forecast period, owing to the government's emphasis on reducing the overall energy consumption. The government is launching various plans which are expected to encourage the consumption of energy-efficient products, thereby propelling the demand for rainscreen cladding in order to reduce the energy consumption of buildings by maintaining insulation.

The rainscreen cladding market in India held a significant market share in 2023 due to Improved GDP, significant population growth, and expanding industrial sector are critical factors for the growth of the construction sector. Increasing foreign direct investments in the country and a rise in several foreign companies entering the Indian market are expected to further boost the growth of this sector. Government initiatives to develop smart cities are anticipated to aid this growth, thereby propelling the demand for rainscreen cladding over the forecast period.

Central & South America Rainscreen Cladding Market Trends

The market growth in Central & South America is attributed to factors such as burgeoning construction activities, urbanization, and a shift toward modern architectural designs are contributing towards the expansion of the market across Central & South America. With a focus on enhancing building aesthetics and functionality, rainscreen cladding offers an attractive solution. In addition, increasing awareness of the importance of building envelope performance and durability drives its adoption. Moreover, as the region experiences varying climatic conditions, the resilience of rainscreen cladding to moisture and extreme weather further drives its market expansion in Central & South America.

The Brazil rainscreen cladding market accounted for a significant market share in 2023. This growth is due to factors such as rapid urbanization and construction projects' demand for modern, and sustainable building solutions, the market for rainscreen cladding is expanding in Brazil. Brazil's diverse climate, with regions experiencing high humidity and heavy rainfall, underscores the importance of effective moisture management, making rainscreen cladding an attractive choice. In addition, as the country focuses on environmental conservation and energy efficiency, rainscreen cladding's ability to improve building performance aligns with these goals.

Middle East & Africa Rainscreen Cladding Market Trends

The rainscreen cladding market inMiddle East & Africa has witnessed the significant revenue share in 2023,owing to factors such as rapid urbanization, escalating construction activities, and stringent building regulations the market of rainscreen cladding is expanding in the Middle East and Africa region. Architectural preferences for contemporary designs and the demand for durable, low-maintenance solutions contribute to its popularity. In humid climates, the need for effective moisture management further boosts adoption. In addition, the region's increasing focus on sustainability and energy efficiency propels the use of rainscreen cladding systems. As extreme weather events become more frequent, the resilience of rainscreen cladding to such conditions adds to its appeal.

Saudi Arabia rainscreen cladding market growthis due toan increase in tourism, population, and urbanization is expected to drive the market for rainscreen cladding in Saudi Arabia during the forecast period. The residential construction activities are expected to grow at a significant CAGR during the forecast period, which will further increase the demand for rainscreen cladding.

Key Rainscreen Cladding Company Insights

Some key players operating in the market include Kingspan Insulation plc,Rockwool International A/S, andM.F. Murray Companies, Inc.

-

Kingspan Insulation plc offers high-performance insulation and building fabric solutions. It operates as a subsidiary of Kingspan Group and specializes in manufacturing floor deck, purlins & rails, channel systems, rainwater systems, window details, barge boards, louvers, flashings, roof tile, and flat-to-pitch over-roofing systems

-

Rockwool International A/S manufactures fire resilient stone wool insulation products, panels, facade cladding, roof detailing materials, tracks, coatings, gaskets, and fences. The company offers its products through Rockwool, Rockfon, Rockpanel, Lapinus, and Grodan brands

Carea Ltd., Everest Industries Limited, and Euro Panels Overseas N.V. are some of the emerging market participants in the global market.

-

Euro Panels Overseas N.V. offers building materials and solutions for construction sector, wherein it has divided its business into four segments, namely small & large roofing elements, fiber cement & plasterboards, insulation & fire protection, and ceramic floor & wall tiles

-

Everest Industries Limited is indulged in manufacturing roofing products, floorings, cladding, ceiling, walls, pre-engineered buildings along with other building products and accessories. It operates through two business segments: building products and steel building

Key Rainscreen Cladding Companies:

The following are the leading companies in the rainscreen cladding market. These companies collectively hold the largest market share and dictate industry trends

- Kingspan Insulation plc

- Carea Ltd.

- M.F. Murray Companies, Inc.

- Celotex Ltd.

- CGL Facades Co.

- Rockwool International A/S

- Eco Earth Solutions Pvt. Ltd.

- FunderMax

- Everest Industries Ltd.

- OmniMax International, Inc.

- Trespa International B.V.

- Middle East Insulation LLC

- Euro Panels Overseas N.V.

- Centria Internationa

- Dow Building Solutions

Recent Developments

-

In April 2022, Kingspan Insulation plc announced to expand its business at 200 Kingspan Way in Frederick County, Kingspan Insulation LLC, a division of the Kingspan Group, a manufacturer of advanced insulation and cutting-edge building solutions, will invest USD 27.0 million, according to Governor Glenn Youngkin. To further increase its presence on the East Coast, the company will increase production capacity by constructing a new facility to produce the highly sought-after, extremely energy-efficient OPTIM-R vacuum insulated panels

-

In September 2021, Kingspan Group announced the acquisition of Minnesota Diversified Products, Inc., a US-based company. The acquisition broadened Kingspan's clientele in the US and its core building insulation business in a market that is anticipated to experience rapid expansion

Rainscreen Cladding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 154.37 billion

Revenue forecast in 2030

USD 233.08 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

March 2023

Quantitative units

Volume in million square meters and revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Spain; Italy; Austria; Poland; Belgium; Denmark; Turkey; Switzerland; China; India; Japan; South Korea; Indonesia; Singapore; Malaysia; Vietnam; Thailand; Brazil; Argentina; Colombia; Saudi Arabia; UAE; Qatar; Kuwait; Bahrain; Oman; Egypt; South Africa

Key companies profiled

Kingspan Insulation plc; Carea Ltd.; M.F. Murray Companies, Inc.; Celotex Ltd.; CGL Facades Co.; Rockwool International A/S; Eco Earth Solutions Pvt. Ltd.; FunderMax; Everest Industries Ltd.; OmniMax International, Inc.; Trespa International B.V.; Middle East Insulation LLC; Euro Panels Overseas N.V.; Centria International; Dow Building Solutions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rainscreen Cladding Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rainscreen cladding market report based on raw material, application, and region:

-

Raw Material Outlook (Volume, Million Square. Meters; Revenue, USD Billion, 2018 - 2030)

-

Fiber Cement

-

Composite Material

-

Metal

-

High Pressure Laminates

-

Terracotta

-

Ceramic

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Official

-

Institutional

-

Industrial

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Austria

-

Poland

-

Belgium

-

Denmark

-

Turkey

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Malaysia

-

Indonesia

-

Thailand

-

Singapore

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

Kuwait

-

Bahrain

-

Oman

-

Egypt

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rainscreen cladding market size was estimated at USD 144.53 billion in 2023 and is expected to reach USD 154.37 billion in 2024.

b. The global rainscreen cladding market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 233.08 billion by 2030.

b. Official led the market and accounted for about 30% share of the revenue in 2023. The segment is inclusive of working spaces including government offices and private offices. Rainscreen claddings are used in these constructions to provide weather resistance, thermal insulation, fire resistance, and aesthetic appeal to the building.

b. Some of the key players operating in the global rainscreen cladding market include Kingspan Insulation plc, Carea Ltd., M.F. Murray Companies, Inc., Celotex Ltd., CGL Facades Co., Rockwool International A/S, Eco Earth Solutions Pvt. Ltd., FunderMax, Everest Industries Limited, OmniMax International, Inc., Trespa International B.V., Middle East Insulation LLC, Euro Panels Overseas N.V.

b. The key factors that are driving the global rainscreen cladding market include, the rainscreen cladding improves the esthetics of the building while protecting it from heavy rainfall and high air pressure.

Table of Contents

Chapter 1 Rainscreen Cladding Market Methodology and Scope

1.1 Research Methodology

1.2 Research Scope and Assumptions

1.3 List of Data Sources

Chapter 2 Rainscreen Cladding Market Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Outlook

Chapter 3 Rainscreen Cladding Market Market Variables, Trends & Scope

3.1 Parent Market Outlook

3.2 Rainscreen cladding market: Value chain analysis

3.3 Rainscreen cladding market: Cost breakup analysis

3.4 Technology Overview

3.4.1 Vented systems

3.4.2 Drained and vented systems

3.4.3 Pressure-equalized systems

3.4.4 Prevailing technology in the rainscreen cladding market and upcoming technological advancements by key players

3.5 Regulatory Framework

3.6 Rainscreen Cladding Market - Market Dynamics

3.6.1 Market Driver Analysis

3.6.1.1 Growth of construction industry

3.6.1.2 Favorable government regulations

3.6.2 Market Restraint Analysis

3.6.2.1 High initial installation cost and maintenance cost

3.6.2.2 Introduction of substitutes

3.7 Rainscreen cladding market: Porter’s five forces analysis

3.8 Rainscreen cladding market: PESTEL analysis

3.9 Market disruption analysis

Chapter 4. Rainscreen Cladding Market: Raw Material Estimates & Trend Analysis

4.1. Rainscreen Cladding Market: Raw Material Movement Analysis, 2023 & 2030

4.2. Fiber Cement

4.2.1. Fiber cement rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

4.3. Composite Material

4.3.1. Composite material rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

4.4. Metal

4.4.1. Metal rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

4.5. High Pressure Laminates

4.5.1. High pressure laminates rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

4.6. Terracotta

4.6.1. Terracotta rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

4.7. Ceramic

4.7.1. Ceramic rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

4.8. Others

4.8.1. Others rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Chapter 5. Rainscreen Cladding Market: Application Estimates & Trend Analysis

5.1. Rainscreen Cladding Market: Application Movement Analysis, 2023 & 2030

5.2. Residential

5.2.1. Rainscreen cladding market estimates and forecasts, for residential application, 2018 - 2030 (Million sq. meters) (USD Billion)

5.3. Commercial

5.3.1. Rainscreen cladding market estimates and forecasts, for commercial application, 2018 - 2030 (Million sq. meters) (USD Billion)

5.4. Official

5.4.1. Rainscreen cladding market estimates and forecasts, for official application, 2018 - 2030 (Million sq. meters) (USD Billion)

5.5. Institutional

5.5.1. Rainscreen cladding market estimates and forecasts, for institutional application, 2018 - 2030 (Million sq. meters) (USD Billion)

5.6. Industrial

5.6.1. Rainscreen cladding market estimates and forecasts, for industrial application, 2018 - 2030 (Million sq. meters) (USD Billion)

Chapter 6. Rainscreen Cladding Market: Regional Estimates & Trend Analysis

6.1. Regional Movement Analysis & Market Share, 2023 & 2030

6.2. Rainscreen Cladding Market: Regional Movement Analysis, 2023 & 2030

6.3. North America

6.3.1. North America rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.3.2. North America rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.3.3. North America rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.3.4. U.S.

6.3.4.1. U.S. rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.3.4.2. U.S. rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.3.4.3. U.S. rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.3.5. Canada

6.3.5.1. Canada rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.3.5.2. Canada rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.3.5.3. Canada rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.3.6. Mexico

6.3.6.1. Mexico rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.3.6.2. Mexico rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.3.6.3. Mexico rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4. Europe

6.4.1. Europe rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.2. Europe rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.3. Europe rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.4. Germany

6.4.4.1. Germany rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.4.2. Germany rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.4.3. Germany rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.5. UK

6.4.5.1. UK rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.5.2. UK rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.5.3. UK rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.6. France

6.4.6.1. France rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.6.2. France rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.6.3. France rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.7. Russia

6.4.7.1. Russia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.7.2. Russia rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.7.3. Russia rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.8. Spain

6.4.8.1. Spain rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.8.2. Spain rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.8.3. Spain rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.9. Italy

6.4.9.1. Italy rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.9.2. Italy rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.9.3. Italy rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.10. Austria

6.4.10.1. Austria rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.10.2. Austria rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.10.3. Austria rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.11. Poland

6.4.11.1. Poland rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.11.2. Poland rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.11.3. Poland rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.12. Belgium

6.4.12.1. Belgium rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.12.2. Belgium rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.12.3. Belgium rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.13. Denmark

6.4.13.1. Denmark rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.13.2. Denmark rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.13.3. Denmark rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.14. Turkey

6.4.14.1. Turkey rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.14.2. Turkey rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.14.3. Turkey rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.4.15. Switzerland

6.4.15.1. Switzerland rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.4.15.2. Switzerland rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.4.15.3. Switzerland rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5. Asia Pacific

6.5.1. Asia Pacific rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.2. Asia Pacific rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.3. Asia Pacific rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.4. China

6.5.4.1. China rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.4.2. China rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.4.3. China rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.5. Japan

6.5.5.1. Japan rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.5.2. Japan rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.5.3. Japan rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.6. India

6.5.6.1. India rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.6.2. India rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.6.3. India rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.7. South Korea

6.5.7.1. South Korea rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.7.2. South Korea rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.7.3. South Korea rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.8. Malaysia

6.5.8.1. Malaysia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.8.2. Malaysia rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.8.3. Malaysia rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.9. Thailand

6.5.9.1. Thailand rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.9.2. Thailand rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.9.3. Thailand rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.10. Indonesia

6.5.10.1. Indonesia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.10.2. Indonesia rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.10.3. Indonesia rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.11. Singapore

6.5.11.1. Singapore rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.11.2. Singapore rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.11.3. Singapore rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.5.12. Vietnam

6.5.12.1. Vietnam rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.5.12.2. Vietnam rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.5.12.3. Vietnam rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.6. Central & South America

6.6.1. Central & South America rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.6.2. Central & South America rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.6.3. Central & South America rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.6.4. Brazil

6.6.4.1. Brazil rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.6.4.2. Brazil rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.6.4.3. Brazil rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.6.5. Argentina

6.6.5.1. Argentina rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.6.5.2. Argentina rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.6.5.3. Argentina rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.6.6. Columbia

6.6.6.1. Columbia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.6.6.2. Columbia rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.6.6.3. Columbia rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7. Middle East & Africa

6.7.1. Middle East & Africa rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.2. Middle East & Africa rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.3. Middle East & Africa rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.4. Saudi Arabia

6.7.4.1. Saudi Arabia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.4.2. Saudi Arabia rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.4.3. Saudi Arabia rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.5. UAE

6.7.5.1. UAE rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.5.2. UAE rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.5.3. UAE rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.6. Qatar

6.7.6.1. Qatar rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.6.2. Qatar rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.6.3. Qatar rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.7. Kuwait

6.7.7.1. Kuwait rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.7.2. Kuwait rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.7.3. Kuwait rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.8. Bahrain

6.7.8.1. Bahrain rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.8.2. Bahrain rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.8.3. Bahrain rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.9. Oman

6.7.9.1. Oman rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.9.2. Oman rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.9.3. Oman rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.10. Egypt

6.7.10.1. Egypt rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.10.2. Egypt rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.10.3. Egypt rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

6.7.11. South Africa

6.7.11.1. South Africa rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

6.7.11.2. South Africa rainscreen cladding market estimates and forecasts, by raw material (Million Sq. Meters) (USD Billion)

6.7.11.3. South Africa rainscreen cladding market estimates and forecasts, by application (Million Sq. Meters) (USD Billion)

Chapter 7. Competitive Landscape

7.1. Vendor Landscape

7.1.1. Raw material Suppliers, Component Manufacturers and assembler/installers

7.2. Competitive Environment

7.2.1. Rainscreen cladding

7.3. Competitive Market Positioning

7.3.1. Rainscreen cladding

Chapter 8. Company Profiles

8.1. Kingspan Insulation plc

8.1.1. Company Overview

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.1.4. Strategic Initiatives

8.2. Carea Ltd.

8.2.1. Company Overview

8.2.2. Financial Performance

8.2.3. Product Benchmarking

8.2.4. Strategic Initiatives

8.3. M.F. Murray Companies, Inc.

8.3.1. Company Overview

8.3.2. Financial Performance

8.3.3. Product Benchmarking

8.3.4. Strategic Initiatives

8.4. Celotex Ltd.

8.4.1. Company Overview

8.4.2. Financial Performance

8.4.3. Product Benchmarking

8.4.4. Strategic Initiatives

8.5. CGL Facades Co.

8.5.1. Company Overview

8.5.2. Financial Performance

8.5.3. Product Benchmarking

8.5.4. Strategic Initiatives

8.6. Rockwool International A/S

8.6.1. Company Overview

8.6.2. Financial Performance

8.6.3. Product Benchmarking

8.6.4. Strategic Initiatives

8.7. Eco Earth Solutions Pvt. Ltd.

8.7.1. Company Overview

8.7.2. Financial Performance

8.7.3. Product Benchmarking

8.7.4. Strategic Initiatives

8.8. FunderMax

8.8.1. Company Overview

8.8.2. Financial Performance

8.8.3. Product Benchmarking

8.8.4. Strategic Initiatives

8.9. Everest Industries Limited

8.9.1. Company Overview

8.9.2. Financial Performance

8.9.3. Product Benchmarking

8.9.4. Strategic Initiatives

8.10. OmniMax International, Inc.

8.10.1. Company Overview

8.10.2. Financial Performance

8.10.3. Product Benchmarking

8.10.4. Strategic Initiatives

8.11. Trespa International B.V.

8.11.1. Company Overview

8.11.2. Financial Performance

8.11.3. Product Benchmarking

8.11.4. Strategic Initiatives

8.12. Euro Panels Overseas N.V.

8.12.1. Company Overview

8.12.2. Financial Performance

8.12.3. Product Benchmarking

8.12.4. Strategic Initiatives

8.13. Centria International

8.13.1. Company Overview

8.13.2. Financial Performance

8.13.3. Product Benchmarking

8.13.4. Strategic Initiatives

8.14. Dow Building Solutions

8.14.1. Company Overview

8.14.2. Financial Performance

8.14.3. Product Benchmarking

8.14.4. Strategic Initiatives

List of Tables

Table 1 Productivity rates for an ACM system found on a two-story building

Table 2 Standard equipment used on projects with ACM:

Table 3 Fiber cement rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 4 Composite material rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 5 Metal rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 6 High pressure laminates rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 7 Terracotta rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 8 Ceramic rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 9 Other rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 10 Rainscreen cladding market estimates and forecasts, for residential application, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 11 Rainscreen cladding market estimates and forecasts, for commercial application, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 12 Rainscreen cladding market estimates and forecasts, for official application, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 13 Rainscreen cladding market estimates and forecasts, for institutional application, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 14 Rainscreen cladding market estimates and forecasts, for industrial application, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 15 Rainscreen cladding market estimates and forecasts, for refurbishment, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 16 North America rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 17 North America rainscreen cladding market volume estimates and forecasts, by raw material 2018 - 2030 (Million Sq. Meters)

Table 18 North America rainscreen cladding market revenue estimates and forecasts, by raw material 2018 - 2030 (USD Billion)

Table 19 North America rainscreen cladding market volume estimates and forecasts, by application 2018 - 2030 (Million Sq. Meters)

Table 20 North America rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 21 U.S. rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 22 U.S. rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 23 U.S. rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 24 U.S. rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 25 U.S. rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 26 Canada rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 27 Canada rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 28 Canada rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 29 Canada rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 30 Canada rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 31 Mexico rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 32 Mexico rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 33 Mexico rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 34 Mexico rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 35 Mexico rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 36 Europe rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million sq. meters) (USD Billion)

Table 37 Europe rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million sq. meters)

Table 38 Europe rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 39 Europe rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million sq. meters)

Table 40 Europe rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 41 Germany rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 42 Germany rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 43 Germany rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 44 Germany rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 45 Germany rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 46 UK rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 47 UK rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 48 UK rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 49 UK rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 50 UK rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 51 France rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 52 France rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 53 France rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 54 France rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 55 France rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 56 Russia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 57 Russia rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 58 Russia rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 59 Russia rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 60 Russia rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 61 Spain rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 62 Spain rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 63 Spain rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 64 Spain rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 65 Spain rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 66 Italy rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 67 Italy rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 68 Italy rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 69 Italy rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 70 Italy rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 71 Austria rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 72 Austria rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 73 Austria rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 74 Austria rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 75 Austria rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 76 Poland rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 77 Poland rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 78 Poland rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 79 Poland rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 80 Poland rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 81 Belgium rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 82 Belgium rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 83 Belgium rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 84 Belgium rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 85 Belgium rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 86 Denmark rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 87 Denmark rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 88 Denmark rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 89 Denmark rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 90 Denmark rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 91 Turkey rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 92 Turkey rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 93 Turkey rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 94 Turkey rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 95 Turkey rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 96 Switzerland rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 97 Switzerland rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 98 Switzerland rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 99 Switzerland rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 100 Switzerland rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 101 Asia Pacific rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 102 Asia Pacific rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 103 Asia Pacific rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 104 Asia Pacific rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 105 Asia Pacific rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 106 China rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 107 China rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 108 China rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 109 China rainscreen cladding market volume estimates and forecasts, by application (Million Sq. Meters)

Table 110 China rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 111 Japan rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 112 Japan rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 113 Japan rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 114 Japan rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 115 Japan rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 116 India rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 117 India rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 118 India rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 119 India rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 120 India rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 121 South Korea rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 122 South Korea rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 123 South Korea rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 124 South Korea rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 125 South Korea rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 126 Malaysia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 127 Malaysia rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 128 Malaysia rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 129 Malaysia rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 130 Malaysia rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 131 Thailand rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 132 Thailand rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 133 Thailand rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 134 Thailand rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 135 Thailand rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 136 Indonesia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 137 Indonesia rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 138 Indonesia rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 139 Indonesia rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 140 Indonesia rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 141 Singapore rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 142 Singapore rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 143 Singapore rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 144 Singapore rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 145 Singapore rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 146 Vietnam rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 147 Vietnam rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 148 Vietnam rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 149 Vietnam rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 150 Vietnam rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 151 Central & South America rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 152 Central & South America rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million sq. meters)

Table 153 Central & South America rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 154 Central & South America rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million sq. meters)

Table 155 Central & South America rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 156 Brazil rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 157 Brazil rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 158 Brazil rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 159 Brazil rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 160 Brazil rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 161 Argentina rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 162 Argentina rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 163 Argentina rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 164 Argentina rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 165 Argentina rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 166 Colombia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 167 Colombia rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 168 Colombia rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 169 Colombia rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 170 Colombia rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 171 Middle East & Africa rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 172 Middle East & Africa rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million sq. meters)

Table 173 Middle East & Africa rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 174 Middle East & Africa rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million sq. meters)

Table 175 Middle East & Africa rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 176 Saudi Arabia rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 177 Saudi Arabia rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 178 Saudi Arabia rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 179 Saudi Arabia rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 180 Saudi Arabia rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 181 UAE rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 182 UAE rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 183 UAE rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 184 UAE rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 185 UAE rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 186 Qatar rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 187 Qatar rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 188 Qatar rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 189 Qatar rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 190 Qatar rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 191 Kuwait rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 192 Kuwait rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 193 Kuwait rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 194 Kuwait rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 195 Kuwait rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 196 Bahrain rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 197 Bahrain rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 198 Bahrain rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 199 Bahrain rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 200 Bahrain rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 201 Oman rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 202 Oman rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 203 Oman rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 204 Oman rainscreen cladding market volume estimates and forecasts, by application (Million Sq. Meters)

Table 205 Oman rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 206 Egypt rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 207 Egypt rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 208 Egypt rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 209 Egypt rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 210 Egypt rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

Table 211 South Africa rainscreen cladding market estimates and forecasts, 2018 - 2030 (Million Sq. Meters) (USD Billion)

Table 212 South Africa rainscreen cladding market volume estimates and forecasts, by raw material, 2018 - 2030 (Million Sq. Meters)

Table 213 South Africa rainscreen cladding market revenue estimates and forecasts, by raw material, 2018 - 2030 (USD Billion)

Table 214 South Africa rainscreen cladding market volume estimates and forecasts, by application, 2018 - 2030 (Million Sq. Meters)

Table 215 South Africa rainscreen cladding market revenue estimates and forecasts, by application, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Rainscreen cladding market: Market snapshot

Fig. 2 Rainscreen cladding market: Market segmentation

Fig. 3 Rainscreen cladding market: Market size and growth prospects, 2018 - 2030

Fig. 4 Rainscreen cladding market - Value chain analysis

Fig. 5 Rainscreen cladding labor cost share by quantity

Fig. 6 Rainscreen cladding material quantity

Fig. 7 Rainscreen cladding material cost

Fig. 8 Rainscreen cladding market - Market dynamics

Fig. 9 Market driver impact analysis

Fig. 10 Market restraint impact analysis

Fig. 11 Rainscreen cladding market: Porter’s five forces analysis

Fig. 12 Rainscreen cladding market - Porter’s Analysis

Fig. 13 Rainscreen cladding market: Raw material movement analysis, 2023 & 2030

Fig. 14 Rainscreen Cladding market: Application movement analysis, 2023 & 2030

Fig. 15 Rainscreen Cladding market: Regional movement analysis, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Rainscreen Cladding Raw Material Outlook (Volume, Million Sq. Meters; Revenue, USD Billion, 2018 - 2030)

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Rainscreen Cladding Application Outlook (Volume, Million Sq. Meters; Revenue, USD Billion, 2018 - 2030)

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Rainscreen Cladding Regional Outlook (Volume, Million Sq. Meters; Revenue, USD Billion, 2018 - 2030)

- North America

- North America Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- North America Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- U.S.

- U.S. Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- U.S. Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- U.S. Rainscreen Cladding Market, By Raw Material

- Canada

- Canada Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Canada Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Canada Rainscreen Cladding Market, By Raw Material

- Mexico

- Mexico Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Mexico Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Mexico Rainscreen Cladding Market, By Raw Material

- North America Rainscreen Cladding Market, By Raw Material

- Europe

- Europe Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Europe Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Germany

- Germany Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Germany Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Germany Rainscreen Cladding Market, By Raw Material

- UK

- UK Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- UK Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- UK Rainscreen Cladding Market, By Raw Material

- France

- France Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- France Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- France Rainscreen Cladding Market, By Raw Material

- Spain

- Spain Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Spain Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Spain Rainscreen Cladding Market, By Raw Material

- Italy

- Italy Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Italy Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Italy Rainscreen Cladding Market, By Raw Material

- Austria

- Austria Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Austria Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Austria Rainscreen Cladding Market, By Raw Material

- Poland

- Poland Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal

- High Pressure Laminates

- Terracotta

- Ceramic

- Others

- Poland Rainscreen Cladding Market, By Application

- Residential

- Commercial

- Official

- Institutional

- Industrial

- Poland Rainscreen Cladding Market, By Raw Material

- Belgium

- Belgium Rainscreen Cladding Market, By Raw Material

- Fiber Cement

- Composite Material

- Metal