Retinal Biologics Market Size & Trends

The global retinal biologics market size was valued at USD 23.01 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.91% from 2024 to 2030. The launch of various drug products targeting retinal diseases and rising market competition is anticipated to drive market growth. Furthermore, the prevalence of vision problems and diabetic retinopathy is also expected to propel the market demand over the forecast period. According to an article published by WHO in 2023, around 2.2 billion individuals across the world have distant or near vision problems.

The outbreak of the COVID-19 pandemic significantly impacted the retinal biologics market. Various studies have been published emphasizing retinal disorders or findings among COVID-19 patients. According to the study published by the Frontiers in June 2021, during the screening of retinal involvement, some patients showed cotton wool spots (CWSs) with/without retinal hemorrhage in the convalescent phase of COVID-19. Furthermore, according to the study published by PLOS ONE in December 2020, vascular lesions such as micro hemorrhages and nerve fiber layer infarcts may be found in severely ill COVID-19 patients during their hospitalization.

Moreover, the increasing prevalence of vision problems is expected to boost the demand for retinal biologics over the forecast period. As per a study published by Nature Aging in November 2022, it was found that India is home to approximately 25% of the visually impaired population worldwide. Furthermore, according to the U.S. Department of Health & Human Services, the economic cost of major vision problems across the nation is estimated to increase to USD 373 billion by 2050. Moreover, the increasing incidences of diabetic retinopathy across the globe are anticipated to propel the market growth. For instance, the study published by Springer Nature in January 2023 states that the prevalence of diabetic retinopathy among type 2 diabetic patients was found to be around 36.3%. The anti-VEGF drugs can reverse or slow down diabetic retinopathy. Thus, the growing prevalence of these disorders is anticipated to drive the demand for retinal biologics.

Drug Class Insights

Based on the drug class, the retinal biologics market is segmented into TNF-a Inhibitor and VEGF-A Antagonist. The VEGF-A Antagonist segment held the largest market share in 2023. The dominance of the segment can be attributed to the increasing product approvals in this segment.

For instance, in January 2022, the U.S. FDA approved Faricimab-svoa (Vabysmo), a medication for wet age-related macular degeneration and diabetic macular edema. This medication uses VEGF-A and Ang-2 effects. Such drug introductions are anticipated to boost the segment growth over the forecast period.

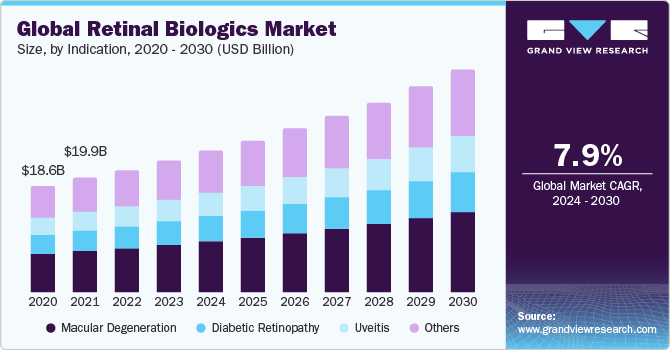

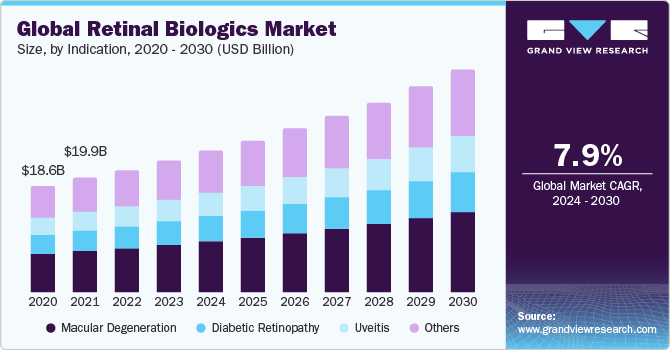

Indication Insights

On the basis of indication, the market is segmented into macular degeneration, diabetic retinopathy, uveitis, and others. The macular degeneration segment accounted for the largest revenue share in 2023, owing to the increasing drug launches for macular degeneration and the rising prevalence of this condition across the globe. For instance, the study published by the National Library of Medicine in September 2022 estimated that around 300 million individuals will suffer from Age-related macular degeneration (AMD) across the world by 2040.

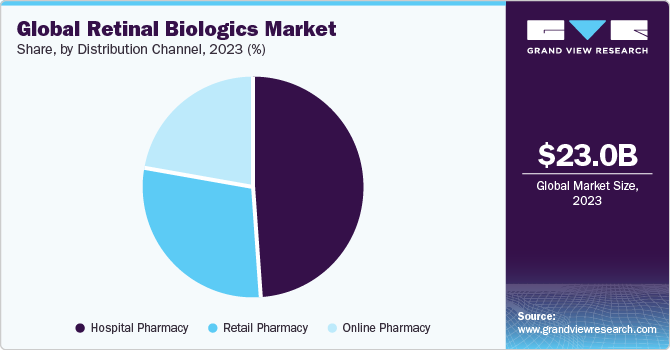

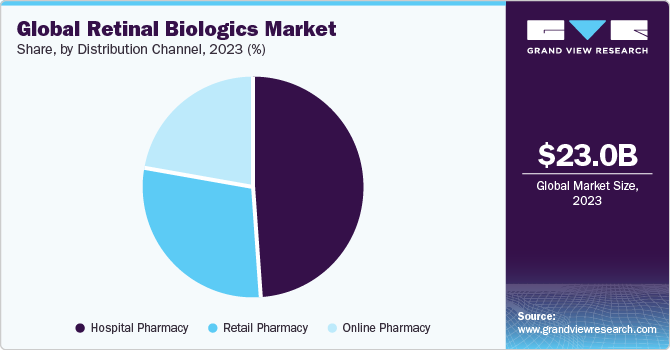

Distribution Channel Insights

On the basis of distribution channels, the market is segmented into retail pharmacies, hospital pharmacies, and online pharmacies. Hospital pharmacies held the largest market share in 2023. The segment is anticipated to grow over the forecast period owing to some benefits associated with it.

These benefits include better access to medical records of patients and availability of a large variety of medications, including those for specialized intents that may only be indicated in a controlled medical setting.

Regional Insights

North America dominated the market in 2023. The presence of major players is anticipated to bolster the market growth in this region further. Furthermore, the key players operating in the region are undertaking various strategies such as acquisitions, product launches, and partnerships to strengthen their regional position. For instance, in June 2020, Novartis revealed the U.S. FDA approval for a label update for Beovu. This update contains the addition of a sub-section reserved for retinal vasculitis or retinal vascular occlusion under ‘Warnings and Precautions. Furthermore, in September 2021, the U.S. FDA approved the first biosimilar, Byooviz, for the treatment of macular degeneration disease.

Competitive Insights

Key players operating in the market are Janssen Pharmaceuticals (Johnson & Johnson), F-Hoffman La Roche Ltd., Oxurion NV, Novartis AG, Allergan, MeiraGTx Limited, Regeneron Pharmaceuticals Inc., OncoGene Pharmaceuticals, and AbbVie Inc. The market participants are constantly undertaking various strategic initiatives like new product development, investments & funding, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In August 2023, Regeneron Pharmaceuticals, Inc. received the U.S. FDA approval for EYLEA HD injection for the treatment of diabetic retinopathy, wet age-related macular degeneration, and diabetic macular edema.

-

In March 2023, Praetego Inc. obtained USD 300 million from the National Eye Institute to advance innovative oral drugs for diabetic retinopathy.