- Home

- »

- Plastics, Polymers & Resins

- »

-

Recycled Engineering Plastics Market, Industry Report, 2030GVR Report cover

![Recycled Engineering Plastics Market Size, Share & Trends Report]()

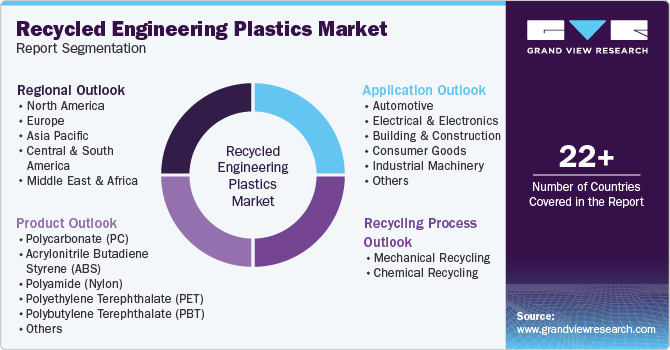

Recycled Engineering Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (PC, ABS, Nylon, PET, PBT), By Recycling Process (Mechanical Recycling, Chemical Recycling), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-539-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recycled Engineering Plastics Market Summary

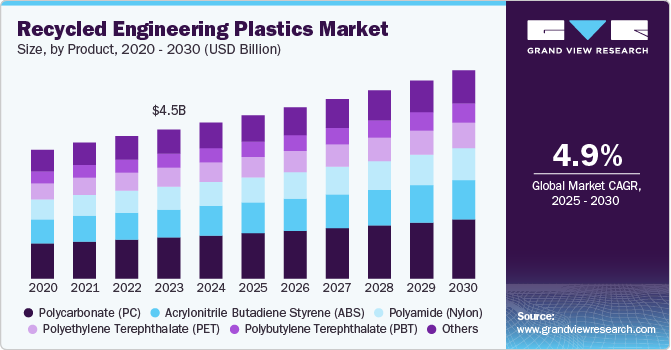

The global recycled engineering plastics market size was estimated at USD 4,723.14 million in 2024 and is projected to reach USD 6.30 billion by 2030, growing at a CAGR of 4.97% from 2025 to 2030. Industries such as automotive, electronics, and packaging are increasingly using recycled engineering plastics to meet sustainability goals and reduce carbon footprints.

Key Market Trends & Insights

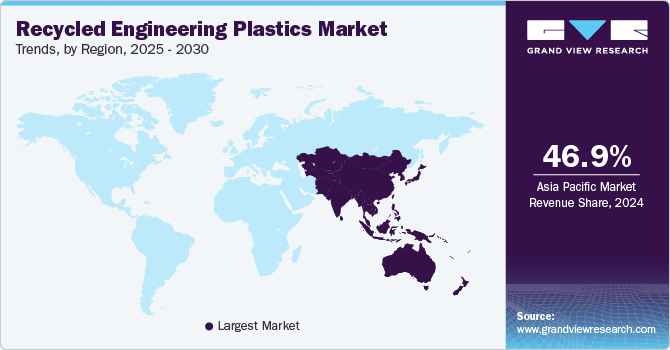

- Asia Pacific dominated the global recycled engineering plastics market and accounted for largest revenue share of 46.99% in 2024.

- Polycarbonate (PC) dominated the recycled engineering plastics market across the Product segmentation in terms of revenue, accounting for a market share of 27.67% in 2024.

- Mechanical recycling dominated the recycled engineering plastics market across the recycling process segmentation in terms of revenue, accounting for a market share of 72.64% in 2024.

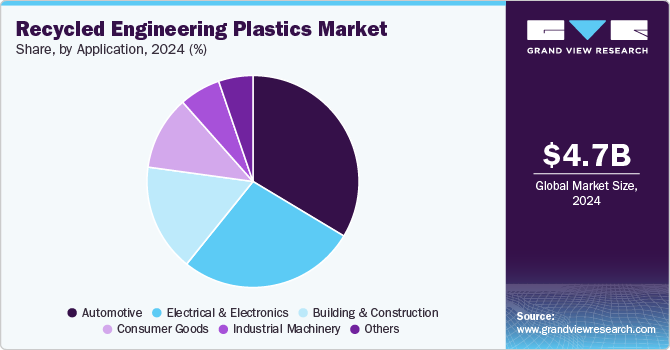

- Automotive dominated the recycled engineering plastics market across the application segmentation in terms of revenue, accounting for a market share of 27.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,723.14 Million

- 2030 Projected Market Size: USD 6.30 Billion

- CAGR (2025-2030): 4.97%

- Asia Pacific: Largest market in 2024

This shift is driven by corporate ESG commitments and consumer preference for eco-friendly products. A significant trend shaping the recycling of engineering plastics is the increasing adoption of circular economy principles. Governments and multinational corporations are shifting towards closed-loop recycling systems, where high-performance plastics are collected, processed, and reintegrated into new products with minimal degradation. The European Union’s Circular Plastics Alliance and similar programs in North America and Asia are promoting advanced mechanical and chemical recycling technologies to ensure that high-value engineering plastics such as polycarbonates (PC), polyamides (PA), and polyether ether ketone (PEEK) retain their structural integrity for reuse. This trend is accelerating due to regulatory pressures, corporate sustainability targets, and growing consumer demand for eco-friendly materials, fostering innovation in material recovery and reuse.

Drivers, Opportunities & Restraints

Government mandates and regulatory frameworks are driving the growth of the recycled engineering plastics market. Regulations such as the EU Waste Framework Directive and China’s National Sword policy have tightened controls on plastic waste management, forcing manufacturers to incorporate higher recycled content in their products. Extended Producer Responsibility (EPR) programs are further compelling companies to invest in sustainable recycling infrastructure, ensuring proper collection and processing of high-performance plastics. In addition, industries such as automotive, electronics, and packaging are facing increased scrutiny to comply with carbon neutrality and sustainable production targets, further accelerating the shift towards recycled engineering plastics.

One of the most promising opportunities in the recycling of engineering plastics lies in the development of chemical recycling and polymer regeneration technologies. Unlike traditional mechanical recycling, which can degrade polymer properties over multiple cycles, advanced chemical processes such as depolymerization, solvolysis, and pyrolysis can break down complex plastic structures into their monomer forms, enabling the production of virgin-quality recycled materials. Companies investing in these technologies can tap into high-value applications in aerospace, automotive, and consumer electronics, where material purity and performance are critical. As these innovations scale up, they have the potential to close the loop on engineering plastics, reducing reliance on fossil-based raw materials and improving supply chain sustainability.

Despite growing demand for recycled engineering plastics, high processing costs remain a major restraint. Unlike commodity plastics, engineering polymers require sophisticated sorting, cleaning, and reprocessing techniques to maintain their mechanical and thermal properties. The capital-intensive nature of chemical recycling plants, coupled with fluctuating energy prices, often makes recycled materials more expensive than virgin plastics. In addition, inconsistent feedstock quality and limited availability of post-consumer engineering plastics pose challenges in achieving cost-effective large-scale recycling. Many industries remain hesitant to adopt recycled content due to concerns over performance variability, making it crucial for stakeholders to enhance process efficiencies and establish economically viable recycling models.

Product Insights & Trends

Polycarbonate (PC) dominated the recycled engineering plastics market across the Product segmentation in terms of revenue, accounting for a market share of 27.67% in 2024. The demand for recycled PC is gaining momentum, particularly in high-performance optical and automotive applications where durability, transparency, and heat resistance are crucial. With increasing sustainability mandates, manufacturers are integrating recycled PC into headlamp lenses, electronic display panels, and lightweight vehicle components to reduce carbon footprints without compromising on quality. Companies such as Covestro and SABIC are advancing post-consumer and post-industrial PC recycling to create eco-friendly alternatives that meet stringent regulatory and performance standards. As industries push for greener material solutions, the adoption of recycled PC is expected to accelerate, particularly in Europe and North America, where circular economy frameworks are strongest.

Recycled Acrylonitrile Butadiene Styrene (ABS) is experiencing rising demand, particularly from the consumer electronics sector, as brands transition to circular manufacturing models. Major technology firms, including Apple, Dell, and HP, are incorporating recycled ABS into laptops, keyboards, and home appliances to reduce reliance on virgin plastics and align with sustainability goals. With regulatory bodies such as the EU pushing for higher post-consumer recycled content in electronics, companies are increasingly investing in advanced ABS recycling technologies. This shift is creating a strong market for high-quality recycled ABS, particularly in Asia-Pacific, where large-scale electronics manufacturing hubs are adapting to evolving sustainability requirements.

Recycling Process Insights & Trends

Mechanical recycling dominated the recycled engineering plastics market across the recycling process segmentation in terms of revenue, accounting for a market share of 72.64% in 2024, driven by the need for cost-effective and scalable solutions to manage high-volume plastic waste. Mechanical recycling processes, such as shredding, washing, and re-extrusion, provide a more economical alternative to chemical recycling, especially for applications where minor material degradation is acceptable. With governments and industries aiming to increase the proportion of recycled content in consumer goods and industrial components, investment in mechanical recycling infrastructure is growing. Advances in automated sorting and purification technologies are further improving the efficiency of mechanical recycling, making it a viable solution for industries that require sustainable yet cost-efficient material recovery.

Chemical recycling is emerging as a key driver in the engineering plastics market, primarily because it enables the recovery of virgin-quality materials from complex and contaminated plastic waste. Unlike mechanical recycling, which degrades polymer properties over multiple cycles, chemical processes such as solvolysis, depolymerization, and pyrolysis allow plastics to be broken down into their original monomers and repolymerized into high-performance materials. This is particularly beneficial for applications in aerospace, medical, and electronics industries where material purity is critical. As investments in chemical recycling scale up, companies are developing more energy-efficient and commercially viable solutions, expanding the market potential for chemically recycled engineering plastics.

Application Insights & Trends

Automotive dominated the recycled engineering plastics market across the application segmentation in terms of revenue, accounting for a market share of 27.72% in 2024. The automotive industry's push for lightweight and fuel-efficient vehicles is driving demand for recycled engineering plastics, particularly in interior and structural components. Automakers are replacing traditional metal parts with recycled polyamides, polycarbonates, and ABS to achieve weight reduction while meeting stringent emission standards. In addition, regulatory frameworks such as the EU’s End-of-Life Vehicle Directive (ELV) are mandating higher recycled content in automotive manufacturing, accelerating the adoption of recycled plastics. As electric vehicle (EV) production grows, manufacturers are increasingly turning to sustainable polymer solutions to enhance performance while aligning with sustainability goals.

The electrical and electronics sector is driving demand for recycled engineering plastics due to increasing regulations on electronic waste (e-waste) disposal and sustainability-focused manufacturing. Governments worldwide are enforcing stricter recycling mandates, requiring manufacturers to incorporate post-consumer recycled content into products such as circuit housings, laptop casings, and connectors. Companies like Lenovo and Samsung are actively integrating recycled ABS and polycarbonate into their product lines to enhance sustainability credentials and comply with regulations such as the EU’s Waste Electrical and Electronic Equipment (WEEE) Directive. With the growing pressure on brands to reduce environmental impact, the use of recycled engineering plastics in electronics manufacturing is becoming a competitive differentiator.

Regional Insights & Trends

Asia Pacific dominated the global recycled engineering plastics market and accounted for largest revenue share of 46.99% in 2024. Asia Pacific is experiencing strong demand for recycled engineering plastics due to the rapid expansion of the electronics and automotive industries. Countries such as India, Japan, and South Korea are increasingly mandating the use of recycled materials in consumer electronics, batteries, and vehicle components to meet sustainability goals. In particular, Japan’s “3R” (Reduce, Reuse, Recycle) initiative and South Korea’s Resource Circulation Act are pushing industries to adopt higher recycled content in production.

China Recycled Engineering Plastics Market Trends

China’s recycled engineering plastics market is expanding as the country focuses on domestic recycling infrastructure following its National Sword policy, which banned the import of foreign plastic waste. To meet growing domestic demand for sustainable materials, China is investing heavily in mechanical and chemical recycling facilities, particularly for engineering plastics used in automotive and consumer electronics. In addition, the country’s push for electric vehicle (EV) production is driving the need for lightweight, high-performance recycled plastics in battery casings and interior components. With stricter waste management policies and local industries prioritizing recycled content, the market for engineering plastic recycling is set for rapid growth.

North America Recycled Engineering Plastics Market Trends

In North America, the recycled engineering plastics market is expanding due to major corporations committing to circular economy initiatives. Leading automotive, electronics, and packaging companies are integrating recycled polymers into their product lines to meet sustainability targets and address consumer demand for eco-friendly materials. The region is also witnessing increasing investments in advanced recycling infrastructure, with companies such as Eastman and Loop Industries developing chemical recycling plants to convert plastic waste into high-quality resins. With regulatory frameworks such as the Canada Plastics Pact and extended producer responsibility (EPR) programs gaining traction, industries across North America are being pushed to enhance the adoption of recycled engineering plastics.

The U.S. recycled engineering plastics market is being driven by government-backed initiatives and technological advancements in recycling processes. Federal and state-level programs, such as the Bipartisan Infrastructure Law, are allocating funds to improve waste management and recycling technologies, promoting higher recycled content in manufacturing. In addition, private sector investments in advanced sorting, depolymerization, and molecular recycling are enhancing the viability of recycled engineering plastics in industries such as aerospace, automotive, and consumer electronics. Major corporations such as Coca-Cola and Ford are setting aggressive sustainability goals, further increasing the demand for recycled high-performance polymers, including polycarbonates and polyamides.

Europe Recycled Engineering Plastics Market Trends

Europe is at the forefront of the recycled engineering plastics market due to its stringent environmental regulations and circular economy policies. The European Union’s Green Deal and Circular Plastics Alliance are driving industries to incorporate a higher percentage of recycled plastics in manufacturing processes. Directives such as the Waste Framework Directive and the Single-Use Plastics Directive are putting pressure on manufacturers to enhance recyclability and reduce plastic waste. Leading companies in automotive, electronics, and packaging are investing in closed-loop recycling models, while innovations in chemical recycling are allowing high-performance engineering plastics to be reused in critical applications without quality degradation.

Key Recycled Engineering Plastics Company Insights

The recycled engineering plastics market is highly competitive, with several key players dominating the landscape. Major companies include MBA Polymers, Inc., Banyan Nation, Polyplastics Group, Covestro AG, Eastman Chemical Company, Trinseo, Veolia Environnement S.A., Borealis, Dow Inc. and Polyvisions Inc. The recycled engineering plastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their Products.

Key Recycled Engineering Plastics Companies:

The following are the leading companies in the recycled engineering plastics market. These companies collectively hold the largest market share and dictate industry trends.

- MBA Polymers, Inc.

- Banyan Nation

- Polyplastics Group

- Covestro AG

- Eastman Chemical Company

- Trinseo

- Veolia Environnement S.A.

- Borealis

- Dow Inc.

- Polyvisions Inc.

Recent Developments

-

In February 2025, Polyplastics Co., Ltd. announced the launch of a new 40% glass-filled recycled PPS (polyphenylene sulfide) compound. The material aimed to meet rising demand for sustainable materials in automotive and other applications. Polyplastics emphasized strict quality control during production. They also hinted at plans to release higher glass-filled grades in the future.

-

In August 2023, Polyplastics, a Japanese engineering plastics manufacturer, announced the launch of its "Duracircle" recycling service, which was scheduled to commence in March 2024. This service enables Polyplastics' customers to recycle industrial waste materials from their production processes by re-compounding them.

Recycled Engineering Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.95 billion

Revenue forecast in 2030

USD 6.30 billion

Growth rate

CAGR of 4.97% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, recycling process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

MBA Polymers, Inc.; Banyan Nation; Polyplastics Group; Covestro AG; Eastman Chemical Company; Trinseo; Veolia Environnement S.A.; Borealis; Dow Inc.; Polyvisions Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Engineering Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented recycled engineering plastics market report on the basis of product, recycling process, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyamide (Nylon)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Others

-

-

Recycling Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mechanical Recycling

-

Chemical Recycling

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Electrical & Electronics

-

Building & Construction

-

Consumer Goods

-

Industrial Machinery

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global recycled engineering plastics market size was estimated at USD 4,723.14 million in 2024 and is expected to reach USD 4.95 billion in 2025.

b. The global recycled engineering plastics market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 6.30 billion by 2030.

b. Polycarbonate (PC) dominated the recycled engineering plastics market across the product type segmentation in terms of revenue, accounting for a market share of 27.67% in 2024. The demand for recycled PC is gaining momentum, particularly in high-performance optical and automotive applications where durability, transparency, and heat resistance are crucial.

b. Some key players operating in the recycled engineering plastics market include MBA Polymers, Inc., Banyan Nation, Polyplastics Group, Covestro AG, Eastman Chemical Company, Trinseo, Veolia Environnement S.A., Borealis, Dow Inc. and Polyvisions Inc.

b. Industries such as automotive, electronics, and packaging are increasingly using recycled engineering plastics to meet sustainability goals and reduce carbon footprints. This shift is driven by corporate ESG commitments and consumer preference for eco-friendly products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.