- Home

- »

- Advanced Interior Materials

- »

-

Reciprocating Air Compressor Market, Industry Report, 2030GVR Report cover

![Reciprocating Air Compressor Market Size, Share & Trends Report]()

Reciprocating Air Compressor Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology, By Lubrication (Oil Free, Oil Filled), By Type (Stationary, Portable), By Application (Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-116-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Reciprocating Air Compressor Market Summary

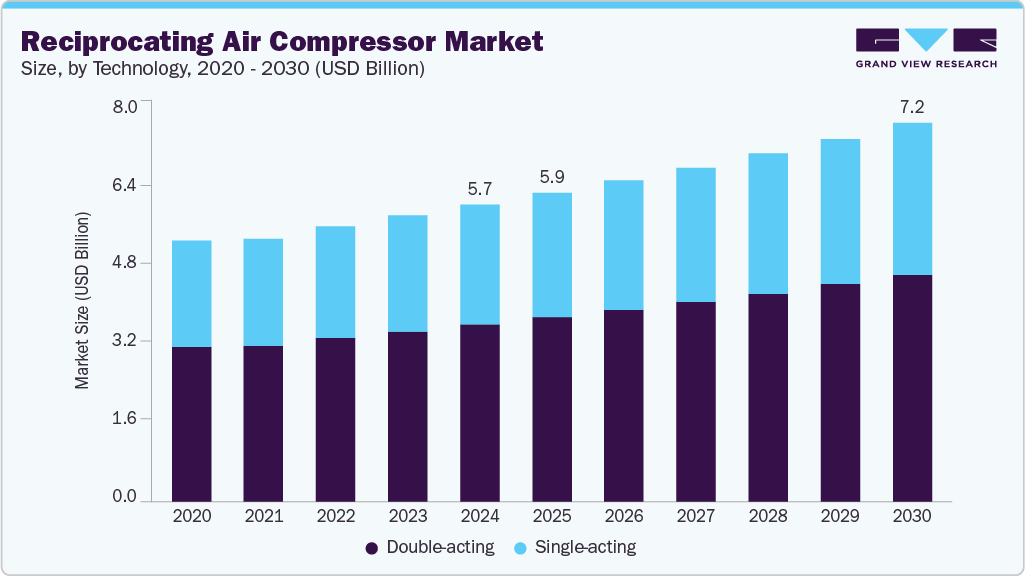

The global reciprocating air compressor market size was estimated at USD 5.67 billion in 2024 and is anticipated to reach USD 7.23 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. Reciprocating air compressors are employed in various sectors, including manufacturing, chemical, and oil & gas.

Key Market Trends & Insights

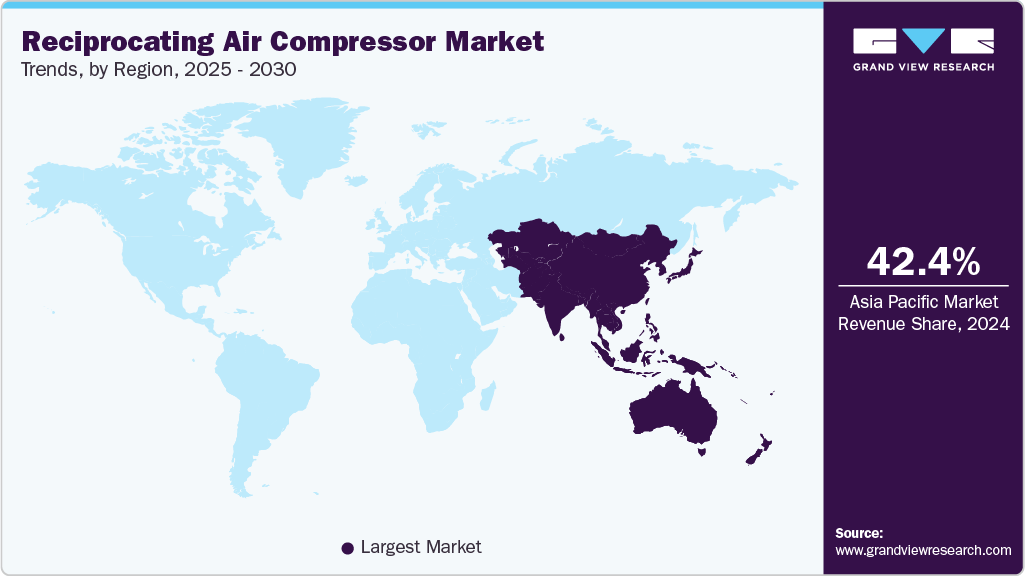

- The Asia Pacific reciprocating air compressor market dominated the global market, with a revenue share of 42.4% in 2024.

- China dominated the Asia Pacific reciprocating air compressor market with the largest revenue share in 2024.

- By technology, the double-acting segment dominated the reciprocating air compressor industry, accounting for the largest revenue share of 59.6% in 2024.

- By lubrication, the oil filled reciprocating air compressor dominated the market with the largest revenue share in 2024.

- By type, the stationary segment dominated the reciprocating air compressor industry with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.67 Billion

- 2030 Projected Market Size: USD 7.23 Billion

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

Moreover, these compressors are versatile and find applications in many other industries and processes due to their ability to provide high-pressure air for various tasks. For instance, the automotive sector relies on reciprocating air compressors for assembly, painting, and repair.According to the U.S. Department of Agriculture, as of 2023, there are many food & beverage processing plants in the U.S. according to the Census Bureau's County Business Patterns. Food & beverage processing plants are located throughout the U.S. California had the most food & beverage manufacturing plants (6,116), while Texas (2,625) and New York (2,600) were also leading food & beverage manufacturing states. Thus, the growing food & beverage industry is expected to propel the demand for reciprocating air compressor industry over the forecast period.

In the food processing and packaging industry, compressed air is utilized for controlling actuators and valves in computerized lines used for bottling, packaging, and filling different products. The presence of oil in compressed air can result in the jamming of bottling, packaging, and filling equipment, causing slowdowns in assembly lines. In addition, as compressed air is also used for supplying oxygen to bacteria during the fermentation of food products, the presence of even a minor amount of oil in it disturbs bacterial activities resulting in the spoilage of end products. These factors are further anticipated to propel the market demand over the forecast period.

Clean air is essentially used in the healthcare industry for manufacturing pills. It is also utilized in culture vessels, aeration tanks, and the packaging of pills. Moreover, reciprocating air compressors are the main components used in medical air systems for transforming power into potential energy present in pressurized air. As the use of compressed air is extended to artificial respiration systems, surgical instruments, and other medical systems, it is anticipated to fuel the global demand for oil-free reciprocating air compressors in the coming years. For instance, ELGI EQUIPMENTS LIMITED provides oil-free air compressors for transporting medical gas used in anesthetic conditions.

Technology Insights

The double-acting segment dominated the reciprocating air compressor industry, accounting for the largest revenue share of 59.6% in 2024. These have crossheads that, in conjunction with the crankshaft and connection rod, produce an entirely straight movement. Due to the higher cost of construction, this technique is exclusively employed in heavy-duty industrial and process compressors starting at 45kW. These aforementioned factors are anticipated to augment the market demand in the coming years. For instance, AF Compressors offer oil-free double-acting reciprocating compressors.

The single-acting segment is expected to grow at a significant CAGR of 4.0% over the forecast period. Single-acting reciprocating air compressors are used in various industries where compressed air is needed. They are well-suited for tasks that require intermittent or moderate levels of compressed air.

When a modest air volume is needed, reciprocating compressors are intended to be utilized sporadically. They are ideal for workshops, home improvement projects, small companies, and construction activities. If the compressor is idle for around 33% of the time, using a reciprocating air compressor is preferable over a rotational compressor. After prolonged periods of downtime, rotary compressors may not perform as well.

Lubrication Insights

The oil filled reciprocating air compressor dominated the market with the largest revenue share in 2024. Oil-filled reciprocating air compressors are suitable for a wide range of industrial applications where the compressed air quality requirements are not as stringent. They are commonly used in manufacturing, automotive repair, construction, and other industrial settings. Further, these can deliver higher pressure and larger air volumes, making them suitable for heavy-duty and high-demand applications.

The oil free segment is expected to grow at the fastest CAGR over the forecast period. Oil-free compressors are essential in applications where the compressed air must be completely free of oil contamination. Industries such as pharmaceuticals, food & beverage, electronics manufacturing, and medical equipment rely on oil-free compressors to ensure the purity of their products and processes. Clean rooms or laboratories, benefit from oil-free reciprocating air compressors. Furthermore, these are preferred for painting and finishing applications where oil particles in the compressed air can reduce the quality of the finish. In addition, these are commonly used in dental and medical equipment, such as dental chairs and breathing apparatus, to maintain a clean and sterile air supply.

Type Insights

The stationary segment dominated the reciprocating air compressor industry with the largest revenue share in 2024. This is due to the high adoption of reciprocating air compressors in the manufacturing sector. A stationary reciprocating air compressor is used in oil refineries, gas processing, chemical, and other industries. In addition, in the oil & gas sector, these compressors are widely used for operating pneumatic equipment for oil extraction & refining, pipelines, and other processes. These aforementioned factors are anticipated to propel the market demand over the forecast period.

For instance, Kaeser offers stationary reciprocating compressors that offer exceptional versatility such as the EUROCOMP series compressors that are designed and constructed for workshop use. In addition, Ingersoll Rand designs and produces robust, single-stage, two-stage reciprocating compressors, as well as related accessories, that are perfect for enterprises like car body shops, small garages, and do-it-yourself projects. A variety of types are available, including portable and lubricated systems. The reciprocating solutions have renewable components that are simple and inexpensive to maintain.

The portable reciprocating air compressor is expected to grow at the fastest CAGR over the forecast period. This is due to the rising adoption of these products in construction and mining activities. Portable reciprocating air compressors are a reliable power source for machines and tools in the construction industry and several other sectors. Furthermore, portable compressors require less maintenance and are easy to handle, so their demand is increasing in low-duty applications. For instance, in May 2022, Elgi Equipments unveiled its new range of energy-efficient, high-performance, and reliable portable air compressors at EXCON 2022. The company introduced two models at the event: the electric-powered PG 110E-13.5 and the diesel-powered PG 575-225.

Application Insights

The manufacturing sector led the reciprocating air compressor industry with the largest revenue share in 2024. These compressors excel at delivering high-pressure air, which is essential for various industrial applications such as powering pneumatic tools, operating machinery, and managing material handling processes. Furthermore, the growing manufacturing industry has given rise to its demand.

The food & beverage sector is expected to grow at the fastest CAGR over the forecast period. Reciprocating air compressors have gained popularity in the food & beverage industry because they provide clean and contaminant-free compressed air. As the oil can contaminate products and compromise their quality, the food & beverage industry requires compressed air free of oil and other contaminants, resulting in a growing demand for reciprocating air compressors in this industry. Companies operating in the food & beverage industry are constantly looking for opportunities to reduce their carbon footprint and energy consumption, which can be achieved by adopting oil-free air compressors. These compressors use less energy and produce less heat, which results in lower operating costs and minimum environmental impact.

The oil & gas application segment held 13.5% of the global market share in 2024. Reciprocating air compressors are widely used in the oil & gas industry, where they perform a crucial role in various upstream, midstream, and downstream processes. The compressors are designed to deliver clean, dry, and contaminant-free compressed air, making them a good option for drilling, well completion, and pipeline maintenance applications. Oil-free reciprocating air compressors require less maintenance than oil-lubricated reciprocating compressors, which improves system reliability and lowers the risk of costly downtime in oil & gas applications.

Regional Insights

The North America reciprocating air compressor market held a substantial market share in 2024 due to various factors, including environmental concerns, stricter regulations, and the need for higher air quality in critical industry applications. Reciprocating air compressors are widely used in industries such as food & beverage, pharmaceuticals, electronics, automotive, and healthcare, where the quality of compressed air is crucial to maintain product integrity, product quality, and ensure operational efficiency.

The U.S. reciprocating air compressor market dominated the North American market, accounting for the largest revenue share in 2024. Industrial & oil & gas demand and tech innovation & energy efficiency are driving the market growth in the U.S.

Europe Reciprocating Air Compressor Market Trends

The Europe reciprocating air compressor market held a substantial market share in 2024. The growing manufacturing industry in the region is a major contributor to the reciprocating air compressor industry. Germany is a leading European importer and exporter, generating USD 930 billion from manufacturing in 2023. Meanwhile, Italy, renowned for its industrialization and manufacturing expertise, produced USD 350 billion

Asia Pacific Reciprocating Air Compressor Market Trends

The Asia Pacific reciprocating air compressor market dominated the global market, with a revenue share of 42.4% in 2024. The region has a growing healthcare industry with increasing demand for medical facilities. Oil-free reciprocating air compressors are widely used in medical and pharmaceutical settings, such as air systems, dental clinics, and labs, driving regional demand. In some countries, regulations mandate their use, especially in pharmaceutical manufacturing. Countries such as China, Japan, and India significantly contribute to the global automotive industry.

China dominated the Asia Pacific reciprocating air compressor market with the largest revenue share in 2024. The growth is driven by rising industrial activity in sectors such as automotive, railways, and construction, along with the growing use of automation and smart technologies in manufacturing.

Key Reciprocating Air Compressor Company Insights

Some of the major companies in the reciprocating air compressor market include Cook Compression, Chart Industries, Frank Compressors, and Galaxy Auto Service Equipment Co.,Ltd.

-

Cook Compression specializes in advanced sealing solutions and performance services for reciprocating compressors. It serves industries such as oil and gas, refining, and petrochemicals.

-

Chart Industries manufactures highly engineered equipment for the industrial gas, energy, and biomedical sectors. The company provides cryogenic systems and technologies for gas liquefaction, storage, and transportation.

Key Reciprocating Air Compressor Companies:

The following are the leading companies in the reciprocating air compressor market. These companies collectively hold the largest market share and dictate industry trends.

- Cook Compression

- Chart Industries

- Frank Compressors

- Galaxy Auto Service Equipment Co.,Ltd.

- IDEX Corporation

- General Electric Company

- Ingersoll Rand

- KAESER KOMPRESSOREN

- MAT Holding, Inc.

- Gardner Denver

- ELGi

- Sollant Group

- Atlas Copco AB

- BAUER GROUP

Recent Developments

-

In April 2025, MANN+HUMMEL revamped its compressed air system with the help of Pattons, (Elgi Equipments Limited’s U.S. arm). The upgrade saved annual costs by over USD 160,000 and reduced consumption by 2 million kWh.

-

In February 2025, ELGi unveiled STABILISOR. This groundbreaking compressed air stabilization technology addresses key challenges, including inefficiency, unstable compressor performance, and excessive wear due to frequent load/unload cycles.

Reciprocating Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.89 billion

Revenue forecast in 2030

USD 7.23 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, lubrication, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Cook Compression; Chart Industries; Frank Compressors; Galaxy Auto Service Equipment Co.,Ltd.; IDEX Corporation; General Electric Company; Ingersoll Rand; KAESER KOMPRESSOREN; MAT Holding, Inc.; Gardner Denver; ELGi; Sollant Group; Atlas Copco AB; and BAUER GROUP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reciprocating Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reciprocating air compressor market report based on technology, lubrication, type, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-acting

-

Double-acting

-

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil Free

-

Oil Filled

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Portable

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Food & Beverage

-

Semiconductor & electronics

-

Healthcare/Medical

-

Oil & Gas

-

Home Appliances

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reciprocating air compressor market size was estimated at USD 5.26 billion in 2022 and is expected to be USD 5.45 billion in 2023.

b. The reciprocating air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 7.22 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 41.9% of the global market share in 2022. The region has a growing healthcare industry with increasing demand for medical facilities. Reciprocating oil free air compressors are commonly used in medical applications and pharmaceutical companies, including in medical air systems, dental clinics, and laboratories, which is expected to drive market demand in the region.

b. Some of the key players operating in the reciprocating air compressor market include Atlas Copco, Bauer Group, BelAire Compressors, Cook Compression, Compressor Products International (CPI), Frank Compressors, Galaxy Auto Stationary Equipment Co. Ltd., Gast Manufacturing, Inc., GENERAL ELECTRIC, Ingersoll Rand Plc, Kaeser Compressors, MAT Industries, LLC, Gardner Denver, ELGi, Sollant Group.

b. The market is expected to be driven by proper conditioning of the air offered by Reciprocating air compressors are employed in a variety of sectors, including manufacturing, oil & gas, chemical, and electrical generation. To address the shortcomings of conventional production procedures, several industries have introduced cost-effective manufacturing strategies. Due to advantages including efficient energy distribution and cost effectiveness, these industries have a significant need for energy-efficient reciprocating air compressors. These factors are expected to positively impact the market demand during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.