- Home

- »

- Healthcare IT

- »

-

RTLS In Healthcare Market Size, Share Analysis Report 2030GVR Report cover

![RTLS In Healthcare Market Size, Share & Trends Report]()

RTLS In Healthcare Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (RFID, Wi-Fi), By Application, By Facility Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-136-7

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

RTLS In Healthcare Market Size & Trends

The global RTLS in healthcare market size was estimated at USD 2.04 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 18.69% from 2023 to 2030. The growth of the market depends on several factors, including increasing demand for asset tracking, growing focus on workflow optimization, and need for improved patient safety. Real Time Location System (RTLS) help healthcare facilities to increase the safety and security of their patients, assets, and staff by delivering real-time location information. Medical institutions, hospitals, and senior living facilities prioritize the safety & security of individuals and property. Patient monitoring, movement management, and access control are among the most crucial parameters to be monitored in a hospital setting. By providing real-time location data, RTLS solutions enable healthcare organizations to increase the safety and security of their personnel, patients, and assets.

The combination of advanced RTLS solutions with security systems, such as access control systems and infant protection systems, can enhance overall security and protect infants and patients by preventing unauthorized visitors from entering certain zones. Thus, RTLS solutions are in high demand in the healthcare industry to satisfy the need for security & safety of patients and valuable assets due to their capacity to protect the facility, patients, and personnel.

With a growing global population and number of patients, patient safety has become a primary and crucial public health concern. WHO predicts that medication errors will result in one death per million individuals in 2022. With a population of 447 million, there are 163,000 annual fatalities in the EU. According to statistics from Spain, Germany, and the United States, between 60 thousand and 131 thousand individuals die annually in Europe. The majority of medical errors are attributable to adverse drug reactions, specimen misidentification, and incorrect blood transfusion, which are primarily caused by incorrect patient and medication identification. The Food and Drug Administration (FDA) estimates that introducing integrated IT infrastructure can prevent 50% of medical errors caused by misidentification.

Furthermore, since the COVID-19 pandemic, hospitals have faced unprecedented challenges. Ageing populations and staff shortages, which place immense pressure on institutions, physicians, employees, patients, and communities, are two additional significant challenges facing the healthcare industry. Doctors, hospitals, and clinics are searching for methods to reduce costs and increase efficiency while still providing patients with the necessary level of care. According to the World Health Organisation, the global shortage of healthcare workers could reach 10 million by 2030, with clinicians facing increasing responsibilities. In addition to monetary challenges, there are also safety hurdles. In a hectic healthcare setting, it is impossible to guarantee that every patient will be monitored at all times, resulting in risky circumstances where patients go unnoticed. Therefore, the demand for real-time location systems to manage and monitor patients in real-time may increase in the future years.

The COVID-19 outbreak has contributed to market growth, especially in the healthcare industry. As a result of the pandemic, hospitals were using RTLS technology to handle patients and staff more and more. RTLS tools, which use wireless communications to identify and track assets and equipment, have been used a lot in the healthcare industry. This technology makes care teams more efficient and accountable during public health situations.

Application Insights

Based on the application, the asset tracking segment held the largest market share in 2022. The segment involves tracking and managing medical equipment, devices, and supplies in real-time, which contributes to improving operational efficiency, reducing asset loss, and enhancing patient care. This segment revolves around real-time tracking and management of medical equipment, devices, and supplies, thereby enhancing operational efficiency, reducing asset loss, and elevating patient care.

The continuous technological advancements in this field and the evident benefits of its utilization underscore the growth prospects during the forecast period. For instance, in April 2023, Energous Corporation and InnoTractor collaborated to integrate wireless power solutions for real-time asset tracking in the rapidly growing IoT-driven sectors. This partnership amalgamates Energous' PowerBridge technology with Wiliot's IoT Pixel tags, resulting in cost-effective, portable, and sustainable asset tracking solutions.

The personnel tracking segment held a significant share of the market in 2022 and is anticipated to expand at a healthy CAGR over the forecast period. The growing adoption of personnel tracking in the RTLS market for healthcare is driven by its significant impact on enhancing staff coordination, patient care, and operational efficiency. As healthcare facilities strive for seamless operations and improved patient outcomes, the demand for personnel tracking solutions is set to rise, driving market expansion.

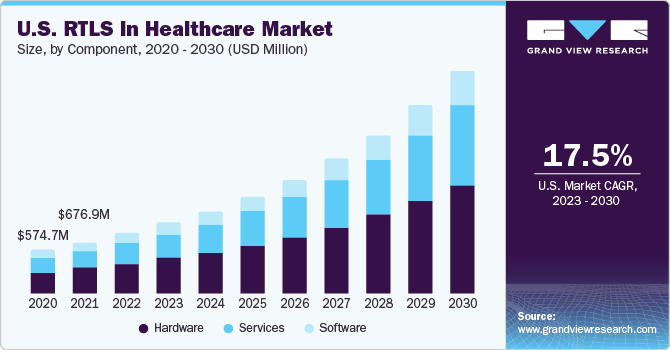

Component Insights

Based on the component, the market is segmented into hardware, software, and services. The hardware segment held the largest market share of more than 47% in 2022. Hardware components like RFID tags, sensors, and communication infrastructure are essential for RTLS functionality. They enable real-time tracking and data collection of assets, patients, and personnel. As accurate tracking is the backbone of RTLS, investment in reliable hardware is critical.

The service segment, encompassing essential components like consulting, support, maintenance, deployment, and integration, is anticipated to grow at the highest CAGR of 19.68% during the forecast period. This surge can be attributed to the increasing recognition of the pivotal role these services play in optimizing operational efficiency, ensuring seamless technology adoption, and enhancing overall customer experience. As businesses continue to prioritize holistic solutions, the service segment's CAGR reflects its pivotal value in driving successful technology implementation and long-term customer satisfaction.

Facility Type Insights

Based on facility type, the market is classified into hospitals & healthcare facilities, and senior living segments. In 2022, the hospitals & healthcare facilities segment held the largest share of the market of approximately 88%. According to the American Hospital Association (AHA), around 25% to 30% of healthcare systems in the United States use some sort of asset tracking.

RTLS is frequently deployed in specific locations or for high-value assets before being implemented hospital-wide or for specific use cases. According to HIMSS, Texas Health Presbyterian Dallas Hospital saved USD 412,000 in the first year after implementing RTLS. Furthermore, according to Health Facilities Management, Stamford Hospital gained patient bed days after a seven-month trial of RTLS, resulting in a USD 627,000 savings.

Furthermore, the hospitals and healthcare facilities are expected to increase significantly. This can be attributable to a variety of factors, including the adoption of RTLS technology to avoid counterfeit medications, guaranteeing patient safety, and cost savings linked with supply chain management, which are the primary factors driving the segment's growth.

Technology Insights

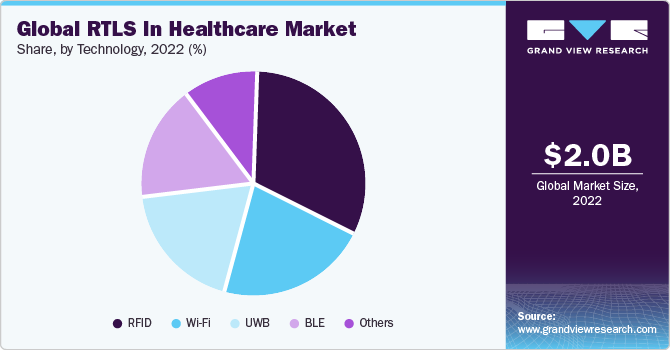

Based on technology, the market is classified into RFID, Wi-Fi, BLE (Bluetooth Low Energy), UWB, and others segments. RFID held the largest market share of more than 29% in 2022 and is anticipated to grow at a CAGR of 19.10% over the forecast period. It is widely adopted for applications like patient tracking, asset management, and supply chain optimization. Continuous technological advancements by market players in RFID, along with its growing usage, underscore substantial opportunities for market expansion. For instance, in May 2023, Fresenius Kabi introduced RFID-enabled Rocuronium Bromide Injection, aligning with the rising demand for RFID technology in healthcare. This move streamlines inventory management, reduces errors, and enhances patient safety, complementing the findings of a recent ASHP Foundation study.

Furthermore, UWB is one of the most rapidly increasing technologies, and the UWB-based RTLS market for healthcare has enormous growth potential over the projected period. This technology works similarly to active RFID in that the tag continuously emits RF energy into the surroundings for receivers to pick up on. UWB is becoming increasingly popular because of benefits such as high precision, extended battery life, high capacity, and quick update rates. Due to these benefits, UWB technologies are suited for high-precision applications in healthcare organizations or facilities.

Regional Insights

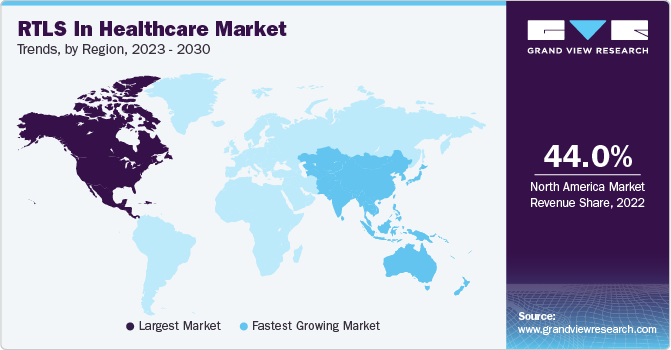

In 2022, North America held the largest market share of over 44% in the market. The adoption of RTLS within the healthcare industry has gained significant momentum, contributing to substantial market growth. This trend is indicative of North America's substantial influence in driving the utilization of RTLS solutions, emphasizing the region's commitment to innovation and its endeavor to improve operational efficiency and patient outcomes across the region. Furthermore, major advancements in RFID technology, as well as the presence of prominent market competitors in the region, are driving market growth.

On the other hand, Asia Pacific is projected to witness the fastest CAGR of 20.52% over the forecast period. This growth can be attributed to the increasing number of hospitals in the region and their growing demand for efficient supply chain management. Furthermore, the presence of a significant pharmaceutical sector and expanding healthcare infrastructure are important factors influencing regional growth.

Key Companies & Market Share Insights

The RTLS market in healthcare is relatively competitive, with companies constantly attempting to deliver customized solutions and pursuing chances for mergers, acquisitions, partnerships, new product launches, and market development. Some prominent players in the global RTLS in healthcare market include:

-

Securitas Healthcare, LLC

-

Zebra Technologies Corp.

-

Hewlett Packard Enterprise Development LP

-

Impinj, Inc.

-

TeleTracking Technologies, Inc.

-

CenTrak, Inc.

-

GE HealthCare

-

UBISENSE

-

Oracle Corporation

-

AiRISTA Flow, Inc.

-

Sonitor Technologies

-

Midmark Corporation

RTLS In Healthcare Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 2.40 billion

The revenue forecast in 2030

USD 7.96 billion

Growth rate

CAGR of 18.69% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, facility type, region

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Securitas Healthcare, LLC.; Zebra Technologies Corp.; Hewlett Packard Enterprise Development LP; Impinj, Inc.; TeleTracking Technologies, Inc.; CenTrak, Inc.; GE HealthCare; UBISENSE; Oracle Corporation; AiRISTA Flow, Inc; Sonitor Technologies; Midmark Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global RTLS In Healthcare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global RTLS in healthcare market report based on component, technology, application, facility type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID

-

Wi-Fi

-

UWB

-

BLE

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Inventory/Asset Tracking & Management

-

Personnel Locating & Monitoring

-

Access Control & Security

-

Environmental Monitoring

-

Supply Chain Management & Automation

-

Others

-

-

Facility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Healthcare Facilities

-

Senior Living Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RTLS in healthcare market size was estimated at USD 2.04 billion in 2022 and is expected to reach USD 2.40 billion in 2023.

b. The global RTLS in healthcare market is expected to grow at a compound annual growth rate of 18.69% from 2023 to 2030 to reach USD 7.96 billion by 2030.

b. North America dominated the RTLS in healthcare market with a share of more than 40% in 2022. This is attributable to major advancements in RFID technology, as well as the presence of prominent market competitors in the region.

b. Some key players operating in the RTLS in healthcare market include Securitas Healthcare, LLC.; Zebra Technologies Corp.; Hewlett Packard Enterprise Development LP; Impinj, Inc.; TeleTracking Technologies, Inc.; CenTrak, Inc.; GE HealthCare; UBISENSE; Oracle Corporation; AiRISTA Flow, Inc; Sonitor Technologies; and Midmark Corporation

b. Key factors that are driving the market growth include increasing demand for asset tracking, growing focus on workflow optimization, and need for improved patient safety.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."