- Home

- »

- Medical Devices

- »

-

Respiratory Disease Testing Market Size, Share Report, 2030GVR Report cover

![Respiratory Disease Testing Market Size, Share & Trends Report]()

Respiratory Disease Testing Market (2023 - 2030 ) Size, Share & Trends Analysis Report By Product (Imaging Tests, Respirometers, Blood Gas Tests), By End-use, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-807-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Respiratory Disease Testing Market Summary

The global respiratory disease testing market size was estimated at USD 6.18 billion in 2022 and is projected to reach USD 7.75 billion by 2030, growing at a CAGR of 2.8% from 2023 to 2030. The constantly rising incidence of respiratory diseases owing to escalating air pollution levels is the prime factor driving the growth of the market. The rising rate of pollutants in the air and the release of hazardous gases causing lung diseases, including chronic obstructive pulmonary disease (COPD) and other respiratory diseases around the world, is driving the growth.

Key Market Trends & Insights

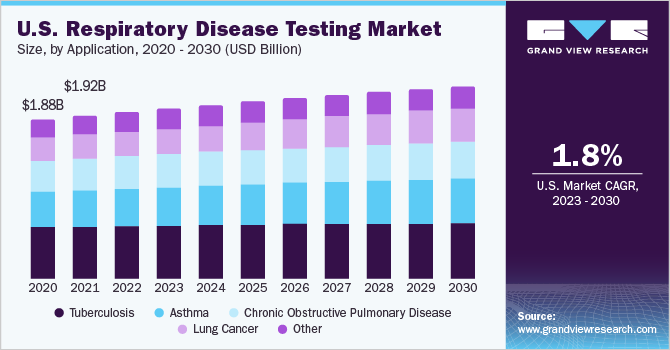

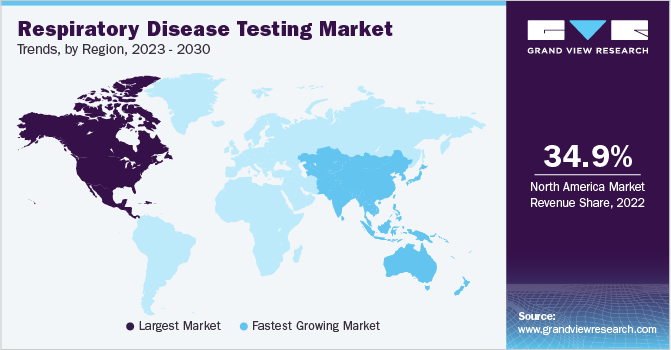

- North America dominated the market and accounted for the largest revenue share of 34.9% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 4.2% during the forecast period.

- By application, the tuberculosis segment accounted for the largest revenue share of around 31.6% in 2022.

- By end use, the hospital segment held the largest revenue share of 45.8% in 2022.

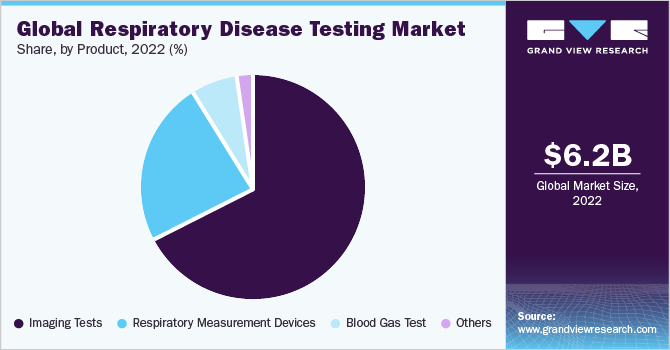

- By product, the imaging tests segment accounted for the largest revenue share of 67.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 6.18 Billion

- 2030 Projected Market Size: USD 7.75 Billion

- CAGR (2023-2030): 2.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The other factors driving the overall growth include the spread of infections such as tuberculosis and hospital-acquired infection, where these tests are used as preliminary detection tools. The increase in air pollution, which results in the discharge of dangerous gases that cause lung diseases such as COPD, is propelling the market growth. According to the Global Initiative for Chronic Obstructive Lung Disease (GOLD), in 2022, globally 200 million people were estimated to be affected by COPD, of which 3.2 million people succumb each year, making it the third leading cause of death globally.

The growth of infectious diseases such as Tuberculosis is driving the need for respiratory disease testing. According to WHO’s Global Tuberculosis Report 2022, globally, the number of people infected by Tuberculosis stands at 10.6 million, of which only 6.4 million were diagnosed. The COVID-19 pandemic positively contributed to the growth of the respiratory disease testing market. During the pandemic, the major economies around the globe were shut down due to the risk of communal transmission. Furthermore, during the pandemic, there were rapid technological advancements and innovations to contain and fight the virus, and various organizations and governments funded various projects and companies to develop new testing methods. This resulted in the development of rapid point-of-care testing and molecular testing. For instance, in March 2020, Abbott received an emergency use authorization (EUA) from the Food and Drug Administration (FDA) for the Abbott ID NOW COVID-19 test. It is a molecular point-of-care test for detecting COVID-19 in less than 5 minutes. It runs on the Abbott ID NOW platform.

The adoption of imaging technologies, such as Computed Tomography (CT), in COPD diagnosis, is expected to drive growth. Technically advanced devices, such as pulse oximeters, for effective management of COPD in outpatients, are rapidly gaining recognition in the marketplace. The shift to noninvasive mechanical ventilation for COPD is expected to fuel the market growth. For instance, in July 2023, Siemens Healthineers launched the NAEOTOM Alpha, the first scanner in the world that utilizes photon-counting technology for Computed Tomography (CT).

Application Insights

The tuberculosis segment accounted for the largest revenue share of around 31.6% in 2022. The increasing cases of tuberculosis have resulted in increased diagnoses, which is the driving factor for the market growth. Tuberculosis is caused due to a weakened immune system. Human Immunodeficiency Virus (HIV) and diabetes mellitus are medical conditions that make people more susceptible to contracting tuberculosis disease if they become infected. According to the CDC, in 2021, the most often reported medical risk factor for TB illness was diabetes mellitus (23.9%). Furthermore, among patients who were diagnosed with tuberculosis, 4.2% of people had HIV.

The lung cancer segment is estimated to register the fastest CAGR of 4.3% over the forecast period. According to the WHO, in 2020, lung cancer resulted in 1.8 million deaths globally. These staggering statistics have resulted in the preventive diagnosis of the disease, which is the driving factor for the market growth. Technological advancement in imaging modalities used to diagnose lung cancer has drastically improved. In addition, the increasing rate of smokers has positively contributed to an increase in lung cancer, leading to increased respiratory disease testing. According to the American Lung Association, smoking is the main cause of lung cancer, out of people who are diagnosed with lung cancer; smoking is the cause of death in 80% of women and 90% of men.

End-use Insights

The hospital segment held the largest revenue share of 45.8% in 2022. Installation and use of advanced respiratory diagnostic equipment, such as X-ray machines and respiratory measurement instruments, including spirometers, pulse oximeters, and noninvasive ventilators, in hospitals result in higher revenue generation. In addition, hospitals are the first choice for patients diagnosed with lung cancer; this is due to tie-ups of hospitals with healthcare insurance providers, which make these hospitals part of the network hospitals. HDFC Ergo General Insurance is India's largest provider of cashless hospitals, with over 12,000 hospitals in its network.

The physician’s clinic segment is expected to grow at the fastest CAGR of 3.6% over the forecast period. Instead of referring patients to outdoor labs, physicians prefer in-house options coupled with the convenience and personalized care that the patient receives at physician clinics are estimated to boost the growth of this segment for the forecasted period. Furthermore, the increase in the rate of hospital-acquired infection has resulted in patients opting for physician clinics to diagnose respiratory disease. According to a report published by WHO in March 2022, 8.9 million people are affected annually by hospital-acquired infections in acute and long-term care facilities in Europe.

Product Insights

The imaging tests segment accounted for the largest revenue share of 67.5% in 2022. The increased adoption of X-ray imaging and other imaging modalities for better visualization and a clear image of the disease stage is driving the growth of the market. Furthermore, the increasing rate of chronic respiratory disease has led to a surge in demand for Computed Tomography (CT) imaging which is aiding the market growth. According to the Centers for Disease Control and Prevention (CDC) in 2021, alone in the U.S. 4.6% of the population was diagnosed with chronic bronchitis, COPD, and emphysema.

The respiratory measurement devices segment is expected to grow at the fastest CAGR of 3.6% during the forecast period. Respiratory measurement devices, also referred to as respirometers, include spirometers, pulse oximeters, capnography, and peak flowmeters. The rising demand for pulse oximeters in this segment is higher compared to other devices. Accurate and effective diagnosis in a short time and preference for these tests by physicians are expected to trigger the growth of the segment over the forecast period. The unprecedented demand for pulse oximeters during the COVID-19 pandemic resulted in exponential market growth. For instance, in 2021, Konica Minolta, Inc., in collaboration with Seki Aoi Techno Co., Ltd. increased their pulse oximeter production capacity by more than 20 times.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 34.9% in 2022. The rising prevalence of respiratory diseases such as COPD, asthma, and other respiratory infections is the prime reason for the dominance of North America. Furthermore, the rising popularity of portable devices, such as advanced spirometers & noninvasive ventilators, is driving the growth. According to the CDC, in 2021, the number of death from lower chronic respiratory disease stood at 142,342 in the U.S.

Asia Pacific is expected to grow at the fastest CAGR of 4.2% during the forecast period. This growth can be mainly attributed to improving healthcare infrastructure and increasing patient awareness regarding the availability of diagnostic procedures. In addition, the rising prevalence of respiratory diseases, the booming medical tourism industry, and growing investments by market players in the region are additional factors anticipated to fuel the market growth in the Asia Pacific. According to the WHO, 2.2 million premature deaths in the Asia Pacific region are caused due to air pollution.

Key Companies & Market Share Insights

The market comprises a large number of participants accounting for a majority of the market share. Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The players, such as BD (CareFusion Corporation), Koninklijke Philips N.V. (Respironics), and ResMed Company have a strong market presence due to a wide product portfolio.

For instance, in January 2019, ResMed acquired Propeller Health, a digital therapeutics firm providing connected health solutions for patients with COPD and asthma. Furthermore, in February 2021, Koninklijke Philips N.V. completed its acquisition of BioTelemetry, Inc. It will boost their cancer diagnostic division, therefore, positively affecting the market for respiratory disease testing. Some prominent players in the global respiratory disease testing market include:

-

Abbott

-

BD

-

Koninklijke Philips N.V.

-

ResMed

-

Fisher & Paykel Appliances Ltd.

-

Medtronic

-

BIOMÉRIEUX

-

Carestream Health

-

SDI Diagnostics

-

Siemens Healthcare GmbH

Respiratory Disease Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.38 billion

Revenue forecast in 2030

USD 7.75 billion

Growth rate

CAGR of 2.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; BD; Koninklijke Philips N.V.; ResMed; Fisher & Paykel Appliances Ltd; Medtronic; BIOMÉRIEUX; Carestream Health; SDI Diagnostics; Siemens Healthcare GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Respiratory Disease Testing Market Report Segmentation

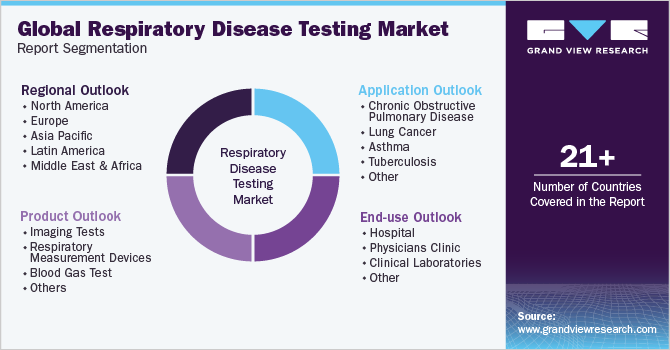

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global respiratory disease testing market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Imaging Tests

-

Respiratory Measurement Devices

-

Blood Gas Test

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Obstructive Pulmonary Disease

-

Lung Cancer

-

Asthma

-

Tuberculosis

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Physicians Clinic

-

Clinical Laboratories

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global respiratory disease testing market size was estimated at USD 6.18 billion in 2022 and is expected to reach USD 6.38 billion in 2023.

b. The global respiratory disease testing market is expected to grow at a compound annual growth rate of 2.8% from 2023 to 2030 to reach USD 7.75 billion by 2030.

b. Imaging tests dominated the respiratory disease testing market with a share of 67.6% in 2022. This is attributable to the increased adoption of X-ray imaging and other imaging modalities for better visualization and a clear picture of the disease condition. Furthermore, increasing demand for CT imaging is expected to drive growth.

b. Some key players operating in the respiratory disease testing market include Becton Dickinson (Carefusion Corporation); Koninklijke Philips N.V.(Respironics); ResMed Company; Fischer & Paykel, Medtronic; MGC Diagnostics Corporation and Subsidiaries; and CAREstream Medical Ltd.

b. Key factors that are driving the market growth include constantly rising incidence of respiratory diseases owing to escalating air pollution levels and the spread of infections such as tuberculosis, and hospital-acquired infections.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.