- Home

- »

- Power Generation & Storage

- »

-

Refrigerant Market Size, Share, Trends, Industry Report 2033GVR Report cover

![Refrigerant Market Size, Share & Trends Report]()

Refrigerant Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Fluorocarbon, Hydrocarbon, Inorganic), By Application (Stationary Air Conditioning, Chillers), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-297-6

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refrigerant Market Summary

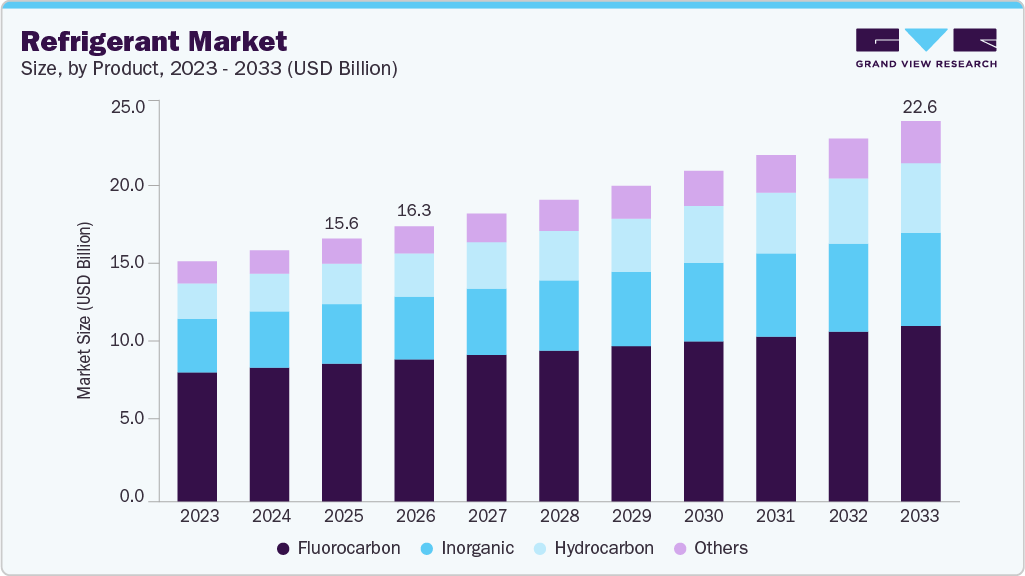

The global refrigerant market size was estimated at USD 15.62 billion in 2025 and is projected to reach USD 22.60 million by 2033, growing at a CAGR of 4.7% from 2026 to 2033. Growth is driven by rising demand from the commercial refrigeration industry and industrial refrigeration industry, supported by expanding cold storage and logistics, including the road transport refrigeration equipment market.

Key Market Trends & Insights

- Asia Pacific is expected to grow at the fastest CAGR of 5.6% from 2026 to 2033.

- By product, the fluorocarbon segment led the market with the largest revenue share of 52.44% in 2025.

- By application, the Domestic Refrigeration segment is expected to witness growth at a 5.0% CAGR.

- By application, the mobile air conditioning segment is anticipated to grow at the fastest CAGR of 4.9% during the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 15.62 Billion

- 2033 Projected Market Size: USD 22.60 Billion

- CAGR (2026-2033): 4.7%

- Europe: Largest market share

- Asia Pacific: Fastest growing market

The increasing adoption of monitoring solutions in the refrigeration monitoring market and the storage refrigeration monitoring market, along with advancements in the commercial refrigeration compressor market, are further supporting growth. Meanwhile, the shift toward eco-friendly technologies is creating opportunities in emerging segments, such as the magnetic refrigeration industry.

Drivers, Opportunities & Restraints

The increasing demand for air conditioning is largely driven by global warming and rising temperatures, making cooling a necessity in residential, commercial, and industrial spaces. This trend supports growth across the commercial refrigeration market, industrial refrigeration market, and related systems, as advancements are making air conditioning and refrigeration solutions more energy-efficient, affordable, and environmentally friendly.

At the same time, concerns about flammability and toxicity are influencing regulatory compliance and production costs, impacting manufacturers across the industrial refrigeration system market and the commercial refrigeration compressor market due to stricter safety requirements. In parallel, carbon dioxide (CO₂) is emerging as a fast-growing refrigerant, widely adopted in supermarkets, vending machines, and display cabinets, strengthening demand in the refrigeration coolers market, refrigeration monitoring market, and storage refrigeration monitoring market, owing to its energy efficiency, strong cooling performance, and low environmental impact compared to conventional refrigerants.

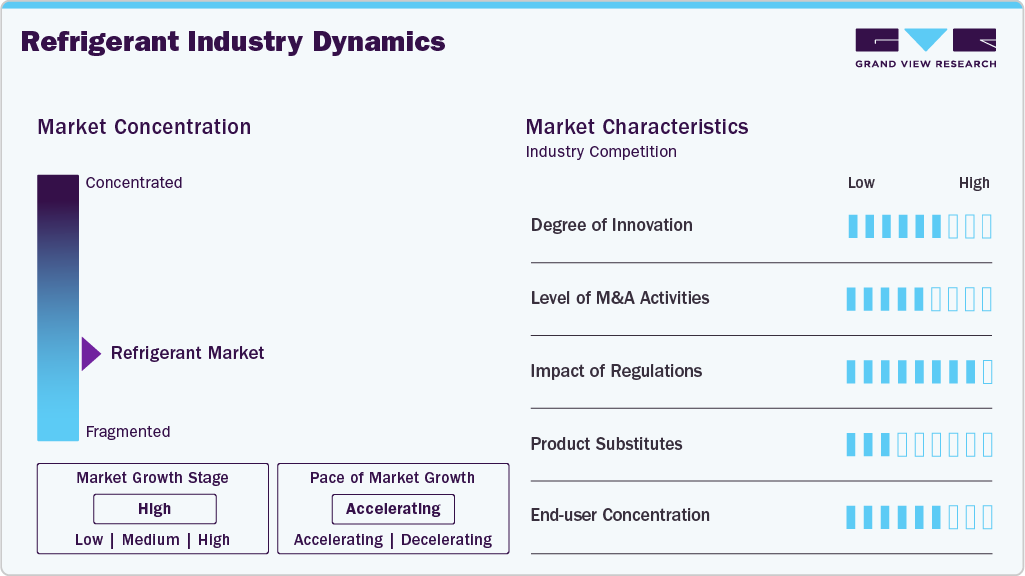

Market Concentration & Characteristics

The refrigerant industry is highly competitive and fragmented, with a few key players holding a significant share. At the same time, emerging economies such as India and China continue to offer strong growth opportunities across the commercial refrigeration industry and the industrial refrigeration industry. To improve efficiency and control production costs, manufacturers are increasingly adopting backward integration, securing raw materials such as fluorspar, hydrofluoric acid, hydrocarbons, ammonia, and carbon dioxide, which supports stability in the industrial refrigeration system market and commercial refrigeration compressor market.

In addition, stringent regulations on fluorocarbon-based refrigerants in developed economies are reducing their use in domestic refrigeration and air conditioning, accelerating the shift toward hydrocarbon and natural refrigerants. This transition is boosting demand in alternative and sustainable segments, including advanced solutions used in the refrigeration coolers market, refrigeration monitoring market, and next-generation technologies such as the magnetic refrigeration industry.

Product Insights

The fluorocarbon segment led the market with the largest revenue share of 52.44% in 2025, driven by its strong thermodynamic performance and widespread use across the commercial refrigeration market, industrial refrigeration market, and industrial refrigeration system market. Fluorocarbon refrigerants, including CFCs, HCFCs, HFCs, and HFOs, are widely used in cooling systems, driven by a steady demand for commercial refrigeration compressors, refrigeration coolers, and road transport refrigeration equipment, as well as applications that require reliable performance and temperature control.

The hydrocarbon segment is expected to register at the fastest CAGR of 7.0% over the forecast period, fueled by growing environmental concerns and regulatory pressure. Hydrocarbon refrigerants, such as propane (R290), isobutane (R600a), and ethylene (R1150), are gaining traction due to their low GWP and zero ODP, thereby increasing their adoption in energy-efficient systems integrated with the refrigeration monitoring market and the storage refrigeration monitoring market. This transition toward sustainable solutions is also encouraging innovation in next-generation technologies, including the magnetic refrigeration market, further reshaping the global refrigerant landscape.

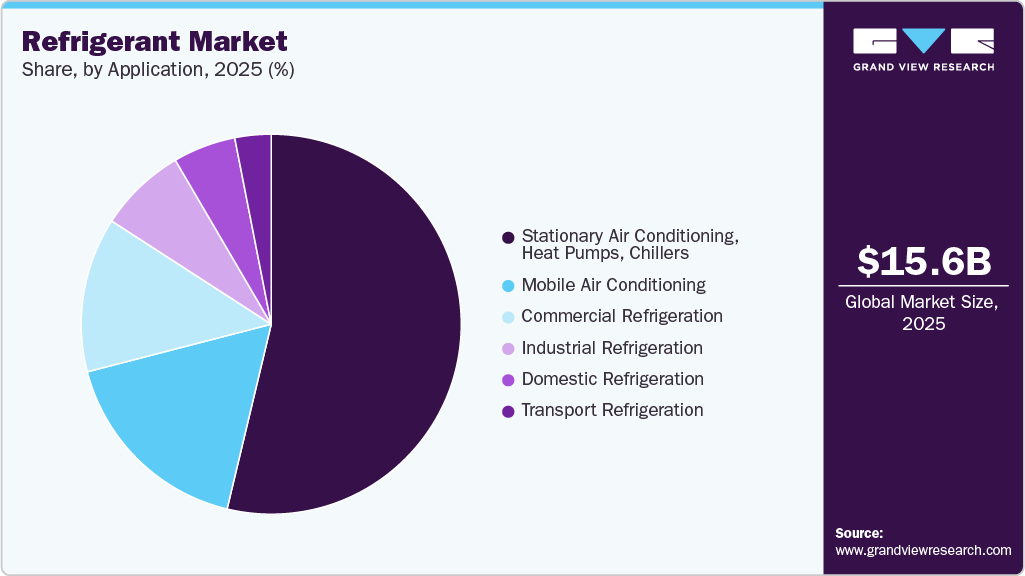

Application Insights

The stationary air conditioning, heat pumps, and chillers segment led the market with the largest revenue share of 53.7% in 2025. Stationary air conditioning, heat pumps, and chillers, significant components of the HVAC (Heating, Ventilation, and Air Conditioning) system, have significantly influenced the refrigerants market due to their extensive use in commercial, industrial, and residential settings. These systems rely heavily on refrigerants to facilitate the exchange of heat, which is pivotal in cooling or heating. Consequently, their dominance in the market is attributed to the sheer necessity of climate control solutions across various sectors, making them key drivers in the demand for refrigerants.

The mobile air conditioning segment is anticipated to grow at the fastest CAGR of 4.9% during the forecast period, primarily aimed at providing comfort to vehicle passengers. It involves using specific refrigerants that effectively transfer heat outside, cooling the vehicle's interior. As concerns about environmental impact and energy efficiency grow, the selection of refrigerants for mobile air conditioning systems is increasingly focused on substances with lower global warming potential and higher efficiency.

Regional Insights

The refrigerant market in North America is characterized by high demand growth in end-use industries, including domestic refrigeration, commercial refrigeration, and mobile air conditioning. Furthermore, growing awareness of environmental protection and the adoption of energy-efficient cooling solutions are also driving the growth of the natural refrigerant industry across the region.

U.S. Refrigerant Market Trends

The refrigerant market in the U.S held a significant share in North America in 2025. This growth is attributed to rising demand for mobile air conditioning units for automobiles in the region. The refrigerants market is also growing due to the rising demand in the commercial and industrial sectors of the region.

Europe Refrigerant Market Trends

Europe dominated the global refrigerant market with the largest revenue share of 31.1% in 2025. The market growth in this region can be attributed to the increasing demand for air conditioning units in automotive, industrial, commercial, and domestic sectors.

The refrigerant market in Germany has been experiencing steady growth in recent years due to the increasing demand for air conditioning units. This rising demand has led to a higher need for refrigerants, which are used in air conditioning units throughout the region. Germany is one of the leading automobile producers in Europe; as a result, there is an increase in industrial and mobile air conditioning in the region, leading to a rising demand for refrigerants.

Asia Pacific Refrigerant Market Trends

The refrigerant market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. The increasing demand for refrigeration and cooling equipment, combined with rapid industrialization and urbanization, will drive market expansion during the forecast period. The Asia Pacific market is expected to grow due to the rapid development of countries such as China, India, Japan, and Australia.

The China refrigerant market is expected to grow rapidly during the forecast period. China is one of the significant producers and consumers of refrigerants. The rising construction projects, industrial projects require ventilation and air conditioning systems, resulting in rising demand for the refrigerants.

Latin America Refrigerant Market Trends

The refrigerant market in Latin America is expected to grow rapidly during the forecast period. This growth is attributed to the increasing number of commercial, manufacturing, and industrial plants in the region. The rise in commercial, manufacturing, and industrial plants requires HVAC and air conditioning units, resulting in higher demand for refrigerants in the region.

Middle East & Africa Refrigerant Market Trends

The Middle East and Africa refrigerant market is expected to grow at a significant CAGR over the forecast period. The climatic conditions experienced by the region have made it a prominent market for cooling products. This results in a rising demand for cooling equipment, such as air conditioners and refrigerators, which in turn leads to increased demand for refrigerants in the region.

Key Refrigerant Company Insight

Some of the key players operating in the market include Honeywell International Inc., Daikin Industries Ltd., and Arkema S A, among others.

-

Honeywell International Inc. manufactures and supplies aerospace products & services, turbochargers, energy-efficient solutions, and products for homes, businesses & transport, specialty chemicals, electronic and advanced materials, process technology for refining and petrochemicals, and security technologies for home, industries, and buildings. The company has its business operating via four segments: aerospace, home and building technologies, performance materials and technologies, and safety & productivity solutions. The company has a global presence.

-

Daikin Industries Ltd is a manufacturer and supplier of cooling equipment and chemicals. It operates via three segments: Air Conditioning and Refrigeration Business, Chemicals, and others. The Air Conditioning and Refrigeration Business segment is responsible for providing residential and commercial air conditioners, residential and commercial air purifiers, large-sized chillers, marine vessel air conditioners, and marine refrigeration units. The Chemicals segment manufactures and supplies fluoropolymers, fluorocarbons, fine chemical products, and chemical engineering machinery. The company has a global presence.

Key Refrigerant Companies:

The following are the leading companies in the refrigerant market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell Industries Inc.

- Daikin Industries Inc.

- Arkema S A

- Dongyue Group

- The Chemours Company

- Mexichem SAB de CV

- Sinochem Group

- Linde Group

- Air Liquide

- SRF Limited

- Gujarat Fluorochemicals Limited

- Asahi Glass Co, Ltd (AGC)

Recent Developments

-

In 2025, Robertshaw launches an upgraded Ranco commercial refrigeration line that reflects continued innovation in the refrigerant industry, with a focus on improved controls and compatibility with low-GWP, energy-efficient refrigerants. The launch supports sustainable refrigeration practices and regulatory compliance, reinforcing demand in the commercial refrigeration segment.

-

In June 2024, Hudson Technologies announced the acquisition of USA Refrigerants for USD 27 million. This acquisition helps Hudson Technologies enter the North America and U.S. markets.

Refrigerant Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 16.34 billion

Revenue forecast in 2033

USD 22.60 billion

Growth rate

CAGR of 4.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Honeywell Industries Inc.; Daikin Industries Ltd.; Arkema S A.; Dongyue Group; The Chemours Company; Mexichem SAB de CV; Sinochem Group; Linde Group; Air Liquide; SRF Limited; Gujarat Fluorochemicals Limited; Asahi Glass Co., Ltd. (AGC).

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

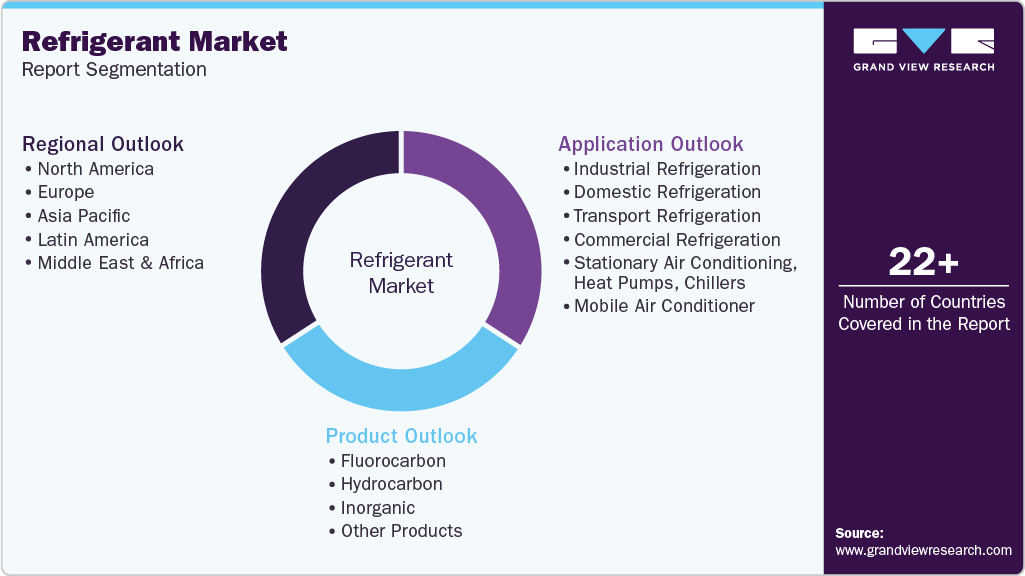

Global Refrigerant Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global refrigerant market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Fluorocarbon

-

Hydrocarbon

-

Inorganic

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Industrial Refrigeration

-

Domestic Refrigeration

-

Transport Refrigeration

-

Commercial Refrigeration

-

Stationary Air Conditioning, Heat Pumps, Chillers

-

Mobile Air Conditioner

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global refrigerant market size was estimated at USD 15.62 billion in 2025 and is expected to reach USD 16.34 billion in 2026.

b. The global refrigerants market is expected to grow at a compound annual growth rate of 4.7% from 2026 to 2033 to reach USD 22.60 billion by 2033.

b. The fluorocarbon segment dominated the refrigerant market in 2025, accounting for 52.4% of the total market share, driven by their strong thermodynamic performance and widespread use across the commercial refrigeration market, industrial refrigeration market, and industrial refrigeration system market.

b. Some key players operating in the refrigerants market include Honeywell Industries Inc.; Daikin Industries Ltd.; Arkema S A.; Dongyue Group; The Chemours Company; Mexichem SAB de CV; Sinochem Group; Linde Group; Air Liquide; SRF Limited; Gujarat Fluorochemicals Limited; Asahi Glass Co., Ltd. (AGC).

b. Growth is driven by rising demand from the commercial refrigeration market and industrial refrigeration market, supported by expanding cold storage and logistics, including the road transport refrigeration equipment market. Increasing adoption of monitoring solutions in the refrigeration monitoring market and storage refrigeration monitoring market, along with advancements in the commercial refrigeration compressor market, are further supporting growth, while the shift toward eco-friendly technologies is creating opportunities in emerging segments such as the magnetic refrigeration market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.