- Home

- »

- Pharmaceuticals

- »

-

Rheumatoid Arthritis Therapeutics Market Size Report, 2030GVR Report cover

![Rheumatoid Arthritis Therapeutics Market Size, Share & Trends Report]()

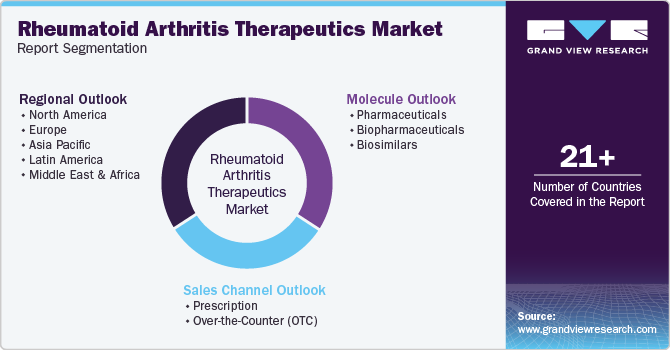

Rheumatoid Arthritis Therapeutics Market Size, Share & Trends Analysis Report By Molecule (Pharmaceuticals, Biopharmaceuticals), By Sales Channel (Prescription, OTC), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-313-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

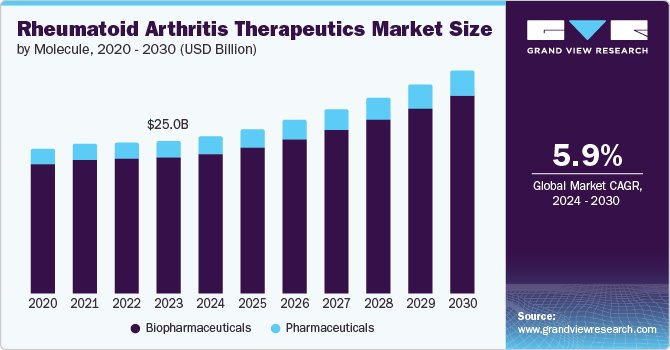

The global rheumatoid arthritis therapeutics market size was estimated at USD 25.01 billion in 2023 and is projected to grow at a CAGR of 5.93% from 2024 to 2030. Growth of the market can be attributed to the increasing demand for Rheumatoid Arthritis (RA) therapeutics drugs due to the rising incidence of RA disease globally. In addition, growing awareness about the disorder among physicians & patients and increasing healthcare expenditure in various countries are expected to propel market growth over the forecast period.

The development and launch of novel therapeutics for the treatment of RA are significantly driving the market growth. The introduction of new biosimilar drugs, such as Cyltezo, Hyrimoz, Amgevita, Erelzi, Avsola, and Rituximab, among others, by key players like Amgen Inc.; Pfizer Inc.; Genentech, Inc.; and Novartis, have changed the treatment landscape of RA. For instance, in July 2023, Boehringer Ingelheim International GmbH received U.S. FDA approval for its Cyltezo (adalimumab-adbm), an interchangeable biosimilar to HUMIRA, for treating various chronic inflammatory diseases, including RA in the U.S.

Similarly, in January 2023, Novartis AG received marketing authorization approval from the European Medicines Agency (EMA)’s Committee for Medicinal Products for Human Use (CHMP) for Sandoz’s citrate-free High-Concentration Formulation (HCF) biosimilar drug, Hyrimoz (adalimumab). The authorization includes all indications covered by the cited medicine—uveitis, RA, ulcerative colitis, and plaque psoriasis. The newly launched biologics and biosimilars target specific immune system molecules or receptors involved in joint pain & inflammation, leading to more effective treatment outcomes. The increased demand for more targeted and efficient is expected to drive the development of advanced biological therapies for rheumatoid arthritis.

There have been many technological advancements in screening procedures for diagnosis purposes and a rise in research for the development of new therapies for the treatment of malignancy. The pharmaceutical industry has been focusing on R&D for developing new anticancer drugs. According to Evaluate Pharma, global R&D spending is estimated to increase from USD 238 billion in 2022 to USD 285 billion by 2028. This rising R&D spending by pharmaceutical companies reflects the increasing interest in developing new anticancer drugs.

Treatment options for RA have seen a shift in trend in recent years due to the development of newer molecules, which help in disease remittance. This shift is driven by a better understanding of the pathophysiology of RA, which has led to the development of targeted biologic and small molecule (synthetic) DMARDs. The first-line treatment options for RA include small-molecule disease-modifying drugs, such as corticosteroids, analgesics, and Nonsteroidal Anti-Inflammatory Drugs (NSAIDs). These drugs can only delay the disease progression or improve inflammatory symptoms. In addition, they can have significant side effects, including gastrointestinal ulcers, immunosuppression, osteoporosis, nausea, cytopenia, fatigue, rashes, liver damage, psoriasis, and infections.

Market Concentration & Characteristics

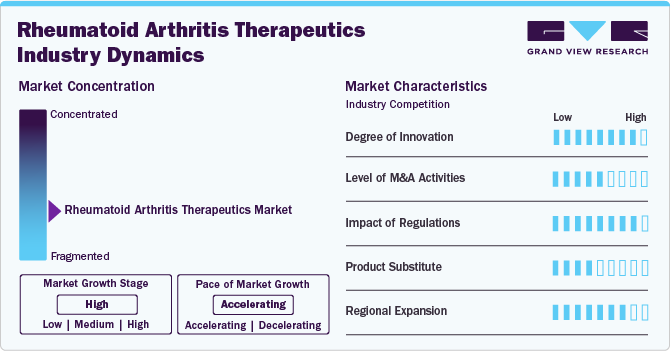

The degree of innovation in the market is high, marked by the emergence of biosimilars and innovative therapies. The introduction of biosimilars for infliximab, etanercept, adalimumab, and rituximab represents a significant shift towards more affordable and accessible treatments. Additionally, the development of a biodegradable polymer system by UC San Diego engineers, which leverages the body's immune system to treat rheumatoid arthritis, showcases cutting-edge research in immunoengineering. This approach, which involves injecting encapsulated all-trans retinoic acid (ATRA) directly into affected joints, demonstrates a novel method for transforming disease-causing cells into regulatory T cells, offering a promising direction for RA treatment. These advancements show the high degree of innovation in Rheumatoid Arthritis (RA) therapeutics, driven by both the pharmaceutical industry and academic research institutions.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in October 2023, Amgen acquired Horizon Therapeutics for USD 27.8 billion and aims to expand its portfolio with Horizon's innovative treatments for rare inflammatory diseases. The acquisition strengthens Amgen's position in treating rare conditions through medicines like TEPEZZA, KRYSTEXXA, and UPLIZNA. Leveraging Amgen's extensive R&D and global presence, the deal is expected to accelerate revenue growth and maintain financial stability.

Regulations have a high impact on the rheumatoid arthritis therapeutics market, influencing the development, approval, and pricing of new treatments. Regulatory changes can create opportunities or constraints, affecting business strategies, compliance costs, and market accessibility. The introduction of novel biologics and the rising penetration of generic drugs are influenced by regulatory environments, shaping market dynamics and competition.

Alternative therapies and complementary and alternative medicine (CAM) approaches, including omega-3 fatty acids, dietary supplements like fish oil and Gamma Linolenic Acid (GLA), and special diets, offer potential substitutes for rheumatoid arthritis (RA) therapeutics. Scientific evidence suggests that omega-3 fatty acids, particularly EPA and DHA, can alleviate joint tenderness and stiffness, potentially reducing NSAID usage. However, the effectiveness of these substitutes varies, with some studies showing benefits in symptom reduction and others indicating inconsistent results. Despite the promising aspects, more research is needed to establish the optimal use and effectiveness of these alternatives in RA management.

The market is poised for significant regional expansion. This expansion reflects the global trend of addressing the growing needs of an aging demographic and the increasing prevalence of RA, underscoring the importance of regional strategies in the development and delivery of rheumatoid arthritis (RA) therapeutics. For instance, in August 2023, Zydus Lifesciences Ltd received final approval from the U.S. FDA to manufacture and market its generic Indomethacin suppositories indicated for moderate to severe RA. This approval granted Zydus Lifesciences 180-day Competitive Generic Therapy (CGT) exclusivity, allowing the company to market its generic Indomethacin suppositories of 50mg strength. This development expanded the company's product portfolio and offered a more affordable treatment option for rheumatoid arthritis (RA) patients in India & potentially in international markets.

Molecule Insights

Biopharmaceuticals segment led the market and accounted for 88.73% of the global revenue in 2023. Biopharmaceuticals are large-molecule drugs that are manufactured, extracted, and synthesized from biological sources. Most of them include proteins and nucleic acids, which can be used for therapeutic purposes. Biopharmaceuticals include biologics with a valid patent term, which are meant for parenteral use. Apart from biologics, biopharmaceuticals also include biosimilars, which do not have a valid patent term and are considered copy biologics by regulators. These biosimilars are introduced after the expiry of biologics patents and have lower costs than patented biologics.

The pharmaceuticals segment held a significant market share in 2023. Treating RA, a chronic inflammatory disease mostly affecting the joints, is significantly aided by pharmaceutical medications. RA is an autoimmune disease that may cause disease progression and disability. Its management has witnessed significant developments during the past few years. After being diagnosed with rheumatoid arthritis, the first-line therapy involves Conventional Disease-Modifying Antirheumatic Drugs(cDMARDs), such as methotrexate, sulfasalazine, and leflunomide, sometimes in combination with glucocorticoids. If this first-line therapy fails as a monotherapy or as a combined therapy, then the decision to use second-line therapy is considered, which includes Biologic Disease-Modifying Antirheumatic Drugs (bDMARDs) and economic alternatives such as biosimilars.

Sales Channel Insights

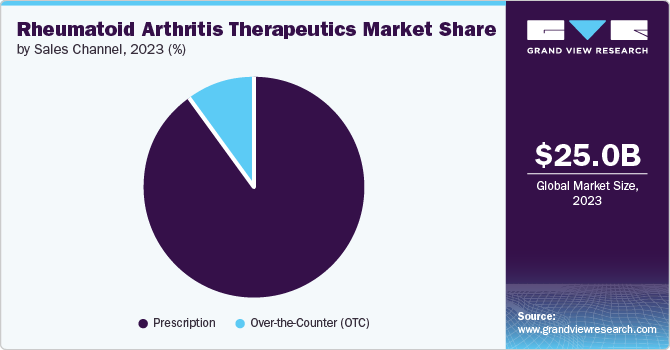

Prescription led the market with a market share of 89.64% in 2023.As rheumatologist consultations rise, the prescription segment is expected to remain dominant in the market for rheumatoid arthritis medications over the forecast period. Rheumatologists consult with RA patients, discussing and recommending prescription-based therapies that are suitable for their treatment. American Rheumatology Network’s rheumatologist Colin C. Edgerton, MD, estimates that prescription drug spending will exceed the U.S. GDP and health spending due to the increased purchase of specialty drugs, including those prescribed by rheumatologists. Although only 2.5% of people use specialty drugs, they cover around 50% of all prescription costs. Those who continue therapy cover most of those expenditures instead of newer customers. Thus, treatment costs with prescription drugs will be higher than OTC drugs, negatively impacting product sales.

Over-the-Counter (OTC) segment is projected to witness a significant CAGR FROM 2024 TO 2030. Self-medication using OTC medications has undergone a paradigm shift in recent years and has expanded throughout the world. Several key variables have supported this approach, such as heightened consumer consciousness, expanded consumer availability of important pharmaceuticals, and financial advantages for the public healthcare infrastructure. According to the Consumer Healthcare Products Association (CHPA), approximately 96% of Americans think OTC medications make treating minor medical conditions easier for people. However, utilizing OTC medications for self-medication carries significant risks, including polypharmacy, overdosing, drug misuse, and drug interactions.

Regional Insights

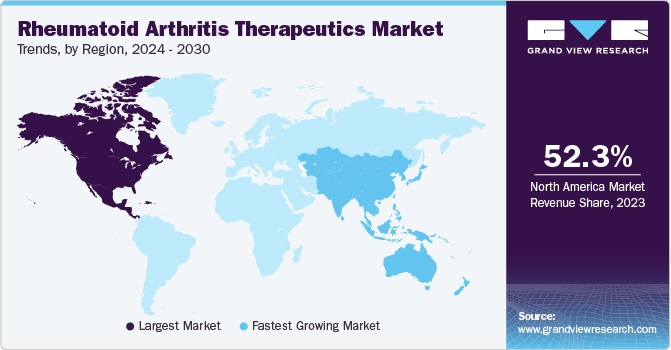

North America rheumatoid arthritis therapeutics market accounted for 52.31% share in 2023.The regional market continues to grow and evolve, driven by demographic shifts, advancements in medical research, regulatory changes, and an increasing emphasis on personalized healthcare. The aging population across the region significantly impacts the demand for rheumatoid arthritis therapeutics. As people live longer, the prevalence of chronic conditions such as RA increases, boosting the need for effective treatment options. This demographic trend is a primary driver of sustained market growth.

U.S. Rheumatoid Arthritis Therapeutics Market Trends

The rheumatoid arthritis therapeutics market in the U.S. is witnessing significant developments and a positive growth trend, driven by product launches, approvals, and promising clinical trials. Recent advancements include the progress of Nipocalimab, an innovative antibody drug developed by the Janssen Pharmaceutical Companies of Johnson & Johnson. In November 2023, early results from a Phase 2a trial indicated that Nipocalimab could effectively decrease autoantibodies, including Anti-citrullinated Protein Antibodies (ACPAs), which are prevalent in the blood of RA patients. The significance of this development lies in its potential to cater to a broader range of RA patients, addressing an urgent need for new therapeutic options.

Europe Rheumatoid Arthritis Therapeutics Market Trends

The Europe rheumatoid arthritis therapeutics market is substantially changing, influenced by healthcare reforms, research advancements, and patient-focused initiatives across different countries. The prevalence of rheumatoid arthritis is increasing due to an aging population and changing lifestyles, leading to a growing demand for effective & innovative treatment options across the continent.

The rheumatoid arthritis therapeutics market in the UK is experiencing advancements and innovations, such as the establishment of a University of York spinout company, Mesenbio. Founded in January 2024, Mesenbio is focused on developing a groundbreaking treatment for adults and children suffering from RA. The company aims to harness the potential of engineered human stem cells to produce a novel therapeutic approach that addresses the root causes of the disease instead of symptomatic treatment.

France rheumatoid arthritis therapeutics market is poised for growth, driven by technological innovation, changing consumer trends, and the increasing prevalence of rheumatic diseases.

The rheumatoid arthritis therapeutics market in Germany is marked by comprehensive research initiatives and long-term observational studies aimed at understanding disease progression and treatment outcomes.

Asia Pacific Rheumatoid Arthritis Therapeutics Market Trends

The Asia Pacific rheumatoid arthritis therapeutics market is experiencing significant growth, driven by the increasing prevalence of rheumatoid arthritis, improving healthcare infrastructure, and advancements in treatment options. The prevalence of rheumatoid arthritis is on the rise across Asia Pacific due to factors such as the aging population, changing lifestyles, and increasing awareness leading to early diagnosis. This rising prevalence has led to a growing demand for effective and affordable RA treatments, prompting healthcare providers & policymakers to focus on improving RA care & management.

The rheumatoid arthritis therapeutics market in China is witnessing significant advancements with the introduction of innovative treatments and the progression of clinical trials. Key developments have emerged recently, showcasing the evolving landscape of RA treatment in the country.

Japan rheumatoid arthritis therapeutics market has seen a significant development with the approval of a subcutaneous injection syringe (methotrexate) for treating RA.

Latin America Rheumatoid Arthritis Market Trends

The Latin America rheumatoid arthritis therapeutics market is influenced by healthcare policies, regulatory environment, and pharmaceutical innovations. While specific country-level data may be limited, insights can be drawn from broader regional trends and developments. In recent years, there has been a shift towards the adoption of biosimilar drugs in the treatment of rheumatoid arthritis across the region.

The rheumatoid arthritis therapeutics market in Brazil is influenced by various factors, including the aging population, which increases the demand for antirheumatic drugs, and the recovery of the economy leading to a shift towards a fast-food diet, resulting in rising cases of obesity and diabetes, thus driving the market growth.

Middle East & Africa (MEA) Rheumatoid Arthritis Market Trends

The Middle East & Africa (MEA) rheumatoid arthritis therapeutics market is undergoing significant developments, influenced by challenges and opportunities. Over the past year, there has been a shift in the region's pharmaceutical landscape, with governments in the Middle East emphasizing domestic pharmaceutical production to reduce dependency on imports.

The rheumatoid arthritis therapeutics market in Saudi Arabia has seen key developments, driven by the increasing prevalence of rheumatoid arthritis, the growing aging population, and the surge in clinical trials for new and advanced medications. The demand for biologics is also on the rise due to their targeted approach to inflammation, aiming to prevent long-term disability associated with rheumatoid arthritis.

Key Rheumatoid Arthritis Therapeutics Company Insights

Some leading players dominate the market with their contributions to the development of new treatments. The market is segmented into biologics and non-biologics, with biologics holding a dominant position.

UCB S.A and Regeneron Pharmaceuticals Inc. are some emerging market participants in the market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Rheumatoid Arthritis Therapeutics Companies:

The following are the leading companies in the rheumatoid arthritis therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie, Inc.

- Boehringer Ingelheim International GmbH

- Novartis AG

- Regeneron Pharmaceuticals Inc.

- Pfizer, Inc.

- Bristol-Myers Squibb Company

- F. Hoffmann-La Roche Ltd.

- UCB S.A.

- Johnson & Johnson Services, Inc.

- Amgen, Inc.

- Lilly (Eli Lilly and Company)

Recent Developments

-

In March 2024, Bristol Myers Squibb launched a USD 1.8 million effort to address Socioeconomic Determinants of Health (SDoH) in four countries—Brazil, India, Thailand, and the UK—with underserved patient needs. The new health equity grants extend the company's long-term commitment to invest USD 150 million in health equity by 2025.

-

In October 2023, Alfasigma S.p.A. agreed to acquire the Jyseleca business from Galapagos, a multinational biotechnology firm headquartered in Belgium specializing in developing revolutionary immunology and oncology treatments.

-

In July 2023, Boehringer Ingelheim International GmbH received U.S. FDA-approved Cyltezo (adalimumab-adbm), an interchangeable biosimilar to HUMIRA, for treating various chronic inflammatory diseases, including RA in the U.S.

Rheumatoid Arthritis Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.76 billion

Revenue forecast in 2030

USD 36.39 billion

Growth rate

CAGR of 5.93% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

AbbVie, Inc.,; Boehringer Ingelheim International GmbH; Novartis AG; Regeneron Pharmaceuticals Inc.; Pfizer, Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; UCB S.A.; Johnson & Johnson Services, Inc.; Amgen, Inc.; Lilly (Eli Lilly and Company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rheumatoid Arthritis Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rheumatoid arthritis therapeutics market report based on molecule, sales channel, and region.

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

NSAIDs

-

Analgesics

-

DMARDs

-

Glucocorticoids

-

-

Biopharmaceuticals

-

Biologics

-

TNF-α antagonists

-

T-cell inhibitors

-

CD20 antigen

-

JAK inhibitors

-

anti-IL6 biologics

-

-

Biosimilars

-

CD20 antigen

-

TNF-α antagonists

-

-

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 -2030)

-

Prescription

-

Over-the-Counter (OTC)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. Biopharmaceuticals dominated the rheumatoid arthritis therapeutics market with a share of 88.73% in 2023. The dominance is attributable to increasing preference of biosimilars by physicians for the treatment of RA.

b. Some of the prominent market participants are AbbVie; Boehringer Ingelheim GmbH; Novartis AG; Regeneron Pharmaceuticals, Inc.; Pfizer, Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; UCB S.A.; Johnson & Johnson Services, Inc.; and Amgen, Inc.

b. Key factors that are driving the market growth include increasing prevalence of arthritis, growing acceptance of biopharmaceuticals, and presence of well-defined regulatory guidelines in developed economies

b. The global rheumatoid arthritis therapeutics market size was estimated at USD 25.01 billion in 2023 and is expected to reach USD 25.76 billion in 2024.

b. The global rheumatoid arthritis therapeutics market is expected to grow at a compound annual growth rate of 5.93% from 2024 to 2030 to reach USD 36.39 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."