- Home

- »

- Plastics, Polymers & Resins

- »

-

Recyclable Inflatable Bags Packaging Market Size Report 2033GVR Report cover

![Recyclable Inflatable Bags Packaging Market Size, Share & Trends Report]()

Recyclable Inflatable Bags Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Dunnage/Air-Bags, Void-fill Inflatable Pillows, In-line Inflatable Systems), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-812-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recyclable Inflatable Bags Packaging Market Summary

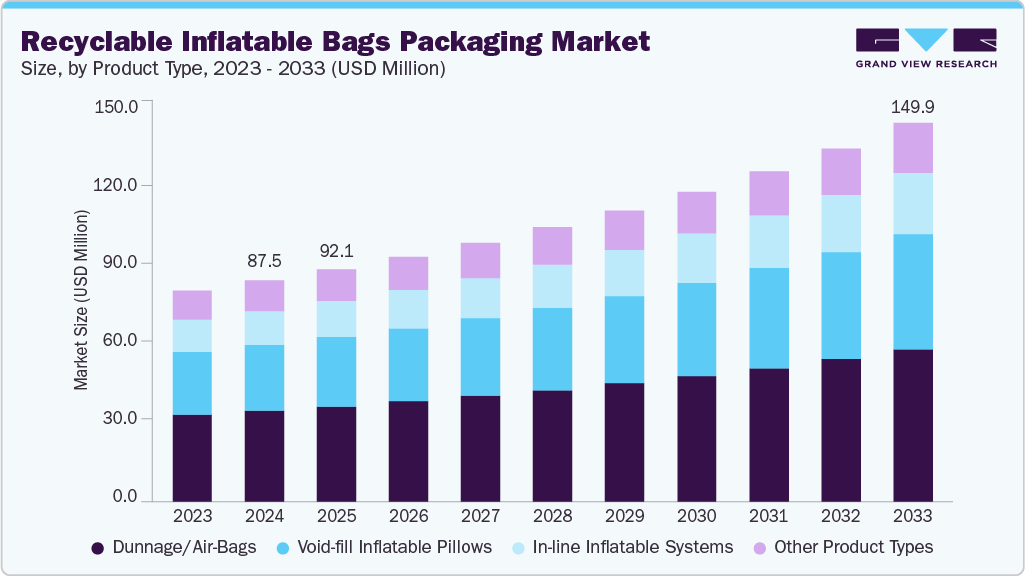

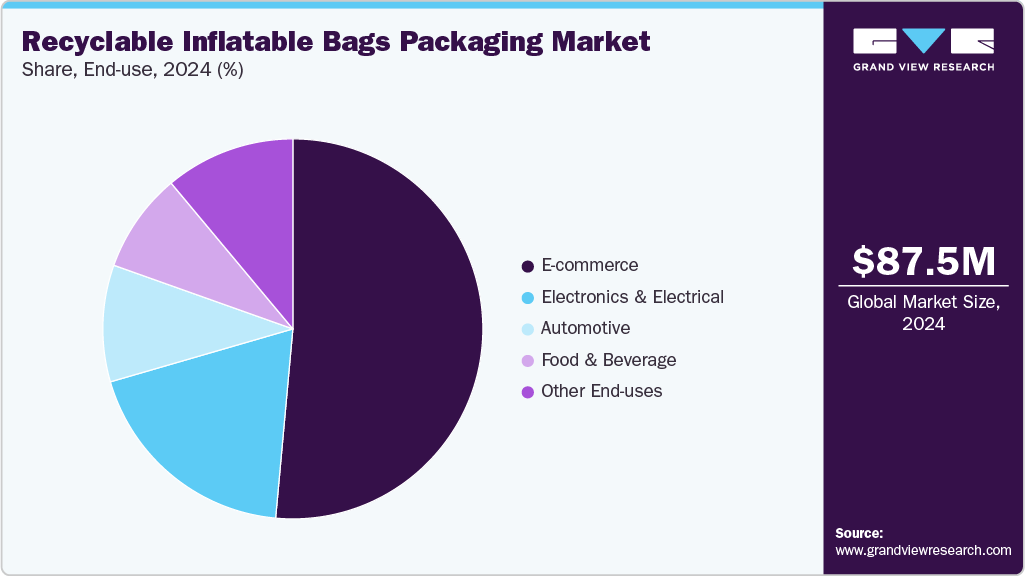

The global recyclable Inflatable bags packaging market size was estimated at USD 87.5 million in 2024 and is expected to reach USD 149.9 million by 2033, expanding at a CAGR of 6.3% from 2025 to 2033. Growing e-commerce and 3PL logistics operations are driving demand for lightweight, space-efficient recyclable inflatable bags that reduce shipping costs and improve product protection.

Key Market Trends & Insights

- Asia Pacific dominated the recyclable Inflatable bags packaging market with the largest revenue share of over 35.0% in 2024.

- The recyclable inflatable bags packaging market in Canada is expected to grow at a substantial CAGR of 7.7% from 2025 to 2033.

- By product type, the in-line inflatable systems segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033 in terms of revenue.

- By end use, the food & beverage segment is projected to grow at the fastest CAGR of 7.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 87.5 Million

- 2033 Projected Market Size: USD 149.9 Million

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest Market in 2024

Additionally, rising sustainability regulations and brand commitments to eco-friendly packaging are boosting the shift toward recyclable air cushions over conventional plastic void-fill solutions. As e-commerce and direct-to-consumer delivery models continue to expand, brands are under pressure to reduce packaging waste and improve the recyclability of protective materials. Recyclable Inflatable bags offer a clear advantage: they use significantly less plastic than traditional void-fill and cushioning materials, minimize transportation emissions due to their low weight, and can be produced using high-recycled-content films. This alignment with sustainability goals makes them increasingly attractive to both large retailers and environmentally conscious consumers.Another major driver is the boom in e-commerce shipments and rising demand for efficient protective packaging. Online retail requires fast fulfillment, efficient storage, and packaging that protects products during high-frequency handling and transit. Inflatable bags, especially recyclable variants, provide on-demand inflation, high cushioning performance, and space-saving benefits compared to paper or foam. Warehouses, 3PLs, and courier companies value the operational efficiencies created by these systems, as they reduce material usage, storage space, and packaging time. As global parcel volumes surge, especially in electronics, cosmetics, and small consumer goods, the demand for recyclable inflatable cushions continues to rise.

Additionally, the industry is driven by stringent global regulations and retailer sustainability commitments. Governments in the EU, U.S., Canada, and Asia-Pacific are enforcing recyclability mandates, recycled content requirements, and taxes on non-recyclable plastics. Large buyers such as Amazon, Walmart, and Unilever are pushing for packaging that is curbside recyclable or compatible with store drop-off systems. These regulatory and corporate pressures incentivize packaging suppliers to innovate recyclable films, develop mono-material solutions, and improve post-consumer recycling streams. As compliance becomes critical, recyclable inflatable bags gain rapid traction as a preferred protective packaging format.

Market Concentration & Characteristics

The industry is strongly shaped by global sustainability pressures, including mandates for recyclable materials, reduced plastic usage, and higher post-consumer recycled content. Manufacturers continuously innovate mono-material PE films, bio-based films, and higher-recyclability air cushions to meet regulatory and corporate sustainability goals.

Innovation is concentrated in film engineering, automated inflation systems, and on-demand packaging technologies. Companies actively invest in R&D for recyclable material blends and air-channel designs to improve load stability and reduce environmental impact.

The industry consists of several small- and mid-sized protective packaging firms, alongside major players such as SEE, Pregis LLC, and Storopack. While still relatively fragmented, consolidation is increasing as larger companies acquire sustainability-focused or technology-driven inflatable packaging startups.

Product Type Insights

The dunnage/air-bags segment recorded the largest market revenue share of over 41.0% in 2024.Dunnage or air-bags are heavy-duty inflatable cushions used primarily for securing and stabilizing cargo during transportation, especially in trucks, containers, and railcars. These products are typically made from recyclable polyethylene (PE) or kraft-paper/PE hybrid materials with high load-bearing capacity. Advanced versions come with controlled inflation valves, moisture resistance, and multi-layer recyclable films. Increasing regulatory pressure to reduce packaging waste in logistics, along with the shift away from non-recyclable foams and wooden bracing materials, strengthens the segment.

The in-line inflatable systems segment is expected to grow at the fastest CAGR of 6.9% during the forecast period. In-line inflatable systems are automated air-cushion production units integrated directly into packaging lines. These machines produce recyclable inflatable bags, pillows, or bubble-style cushions on-demand, allowing high-volume packing environments to streamline operations. They support customizable inflation levels, automated cutting, and real-time operational monitoring. Industries such as 3PL fulfillment centers, electronics distribution hubs, and large-scale warehouses rely on these systems for consistent, efficient, and sustainable packaging output.

End Use Insights

The e-commerce segment recorded the largest market share of over 51.0% in 2024.E-commerce is one of the largest consumers of recyclable inflatable bags due to the sector’s massive parcel volume and demand for lightweight, space-efficient protective packaging. Online marketplaces such as Amazon, Flipkart, and Alibaba increasingly rely on recyclable air pillows to protect diverse products, from cosmetics and books to small electronics. The transition away from bulky bubble wrap toward recyclable air pillows supports warehouse automation, lowers storage requirements, and enhances sustainability credentials.

The food & beverage segment is projected to grow at the fastest CAGR of 7.0% during the forecast period. In this segment, recyclable inflatable bags are increasingly used for protecting bottled beverages, glass jars, edible oils, premium alcohol bottles, and artisanal packaged foods. Inflatable wine and bottle sleeves made from recyclable materials are widely adopted by online beverage retailers, cloud kitchens, gourmet brands, and subscription-box companies to prevent breakage during last-mile deliveries. The shift toward premiumization in beverages and the growth of delivery-driven food categories have boosted the need for robust, recyclable cushioning, which ensures product safety and enhances customer experience.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 35.0% in 2024 and is witnessing strong growth as it expected to grow at the fastest CAGR of 6.9% during the forecast period. Asia Pacific is driving the recyclable inflatable bags packaging market due to the presence of significant manufacturing and e-commerce hub, generating massive demand for protective and cost-efficient packaging.

The region houses extensive electronics, textiles, FMCG, and automotive supply chains, all of which rely heavily on inflatable packaging to reduce damage during cross-border shipment. Rapid growth of e-commerce giants such as Alibaba, JD.com, Flipkart, and Tokopedia significantly increases the use of recyclable air pillows and inflatable bags for small parcels. These industries value lightweight packaging that reduces logistics costs and supports high parcel throughput, making the region a volume-intensive market.

North America Recyclable Inflatable Bags Packaging Market Trends

North America drives the market due to its advanced e-commerce penetration, led by Amazon, Walmart, Shopify merchants, and 3PL logistics companies, all of which rely extensively on recyclable inflatable packaging to optimize parcel shipping. The region’s high product return rates, especially in fashion, consumer electronics, and home goods, create substantial demand for protective yet lightweight cushioning options.

U.S. states such as California, Oregon, and Washington are enforcing stricter regulations on non-recyclable packaging, pushing companies toward environmentally responsible alternatives. The packaging industry’s strong investment in automation, digital printing, and sustainable materials also supports rapid expansion. Moreover, the growth of electronics, medical devices, and premium beverages in the U.S. and Canada drives increased use of recyclable cushioning.

Europe Recyclable Inflatable Bags Packaging Market Trends

EU policies such as the Single-Use Plastics Directive and the Packaging and Packaging Waste Regulation (PPWR) reinforce the need for recyclable protective packaging, making inflatable bags an ideal alternative to EPS foam and multilayer plastic films. European consumers also show high environmental awareness, accelerating demand for recyclable, lightweight, and low-carbon packaging. Europe has a dense network of automotive, electronics, pharmaceutical, and luxury goods manufacturers, all of which require high-quality, protective packaging for regional and global exports.

Key Recyclable Inflatable Bags Packaging Company Insights

The competitive environment of the recyclable inflatable bags packaging market is characterized by a mix of established global packaging manufacturers and emerging sustainability-focused innovators competing on product performance, recyclability, and cost efficiency. Major players differentiate through material innovation, such as mono-material air cushions, biodegradable films, and high-recycled-content inflatable bags, while also expanding capacity and geographic reach to serve fast-growing e-commerce, electronics, and industrial sectors.

Competition is further intensified by increasing regulatory pressure for sustainable packaging, pushing companies to invest in R&D and circular solutions, while pricing remains influenced by raw material volatility and operational efficiency. Strategic partnerships with logistics providers, automation system integrators, and recyclers are becoming key competitive levers, enabling players to offer integrated protective packaging solutions that meet both performance and environmental expectations.

-

In August 2024, Sealed Air launched BUBBLE WRAP Ready-To-Roll Embossed Paper, a sustainable fiber-based packaging solution combining cushioning and abrasion protection. Lightweight, durable, and versatile, it conforms to various shapes and is easy to use with a tearable dispenser. This innovation highlights Sealed Air’s commitment to recyclable, eco-friendly packaging.

-

In November 2023, Sealed Air launched BubbleWrap Extreme HRC Air Pillows made from 95% recycled plastic, using 20% less material while maintaining protection. Quick to inflate via the Rocket system and available in multiple sizes, these lightweight cushions help e-commerce companies reduce material use, energy consumption, and carbon footprint.

Key Recyclable Inflatable Bags Packaging Companies:

The following are the leading companies in the recyclable inflatable bags packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Sealed Air

- Pregis LLC

- Airpack Systems

- Storopack Hans Reichenecker GmbH

- Hanchett Paper Company

- JohnPac

- Intpkg Packing

- Southern Packaging, LP

- Ameson Packaging

- Hangzhou Bing Jia Tech. Co., Ltd.

- JahooPak

- DONGGUAN DINUO PACKAGING CO., LTD.

Recyclable Inflatable Bags Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 92.1 million

Revenue forecast in 2033

USD 149.9 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Sealed Air; Pregis LLC; Airpack Systems; Storopack Hans Reichenecker GmbH; Hanchett Paper Company; JohnPac; Intpkg Packing; Southern Packaging, LP; Ameson Packaging; Hangzhou Bing Jia Tech. Co., Ltd.; JahooPak; DONGGUAN DINUO PACKAGING CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recyclable Inflatable Bags Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global recyclable inflatable bags packaging market report based on product type, end use and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Dunnage/Air-Bags

-

Void-fill Inflatable Pillows

-

In-line Inflatable Systems

-

Other Product Types

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

E-commerce

-

Electronics & Electrical

-

Automotive

-

Food & Beverage

-

Other End Uses

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recyclable inflatable bags packaging market was estimated at around USD 87.5 million in the year 2024 and is expected to reach around USD 91.1 million in 2025.

b. The global recyclable inflatable bags packaging market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach around USD 149.9 billion by 2033.

b. The e-commerce segment dominated the recyclable inflatable bags packaging market because high parcel volumes and frequent shipments require lightweight, cost-efficient, and protective cushioning to prevent product damage.

b. The e-commerce segment dominated the recyclable inflatable bags packaging market because high parcel volumes and frequent shipments require lightweight, cost-efficient, and protective cushioning to prevent product damage.

b. The recyclable inflatable bags packaging market is driven by rising e-commerce shipments and the need for lightweight, cost-efficient protective packaging that reduces product damage and shipping costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.