- Home

- »

- Advanced Interior Materials

- »

-

Recycled Metal Market Size, Share & Growth Report, 2030GVR Report cover

![Recycled Metal Market Size, Share & Trends Report]()

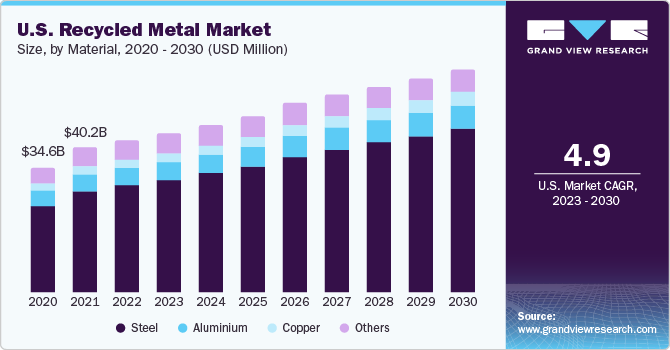

Recycled Metal Market Size, Share & Trends Analysis Report By Material (Copper, Steel, Aluminum, Others), By Region (North America, Asia Pacific, Central & South America, MEA, Europe), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-768-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Advanced Materials

Recycled Metal Market Size & Trends

The global recycled metal market size was valued at USD 1.07 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The market growth is driven by increasing emphasis on the secondary production of metals owing to environmental concerns such as energy consumption and scrap disposal. Metal recycling is an important aspect as metals can be recycled several times without any alterations in their characteristics. As a result, scrap metal possesses major significance for use as a raw material for secondary production.

Growing environmental concerns about depletion of non-renewable resources, increasing harmful emissions from manufacturing plants, and improper waste disposal have led to the growth of the recycling industry, of which metal recycling constitutes a major part. Factors such as regulations about mining ores and increasing raw material prices are propelling the demand for recycled metal. The product reduces the manufacturing cost significantly, this benefit is further favoring its market growth.

Governments across the world are pushing for raising metal production capacity by making positive policies and providing incentives to the recycling industry. For instance, in May 2022, the Indian government signed the Comprehensive Economic Partnership Agreement (CEPA) with the UAE government. This agreement is expected to make it easier for India to import scrap from UAE. India produces 118 million tons of steel, and the country is targeting to produce 300 million tons by 2030. Thus, recycled metal is going to play a major role in achieving the said target.

Owing to the surge in demand for sustainability and reduction of carbon dioxide emission, companies are adopting the usage of recycled material, which is anticipated to boost the demand for recycled metal in the coming years. For instance, in April 2022, Apple Inc announced that nearly 20% of all materials used in Apple Inc products were recycled in 2021, and 59% of all the aluminum Apple shipped in its products came from recycled sources in 2021.

With the increasing demand for recycled metal, key market players in the industry are investing to construct new metal recycling facilities. For example, in November 2021, Aurubis AG announced that they going to invest EUR 300 million (USD 322.7 million) to develop a complex metal recycling material plant in Augusta, U.S., which is expected to have a capacity of 90,000 tons per year for recycling complex metal. The construction of the plant is expected to begin in 2022 and will be commissioned in 2024.

One of the issues with recycling metal is that some metal becomes contaminated, which makes it difficult to recycle. When metal comes under contact with harmful toxins, even if it is washed it can’t be guaranteed that all the chemical has been removed, which can prove dangerous to end-users. Thus, contaminated metal should not be recycled. Some metals such as lead and mercury should also not be recycled. Mercury is highly toxic if handled incorrectly and it can do serious damage to the kidneys, brain, and lungs. Lead poisoning can cause severe pain in muscles and joints. Metal recycling needs to be done with immense care and with appropriate precaution.

Material Insights

Based on thematerial, the market has been segmented into steel, aluminum, copper, and others. Steel is the most recycled metal in the world, as a result, it held a considerable market share of around 35.8% in 2022 and is expected to grow at the fastest CAGR of 7.3% during the forecast period. The growing consumption of steel in construction, automotive, electronics, and consumer goods industries is projected to result in increased demand over the forecast period.

Factors including the utilization of non-renewable resources, consumption of a large amount of energy, fluctuation in raw material prices, and regulations about mining ores have compelled manufacturers to adopt the Electric Arc Furnace (EAF) process over the Basic Oxygen Furnace (BOF) process for its utilization in crude steel production. This has led to an increased demand for recycled steel across the world. According to the World Steel Association, in 2021, global EAF output accounted for about 30% of global steel production.

Aluminum accounted for the revenue share of 5.1% in 2022. Aluminum is consumed at a large scale and holds high value as scrap material. The demand for aluminum is anticipated to increase rapidly over the forecast period owing to its increasing demand in the automotive and consumer goods industries. Global demand for primary aluminum reached an estimated 68.7 million tons in 2021, a 8% increase from the 2020. This is a positive sign for the recycled aluminum market as more demand for aluminum leads to its increased production.

The secondary production of aluminum is gaining popularity over primary as recycling aluminum saves over 90% energy compared to primary production. Scrap aluminum constitutes a share of more than 90% in the raw material composition to produce one ton of aluminum by the secondary process.

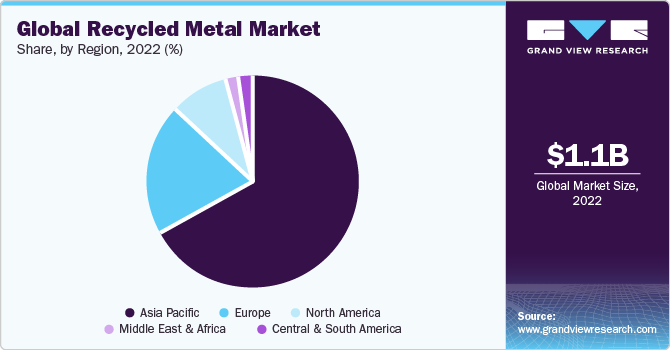

Regional Insights

Asia Pacific dominated the global recycled metal market and accounted for the largest revenue share of 67.3% in 2022. The increasing concerns for the environment and proper waste management are driving the market growth of recycled metal in the region. For instance, Malaysia is targeting to increase its recycling rate by 2% each year by 2025. The country has set a target to achieve a 40% recycling rate by 2025.

China is anticipated to dominate the recycled metal production & consumption in the Asia Pacific over the forecast period. To country intends to meet its climate commitments and plans to increase its use of recycled metals such as copper, steel, and aluminum. It is planning to increase its consumption of steel scrap by 25% by 2023. This plan is expected to boost the demand for recycled metal in the country across the forecast period.

MEA is expected to grow at the fastest CAGR of 7.8% during the forecast period. The countries across the region are trying to create a circular economy, which has pushed the investment in the recycling of metals. For instance, in February 2022, Emirates Global Aluminum PJSC announced that they are going to build the largest aluminum recycling facility in UAE. The plant is expected to have a recycling capacity of 150,00 tons per year of aluminum scrap. The production is expected to start by 2024, which is anticipated to boost the production of recycled metal in the region.

The demand for recycled metal in Saudi Arabia is anticipated to be driven by the country’s increasing attempts to move to more sustainable waste management. For instance, in September 2021, the country announced that they are going to invest SAR 24 billion (USD 6.4 billion) in waste recycling by 2035. This investment is expected to drive the market growth for the recycled metal in the country over the coming years.

Key Companies & Market Share Insights

The global market is unorganized and fragmented. The presence of various small and large players, increasing demand for scrap, growing environmental concerns, and related regulations have compelled new entrants and existing players to venture into the market and explore new regions for business growth.

For example, in June 2019, Tata Steel announced its plan to set up India’s first recycling plant in Haryana. This initiative is aimed at helping the company gain an early mover advantage in the Indian market. Some of the prominent players in the global recycled metal market include:

-

CMC

-

European Metal Recycling Ltd.

-

Norsk Hydro ASA

-

GFG Alliances

-

Novelis

-

Tata Steel

Recent Developments

-

In March 2023, Commercial Metals Company (CMC) acquired Roane Metals Group LLC, a metal recycling company. This acquisition is expected to enhance the security and supply of competitively priced inputs to CMC's steelmaking operations.

-

In September 2022, Commercial Metals Company (CMC) acquired Advanced Steel Recovery, LLC, a leading supplier of recycled ferrous metals located in Southern California which handles approximately 300,000 tons of scrap annually across its processing, industrial collection, and brokerage platforms. This acquisition will enable the growth of CMC in the Western U.S.

-

In September 2022, European Metal Recycling Ltd. (EMR) announced its partnership with Tata Steel UK and Darlow Lloyd & Sons. This partnership is expected to help companies to build a new circular supply chain, developing high-quality grades of recycled steel for the production of low carbon impact ‘green steel’.

-

In July 2022, Novelis Inc. announced its partnership with Alloys, Inc. This partnership will help Novelis to access Sortera's advanced sorting technologies, including data analytics and advanced sensors, which enable them to recycle and reuse higher amounts of both automotive post-production and post-consumer scrap.

Recycled Metal Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.14 billion

Revenue forecast in 2030

USD 1.66 billion

Growth rate

CAGR of 5.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million, Volume in Million Tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; & MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Russia; Turkey; China; Japan; India; Australia; Indonesia; Thailand,; Malaysia; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

CMC; European Metal Recycling Ltd.; Norsk Hydro ASA; GG Alliances; Novelis; Tata Steel

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recycled Metal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global recycled metal market on the basis of material and region:

-

Material Outlook (Revenue in USD Million, Volume in Million Tons, 2018 - 2030)

-

Steel

-

Aluminium

-

Copper

-

Others

-

-

Regional Outlook (Revenue in USD Million, Volume in Million Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global recycled metal market size was estimated at USD 1.07 billion in 2022 and is expected to reach USD 1.13 billion in 2023.

b. The global recycled metal market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 1.66 billion by 2030.

b. Steel dominated the recycled metal market with a share of 70.4% in 2022. This is attributable to growing consumption of steel in construction, automotive, electronics, and consumer goods industries.

b. Some key players operating in the recycled metal market include CMC, European Metal Recycling, Norsk Hydro ASA, GFG Alliances, Novelis, and Tata Steel.

b. Key factors that are driving the market growth include increasing emphasis on the secondary production of metals owing to environmental concerns such as energy consumption and scrap disposal.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."