- Home

- »

- Advanced Interior Materials

- »

-

Robotic Drilling Market Size & Share, Industry Report, 2030GVR Report cover

![Robotic Drilling Market Size, Share & Trends Report]()

Robotic Drilling Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Onshore, Offshore), By Installation (Retrofit, New Builds), By Component (Hardware, Software), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-386-2

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Robotic Drilling Market Size & Trends

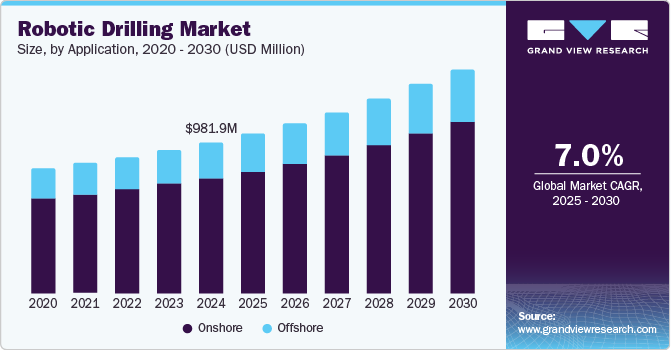

The global robotic drilling market size was valued at USD 981.9 million in 2024 and is expected to grow at a CAGR of 7.0% from 2025 to 2030. Rising demand for automation in industries is driving the adoption of robotic drilling technologies as businesses seek to improve efficiency, reduce human labor, and enhance safety. Automation allows for more precise, faster, and cost-effective drilling operations, addressing the challenges of traditional methods. Moreover, the increasing global demand for fossil fuels creates pressure to optimize exploration and extraction processes.

Robotic drilling systems offer a solution by improving precision, reducing operational costs, and enabling operations in remote or hazardous locations, thus accelerating market growth in the energy and mining sectors. According to the Economist Intelligence Unit, demand for oil and gas is expected to increase in the decade to 2030, largely driven by India and Middle East & African countries. The International Energy Agency projected the global oil demand is expected to be around 8% higher in 2030 compared to the numbers in 2021.

Industry demand for precision and efficiency is accelerating the adoption of robotic drilling systems as businesses seek to optimize operations and reduce errors. These systems offer improved accuracy, faster drilling, and lower operational costs, making them highly attractive to industries such as oil, gas, and mining. The rise of unmanned and autonomous systems is further expected to support this trend, enabling drilling in hazardous or remote locations without human intervention. This shift toward automation and precision is expected to drive the growth of the robotic drilling industry in the coming years.

Application Insights

The onshore segment held the largest revenue share of 76.3% in 2024, fueled by the widespread adoption of robotic drilling machines in oil & gas exploration, mining, and construction industries. Onshore drilling operations benefit from robotic systems that enhance efficiency, reduce operational costs, and improve safety. The accessibility of onshore sites allows easy implementation of robotic drilling technology, enabling faster integration and scalability. Rising demand for precision and automation in these sectors has further propelled the growth of robotic drilling in onshore applications, contributing to its dominant market share.

The offshore segment is anticipated to grow at a significant rate over the forecast period, attributed to increasing demand for deepwater exploration and production. Advancements in automation, AI, and robotics are improving drilling efficiency, safety, and cost-effectiveness in challenging offshore environments. These technologies enable remote operations in harsh conditions, reducing human risk and operational costs. As oil & gas companies seek to maximize resource extraction from offshore reserves, the integration of robotic systems into drilling operations is expected to experience significant expansion, positioning the offshore segment for rapid expansion.

Component Insights

The hardware segment accounted for the largest share in 2024 due to its crucial role in the overall performance and efficiency of drilling operations. Advanced robotic drilling systems rely heavily on high-performance hardware components, such as robotic arms, sensors, and precision tools, which are essential for automating tasks and enhancing accuracy. Ongoing technological advancements, along with the increasing demand for more efficient, cost-effective, and precise drilling solutions, have fueled investments in hardware. Furthermore, hardware innovations that improve reliability and reduce maintenance have significantly contributed to the market share.

The software segment is set to grow at the fastest CAGR from 2025 to 2030, fueled by advancements in artificial intelligence, machine learning, and real-time data analytics. Software solutions play a crucial role in optimizing drilling performance, improving predictive maintenance, and enhancing decision-making processes. These technologies enable remote monitoring and control of drilling operations, increasing efficiency and safety. As operators look to streamline operations and reduce costs, the demand for sophisticated software platforms that integrate with robotic systems is expected to rise, driving growth of this segment over the projected period.

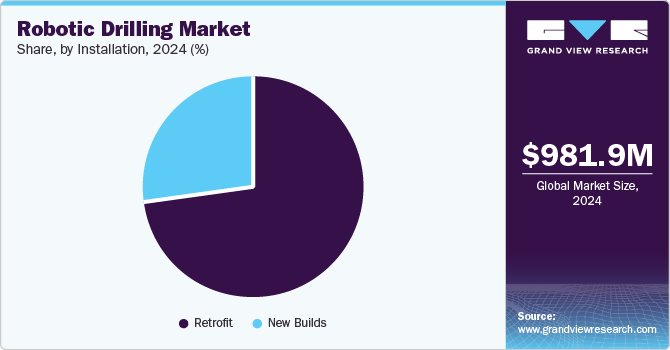

Installation Insights

The retrofit segment accounted for the largest revenue share in 2024, owing to its cost-effectiveness and ability to upgrade existing drilling systems. Many oil & gas operators prefer retrofitting their current rigs with advanced robotic technologies rather than investing in new infrastructure. This approach allows companies to enhance operational efficiency, safety, and automation without the need for extensive capital expenditure. Retrofit solutions also extend the lifespan of existing equipment, making them an attractive choice for improving performance while minimizing downtime and reducing overall costs in drilling operations.

The new builds segment is projected to be the fastest-growing segment with a significant CAGR during the forecast period, driven by the growing demand for state-of-the-art drilling rigs equipped with advanced automation technologies. Oil and gas companies are increasingly investing in cutting-edge infrastructure to enhance efficiency, safety, and performance from the outset. These new builds integrate robotic systems designed to optimize drilling operations, reduce human intervention, and lower operational costs. As exploration and production activities increase, the need for high-tech, customized drilling rigs is set to drive substantial growth in the new builds segment.

Regional Insights

North America robotic drilling market held the largest revenue share of 32.1% in 2024. Increased adoption of automation is driving the growth of the North American robotic drilling industry by enabling companies to improve operational efficiency and reduce costs. Automation streamlines drilling processes, enhances precision, and minimizes the need for manual labor, leading to lower operational expenses. With a focus on reducing downtime and optimizing resource use, robotic drilling systems offer significant advantages in terms of productivity. This shift toward automated solutions is helping companies stay competitive and meet the demand for more efficient and cost-effective drilling operations, fueling market expansion in the region.

U.S. Robotic Drilling Market Trends

TheU.S. robotic drilling market held the largest share in 2024, fueled by the focus on environmental sustainability and growth of the energy sector. As environmental regulations become more stringent, robotic drilling technologies offer cleaner, more efficient operations, minimizing environmental impact during exploration and extraction. Moreover, the expanding energy sector, particularly in oil & gas, has contributed to the demand for advanced drilling solutions. Robotic systems improve productivity while reducing resource waste, helping energy companies meet sustainability goals. This combination of regulatory pressure and energy sector growth has been accelerating the adoption of robotic drilling technologies across the U.S.

Europe Robotic Drilling Market Trends

Europe robotic drilling market is set to witness significant expansion over the forecast period. Supportive regulatory frameworks in Europe are expected to play a crucial role in driving the growth of the robotic drilling industry by setting clear safety standards and promoting the adoption of advanced technologies. Stricter regulations regarding environmental impact and safety of workers are encouraging oil & gas companies to invest in robotic systems that enhance efficiency while reducing human intervention. Prioritizing safety and operational efficiency, robotic drilling solutions help minimize risks, improve accuracy, and ensure compliance with stringent regulations, ultimately expanding the market as companies seek to meet these evolving industry demands.

Asia Pacific Robotic Drilling Market Trends

Asia Pacific robotic drillingmarket is expected to be the fastest-growing region with a CAGR of 8.2% from 2025 to 2030 due to ongoing technological advancements and significant industrialization. Innovations in automation, artificial intelligence, and machine learning are enhancing drilling efficiency, precision, and safety, enhancing the appeal of robotic systems across industries. The rapid industrial growth in the region, particularly in China and India, is expected to drive demand for advanced drilling solutions in sectors such as oil, gas, and mining. These technological improvements, along with infrastructure expansion projects, continue to fuel the growth of the robotic drilling industry and increase its overall size.For instance, in February 2024, Oil India Ltd. announced plans to double its exploration acreage at offshore facilities in coming years.

China robotic drilling market is expected to grow at the fastest CAGR during the forecast period, driven by the growth in oil & gas exploration and ongoing infrastructure development in China. As China expands its oil and gas extraction efforts, particularly in offshore fields, robotic drilling technologies offer enhanced efficiency, accuracy, and safety. In addition, the focus of China on renewable energy initiatives is expected to fuel demand for advanced drilling systems to tap into resources such as shale gas and geothermal energy. These factors are expected to significantly increase market size, positioning robotic drilling as an essential tool in both traditional and renewable energy sectors.

Key Robotic Drilling Company Insights

Some of the key companies in the robotic drilling industry include Nabors Industries Ltd.; Precision Drilling Corporation; Weatherford; Huisman Equipment B.V.; NOV.; Rigarm Inc.; Sekal AS; Drillmec; Abraj; Ensign Energy Services; Drillform Technical (HMH); and Automated Rig Technologies Ltd.

-

Drillmec offers innovative drilling equipment and services for the oil and gas industry. It specializes in designing and manufacturing drilling rigs, well service rigs, and automation systems, focusing on efficiency, sustainability, and technological advancement.

-

Ensign Energy Services provides drilling and well-servicing solutions for the oil & gas industry. It offers advanced drilling rigs, equipment, and related services, focusing on high performance, safety, and efficiency in energy exploration and production.

Key Robotic Drilling Companies:

The following are the leading companies in the robotic drilling market. These companies collectively hold the largest market share and dictate industry trends.

- Nabors Industries Ltd.

- Precision Drilling Corporation

- Weatherford

- Huisman Equipment B.V.

- NOV.

- Rigarm Inc.

- Sekal AS

- Drillmec

- Abraj

- Ensign Energy Services

- Drillform Technical (HMH)

- Automated Rig Technologies Ltd.

Recent Developments

-

In February 2024, Siemens introduced new Tecnomatix 2402 version software. The new software offers advanced digital manufacturing software to empower businesses. It includes robotic applications for various end uses including drilling.

-

In December 2023, a consortium of companies TEGRAD d.o.o., PIRNAR & SAVŠEK d.o.o., and KOVINC d.o.o. announced a plan to develop and launch digitized solutions for automated drilling over the period starting from December 2023 to November 2025.

Robotic Drilling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.04 billion

Revenue forecast in 2030

USD 1.46 billion

Growth rate

CAGR of 7.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, installation, component, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Nabors Industries Ltd.; Precision Drilling Corporation; Weatherford; Huisman Equipment B.V.; NOV.; Rigarm Inc.; Sekal AS; Drillmec; Abraj; Ensign Energy Services; Drillform Technical (HMH); Automated Rig Technologies Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robotic Drilling Market Report Segmentation

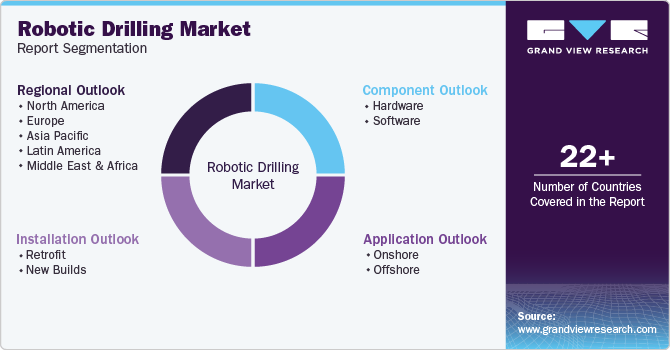

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global robotic drilling market report based on application, installation, component, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Retrofit

-

New Builds

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.