- Home

- »

- Medical Devices

- »

-

Refurbished MRI Systems Market, Industry Report, 2030GVR Report cover

![Refurbished MRI Systems Market Size, Share & Trends Report]()

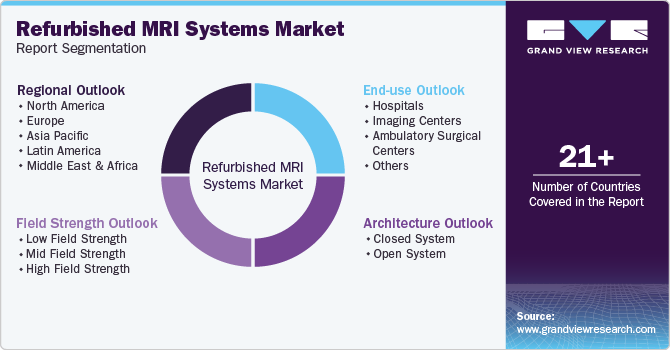

Refurbished MRI Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Architecture (Closed System, Open System), By Field Strength (Low Field Strength, Mid Field Strength, High Field Strength), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-160-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Refurbished MRI Systems Market Trends

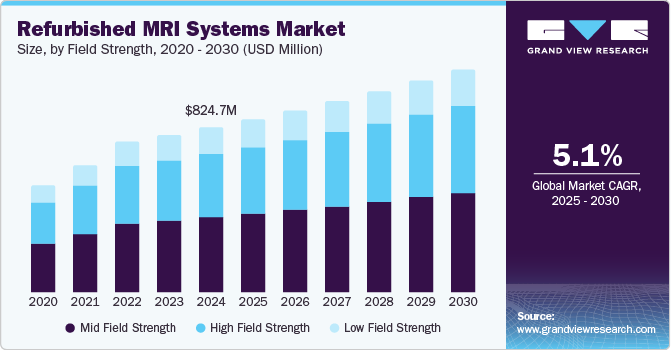

The global refurbished MRI systems market size was valued at USD 824.7 million in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. Key factors contributing to the market's growth are the high cost of new MRI systems and the growing demand for healthcare services. Furthermore, the increasing number of suppliers for refurbished MRI systems is also expected to propel market growth.

Refurbished medical devices are restored devices that are rebuilt to meet the safety and performance without changing the intended use of the original device. To ensure its reliability, efficacy, and safety, medical equipment must be refurbished before being used again. Most hospitals and diagnostic centers understand that purchasing a used medical device is a desirable choice. A key factor driving the market is the widespread clinical use of imaging equipment in the diagnosis of various illnesses. With the exception of a few mild illnesses, medical imaging tools such as MRI machines are frequently utilized in the diagnosis of almost all medical conditions.

The demand for refurbished MRI systems worldwide is increasing due to their superior qualities compared to other devices, such as X-rays and CT scans, as they employ powerful magnetic fields and radio waves, rather than ionizing radiation, to produce images of the body. This results in more safety for patients, which accounts for the rise in market expansion with wider trends in medical technology and patient treatment

According to an article published by LBN Medical in February 2023, the average cost of MRI systems featuring a magnetic field strength of 1.5T or lower is approximately USD 367.20. Also, the cost of the 3T MRI system is approximately more than USD 419.66 million. According to an article published by NCBI in July 2023, the MRI system carries an initial acquisition expense of USD 189.48 million. For healthcare providers, purchasing an MRI machine requires a significant investment due to its high cost. Due to the wide range of sizes and magnetic strengths available for MRI equipment, the price may vary.

Healthcare costs is rising quickly, leading to a focus on the prices of medical services and products. Research and development costs, profit margins, and the complicated global market for medical devices influence high costs. The refurbished MRI systems are 35 - 45% less expensive than the new system’s prices. Hence, the high price of the original MRI devices is expected to contribute to the growth of the refurbished MRI systems industry. The market growth is influenced by the presence of several refurbished device suppliers. This increased competition benefits buyers by offering a wider range of options. Reputed suppliers often provide warranties, repair services, and ongoing support for refurbished MRI systems, giving healthcare facilities confidence in their purchase and ensuring that the equipment remains in good working condition.

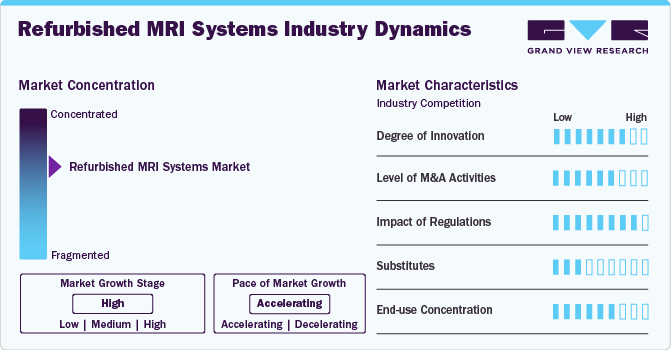

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The global refurbished MRI systems industry has witnessed a significant degree of innovation, marked by advancements to enhance both performance and cost-effectiveness. Manufacturers are incorporating new technologies to ensure that these systems align with the latest diagnostic standards. For instance, integration of advanced imaging software and artificial intelligence algorithms has become very common, enhancing the overall accuracy and efficiency of the MRI systems.

Manufacturers are incorporating new technologies to ensure that these systems align with the latest diagnostic standards. A 2024 study by Elsevier studied the integration of advanced imaging software with AI algorithms, recommending continued investment, establishment of ethical guidelines, and training for healthcare professionals to ensure the overall accuracy and efficiency of the MRI systems.

Key players have been strategically engaging in mergers & acquisitions to strengthen their market presence with a broader product portfolio. In May 2023, Siemens Healthineers collaborated with the hospital giant CommonSpirit Health to acquire Block Imaging. Block Imaging is the key refurbished medical equipment, service, and parts supplier company. This acquisition is aimed at providing sustainable options and supporting growing demand among hospitals, healthcare systems, and others.

Variations in national regulations and policies regarding refurbished medical devices can be seen. Major markets, such as the U.S. and EU, accept the sale and import of refurbished medical devices, while other countries do not.

Architecture Insights

Closed systems dominated the market, with the largest revenue share of 72.0% in 2024. These systems are used traditionally. However, closed systems have very low acceptance by patients with claustrophobia, and they also possess chances of suffocation. Thus, companies are focusing on research to develop advanced open systems that have more acceptance by patients with claustrophobia.

Companies are investigating improved open systems that might be more tolerable for these patients. Nevertheless, evidence backing open MRIs is scarce, and the image quality typically falls short of that produced by closed MRIs.

The open systems segment is expected to grow at the fastest rate over the forecast period, Open systems are specially designed for increasing patient convenience. These systems provide a larger space for patients. The demand for MRI scans is increasing, partly due to rising obesity levels, which is resulting in more requests for open MRIs. According to World Health Organization (WHO), in 2022,5 billion adults (aged 18 years and above) were overweight, and out of these, 890 million individuals were experiencing obesity. This increasing trend highlights the necessity for accessible imaging solutions that meet various patient requirements, making open MRI systems a significant component in the changing healthcare environment.

Field Strength Insights

The mid field strength segment dominated the market and accounted for the largest revenue share of 45.9% in 2024. These MRI machines aid in more accurate picture capture and are affordable. These MRI systems are suitable for a variety of diagnostic uses, including imaging of the musculoskeletal system, the brain, and the abdomen. Compared to high-field strength systems, midfield strength systems are frequently more affordable to buy and run. Due to this, they are a popular option for smaller clinics and healthcare facilities with limited resources.

The high field strength segment is expected to grow at the fastest CAGR over the forecast period. High-field MRI devices acquire images more rapidly when compared to low and mid-field systems. This is especially helpful for individuals like children or claustrophobic people who have trouble staying motionless during the imaging process. For spectroscopic studies, which examine the chemical composition of tissues and can be used to identify uncertainties at the molecular level, high-field refurbished MRI devices are more suitable. Thus, high-field strength MRI systems can often achieve the same diagnostic information in shorter scan times, improving patient throughput and overall efficiency in a clinical setting.

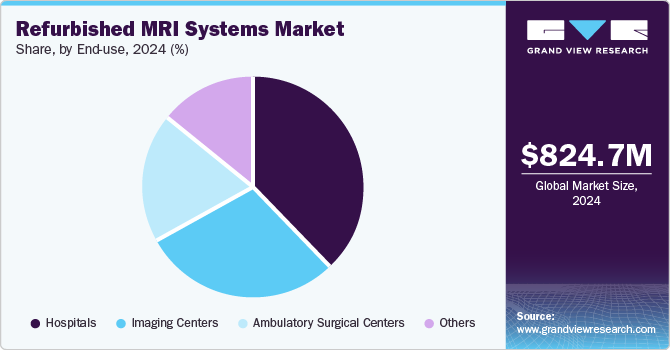

End Use Insights

Hospitals held the largest revenue share of 37.8% in 2024. Many used MRI systems come with advanced hardware and software improvements, guaranteeing that they satiate the most recent imaging requirements. Hospitals can use cutting-edge imaging methods without having to purchase new equipment. Due to rising demand from healthcare facilities looking for affordable alternatives, the market for refurbished MRI systems has been expanding. This increasing trend is likely to continue, particularly as hospitals work to improve their imaging offerings.

Imaging centers are anticipated to witness significant growth over the forecast period. Increased demand for non-invasive diagnostics is encouraging the emergence of numerous specialized facilities that offer services like MRI. Different medical experts have started their facilities that offer MRI at a reasonable price to suit this rising need. This trend is fostering the utilization of refurbished MRI systems in the medical field, as they require less investment compared to installing new MRI units. During the projected period, expanding government initiatives to enhance and expand the supply of imaging centers to expand access in rural areas are anticipated to drive sector expansion.

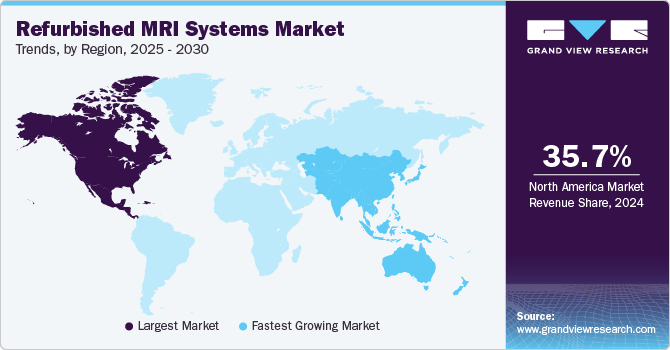

Regional Insights

North America refurbished MRI market dominated the market with the largest revenue share of 35.7% in 2024. The growing prevalence of chronic diseases, including cardiovascular issues, breast cancer, and neurological conditions, has driven a growing demand for imaging analysis in this field. The region is anticipated to continue its dominance in the coming years. Technological advancements, along with an increase in the prevalence of chronic illnesses, are expected to drive refurbished MRI system market growth over the forecast period. In North America, a number of companies specialize in refurbishing and marketing MRI equipment. These businesses frequently have a wealth of experience in the medical imaging sector, and they offer guarantees and service agreements to guarantee the dependability of their refurbished equipment.

The medical imaging equipment market continues to be crucial to the healthcare sector, and refurbished systems present an excellent option compared to new equipment as they are assured to perform just as effectively as a new OEM version of the same model. Many companies backed by extensive medical imaging knowledge focus on refurbishing and selling MRI equipment with excellence, which enhances their market standing and increases healthcare providers' overall trust in the efficacy of refurbished medical imaging equipment.

U.S Refurbished MRI Market Trends

The U.S. refurbished MRI systems market dominated, with a revenue share of 78.2% in 2024. Hospitals' increasing requirement for cost-effective medical devices drives the demand, enabling them to enhance their revenue while still delivering quality service.

Europe Refurbished MRI Market Trends

Europe refurbished MRI systems market is expected to grow substantially over the forecast period. MRI plays a crucial role in combating life-threatening illnesses such as brain tumors, cancers, and cardiovascular disorders. The increasing incidence rate of these disorders is expected to propel market growth in the coming years.

Asia Pacific Refurbished MRI Market Trends

Asia Pacific refurbished MRI market is expected to register the fastest CAGR of 6.0% over the forecast period. New regulations in the region are anticipated to standardize the procedure and stimulate regional market growth. In February 2022, the MDA (Malaysian Medical Device Authority) established regulations pertaining to the criteria for registering refurbished medical equipment. For reprocessed medical equipment, there are two registration procedures: ROUTE (A) for the original supplier and ROUTE (B) for third-party refurbishers. Lucrative growth opportunities in developing countries are likely to contribute to the regional market growth.

Key Refurbished MRI Systems Company Insights

Some key companies operating in the market include GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V., among others. Key players operating in the market are focusing on the development of refurbished MRI market systems in terms of sustainability and efficiency to gain a significant revenue share.

-

GE HealthCare is a global pharmaceutical diagnostic, medical technology, and digital solutions company. The company operates in imaging, ultrasound, pharmaceutical diagnostics, and patient care solutions. The ultrasound segment includes diagnosis, screening, monitoring of multiple diseases, and therapy support. The pharmaceutical diagnostics segment includes diagnostic imaging agents, which are used to enhance nuclear medicine procedures and radiology across pathways.

-

Radio Oncology Systems Inc. provides affordable, high quality refurbished and used radiation oncology and diagnostic imaging equipment solutions to facilities globally.

Key Refurbished MRI Systems Companies:

The following are the leading companies in the refurbished MRI systems market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- GE Healthcare

- CANON MEDICAL SYSTEMS CORPORATION

- Siemens Healthineers

- Avante Health Solutions

- Integrity Medical Systems, Inc.

- Radiology Oncology Systems

Recent Developments

-

In May 2023, Siemens Healthineers collaborated with CommonSpirit Health to acquire Block Imaging. Block Imaging provides refurbished medical equipment, servicing, and parts. The acquisition aimed to encourage efforts to repair and reuse equipment, provide greater value to consumers and their patients, and reduce waste.

-

In January 2023, Radon Medical Imaging (Radon) announced the acquisition of Premier Imaging Medical Systems. Premier provides maintenance services and sales for new, used, and refurbished imaging and biomedical equipment.

Refurbished MRI Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 865.2 million

Revenue forecast in 2030

USD 1,108.3 million

Growth rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report Updated

March 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Architecture, field strength, end use

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; CANON MEDICAL SYSTEMS CORPORATION; Siemens Healthineers; Avante Health Solutions; Integrity Medical Systems, Inc.; Radiology Oncology Systems

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Refurbished MRI Systems Market Report Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global refurbished MRI systems market report based on architecture, field strength, end use and region.

-

Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Closed System

-

Open System

-

-

Field Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Field Strength

-

Mid Field Strength

-

High Field Strength

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.