- Home

- »

- Advanced Interior Materials

- »

-

Rotary Pumps Market Size, Share & Growth Report, 2030GVR Report cover

![Rotary Pumps Market Size, Share & Trends Report]()

Rotary Pumps Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Screw Pump, Gear Pump), By End-use (Chemical, Oil & Gas, Power Generation, Agriculture), By Region (Asia Pacific, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-156-0

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rotary Pumps Market Size & Trends

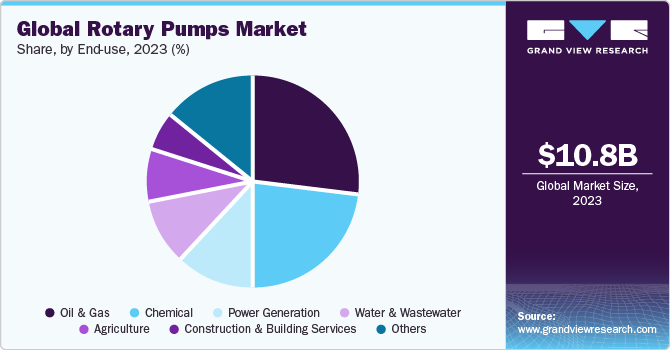

The global rotary pumps market size was estimated at USD 10.8 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. The increasing fluid handling requirements in various industries, such as oil & gas, chemicals, and wastewater treatment, have been primarily driving the market growth. As these rotary pumps are flexible in terms of handling various fluids across different viscosity ranges, they are becoming a more suitable option. Companies are under more pressure than ever to reduce their carbon footprint. Strategic investments in environmentally friendly technologies, particularly energy-efficient rotary pumps, have shown to be successful in reducing energy use and emissions. To better fit with sustainable corporate practices and environmental goals, organizations are prioritizing product usage to increase the carbon efficiency of their facility operations.

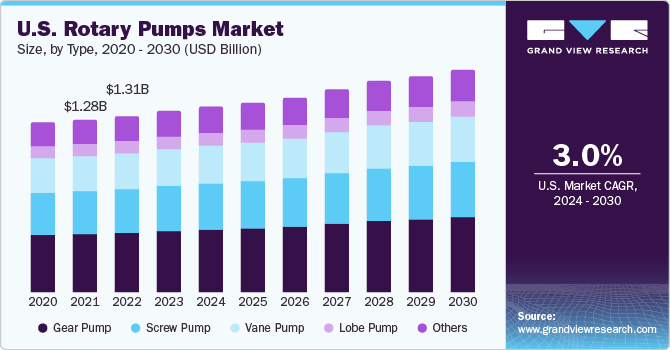

The growth in the construction and oil & gas industries in the U.S. is a key factor contributing to a rise in demand for rotary pumps. As rotary pumps are significantly used in the oil & gas industry to transport fluid from one point to another during the refining process, the U.S. market will witness significant growth. Furthermore, the U.S. has the most robust chemical processing industry, which widely uses rotary pumps to transfer varying-density fluids during the manufacturing process. With a rise in the operations of the chemical processing industry, product demand is expected to increase in the U.S. The ever-changing end-use industry needs and rising importance of energy efficiency & sustainability showcase the future market trends.

To cater to these needs, key players are developing more energy-efficient pumps with less carbon footprint presence. These newly designed pumps have variable speed drives (VSDs) to further develop the market. Some industries, such as chemical processing, require specialized rotary pumps to handle highly corrosive, viscous & acidic fluids. Hence, manufacturers are offering customization options and expertise to cater to those demands. Moreover, with a rise in digitalization and the Internet of Things (IoT), companies are offering IoT-based pump solutions to enhance the functionality of rotary pumps. The market is highly competitive and concentrated with numerous players having expertise in product design and development. Key companies heavily invest in R&D activities, which enables them to retain their market share thereby further penetrating the industry.

Type Insights

The gear pump segment accounted for the largest share 34.3% in 2023. A gear pump is a common type of rotary pump that falls under the positive displacement category. It functions by employing rotating gears that mesh to propel fluid. The fundamental principle behind gear pumps is to capture and move fluid by utilizing the gaps formed between the teeth of these rotating gears. Gear pumps are commonly used in various industries, including hydraulic systems, lubrication systems, fuel transfer, and chemical processing. They are particularly highly suited for handling a wide range of fluids with different corrosivity, viscosity, and density. They are more reliable in maintaining the flow rate, and low maintenance. The screw pump segment is expected to grow at the fastest CAGR of 5.5% from 2024 to 2030.

A screw pump is a type of positive displacement rotary pump that operates using rotating screws to move fluid from the input point to the output point. These pumps are designed to trap and transport fluid through the axial movement of the screws or rotors, making them suitable for various applications, especially when handling high-viscosity liquids or slurries. There are different types of screw pumps like single screw pump or multi screw pump. Screw pumps are used in the oil & gas industry to transfer crude oil and refined products during the refining and storing process in the refineries. They are also used in the wastewater treatment and food processing industries, as they are less sensitive to the vibrations being generated during fluid transfer. As the fluid transfer rate depends on the rotary movement of the screw, they are used to precisely control the discharge rates.

End-use Insights

The oil & gas end-use segment accounted for the largest share of 27.3% of the overall revenue in 2023. Rotary pumps are widely used in the oil and gas industry for various critical functions due to their reliability, versatility, and ability to handle a wide range of fluids, including crude oil and refined products. Furthermore, they are used for the transfer of crude oil from wellheads to storage tanks, between two storage tanks, and for loading and unloading from tankers and pipelines. These pumps are well-suited to handle the varying viscosities and abrasive nature of crude oil. In the oil & gas industry, it is very important to maintain the discharge rate.

This discharge rate is directly proportional to the revolutions per minute (RPMs) of rotary pumps. With the use of appropriate control systems, it is feasible to control the RPMs and thereby maintain the discharge rates & reliability. Furthermore, as the viscosity of crude oil changes continuously across the refining process, rotary pumps are widely used in the industry. The chemical segment is expected to register the fastest CAGR of 5.9% from 2024 to 2030. Rotary pumps are used in the chemical industry due to their ability to handle a wide range of chemical substances, including corrosive and viscous liquids.

Gear and screw pumps are used to transfer various chemicals from one container or vessel to another. They ensure accurate and controlled flow rates, which are crucial for chemical processing. The quality of chemical processing often involves metering of chemicals for accurate dosing, so that product quality can be increased by controlling the process variables, such as discharge rates and pressure of fluid. In the case of rotary pumps, it is easy to control these process variables. Hence, rotary pumps are used to mix chemicals and create chemical blends for various manufacturing processes, including cosmetics.

Regional Insights

Asia Pacific accounted for the largest revenue share of 40.4% in 2023. Rapid industrialization, coupled with the growing demand for fluid handling in several countries, including China and India, is expected to boost the market potential. The agriculture & chemical and food processing industries in Asia Pacific have been witnessing significant growth on account of rising urbanization and per capita income. Pumps are considered prime inputs in the agriculture sector, as adequate water supply to watershed areas is not possible without pumps. In addition, many countries in Asia Pacific are likely to flourish due to the rising investments by governments in the agriculture, power generation, and construction sectors.

Furthermore, the expansion of industrial operations in the pharmaceutical sector due to the region’s sustainable economic development has been propelling its growth. MEA is expected to grow at the second-highest CAGR of 5.1% due to the well-developed oil & gas and power generation industries. The region is a major oil & gas-producing hub. Rotary pumps are used during the crude oil transferring, and refining process. Moreover, Middle Eastern countries have been investing heavily in constructing facilities that can generate potable water from saline water. Rotary pumps are used to transfer the water treatment plants.

These factors are expected to drive the regional market growth. Europe accounted for the second-largest revenue share in 2023. The market growth in this region is expected to be mainly driven by its developed industrial sector. Rotary pumps are used in various industrial processes, such as lubrication, coolant circulation, and hydraulic systems, driving regional demand. Furthermore, the demand for more efficient rotary pumps to reduce carbon footprint in industrial processes & improve carbon credit also drives market growth in this region.

Key Companies & Market Share Insights

Manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new material developments, and geographical expansions, to enhance market penetration and cater to the changing requirements of various end-use industries. Some of the major companies have undertaken measures, such as technological upgrades and investments in R&D activities, to penetrate the market. For instance, in May 2023, 19 new sizes were added to the MegaCPK pump series by KSB SE & Co. KGaA. Given that clients can select from 55 sizes for pumps with more than 78 hydraulic systems, this product extension is anticipated to enhance the company's product mix for the chemical market.

Key Rotary Pumps Companies:

- Atlas Copco AB

- Dover Corporation

- Xylem Inc.

- Colfax Corporation

- IDEX Corporation

- Flowverse Corporation

- KSB SE & Co. KGaA

- HMS Group

- Pentair Ltd.

- SPX Flow

- Alfa Laval

- Gardner Denver Inc.

- ITT INC.

- Roper Technologies Inc.

- Schlumberger Ltd.

Rotary Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.2 billion

Revenue forecast in 2030

USD 14.9 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World (Central, South America, Middle East & Africa)

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Australia; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Atlas Copco AB; Dover Corp.; Xylem Inc.; Colfax Corp.; IDEX Corporation; Flowverse Corp.; KSB SE & Co. KGaA; HMS Group; Pentair Ltd.; SPX Flow; Alfa Laval; Gardner Denver Inc.; ITT INC.; Roper Technologies Inc.; Schlumberger Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

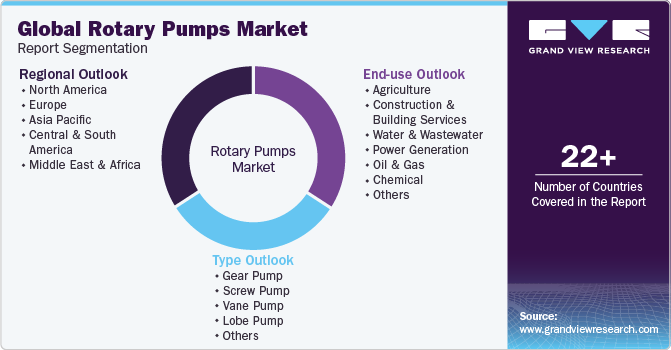

Global Rotary Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the rotary pumps market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gear Pump

-

Screw Pump

-

Vane Pump

-

Lobe Pump

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Construction & Building Services

-

Water & Wastewater

-

Power Generation

-

Oil & Gas

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

MEA

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global rotary pumps market size was estimated at USD 10.8 billion in 2023 and is expected to reach USD 11.2 billion in 2024.

b. The global rotary pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 and reach USD 14.9 billion by 2030.

b. Asia Pacific dominated the rotary pumps market in 2023 with a share of 40.4%, owing to the increasing investments in agriculture, water treatment to cater to the growing urbanization.

b. Some of the key players operating in the rotary pumps market include, Atlas Copco AB, Dover Corporation, Xylem Inc., Colfax Corporation, IDEX Corporation, Flowverse Corporation, KSB SE & Co. KGaA, HMS Group, Pentair Ltd., SPX Flow, Alfa Laval, Gardner Denver Inc., ITT INC., Roper Technologies Inc., Schlumberger Ltd.

b. The increasing fluid handling requirements in various industries such as oil & gas, chemicals have been propelling the market. Further, regulatory compliance and technological advancements in pump technology for energy efficient pumps are driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.