- Home

- »

- Medical Devices

- »

-

RNA Targeting Small Molecule Drug Discovery Market Report, 2030GVR Report cover

![RNA Targeting Small Molecule Drug Discovery Market Size, Share & Trends Report]()

RNA Targeting Small Molecule Drug Discovery Market Size, Share & Trends Analysis Report By Indication (Cancer, Infectious Diseases), By End-User, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global RNA targeting small molecule drug discovery market size was valued at USD 1.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.9% from 2023 to 2030. The increasing demand for RNA targeted small molecule drugs due to their ability to target a broad range of diseases, such as cancer, neurological disorders, and genetic disorders, is expected to drive market growth. Additionally, advancements in RNA targeted drug discovery technologies and increased government funding for RNA research are also contributing to market growth. However, the high cost of drug development and the complexity of RNA based drug discovery are expected to hinder market growth to some extent.

The RNA targeting small molecules drug discovery industry is expected to transform the way the healthcare industry currently treats several diseases. These medications function by specifically targeting RNA molecules, which are appealing drug development targets since they are essential for controlling gene expression. Drugs that target RNA offer the potential to address conditions that have historically been challenging to treat with traditional medications. These include conditions that are caused by mutations in particular genes. Owing to the recently validated advantages of RNA-targeting small molecules, several companies are investing in this novel emerging field. There are several drug candidates in the pipeline, which are anticipated to be launched by 2024 and later.

The RNA targeting small molecules drug discovery industry promises a bright future. However, there are still several obstacles that pose a challenge to its growth. These include the exorbitant cost of medication research. This can reach billions of dollars and is one of the main obstacles. Creating RNA-targeted medications necessitates specialized knowledge and cutting-edge technology, which further raises the price of drug development. Moreover, it may be challenging to find prospective therapeutic candidates due to the intricacy of RNA-based drug discovery, which could add to the expense and length of time needed for drug development. Pharmaceutical corporations are heavily spending on research and development to address these issues, and they are collaborating with academic institutions and contract research groups to hasten the drug discovery and development process.

The COVID-19 pandemic had a mixed impact on the RNA targeting small molecules drug discovery industry. On the one hand, the pandemic has increased the demand for fresh approaches to treating viral illnesses, including those brought on by RNA viruses. By preventing viral RNA from replicating, RNA-targeted medications may be beneficial in treating viral infections. As a result, there is now more interest in developing RNA-targeted medicines to treat COVID-19 and other viral infections.

On the other hand, the pandemic has also hampered efforts to create new drugs because numerous academic institutions and pharmaceutical firms had to transfer funding to COVID-19 research. This has caused funding issues for non-COVID-19 drug discovery initiatives as well as delays in the development of RNA-targeted medications for other disorders. Timelines for drug development have been considerably extended as a result of supply chains and clinical studies being affected by the epidemic. To overcome the challenges posed by the COVID-19 pandemic, pharmaceutical companies have had to adapt and innovate in several ways. One recent example is the partnership between AstraZeneca and the University of Oxford to develop and distribute a COVID-19 vaccine. This partnership involved a collaborative effort to develop a vaccine that was both effective and scalable, which required the use of innovative technologies and processes.

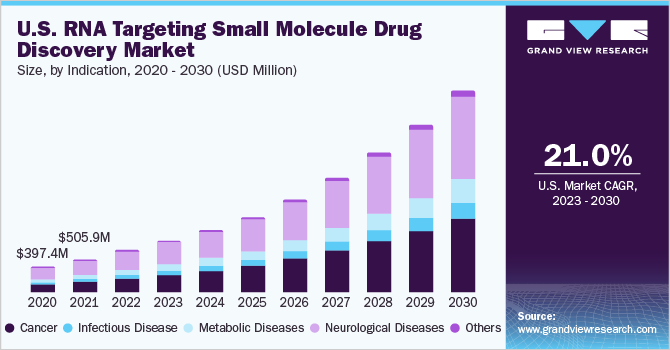

Indication Insights

Due to the high frequency of cancer and the urgent need for more effective treatments, the cancer segment is anticipated to witness a lucrative CAGR of 21.3% in the RNA-targeting small molecules drug discovery industry. RNA-targeted medications are advantageous for treating cancer because they can target cancer cells only and are made to specifically target cancer-related genetic alterations, which increases their efficacy and minimizes adverse effects. Many pharmaceutical companies are investing heavily in RNA-targeted drug discovery for cancer treatment, which is expected to drive market growth in the coming years. While the cancer segment is expected to witness considerable growth, the market is also expected to diversify as more RNA-targeted drugs are developed for other indications, such as genetic disorders and viral infections.

The neurological diseases segment, on the other hand, held a significant market share of 40.1% in 2022 across the market. The high revenue share of the segment is primarily due to the increasing number of companies augmenting their neurological drug pipeline of RNA-targeted small molecules. For instance, in January 2019, Skyhawk Therapeutics, Inc. and Biogen Inc announced a strategic agreement to utilize Skyhawk’s SkySTAR technology platform to discover innovative RNA-targeting small molecule treatments for patients with neurological diseases. Hence, such initiatives are supporting the lion’s share of the segment and thereby boosting the growth of the RNA-targeting small molecules drug discovery industry.

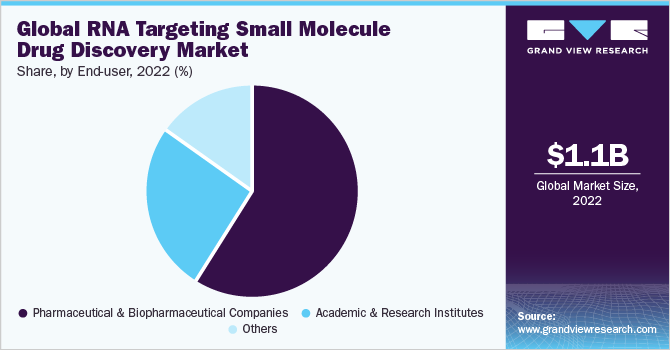

End-user Insights

Pharmaceutical and biopharmaceutical companies have vast resources and experience in terms of drug discovery, and thus, the segment is projected to continue to dominate the market with a revenue share of 59.1% in 2022. There are several small to medium-sized biopharmaceutical companies penetrating the market. These new competitors are introducing cutting-edge strategies in the industry, which can spur future expansion and competitiveness. The recent USD 115 million funding round for Ribometrix to develop new RNA-targeted therapeutics is evidence of the significant demand and opportunity for innovation in the RNA-targeting small molecules drug discovery industry.

The academic and research institutes, on the other hand, are anticipated to witness a significant CAGR of 20.9% in the global market. With new players entering the market, collaborations between pharmaceutical companies and academic institutions are becoming increasingly common, thereby supporting the growth of academic and research institutes in this field.

The integration of advanced technologies, such as artificial intelligence and DNA-encoded library technology, is also driving innovation in the market. As the RNA-targeting small molecule drug discovery industry evolves, it presents exciting opportunities for research institutes to develop new drugs and technologies targeting RNA, which could revolutionize the treatment of various diseases.

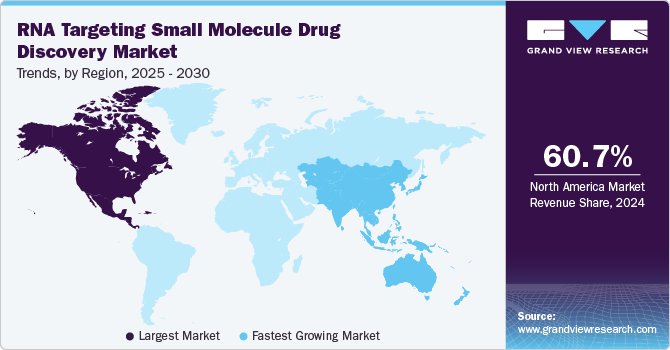

Regional Insights

Globally, the RNA-targeting small molecule drug discovery industry is dominated by North America, with a market share of 60.5% in 2022. High shares of the region are majorly due to the presence of a large number of the world's top pharmaceutical and biopharmaceutical firms, including Skyhawk Therapeutics, Inc.; Ribometrix; and Arrakis Therapeutics in the region. These businesses have the resources and know-how necessary to design and produce RNA-targeted medications on a big scale. They are spending extensively on the discovery of pharmaceuticals that target RNA. Moreover, they have established relationships with regulatory agencies and healthcare providers, which are crucial for obtaining regulatory approval and launching new drugs. North America also has a well-established healthcare infrastructure, which supports the development and commercialization of new drugs. The market in North America is expected to continue its dominance due to the increasing demand for RNA-targeted drugs and the presence of leading market players.

Due to rising investments in healthcare infrastructure and R&D activities, the Asia Pacific region is predicted to experience a stable growth rate of 20.6% CAGR in the RNA-targeting small molecule drug discovery industry. The rising incidence of chronic diseases, including cancer, cardiovascular conditions, and neurological disorders, is driving the market in this region and has boosted the demand for cutting-edge RNA-targeted medications. The governments in the region are also taking initiatives to support research and development activities, which is expected to drive the growth of the market further. Moreover, the increasing investment in healthcare infrastructure and the availability of skilled labor are expected to contribute to the growth of the market in the Asia Pacific region. Companies like AXXAM S.p.A. and xFOREST Therapeutics Co., Ltd are expanding their operations in the region to tap into the growing market opportunities.

Key Companies & Market Share Insights

Many companies are contending for market dominance in the highly competitive RNA-targeting small molecule drug discovery industry. Skyhawk Therapeutics, Inc.; PTC Therapeutics; Arrakis Therapeutics; and Ribometrix are a few of the market's major participants. Because of their experience and resources in the development and production of RNA-targeted pharmaceuticals, these companies have a substantial presence on the market. To get regulatory permission and introduce new treatments, they have developed connections with healthcare providers and regulatory organizations.

Also, they have access to state-of-the-art infrastructure and technologies, such as high-throughput screening platforms, genomics, and proteomics, which speed up the process of drug discovery and development. For instance, in 2019, a biotechnology startup called Ribometrix announced USD 7.8 million in fresh funding to improve their RNA-targeting drug discovery platform. Ribometrix focuses on creating small-molecule medications that target RNA.

Similarly, other companies are also making significant investments in the RNA-targeting small molecule drug discovery industry. For instance, AXXAM S.p.A., a leading provider of integrated drug discovery services, has established an RNA therapeutics platform to identify and develop RNA-targeted drugs. Overall, the RNA-targeting small molecule drug discovery industry is dynamic and highly competitive, with several key players and new entrants expected to drive further growth and innovation in the coming years. Some prominent players in the global RNA targeting small molecule drug discovery market include:

-

Accent Therapeutics

-

Anima Biotech Inc.

-

Arrakis Therapeutics

-

AstraZeneca

-

Epics Therapeutics

-

Expansion Therapeutics

-

Hoffmann-La Roche Ltd

-

H3 Biomedicine Inc.

-

PTC Therapeutics

-

Ribometrix

-

Servier Laboratories

-

Skyhawk Therapeutics, Inc.

RNA Targeting Small Molecule Drug Discovery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,354.0 million

Revenue forecast in 2030

USD 5.1 billion

Growth rate

CAGR of 20.9% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments Covered

Indication, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait

Key companies profiled

Accent Therapeutics; Anima Biotech Inc.; Arrakis Therapeutics; AstraZeneca; Epics Therapeutics; Expansion Therapeutics; Hoffmann-La Roche Ltd; H3 Biomedicine Inc.; PTC Therapeutics; Ribometrix; Servier Laboratories; Skyhawk Therapeutics, Inc

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

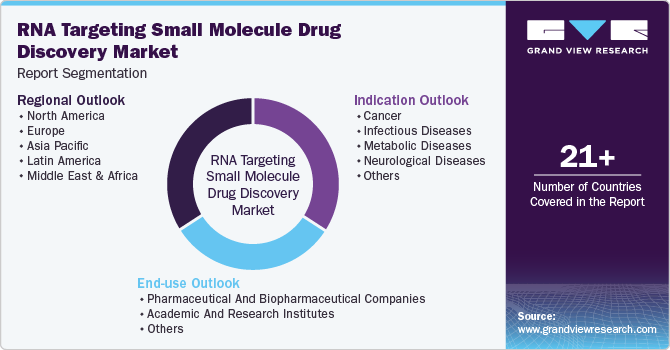

Global RNA Targeting Small Molecule Drug Discovery Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global RNA targeting small molecule drug discovery market report based on indication, end-user, and region.

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Infectious Disease

-

Metabolic Diseases

-

Neurological Diseases

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biopharmaceutical Companies

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RNA targeting small molecule drug discovery market size was estimated at USD 1.1 billion in 2022 and is expected to reach USD 1.4 billion in 2023.

b. The global RNA targeting small molecule drug discovery market is expected to grow at a compound annual growth rate of 20.9% from 2023 to 2030 to reach USD 5.1 billion by 2030.

b. By indication, the neurological diseases segment held a market share of 40.1% in 2022. The increasing pipeline of RNA-targeting small molecule drugs for neruological conditions is one of the prominant factors supporting the segment's high shares.

b. Some key players operating in the RNA targeting small molecule drug discovery market include Skyhawk Therapeutics, Inc., Arrakis Therapeutics, Ribometrix and a few others.

b. Increasing pipeline along with growing private and public funding for the discovery and development of RNA-targeting small molecule drugs are some of the key factors supporting the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."