- Home

- »

- Medical Devices

- »

-

Regulatory Consulting Outsourcing Services Market Report, 2030GVR Report cover

![Regulatory Consulting Outsourcing Services Market Size, Share & Trends Report]()

Regulatory Consulting Outsourcing Services Market Size, Share & Trends Analysis Report By Category (Pharmaceuticals, Medical Devices), By Company Size, By Indication, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-255-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

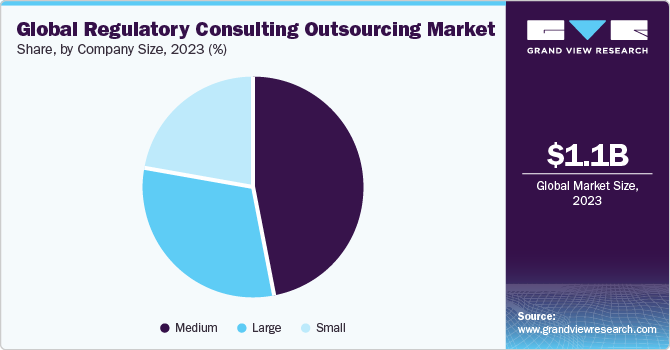

The global regulatory consulting outsourcing services market size was estimated at USD 1.10 billion in 2023 and is projected to grow at a CAGR of 8.36% from 2024 to 2030. Rising clinical trials, stringent regulatory scenarios, and the advent of end-to-end service providers are key drivers for this market. Healthcare organizations face substantial risks related to non-compliance with regulations, which can result in hefty fines, legal issues, and damage to reputation. Outsourcing regulatory consulting services helps mitigate these risks by ensuring adherence to regulatory standards.

The shrinking pipeline of blockbuster drugs has led to efficient manufacturing and development of pharmaceutical products, which led to the adoption of the full-time regulatory outsourcing models by life sciences companies to reduce the overall cost of development. Small- and mid-size companies hire regulatory consultants to manage their regulatory services in the new territories. Thus, demand for regulatory consultants for small and mid-size life sciences companies is expected to increase owing to the expansion of these companies into new and emerging markets, which is expected to contribute to the growth of the global Regulatory consulting outsourcing market.

The growing number of clinical trials worldwide, stringent regulations in developed markets, and legal/regulatory reforms are some of the major driving factors for market growth. For instance,

The legislation concerning pharmaceuticals in the EU (Directive 2001/83 and Regulation 726/2004) has facilitated the authorization of safe, effective, and high-quality medicinal products. Following four years of consideration, the EU Commission presented its recommendations for new legislation on April 26, 2023. This proposed update of the aforementioned EU pharmaceutical legislation marks the first significant review of pharmaceutical regulations since 2004.

Furthermore, an increase in efforts by companies to expand their geographical reach and gain rapid approvals in global markets is expected to further contribute to the adoption of outsourcing models for regulatory consulting services. Regulatory approval procedures are becoming increasingly stringent, and market players aim to receive product approvals in their first attempt to gain market share. Companies are required to have an in-house regulatory department or outsource their regulatory-related services due to stringent regulatory conditions in developed markets and changing regulations in developing ones.

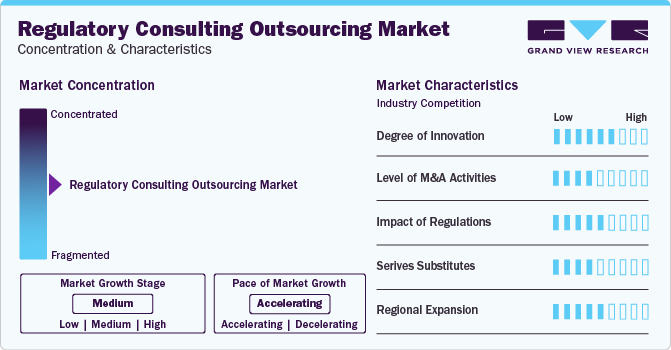

Market Concentration & Characteristics

The market is fragmented, with multiple players offering regulatory consulting services. Changes in regulatory requirements can create opportunities for consulting firms to offer specialized services to help clients navigate new compliance challenges. Established firms with a track record of expertise in specific regulatory areas is expected to have a competitive advantage in capturing these opportunities.

The market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation. The advancement of technology, particularly in areas such as artificial intelligence, machine learning, and automation, has revolutionized how regulatory compliance is managed. Consulting firms are leveraging these technologies to streamline processes, enhance accuracy, and provide more efficient services to their clients.

Regulatory consulting outsourcing services are also characterized by a medium level of merger and acquisition (M&A) activity by a key player. M&A activity allows larger players to consolidate the market by acquiring these smaller firms, thereby increasing their market share and strengthening their position in the industry.

Regulations have a significant impact on the Regulatory Consulting Outsourcing Services. The healthcare industry is one of the most heavily regulated sectors globally, with a myriad of laws, regulations, and compliance standards governing various aspects of healthcare delivery, including patient care, data privacy, billing practices, and drug manufacturing. Navigating this complex regulatory landscape requires specialized expertise and ongoing compliance support, driving the demand for regulatory consulting services.

Regulatory Consulting Outsourcing Services is characterized by a medium impact of regional expansion. Regulatory requirements vary significantly from one region to another due to differences in laws, regulations, and cultural factors. As a result, regulatory consulting firms often need to establish a local presence and develop specialized expertise in each region they operate in. This can pose challenges and limit the scalability of regional expansion efforts.

Regulatory Consulting Outsourcing Services is characterized by a medium impact of service expansion.Regulatory consulting firms often specialize in specific industries or regulatory domains, focusing their expertise on niche areas. While they may expand their services to cover a broader range of regulatory requirements, they typically maintain a core focus on their areas of specialization.

Category Insights

The drugs segment dominated the market in 2023 and accounted for the largest share of over 30% of the overall revenue. High demand for wearables and technological advancements in material science, design languages, personalized healthcare, and additive manufacturing are anticipated to contribute to the growth of medical devices. These factors are anticipated to increase market rivalry, which in turn is expected to encourage manufacturers & technology developers to focus on core competencies (such as the development of innovative technology solutions) and outsource non-core activities (such as regulatory consultancy) to gain first mover advantage and outperform the competition.

However, the biologics segment is expected to witness a higher CAGR of 9.46% over the forecast period. Biologics, including products such as vaccines, gene therapies, and monoclonal antibodies, often have a more complex regulatory pathway than small molecule drugs. The regulatory landscape for biologics is evolving rapidly with advancements in biotechnology, requiring specialized expertise to navigate regulatory requirements.

Indication Insights

The oncology segment dominated the market in 2023 and accounted for the largest share of the overall revenue. The segment is expected to maintain its position over the forecast period. This trend can be attributed to the widespread occurrence of cancer, which has created a demand for safe and effective treatment alternatives. Additionally, oncology stands out as one of the most lucrative markets for pharmaceutical and biotechnology companies, leading to a rise in the number of research and development projects pursued by these entities.The sheer volume of oncology drugs in development necessitates extensive regulatory support throughout the drug development lifecycle, from preclinical development to post-marketing surveillance.

The immunology segment is expected to witness a higher CAGR of 9.89% over the forecast period. The robust immunology pipeline of pharmaceutical and biopharmaceutical companies is anticipated to boost segment growth further. Moreover, Immunotherapy, including treatments such as immune checkpoint inhibitors, CAR-T cell therapy, and therapeutic vaccines, has gained significant momentum in recent years. These innovative therapies require specialized regulatory knowledge and experience to navigate the approval processes, which can be more intricate than traditional pharmaceuticals.

End-use Insights

The pharmaceutical companies segment dominated the market in 2023 and accounted for the largest share of more than 40% of the global revenue.Since many pharmaceutical companies have products belonging to various stages of a life cycle, aligning the regulation and products with respective market standards in terms of drug registrations, approvals, & market entry is a challenge. Thus, outsourcing regulatory consultancy enables these companies to ensure compliance to market-specific regulations cost-effectively and efficiently. Moreover, an increase in the number of approved pharmaceutical products is also anticipated to fuel the market.

On the other hand, the biotechnology companies segment is expected to have significant growth during the forecast period.Biotechnology companies operate in a highly regulated environment due to the nature of their products, which often involve genetic engineering, novel drug development, and advanced therapies. Navigating through regulatory requirements can be challenging, requiring specialized knowledge and expertise.

Company Size Insights

The medium-sized companies segment dominated the global market in 2023 and accounted for the largest share of over 45% of the overall revenue. The anticipated growth in this segment's market share is expected to be fueled by the presence of numerous mid-sized established providers, particularly those held privately. These companies boast a robust presence in specific markets or even across multiple global markets, offering a diverse range of services that can vary from a few specialized offerings to a comprehensive suite. Such distinctions in service offerings are primarily influenced by the internal structure of the company, its technical prowess, and the availability of skilled talent.

On the other hand, the large-size companies segment is expected to have significant growth during the forecast period. Large companies generally prefer service providers of similar size to meet various regulatory needs arising due to their large geographic network, wide product lines, and different service offerings. These companies tend to seek long-term partnerships with service providers rather than a one-time client-vendor relationship. Moreover, according to an article published by GEP (2021), large pharma companies generally outsource about 50% of their regulatory affair needs. These organizations tend to have the required infrastructure, and expertise required for their regulatory submissions and thus, employ a service provider to supplement their internal regulatory affairs team.

Regional Insights

North America dominated the global market in 2023 and accounted for the largest share of over 38% of the overall revenue. The stringent regulatory procedures and increased research and development investments in North America are expected to drive demand for outsourcing regulatory consulting services among major biopharmaceutical companies. North America hosts a multitude of biopharmaceutical and medical device firms that are entrusting some of their regulatory responsibilities to external service providers, thus fostering the expansion of the regulatory consulting outsourcing services market.

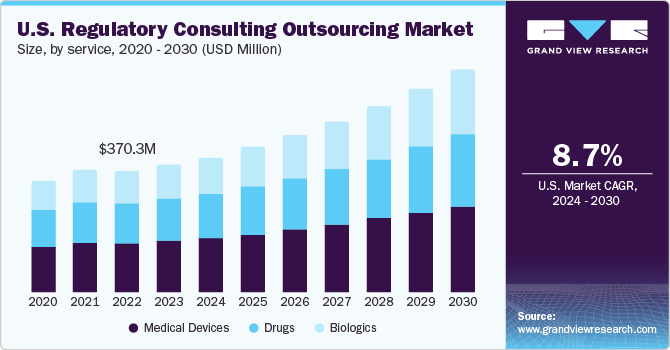

U.S. Regulatory Consulting Outsourcing Services Market Trends

Regulatory consulting outsourcing services market in the U.S. held the largest share in North America. The U.S. accounts for a major share of clinical trial applications across the globe. Along with branded and patented products, there is also a strong demand for cost-effective generic and biosimilar products in this region. In addition, there is also a significant increase in the import of generic and biosimilar products from emerging countries, which is increasing the demand for regulatory service providers in the region.

Asia Pacific Regulatory Consulting Outsourcing Services Market Trends

Asia Pacific regulatory consulting outsourcing services market is expected to witness a CAGR of 10.46% over the forecast period. Expansion of established biopharmaceutical companies in the region is expected to increase the demand for regulatory service providers owing to the region's heterogeneous and complex regulatory environment, which may further fuel the market's growth. Cost efficiency is a major factor for outsourcing regulatory services in this region as biopharmaceutical companies face tremendous pressure to reduce cost of R&D.

Regulatory consulting outsourcing services market in China held the largest share in Asia Pacific. Growing geriatric population and presence of a large pool of population belonging to the middle-income group are further increasing the demand for innovative and cost-effective medicines, which is expected to attract major biopharmaceutical and medical device companies in this region.

India regulatory consulting outsourcing services market has a huge demand from global life sciences companies. Cost benefits, improved infrastructure facilities, and a large pool of technical expertise are some of the major drivers for the growth of the regulatory consulting outsourcing market in this region. Global biopharmaceutical companies outsource manufacturing of biopharmaceutical products for clinical trials or sales in emerging countries such as India.s

Europe Regulatory Consulting Outsourcing Services Market Trends

Europe regulatory consulting outsourcing services market is expected to grow at a moderate CAGR over the forecast period. Established regulatory consulting outsourcing services support manufacturers in choosing the best option for regulatory compliance, improving the quality of medical device processes, and creating lifelong value. In addition, cost efficiency is a major factor for outsourcing regulatory services in this region.

Regulatory consulting outsourcing services market in the UK held a significant share in Europe. The demand for generic products has also grown considerably owing to government support for generics over branded drugs. This trend attracts various small- and mid-size biopharmaceuticals and medical device companies to enter the UK, thereby increasing the demand for regulatory support services.

Latin America Regulatory Consulting Outsourcing Services Market Trends

Latin America regulatory consulting outsourcing services marketis driven by emerging demand for innovative pharmaceutical and medical device solutions, which has led to continuous demand for regulatory consulting outsourcing services. Technological advancements are further enabling various companies to invest in the Latin American market. Cost efficiency is a major factor for outsourcing regulatory services in this region.

Regulatory consulting outsourcing services in Brazil held a major share in Latin America. Brazil accounts for largest biopharmaceutical market in Latin America, and the region is expected to dominate the Regulatory consulting outsourcing market during the forecast period. Brazil is expected to be the target market for international generic & innovator companies, thereby contributing to the growth of the regulatory outsourcing market.

MEA Regulatory Consulting Outsourcing Services Market Trends

MEA regulatory consulting outsourcing services market is driven by a growing population, and increasing government efforts to improve access to healthcare are expected to attract global healthcare companies into this market, contributing to the demand for regulatory consulting outsourcing services. In addition, an increasing number of biopharmaceutical & medical device companies outsource regulatory consulting services due to technological advancements, cost-effectiveness, and easy process. This is expected to contribute to the rising demand for the regulatory consulting outsourcing services market.

Regulatory consulting outsourcing services market in the South Africa held a significant share in MEA. The growing technological advancements, increasing prevalence of diseases, and growing adoption of regulatory services as compared to China, India, and Brazil are expected to contribute to the growth in South Africa, increasing the demand for regulatory consulting outsourcing services.

Key Regulatory Consulting Outsource Services Company Insights

Key companies are implementing diverse market strategies, including mergers and acquisitions, collaborations, regional expansion, portfolio diversification, and competitive pricing, to thrive in the competitive landscape and capture a larger market share. For instance, in September 2022, Parexel announced the addition of five former regulators to its Regulatory & Access Consulting team. This move aims to expedite the progress of new treatments for patients on a global scale.

Key Regulatory Consulting Outsource Services Companies:

The following are the leading companies in the regulatory consulting outsourcing services market. These companies collectively hold the largest market share and dictate industry trends.

- Parexel International Corporation

- ICON plc

- IQVIA

- Syneos Health

- Navigant Consulting, Inc.

- Premier Research

- Weinberg Group

- ProPharma

- PharmaLex GmbH

- LabCorp

Recent Developments

-

In November 2023, Odyssey Health selected Syneos Health to assist in its concussion treatment trial, offering regulatory review services for the clinical development plans involving Odyssey's concussion drug ONP-002 and innovative intranasal device.

-

In November 2022, PharmaLex bolsters its presence in regulatory services following its merger with strategic consultancy BlueReg. The merger enriches PharmaLex's skill set and capabilities across its Value Delivery Centers within the group.

Regulatory Consulting Outsourcing Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.17 billion

Revenue forecast in 2030

USD 1.90 billion

Growth rate

CAGR of 8.36% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, indication, end-use, company size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

ICON plc.; IQVIA, Syneos Health; Navigant Consulting, Inc.; Premier Research; Covance; Weinberg Group; ProPharma; PharmaLex GmbH; LabCorp

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Regulatory Consulting Outsourcing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global regulatory consulting outsourcing services market report based on category, indication, end-use, company size, and region:

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drugs

-

Biologics

-

Medical Devices

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Infectious Disease

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biotechnology Companies

-

Pharmaceutical Companies

-

Medical Device Companies

-

-

Company Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global regulatory consulting outsourcing services market size was estimated at USD 1.10 billion in 2023 and is expected to reach USD 1.17 billion in 2024.

b. The global regulatory consulting outsourcing services market is expected to grow at a compound annual growth rate of 8.36% from 2024 to 2030 to reach USD 1.90 billion by 2030.

b. North America dominated the regulatory consulting outsourcing services market with a share of 38.9% in 2023. The stringent regulatory procedures and increased research and development investments in North America are expected to drive a demand for outsourcing regulatory consulting services among major biopharmaceutical companies.

b. Some key players operating in the regulatory consulting outsourcing services market include Parexel International Corporation, ICON plc., IQVIA, Syneos Health, Navigant Consulting, Inc., Premier Research, Weinberg Group, ProPharma, PharmaLex GmbH, LabCorp.

b. Key factors that are driving the market growth include Healthcare organizations face substantial risks related to non-compliance with regulations, which can result in hefty fines, legal issues, and damage to reputation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."