- Home

- »

- Medical Devices

- »

-

Respiratory Oxygen Delivery Devices Market Report, 2030GVR Report cover

![Respiratory Oxygen Delivery Devices Market Size, Share & Trends Report]()

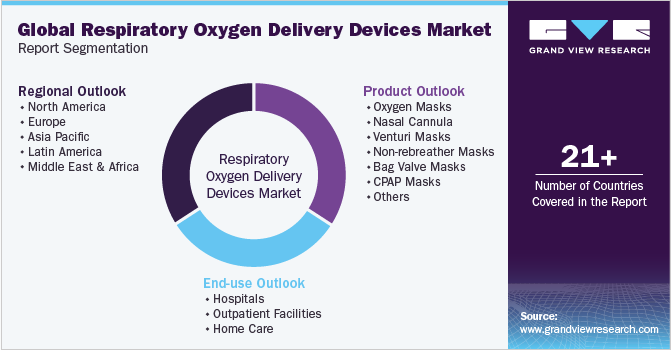

Respiratory Oxygen Delivery Devices Market Size, Share & Trends Analysis Report By Product (Oxygen Masks, Nasal Cannula), By End-use (Hospitals, Outpatient Facilities, Home Care), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-128-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Report Overview

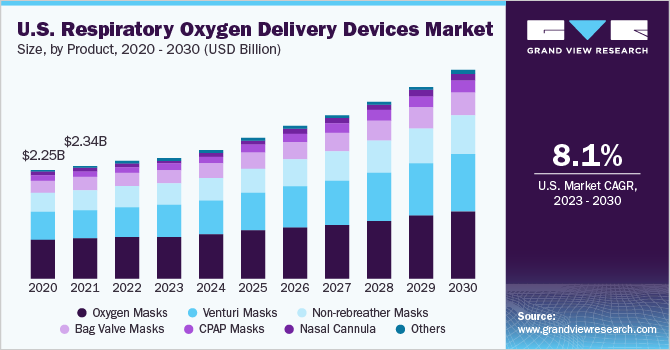

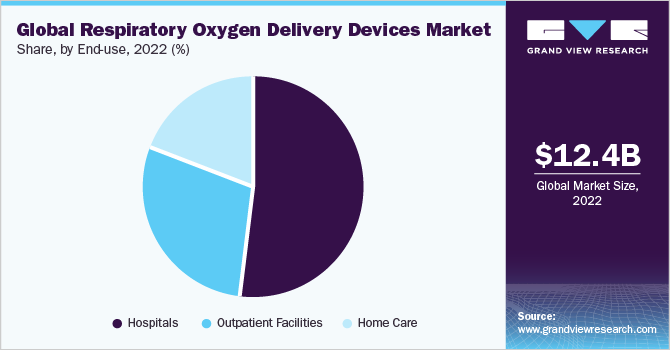

The global respiratory oxygen delivery devices market size was estimated at USD 12.43 billion in 2022 and is estimated to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. The growing prevalence of respiratory disorders, such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea, is a significant driver, creating a steady demand for efficient oxygen delivery solutions. An aging global population also contributes to the increased need for respiratory support, as elderly individuals are more susceptible to respiratory conditions. Technological advancements, such as portable and user-friendly oxygen delivery devices, also drive market growth, enabling patients to lead more active lives while managing their conditions.

Moreover, the ongoing focus on improving healthcare infrastructure in developing regions and the increasing awareness about the importance of timely and appropriate respiratory care further propel the market for these devices. Overall, the confluence of medical needs, developing technology, and expanding healthcare access collectively fuel the market growth. As per a CDC health advisory and media briefing in November 2022, the U.S. experienced an increasing prevalence of respiratory syncytial virus (RSV) across 8 out of 10 public health regions. This was emphasized by RSV's impact on young children, with approximately 100 annual respiratory deaths in children under the age of 1 exceeding the risk posed by influenza.

While RSV infections are common among children by the age of 2 years, the virus extends its impact beyond this demographic to include older children susceptible to severe infections. The yearly statistical data in the U.S. shows RSV’s repercussions, including 2.1 million outpatient visits for children aged below 5 years and 58,000 to 80,000 hospitalizations within the same age bracket. In addition, healthcare professionals noted an unexpected early rise in RSV cases for the Fall 2022-Spring 2023 season, aggravating the challenges faced by healthcare institutions already struggling with the upsurge in influenza and COVID-19 cases. Furthermore, the CDC’s report as of November 2022 revealed a substantial increase in positive RSV antigen and PCR tests compared to 2021.

Moreover, it's important to underline that the impact of RSV extended to adults aged 65 years and above, leading to a range of 60,000 to 120,000 hospitalizations within this demographic. The increased hospitalizations, outpatient visits, and severity of RSV cases indicate a growing need for efficient respiratory care and oxygen delivery devices. This demographic shift towards an increasing global elderly population holds significant growth opportunity for the market. As this age group faces an increased risk of respiratory issues, including chronic conditions, the demand for reliable and efficient respiratory treatment is expected to rise.

For instance, as per an article published by the United States Census Bureau 2020, the Asian population had increased and passed a striking count of 4.5 billion individuals, including major nations, such as China and India, which show populations exceeding one billion. This comprised more than half of the global populace. Within this demographic, an estimated 414 million Asians were aged 65 or older, exceeding the entire population of the U.S. by around 20%. Moreover, the analysis projected that by 2060, the ranks of Asians aged 65 and above would increase to exceed 1.2 billion. This forecast implies a future where one in every 10 individuals globally will be a senior citizen in Asia. The COVID-19 pandemic has substantially boosted the growth of the market.

The virus's strong respiratory impact led to a surge in severe cases requiring oxygen therapy, driving demand for devices like ventilators and oxygen concentrators in hospitals and ICUs. The need for extended oxygen therapy in patients with complications such as ARDS and pneumonia further fueled this demand. The shift towards home-based care for mild cases also prompted an increased interest in portable oxygen concentrators. The pandemic accelerated research and innovation, resulting in advanced respiratory care technologies. Overall, COVID-19 emphasized the importance of respiratory support, catalyzing market expansion and the development of more effective oxygen-delivery solutions, thus increasing demand for respiratory oxygen-delivery devices, thereby driving the market growth.

Product Insights

The Oxygen Masks segment dominated the market and held the largest revenue share of 35.96% in 2022. These masks provide a simple and effective means of delivering oxygen to patients across various clinical settings. Their ease of use makes them suitable for acute care scenarios and long-term oxygen therapy. Oxygen masks are beneficial for patients requiring low to moderate oxygen flow rates and can be easily adjusted to accommodate different oxygen concentrations. Their availability in various sizes and styles enables customization to fit different patient needs, including pediatric and adult populations. The familiarity of healthcare professionals with oxygen masks and their cost-effectiveness further contribute to their market dominance, making them an initial component of respiratory care protocols, thereby driving the market growth.

The venturi masks segment is expected to witness the fastest growth rate of 8.6% over the forecast period. These masks offer precise and controlled oxygen delivery by utilizing a unique system that mixes oxygen with room air at specific ratios, resulting in accurate oxygen concentration delivery. This feature is crucial in managing patients with respiratory conditions who require precise oxygen levels. Venturi masks are particularly preferred for chronic obstructive pulmonary disease (COPD) patients, where maintaining precise oxygen saturation is essential.

End-use Insights

The hospitals segment held the largest revenue share of 51.76% in 2022. The segment is projected to expand further at the fastest CAGR of 8.0% maintaining its dominant industry position throughout the forecast period. Hospitals are the primary centers for diagnosing and treating various respiratory conditions and diseases, including acute respiratory infections and chronic obstructive pulmonary disease (COPD). The increasing prevalence of these respiratory ailments has led to a higher demand for respiratory care and interventions, thereby driving the need for effective respiratory oxygen delivery devices.

In addition, hospitals handle a diverse range of patients, including those with compromised immune systems and respiratory vulnerabilities. Moreover, the ongoing efforts to manage and prevent respiratory infections, especially after global health crises like COVID-19, have forced hospitals to enhance their respiratory protection measures. This includes the widespread adoption of respiratory oxygen delivery devices to ensure optimal patient care and infection control.

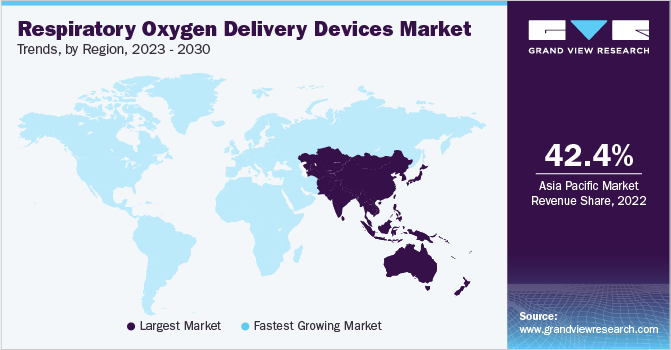

Regional Insights

Asia Pacific has dominated the market and held the largest revenue share of 42.40% in 2022. The region's high prevalence of respiratory diseases, increasing applications in home care settings, a continuation of demographic & economic trends, and technological advancements are major factors contributing to market growth in the region. Furthermore, some major market players are adopting certain strategic initiatives, such as collaborations, acquisitions, and new product launches, which help them strengthen their market position. For instance, in April 2020, CAIRE, Inc. expanded its oxygen therapy solutions portfolio in China. With this, the company will be able to expand the distribution of its oxygen therapy solutions in the country.

Thus, the growing focus on developing innovative respiratory devices in Asia Pacific will drive the market growth over the forecast period. North America also held a significant revenue share of the market in 2022. The market growth in this region can be attributed to the availability of the latest technologies, continuous product launches, and the presence of major industry players. Some of the market leaders in North America are GE Healthcare, CAIRE, Inc., Koninklijke Philips N.V., and Medtronic. Furthermore, the growing government funding to overcome the burden of the increasing prevalence of respiratory disorders is expected to boost market growth.

Key Companies & Market Share Insights

Key companies are actively formulating strategic approaches to enhance their market presence and gain a competitive advantage within the sector. These key players are emphasizing strategic maneuvers, encompassing mergers and acquisitions, collaborative ventures, partnerships, substantial investments, and the introduction of innovative products to augment their capabilities and broaden their range of offerings. For instance, in June 2023, Airway Management, a manufacturer and provider of sleep therapy products, introduced the Morf Nasal CPAP Mask featuring a new biodegradable seal, marking a significant step towards sustainability in the industry. This improvement addresses patient comfort and environmental concerns, potentially driving market growth by appealing to eco-conscious consumers and setting a new standard for respiratory oxygen delivery devices. Some of the major players in the global respiratory oxygen delivery devices market are:

-

GE Healthcare

-

Koninklijke Philips N.V.

-

ICU Medical (Smiths Medical)

-

Invacare Corporation

-

Medtronic

-

Fisher & Paykel Healthcare

-

ResMed

-

Linde

-

Mindray

-

Chart Industries

-

Drägerwerk AG & Co. KGaA

-

DeVilbiss Healthcare

Respiratory Oxygen Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.73 billion

Revenue forecast in 2030

USD 21.73 billion

Growth rate

CAGR of 7.9 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; Medtronic; Fisher & Paykel Healthcare; ResMed; Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; DeVilbiss Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Respiratory Oxygen Delivery Devices Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the respiratory oxygen delivery devices market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxygen Masks

-

Nasal Cannula

-

Venturi Masks

-

Non-rebreather Masks

-

Bag Valve Masks

-

CPAP Masks

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global respiratory oxygen delivery devices Market size was estimated at USD 12.43 billion in 2022 and is expected to reach USD 12.73 billion in 2023.

b. The global respiratory oxygen delivery devices Market is expected to grow at a CAGR of 7.9% from 2023 to 2030 to reach a value of USD 21.73 billion in 2030.

b. The oxygen mask segment dominated the market in 2022 with a share of 36.0%. The demand for oxygen masks is primarily driven by the need for oxygen therapy in various healthcare settings, including hospitals, clinics, and home healthcare. Furthermore, innovations in mask design have led to improved comfort and efficiency for patients. This is expected to impel the demand over a forecast period.

b. Some of the key players operating within the global respiratory oxygen delivery devices market for respiratory oxygen delivery devices include Philips Healthcare, ResMed, Medtronic, Chart Industries, Invacare, Drive DeVilbiss Healthcare, Masimo, Medline Industries Inc., Air Liquide, HERSILL S.L., Precision Medical Inc., Medical Depot Inc.

b. The growing prevalence of sleep apnea is also a significant growth driver of this market. Also, the technological advancements in oxygen delivery devices to make them more efficient, user-friendly, and portable is another factor impelling the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."