- Home

- »

- Pharmaceuticals

- »

-

Rare Diseases Treatment Market Size, Industry Report, 2030GVR Report cover

![Rare Diseases Treatment Market Size, Share & Trends Report]()

Rare Diseases Treatment Market Size, Share & Trends Analysis Report By Therapeutic Area (Cancer, Musculoskeletal Conditions), By Route Of Administration, By Drug Type, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-965-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Rare Diseases Treatment Market Trends

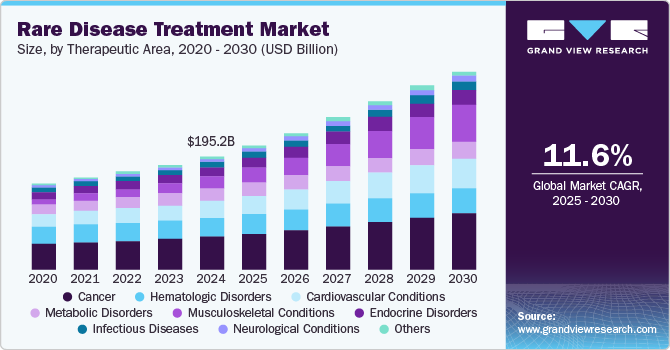

The global rare disease treatment market size was estimated at USD 195.2 billion in 2024 and is anticipated to expand at a CAGR of 11.6% by 2030. The presence of a strong product pipeline and their expected launches are expected to drive market growth. For instance, in October 2024, FDA announced seven new clinical trial grants for advancement in research on rare disease treatments, which are often overlooked. These new projects include the treatment for Cancer, Cushing’s syndrome, lymphatic malformations, inherited eye disease, and blood disorders. Increased funding for such research projects fuels the launch of new drugs and treatments for diseases and further boosts the market growth.

Governments of several countries, especially developed nations, are taking efforts to support the development of orphan drugs. Many organizations, including governmental and non-governmental institutions are providing incentives, exemptions from certain fees, and other benefits in order to boost the availability of treatments for such unusual medical conditions. For instance, according to the data published in August 2024, by the Centre for Innovation in Regulatory Science, major regulatory authorities observed an exponential growth in the proportion of new active substances receiving orphan designation. The numbers found were as follows, EMA approved 38% drugs in 2022 as compared to 33% in 2017, FDA approved 55% of orphan drugs as compared to 44% in 2017. These increasing numbers of drug approvals for orphan designation are attributed to the growing incentives for R&D in diseases.

Furthermore, technological advancements play a pivotal role in the growth of the market. Innovations in next-generation sequencing (NGS), bioinformatics, and gene therapies have revolutionized the healthcare industry. For instance, as per the information published in January 2024 by Drug Discovery World (DDW), researchers have found potential use of mRNA in a preclinical study to effectively treat a unusual liver disease named as “argininosuccinic aciduria.” These technologies enable diagnostic accuracy, identification of uncommon disease, and treatment choice. Such advancements in the pharmaceutical industry are expected to surge rare diseases treatment industry growth during the forecast period.

Moreover, the growing emphasis on patient-centric healthcare models is shaping the market. As healthcare systems move towards more individualized approaches, there is an increased focus on understanding patients' unique biological profiles. This trend is leading to the development of more precise therapeutics that can enhance treatment efficacy and minimize adverse effects. By tailoring medical interventions to individual patients, healthcare providers can improve overall patient satisfaction and outcomes, further propelling the growth of the market.

Therapeutic Area Insights

Cancer segment dominated the market with the largest market share of 28.2% in 2024. This dominance can be attributed to the high prevalence and recurrence rate of rare cancer indications. Cancers such as hepatoblastoma, thymic carcinoma, and essential thrombocythaemia are considered uncommon but are equally fatal and need to be addressed with potential treatment. The incidences of such cases are increasing every year for instance, according to the data mentioned in Orphanet heapatoblastoma comprises of 0 to 5% of all pediatric tumors. It is observed that the case of this disease is increasing every year by 5% in children, which will in turn boost the demand for cancer treatments over the forecast period.

Musculoskeletal conditions segment is expected to grow at a significant CAGR rate over the forecast period. The growth of this segment can be attributed to the increasing prevalence of musculoskeletal disorders and new product approvals for treatment. For instance, in August 2024 , U.S. FDA approved axatilimab-csfr for the treatment of chronic graft-versus-host disease (cGVHD) which is a fatal condition that can occur after a bone marrow or stem cell transplant. This approval is expected to boost the segment growth during the forecast period.

Drug Insights

Biologics dominated the market with the largest share of 58.1% in 2024, due to its ability to address complex and previously untreatable conditions. Their high specificity and efficacy make them particularly suitable for treating uncommon genetic and metabolic disorders. Owing to numerous benefits key players in the market are developing novel therapies to treat unusual diseases. For instance, in September 2024 , Sanofi announced that Dupixent- a biologic met all the secondary end points in a pivotal study to treat bullous pemphigoid (BP) in adults. It has received orphan drug designation by U.S. FDA and if approved, it will be the first and only targeted medicine to treat BP. Such remarkable developments in the sector fuel the market growth.

Biosimilar segment is expected to grow at a significant CAGR rate over the forecast period. The patents expiration of orphan biologics and supportive regulatory policies is expected to pave the way for new players to enter the market and drive competition, reducing the drug price used for treatment of various unique diseases, thereby driving segment growth. Extensive research and product launch also contribute in the growth of the biosimilar sector. For instance, according to the data released in May 2024 , FDA approved Bkemv and Soliris which are the first interchangeable biosimilars for two rare diseases paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS).

Route of Administration Insights

Injectable segment dominated the market with the largest share of 65.5% in 2024, driven by its effectiveness in delivering drug directly into the bloodstream or targeted tissues. Key players in the market are launching new injectables for maximum therapeutic effect in the treatment of several chronic diseases. For instance, in October 2024, U.S. FDA approved Pfizer’s HYMPAVZI, a subcutaneous injection for the treatment of Hemophilia A or B which is a rare hematological disease. This approval is expected to boost injectable segment during the forecast period.

Others segment is expected to grow at a significant CAGR rate over the forecast period. Many treatments administered through other routes including topical treatments, intranasal therapy, inhalation therapy among many others is included under this segment. With rising research and development of pharmaceuticals to treat rare diseases, the segment is anticipated to grow in the coming years. For instance, in January 2023, Mankind Corporation announced the advancement of clofazimine inhalation suspension to Phase 2/3 study to efficiently treat rare lung disease. This product approval is anticipated to boost the rare diseases treatment industry growth.

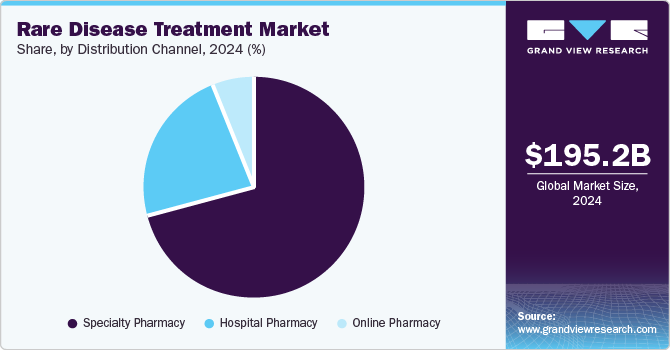

Distribution Channel Insights

Specialty pharmacy dominated the market with the largest share of 70.5% in 2024, due to their expertise in managing complex therapies that require specialized handling, storage, and administration. Market players in the industry are involving in strategic collaborations with such specialty pharmacies for substantial distribution of their orphan drugs. For instance, in September 2024, Calliditas Therapeutics announced the selection of PANTHERx Rare, a specialty pharmacy for the distribution of their TARPEYO- a delayed release capsule to treat kidney disease. These collaborations entrust more people and boost adoption, thus propelling rare diseases treatment industry growth.

Hospital pharmacy segment is the fastest-growing segment and is expected to grow at a CAGR rate over the forecast period driven by the growing prevalence of rare diseases diagnosed and treated in hospitals. In addition, rare disease patients frequently require biologics, gene therapies, or enzyme replacement therapies that demand expert handling and administration, which hospital pharmacies are well-equipped to provide. These pharmacies also play a crucial role in ensuring seamless access to high-cost and specialty drugs through institutional frameworks and reimbursement programs.

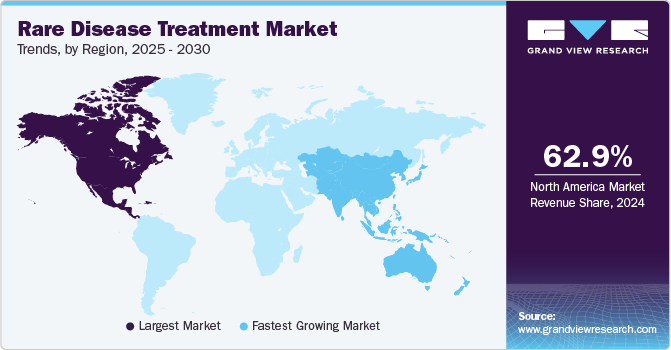

Regional Insights

The North America rare disease treatment market dominated the global market and accounted for 62.9% of revenue share in 2024, which can be attributed to high burden of disease, favorable healthcare infrastructure, and new product approvals for treatment. For instance, in September 2024 FDA approved Miplyffa- an oral medication to treat neurological symptoms related to Niemann-Pick disease, type C (NPC). It is also the first FDA approved drug for the treatment of NPC.

U.S. Rare Disease Treatment Market Trends

The U.S. rare disease treatment market held a significant share of North America market in 2024, driven by advancements in genomics and increased demand for targeted therapies. Rising investments in research, regulatory support for orphan drugs, and a growing emphasis on precision medicine in oncology and other chronic disease management are further propelling market expansion in this sector.

Europe Rare Disease Treatment Market Trends

The Europe rare disease treatment market driven by supportive regulatory framework, increased investment in research and innovation, and rising awareness of rare conditions. For instance, as per the news published in November 2024, Oranda Therapeutics, a rare disease company based in Ireland announced the launch of their Series A Funding round to gain commercial EMEA license for a treatment intended to treat hyperphagia in patients with Prader-Willi syndrome.

The UK rare disease treatment market is expected to show significant growth driven by increasing research and development investments and enhanced funding for innovative projects. This financial support is facilitating the discovery of novel drugs and advancing precision medicine initiatives, leading to improved and targeted therapies, ultimately enhancing patient outcomes across the region.

The Germany rare disease treatment market is experiencing significant growth, largely due to the rising prevalence of chronic disorders such as cancer, and cardiovascular diseases. This increasing burden on healthcare systems is driving demand for targeted treatments and tailored therapies, fostering advancements in personalized medicine and enhancing patient care in the region.

The rare disease treatment market in France is driven by a diverse array of therapeutic areas, reflecting the complex landscape of unmet medical needs. Cancer therapies lead the way, as advancements in precision medicine and targeted treatments address the unique challenges posed by rare oncological conditions. Neurological disorders are another critical area, where innovative approaches for diseases such as amyotrophic lateral sclerosis (ALS) and rare epileptic syndromes are gaining traction. Similarly, cardiovascular conditions, including rare genetic heart diseases, are witnessing a surge in research and development initiatives aimed at offering life-saving solutions.

Asia Pacific Rare Disease Treatment Market Trends

The Asia Pacific rare disease treatment market is expected to grow at the fastest CAGR over the forecast period. The growth of the market in the region is owing to growing healthcare reforms in the region aided by improved healthcare infrastructure, a growing population, and an increase in the number of companies entering the market. The Asia Pacific region has a large population and high cancer prevalence. Thus, the demand of novel treatments for rare cancers, musculoskeletal disorders, and others has increased in the past few years owing to growing government initiatives, collaborations for the distribution and supply of these drugs. For instance, as per the data published in June 2024 , Delhi high court demanded 11.84 Lakh rupees to AIIMS for the treatment of rare disease.

The China rare disease treatment market is growing at a lucrative rate. Presence of government funding and initiatives in the region further fuels regional growth. The cumulative demand across therapeutic areas underscores the total growth potential of the rare disease treatment industry in China, driven by continued innovation, regulatory incentives, and patient advocacy efforts.

The rare disease treatment market in Japan is witnessing notable growth, driven by advancements across multiple therapeutic areas and reinforced by supportive government initiatives. In Japan, the government’s focus on addressing unmet medical needs, particularly in oncology, has bolstered the development of targeted therapies for rare cancers. Neurological conditions, such as rare forms of dementia and epilepsy, are gaining significant attention, supported by Japan’s robust healthcare infrastructure and innovation in biopharmaceutical research. Cardiovascular conditions, including rare congenital heart diseases, and musculoskeletal disorders, such as osteogenesis imperfecta, also represent key growth segments, with advancements in gene therapies and regenerative medicine leading the charge.

Latin America Rare Disease Treatment Market Trends

The Latin America rare disease treatment market exhibits high growth potential for the market. driven by improvements in healthcare infrastructure and strong government support. Many countries in the region are investing in modernizing their healthcare systems, which enhances access to advanced diagnostic tools and personalized treatment options.

The Brazil rare disease treatment market is anticipated to grow significantly in the forecast owing to Rare hematologic disorders, such as hemophilia and sickle cell disease, are a critical focus area, supported by public health programs aimed at improving diagnostics and treatments. The rising prevalence of infectious diseases, including certain rare tropical diseases, also drives the need for specialized treatments in Brazil. Moreover, metabolic and endocrine disorders, such as Gaucher’s disease and rare types of diabetes, are experiencing growing awareness and improved access to therapies, aided by collaborations between the government and pharmaceutical companies.

Middle East & Africa Rare Disease Treatment Market Trends

The MEA rare disease treatment market is anticipated to grow significantly in the forecast period. Governments in the region, particularly in the Gulf Cooperation Council (GCC) countries, are prioritizing healthcare advancements and rare disease initiatives through policies, subsidies, and partnerships with global pharmaceutical companies. For instance, in June 2024, the Department of Health-Abu Dhabi and AstraZeneca have joined hands to establish a center for rare diseases in Abu Dhabi to improve the diagnosis and treatment for such diseases.

Saudi Arabia Market Trends

The Saudi Arabia rare disease treatment market growth is driving the market, largely supported by government funding aimed at enhancing healthcare innovation. Increased investment in research initiatives and the establishment of advanced healthcare facilities are fostering the development of novel therapies, which are essential for improving disease treatment strategies and patient care in the region.

Key Rare Disease Treatment Company Insights

Key players in the rare disease treatment market include Bayer AG, AstraZeneca, Pfizer Inc., and Bristol Myers Squibb Company These leading pharmaceutical companies are at the forefront of developing and manufacturing drugs for disease. With their extensive product portfolios and global market reach, they are well-positioned to address the growing demand for safer and more effective rare disease treatments. By expanding access to affordable options and fostering innovation in drug development, these companies are playing a crucial role in enhancing patient care and improving treatment outcomes in the rare disease management landscape.

Key Rare Disease Treatment Companies:

The following are the leading companies in the rare disease treatment market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Pfizer, Inc.

- PTC Therapeutics Inc.

- AstraZeneca

- Novartis AG

- Takeda Pharmaceutical Company Ltd

- Bayer AG

- AbbVie Inc.

- Merck & Co. Inc.

- Bristol Myers Squibb Company

Recent Developments

-

In September 2024, the U.S. FDA approved arimoclomol (Miplyffa) drug developed by Zevra Therapeutics for treatment of patient with Niemann-Pick disease type C. This drug is used in combination with Johsnon & Johnson’s Zavesca drug.

-

In June 2024, ANI Pharmaceuticals, Inc. signed an agreement to acquire Alimera Sciences, Inc. to foster their rare disease infrastructure and expand business. ILUVIEN and YUTIQ are two commercial products that have significant growth potential in the market.

-

In January 2024, Sanofi planned to acquire Inhibrx, Inc. to enhance Sanofi’s rare disease portfolio by addition of best-in-class Alpha-1 Antitrypsin Deficiency to pipeline. INBRX-101 is used in the treatment of rare lung infection which will further strengthen company’s position in the market.

Rare Disease Treatment Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 216.24 billion

The revenue forecast in 2030

USD 374.39 billion

Growth rate

CAGR of 11.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic area, drug, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; Pfizer, Inc.; PTC Therapeutics Inc.; AstraZeneca, Novartis AG; Takeda Pharmaceutical Company Ltd; Bayer AG; AbbVie Inc.; Merck & Co. Inc.; Bristol Myers Squibb Comapny

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Rare Diseases Treatment Market Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the rare disease treatment market on the basis of therapeutic area, drug, route of administration, distribution channel, and regions.

-

Therapeutic Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Neurological Conditions

-

Cardiovascular Conditions

-

Musculoskeletal Conditions

-

Hematologic Disorders

-

Infectious Diseases

-

Metabolic Disorders

-

Endocrine Disorders

-

Others

-

-

Drug Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics

-

Biosimilar

-

Small molecules

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rare disease treatment market is expected to witness a compound annual growth rate of 11.60% from 2025 to 2030 to reach USD 374.39 billion in 2030.

b. The global rare disease treatment market size was estimated at USD 195.2 billion in 2024 and is expected to reach USD 216.25 billion in 2025.

b. Based on the therapeutic area, cancer dominated the market in 2024 with a share of 28.18% owing to the high prevalence of rare cancers coupled with the presence of a large number of products approved for their treatment.

b. Some key players operating in the rare disease treatment market include companies such as F. Hoffmann-La Roche Ltd, Pfizer, Inc., Takeda Pharmaceutical Company Limited, PTC Therapeutics, AstraZeneca, Novartis AG, and Novo Nordisk amongst others.

b. Key factors driving the rare disease treatment market growth include increasing product launches, rising prevalence of rare diseases, and rising investment in R&D for rare disease treatment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."