- Home

- »

- Medical Devices

- »

-

Recreational Oxygen Equipment Market Size Report, 2030GVR Report cover

![Recreational Oxygen Equipment Market Size, Share & Trends Report]()

Recreational Oxygen Equipment Market Size, Share & Trends Analysis Report By Product (Oxygen Concentrators, Oxygen Bar Equipment), By Application (Athletics, Medical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-749-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

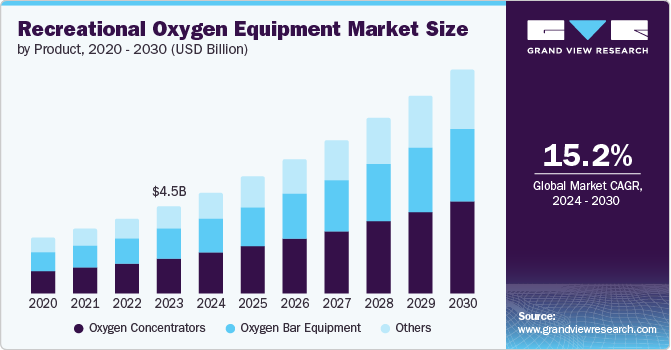

The global recreational oxygen equipment market size was valued at USD 4.5 billion in 2023 and is projected to grow at a CAGR of 15.2% from 2024 to 2030. This growth is attributed to the preference of youngsters towards sports activities, the development of high stress among people, and pollution levels in various states or countries. In addition, the increasing prevalence of respiratory diseases and rising demand for oxygen in healthcare settings are significant contributors. Furthermore, the growing popularity of recreational activities and sports and technological advancements in oxygen delivery systems enhance market growth.

Recreational oxygen benefits recovery by providing the energy required and more stamina. This type of oxygen differs from medical oxygen as it doesn't require a prescription. Hence, this will likely lead to an increase in the requirement, expected to drive market growth. Moreover, because of the growing awareness about the advantages of oxygen products and the focus on improving health and wellness, the demand for these products is expected to grow significantly in the upcoming years.

In addition, the shift of people to different sports and the benefits of recreational oxygen, such as providing higher energy and vitality, relief from altitude fear, faster muscle recovery, and better overall performance, results in market growth. In addition, the growing prevalence of respiratory illnesses like chronic obstructive pulmonary disease, COPD, and asthma is driving demand for oxygen therapy aspeople try to cope with their respiratory conditions and improve their quality of life.

Furthermore, recreational oxygen includes benefits such as a higher oxygen intake (O2), relieving stress, bringing quality sleep, reducing muscle aches, increasing energy, and recovering quickly from jet lag and hangovers. Conversely, lack of oxygen leads to tiredness, low energy, and slower recovery. Other vital factors such as use in the healthcare industry for various applications, the impact of increasing pollution with advancements in day-to-day human activities, the prevalence of obesity hypoventilation syndrome (OHS) & respiratory diseases due to hectic lifestyles, and the rising geriatric population across the globe boost the demand for recreational oxygen equipment.

Product Insights

The oxygen concentrators dominated the market and accounted for the largest revenue share of 40.9% in 2023.These devices are used to deal with respiratory diseases worldwide. Oxygen concentrators are portable and require less maintenance. They are widely used in healthcare settings to treat patients with respiratory conditions such as chronic obstructive pulmonary disease (COPD) and asthma. Various companies offer a wide range of such equipment, i.e., portable oxygen canisters or oxygen concentrators, catering to varied customers ranging from athletes and continuous users to those who seek respiratory support.

Oxygen bar equipment is expected to grow at a CAGR of 14.8% over the forecast period. This growth is attributed to increasing air pollution and rising demand for wellness experiences. Consumers seek oxygen bars to alleviate stress and enhance relaxation as urban air quality deteriorates. In addition, the popularity of recreational activities and sports encourages the use of oxygen for performance enhancement. Furthermore, government initiatives promoting oxygen bars further support market expansion, as seen in programs aimed at developing natural oxygen bar facilities in various regions.

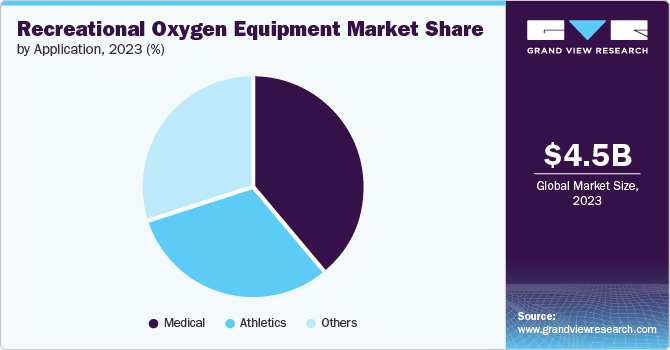

Application Insights

The medical application dominated the market and accounted for the largest revenue share of 39.2% in 2023. This growth is driven by the rising prevalence of respiratory complications and cardiovascular disorders worldwide. In addition, the elderly population is susceptible to developing respiratory diseases such as asthma or chronic obstructive pulmonary disease, further fueling the segment’s growth. Furthermore, governments, healthcare research firms, and key companies need sufficient oxygen supply and investments in oxygen concentrators and cylinders to boost the recreational equipment market.

Athletics applications are expected to grow at a CAGR of 15.6% over the forecast years. This growth is attributed to the increasing awareness of the benefits of recreational oxygen therapy among athletes, such as improved endurance, faster muscle recovery, and enhanced athletic performance, driving the demand for the segment. In addition, the growing popularity of different sports and fitness activities across regions contributes to the market expansion. Furthermore, the high-stress levels among athletes and the decrease in the optimal oxygen level during strenuous activities further contribute to the growth of the athletics applications segment in the recreational oxygen equipment market.

Regional Insights

North America recreational oxygen equipment market dominated the global market and accounted for the largest revenue share of 36.2% in 2023. The presence of developed home healthcare facilities, favorable reimbursement policies, and increased demand for recreational oxygen, such as portable oxygen concentrators, oxygen bars, and canned oxygen, drives this growth. In addition, heightened participation in sports and recreational activities boosts the need for oxygen equipment to enhance performance and recovery, further supporting market expansion and projecting significant growth in the coming years.

U.S. Recreational Oxygen Equipment Market Trends

The recreational oxygen equipments market in the U.S. dominated the North American market, with the largest revenue share of 79.7% in 2023. The country's aging population is a significant factor driving the market's growth. The elderly population is more likely to suffer from chronic respiratory conditions and may require home-based oxygen therapy. In addition, increasing healthcare expenditures, rising demand for mobilized concentrators and cans, and continuous innovations in oxygen for recreational use are expected to drive the market’s growth in the country.

Asia Pacific Recreational Oxygen Equipment Market Trends

The recreational oxygen equipments market in Asia Pacific is expected to grow at a CAGR of 15.5% over the forecast years. This growth is attributed to continuous research and developments, rising air pollution, and demand for recreational oxygen supplements created by individuals. In addition, increasing government initiatives for promoting awareness, a rise in medical tourism, a rising geriatric population, and an increasing demand for portable concentrators in the region further contribute to expanding the market.

The recreational oxygen equipments market in China is expected to witness significant growth over the forecast years, owing to the rising levels of air pollution linked with respiratory disorders that have fueled the requirement for supplemental oxygen in the country. In addition, the increasing awareness of health and early diagnosis of respiratory diseases has led to the necessity of the healthcare sector. Furthermore, the aging population and the prevalence of chronic respiratory diseases also contribute to the market growth as more individuals seek home-based oxygen therapy.

Europe Recreational Oxygen Equipment Market Trends

Europe recreational oxygen equipments market is expected to grow substantially over the projected years. This growth is attributed to the increasing awareness of health and wellness, which drives demand for oxygen therapy as consumers seek to enhance energy levels and recovery. In addition, technological advancements in portable oxygen devices also facilitate accessibility, while concerns over air quality and pollution further boost the need for recreational oxygen solutions. Furthermore, companies contribute to this growth by continuously innovating and developing equipment to meet people's needs.

The recreational oxygen equipments market in the UK is expected to experience significant growth over the forecast years owing to innovations in portable and user-friendly oxygen devices, which have made them more accessible and appealing to people. Furthermore, the popularity of fitness and sports activities has increased the demand for oxygen equipment to enhance athletic performance and recovery.

Key Recreational Oxygen Equipment Company Insights

Key companies in the recreational oxygen equipment market include Oxygen Plus. Inc., Koninklijke Philips N.V., Boost Oxygen, LLC, CAIRE Inc., Chart Industries, Invacare Corporation, Korrida, Inogen, Inc., and Zadro Inc., in the market, are focusing on development & to gain a competitive edge in the industry.

-

Boost Oxygen, LLC manufactures and fills all its canisters in the U.S. The company provides portable, 95% pure supplemental oxygen canisters. Their products are designed to provide all-natural respiratory support for various uses, including sports, high-altitude activities, and general wellness.

-

Koninklijke Philips N.V.is a provider of electronics and health technology. Its product portfolio comprises advanced diagnostic imaging systems such as MRI and CT scanners, interventional X-ray systems for minimally invasive procedures, and patient monitoring solutions for critical care. The company also innovates in sleep and respiratory care products such as CPAP machines and oxygen concentrators and offers a range of personal health devices.

Key Recreational Oxygen Equipment Companies:

The following are the leading companies in the recreational oxygen equipments market. These companies collectively hold the largest market share and dictate industry trends.

- Oxygen Plus. Inc.

- Koninklijke Philips N.V.

- Boost Oxygen, LLC.

- CAIRE Inc.

- Chart Industries

- Invacare Corporation

- Korrida

- Inogen, Inc.

- Zadro Inc.

- 2ND WIND OXYGEN BARS

- VitalAire

- Vitality Now

Recent Developments

-

In June 2024, Society Brands, an e-commerce aggregator, acquired Vitality Now, a direct-to-consumer health supplement retailer. This marked Society Brands' 12th acquisition since 2022 and its fifth consecutive deal in the consumer direct health and personal care sector, which now accounts for approximately 75% of its revenues.

-

In July 2024, Koninklijke Philips N.V. and Bon Secours Mercy Health (BSMH) entered into a multi-year partnership to enhance patient monitoring across BSMH's 49 hospitals. Through this collaboration, BSMH clinicians gained access to Philips' latest patient monitoring innovations, including a scalable platform that integrates patient data and provides valuable insights. The partnership standardized patient monitoring practices for BSMH, leading to cost savings through an outcome-based payment model. The freed-up funds will be reinvested to drive further innovation and development within BSMH's healthcare system.

Recreational Oxygen Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.2 billion

Revenue forecast in 2030

USD 11.5 billion

Growth rate

CAGR of 15.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, Australia, South Korea, Singapore, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Oxygen Plus. Inc.; Koninklijke Philips N.V.; Boost Oxygen, LLC.; CAIRE Inc.; Chart Industries; Invacare Corporation; Korrida; Inogen, Inc.; Zadro Inc.; 2ND WIND OXYGEN BARS; VitalAire; Vitality Now

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recreational Oxygen Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recreational oxygen equipment market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxygen Concentrators

-

Oxygen Bar Equipment

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Athletics

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."