- Home

- »

- Medical Devices

- »

-

Remote Patient Monitoring System Market Report, 2030GVR Report cover

![Remote Patient Monitoring System Market Size, Share & Trends Report]()

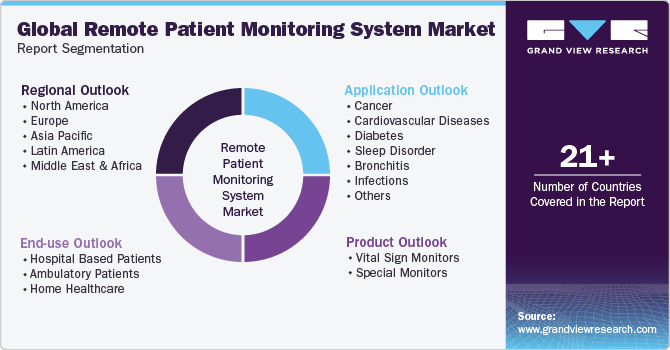

Remote Patient Monitoring System Market Size, Share & Trends Analysis Report By Product (Vital Sign Monitor, Specialized Monitor), By End-use (Hospital Based Patient, Ambulatory Patient), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-383-6

- Number of Report Pages: 172

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global remote patient monitoring system market size was estimated at USD 5.2 billion in 2023 and is expected to register a compound annual growth rate (CAGR) of 18.6% from 2024 to 2030. The outbreak of COVID-19 caused a significant impact on the remote patient monitoring system. The remote monitoring systems serve with improved chronic disease management including early warning signs and progress tracker thus boosting its demand in the coming years at a global level. The COVID-19 pandemic led to a shortage of space in hospitals. Apart from this, patients, especially those suffering from chronic diseases, were advised to avoid physical visits to hospitals owing to the threat of getting infected. This led to the development of remote patient monitoring market.

A large number of investments are made by firms by collaborating, acquiring, and partnering with new emerging startups. The personalized telemedicine app provides a communication platform for remote and real-time monitoring of patients that acts as a bridge between caregiver and patient. This step-change, borne out of necessity, changed the entire look of the remote patient monitoring market post-COVID-19. This change has sped up recovery rates as consumers are more willing to join the app. It has also increased the provider's willingness to use the app, and it offers greater access and reimbursements.

The growing collaboration between the healthcare players to advance patient monitoring programs is expected to propel the market growth. For instance, in August 2023, EPIC Health and OMRON Healthcare, Inc. collaborated to address the health inequities in Detroit, U.S. Within the collaboration, OMRON Healthcare will deploy VitalSight, a remote patient monitoring service to diagnose patients suffering from high blood pressure.

Market Concentration & Characteristics

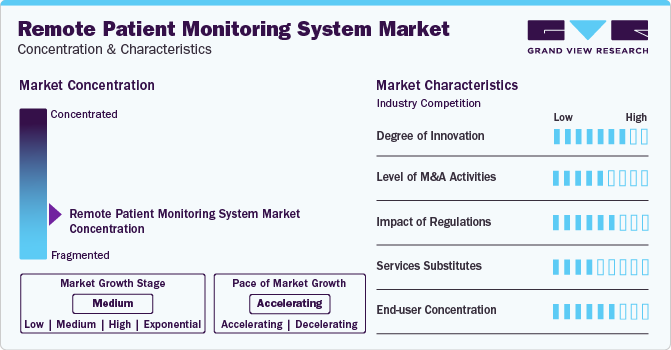

The remote patient monitoring system market is currently in a high-growth stage, with the pace of expansion accelerating. This market is marked by a significant level of innovation, driven by the increasing incidence of chronic disorders and a rising geriatric population.

The growing chronic condition across the globe is expected to propel market growth. Chronic conditions account for 90% of the healthcare costs in the U.S. annually. This can be prevented by timely assistance provided to patients using a remote monitoring system. It can delay emergency room visits and hospitalizations as the telemedicine app helps in digitizing and automating critical tasks, which reduces hospital administrative tasks thus expanding the usage of remote monitoring systems in the coming years.

According to the Centers for Disease Control and Prevention (CDC), over 100 million people have hypertension in the U.S. Hypertension further increases the risk of heart disease. The American Heart Association (AHA) also supports initiatives that increase access to the use of Remote Patient Monitoring technologies (RPM) for better health management. Similarly, the growing number of neurological disorders and cancer cases across the globe is expected to drive growth. In the U.S., more than 1 million adults are diagnosed annually with chronic brain diseases. In addition, around 19.3 million new cancer cases and almost 10.0 million cancer deaths occurred in 2020.

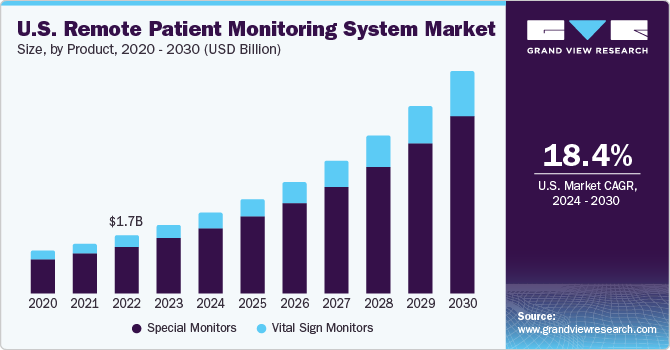

Product Insights

Based on product, the market is segmented into vital sign monitors and special monitors. The special monitors segment led the market with a share of over 82.54% in 2023 due to its ability to monitor clinically important data pre and post-surgery, identify symptoms, and prevent complications. Advanced features such as wireless communication and iPad connectivity allow early diagnosis and higher applicability of the products. Vital sign monitors can effectively track a patient's ECG, noninvasive blood pressure, body temperature, respiration rate, and brain activity. Integration of more than one vital sign monitor in a single system is expected to boost the popularity of these products thereby leading to increased adoption during the forecast period.

Vital sign monitors are commonly used, and the segment is expected to witness the fastest CAGR of 20.2% over the forecast period. Heart rate monitor is identified as the dominating product sub-segment due to the increasing incidence of cardiac conditions globally. The surge in the number of individuals with heart disorders has led to the increased usage of these monitors. In November 2022, Shenzhen Mindray Bio-Medical Electronics Co., Ltd. launched VS9, a vital sign monitoring device. The device can perform multifaceted functions such as non-invasive blood pressure, pulse oximetry, and temperature measurements.

Application Insights

Based on application, the market is segmented into cancer, cardiovascular diseases, diabetes, sleep disorder, weight management and fitness monitoring, bronchitis, infections, virus, dehydration, and hypertension. Diabetes emerged as the leading application segment in 2023 and accounted for 13.2% of the market share. Diabetes is one of the leading causes of death, which requires continuous monitoring of blood glucose levels. It is known to affect various functions of the body including heart activity, vision, liver function, and renal activity. Continuous and routine monitoring is required in diabetes, which can be easily accomplished using remote patient monitoring devices.

The hypertension application segment is also expected to witness significant growth over the forecast period. Hypertension increases the risk of cardiovascular diseases. According to the World Health Organization (WHO), over 1 billion people have hypertension worldwide. Remote patient monitoring can play a key role in controlling hypertension. The cardiovascular disease treatment segment is expected to witness lucrative growth of 19.5% over the forecast period due to the increasing prevalence of the disease.

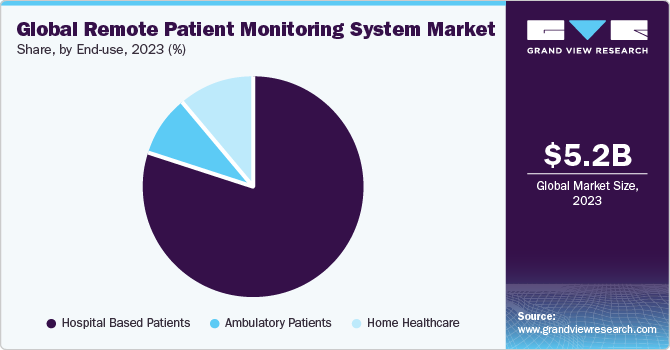

End-use Insights

The hospital-based patient segment was the leading end-use segment in 2023 and accounted for 79.7% of the market share. Hospitals cater to a large number of outpatients as well as inpatients. They offer a large number of diagnostic tests and have a larger technical staff for catering to the needs of the patients. The large patient pool and increasing number of tests being performed are the vital drivers for the segment growth.

However, alternate site monitoring, especially home healthcare, is anticipated to exhibit a sturdy CAGR over the forecast period. The cost-efficiency of this alternate site along with the availability of qualified resources is expected to support the growth. Considering the increasing strain on hospital resources and personnel, remote patient monitoring presents market players with huge opportunities in terms of partnering with hospitals & other healthcare settings and launching new products to facilitate affordable care at a patient’s home. Apart from this, COVID-19 increased the number of patients interacting with their doctors from home, boosting demand for the remote patient monitoring system.

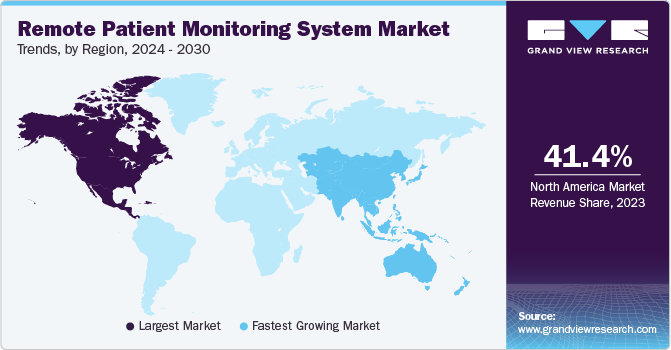

Regional Insights

North America dominated the remote patient monitoring system industry in 2023, accounting for more than 41.37% of the total market share. The increase in the incidence of chronic diseases, demand for wireless and portable systems coupled with the presence of sophisticated reimbursement structures aimed at cutting out-of-pocket expenditure are the major factors attributed to the regional growth.

Europe, especially the Western European countries, is expected to remain the second most revenue-generating region over the forecast period due to the higher mortality rate and rising demand for low-cost treatment. Rising demand for in-house monitoring, supportive central data management systems, and rising accuracy and efficiency of remote patient monitors are the high-impact rendering drivers for the regional growth. Asia Pacific is expected to witness the fastest CAGR over the forecast period owing to the presence of untapped opportunities in the emerging markets of India and China. Japan is expected to be a key revenue generator owing to its wide old age (65+) population. Furthermore, rising cases of chronic disorders is a significant factor contributing to the expansion of the remote patient monitoring market in India.

Key Companies & Market Share Insights

The major trend in the market is the enhancement of existing technologies, new product launches, product portfolio expansion, and mergers or tie-ups with healthcare facilities. In August 2023, GE HealthCare received approval from the U.S. FDA for a portrait patient monitoring system. The system comprises wearable sensors that detect and wirelessly transmit vital patient signs to a monitor. Similarly, in October 2023, Ricoh USA, Inc. launched RICOH Remote Patient Monitoring (RPM) service. The service is expected to ease the healthcare staffing challenges.

Key Remote Patient Monitoring System Companies:

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Nihon Kohden Corporation

- Omron Corporation

- OSI Systems, Inc.

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd

- Welch Allyn

- Smiths Medical

- Abbott

- Boston Scientific Corporation

- Dräger Medical

- GE Healthcare

- Honeywell

- Johnson & Johnson

- LifeWatch

- Medtronic

- Masimo

- Vitls, Inc

- CareValidate

- Biotronik

- American Telecare

Recent Developments

-

In January, 2024, Apollo Hospital a renowned multi-specialty hospital in India, announced a ground-breaking alliance with LifeSigns, a premier AI-powered health monitoring technology firm.

-

In May 2023, Philips launched Virtual Care Management, a comprehensive portfolio of flexible solutions and services health systems, providers, payers, and employers to motivate and engage with patients from anywhere.

-

OMRON Healthcare, Inc., a global leader in remote blood pressure monitoring and personal health technology in January, 2022, announced the introduction of new remote patient monitoring services at the 2022 Consumer Electronics Show (CES), alongside connected blood pressure monitors and an advanced mobile app.

Remote Patient Monitoring System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.1 billion

Revenue forecast in 2030

USD 16.9 billion

Growth rate

CAGR of 18.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Thailand; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Nihon Kohden Corporation; Omron Corporation; OSI Systems, Inc.; Koninklijke Philips N.V.; F. Hoffmann-La Roche Ltd; Welch Allyn; Smiths Medical; Abbott; Boston Scientific Corporation; Dräger Medical; GE Healthcare; Honeywell; Johnson & Johnson; LifeWatch; Medtronic; Masimo; Vitls, Inc.; CareValidate; Biotronik; American Telecare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Remote Patient Monitoring System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global remote patient monitoring system market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vital Sign Monitors

-

Blood Pressure Monitors

-

Pulse Oximeters

-

Heart Rate Monitor (ECG)

-

Temperature Monitor

-

Respiratory Rate Monitor

-

Brain Monitoring (EEG)

-

-

Special Monitors

-

Anesthesia Monitors

-

Blood Glucose Monitors

-

Cardiac Rhythm Monitor

-

Respiratory Monitor

-

Fetal Heart Monitors

-

Prothrombin Monitors

-

Multi Parameter Monitors (MPM)

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Cardiovascular Diseases

-

Diabetes

-

Sleep Disorder

-

Weight Management and Fitness Monitoring

-

Bronchitis

-

Infections

-

Virus

-

Dehydration

-

Hypertension

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Based Patients

-

Ambulatory Patients

-

Home Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global remote patient monitoring system market size was estimated at USD 5.2 billion in 2023 and is expected to reach USD 6.1 billion in 2024.

b. The global remote patient monitoring system market is expected to grow at a compound annual growth rate of 18.6% from 2024 to 2030 to reach USD 16.9 billion by 2030.

b. North America dominated the remote patient monitoring system market with a share of 41.37% in 2023. This is attributable to the increasing geriatric population, the incidence of chronic diseases, demand for wireless and portable systems coupled with the presence of a sophisticated reimbursement structure aimed at cutting out-of-pocket expenditure levels.

b. Some key players operating in the remote patient monitoring system market include Honeywell; American Telecare; Roche; Philips Healthcare; Bosch; Biotronik; Intel; Welch Allyn; Health anywhere Inc.; Johnson & Johnson; and Covidien Plc.

b. Key factors that are driving the RPM system market growth include the growing geriatric population and their rising demand for a better lifestyle along with quality care and cost-effective treatment.

Table of Contents

Chapter 1 Remote Patient Monitoring System Market: Methodology and Scope

1.1 Segment Market Scope

1.2 Regional Scope

1.3 Estimates and Forecast Timeline

Chapter 2 Remote Patient Monitoring System Market: Methodology

2.1 Research Methodology

2.1.1 Information Procurement

2.2 Information or Data Analysis

2.3 Market Formulation & Validation

2.4 Model Details

2.4.1 Commodity Flow Analysis (Model 1)

2.4.1.1 Approach 1: Commodity Flow Approach

2.5 List of Secondary Sources

2.6 List of Primary Sources

2.7 List of Abbreviations

2.8 Objectives

2.8.1 Objective 1

2.8.2 Objective 2

Chapter 3 Remote Patient Monitoring System Market: Executive Summary

3.1 Market Outlook

3.2 Segment Outlook

3.3 Competitive Insights

Chapter 4 Remote Patient Monitoring System Market: Variables, Trends & Scope

4.1 Market Lineage Outlook

4.1.1 Parent market outlook

4.1.2 Related/ancillary market outlook

4.2 Market Segmentation

4.3 Business Segment Trends

4.3.1 Product segment analysis

4.3.2 Application segment analysis

4.3.3 End-use segment analysis

4.3.4 Regional segment analysis

4.4 Product Pipeline

4.5 User perspective analysis

4.5.1 Consumer Behavior Analysis

4.5.2 Market Influencer Analysis

4.6 Regulatory Framework

4.6.1 Reimbursement framework

4.6.2 Standards & Compliances

4.7 Market Variable Analysis

4.7.1 Market driver analysis

4.7.1.1 Increasing geriatric population

4.7.1.2 Rising prevalence of chronic conditions

4.7.1.2.1 Neurological disorders

4.7.1.2.2 Cancer

4.7.1.3 Cost-effective treatment

4.7.1.4 Rising demand for wireless and portable systems

4.7.1.5 Technological advancement

4.7.2 Market restraint analysis

4.7.2.1 Data security concerns

4.7.2.2 Lack of supportive reimbursement coverage

4.7.3 Industry Challenges

4.7.3.1 Interoperability of data

4.7.3.2 Digital literacy

4.8 Penetration & Growth Prospect Mapping

4.9 Business Environment Analysis tools

4.9.1 SWOT Analysis, by PEST

4.9.1.1 Political & legal Landscape

4.9.1.1.1 Strength

4.9.1.1.2 Weakness

4.9.1.1.3 Opportunity

4.9.1.1.4 Threat

4.9.1.2 Economical Landscape

4.9.1.2.1 Strength

4.9.1.2.2 Weakness

4.9.1.2.3 Opportunity

4.9.1.2.4 Threat

4.9.1.3 Social & Technology Landscape

4.9.1.3.1 Strength

4.9.1.3.2 Weakness

4.9.1.3.3 Opportunity

4.9.1.3.4 Threat

4.9.2 Porter’s five forces analysis

4.9.2.1 Bargaining Power of Supplier

4.9.2.2 Bargaining Power of Buyer

4.9.2.3 Threat of Substitution

4.9.2.4 Threat of new entrant

4.9.2.5 Competitive rivalry

4.9.3 Major Deals & Strategic Alliances Analysis

Chapter 5 Product Estimates And Trend Analysis

5.1 Definition and Scope

5.2 Remote patient monitoring systems market: Product Movement Analysis

5.3 Vital Sign Monitors

5.3.1 Vital Signs Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3.2 Blood pressure monitor

5.3.2.1 Blood Pressure Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3.3 Pulse oximeter

5.3.3.1 Pulse Oximeter Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3.4 Heart Rate Monitor (ECG)

5.3.4.1 Heart Rate Monitor (Ecg) Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3.5 Temperature monitor

5.3.5.1 Temperature Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3.6 Respiratory rate monitor

5.3.6.1 Respiratory Rate Monitors Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.3.7 Brain monitoring (EEG)

5.3.7.1 Brain Monitoring Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4 Special monitors

5.4.1 Special Monitors Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.2 Anesthesia monitor

5.4.2.1 Anesthesia Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.3 Blood glucose monitor

5.4.3.1 Blood Glucose Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.4 Cardiac rhythm monitor

5.4.4.1 Cardiac Rhythm Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.5 Respiratory monitor

5.4.5.1 Respiratory Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.5.2 Spirometers

5.4.5.2.1 Spirometers market ESTIMATES AND FORECASTS, 2018 - 2030 (USD Million)

5.4.5.3 Capnographs

5.4.5.3.1 Capnographs market ESTIMATES AND FORECASTS, 2018 - 2030 (USD Million)

5.4.6 Fetal heart monitor

5.4.6.1 Fetal Heart Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.7 Prothrombin monitor

5.4.7.1 Prothrombin Monitor Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.8 Multi Parameter monitor (MPM)

5.4.8.1 Multi Parameter Monitor (MPM) Market Estimates And Forecasts, 2018 - 2030 (USD Million)

5.4.9 Others

5.4.9.1 Others Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 6 Application Estimates And Trend Analysis

6.1 Definition and Scope

6.2 Remote patient monitoring systems market: Application Movement Analysis

6.3 Cancer

6.3.1 Cancer Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.4 Cardiovascular Diseases

6.4.1 Cardiovascular Diseases Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.5 Diabetes

6.5.1 Diabetes Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.6 Sleep Disorders

6.6.1 Sleep Disorders Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.7 Weight Management and Fitness Monitoring

6.7.1 Weight Management and Fitness Monitoring Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.8 Bronchitis

6.8.1 Bronchitis Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.9 Infections

6.9.1 Infections Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.9.1.1 Eye Infectionss Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.9.1.2 Sinus Infectionss Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.9.1.3 Strep Throats Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.10 Virus

6.10.1 Virus market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.11 Dehydration

6.11.1 Dehydration Market Estimates And Forecasts, 2018 - 2030 (USD Million)

6.12 Hypertension

6.12.1 Hypertension Market Estimates And Forecasts, 2018 - 2030 (USD Million)

Chapter 7 End-use Estimates And Trend Analysis

7.1 Definition and Scope

7.2 Remote Patient Monitoring Systems Market: End-use Movement Analysis

7.3 Hospital Based Patients

7.3.1 Hospital-based patients market estimates and forecasts, 2018 - 2030 (USD Million)

7.4 Ambulatory Based Patients

7.4.1 Ambulatory based patients market estimates and forecasts, 2018 - 2030 (USD Million)

7.5 Home Healthcare

7.5.1 Home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 8 Remote Patient Monitoring Market: Regional Analysis

8.1 Remote patient monitoring systems Market Share by Region, 2023 & 2030

8.2 North America

8.2.1 North America Remote Patient Monitoring Market, 2018 - 2030 (USD Million)

8.2.2 U.S.

8.2.2.1 Key Country Dynamics

8.2.2.2 Competitive Scenario

8.2.2.3 Regulatory Framework

8.2.2.4 U.S. Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.2.3 Canada

8.2.3.1 Key Country Dynamics

8.2.3.2 Competitive Scenario

8.2.3.3 Regulatory Framework

8.2.3.3 Canada Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3 Europe

8.3.1 Europe Remote patient monitoring system market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.2 UK

8.3.2.1 Key Country Dynamics

8.3.2.2 Competitive Scenario

8.3.2.2 Regulatory Framework

8.3.2.4UK Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.3 Germany

8.3.3.1 Key Country Dynamics

8.3.3.2 Competitive Scenario

8.3.3.3 Regulatory Framework

8.3.3.4 Germany Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.4 France

8.3.4.1 Key Country Dynamics

8.3.4.2 Competitive Scenario

8.3.4.3 Regulatory Framework

8.3.4.4 France Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.5 Italy

8.3.5.1 Key Country Dynamics

8.3.5.2 Competitive Scenario

8.3.5.3 Regulatory Framework

8.3.5.4 Italy Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.6 Spain

8.3.6.1 Key Country Dynamics

8.3.6.2 Competitive Scenario

8.3.6.3 Regulatory Framework

8.3.6.4 Spain Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.7 Sweden

8.3.7.1 Key Country Dynamics

8.3.7.2 Competitive Scenario

8.3.7.3 Regulatory Framework

8.3.7.4 Sweden Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.8 Denmark

8.3.8.1 Key Country Dynamics

8.3.8.2 Competitive Scenario

8.3.8.3 Regulatory Framework

8.3.8.4 Denmark Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.3.9 Norway

8.3.9.1 Key Country Dynamics

8.3.9.2 Competitive Scenario

8.3.9.3 Regulatory Framework

8.3.9.4 Norway Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific Remote patient monitoring system market estimates and forecasts, 2018 - 2030 (USD Million)

8.4.2 Japan

8.4.2.1 Key Country Dynamics

8.4.2.2 Competitive Scenario

8.4.2.3 Regulatory Framework

8.4.2.4Japan Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.4.3 China

8.4.3.1 Key Country Dynamics

8.4.3.2 Competitive Scenario

8.4.3.3 Regulatory Framework

8.4.3.4 China Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.4.4 India

8.4.4.1 Key Country Dynamics

8.4.4.2 Competitive Scenario

8.4.4.3 Regulatory Framework

8.4.4.4 India Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.4.5 Thailand

8.4.5.1 Key Country Dynamics

8.4.5.2 Competitive Scenario

8.4.5.3 Regulatory Framework

8.4.5.4 Thailand Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.4.6 South Korea

8.4.6.1 Key Country Dynamics

8.4.6.2 Competitive Scenario

8.4.6.3 Regulatory Framework

8.4.6.4 South Korea Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.4.7 Australia

8.4.7.1 Key Country Dynamics

8.4.7.2 Competitive Scenario

8.4.7.3 Regulatory Framework

8.4.7.4 Australia Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.5 Latin America

8.5.1 Latin America remote patient monitoring system market estimates and forecasts, 2018 - 2030 (USD Million)

8.5.2 Brazil

8.5.2.1 Key Country Dynamics

8.5.2.2 Competitive Scenario

8.5.2.3 Regulatory Framework

8.5.2.4 Brazil Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.5.3 Mexico

8.5.3.1 Key Country Dynamics

8.5.3.2 Competitive Scenario

8.5.3.3 Regulatory Framework

8.5.3.4 Mexico Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.5.4 Argentina

8.5.4.1 Key Country Dynamics

8.5.4.2 Competitive Scenario

8.5.4.3 Regulatory Framework

8.5.4.4 Argentina Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.6 Middle East & Africa (MEA)

8.6.1 MEA remote patient monitoring system market estimates and forecasts, 2018 - 2030 (USD Million)

8.6.2 South Africa

8.6.2.1 Key Country Dynamics

8.6.2.2 Competitive Scenario

8.6.2.3 Regulatory Framework

8.6.2.4 South Africa Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.6.3 Saudi Arabia

8.6.3.1 Key Country Dynamics

8.6.3.2 Competitive Scenario

8.6.3.3 Regulatory Framework

8.6.3.4 Saudi Arabia Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.6.4 UAE

8.6.3.1 Key Country Dynamics

8.6.3.2 Competitive Scenario

8.6.3.3 Regulatory Framework

8.6.3.4 UAE Remote Patient Monitoring System, 2018 - 2030 (USD Million)

8.6.5 Kuwait

8.6.3.1 Key Country Dynamics

8.6.3.2 Competitive Scenario

8.6.3.3 Regulatory Framework

8.6.3.4 Kuwait Remote Patient Monitoring System, 2018 - 2030 (USD Million)

Chapter 9 Competitive Analysis

9.1 Global Market Share Analysis

9.2 Company/Competition Categorization (Key Innovators, Market Leaders, Emerging Players)

9.3 Company Profiles

9.3.1 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

9.3.1.1 Company Overview

9.3.1.2 Financial Performance

9.3.1.3 Product Benchmarking

9.3.1.4 Strategic Initiatives

9.3.2 Nihon Kohden Corporation.

9.3.2.1 Company Overview

9.3.2.2 Financial Performance

9.3.2.3 Product Benchmarking

9.3.2.4 Strategic Initiatives

9.3.3 Omron Corporation.

9.3.3.1 Company Overview

9.3.3.2 Financial Performance

9.3.3.3 Product Benchmarking

9.3.3.4 Strategic Initiatives

9.3.4 OSI Systems, Inc.

9.3.4.1 Company Overview

9.3.4.2 Financial Performance

9.3.4.3 Product Benchmarking

9.3.4.4 Strategic Initiatives

9.3.5 Koninklijke Philips N.V.

9.3.5.1 Company Overview

9.3.5.2 Financial Performance

9.3.5.3 Product Benchmarking

9.3.5.4 Strategic Initiatives

9.3.6 F. Hoffmann-La Roche Ltd.

9.3.6.1 Company Overview

9.3.6.2 Financial Performance

9.3.6.3 Product Benchmarking

9.3.6.4 Strategic Initiatives

9.3.7 Welch Allyn.

9.3.7.1 Company Overview

9.3.7.2 Financial Performance

9.3.7.3 Product Benchmarking

9.3.7.4 Strategic Initiatives

9.3.8 ALTEN Calsoft Labs.

9.3.8.1 Company Overview

9.3.8.2 Financial Performance

9.3.8.3 Product Benchmarking

9.3.8.4 Strategic Initiatives

9.3.9 Smiths Medical.

9.3.9.1 Company overview

9.3.9.2 Financial Performance

9.3.9.3 Product Benchmarking

9.3.9.4 Strategic Initiatives

9.3.10 Abbott

9.3.10.1 Company Overview

9.3.10.2 Financial Performance

9.3.10.3 Product Benchmarking

9.3.10.4 Strategic Initiatives

9.3.11 American TeleCare

9.3.11.1 Company Overview

9.3.11.2 Financial Performance

9.3.11.3 Product Benchmarking

9.3.11.4 Strategic Initiatives

9.3.12 Boston Scientific Corporation

9.3.12.1 Company Overview

9.3.12.2 Financial Performance

9.3.12.3 Product Benchmarking

9.3.12.4 Strategic Initiatives

9.3.13 Dräger Medical

9.3.13.1 Company Overview

9.3.13.2 Financial Performance

9.3.13.3 Product Benchmarking

9.3.13.4 Strategic Initiatives

9.3.14 GE Healthcare

9.3.14.1 Company Overview

9.3.14.2 Financial Performance

9.3.14.3 Product Benchmarking

9.3.14.4 Strategic Initiatives

9.3.15 Honeywell Life Care Solutions

9.3.15.1 Company Overview

9.3.15.2 Financial Performance

9.3.15.3 Product Benchmarking

9.3.15.4 Strategic Initiatives

9.3.16 Johnson & Johnson Services, Inc.

9.3.16.1 Company Overview

9.3.16.2 Financial Performance

9.3.16.3 Product Benchmarking

9.3.16.4 Strategic Initiatives

9.3.17 LifeWatch

9.3.17.1 Company Overview

9.3.17.2 Financial Performance

9.3.17.3 Product Benchmarking

9.3.17.4 Strategic Initiatives

9.3.18 Masimo

9.3.18.1 Company Overview

9.3.18.2 Financial Performance

9.3.18.3 Product Benchmarking

9.3.18.4 Strategic Initiatives

9.3.19 Medtronic Plc

9.3.19.1 Company Overview

9.3.19.2 Financial Performance

9.3.19.3 Product Benchmarking

9.3.19.4 Strategic Initiatives

List of Tables

Table 1 List of abbreviation

Table 2 List of secondary sources

List of Figures

Fig. 1 Market research process

Fig. 2 Information Procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 QFD modeling for market share assessment

Fig. 6 Market formulation & validation

Fig. 7 Remote patient monitoring devices market snapshot (2023)

Fig. 8 Remote patient monitoring devices market: Segment snapshot (2023 & 2030)

Fig. 9 Competitive Insights (2023)

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Remote patient monitoring devices market segmentation

Fig. 13 Consumer behavior analysis

Fig. 14 Market driver relevance analysis (Current & future impact)

Fig. 15 Global geriatric population, 2023 - 2030 (Million)

Fig. 16 Market restraint relevance analysis (Current & future impact)

Fig. 17 Industry challenges analysis (Current & future impact)

Fig. 18 SWOT analysis, by factor (political & legal, economic and technological)

Fig. 19 Porter’s five forces analysis

Fig. 20 Remote patient monitoring devices market product outlook: Key takeaways

Fig. 21 Remote patient monitoring devices market: Product movement analysis

Fig. 22 Vital signs monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 23 Blood pressure monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 Pulse oximeter market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 25 Heart rate monitor (ECG) market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 26 Temperature monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 27 Respiratory rate monitors market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 28 Brain monitors market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 29 Special monitors market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 30 Anesthesia monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 31 Blood glucose monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 32 Cardiac rhythm monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 33 Respiratory monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 34 Spirometers market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 35 Capnographs market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 36 Fetal heart monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 37 Prothrombin monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 38 Multi parameter monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 39 Others monitor market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 40 Remote patient monitoring devices market application outlook: Key takeaways

Fig. 41 Remote patient monitoring devices market: Application movement analysis

Fig. 42 Cancer market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 43 Cardiovascular diseases market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 44 Diabetes market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 45 Sleep disorders market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 46 Weight management and fitness monitoring market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 47 Bronchitis market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 48 Infections market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 49 Eye Infections market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 50 Sinus Infections market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 51 Strep Throat market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 52 Virus market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 53 Dehydration market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 54 Hypertension market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 55 Remote patient monitoring devices market end-use outlook: Key takeaways

Fig. 56 Remote patient monitoring devices market: End-use movement analysis

Fig. 57 Hospital based patients market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 58 Ambulatory based patients market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 59 Home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 60 Regional market place: Key takeaways

Fig. 61 Regional market snapshot

Fig. 62 Regional market share, 2023 (%)

Fig. 63 Leading Players

Fig. 64 Regional outlook, 2023 & 2030

Fig. 65 North America remote patient monitoring devices market

Fig. 66 North America remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 67 U.S. remote patient monitoring devices market

Fig. 68 U.S. remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 69 Canada remote patient monitoring devices market

Fig. 70 Canada remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 71 Europe remote patient monitoring devices market

Fig. 72 Europe remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 73 UK remote patient monitoring devices market

Fig. 74 UK remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 75 Germany remote patient monitoring devices market

Fig. 76 Germany remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 77 France remote patient monitoring devices market

Fig. 78 France remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 79 Italy remote patient monitoring devices market

Fig. 80 Italy remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 81 Spain remote patient monitoring devices market

Fig. 82 Spain remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 83 Sweden remote patient monitoring devices market

Fig. 84 Sweden remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 85 Denmark remote patient monitoring devices market

Fig. 86 Denmark remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 87 Norway remote patient monitoring devices market

Fig. 88 Norway remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 89 Asia Pacific remote patient monitoring devices market

Fig. 90 Asia Pacific remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 91 Japan remote patient monitoring devices market

Fig. 92 Japan remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 93 China remote patient monitoring devices market

Fig. 94 China remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 95 India remote patient monitoring devices market

Fig. 96 India remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 97 Thailand remote patient monitoring devices market

Fig. 98 Thailand remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 99 South Korea remote patient monitoring devices market

Fig. 100 South Korea remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 101 Australia remote patient monitoring devices market

Fig. 102 Australia remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 103 Latin America remote patient monitoring devices market

Fig. 104 Latin America remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 105 Brazil remote patient monitoring devices market

Fig. 106 Brazil remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 107 Mexico remote patient monitoring devices market

Fig. 108 Mexico remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 109 Argentina remote patient monitoring devices market

Fig. 110 Argentina remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 111 MEA remote patient monitoring devices market

Fig. 112 MEA remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 113 South Africa remote patient monitoring devices market

Fig. 114 South Africa remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 115 Saudi Arabia remote patient monitoring devices market

Fig. 116 Saudi Arabia remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 117 UAE remote patient monitoring devices market

Fig. 118 UAE remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 119 Kuwait remote patient monitoring devices market

Fig. 120 Kuwait remote patient monitoring devices market estimates and forecasts, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Remote Patient Monitoring Systems Product Outlook (Revenue, USD Million, 2018 - 2030)

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Remote Patient Monitoring Systems Application Outlook (Revenue, USD Million, 2018 - 2030)

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Remote Patient Monitoring Systems End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Remote Patient Monitoring Systems Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- North America Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- North America Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- U.S.

- U.S. Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- U.S. Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- U.S. Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- U.S. Remote Patient Monitoring Systems Market, By Product

- Canada

- Canada Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Canada Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Canada Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Canada Remote Patient Monitoring Systems Market, By Product

- North America Remote Patient Monitoring Systems Market, By Product

- Europe

- Europe Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Europe Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Europe Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Germany

- Germany Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Germany Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Germany Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Germany Remote Patient Monitoring Systems Market, By Product

- UK

- UK Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- UK Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- UK Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- UK Remote Patient Monitoring Systems Market, By Product

- France

- France Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- France Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- France Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- France Remote Patient Monitoring Systems Market, By Product

- Italy

- Italy Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Italy Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Italy Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Italy Remote Patient Monitoring Systems Market, By Product

- Spain

- Spain Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Spain Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Spain Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Spain Remote Patient Monitoring Systems Market, By Product

- Sweden

- Sweden Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Sweden Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Sweden Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Sweden Remote Patient Monitoring Systems Market, By Product

- Denmark

- Denmark Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Denmark Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Denmark Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Denmark Remote Patient Monitoring Systems Market, By Product

- Norway

- Norway Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Norway Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Norway Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Norway Remote Patient Monitoring Systems Market, By Product

- Europe Remote Patient Monitoring Systems Market, By Product

- Asia Pacific

- Asia Pacific Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Asia Pacific Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Asia Pacific Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- China

- China Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- China Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- China Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- China Remote Patient Monitoring Systems Market, By Product

- Japan

- Japan Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Japan Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Japan Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Japan Remote Patient Monitoring Systems Market, By Product

- India

- India Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- India Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- India Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- India Remote Patient Monitoring Systems Market, By Product

- Thailand

- Thailand Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Thailand Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Thailand Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Thailand Remote Patient Monitoring Systems Market, By Product

- South Korea

- South Korea Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- South Korea Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- South Korea Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- South Korea Remote Patient Monitoring Systems Market, By Product

- Australia

- Australia Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Australia Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Australia Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Australia Remote Patient Monitoring Systems Market, By Product

- Asia Pacific Remote Patient Monitoring Systems Market, By Product

- Latin America

- Latin America Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Latin America Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Latin America Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Mexico

- Mexico Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Mexico Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Mexico Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Mexico Remote Patient Monitoring Systems Market, By Product

- Brazil

- Brazil Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Brazil Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Brazil Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Brazil Remote Patient Monitoring Systems Market, By Product

- Argentina

- Argentina Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Argentina Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Argentina Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Argentina Remote Patient Monitoring Systems Market, By Product

- Latin America Remote Patient Monitoring Systems Market, By Product

- MEA

- MEA Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- MEA Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- MEA Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- South Africa

- South Africa Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- South Africa Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- South Africa Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- South Africa Remote Patient Monitoring Systems Market, By Product

- Saudi Arabia

- Saudi Arabia Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Saudi Arabia Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Saudi Arabia Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Saudi Arabia Remote Patient Monitoring Systems Market, By Product

- UAE

- UAE Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- UAE Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- UAE Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- UAE Remote Patient Monitoring Systems Market, By Product

- Kuwait

- Kuwait Remote Patient Monitoring Systems Market, By Product

- Vital sign monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

- Special monitors

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

- Vital sign monitors

- Kuwait Remote Patient Monitoring Systems Market, By Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

- Kuwait Remote Patient Monitoring Systems Market, By End-use

- Hospital based patients

- Ambulatory patients

- Home Healthcare

- Kuwait Remote Patient Monitoring Systems Market, By Product

- MEA Remote Patient Monitoring Systems Market, By Product

- North America

Remote Patient Monitoring System Market Dynamics

Driver: Increasing Geriatric Population

The increasing elderly population worldwide is expected to propel the market growth. According to the World Health Organization (WHO), there are over 40 million people in the U.S. alone who are above the age of 65 years. This number is expected to double by 2050. Japan has the highest geriatric population which provides potential growth opportunities to this market in the country. The percentage of geriatric population is expected to reach 22.0% by 2050. Aging is considered as the foremost risk factor for chronic conditions such as diabetes, cardiovascular disorders, and sleep disorders, this increasing the growth opportunity for the market.

Driver: Rising Prevalence Of Chronic Conditions

According to the WHO, major chronic diseases account for around 60.0% of the total number of deaths and 43.0% of the global burden of diseases. Cardiac arrhythmia, hypertension, ischemic conditions, sleep apnea, diabetes, hyperlipidemia, asthma, and Chronic Obstructive Pulmonary Disease (COPD) are other prevalent chronic conditions that are reported globally. Remote patient monitoring applications provide healthcare professionals with a broad range of real-time health data, which makes timely intervention possible, thus making it a far more reliable option as compared to conventional medical consultation with doctors.

The presence of stringent government policies and regulations of WHO for remote patient monitoring devices is expected to encourage many organizations to develop novel drugs for the treatment of chronic diseases. For instance, under the Remote Patient Monitoring Project (RPMP) initiated by the Canadian government, in February 2015, devices such as weighing scales, pulse oximeters, and blood pressure monitors were distributed and a nursing team was formed to monitor patients. This initiative was undertaken to promote the use of patient monitoring devices and ensure efficient management of chronic conditions.

Restraint: Data Security Concerns

Although growing use of smartphones and digital devices has created new frontiers in the healthcare sector, it has led to serious security issues related to the amount of big data contained by these technological innovations. According to the Identity Theft Resource Center’s (ITRC) 2019 Data Breach Report, there were 525 medical and healthcare data breaches, exposing over 39 million sensitive records. Data security concerns create the need of confidential medical systems to maintain patient records. The rising number of public and hybrid cloud computing in healthcare sector is a great concern. The increase in cybercrimes, online data mismanagement, and presence of various unauthenticated users are expected to impact the market growth negatively.

What Does This Report Include?

This section will provide insights into the contents included in this remote patient monitoring system market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Remote patient monitoring system market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Remote patient monitoring system market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology