- Home

- »

- IT Services & Applications

- »

-

Real Estate Software Market Size And Share Report, 2030GVR Report cover

![Real Estate Software Market Size, Share & Trends Report]()

Real Estate Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Contract Software, Customer Relationship Management Software), By Deployment (Cloud, On-premise), By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-822-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Real Estate Software Market Summary

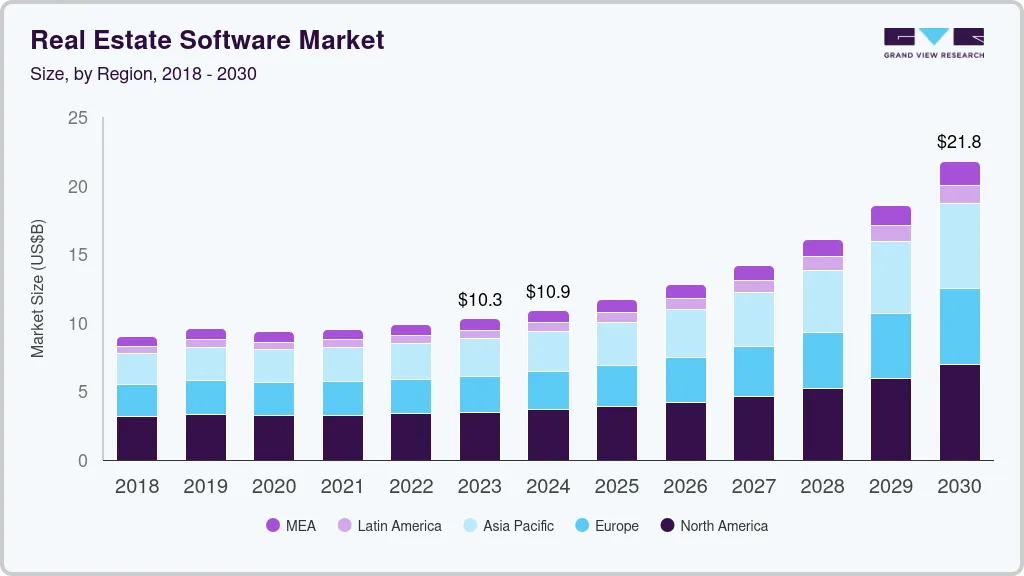

The global real estate software market size was evaluated at USD 10,285.7 million in 2023 and is projected to reach USD 21,766.9 million by 2030, growing at a CAGR of 11.3% from 2024 to 2030. The interruption of many construction activities across the globe during the COVID-19 pandemic led to a small decline in the market.

Key Market Trends & Insights

- North America held the major share of 34.08% of the target market in 2022..

- Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 13.7%.

- By type, the customer relationship management software segment accounted for the largest market share of 27.20% in 2022.

- By deployment, the cloud segment accounted for a market share of 52.37% in 2022.

- By application, the residential segment accounted for a market share of 52.40% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 10,285.7 Million

- 2030 Projected Market Size: USD 21,766.9 Million

- CAGR (2024-2030): 11.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

However, it is expected to recover post-pandemic due to the increased digitization of existing customer data and records, which help clients predict purchasing behavior and customer trends. Population growth and rapid urbanization have led to a rise in major infrastructure development projects using smart solutions in recent years. Furthermore, the adoption of new software technologies such as cloud and artificial intelligence across several applications in the real estate market is also driving the growth. Real estate software helps increase the productivity of businesses as they work in various areas such as social media, online advertising, and websites, leading to higher demand for efficient software tools. Moreover, factors such as the increased digitization of real estate businesses and improvements in automation technologies have positively impacted the market in recent years. Additionally, the demand for better data management strategies and sensitive data protection is pushing firms to use a variety of software solutions and boost client retention.

Key vendors in the real estate software market are adopting various technologies to offer products more relevant to the various needs of customers. Virtualization and adoption of Virtual Reality (VR) are expected to favor market growth as they help save time and resources, expand reach to include long-distance buyers, and increase user engagement. Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are allowing businesses to automate time-consuming tasks, resulting in a better ROI.

For instance, IBM TRIRIGA included new AI capabilities in its real estate software. The new features are expected to help facility and real estate managers optimize office spaces and improve their workplace experience. Additionally, blockchain technology and smart contracts are helping simplify transactions and reduce the number of stakeholders, leading to a greater level of transparency.

Real estate software is employed to automate various processes or tasks and speed up the workflow. Internal teams such as sales and marketing, finance, and top management can better analyze the customer journey by monitoring the different segments of the real estate software, gathering information about leads, managing dashboards for employees, and tracking financial data for orders.

These factors could facilitate the growth of the real estate software market in the near future. However, the high investments required and the high training cost of the workforce could hamper the market growth to a certain extent. Property management businesses are transitioning to online platforms, which could further increase the cost of real estate software and hamper the growth of the market.

Type Insights

The customer relationship management software segment accounted for the largest market share of 27.20% in 2022. CRM software supports realtors in staying organized, moving tenants, following up with potential buyers, and closing sales deals on properties. CRM software also helps improve productivity and efficiency by speeding up routine processes and keeping customers and clients up to date about recent updates. The adoption of smart technologies and enterprise applications for project management could further drive the segment’s growth. Additionally, the rising demand for CRM solutions for ensuring the security of sensitive information could have a positive impact on the CRM software segment.

The contract software segment is anticipated to grow at a CAGR of 13.5% during the forecast period. Contract management software can assist in tightening inspection, compliance with regulatory requirements, reducing investor fears, and building customer trust. Data privacy regulation compliance facilitates protection from internal and external security threats, thus building trust among real estate customers. The adoption of digital technologies such as e-signatures and AI-assisted contract management are driving the growth of this segment.

Deployment Insights

The cloud segment accounted for a market share of 52.37% in 2022. Cloud-based software provides faster and more efficient data access to real estate companies, thus increasing their workflow productivity. Moreover, efficient management of large volumes of data is possible through the cloud deployment model that has higher security standards. The significant growth in construction activities globally is expected to drive the usage of cloud technologies to better manage businesses and help improve efficiency and productivity by using data to streamline processes.

The on-premise segment is anticipated to grow at a CAGR of 12.0% during the forecast period. As compared to the on-premise deployment model, the cloud model does not require additional hardware, making it cost-efficient and economical for small-scale businesses. Furthermore, the storage capacity of the cloud can be easily upgraded or downsized based on requirements and the pay-as-you-go feature makes it more attractive. Moreover, cloud-based construction and project management solutions offer organizations functionalities such as project management, scheduling, and automating tasks into a single dashboard, which could deflate the demand for on-premise solutions.

Application Insights

The residential segment accounted for a market share of 52.40% in 2022. Real estate software demand in the residential and commercial sectors has seen significant growth in recent years. The rising preference for homeownership and constantly rising residential property prices are also driving the demand for real estate software. Buildings have seen an increase in modern infrastructure and commercial spaces have grown significantly in previous years.

The commercial segment is anticipated to grow at a CAGR of 13.7% during the forecast period. Real estate software helps residential and commercial property builders to track associated activities such as transaction updates, storage of property management, legal documents, and easy handling of property accounts. Many countries have also seen an increase in the number of retail shops that require knowledge about property and building leases. Real estate software solutions can assist businesses and customers to acquire relevant knowledge.

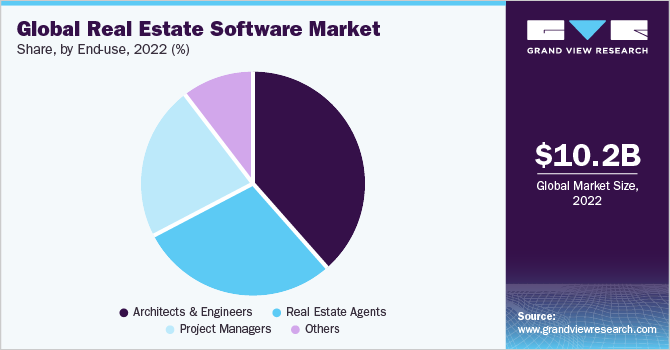

End-use Insights

The architects & engineers segment accounted for a market share of 37.66% in 2022. The segment is expected to continue to dominate the market during the forecast period as well. The rising demand for commercial and residential real estate is compelling architects and engineers to spend increasing time developing feasibility reports for new projects. Real estate software ensures the easy and quick generation of these reports, allowing engineers and architects to focus on their core tasks. Additionally, real estate software helps provide interactive, virtual tours of properties that can be used by architects to provide customers with a better understanding of their designs.

The real estate agents segment is anticipated to grow at a CAGR of 13.1% during the forecast period. The real estate agents segment is expected to emerge as the fastest-growing segment over the forecast period. This can be attributed to the increase in the adoption of digital technologies such as VR, AI, and blockchain in the real estate industry. Real estate agents have started adopting digital technologies such as remote property viewing, remote marketing and sales, and digital management of properties to attract and retain customers. For instance, the Zoho CRM software built for real estate agents offers property management, sales process management, and automation features for real estate agents and real estate developers.

Regional Insights

North America held the major share of 34.08% of the target market in 2022. An increase in urbanization and infrastructure development activities and the adoption of new technologies for various commercial and residential applications are positively impacting the market growth in this region. The COVID-19 pandemic has significantly impacted consumer and business sentiments in the region, leading to the low growth rate of the construction industry. However, the industry is expected to recover in 2021 due to a rise in infrastructure investments and an increased focus on smart city projects.

Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 13.7%. Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The growth is attributed to the favorable development of regional economies and the promising expansion of the construction industry. The region is considered a major market for real estate software due to the growth of the real estate sector in India, Singapore, Japan, China, and Southeast Asian countries. Other key factors driving the demand for real estate software in the region include the implementation of advanced technology and favorable government and regulatory norms.

Key Companies & Market Share Insights

The key players operating in the market include Accruent; Altus Group Ltd.; Autodesk Inc.; CoStar Realty Information Inc.; Microsoft Corporation; MRI Software LLC; Oracle Corporation; RealPage Inc.; SAP SE; SMR Group; and Trimble Inc. To broaden their product offering, industry companies utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In April 2021, MRI Software acquired Manhattan, Trimble’s real estate and workplace solutions business, to enhance its workplace management offerings. Some prominent players in the global real estate software market include:

-

Accruent

-

Altus Group

-

Altus Group Ltd.

-

Autodesk Inc.

-

CoStar Realty Information Inc.

-

Microsoft Corporation

-

MRI Software LLC

-

Oracle Corporation

-

RealPage Inc.

-

SAP SE

-

SMR Group

-

Trimble Inc.

-

Yardi Systems Inc.

Real Estate Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10,882.2 million

Revenue forecast in 2030

USD 21,766.9 million

Growth rate

CAGR of 11.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report update

June 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Accruent; Altus Group Ltd.; Autodesk Inc.; CoStar Realty Information Inc.; Microsoft Corporation; MRI Software LLC; Oracle Corporation; RealPage Inc.; SAP SE; SMR Group; Trimble Inc.; Yardi Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Real Estate Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global real estate software market report based on type, deployment, end-use, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Customer Relationship Management Software

-

Enterprise Resource Planning Software

-

Property Management Software

-

Contract Software

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architects & Engineers

-

Project Managers

-

Real Estate Agents

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commerical

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global real estate software market size was estimated at USD 10.24 billion in 2022 and is expected to reach USD 10.89 billion in 2023.

b. The global real estate software market is expected to grow at a compound annual growth rate of 12.8% from 2023 to 2030 to reach USD 25.39 billion by 2030.

b. North America dominated the real estate software market with a share of over 34.08% in 2022. An increase in urbanization and infrastructure development activities and the adoption of new technologies for various commercial and residential applications are positively impacting the market growth in this region.

b. Some key players operating in the real estate software market include Accruent, Altus Group Ltd., Autodesk Inc., CoStar Realty Information Inc., Microsoft Corporation, MRI Software LLC, Oracle Corporation, RealPage Inc., SAP SE, SMR Group, and Trimble Inc.

b. Key factors that are driving the real estate software market growth include the growing population and rapid urbanization has led to a rise in major infrastructure development projects using smart solutions in recent years. Furthermore, the adoption of new software technologies such as cloud and artificial intelligence across several applications in the real estate market is also driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.