- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Romania Dietary Supplements Market Size Report, 2030GVR Report cover

![Romania Dietary Supplements Market Size, Share & Trends Report]()

Romania Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-660-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Romania Dietary Supplements Market Trends

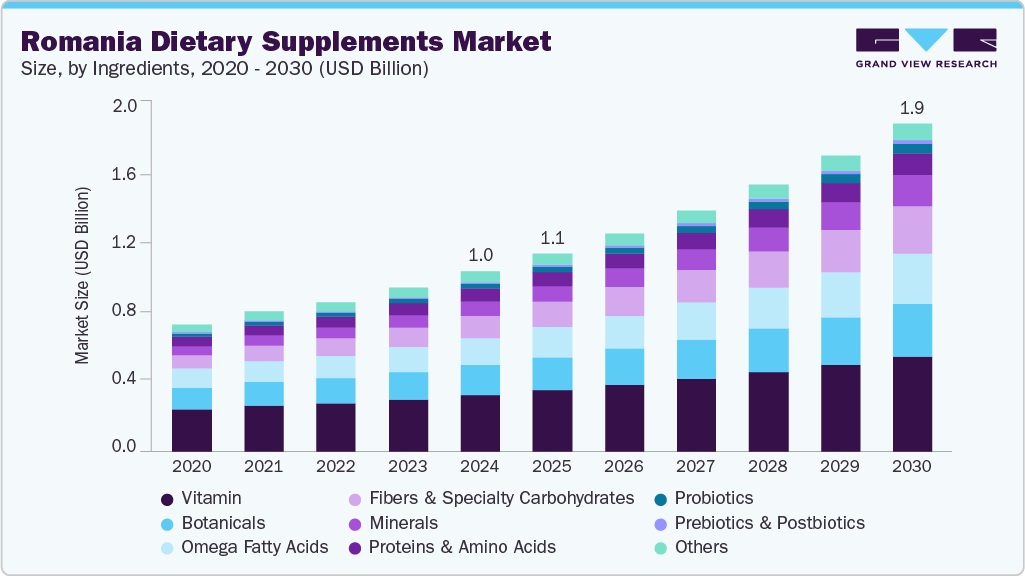

The Romania dietary supplements market size was estimated at USD 1,039.6 million in 2024 and is projected to grow at a CAGR of 10.6% from 2025 to 2030. The country’s growth is attributed to the evolving consumer preferences, broader socio-economic trends, and the rising awareness about health and wellness among Romanians. Consumers are becoming more conscious of preventive healthcare with the increasing flow of information via social media, online health platforms, and wellness influencers. This shift in mindset has amplified interest in products that support immunity, digestion, cognitive function, and overall vitality.

The aging population is significantly driving market demand. In Romania, individuals aged 65 and over make up 19.2% of the total population, with projections indicating this could rise to 27.7% by 2050. As the median age in Romania increases, there is a growing interest in supplements that help manage age-related conditions such as osteoporosis, joint health, cardiovascular wellness, and memory enhancement. This demographic shift, along with increasing life expectancy, makes dietary supplements an appealing addition to daily routines.

Another significant contributor is the growing disposable income and urbanization, which have led to more health-conscious spending habits, especially among the younger, urban demographic. These consumers are more likely to engage with fitness trends, pursue gym memberships, and adopt dietary regimens that include protein powders, vitamins, and herbal supplements. Additionally, the expansion of e-commerce platforms has dramatically improved access to both local and international supplement brands, making it easier for consumers to explore a broader range of products.

Consumer Insights

In Romania, the dietary supplements industry is experiencing notable growth, driven by a health-conscious population increasingly seeking products that support overall well-being. Approximately 70% of Romanians report using dietary supplements, a behavior amplified by the COVID-19 pandemic, which heightened interest in strengthening the immune system. Among the most popular supplements are Vitamin C, Vitamin D, and magnesium, with consumers often opting for capsule or tablet forms.

Consumer preferences in Romania are evolving towards natural and plant-based supplements, with a growing demand for products that align with vegan and sustainable lifestyles. The average Romanian spends USD 40.72 annually on supplements, which is below the European average of USD 102.34 per capita, indicating potential for market growth.

Ingredients Insights

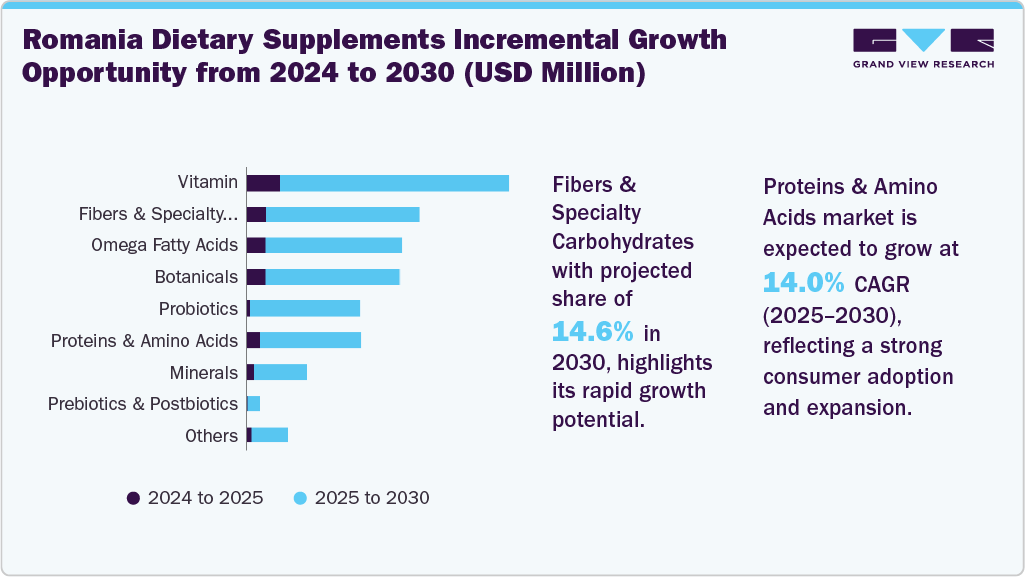

Vitamins dominated the Romanian dietary supplements market and accounted for a share of 31.3% in 2024, owing to the widespread awareness of vitamins' role in boosting immunity, especially in the wake of recent global health concerns. This has led consumers to proactively seek vitamin C, D, and multivitamins to fortify their immune systems and overall well-being.

The proteins & amino acids segment is expected to experience the fastest CAGR from 2025 to 2030. As fitness culture continues to spread, particularly among younger and urban populations, there's a rising demand for supplements that support muscle growth, recovery, and endurance-core benefits associated with proteins and amino acids. Additionally, this segment has been gaining traction beyond just bodybuilders or athletes. Consumers seeking weight management solutions, improved metabolic function, or plant-based alternatives are increasingly turning to protein powders, bars, and amino acid blends.

Form Insights

Tablets dominated the market and accounted for a share of 31.4% in 2024, owing to their convenience, shelf stability, and precise dosage. For consumers seeking simplicity and portability, tablets offer a familiar and fuss-free format that integrates seamlessly into daily routines. Their compact size and ease of use-no measuring, mixing, or special storage required-make them especially appealing for working adults, older adults, and on-the-go users. For instance, in July 2024, ISO PLUS launched the MyElements range in Romania, featuring individually packaged effervescent and chewable toothpaste tablets.

The gummies segment is expected to experience the fastest CAGR of 12.1% from 2025 to 2030. This growth is largely fueled by the rising demand for pleasant-tasting, easy-to-consume alternatives to traditional pills and tablets. Gummies offer a more enjoyable user experience, making supplement intake feel less like a chore and more like a treat, especially for children, seniors, and pill-averse consumers.

In August 2024, Aenova announced the implementation of new gummy line for food and pharma grade at its site in Cornu, Romania. With a capacity of around 1 billion gummies yearly, the new gummy line was expected to be launched by the end of 2024.

Type Insights

Prescribed supplements dominated the market and accounted for a share of 55.4% in 2024, owing to their clinical credibility and physician-driven usage. Many consumers in Romania rely heavily on medical guidance when selecting supplements, especially for managing chronic conditions, deficiencies, or post-surgery recovery. Prescribed products offer reassurance of safety, dosage accuracy, and efficacy-critical factors for those dealing with more complex health concerns.

The OTC segment is expected to experience the fastest CAGR from 2025 to 2030. As health literacy improves and consumers become more proactive about managing their well-being, there’s growing confidence in self-selecting supplements without a physician’s prescription.

Application Insights

The immunity segment dominated the Romanian dietary supplements market with a revenue share of 14.4% in 2024. This dominance was largely driven by lingering health concerns following the pandemic, which reshaped consumer priorities around strengthening the body’s natural defenses. Romanian consumers increasingly turned to immunity-focused products such as vitamin C, vitamin D, zinc, and herbal blends like echinacea and elderberry-ingredients widely promoted for their immune-supporting properties.

The prenatal health segment is expected to grow at the fastest CAGR from 2025 to 2030. The growth of segment is attributed to the heightened awareness around maternal nutrition and fetal development. Expecting mothers are increasingly prioritizing prenatal care, and healthcare professionals are more frequently recommending supplements to support both maternal well-being and the baby’s healthy growth-particularly during critical stages of pregnancy.

End Use Insights

The adult segment accounted for the largest market share of 62.2% in 2024. Adults often face lifestyle-induced stress, nutritional gaps from irregular diets, and early-onset chronic conditions like hypertension, fatigue, or digestive issues-driving demand for supplements that can help maintain vitality, energy, and disease prevention. This demographic also includes a large working population with the purchasing power and awareness to make informed supplement choices.

The geriatric segment is anticipated to grow at the fastest CAGR during the forecast period. The country's aging population and rising emphasis on healthy aging and chronic disease management. As more Romanians enter their senior years, there's a stronger focus on maintaining mobility, cognitive health, bone density, cardiovascular function, and overall vitality-needs that dietary supplements are well-positioned to support.

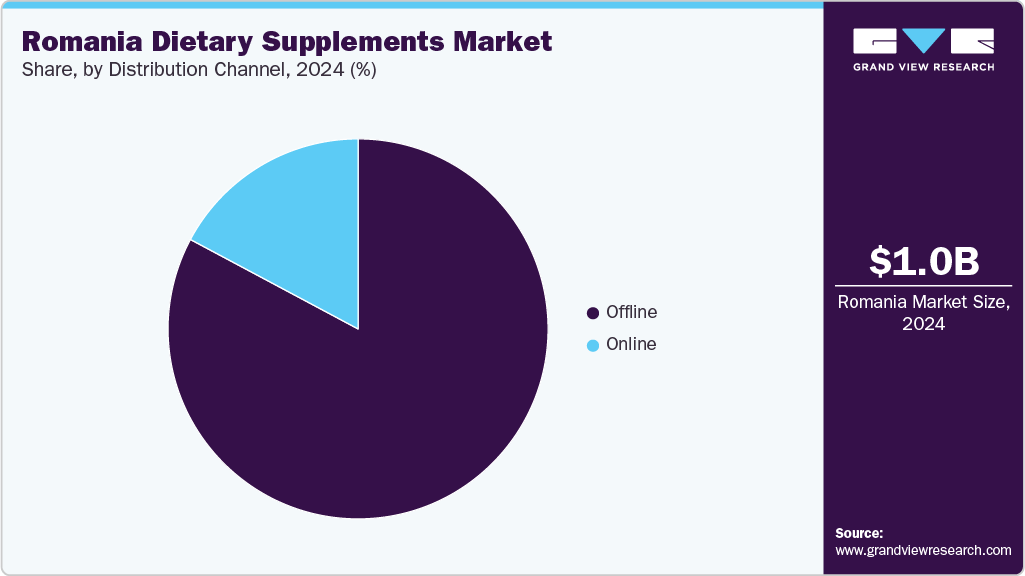

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. The segment growth is largely driven by consumer trust in in-person purchasing, where pharmacies, health stores, and supermarkets offer a sense of credibility and immediate access to expert advice. Romanians often prefer discussing their health needs with pharmacists or store personnel before purchasing, especially when selecting supplements for specific conditions or age groups.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. Consumers increasingly prioritize flexibility and time-saving options, and online platforms provide a seamless way to research, compare, and purchase supplements, often with access to a broader product selection than traditional brick-and-mortar outlets availability and doorstep delivery.

Key Romania Dietary Supplements Company Insights

Some of the key companies operating in Romania dietary supplements industry include Fiterman Pharma, Bayer AG, Herbalife International of America, Inc., Nestlé, and others.

-

Fiterman Pharma is a prominent Romanian pharmaceutical company with over 30 years of experience producing medicines, medical devices, dietary supplements, and dermato-cosmetics. Known for its strong local roots and commitment to quality, Fiterman has developed a diverse portfolio of over 250 products across 20+ therapeutic areas.

-

Bayer AG has a well-established presence in Romania, particularly through its Consumer Health division. In the Romanian dietary supplements, Bayer is known for trusted brands such as Supradyn and Berocca, which focus on energy, immunity, and overall wellness.

Key Romania Dietary Supplements Companies:

- Fiterman Pharma

- Bayer AG

- Herbalife International of America, Inc.

- Nestlé

- Sun Pharmaceutical Industries Ltd.

- GSK plc.

- Abbott

- Himalaya Wellness Company

Recent Developments

- In June 2025, Alfasigma launched Vesvein Legs, a vascular health supplement, in Romania and announced further investments.

Romania Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,039.6 million

Revenue forecast in 2030

USD 1,896.4 million

Growth rate

CAGR of 10.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel

Key companies profiled

Fiterman Pharma; Bayer AG; Herbalife International of America, Inc.; Nestlé; Sun Pharmaceutical Industries Ltd.; GSK plc.; Abbott; Himalaya Wellness Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Romania Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Romania dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.