- Home

- »

- Healthcare IT

- »

-

RFID In Pharmaceuticals Market Size & Growth Report, 2030GVR Report cover

![RFID In Pharmaceuticals Market Size, Share & Trends Report]()

RFID In Pharmaceuticals Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (RFID Tag, RFID Readers), By Type (Chipped RFID, Chipless RFID), By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-086-2

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

RFID In Pharmaceuticals Market Summary

The global RFID In Pharmaceuticals market size was valued at USD 4.7 billion in 2022 and is projected to reach USD 8.7 billion by 2030, growing at a CAGR of 7.8% from 2023 to 2030. One of the key drivers is the growing implementation of regulatory guidelines aimed at ensuring a secure drug supply in response to the increasing prevalence of counterfeit drugs.

Key Market Trends & Insights

- North America held the largest market share of over 48.0% in the market in 2022.

- Asia Pacific is projected to witness the fastest growth during the forecast period.

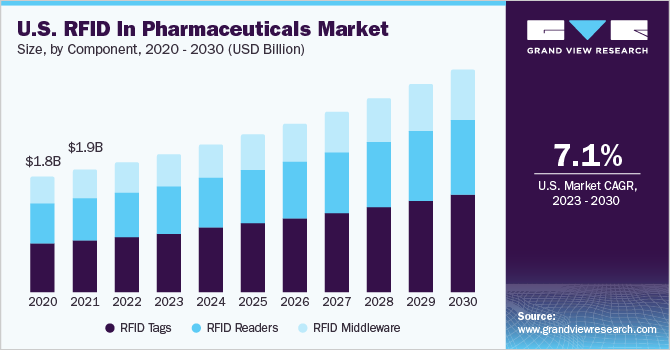

- By component, the RFID tags segment held the largest market share of over 40% in 2022.

- By type, the chipped RFID segment had the largest market share, accounting for over 64% in 2022.

- By application, the drug tracking and tracing segment held the largest market share of over 50% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.7 Billion

- 2030 Projected Market Size: USD 8.7 Billion

- CAGR (2023-2030): 7.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Additionally, there is a growing demand for efficient supply chain management in the pharmaceutical industry. The introduction of advanced Radio-frequency identification (RFID) technology and the increasing adoption of RFID tags for authentication, real-time tracking, and tracing of drugs are also expected to contribute to market growth. The growing incidences of counterfeit drugs is the primary driving factor behind the increased adoption of RFID technology in the pharmaceutical industry. The COVID-19 pandemic has further increased the issue, leading to a surge in incidents involving counterfeit products. According to the Authentication Solution Providers' Association (ASPA), in India there was a 47% increase in cases of substandard and falsified (SF) medical items from 2020 to 2021. A significant portion of these incidents involved COVID-19-related medical products such as, COVID test kits, medicines, vaccines, antibiotics, sanitizers, and face masks. Similarly, the World Health Organization's global surveillance and monitoring system for substandard and counterfeit medical products uncovered fraudulent versions of the COVID-19 vaccine Covishield in Uganda and India in 2021.

Furthermore, according to a study conducted by Sage journals, the Zambia Medicines Regulatory Authority (ZAMRA) issued a total of 119 alerts between 2018 and 2021. Out of these, 83 (69.7%) were product recalls. The number of recalls increased in 2020 (44.6%) and 2021 (22.9%). The majority of the recalled products were substandard antiseptics and disinfectants, which were in high demand during the COVID-19 pandemic. RFID technology provides a reliable method to access product details, track and trace pharmaceuticals in the supply chain, and lower the overall cost of business (TCOB) during product recalls. As a result, the increased adoption of Radio-frequency identification (RFID) technology for product recall management is anticipated to drive market growth.

Pharmaceutical industries are incorporating radio frequency identification into their supply chain to make it more efficient and improve patient safety while saving time and reduce costs. For instance, in 2020, Sandoz, a division of Novartis that specializes in generic pharmaceuticals and biosimilars, partnered with Kit Check, to integrate their drug supply-chain management technology into two of their products. Similarly, in October 2020, QuVA Pharma, Inc., extended its collaboration with Kit Check to help hospitals enhance medication management and automation using RFID tags. These RFID tags integrated into medicines enable pharmacists to quickly and easily add batches to inventory and monitor the movement of medicines from the pharmacy to patients in a hospital.

Furthermore, the market growth of RFID technology is expected to be driven by significant product launches from key market players. In February 2022, Avery Dennison Smartrac unveiled its RAIN radio frequency identification inlay (AD Minidose U9), developed specifically for use in pharmaceuticals. This new technology provides value to healthcare, lab, and pharmacy facilities, aiding with inventory and supply chain management.

Component Insights

The RFID tags segment held the largest market share of over 40% in 2022, due to rising awareness about the benefits of these tags, which is expected to drive the growth of this segment. Tags can be utilized at various locations to track and trace different types of drugs, vaccines, and other medical products. These factors contribute to the dominance of this segment during the forecast period.

Furthermore, it enables easy access to inventory management, faster workflow processing, and real-time drug monitoring, drug usage, and reduce the drug counterfeiting, these factors are also expected to contribute to the segment growth.

RFID Readers accounted a significant revenue share in 2022. These readers are used to collect information from tags, aiding in object tracking. Data is transmitted from the tag to the reader using radio waves. Additionally, these readers can be combined with technologies like GPS and sensors, making them valuable in logistics, transportation, and supply chain management. Furthermore, with the advancements in data analytics and cloud computing, readers can offer real-time insights and analytics, which help optimize processes and enhance decision-making.

Type Insights

In 2022, the chipped RFID segment had the largest market share, accounting for over 64%. This technology involves in implementing RFID chips into pharmaceutical products, creating a unique identifier for each product. This enables real-time authentication throughout the supply chain.

With chipped radio frequency identification, manufacturers can verify the authenticity of drugs at every stage, from production to distribution. This helps to mitigate the risks associated with counterfeit drugs, ensuring that patients receive correct and safe medications.

Chipless RFID segment is expected to gain popularity in the pharmaceutical industry over the forecast period, due to this technology overcomes the hardware limitations encountered by chipped technology. As chipless technology continues to advance, pharmaceutical companies can benefit from streamlined operations, cost reduction, improved counterfeit drug detection, and enhanced patient safety.

Application Insights

The drug tracking and tracing held the largest market share of over 50% in 2022. This segment's growth is driven by increasing incidences of counterfeit drugs and the widespread adoption of advanced RFID technology in pharmaceutical industry. According to the Pharmaceutical Security Institute data, there is a significant rise in incidents of counterfeiting, with illegal trafficking of medicines increasing by 38% across 137 countries from 2016 to 2020.

Moreover, according to an article published by NCBI in July 2022, counterfeit drugs can encompass both generic and branded medications, as well as excipients and active substances. The trafficking of substandard and counterfeit drugs has been on the rise during the Covid pandemic, leading to a higher demand for radio frequency identification technologies to combat this problem.

The drug quality and management segment are anticipated to witness the fastest growth over the forecast period. Drug quality management practices can help pharmaceutical manufacturers and healthcare providers to ensure the integrity and safety of their products. By implementing effective quality management system, manufacturers can maintain high standards and safety of the patient health.

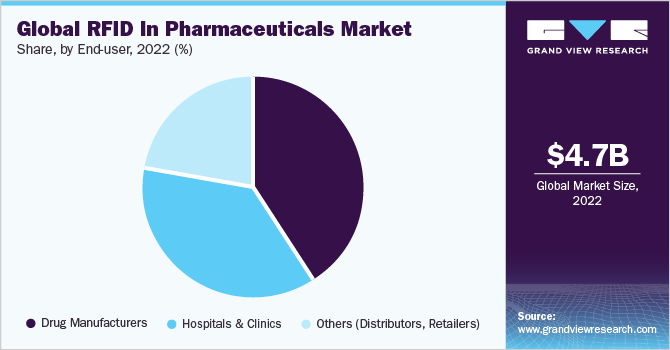

End-user Insights

The drug manufacturers segment held the largest market share of over 41% in 2022. This growth can be attributed to several factors, including rising adoption of advanced RFID technology to identify counterfeit drugs and the benefits of drug tracking systems in streamlining efficient workflows between pharmaceutical organization, wholesaler, distributors and healthcare organization.

There has been a rise in the proliferation and distribution of counterfeit drugs, which affect significant health risks. Radio frequency identification technology assist in detecting such counterfeit drugs and helps manufacturers refrain from distributing them in the market. Additionally, this technology help in inventory management and reduces labelling errors, further driving the growth of this segment.

Furthermore, the hospitals and clinics is expected to experience significant growth during the forecast period. This can be attributed to various factors, such as the adoption of RFID technology to avoid counterfeit drugs, ensuring patient safety, and the cost reduction associated with supply chain management are the key factors driving the growth of the segment.

Regional Insights

In 2022, North America held the largest market share of over 48.0% in the market. This can be attributed to the increasing risks associated with substandard and falsified drugs and the presence of stringent regulatory frameworks in the region. A report published in the Annals of Pharmacotherapy in March 2022 highlighted that the Food and Drug Administration's (FDA) Office of Criminal Investigations conducted 130 operations to combat counterfeit drugs between 2016 and 2021.

Moreover, significant advancement in RFID technologies and of presence of key market players in the region is also contributing to the market growth. For instance, in November 2022, Impinj introduced two new RAIN RFID Tag Chips that aim to enhance IoT connectivity for industries such as pharmaceuticals, food, and automotive. These new tag chips are specifically designed to assist large enterprises in effectively managing product shelf life, ensuring compliance with regulations, and reducing waste.

On the other hand, the Asia Pacific is projected to witness the fastest growth during the forecast period. This growth can be attributed to the increasing number of pharmaceutical companies in the region and their growing demand for efficient supply chain management. Additionally, the presence of a large pharmaceutical industry and improving healthcare infrastructure are key factors contributing to the regional growth.

Key Companies & Market Share Insights

The market for RFID in pharmaceuticals is moderately competitive, with players continuously striving to offer customized solutions and exploring opportunities for mergers, acquisitions, partnership, new product launches and expansion into new markets. For instance, in February 2023, Avery Dennison Smartrac has announced a significant investment of USD 100 million in expanding its RFID tags production capacity in Americas region with the new manufacturing capacity site in Mexico. Some of the key players in the RFID in pharmaceuticals market include:

-

Zebra Technologies Corp.

-

CCL Healthcare

-

Fresenius Kabi AG

-

Avery Dennison Corporation

-

Impinj Inc.

-

Bluesight

-

Terso Solutions Inc.

-

GAO RFID Group

-

Tageos

-

Alien Technology, LLC.

RFID In Pharmaceuticals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.1 billion

Revenue forecast in 2030

USD 8.7 billion

Growth rate

CAGR of 7.8% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, end-user, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Zebra Technologies Corp.; CCL Healthcare; Fresenius Kabi AG; Avery Dennison Corporation; Impinj, Inc.; Bluesight; Terso Solutions, Inc.; GAO RFID Group; Tageos; Alien Technology, LLC.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options.

Global RFID In Pharmaceuticals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global RFID in pharmaceuticals market report based on component, type, application, end-user and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

RFID Tags

-

RFID Readers

-

RFID Middleware

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chipped RFID

-

Chipless RFID

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Track & Tracing Systems

-

Drug Quality Management

-

Others

-

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Manufacturers

-

Hospitals & Clinics

-

Others (Distributors, Retailers)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RFID in pharmaceuticals market size was estimated at USD 4.7 billion in 2022 and is expected to reach USD 5.1 billion in 2023.

b. The global RFID in pharmaceuticals market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 20230 to reach USD 8.7 billion by 2030.

b. North America dominated the RFID in pharmaceuticals market with a share of over 48% in 2022. This is attributable to increasing risks associated with substandard and falsified drugs and the presence of stringent regulatory frameworks in the region.

b. Some key players operating in the menstrual health apps market include Zebra Technologies Corp., CCL Healthcare, Fresenius Kabi AG, Avery Dennison Corporation, Impinj, Inc., Bluesight, Terso Solutions, Inc., GAO RFID Group, Tageos, Alien Technology, LLC.

b. Key factors that are driving the RFID in pharmaceuticals market growth include rising incidences of counterfeit drugs, and growing adoption of RFID by pharmaceutical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.