- Home

- »

- Next Generation Technologies

- »

-

Robot As A Service Market Size And Share Report, 2030GVR Report cover

![Robot As A Service Market Size, Share & Trends Report]()

Robot As A Service Market (2023 - 2030) Size, Share & Trends Analysis Report By Enterprise Size (SME, Large), By Application (Handling, Dispensing, Welding & Soldering), By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-096-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Robot As A Service Market Summary

The global robot as a service market size was estimated at USD 1.05 billion in 2022 and is projected to reach USD 4.12 billion by 2030, growing at a CAGR of 17.5% from 2023 to 2030. Robot as a service (RaaS) refers to a business model where companies offer robots for any services that allow customers to use them on a subscription or pay-per-use basis rather than purchasing them outright.

Key Market Trends & Insights

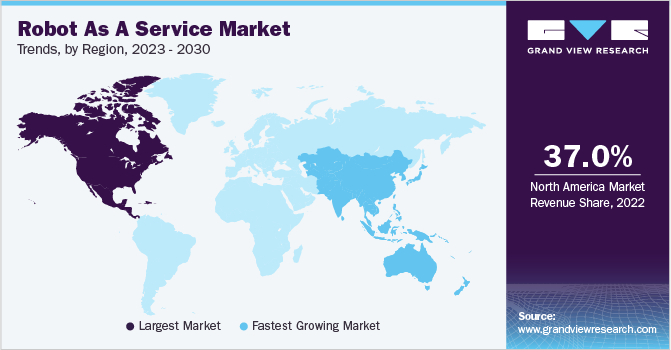

- The North America accounted for the highest market share of over 37.0% in 2022.

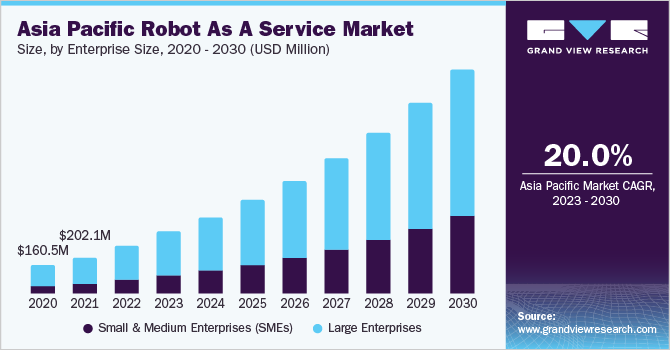

- The Asia Pacific region is anticipated to record the highest CAGR of around 20.0% over the forecast period.

- Based on enterprise size, the large enterprises segment held a market share of around 69.0% in 2022.

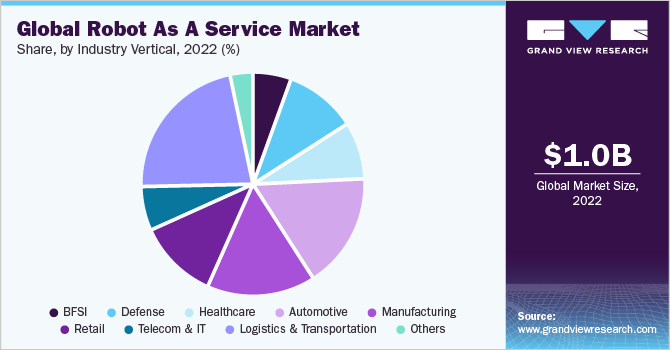

- Based on industry vertical, the automotive segment accounted for a significant market share of around 17.0% in 2022.

- Based on application, the handling segment accounted for the highest market share of over 36.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.05 Billion

- 2030 Projected Market USD 4.12 Billion

- CAGR (2023-2030): 17.5%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

This market growth can be attributed to the increasing demand for automation and robotics in various industries, including manufacturing, healthcare, retail, and logistics. As these industries seek to improve efficiency and productivity, they turn to robots to perform repetitive tasks, handle dangerous materials, and assist with various other functions. The market growth is expected to remain robust across various industries. For instance, in the manufacturing sector, robots are increasingly being used to perform tasks such as welding, painting, and material handling, freeing up human workers to focus on more complex and creative tasks. In healthcare, robotics are used for patient monitoring, medication delivery, and surgery. The market is also growing due to the increasing availability of cloud-based robotics platforms. These platforms allow companies to easily access and deploy robots without significant upfront investments in hardware or software.

Cloud-based robotics also enables more advanced capabilities, such as machine learning and AI, which can help robots learn and adapt to new tasks and environments. It is likely to contribute to the growth as the emergence of the Industry 4.0 is characterized by integrating advanced technologies such as IoT, AI, and robotics into manufacturing and other industries. As Industry 4.0 continues to gain traction, the demand for autonomous and subscription-based robots is expected to increase as companies seek to leverage these technologies to improve efficiency and productivity.

The subscription model allows businesses to avoid the high initial capital expenditure of purchasing robots outright. Instead, they pay a regular subscription fee, often including maintenance, upgrades, and support. This cost structure enables businesses to allocate their budget more efficiently and allocate resources to other areas of their operations. Subscriptions also offer flexibility in terms of the number of robots and the subscription duration. Businesses can easily scale up or down their robot deployments based on changing needs. This scalability is particularly beneficial for businesses with seasonal demands or those undergoing rapid growth or transformation.

The subscription model also ensures businesses access to the latest robotics technology and innovations. Robotics companies often include regular updates and upgrades as part of the subscription package, allowing businesses to stay at the forefront of technological advancements without investing in new equipment. Typically, subscription models include maintenance, repairs, and technical support services. Robotics companies ensure that the robots function optimally and handle any required repairs or maintenance. This relieves businesses of the burden of maintaining a specialized in-house team or dealing with downtime due to technical issues.

The market is home to rapid technological advancements, contributing to its growth and expansion into various industries. The development of advanced sensors and perception technologies enables robots to perceive and interact with their environment, including detecting obstacles and recognizing objects. This is particularly important in industries such as manufacturing and logistics, where robots need to navigate complex environments and handle a wide range of materials. Developing advanced robotics software and algorithms enables robots to perform complex tasks such as machine learning, artificial intelligence, and natural language processing. These capabilities are particularly important in industries where robots need to be able to communicate with people and make decisions based on complex data.

Artificial intelligence is a key market driver as it enables robots to perform a wide range of complex tasks and learn from their experiences to improve their performance over time. AI has enabled robots to perform tasks that were previously impossible or impractical. For example, robots can now analyze vast amounts of data to detect patterns and make predictions, which can be used in industries such as finance and healthcare to make more informed decisions.

In manufacturing, robots can use AI to optimize production processes & detect and correct defects in real time. AI enables robots to learn and adapt to new tasks and environments. This is particularly important in industries such as logistics and transportation, where robots need to navigate complex environments and interact with humans and other machines. Using machine learning algorithms, robots can learn from their experiences and improve their performance over time, making them more efficient and effective. AI enables robots to work alongside humans collaboratively. This is particularly important in industries such as healthcare and manufacturing, where robots need to work alongside human workers to perform surgery and assembly line operations.

AI robots can be trained to work alongside humans and respond to their actions, making them more effective and safer. For instance, MediBot Inc., a leading provider of robotic solutions for healthcare facilities, offers a subscription-based model to hospitals and clinics, leveraging robots for various automotive tasks and enhancing patient care. The company offers a range of specialized robots designed for different healthcare applications. These robots can include autonomous delivery robots for medication and suppliers, telepresence robots for remote consultations, and disinfection robots to maintain a clean and sterile environment.

Enterprise Size Insights

The large enterprises segment held a market share of around 69.0% in 2022. The robots offer a flexible and scalable option for large organizations to deploy and use robots without incurring high upfront costs or requiring specialized technical expertise. The service providers offer various pricing models, including pay-as-you-go and subscription-based models, which are particularly appealing to large organizations with fluctuating demand or due to a temporary or seasonal increase in capacity. Additionally, service providers offer customization and integration services, enabling large organizations to tailor robot solutions to their specific needs and integrate them into their existing systems and processes.

The small & medium enterprises (SMEs) segment is expected to record a significant CAGR of around 19.0% from 2023 to 2030. The market for SMEs is increasing due to the growing demand for automation, efficiency, and cost savings in various industries. SMEs can benefit from deploying robots in their operations, enabling them to perform tasks with higher accuracy, speed, and reliability, thus improving overall productivity. Moreover, service providers offer various pricing models, including pay-as-you-go, which is particularly appealing to SMEs with limited budgets and resources. Additionally, service providers offer support and maintenance services, enabling SMEs to focus on their core competencies while leaving the robot operation and maintenance to the service provider.

Industry Vertical Insights

The automotive industry vertical accounted for a significant market share of around 17.0% in 2022. The automotive industry heavily relies on automation to streamline manufacturing processes and improve efficiency, and service providers offer subscription-based solutions with industrial robots for tasks such as assembly, welding, painting, and material handling. Automotive manufacturers can access the required robotic system without the need for large upfront investment, allowing them to scale their production capacity and adapt to market demands more easily.

Cobots are designed to work alongside human workers, enhancing safety and productivity on the assembly line. Service providers offer cobots equipped with advanced sensing and control capabilities, allowing automotive manufacturers to automate repetitive tasks while ensuring human-robot collaboration. The subscription models enable manufacturers to deploy cobots as needed, optimizing production processes and reducing the risk of injuries.

The BFSI industry vertical is predicted to grow at a CAGR of over 21.0% from 2023 to 2030. Service providers offer robots equipped with natural language processing and artificial intelligence capabilities to enhance customer service in the BFSI industry. These robots can be used as virtual assistants, providing personalized assistance, answering frequently asked questions, and guiding customers through basic banking processes. The subscription model allows banks and financial institutions to deploy customer service robots without significant upfront costs, improving customer experience and reducing wait times.

The BFSI sector deals with a vast amount of paperwork and document processing, which can be simplified by robots with intelligent optical character recognition capabilities to automate document processing tasks such as data extraction, verification, and classification. By subscribing to these robots, banks and financial institutions can automate these labor-intensive processes, reducing errors, improving efficiency, and freeing up human resources for more complex tasks.

Application Insights

The handling application accounted for the highest market share of over 36.0% in 2022. The booming e-commerce industry has led to increased demand for efficient material handling solutions. Autonomous mobile robots or robotic arms are used for tasks such as order picking, sorting, packaging, and palletizing. These robots can navigate through dynamic environments, collaborate with human workers and optimize the fulfillment process. The flexibility of this service enables businesses to scale their material handling operations based on fluctuating order volumes and seasonal demands. Traditional warehouses are transitioning towards automated systems to improve efficiency and reduce costs.

AMRs equipped with advanced sensors and mapping technologies can navigate warehouses, collect and deliver items, and optimize the layout for efficient storage and retrieval. In industries such as manufacturing and logistics, there is a need for handling heavy and bulky items as these robots offer high payload capacity and can assist in moving heavy loads. These robots can automate tasks such as loading/unloading trucks, moving large components, and pallet handling.

The dispensing application segment is predicted to grow at a CAGR of around 21.0% from 2023 to 2030. Companies provide robots for dispensing tasks in the food and beverage industry. These robots can accurately dispense ingredients, such as sauces, toppings, and dressings, onto food items or into containers. They ensure consistency, reduce waste and enhance hygiene standards in food preparation processes. Dispensing medications and fluids with precision are critical in the pharmaceutical and healthcare sector.

These robots are equipped with the necessary sensors and technologies to accurately dispense medications, liquids, or chemicals in controlled quantities. These robots ensure dosage accuracy, reduce errors and enhance patient safety. Robots are employed in dispensing applications in various chemical and manufacturing processes. They offer the capability of dispensing adhesives, sealants, coatings, and other materials with precision and consistency. These robots can automate the dispensing process, thereby improving efficiency, reducing waste, and ensuring uniform product quality.

Regional Insights

North America accounted for the highest market share of over 37.0% in 2022 due to the increasing adoption of automation and the growing need for cost-effective solutions are some of the key factors driving the growth of the market. This robot offers several advantages over traditional robot purchasing, such as lower upfront cost, reduced risk, and greater flexibility. This has made them attractive options for small and medium-sized businesses that may not have the resources to invest in their robotics infrastructure. Furthermore, advancements in technology, such as artificial intelligence and the IoT, are expected to fuel the market growth in the region further. These technologies enable robots to become more intelligent, efficient, and autonomous, making them even more valuable for businesses across various industries.

Asia Pacific region is anticipated to record the highest CAGR of around 20.0% over the forecast period. The market has experienced significant growth in recent years and is expected to grow further during the forecast period. The increasing adoption of automation in various industries, such as manufacturing, healthcare, and logistics, is driving the market demand in the region. These robots offer several benefits over traditional robots, such as lower upfront costs, reduced risks, and greater flexibility, making them attractive options for businesses across various sectors. Furthermore, the APAC region is home to several countries, such as China; Japan; South Korea; and Singapore, investing heavily in robotics and automation. This investment is driving innovation and development in the robotics industry, which is expected to fuel the regional market’s growth.

Key Companies & Market Share Insights

Key players in the global robot as a service (RaaS) market are highly competitive, with several players vying for a larger market share. Companies have formed partnerships and collaborations with other businesses and organizations to expand their reach and promote the benefits of RaaS. Companies have been expanding their product offerings to meet the evolving need of their customers. They are investing heavily in research and development to improve the functionality and capabilities of their robots. This investment has led to the development of new technologies, such as AI and the IoT, that drive innovation in the industry. For instance, in January 2023, ABB partnered with leading technical universities in Vietnam, which helps students receive a high-quality education in applications and robotics programming. Some prominent players in the global robot as a service market include:

-

Ademco Global

-

Aethon

-

ABB Group

-

Amazon Web Services Inc.

-

Beetl Robotics

-

Berkshire Grey Inc.

-

Cobalt Robotics

-

CYBERDYNE Inc.

-

Fanuc Corporation

-

iRobot Corporation

-

inVia Robotics

-

Kongsberg Maritime

-

KUKA AG

-

Locus Robotics

-

Northrop Grumman

-

RedZone Robotics

-

Relay Robotics

-

Yaskawa Electric Corporation

Robot As A Service Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 1.33 billion

The revenue forecast in 2030

USD 4.12 billion

Growth rate

CAGR of 17.5% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Enterprise size, application, industry vertical, region

Country scope

U.S.; Canada; Germany; UK; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Mexico; UAE; South Africa

Key companies profiled

Ademco Global; Aethon; Amazon Web Services Inc.; Beetl Robotics; Berkshire Grey Inc.; Cobalt Robotics; CYBERDYNE Inc.; iRobot Corporation; inVia Robotics; Kongsberg Maritime; KUKA AG; Locus Robotics; Northrop Grumman; RedZone Robotics; Relay Robotics

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Robot As A Service Market Report Segmentation

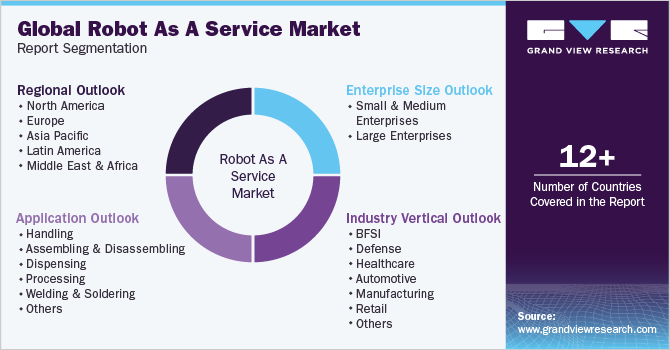

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global robot as a service (RaaS) market report based on enterprise size, application, industry vertical, and region:

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handling

-

Assembling and Disassembling

-

Dispensing

-

Processing

-

Welding and Soldering

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Defense

-

Healthcare

-

Automotive

-

Manufacturing

-

Retail

-

Telecom & IT

-

Logistics & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East and Africa

-

UAE

-

South Africa

-

Rest of the Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global robot as a service market size was estimated at USD 1.05 billion in 2022 and is expected to reach USD 1.33 billion in 2023.

b. The global robot as a service market is expected to grow at a compound annual growth rate of 17.5% from 2023 to 2030 to reach USD 4.12 billion by 2030.

b. North American region dominated the RaaS market with a share of around 37% in 2022. The growth is attributed to the increasing adoption of automation and the growing need for cost-effective solutions. Advancements in technology, such as artificial intelligence and the IoT, are expected to fuel the market growth in the region further.

b. Some key players operating in the robot as a service market include Fanuc Corporation, iRobot Corporation, Cobalt Robotics, ABB Group, KUKA AG, Parrot Drone SAS, and many others.

b. The market's growth is due to increasing demand for automation and robotics in various industries, including manufacturing, healthcare, retail, and logistics. As these industries seek to improve efficiency and productivity, they turn to robots to perform repetitive tasks, handle dangerous materials and assist with various other functions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.