- Home

- »

- Medical Devices

- »

-

Rare Hemophilia Factors Market Size & Share Report, 2030GVR Report cover

![Rare Hemophilia Factors Market Size, Share & Trends Report]()

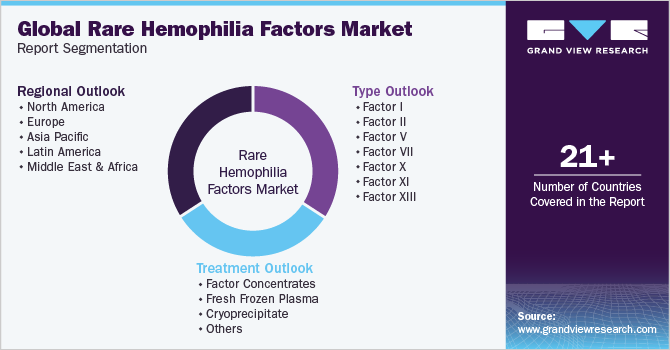

Rare Hemophilia Factors Market Size, Share & Trends Analysis Report By Type (Factor I, Factor II, Factor VII), By Treatment (Factor Concentrates, Fresh Frozen Plasma, Cryoprecipitate), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-104-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global rare hemophilia factors market size was estimated at USD 294.7 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Several new factor concentrates securing approvals from regulatory bodies, such as the U.S. FDA, and government initiatives aimed at increasing diagnosis & treatment rates are among the key trends driving the market growth.Due to the scarcity of specific clotting factors, patients with rare types of hemophilia face unique challenges. The need to address these patients' unmet medical needs drives the demand for rare hemophilia factors. The COVID-19 pandemic impacted ongoing and planned clinical trials for specific clotting factor therapies significantly. Many trials had to be put on hold or postponed due to restrictions on in-person visits, the prioritization of resources for COVID-19-related research, and patient safety concerns.

These setbacks slowed the development and approval of new therapies, potentially delaying the introduction of novel treatments for rare hemophilia types. The emphasis of healthcare systems and providers shifted to managing the COVID-19 crisis, which included diagnosing, treating, and preventing the virus's spread. This shift in priorities, combined with the strain on healthcare resources, may have influenced the attention and resources devoted to the treatment of rare diseases, such as hemophilia. The redirection of resources and healthcare professionals' attention to COVID-19-related care have impacted the overall management and support available for patients with rare hemophilia. With increasing R&D activities by key players, such as Novo Nordisk and CSL Behring, the market is witnessing a spike in the number of new factor concentrates.

Specific clotting factor products tailored to rare hemophilia types have become critical in improving treatment outcomes. Advances in diagnostic techniques, as well as increased awareness about rare hemophilia types, have contributed to an increase in the demand for specific clotting factors. Early and accurate diagnosis enables healthcare providers to identify patients with rare hemophilia types and determine the best treatment options. As healthcare professionals and patients become more aware, there is a greater demand for specialized clotting factor therapies. In the recent past, several concentrates have received marketing approvals from regulatory bodies. For instance, in August 2022, The Food and Drug Administration (FDA) announced the approval of Rebinyn, a coagulation factor IX recombinant, for routine prophylaxis to reduce the frequency of bleeding episodes in children and adults with hemophilia B.

The recombinant DNA-derived coagulation Factor IX concentrate is also approved for the treatment and control of bleeding episodes as well as the management of bleeding during surgery. Advances in diagnostic techniques, as well as increased awareness about rare hemophilia types, have contributed to an increase in the demand for specific clotting factors. Early and accurate diagnosis enables healthcare providers to identify patients with rare hemophilia types and determine the best treatment options. As healthcare professionals and patients become more aware, there is a greater demand for specialized clotting factor therapies. In addition, in recent years, the field of hemophilia treatment has seen significant advancements, including the development of novel clotting factor products.

These advancements have increased the number of treatment options available to patients with rare hemophilia types, resulting in increased demand for specific clotting factors that address their deficiencies. The availability of newer, more effective therapies has increased market demand. Government initiatives and mandates have also increased patient and practitioner awareness about the rare hemophilia coagulation disorders, and also have established stringent regulatory policies to ensure rigorous licensing and drug approval, thereby revving up diagnosis and treatment rates. This, in turn, is likely to boost the growth of the market over the forecast period. For instance, regulatory agencies, such as the FDA in the U.S. and the EMA in Europe, have established stringent drug approval and licensing procedures.

Manufacturers of specific clotting factor therapies for rare hemophilia must submit extensive clinical trial data demonstrating their products' safety and efficacy. These regulatory bodies assess the data to determine whether the benefits outweigh the risks before granting marketing and distribution approval. In addition, initiatives by the International Rare Diseases Research Consortium (IRDiRC) in Europe to develop 200 new therapies for such diseases by 2020 and provide funding for studies and R&D activities are expected to bolster market growth. Moreover, the growth of regional markets, such as China, is also driven by initiatives taken by patient advocacy groups, academic institutions, other nonprofit organizations, and pharmaceutical companies.

For instance, The Chinese Organization for Rare Disorders (CORD) and societies, such as Haemophilia Home of China, are actively involved in initiating pilot projects to increase awareness, diagnosis rate, and treatment options for rare disorders in China. The rising adoption of prophylactic treatments by patients is also contributing to market growth. Prophylaxis has several advantages, such as reduced incidence of joint pain and reduced joint damage. Patients with severe rare hemophilia disorders are recommended prophylactic treatment to avoid bleeding episodes and improve quality of life. For instance, long-term prophylactic treatment with NovoThirteen (rFXIII-A) is recommended for both adult and pediatric patients with congenital factor XIII A-subunit deficiency. The efficacy and performance of prophylaxis are enhanced by continuous treatment, thereby triggering the adoption rate. This, in turn, is likely to boost market growth over the forecast period.

Treatment Insights

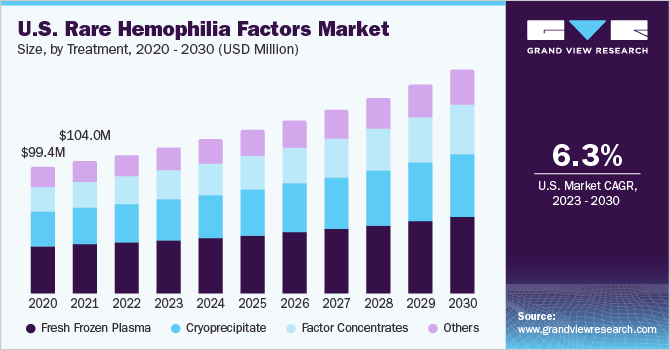

On the basis of treatments, the global industry has been further segmented into factor concentrates, fresh frozen plasma, cryoprecipitate, and others. The others segment comprises prothrombin complex concentrate (PCC), desmopressin, and antifibrinolytic drugs. The fresh frozen plasma segment held the largest revenue share in 2022. Fresh frozen plasma contains all clotting factors and blood proteins. Due to the limited availability and affordability of factor concentrates, fresh frozen plasma is used routinely to manage bleeding episodes in rare hemophilia deficiencies.

The factor concentrates segment is projected to expand at the fastest growth rate during the forecast period. Factor concentrates are considered to be the safest and most effective treatment option. They are gaining preference for other treatment options, such as cryoprecipitate and fresh frozen plasma, as they allow the replacement of specific defective or deficient proteins without adverse effects created by transfusion reactions or volume overloads.

Type Insights

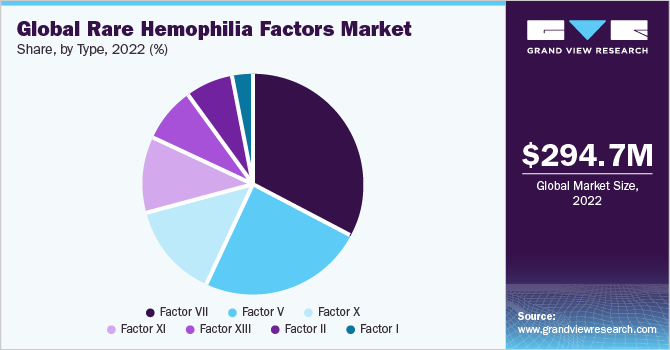

On the basis of types, the market is further segmented into Factor I, II, V, VII, X, XI, and XIII. The F-VII deficiency segment dominated the global market with a revenue share of 32.5% in 2022 and is also expected to grow at the fastest CAGR of 7.6% over the forecast period. The growth of the segment can be attributed to the availability of treatment options, such as recombinant factor VIIa (rFVIIa), NovoSeven (manufactured by NovoNordisk, Denmark).

The awareness about rare hemophilia deficiencies is anticipated to increase over the forecast period due to efforts taken by organizations, such as the World Federation of Hemophilia (WFH), for patient advocacy and to improve the diagnosis and treatment of rare hemophilia disorders. Factor VII deficiency has the highest prevalence of 1 per 300,000-500,000 as per the National Hemophilia Foundation. Moreover, as per a publication by “Hemophilia of Georgia” in 2013, several new rFVIIa products, counterparts of NovoSeven, were being developed by industry players, such as CSL Behring, Pfizer/Catalyst Biosciences, and Baxter. Such competitive rivalry among key players is poised to provide a fillip to the market.

Regional Insights

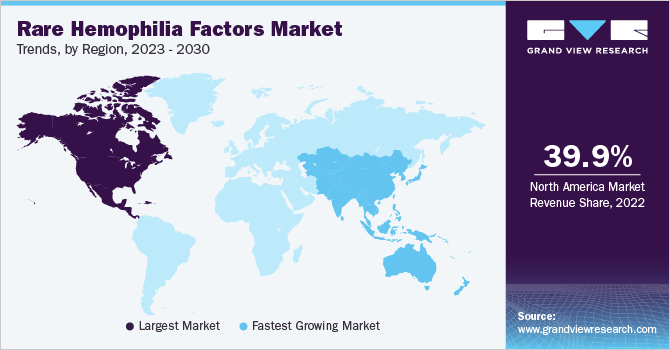

North America dominated the global market with a revenue share of 39.9% in 2022. Government initiatives to increase the rate of diagnosis & reduce treatment costs, research activities to improve the management of rare hemophilia conditions, and the strong presence of key players are some of the factors supplementing the growth of the regional market. For instance, the National Organization for Rare Disorders (NORD), headquartered in the U.S., provides several research grants for the study of rare diseases. In addition, U.S. FDA approvals for certain coagulation factor concentrates in recent years have helped the regional market to gain traction.

Asia Pacific is expected to witness the fastest CAGR of 8.2% over the forecast period owing to the growing population and rising incidence of autosomal recessive disorders due to consanguineous marriages in countries, such as India, Pakistan, and China. As per an article titled “Epidemiological study of consanguineous marriage and its effects,” published in the International Journal of Community Medicine and Public Health, the prevalence of consanguineous marriages is high in the Middle East, Africa, and South Asia, estimated at around 20.0% to 50.0% of all marriages.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by key participants to maintain and grow their global reach. For instance, in May 2022, F. Hoffmann-La Roche Ltd., a multinational healthcare company based in Sweden, announced the extension of its partnership with the World Federation of Hemophilia (WFH) to extend access to hemophilia treatments through to the end of 2028.

Under this partnership, F. Hoffmann-La Roche Ltd. will provide its prophylactic (preventive) treatment for hemophilia A to the WFH's Humanitarian Aid Programme under the terms of the agreement. The WFH will then distribute the treatment to people in areas where there is little or no access to high-quality hemophilia treatments. The following are some of the major participants in the global rare hemophilia factors market:

-

Novo Nordisk

-

Biogen

-

Bayer Healthcare

-

Pfizer, Inc.

-

Shire

-

Baxalta (Baxter Healthcare)

-

CSL Behring

-

Bio Products Laboratory Ltd.

Rare Hemophilia Factors Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 312.3 million

Revenue forecast in 2030

USD 499.5 million

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Novo Nordisk; Biogen; Bayer healthcare; Pfizer, Inc.; Shire; Baxalta; CSL Behring; and Bio Products Laboratory Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rare Hemophilia Factors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rare hemophilia factors market report on the basis of type, treatment, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Factor I

-

Factor II

-

Factor V

-

Factor VII

-

Factor X

-

Factor XI

-

Factor XIII

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Factor Concentrates

-

Fresh Frozen Plasma

-

Cryoprecipitate

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rare hemophilia factors market size was estimated at USD 294.7 million in 2022 and is expected to reach USD 312.3 million in 2023.

b. The global rare hemophilia factors market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 499.5 billion by 2030.

b. North America accounted for 39.8% market share in 2022. Government initiatives to increase the rate of diagnosis & reduce treatment costs, research activities to improve the management of rare hemophilia conditions, and the strong presence of key players some of the factors supplementing the growth of the region.

b. Some of the companies operating in the market are Novo Nordisk; Biogen; Bayer healthcare; Pfizer, Inc.; Baxalta; CSL Behring; and Bio Products Laboratory Ltd.

b. With increasing R&D activities by key market players such as Novo Nordisk and CSL Behring, the market is witnessing a spike in the number of new factor concentrates.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."