- Home

- »

- Digital Media

- »

-

Retail Media Platform Market Size, Industry Report, 2033GVR Report cover

![Retail Media Platform Market Size, Share & Trends Report]()

Retail Media Platform Market (2025 - 2033) Size, Share & Trends Analysis Report By Ad Format (Display Ads, Search Ads, Sponsored Content), By Platform Type (Retailer-Owned Media Networks, Third-Party Media Networks), By Deployment, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-470-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Media Platform Market Summary

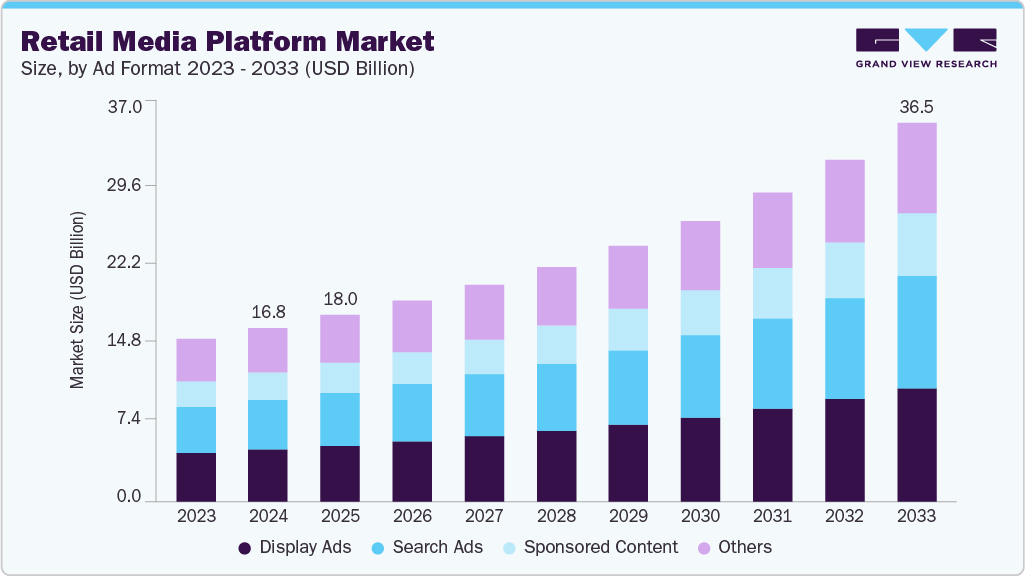

The global retail media platform market size was estimated at USD 16.77 billion in 2024 and is projected to reach USD 36.53 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The ongoing digital transformation in retail has led to a surge in e-commerce, creating more digital real estate for advertising opportunities.

Key Market Trends & Insights

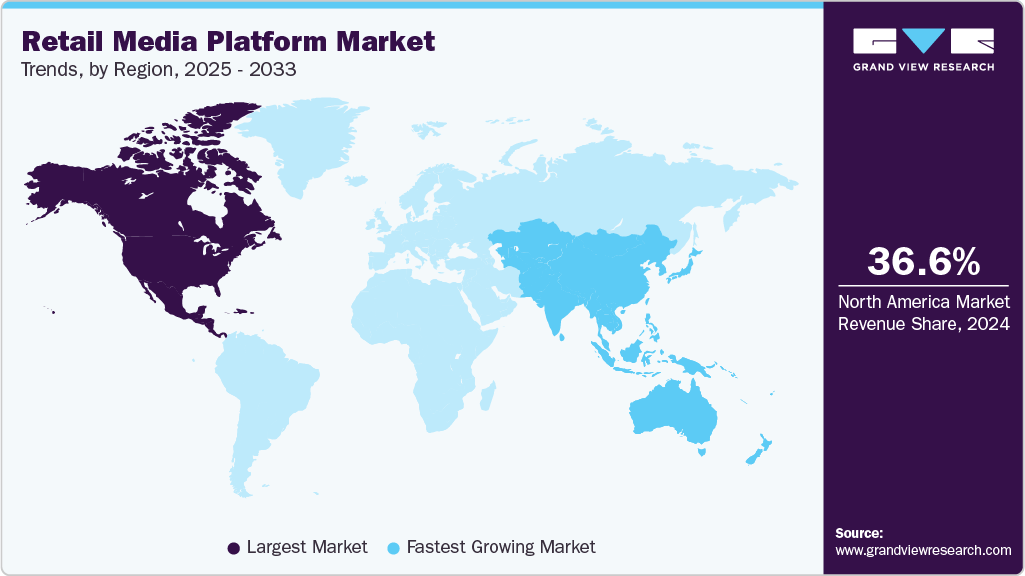

- North America held 36.6% revenue share of the global retail media platform market in 2024.

- In the U.S., the growing shift in advertising spend from traditional channels to digital commerce environments is accelerating the demand for the retail media platform market.

- By ad format, display ads segment held the largest revenue share of 30.1% in 2024.

- By platform type, retailer-owned media networks segment held the largest revenue share in 2024.

- By deployment, cloud segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.77 Billion

- 2033 Projected Market Size: USD 36.53 Billion

- CAGR (2025-2033): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

The rise of e-commerce and omnichannel retailing is another major driver of the retail media platform market. As consumers blend online and offline shopping journeys, retailers are investing in digital advertising networks that seamlessly integrate across web, app, and in-store digital screens. These platforms enable advertisers to create unified campaigns that engage customers at multiple touchpoints, increasing the likelihood of brand recall and purchase. Moreover, the surge in mobile shopping and the adoption of retail apps are creating more opportunities for embedded advertising, further fueling demand for advanced retail media solutions.

The retail media platform market is also being driven by the rapid digital transformation across the retail sector, where investments in advanced retail technologies are reshaping how brands connect with consumers. Retailers are integrating sophisticated digital signage, interactive displays, and connected in-store experiences that complement online advertising efforts, creating a seamless consumer journey. This convergence of physical and digital retail experiences increases the effectiveness of retail media campaigns, as shoppers are exposed to consistent messaging across multiple channels. The ability to deliver dynamic, context-aware content based on real-time inventory, promotions, and customer behavior further enhances the appeal of these platforms for advertisers seeking higher engagement rates.

The increasing adoption of self-serve advertising models within retail media platforms is fueling the retail media platform market growth. By enabling brands and agencies to create, manage, and optimize their campaigns independently, retailers are opening the door to a wider pool of advertisers, including small and mid-sized businesses. This democratization of access is encouraging more companies to participate in retail media ecosystems, driving up demand for platform capabilities and expanding the range of ad formats offered. Self-serve portals also allow advertisers to test and refine campaigns quickly, making retail media an attractive channel for agile marketing strategies.

The expansion of retail media into non-traditional retail sectors is also broadening the retail media platform market scope. Beyond grocery, fashion, and electronics, industries such as travel, hospitality, automotive, and even financial services are exploring retail media partnerships to reach highly relevant audiences. For instance, airlines and hotels can use retail media platforms to promote add-on services or exclusive offers during booking processes, leveraging the same targeting principles that drive product sales in e-commerce. This cross-industry adoption is diversifying revenue streams for platform providers and creating new growth opportunities.

Furthermore, the growing sophistication of shopper data analytics is significantly enhancing the value proposition of the retail media platform market. Retailers are using transactional data and incorporating behavioral, demographic, and location-based insights to build comprehensive customer profiles. This allows for precision targeting beyond simple product recommendations, enabling brands to deliver messaging that resonates with customers’ lifestyles, preferences, and purchasing intent. As these insights become more detailed and predictive, the return on investment for retail media campaigns is expected to increase, encouraging more advertisers to adopt them.

Ad Format Insights

The display ads dominated the retail media platform market in 2024 with a revenue share of over 30.0%. Display ads excel in capturing consumer attention through visually engaging elements, making them optimal for showcasing product images, promotions, and brand messaging. As users navigate retail platforms, these visually appealing ads stand out, driving engagement and facilitating the conversion of browsers into buyers. In addition, display ads play a crucial role in retargeting efforts within retail media platforms. By leveraging first-party data, retailers can effectively reach users who have previously expressed interest in specific products. This targeted approach enhances ad relevancy, ensuring that consumers see ads tailored to their interests, which significantly increases the likelihood of conversion. Together, these factors underscore display ads' effectiveness in driving engagement and sales.

The search ads segment is projected to be the fastest-growing segment from 2025 to 2033. Search ads are highly effective in capturing high-intent traffic by targeting consumers who are actively searching for specific products. This direct alignment with user intent allows search ads to drive conversions and sales, reaching consumers precisely when they are most likely to make a purchase decision. In addition, the seamless integration of search ads within retail media platforms enhances the overall shopping experience. By placing paid ads directly alongside organic search results, brands increase their visibility and accessibility. This strategic placement gets attention and encourages consumer engagement with the ads while browsing, ultimately boosting the likelihood of conversions. These factors make search ads a critical component of successful retail media strategies.

Platform Type Insights

The retailer-owned media networks segment dominated the retail media platform market with a revenue share of over 59.0% in 2024. Retailers are actively seeking to monetize their websites and digital traffic as a strategic move to enhance revenue. By establishing their own media networks, they can create advertising spaces which are useful for brands to reach consumers effectively. This approach generates additional revenue streams and leverages the existing customer base that retailers have cultivated over time. By offering targeted advertising opportunities, retailers can provide brands with access to engaged audiences who are already familiar with their platforms. This symbiotic relationship benefits both parties; brands gain valuable exposure, while retailers capitalize on their digital assets, transforming their platforms into profit-generating media channels that complement their core retail operations.

The third-party media networks segment is projected to be the fastest-growing segment from 2025 to 2033. Third-party media networks enhance advertising effectiveness by offering a diverse array of ad inventory across multiple retail platforms, significantly increasing brands' reach and exposure. This variety allows advertisers to engage with various consumer segments, tailoring their campaigns to specific audiences. In addition, these networks leverage extensive consumer data to provide valuable insights into audience behavior and preferences. This data-driven approach enables brands to optimize their targeting strategies, ensuring that ads resonate with the right consumers at the right time. By understanding audience dynamics, advertisers can refine their campaigns for better performance and higher return on investment (ROI). Aforementioned factors make third-party media networks a powerful tool for brands in the competitive retail landscape.

Deployment Insights

The cloud segment dominated the retail media platform market with a revenue share of over 64.0% in 2024. Cloud solutions provide retailers with the scalability needed to expand their advertising operations quickly and efficiently in response to rising digital advertising demand. This infrastructure allows businesses to enhance their capabilities without the burden of significant upfront investments in hardware. In addition, cloud services offer notable cost efficiency by minimizing the need for expensive on-premises infrastructure and ongoing maintenance. Retailers can utilize pay-as-you-go pricing models, which enable them to optimize their advertising budgets and allocate resources more effectively. This flexibility allows businesses to access advanced technologies and tools that enhance their advertising strategies while maintaining financial control.

The on-premises segment is projected to be the fastest-growing segment from 2025 to 2033. On-premises solutions offer platform owners enhanced data security and privacy by providing greater control over their data management. This level of control is crucial for businesses that handle sensitive customer information and must adhere to strict regulatory requirements. By hosting data locally, retailers can implement robust security measures tailored to their specific needs. In addition, on-premises systems allow for extensive customization, enabling retailers to align their advertising platforms, workflows, and features with their unique operational requirements and brand strategies. This flexibility ensures that retailers can create tailored solutions that effectively address their specific challenges and objectives, fostering an environment that supports both security and adaptability in a competitive market.

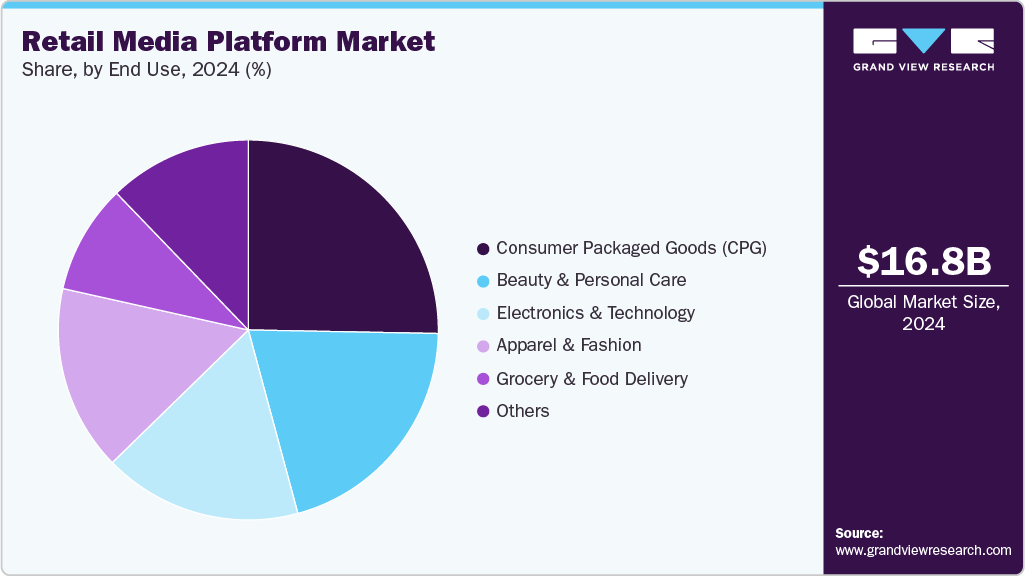

End Use Insights

The consumer packaged goods (CPG) segment dominated the retail media platform market with a market share of over 25.0% in 2024. Consumer packaged goods (CPG) brands are increasingly reallocating their advertising budgets to digital platforms, allowing them to engage more effectively with consumers where they shop. This shift from traditional media to digital channels enhances targeting and relevance, resulting in improved campaign effectiveness. In addition, the rapid expansion of e-commerce presents new opportunities for CPG brands to advertise within retail media environments. As online shopping becomes more prevalent, these brands leverage retail media platforms to boost product visibility and drive sales, capitalizing on the growing trend of digital commerce to connect with consumers at critical buying moments.

The beauty and personal care segment is projected to be the fastest-growing segment from 2025 to 2033. The shift to digital shopping has prompted beauty and personal care brands to invest heavily in digital advertising, as consumers increasingly prefer online channels for purchasing products. Retail media platforms provide these brands with opportunities to engage shoppers at key moments in their buying journeys, enhancing visibility and driving sales. In addition, the rise of influencer marketing has created a demand for targeted advertising solutions. Retail media platforms facilitate brands in leveraging influencer partnerships to deliver personalized ads, helping them reach broader audiences effectively. This combination of digital engagement and influencer collaboration significantly boosts brand awareness and consumer connection in the beauty sector.

Regional Insights

North America retail media platform market dominated the global market with a revenue share of 36.6% in 2024. North America, especially the U.S., boasts a highly developed e-commerce ecosystem, with major platforms like Amazon and Walmart driving retail media efforts. These platforms offer brands extensive reach, making digital advertising a key investment to engage a large online consumer base. In addition, the region has some of the highest digital advertising expenditures globally. Brands are increasingly allocating resources to retail media platforms to enhance product visibility, target the right audiences, and capture consumer attention. This robust digital ad spend reflects the growing importance of retail media in driving online sales and boosting brand presence in the competitive market.

U.S. Retail Media Platform Market Trends

The U.S. retail media platform industry is projected to grow during the forecast period. The U.S. boasts one of the highest levels of consumer spending globally, making it an attractive market for brands to invest in a retail media platform. By targeting high-spending consumers, brands can effectively capture interest and drive sales. In addition, the rapid growth of omnichannel retailing in the U.S. has enhanced the role of retail media platforms in connecting online and offline shopping experiences. This integration creates seamless consumer journeys, boosting engagement and improving ad performance across multiple touchpoints. As retailers embrace this approach, retail media continues to grow as a critical tool for brands to reach and engage their audiences effectively.

Asia Pacific Retail Media Platform Market Trends

The Asia Pacific retail media platform industry is expected to be the fastest growing segment, with a CAGR of 26.8% over the forecast period. Asia Pacific is witnessing rapid e-commerce expansion, particularly in markets like China, India, and Southeast Asia. This growth in online shopping is fueling demand for retail media platforms as brands aim to engage consumers in these booming digital markets. Additionally, the region is a mobile-first economy, with high mobile penetration in countries like China, India, and Indonesia. Consumers predominantly shop via mobile devices, prompting retail media platforms to optimize for mobile, enabling brands to reach and target shoppers directly on their preferred devices. This mobile-centric approach is crucial in driving retail media growth across Asia Pacific's diverse markets.

The retail media platform industry in China is projected to grow during the forecast period. The rapid expansion of livestreaming and social commerce is driving the retail media platform market growth in China. Platforms such as Douyin (TikTok’s Chinese version) and Kuaishou have transformed retail advertising by merging entertainment and shopping into a single interactive experience. Retail media platforms are increasingly embedding livestreaming features that allow brands and influencers to promote products in real time, interact with viewers, and instantly direct them to purchase links. The success of these formats is driving more retailers to invest in retail media strategies that prioritize interactive and immersive content, catering to China’s digitally savvy, mobile-first audience.

Europe Retail Media Platform Market Trends

The retail media platform industry in Europe is expected to grow during the forecast period. European retailers are embracing digital transformation to enhance their online presence and stay competitive with global players. This shift is driven by the growing adoption of retail media platforms, which allow retailers to engage customers more effectively in the digital space. The increasing penetration of e-commerce, particularly in key markets such as the UK, Germany, and France, further boosts demand for these platforms. As online shopping gains popularity, brands are investing more in digital advertising through retail media platforms to reach expanding e-commerce audiences, improve visibility, and drive sales across Europe’s dynamic retail landscape.

The retail media platform industry in the UK is grow during the forecast period. The growing embrace of DevOps and continuous integration/continuous platform type (CI/CD) practices across the UK is also accelerating CaaS adoption. Many UK-based businesses are striving to reduce development cycles and improve responsiveness to customer demands. CaaS platforms, especially those integrated with managed Kubernetes and automated orchestration tools, allow development teams to deploy and scale containerized applications consistently across testing, staging, and production environments. This ability to standardize and automate the application lifecycle has made CaaS a strategic asset for digital-first organizations seeking to remain competitive in a fast-moving market.

Key Retail Media Platform Company Insights

Some of the key companies operating in the market, include Amazon Advertising and Walmart Connect, among others are some of the leading participants in the retail media platform market.

-

Amazon Advertising is the marketing arm of Amazon.com, Inc., consolidating its various advertising services into a unified platform in 2018. The product portfolio spans a diverse range of advertising solutions tailored to different marketing objectives. Sponsored Products allow advertisers to promote individual product listings, driving visibility and sales. Sponsored Brands provide a way for businesses to showcase multiple products alongside their logo and a custom headline, enhancing brand recognition.

-

Walmart Connect is the retail media and advertising arm of Walmart Inc. Walmart Connect unites Walmart's unmatched omnichannel footprint, deep first-party shopper data, and advanced measurement capabilities into a powerful retail media platform. By serving Sponsored Search and Display Online, Off-site programmatic campaigns, and in-store ad formats, it presents a holistic advertising solution designed for an interconnected retail environment.

PubMatic, Inc., and Ulta Beauty, Inc. are some of the emerging market participants in the retail media platform market.

-

PubMatic, Inc. is an infrastructure-first digital advertising technology company. PubMatic's product portfolio is both extensive and technically sophisticated, designed to serve publishers, media buyers, data providers, and commerce media networks. It offers a robust sell-side platform alongside tools like OpenWrap, Connect, Activate, and Identity Hub.

-

Ulta Beauty, Inc. is a specialty beauty retailer. Ulta retail media offerings, including a strategic partnership with Rokt that brings non-endemic advertising (i.e., ads from brands not sold by Ulta, such as Hulu or PayPal) into customer touchpoints, especially in post-purchase transaction moments. This move broadens advertiser reach, enhances user experience, and diversifies revenue sources.

Key Retail Media Platform Companies:

The following are the leading companies in the retail media platform market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Advertising

- Walmart Connect

- Google Ads

- Meta Ads

- Criteo

- The Trade Desk

- Kroger Precision Marketing

- Instacart Ads

- Wayfair LLC

- PubMatic, Inc.

- Ulta Beauty, Inc.

- Target Brands, Inc.

- Best Buy

- CVS Health

- Walgreen Co.

Recent Developments

-

In September 2024, Instacart partnered with independent grocers to help them establish and grow their Retail Media Platform using Carrot Ads, an on-site advertising technology. This collaboration allows advertisers to more easily and effectively promote their products across a wide network of local grocery stores, supporting the communities they serve by driving sales for both the retailers and brands.

-

In April 2024, Walmart Connect announced its plans to expand its advertising capabilities, focusing on marketplace sellers and non-endemic brands. Key initiatives include programmatic on-site display ads, international expansion, and in-store campaigns. Walmart also aims to improve ad targeting and measurement with new tools like in-store attribution and conversion lift. Partnerships with Roku and TikTok will enhance omnichannel reach, while self-service tools will help brands create and manage campaigns more easily.

-

In March 2024, Lowe's partnered with Google to create a new retail media solution that combines Lowe's extensive customer data with Google's advertising technology. This collaboration aims to provide targeted advertising opportunities for brands in the home improvement sector, allowing them to engage effectively with consumers across Google Search and Shopping platforms.

Retail Media Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.99 billion

Revenue forecast in 2033

USD 36.53 billion

Growth rate

CAGR of 9.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Ad format, platform type, deployment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Advertising; Walmart Connect; Google Ads; Meta Ads; Criteo; The Trade Desk; Kroger Precision Marketing; Instacart Ads; Wayfair LLC; PubMatic, Inc.; Ulta Beauty, Inc.; Target Brands, Inc.; Best Buy; CVS Health; Walgreen Co.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Media Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the retail media platform market report based on ad format, platform type, deployment, end use, and region:

-

Ad Format Outlook (Revenue, USD Billion, 2021 - 2033)

-

Display Ads

-

Search Ads

-

Sponsored Content

-

Others

-

-

Platform Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retailer-Owned Media Networks

-

Third-Party Media Networks

-

Integrated Media Platforms

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-Premises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Consumer Packaged Goods (CPG)

-

Electronics and Technology

-

Apparel and Fashion

-

Grocery and Food Delivery

-

Beauty and Personal Care

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global retail media platform market was valued at USD 16.77 billion in 2024 and is expected to reach USD 17.99 billion in 2025.

b. The global retail media platform market is expected to grow at a compound annual growth rate of 9.3% from 2025 to 2033 to reach USD 36.53 billion by 2033.

b. The cloud segment accounted for the largest market share of 64.4% in 2023. Cloud solutions provide retailers with the scalability needed to expand their advertising operations quickly and efficiently in response to rising digital advertising demand. This infrastructure allows businesses to enhance their capabilities without the burden of significant upfront investments in hardware.

b. Key players operating in the retail media platform market include Amazon Advertising, Walmart Connect, Google Ads, Meta Ads, Criteo, The Trade Desk, Kroger Precision Marketing, Instacart Ads, Target Roundel, Yahoo Advertising and PubMatic.

b. The ongoing digital transformation of retail has led to a surge in e-commerce, creating more digital real estate for advertising opportunities. Retailers are increasingly looking to monetize their online traffic and turn their websites into ad platforms, offering valuable first-party data for highly targeted campaigns. The shift in consumer behavior toward online shopping and personalized experiences has also fueled investment in retail media platform, as brands need to reach consumers in environments where they are most likely to make purchases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.