- Home

- »

- Pharmaceuticals

- »

-

Rehabilitation Robots Market Size And Share Report, 2030GVR Report cover

![Rehabilitation Robots Market Size, Share & Trends Report]()

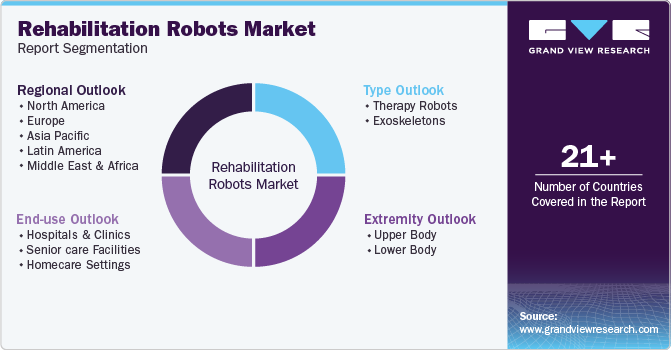

Rehabilitation Robots Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Therapy Robots, Exoskeleton), By Extremity (Upper Body, Lower Body), By End-use (Hospitals & Clinics, Senior Care Facilities, Homecare Settings), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-968-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rehabilitation Robots Market Summary

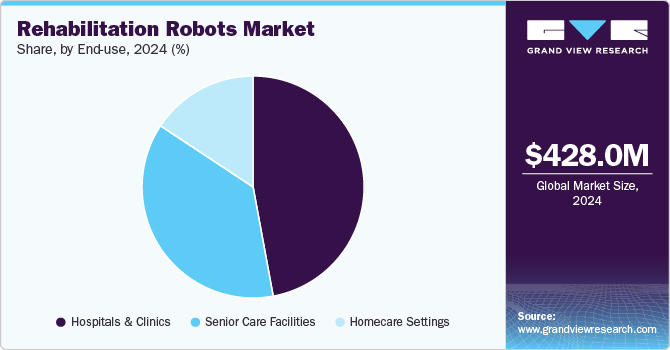

The global rehabilitation robots market size was estimated at USD 428.0 Million in 2024 and is projected to reach USD 1,031.2 Million by 2030, growing at a CAGR of 15.2% from 2025 to 2030.The growth can be attributed to the rising per capita healthcare spending and rapid adoption of technologically advanced equipment in the healthcare sector.

Key Market Trends & Insights

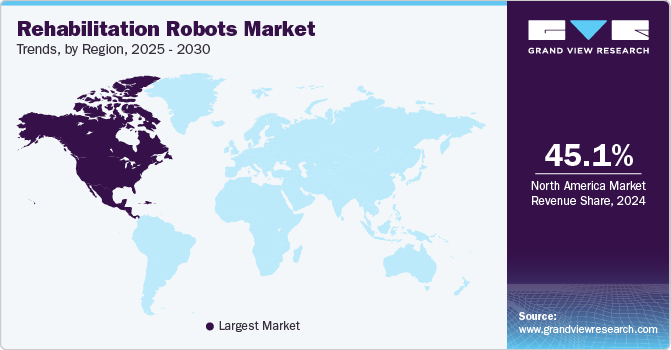

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Japan is expected to register the highest CAGR from 2025 to 2030.

- By type, the exoskeletons segment dominated the rehabilitation robots market in 2024.

- By extremity, the lower body segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 428.0 Million

- 2030 Projected Market Size: USD 1,031.2 Million

- CAGR (2025-2030): 15.2%

- North America: Largest market in 2024

The rising prevalence of strokes and the rapidly growing population of older adults are some of the key driving factors responsible for growth. Technological advancements are also playing a major role in supporting industry growth. Furthermore, increasing disorders such as cumulative trauma disorder, repetitive strain injury, and occupational overuse syndromes further impact the market positively.

The information provided on GOV.UK indicates that in 2023, 18.4% of individuals aged 16 and above reported having a long-term musculoskeletal (MSK) condition. This percentage reflects a rise from the 17.6% prevalence in 2022, but it was lower compared to 2019, when it stood at 18.8%. This increasing number of people suffering from such conditions is resulting in the high use of rehab robots as these devices help differently abled or physically challenged patients in standing up, balancing, and maintaining gait.

The rising prevalence of spinal cord injuries is driving the expansion of rehabilitation robots, as individuals with spinal cord injuries are advised to utilize exoskeletons to enhance their situation. This has emerged as a significant factor in the acceptance of exoskeletons and therapy robots by both patients and healthcare providers. According to WHO report published in 2024, more than 15 million people were living with spinal cord injury, and this increase in the number of patients is resulting in the rising use of exoskeletons.

Additionally, there is a growing need for rehab robots due to their numerous advantages. They allow individuals with spinal cord injuries to walk and stand with minimal energy expenditure. Moreover, the integration of AI, machine learning, and advanced sensors presents new possibilities for the market. The rising number of elderly people with chronic illnesses also contributes to market growth.

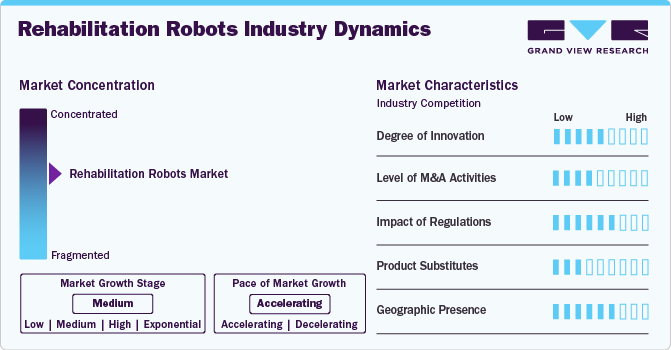

Market Concentration & Characteristics

The degree of innovation in the market for rehabilitation robots is rapidly advancing, driven by technological breakthroughs and a growing emphasis on personalized patient care. Innovations in robotics, artificial intelligence, and machine learning are enabling the development of sophisticated rehabilitation devices that provide tailored therapies to meet individual patient needs. These robots can adapt in real time to a patient's progress, offering precise feedback and adjustments that enhance the effectiveness of rehabilitation programs.

The market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for rehabilitation robots. In August 2023, ReWalk Robotics Ltd. stated the completion of the previously disclosed acquisition of AlterG, Inc., a prominent innovator and supplier of Anti-Gravity systems for application in neurological and physical rehabilitation.

In many regions, including North America and Europe, regulatory bodies such as the FDA and EMA establish stringent guidelines to ensure the safety, efficacy, and quality of robotic rehab devices. These regulations promote high standards, encouraging manufacturers to invest in research and development while adhering to rigorous testing protocols.

The market faces competition from a variety of product substitutes that influence patient choice and treatment options. Traditional rehabilitation methods, such as physical therapy and occupational therapy, remain prevalent, offering personalized, hands-on treatment that can be highly effective for many patients. Additionally, emerging technologies, such as virtual reality (VR) and augmented reality (AR) therapies, provide engaging alternatives that can enhance patient motivation and adherence to rehabilitation protocols.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising product approvals and funding create more opportunities for market players to enter new regions. In April 2022, Hangzhou RoboCT Technology Development Co., a Chinese company that manufactures rehabilitation robots, secured USD15.7 million in a Series A+ funding round, with Fortune Capital leading the investment.

Type Insights

In 2024, the exoskeletons segment dominated the rehabilitation robots market and accounted for the largest revenue share. The growing elderly population is expected to contribute to an increase in the usage of exoskeletons. For instance, the European Commission has published data indicating that it is estimated that there will be nearly 500,000 people aged 100 or over in the EU-27 by 2050. In addition, the increasing prevalence of cerebral palsy, the most common childhood disability, is expected to increase the usage rate of exoskeleton robots. Increasing product launches and approvals are fostering market growth. In October 2024, German Bionic, a renowned company in active exoskeleton technology, unveiled the latest Apogee+ power suit tailored for the healthcare industry. The Apogee+ power suit promises notable enhancements in strength and intelligence, providing healthcare professionals with augmented capabilities to minimize fatigue and injury risks while improving overall operational efficiency in medical facilities and residential care facilities.

The therapy robots segment in the market is anticipated to witness the fastest growth with a CAGR of 15.9% over the forecast period. The growth can be attributed to the growing adoption of therapy robots by the healthcare sector, growing investment in R&D to build technologically advanced products and growing awareness about therapy robots. The growing incidence of paralysis, spinal cord injury, and stroke is a key factor driving the growth of the segment.

Extremity Insights

In 2024, the lower body segment dominated the market and accounted for the largest revenue share. The lower-body segment is expected to experience increased adoption, penetration, and growth due to a rapidly aging population, a rise in the incidence of lower body disabilities, and an increase in paralyzed patients. The robotic lower-body exoskeleton serves as a support for lower limb paralysis and promotes muscle activity in the lower body. These devices are primarily utilized by frail elderly individuals and those with conditions such as multiple sclerosis, stroke, and severe gait impairment. Furthermore, increasing research and development activities in lower limb rehab robots are fostering segmental growth. In October 2022, Dr. Jayant Kumar Mohanta, a researcher at IIT Jodhpur, developed a robotic trainer for lower limb rehabilitation suitable for physiotherapy.

The upper body segment in the market is anticipated to witness fastest growth with a CAGR of 15.5% over the forecast period. Advantages associated with the use and implementation of robotic technologies for upper limbs, such as neurological impairments, post-stroke rehabilitation, and musculoskeletal issues, are accelerating market growth. Furthermore, robots and exoskeletons support individuals with disabilities, assisting them in their daily activities and contributing to the growth of the segment. In addition, growing funding for the development of advanced rehab robots is propelling market growth. In May 2021, Harmonic Bionics secured Series A funding of USD 7 million for their upper-extremity exoskeleton.

End-use Insights

In 2024, the hospitals & clinics segment dominated the market and accounted for the largest revenue share of 47.1%. The growth is primarily due to the rise in healthcare spending and the rapid acceptance of advanced technology in healthcare centers. Additionally, a significant number of people with spinal cord injuries, musculoskeletal disorders, and other conditions seek rehabilitation services in hospitals, which contributes to the growth of this sector. Moreover, an increase in awareness of technologically advanced systems and a higher number of FDA approvals for medical exoskeletons are supplementing market growth.

The senior care facilities segment in the market is anticipated to witness significant growth over the forecast period due to the rising geriatric population. Additionally, the expansion of government programs aimed at constructing senior care facilities globally, along with the rising need to enhance healthcare services for elderly individuals, contributes to the market's growth.

Regional Insights

North America rehabilitation robots dominated the market in 2024 and accounted for the largest revenue share of 45.1%. The increasing prevalence of spinal cord injury is fueling market growth. The surging disabled population and growing geriatric population are among the factors driving the industry expansion. In 2021, the U.S. Census Bureau reported that approximately 42.5 million individuals in the civilian noninstitutionalized population in the U.S. have disabilities, constituting 13% of this demographic.

U.S. Rehabilitation Robots Market Trends

U.S. rehabilitation robots market in the held the largest share of 86.9% in 2024. Increasing adoption of strategic initiatives by market players is driving market growth. In August 2024, Procept BioRobotics revealed that it had obtained clearance from the FDA for its advanced Hydros robotic surgery system.

Canada rehabilitation robots market is anticipated to register the fastest growth during the forecast period. Continuous technological development and significant research spending in the healthcare sector by government organizations are fostering market growth. Moreover, private entities providing funding for research and development to create advanced technological products are escalating market growth.

Europe Rehabilitation Robots Market Trends

Europe rehabilitation robots market is anticipated to register the fastest growth during the forecast period. Region's aging population and the increasing prevalence of chronic diseases are supplementing market growth. European countries are investing heavily in healthcare innovations to improve patient outcomes, thereby boosting market growth.

Germany rehabilitation robots market is anticipated to register a considerable growth rate during the forecast period due to a strong emphasis on technological innovation and a well-established healthcare infrastructure. Moreover, increasing funding in robotic systems are supplementing market growth. In September 2024, Reactive Robotics, a healthcare startup based in Munich specializing in AI and robot-assisted mobilization for hospitals and care facilities, announced that it had obtained an extra USD 5.4 million in funding.

UK rehabilitation robots market is anticipated to register a considerable growth rate during the forecast period. The National Health Service’s (NHS) ongoing efforts to enhance patient care and efficiency in rehabilitation practices are driving market growth. The focus on improving patient engagement and outcomes further accelerates the adoption of robotic technologies in rehabilitation settings.

Asia Pacific Rehabilitation Robots Market Trends

Asia Pacific rehabilitation robots market is anticipated to register the fastest growth rate during the forecast period owing to the rising healthcare expenditures, and an increasing awareness of advanced rehabilitation technologies. Moreover, the aging population in this region necessitates effective rehabilitation solutions for age-related conditions and injuries.

China rehabilitation robots market held the largest share in 2024. Availability of advanced robotic system in the country is driving market growth. In November 2023, Syrebo, a top provider of rehabilitation solutions, introduced two innovative products at MEDICA 2023, the Hand Rehabilitation Robot (BCI) and the Upper Limb Rehabilitation Robot.

Japan rehabilitation robots market is anticipated to register a considerable growth during the forecast period. The growing geriatric populations that are prone to various age-related conditions, such as stroke and degenerative diseases, are driving the demand for rehabilitation robot. The National Institute of Population and Social Security Research states that Japan is projected to have 34.8% of its population aged over 65 by 2040.

Latin America Rehabilitation Robots Market Trends

Latin America rehabilitation robots market is anticipated to register the fastest growth during the forecast period. The increasing healthcare investments and a rising prevalence of chronic illnesses and disabilities are significant factors boosting industry growth.

Brazil rehabilitation robots market is anticipated to register a considerable growth during the forecast period. Increasing awareness of the importance of rehabilitation therapies and the rising incidence of disabilities are fostering market growth. In Brazil, around 18.6 million individuals aged 2 years and older (which accounts for 8.9% of this age group) had some form of disability. This information is derived from the Persons with Disability section of the 2022 Continuous PNAD.

Middle East & Africa (MEA) Rehabilitation Robots Market Trends

MEA rehabilitation robots market is anticipated to register the fastest growth during the forecast period, due to an increasing focus on healthcare modernization and improving rehabilitation services. Governments in several countries are investing in healthcare infrastructure, aiming to enhance patient care and address the rising prevalence of conditions requiring rehabilitation, such as stroke and musculoskeletal disorders.

South Africa rehabilitation robots market is anticipated to register a considerable growth during the forecast period. The increasing prevalence of conditions such as stroke, spinal injuries, and orthopedic disorders are fostering regional growth.

Key Rehabilitation Robots Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Rehabilitation Robots Companies:

The following are the leading companies in the rehabilitation robots market. These companies collectively hold the largest market share and dictate industry trends.

- CYBERDYNE INC.

- Lifeward (ReWalk Robotic)

- Rex Bionics Ltd.

- Hocoma (Part of DIH Medical)

- Life Science Robotics

- Rehab-Robotics Company Limited

- Ekso Bionics

- Tyromotion GmbH

- BIONIK

- AlterG, Inc.

- BioXtreme Ltd.

- Fourier

Recent Developments

-

In December 2023, Motusium and Curexo announced a partnership. This collaboration results in Motusium playing a significant role in the U.S. expansion of Curexo's Morning Walk, which is a robot for gait rehabilitation.

-

In September 2023, Bionik Laboratories obtained a patent from the U.S. Patent and Trademark Office (USPTO) for its rehabilitation technology. Innovative rehabilitation technology includes a new device and technique that offer positioning and guidance for patients during upper-extremity rehabilitation.

-

In April 2023, Harmonic Bionics launched the Harmony SHR robotic rehabilitation system following FDA registration.

-

In 2022, Ekso Bionics Holdings, Inc., a leading player in exoskeleton technology for medical and industrial applications, has announced that it has obtained 510(k) clearance from the U.S. FDA to sell its EksoNR robotic exoskeleton for the treatment of Multiple Sclerosis (MS) patients.

Rehabilitation Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 508.29 million

Revenue forecast in 2030

USD 1.03 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, extremity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

CYBERDYNE INC.; Lifeward (ReWalk Robotic); Rex Bionics Ltd.; Hocoma (Part of DIH Medical); Life Science Robotics; Rehab-Robotics Company Limited; Ekso Bionics; Tyromotion GmbH; BIONIK; AlterG, Inc.; BioXtreme Ltd.; Fourier

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rehabilitation Robots Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global rehabilitation robots market report on the basis of type, extremity, end-use, and region:

-

Type Outlook (Revenue USD Million, 2018 - 2030)

-

Therapy Robots

-

Exoskeletons

-

-

Extremity Outlook (Revenue USD Million, 2018 - 2030)

-

Upper Body

-

Lower Body

-

-

End-use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals & clinics

-

Senior care facilities

-

Homecare settings

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rehabilitation robots market size was estimated at USD 428.0 million in 2024 and is expected to reach USD 508.3 million in 2025.

b. The global rehabilitation robots market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030 to reach USD 1.03 billion by 2030.

b. Exoskeleton held the largest market share of 57.2% in 2024. The growing elderly population is expected to contribute to an increase in the usage of exoskeletons.

b. Some key players operating in the rehabilitation robots market includes CYBERDYNE INC., Lifeward (ReWalk Robotic), Rex Bionics Ltd. Hocoma (Part of DIH Medical), Life Science Robotics, Rehab-Robotics Company Limited, Ekso Bionics, Tyromotion GmbH, BIONIK, AlterG, Inc., BioXtreme Ltd., Fourier

b. The rising prevalence of stroke and the rapidly growing population of older adults are some of the key driving factors responsible for the growth of the market. In addition, technological advancements are also playing a major role in supporting growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.