- Home

- »

- Consumer F&B

- »

-

Ready To Drink Tea And Coffee Market Size Report, 2030GVR Report cover

![Ready To Drink Tea And Coffee Market Size, Share & Trends Report]()

Ready To Drink Tea And Coffee Market Size, Share & Trends Analysis Report By Product (RTD Tea, RTD Coffee), By Packaging (Canned, Glass Bottle), By Price, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-192-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global ready to drink tea and coffee market size was estimated at USD 103.62 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The increasing prevalence of on-the-go consumption, particularly among the urban population and younger demographic, has significantly contributed to its market growth. Consumers are attracted to the wide array of flavors and varieties available in the ready-to-drink (RTD) tea and coffee segment, catering to their diverse preferences. Moreover, the shift towards healthier and more convenient beverage options has been a key driver in market growth.

As health and wellness trends gain momentum, the inclusion of functional ingredients, natural and clean label formulations, specific health claims, specialty varieties, and reduced sugar content in RTD tea and coffee products has gained prominence. RTD tea and coffee is a subgroup of soft drinks although it differs in the function with proven health benefits. The altering lifestyles, which encourage on-the-go eating, and a growing trend of replacing meals with smaller nutritional snacks and drinks have resulted in the adoption of RTD tea and coffee. Growing consumer awareness regarding the health concerns caused by the consumption of carbonated drinks is leading to a shift towards RTD tea and coffee. Another factor attributing to the growth of the market is the health-conscious population who prefer the antioxidant property of RTD tea.

Positioning RTD tea and coffee as recreational products has significantly benefitted in attracting millennials, which further augments the product demand. Rapid socio-economic development over the last two decades has led to a rise in several chronic health conditions such as cancer, heart disease, and diabetes. Health advantages coupled with the consumption of RTD tea and coffee is driving the attention of consumers, particularly the aging population, which is further boosting consumer inclination towards RTD tea and coffee. Various types of RTD tea and coffee products are being launched in the market to cater to the wide consumer base spread across geographies.

For instance, in April 2022, Lavazza, a well-known Italian coffee company, launched a line of RTD beverages specially designed for the U.S. market. This new range includes four unique styles: Nitro Cold Brew, Classic Cold Brew, Double Shot Cold Brew with Oat Milk, and Cappuccino Cold Brew with Milk. All these options will be made using United States Department of Agriculture (USDA) certified organic and Rainforest Alliance-certified Arabica coffee.

However, unforeseeable rainfall and a rise in the cost of agricultural inputs increase the cost of raw materials, thereby increasing the cost of the final product. The higher cost of RTD tea and coffee than conventional hot tea and ground coffee is one of the major hindrances to the growth of the market. Moreover, ancient practices of drinking hot tea and coffee act as a constraint to market expansion. The crucial and indispensable winning imperative of the industry is a widely spread distribution network across different geographies by major players which helps them in supplying the product to a vast number of consumers.

Product Insights

The RTD tea market accounted for a 62.0% share of the global revenue in 2022. Some of the commonly consumed RTD tea variants include black, green, fruit, herbal, matcha, oolong, and iced. Owing to the increasing working population and hectic schedules of professionals, the demand for the product has escalated significantly. Growing preferences for carbonated RTD tea among consumers are driving segment growth. Furthermore, as global soda consumption has been declining consistently due to its health hazards, it is creating an ideal opportunity for the product manufacturers of RTD tea and coffee to capitalize on its market and get a share of the global market.

The RTD coffee market is anticipated to grow at a CAGR of 6.5% from 2023 to 2030. A few commonly found RTD coffee in the market include cold brew, flavored, ice coffee, plant-based, functional, and infused coffee. They are manufactured using various ingredients such as extracts, additives, preservatives, natural and artificial sweeteners, flavors, acidulants, and nutraceuticals. Coffee is a well-accepted beverage and is considered to be a healthy replacement for carbonated soft drinks owing to which the demand for the product is likely to grow exponentially. RTD coffee is an excellent source of instant energy and is full of antioxidants, and thus, is accepted by youngsters as well as middle-aged working professionals.

RTD coffee offers convenience by using either coffee extract or brewed coffee that can be consumed in both cold and hot forms. It is well-accepted as a gourmet product and is broadly used by consumers to relax from their busy lifestyles. Manufacturers are not only striving to improve their sales and distribution network but also focusing on new innovative products with different flavors as a key strategy to expand their business. For instance, in April 2023, Chamberlain Coffee, a U.S. based coffee lifestyle brand, introduced a range of RTD plant-based lattes. These cold-brew lattes will be exclusively sold at Walmart stores and will come in four flavors: cinnamon bun, mocha, vanilla, and traditional cold brew. All the flavors are free from dairy and instead are crafted using coconut cream, almond milk, and natural sweeteners such as date syrup.

Packaging Insights

The market is segmented into canned, glass bottles, PET bottles, and others. The PET bottles led the market and accounted for a 33.7% revenue share in 2022. The ease of handling coupled with low manufacturing cost is boosting the demand for this type of packaging. In addition, the ability of PET bottles to be molded in different sizes and shapes and multiple colors has resulted in a large manufacturer adopting this type of packaging. Manufacturers use attractive packaging solutions to grab the consumer's attention and offer them a genuine and luxurious experience through their high-quality products.

The advantages of PET bottles include breakage resistance as compared to their glass counterparts, high durability, and less consumption of sources such as energy, time, and cost for manufacturing in contrast to glass bottles. The demand for PET bottles for the packaging of RTD tea and coffee is increasing due to its recyclability and reusability. PET bottles are easily recycled from various secondary products including pillow stuffing, carpet fibers, tote bags, and strapping materials. Lightweight plastic bottles reduce the cost of transporting materials to recycling centers. Thus, the multiple benefits of PET bottles over other packaging types contribute to its overall growth in the market.

Canned packaging stood as the second largest segment in 2022 and is projected to grow substantially over the forecast period. The growth is contributed by aspects such as flavor preservation and enhanced product shelf-life. The canned packaging of these beverages adds to the convenience of consumers. The manufacturers opt for canned packaging as it helps to accentuate the brand image of the product in the minds of consumers.

For instance, in January 2023, The RYL Company, a wellness-focused RTD tea brand, officially debuted in Wegmans and select Whole Foods Market stores across the Northeastern U.S.The company utilized its proprietary "Ryl Polyphenol Technology" to deliver a consistent 200mg of tea polyphenols in each can.Furthermore, these teas are formulated to be zero sugar, zero calories, and devoid of artificial ingredients. In addition, the products are packaged in fully recyclable aluminum cans, aligning with environmental sustainability efforts.

Price Insights

Economically-priced products dominated the market with a 62.6% share of the global revenue in 2022, owing to their wide availability and affordability.Economically-priced RTD tea and coffee products are easily available in grocery stores, convenience stores, and online retailers, making them highly accessible to consumers. Compared to premium or super-premium options, these economically-priced products are more affordable, making them an attractive choice for consumers seeking convenience and value for their money.

The premium-priced products are projected to register the fastest CAGR of 6.8% over the forecast period. This growth is driven by the rising consumer demand for top-notch, innovative RTD tea and coffee offerings. Consumers are becoming increasingly conscious of the quality of the food and beverages they consume and are willing to invest in premium products that they perceive as being of superior quality. This trend reflects their desire for an elevated and distinctive RTD tea and coffee experience, prompting the growth of the premium segment.

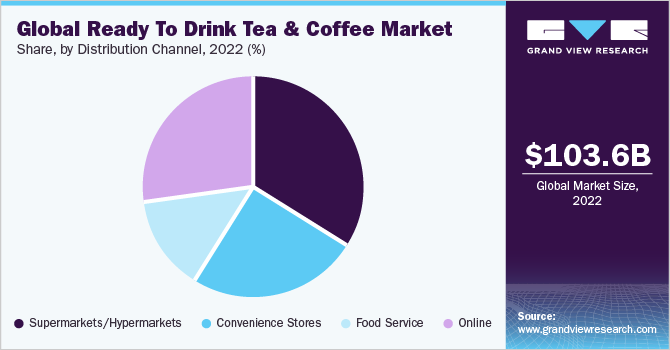

Distribution Channel Insights

With unique distribution strategies, RTD tea and coffee manufacturers can tap most of the global markets. The supermarkets/hypermarkets have made the largest contribution to the global market in terms of revenue, accounting for over 33.6% share in 2022. Changing retail landscape and growing number of supermarket chains as part of smart cities especially in densely populated countries such as India is fueling the sales of RTD tea and coffee through this distribution channel. In addition, the large amount of shelf space available in supermarkets/hypermarkets is responsible for the strong sales of RTD tea and coffee through this channel in 2022.

The progression of the food service industry as a distribution channel has drawn the attention of a large number of manufacturers. Foodservice distribution channel consists of a network of distributors that supply products to cafeterias, hotels & restaurants, and industrial caterers, among others. The rise in the culture of cafés and grab-and-go concepts around the globe is projected to drive the demand for RTD tea and coffee products through these channels.

Convenience stores are another distribution channel that holds the majority share of the distribution channel. These stores are growing around the globe owing to increasing urbanization and easy accessibility to consumers. In most developing economies, convenience stores are typically located within the residential townshipor in close-by areas, or near offices, making them convenient for busy customers to make quick purchases. It acts as a significant distribution network in countries such as Japan and China. These countries have been at the forefront of setting up convenience stores. The wide network of these stores is responsible for manufacturers giving them preference.

The online distribution segment is set to grow at the fastest pace over the forecast period, projected at a CAGR of 6.8% from 2023 to 2030. Rising internet penetration amongst consumers as well as target consumer marketing done by companies are likely to fuel the growth of this segment. Aggressive promotional activities by product manufacturers on various social media platforms are driving market growth. In addition, through online retail platforms, consumers can place orders effortlessly, while product manufacturers and vendors can reach audiences present in remote locations. With an online presence, the product manufacturers and vendors, can now operate at a minimal expense and invest increasingly in R&D activities for the improvement of their products.

Regional Insights

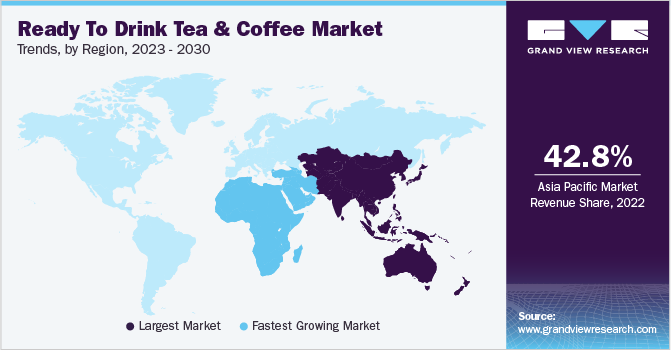

Asia Pacific market for RTD tea and coffee made the largest contribution to the global market, accounting for over 42.8% in 2022. Countries such as India, China, and Japan which have a high number of tea and coffee plantations drive the demand for the product in the region. The Asia Pacific region is anticipated to witness healthy growth over the forecast period, particularly in economies such as Indonesia and Thailand. In addition, the penetration of modern grocery retail chains in ASEAN countries including Malaysia, Thailand, Indonesia, and the Philippines is boosting the sales of RTD tea and coffee and therefore is expected to make remarkable growth in the forthcoming years.

Furthermore, the market in China for RTD tea and coffee emerged as a dominant market in the Asia Pacific region with a revenue share of 36.4% in 2022, owing to a large consumer base and changing lifestyle. The Australia & New Zealand market for RTD tea and coffee is expected to grow at a CAGR of 6.8% from 2023 to 2030. The market in India for RTD tea and coffee is expected to grow at a CAGR of 7.6% from 2023 to 2030, driven by changing consumer preferences, the rising popularity of convenience beverages, and the expanding urban population.

The Middle East & Africa RTD tea and coffee industry is expected to witness the highest growth with a CAGR of 7.5% from 2023 to 2030. The changing retail landscape coupled with the high consumption of these products is expected to provide a boost to the consumption of RTD products in the region. Moreover, outgrowing the foodservice sector in this region can further increase the demand for RTD tea and coffee. The product manufacturers are developing variants infused with fruity and floral flavors such as orange, apple, peach, rose, and lavender, and with enhanced taste using plant-based milk, which is projected to fuel the demand.

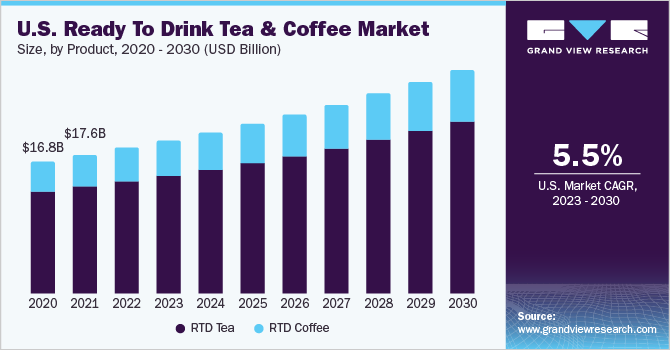

North America is expected to witness moderate growth wherein the growth is majorly driven by countries including the U.S. and Canada. The growth of the U.S. market is propelled by the rising importance being given to health and related habits. Higher consumer spending power, increase in consumer awareness about health benefits, and growing adoption of organically or naturally grown food & beverages over carbonated soft drinks are consolidating market growth in the region. In addition, manufacturers in the region are in constant competition to introduce new flavors to gain a competitive edge over each other.

Europe is expected to witness a steady CAGR of 5.8% over the forecast period. The fast-paced lifestyles of European consumers have led to an increased demand for convenient and portable beverage options. The introduction of innovative flavors, unique blends, and product variety in the RTD tea and coffee market has attracted consumer interest. For instance, in August 2022, German retailer Edeka launched a new private-label ice tea brand. The brand offers RTD iced tea in four flavors - mango-passion fruit, watermelon, raspberry-blueberry, and lemon-cactus fruit, in convenient 750 ml packs. Germany market for RTD tea and coffee emerged as a dominant market in Europe region with a revenue share of 17.4% in 2022. The UK market for RTD tea and coffee is expected to grow at a CAGR of 6.2% from 2023 to 2030.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In December 2022, MatchaKo introduced the first RTD premium matcha beverage certified as being organic, vegan, and Non-GMO. This product offers a healthier option with fewer calories compared to sugary drinks and distinguishes itself as the sole shelf-stable matcha drink holding both organic and non-GMO certifications. The matcha used in the beverage is sourced from Japan and is of superior ceremonial-grade quality.

-

In April 2022, Red Diamond Coffee & Tea expanded its RTD tea selection with an 11-oz. bottle to enhance its product line and address size gaps. These new single-serve bottles consist of just two or three ingredients, including water, tea leaves, and either sugar or Splenda for the sweetened variants. The company avoids using concentrate or preservatives in their RTD teas.

-

In July 2021, Bottleshot Cold Brew, a canned coffee brand, announced its expansion in the UK by securing its listing with Ocado for online sales and WHSmith Travel stores for online sales.

Some key playersin the global ready to drink tea and coffee market include:

-

Suntory Holdings Limited

-

Nestlé

-

The Coca Cola Company

-

Unilever

-

Asahi Group Holdings, Ltd.

-

PepsiCo

-

Starbucks Coffee Company

-

Monster Energy Company

-

Danone

-

AriZona Beverages USA

Ready To Drink Tea And Coffee Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 109.57 billion

Revenue forecast in 2030

USD 167.89 billion

Growth Rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, packaging, price, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Japan; China; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Suntory Holdings Limited; Nestlé; The Coca-Cola Company; Unilever; Asahi Group Holdings, Ltd.; PepsiCo; Starbucks Coffee Company; Monster Energy Company; Danone; AriZona Beverages USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ready To Drink Tea And Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the ready to drink tea and coffee market report based on product, packaging, price, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

RTD Tea

-

Black

-

Green

-

Fruit

-

Kombucha

-

Others

-

-

RTD Coffee

-

Cold brew coffee

-

Iced coffee

-

Flavored coffee

-

Others

-

-

-

Packaging Outlook (Revenue, USD Million, 2017 - 2030)

-

Canned

-

Glass Bottle

-

PET Bottle

-

Others

-

-

Price Outlook (Revenue, USD Million, 2017 - 2030)

-

Premium

-

Economy

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Food Service

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ready to drink tea and coffee market size was estimated at USD 103.62 billion in 2022 and is expected to reach USD 109.57 billion in 2023.

b. The ready to drink tea and coffee market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 167.89 billion by 2030.

b. The RTD tea products dominated the market and accounted for a 62.0% share of the global revenue in 2022. Some of the commonly consumed RTD tea variants include black, green, fruit, herbal, matcha, oolong and iced. Owing to the increasing working population and hectic schedules of professionals’ demand for the product has escalated significantly. Growing preferences for carbonated RTD tea among consumers are driving the segment growth. Further, as global soda consumption has been declining consistently due to its health hazards, it is creating an ideal opportunity for the product manufacturers of RTD tea and coffee to capitalize on the market and gain shares in the global arena

b. Some of the key market players in the ready to drink tea and coffee market are SUNTORY HOLDINGS LIMITED; Nestlé; The Coca Cola Company; Unilever; ASAHI GROUP HOLDINGS, LTD.; PepsiCo; Starbucks Coffee Company; Monster Energy Company; Danone; AriZona Beverages USA, among others.

b. The factors such as the rise in on-the-go consumption patterns, particularly among urban populations and younger demographics, and the availability of a wide range of flavors and varieties in the Ready to drink tea and coffee market are significant drivers of market growth. Additionally, the shift in consumer preferences towards healthier and more convenient options has fueled the growth of the Ready to drink tea and coffee market. Furthermore, the health and wellness trends have driven the inclusion of functional ingredients, natural and clean label formulations, specific health claims, specialty varieties, and reduced sugar content in the Ready to drink tea and coffee market, meeting the demands of health-conscious consumers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."