- Home

- »

- Digital Media

- »

-

Retail Media Networks Market Size And Share Report, 2030GVR Report cover

![Retail Media Networks Market Size, Share, & Trends Report]()

Retail Media Networks Market (2024 - 2030) Size, Share, & Trends Analysis Report By Advertising Format (Display Ads, Video Ads, Sponsored Products), By Platform Type, By Industry Vertical, And Segment Forecasts

- Report ID: GVR-4-68040-453-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Media Networks Market Summary

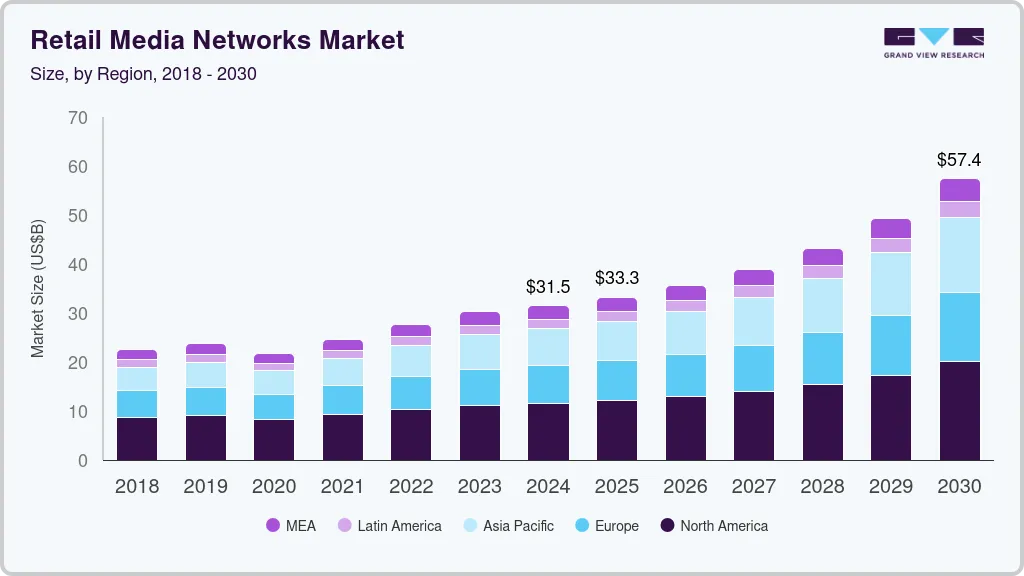

The global retail media networks market size was estimated at USD 30.02 billion in 2023 and is projected to reach USD 56.97 billion by 2030, growing at a CAGR of 10.5% from 2024 to 2030. The rapid growth of e-commerce is driving growth of the market, as more consumers shift to online shopping.

Key Market Trends & Insights

- North America held the share of 37.0% of the retail media networks market in 2023.

- The retail media networks market in the U.S. is expected to grow significantly from 2024 to 2030.

- By advertising format, the display ads segment accounted for the largest market share of 39.0% in 2023.

- By platform type, the retailer-owned networks segment accounted for the largest market share of 67.5% in 2023.

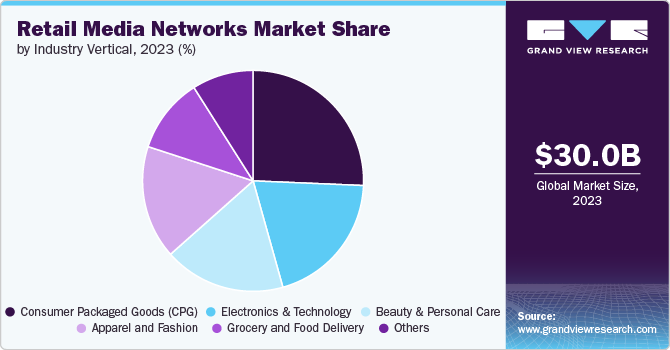

- By industry vertical, the Consumer Packaged Goods (CPG) segment accounted for the largest market share of 25.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.02 Billion

- 2030 Projected Market Size: USD 56.97 Billion

- CAGR (2024-2030): 10.5%

- North America: Largest market in 2023

This trend has been accelerated by the convenience and variety offered by online platforms, prompting brands to leverage retail media networks to maintain visibility and engagement with their target audiences. Moreover, changing consumer shopping habits, including increased reliance on mobile devices and online platforms, are prompting retailers to invest in retail media networks to connect with consumers.

Retailers have access to vast amounts of first-party data, enabling more precise targeting of ads based on customer behavior and preferences. This level of personalization improves the effectiveness of ads, helping brands reach their ideal audience while enhancing the shopping experience for consumers. In an era where third-party cookies are being phased out, retailers' proprietary data becomes a key asset in digital advertising.

The shift in advertising budgets from traditional media to digital platforms also supports retail media networks (RMN) growth. Brands are increasingly allocating more resources to retail media as they seek higher returns on investment. Since RMNs offer a clear path to purchase, they provide better attribution for ad spend, driving demand for this advertising model.

The expansion of retail ecosystems and the integration of physical and digital channels play a crucial role in the growth of RMNs. Retailers are creating seamless omnichannel experiences, allowing them to reach customers both in-store and online. This enhances the potential for cross-channel advertising campaigns, further boosting the RMN market.

Moreover, the increasing need for first-party data utilization in retail media is boosting the market growth. As third-party cookies decline, retailers are seeking innovative solutions to capitalize on their vast consumer data, enabling more personalized and effective advertising strategies that drive higher returns on ad spend. For instance, in September 2024, Pentaleap GmbH, a retail media technology provider, announced the launch of its modular retail media platform. The platform aims to maximize the potential of retail media networks (RMNs) for onsite monetization and fosters an open and efficient ecosystem for both RMNs and advertisers. The Publisher Manager portal provides complete control over site monetization through tools, enabling increased revenue without compromising relevance for RMNs.

Advertising Format Insights

The display ads segment accounted for the largest market share of 39.0% in 2023 due to the increasing digitization of retail has shifted more consumers to e-commerce platforms, where retailers have vast amounts of first-party data that advertisers can leverage for targeted campaigns. Moreover, retailers are investing heavily in building their advertising platforms to enhance their margins, reducing reliance on external ad networks. This strategic move benefits both retailers and brands, as advertisers gain access to valuable shopper data, enabling more precise targeting. The National Retail Federation reports that in 2024, 80% of shopping continues to occur in physical stores, representing a crucial opportunity for brands and retailers to engage with consumers.

The video ads segment is anticipated to grow at the significant CAGR over the forecast period. The surge in online shopping has created more opportunities for video ad placements across digital retail environments, such as product pages, checkout screens, and homepages. As more consumers spend time browsing e-commerce platforms, video ads serve as a medium to provide product demonstrations, tutorials, or brand stories, making them highly influential in the consumer decision-making process.

Platform Type Insights

The retailer-owned networks segment accounted for the largest market share of 67.5% in 2023. The rise of privacy regulations, such as the General Data Protection Regulation (GDPR) and the phasing out of third-party cookies, has made first-party data more critical than ever. Retailers, who already have direct relationships with consumers, are well-positioned to capitalize on this regulatory shift. Brands are increasingly turning to retailer-owned networks to reach audiences in a compliant manner, as these networks provide access to first-party data without infringing on privacy rules.

The third-party networks segment is anticipated to grow at the significant CAGR over the forecast period. Brands are increasingly looking for seamless integration across various platforms to maintain consistent messaging and branding across both retailer-owned media and third-party networks. As retailers collaborate with third-party networks, they create an ecosystem where advertisers can manage their campaigns more holistically, ensuring that ad messaging aligns across the entire digital landscape. This approach not only strengthens brand recall but also improves conversion rates as consumers encounter ads at multiple touchpoints

Industry Vertical Insights

The Consumer Packaged Goods (CPG) segment accounted for the largest market share of 25.7% in 2023. The increasing adoption of direct-to-consumer strategies by CPG brands is a key driver for RMN growth. By partnering with retailers through RMNs, CPG brands can replicate some of the benefits of D2C models, such as owning a direct channel for communication with customers. RMNs give CPG companies access to consumer data that helps in understanding shopping behavior and tailoring offers, similar to D2C platforms.

The beauty and personal care segment is anticipated to grow at the significant CAGR over the forecast period owing to the increasing influence of social commerce and influencer marketing in the beauty industry. RMNs integrate these trends by offering advertisers the ability to run interactive, shoppable ads that combine the appeal of influencer-driven content with the convenience of direct purchasing options. This approach boosts brand visibility and encourages impulse purchases, particularly in the beauty and personal care category, where product trial and experimentation are common consumer behaviors.

Regional Insights

North America held the share of 37.0% of the retail media networks market in 2023. Programmatic advertising is becoming more prevalent within RMNs in North America. By automating the ad-buying process, programmatic tools allow retailers and brands to run more efficient, data-driven campaigns. Real-time bidding (RTB) and advanced audience segmentation ensure that ads are served to the right shoppers at the right time, improving both the relevance of ads and return on investment (ROI). Retailers are also integrating AI and machine learning to optimize ad placements and performance. For instance, in April 2024, Walmart, a leading U.S. retailer, revealed its expansion plans for its Retail Media Network, Walmart Connect. These plans aim to boost advertiser participation, introduce new ad formats, and enhance measurement tools to better demonstrate the platform's effectiveness.

U.S. Retail Media Networks Trends

The retail media networks market in the U.S. is expected to grow significantly from 2024 to 2030. Many U.S. retailers are creating their own media properties and ecosystems to support RMN growth. These include custom content platforms, shoppable ads, and branded content opportunities. For example, Kroger Precision Marketing (KPM) offers brands access to targeted digital and programmatic advertising across its network of grocery platforms. Retailers are positioning themselves as both commerce and media companies, offering brands comprehensive solutions that go beyond traditional advertising.

Europe Retail Media Networks Trends

The retail media networks market in Europe is growing significantly at a CAGR of 10.7% from 2024 to 2030. Retailers in the region are increasingly leveraging first-party data to offer precise targeting and measurement capabilities, enhancing the effectiveness of advertising campaigns. According to IAB Europe, European-level association for the digital marketing and advertising ecosystem over 90% of advertisers are partnering with retailers to reach consumers at critical points in their purchasing journey.

Asia Pacific Retail Media Networks Trends

The retail media networks market in Asia Pacific is growing significantly at the CAGR of 12.5% from 2024 to 2030. Increasing disposable incomes across the Asia Pacific region are enabling consumers to spend more on goods and services, thereby boosting retail activity and creating a favorable environment for retail media networks. Moreover, the region has a vast mobile user base, allowing retailers to engage consumers directly through mobile devices with tailored advertising. This mobile-centric approach is crucial for reaching tech-savvy consumers who prefer shopping on their smartphones.

Key Retail Media Networks Company Insights

Key players operating in the retail media networks market include Amazon, Best Buy, eBay Inc., Target, and Walmart. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2024, Lowe's partnered with Google to create a new retail media solution that combines Lowe's extensive customer data with Google's advertising technology. This collaboration aims to provide targeted advertising opportunities for brands in the home improvement sector, allowing them to engage effectively with consumers across Google Search and Shopping platforms. The initiative is part of a closed beta program, marking Lowe's as one of the first retailers to test this approach to advertising.

-

In April 2024, Home Depot rebranded its advertising division from Retail Media+ to Orange Apron Media. This change reflects the company's commitment to enhancing its retail media network and attracting more brands to advertise on its platform. The new name draws inspiration from the orange aprons worn by employees, symbolizing service and expertise, and aims to differentiate Home Depot in the competitive retail media landscape.

-

In May 2023, Instacart, partnered with independent grocers to help them establish and grow their retail media networks using Carrot Ads, an on-site advertising technology. This collaboration allows advertisers to more easily and effectively promote their products across a wide network of local grocery stores, supporting the communities they serve by driving sales for both the retailers and brands.

Key Retail Media Networks Companies:

The following are the leading companies in the retail media networks market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon

- Albertsons

- Best Buy

- Carrefour

- CVS Health

- eBay Inc.

- Home Depot

- Instacart

- Kroger

- Lowe’s

- Sephora

- Target

- Walmart

Retail Media Network Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.29 billion

Revenue forecast in 2030

USD 56.97 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Advertising format, platform type, industry vertical, and region

Regional scope

North America, Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon; Albertsons; Best Buy; Carrefour; CVS Health; eBay Inc.; Home Depot; Instacart; Kroger; Lowe’s; Sephora; Target; Walmart

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Media Networks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the retail media network market report based on advertising format, platform advertising format, industry vertical, and region.

-

Advertising Format Outlook (Revenue, USD Billion, 2018 - 2030)

-

Display Ads

-

Video Ads

-

Sponsored Products

-

Others

-

-

Platform Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retailer-Owned Networks

-

Third-Party Networks

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Packaged Goods (CPG)

-

Electronics and Technology

-

Apparel and Fashion

-

Grocery and Food Delivery

-

Beauty and Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail media networks market size was estimated at USD 30.02 billion in 2023 and is expected to reach USD 31.29 billion in 2024.

b. The global retail media networks market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 56.97 billion by 2030.

b. North America held the share of 37.0% of the retail media networks market in 2023. Programmatic advertising is becoming more prevalent within RMNs in North America. By automating the ad-buying process, programmatic tools allow retailers and brands to run more efficient, data-driven campaigns.

b. Some key players operating in the retail media networks market include Amazon, Albertsons, Best Buy, Carrefour, CVS Health, eBay Inc., Home Depot, Instacart, Kroger, Lowe’s, Sephora, Target, and Walmart

b. The rapid growth of e-commerce is driving growth of the market, as more consumers shift to online shopping. This trend has been accelerated by the convenience and variety offered by online platforms, prompting brands to leverage retail media networks to maintain visibility and engagement with their target audiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.