- Home

- »

- Pharmaceuticals

- »

-

Rozanolixizumab (Rystiggo) Market, Industry Report, 2033GVR Report cover

![Rozanolixizumab (Rystiggo) Market Size, Share & Trends Report]()

Rozanolixizumab (Rystiggo) Market (2025 - 2033) Size, Share & Trends Analysis Report By Indication (Generalized Myasthenia Gravis (gMG), Emerging Pipeline Applications), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-644-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rozanolixizumab (Rystiggo) Market Summary

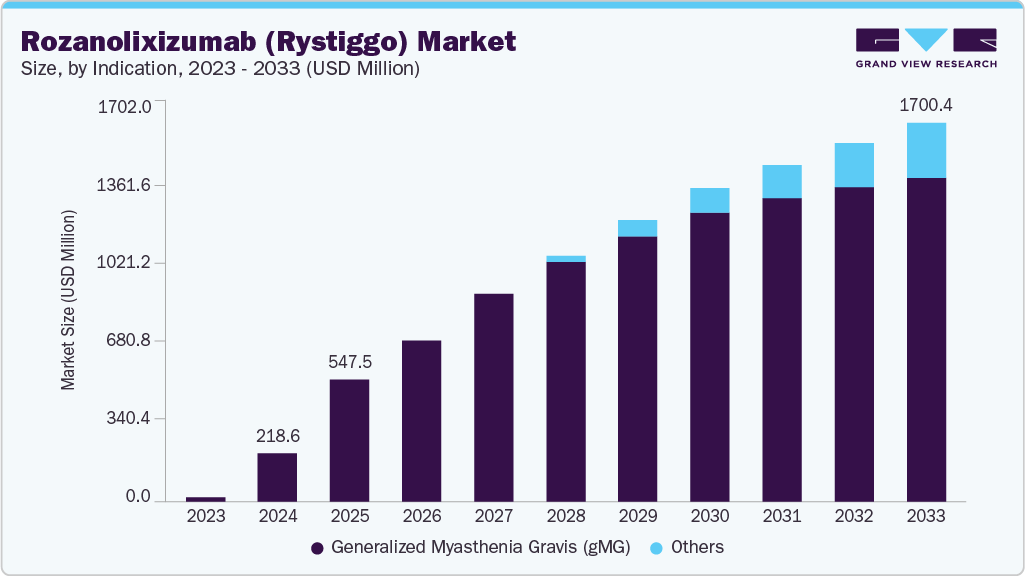

The global rozanolixizumab (Rystiggo) market size was estimated at USD 218.61 million in 2024 and is projected to reach USD 1,700.40 million by 2033, growing at a CAGR of 15.22% from 2025 to 2033. The increasing prevalence of chronic plaque psoriasis and psoriatic arthritis drives greater demand for advanced biologic therapies.

Key Market Trends & Insights

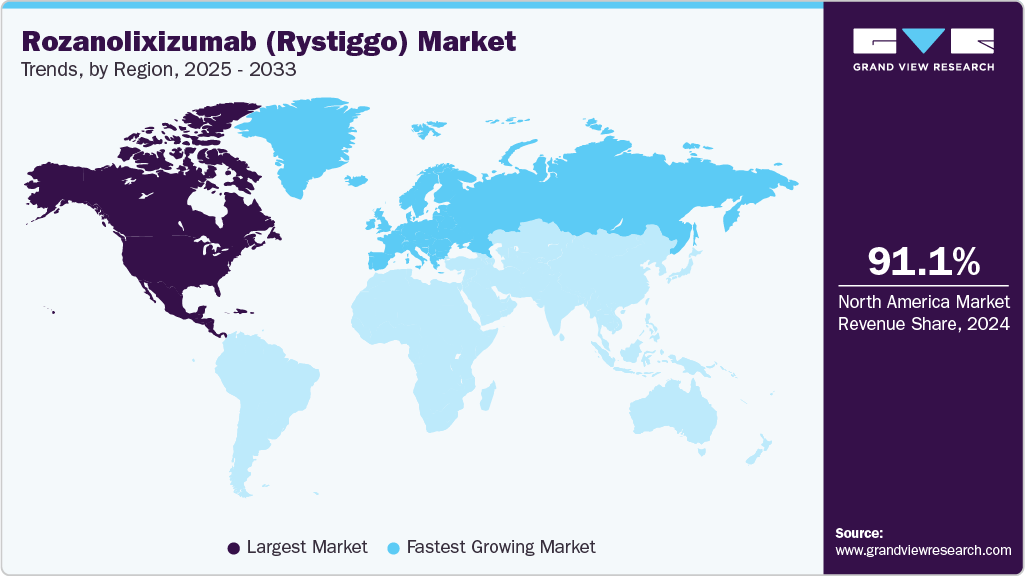

- North America rozanolixizumab (Rystiggo) market held the largest share of 91.09% of the global market in 2024.

- The rozanolixizumab (Rystiggo) market in the U.S. is expected to grow significantly over the forecast period.

- By application, the generalized myasthenia gravis (gMG) segment held the highest market share of 100.00% in 2024.

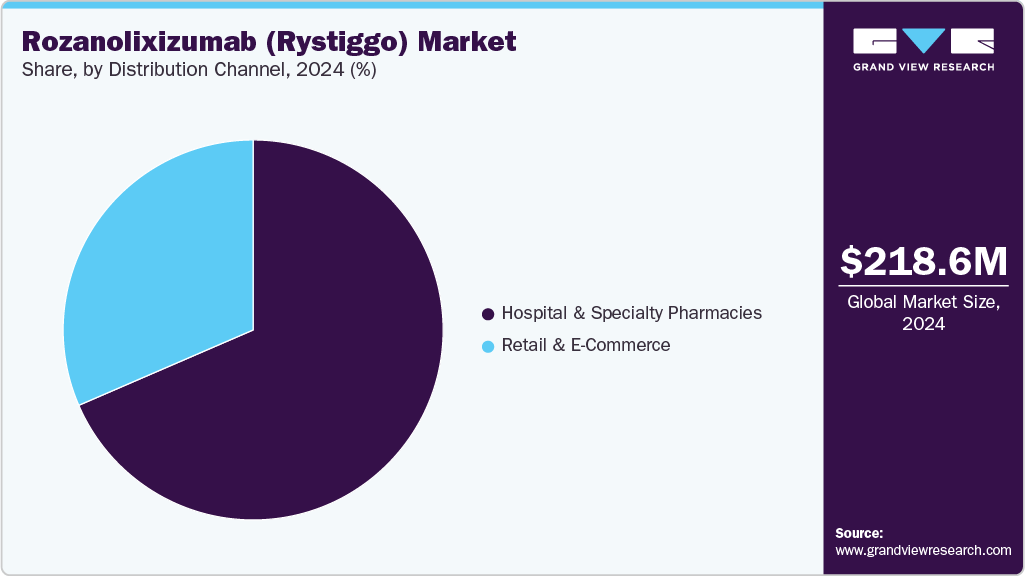

- By distribution channel, the hospital & specialty pharmacies segment held the highest market share of 68.51% in 2024.

- Online pharmacies are the fastest-growing distribution channel, fueled by e-commerce and telemedicine growth.

Market Size & Forecast

- 2024 Market Size: USD 218.61 Million

- 2033 Projected Market Size: USD 1,700.40 Million

- CAGR (2025-2033): 15.22%

- North America: Largest market in 2024

- Europe: Fastest growing market

The market is driven by its approval for generalized myasthenia gravis (gMG). Key trends include rising demand for targeted therapies and global regulatory approvals, fueled by potential approvals and increasing healthcare access. Growth is supported by UCB’s innovative approach and emerging pipeline applications. The rozanolixizumab (Rystiggo) market targets gMG, a chronic autoimmune disorder, with growing prevalence driving demand. Approved in the U.S. and Europe, Rystiggo’s subcutaneous administration and efficacy in reducing IgG antibodies fuel its adoption. Market growth is propelled by rising diagnosis rates and an aging population susceptible to autoimmune diseases. UCB’s focus on expanding indications further supports the projected increase by 2033.

Rystiggo’s key advantage lies in its novel FcRn-targeting mechanism, offering significant improvements in gMG symptoms like swallowing and breathing, as demonstrated in the MycarinG study. Compared to plasma exchange, it reduces side effects while maintaining efficacy. Its subcutaneous delivery enhances patient convenience, positioning it favorably against intravenous competitors.

Emerging innovations include trials for chronic inflammatory demyelinating syndrome (CIDP) and self-administration methods. Successful pipeline expansion could double the addressable market by 2033. Advances in delivery systems aim to improve compliance, while potential biosimilars may introduce competition, balancing cost and accessibility in the long term.

Pipeline Analysis

rozanolixizumab (Rystiggo), developed by UCB, is advancing through a robust clinical pipeline targeting multiple IgG-mediated autoimmune diseases beyond its approved indication for generalized myasthenia gravis (gMG). Additionally, a Phase 3 trial (NCT05063162) for myelin oligodendrocyte glycoprotein antibody-associated disease (MOG-AD) began in 2021. Expected results in coming year could make rozanolixizumab the first FDA-approved MOG-AD therapy.

These innovations could expand market penetration, particularly in developed markets. Despite these advancements, UCB discontinued CIDP Phase 3 development in 2023 to focus on neuro-inflammatory indications, reflecting strategic prioritization. The pipeline’s success hinges on regulatory approvals and managing side effects like headaches, reported in 48% of gMG trial patients.

Table: Patent & Exclusivity Summary

Region

Protection Type

Expiry Year

Notes

U.S.

Patent

2035

Covers composition of matter

U.S.

Exclusivity

2030

Orphan drug status for gMG

EU

Patent

2036

Method of use for gMG

EU

Exclusivity

2031

Market exclusivity for gMG

Japan

Patent

2037

Formulation patent

Canada

Patent

2034

Manufacturing process

Citations: USPTO, EMA (2024), UCB Annual Report (2023).

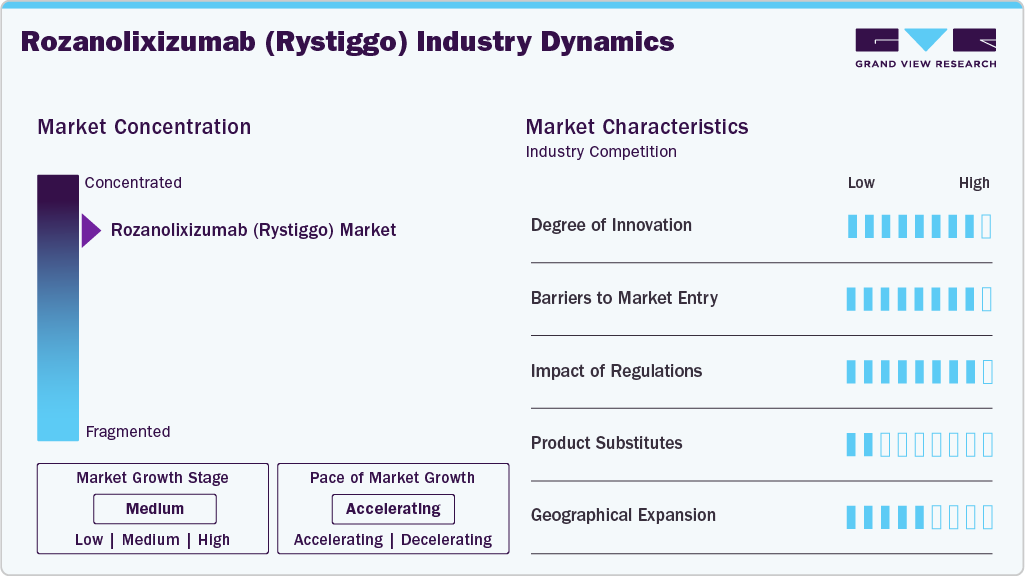

Market Concentration & Characteristics

The rozanolixizumab (Rystiggo) market exhibits high concentration, with UCB dominating as the sole developer and distributor of Rystiggo. This concentration stems from UCB’s proprietary FcRn technology and early regulatory approvals, including the FDA’s in 2023 and the EC’s in 2024. The market’s structure limits competition, as few companies can match UCB’s clinical expertise and patent protection, which extends to 2038 globally. However, this monopoly may face challenges post-2030 with potential biosimilar entries, though high R&D costs and regulatory hurdles create significant barriers for new entrants, ensuring UCB’s dominance through the forecast period.Barriers to market entry are high due to the complexity of biologics development and stringent regulatory requirements from bodies such as the FDA and EMA. The impact of regulations is moderate-High, as approvals facilitate growth, but varying global standards can delay expansion.Product substitutability is low, given Rystiggo’s unique mechanism, though alternatives like Vyvgart pose indirect competition. Market growth is in a medium stage, with an accelerating pace as new approvals and indications emerge.

Geographic expansion is moderate, with North America and Europe leading, while Asia Pacific shows rapid growth potential. Opportunities for UCB include leveraging partnerships to penetrate emerging markets such as Japan, where UCB launches the ONWARD initiative for patient assistance and RYSTIGGO (rozanolixizumab) gets approved in Japan for two additional administration techniques. In addition, self-administration innovations could capture a larger patient base, particularly in home healthcare settings, driving further market penetration and growth through 2030.

Challenges include Rystiggo’s high annual cost of approximately USD 218,478 to $655,434 per patient per year as per Canada’s Drug Agency which restricts access in regions with limited reimbursement, such as Latin America and the Middle East & Africa. Regulatory variability across countries complicates global rollout, while the potential for biosimilars post-2030 threatens UCB’s market share. To counter these, UCB must focus on pricing strategies, patient support programs, and continuous innovation to maintain its competitive edge..

Indication Insights

Rozanolixizumab (Rystiggo), a monoclonal antibody targeting the neonatal Fc receptor (FcRn), has established itself as a critical therapeutic option for rare autoimmune disorders, with generalized myasthenia gravis (gMG) as its cornerstone indication. In 2024, gMG accounted for almost 100% of Rystiggo’s global revenue, including the United States, European Union, and Japan. The dominance of gMG reflects its relatively higher prevalence among rare neurological disorders, with global estimates suggesting 100-350 cases per million people, translating to a sizable patient population requiring targeted therapies. The U.S. FDA approval on June 27, 2023, followed by EMA and PMDA approvals, has solidified Rystiggo’s position in this segment, with robust adoption in clinical practice due to its demonstrated efficacy in improving MG-ADL (Myasthenia Gravis Activities of Daily Living) scores, as evidenced by the MycarinG study. The therapy’s ability to reduce circulating immunoglobulin G (IgG) levels, a key driver of gMG pathology, has made it a preferred choice for patients with moderate-to-severe disease, particularly those refractory to conventional treatments like corticosteroids or immunosuppressants. Additionally, ongoing real-world evidence studies are expected to further validate its long-term benefits, potentially increasing its market penetration.

Beyond its approved indication for generalized myasthenia gravis (gMG), rozanolixizumab’s emerging pipeline indications such as chronic inflammatory demyelinating polyneuropathy (CIDP) and other IgG-mediated autoimmune disorders—are poised to diversify its market footprint significantly. Although clinical trials in CIDP and related conditions have shown mixed results, emerging data indicate improvements in functional outcomes, including grip strength and Inflammatory Neuropathy Cause and Treatment (INCAT) disability scores in some patient subsets, suggesting potential clinical benefit.

Distribution Channel Insights

Hospital and specialty pharmacies dominate the distribution of rozanolixizumab (Rystiggo), a biologic needing specialized handling, which holds a 68.51% share of the market in 2024. This dominance stems from the need for controlled storage conditions (e.g., refrigeration at 2-8°C), precise administration protocols, and close patient monitoring, particularly for gMG patients receiving subcutaneous infusions. Hospital pharmacies, often integrated with neurology clinics, ensure seamless delivery and administration, while specialty pharmacies cater to outpatient settings with expertise in managing high-cost biologics. The segment’s growth is supported driven by expanding regulatory approvals in new markets and increasing demand for biologics in hospital-based care. Investments in cold-chain logistics and partnerships with healthcare providers further bolster this channel’s capacity to meet rising demand.

Retail and e-commerce channels, while smaller, are the fastest-growing distribution segments projected to grow through 2033. This growth is fueled by the increasing trend toward self-administration, enabled by Rystiggo’s subcutaneous formulation, which allows patients to manage treatment at home with proper training. E-commerce platforms, including online pharmacies have gained traction in developed markets, offering convenience, competitive pricing, and direct-to-patient delivery. This segment is driven by digital adoption, improved reimbursement policies for home-based therapies, and patient preference for cost-effective options. In regions like North America and Western Europe, robust digital infrastructure and regulatory frameworks supporting telehealth further accelerate this trend.

Regional Insights

North America holds the largest share in the rozanolixizumab (Rystiggo) market in 2024, driven by early regulatory approvals and a sophisticated healthcare ecosystem. In the U.S., the Food and Drug Administration (FDA) approved Rystiggo on June 2023, for adult patients with gMG, based on the Phase 3 MycarinG study, which demonstrated a statistically significant improvement in MG-ADL (Myasthenia Gravis Activities of Daily Living) scores (-3.4 vs. -0.8 for placebo, p<0.001). The study, involving 200 patients across multiple centers, confirmed Rystiggo’s efficacy in reducing symptom severity, with common adverse events including headache and infections. Rystiggo is administered as a subcutaneous infusion, primarily through specialty pharmacies and hospital-based neurology clinics, ensuring compliance with its storage requirements (2-8°C). The U.S. benefits from a high prevalence of gMG, estimated at 100-350 cases per million, equating to approximately 36,000-60,000 patients, supported by robust awareness campaigns from the Myasthenia Gravis Foundation of America (MGFA).

In Canada, Health Canada approved Rystiggo in 2024 for the same indication, with the Canadian Agency for Drugs and Technologies in Health (CADTH) actively reviewing reimbursement recommendations to enhance patient access. The region’s advanced cold-chain logistics, extensive network of neurologists, and integration of biologics into treatment protocols facilitate Rystiggo’s uptake, with patient support programs from UCB Pharma addressing barriers like co-pay challenges. Ongoing real-world evidence studies in North America are further validating Rystiggo’s long-term benefits, particularly in refractory gMG cases.

U.S. Rozanolixizumab (Rystiggo) Market Trends

The U.S. market for rozanolixizumab (Rystiggo) has seen steady growth, as the first therapy approved for both gMG subtypes anti-AChR or anti-MuSK antibodies, Rystiggo has gained traction among neurologists seeking targeted treatments. UCB’s efforts to enhance patient access through the ONWARD program, which includes support for self-administration, have bolstered its adoption. The drug’s subcutaneous delivery and efficacy in improving daily activities such as breathing and swallowing make it a preferred choice for many clinicians tailoring therapies to individual patient needs.

Despite its success, Rystiggo faces challenges in the U.S. market, including competition from other FcRn inhibitors like efgartigimod (Vyvgart), which also targets gMG. High treatment costs pose a barrier, often limiting access for patients without robust insurance coverage. Additionally, the need for specialized administration in hospital settings can deter some patients, though UCB is addressing this with self-administration options. Side effects such as headaches and infections, while manageable, require careful monitoring. UCB’s focus on long-term safety data and potential new indications may help sustain its market position through 2033.

Europe Rozanolixizumab (Rystiggo) Market Trends

Europe is a key market for Rystiggo, characterized by harmonized regulatory frameworks and strong healthcare systems. The European Medicines Agency granted marketing authorization for rozanolixizumab (Rystiggo) on January 5, 2024, for adult patients with generalized myasthenia gravis (gMG). This approval was based on the pivotal Phase 3 MycarinG study, which demonstrated a statistically significant 3.4-point improvement in MG-ADL scores compared to placebo, reflecting meaningful enhancements in patients’ daily functioning. The approval covers all 27 EU member states, with Germany, France, Italy, Spain, and the UK leading adoption.

The UK market for rozanolixizumab is shaped by rapid integration into NHS pathways for generalized myasthenia gravis (gMG), supported by NICE evaluations emphasizing value-based pricing. Adoption is guided by neurologist-led multidisciplinary clinics in tertiary care centers. Clinical awareness and early diagnostic referrals through NHS reforms are accelerating biologic initiation. Hospital pharmacies are primary dispensing points, but community and online pharmacy channels are evolving for chronic maintenance doses. The UK plays a significant role in Rystiggo’s real-world data collection and inclusion in ongoing investigator-led research trials for other autoimmune indications.

Germany’s Rystiggo market demonstrates robust uptake due to early approval, physician familiarity with anti-FcRn mechanisms, and high biologic penetration in the neurology segment. The country’s structured reimbursement and integrated care pathways ensure access through both university hospitals and private neurology clinics. E-prescription systems and specialty pharmacy collaborations streamline treatment continuity. Germany’s health informatics infrastructure enables robust treatment outcome tracking, while ongoing registry inclusion supports pharmacovigilance. Interest in expanding usage for CIDP and other neuromuscular conditions is growing in academic centers.

Rozanolixizumab has been adopted steadily in France due to strong institutional support for rare disease management and universal reimbursement for high-cost orphan drugs. Neuromuscular reference centers and national myasthenia registries guide clinical practice, with growing familiarity among prescribers. Hospital-based neurology units lead biologic administration, with retail pharmacies expanding coverage for follow-up doses. Telemedicine initiatives and national neurologist training programs enhance treatment reach. While biosimilar discussions have begun for FcRn inhibitors, their market entry remains years away, securing near-term Rystiggo market exclusivity.

Asia Pacific Rozanolixizumab (Rystiggo) Market Trends

The Asia Pacific region is expected to witness the fastest CAGR of 17.4% for Rystiggo, driven by increased autoimmune disease awareness, expanding healthcare budgets, and fast-track biologic approvals. Japan, China, South Korea, and India anchor demand, supported by rising neurology specialist density and improved patient referral systems. Local regulatory bodies are prioritizing access to FcRn-targeted therapies for rare and underserved autoimmune conditions. Hospital and specialty outpatient centers dominate distribution, while online pharmacy access is growing in urban areas. APAC is becoming a regional trial and pharmacoeconomics hub for Rystiggo’s label expansion.

Japan’s Rystiggo market benefits from the drug’s origin from a domestic research base, strong governmental support for orphan drugs, and a highly specialized neurology workforce. The universal health insurance system ensures rapid post-approval coverage, and neurologists in university hospitals are key prescribers. Administration is managed through hospital-affiliated outpatient infusion centers. Japan is actively supporting label expansion into CIDP and other antibody-mediated disorders through local trials. Patient support programs and digital compliance tools are key to long-term therapy adherence.

China's Rystiggo market is growing rapidly, supported by central government policies on rare disease inclusion in national insurance lists and reform-driven hospital investment. Urban tertiary hospitals are the primary centers for gMG diagnosis and treatment, with pilot programs underway in provincial cities. The government is promoting local clinical trials and public-private research partnerships for FcRn inhibitors. Market access is supported by centralized procurement and a shift toward patient-assistance programs. Strategic label expansion into CIDP and antibody-mediated diseases is a focus of ongoing regulatory engagement.

Latin America Rozanolixizumab (Rystiggo) Market Trends

Latin America shows early-stage adoption of Rystiggo, led by Brazil, Argentina, and Mexico, where growing investment in rare disease treatment is underway. Regulatory delays and non-uniform reimbursement structures continue to be key barriers, although specialty neurology centers are driving access in major cities. Government-backed access programs and partnerships with international nonprofit health organizations are aiding early therapy access. Interest in Rystiggo’s clinical profile is rising as neurologists seek alternatives to IVIG and plasma exchange. Biosimilar pathways are in exploratory stages in the region.

Brazil’s Rystiggo market is expanding as the Ministry of Health increases focus on rare diseases and neurologic care infrastructure. Public hospital infusion centers handle most biologic administration, with private-sector neurologists increasingly adopting FcRn inhibitors. Policy frameworks are being developed to streamline access to high-cost drugs, supported by central procurement and local clinical protocols. Medical societies and patient groups are advocating for updated national treatment guidelines. Pilot programs for CIDP and other indications are being proposed for post-approval real-world studies.

Middle East & Africa Rozanolixizumab (Rystiggo) Market Trends

The Middle East & Africa region is witnessing a gradual increase in demand for Rystiggo, especially in Gulf countries like Saudi Arabia and the UAE. Adoption is driven by rising prevalence of autoimmune neuromuscular conditions and investment in tertiary care infrastructure. Regulatory authorities are streamlining approvals for orphan drugs and offering reimbursement under specialized healthcare schemes. Rystiggo is distributed primarily through hospital pharmacies, with digital health platforms improving patient education and adherence. Government-led initiatives to boost neurology training and rare disease recognition are fostering long-term growth potential.

Saudi Arabia’s Rystiggo market is progressing steadily, supported by Vision 2030 healthcare reforms and national focus on neuromuscular disease care. Access is primarily through government hospitals and specialized neurology clinics, with biologic procurement integrated into centralized public tenders. Early adoption is supported by medical education initiatives and diagnostic outreach campaigns. Digital prescription systems and hospital-telehealth integration are improving follow-up care. Regulatory authorities are aligning with international standards for rare disease drug evaluation, creating an enabling environment for Rystiggo’s future label expansions.

Key Rozanolixizumab (Rystiggo) Company Insights

UCB leads the rozanolixizumab market with Rystiggo, focusing on pipeline expansion, global approvals, and self-administration innovations. Competitors in the autoimmune space, like Roche and Sanofi, may challenge with similar therapies. UCB’s strategy emphasizes partnerships and patient-centric solutions to maintain dominance through 2033.

Key Rozanolixizumab (Rystiggo) Companies:

The following are the leading companies in the rozanolixizumab (rystiggo) market. These companies collectively hold the largest market share and dictate industry trends.

- UCB

Recent Developments

-

In January 2024, the European Commission approved Rystiggo for adult patients with generalized myasthenia gravis, enabling access across 27 EU countries, Iceland, Liechtenstein, and Norway. Based on the MycarinG study’s significant MG-ADL score improvements, this milestone strengthens UCB’s neurology portfolio and enhances patient access through specialized clinics.

-

In March 2024, UCB announced positive Phase 3 trial results for Rystiggo in CIDP, demonstrating significant improvements in INCAT disability scores and grip strength. This advances Rystiggo’s potential as a novel treatment for nerve disorders, addressing unmet needs compared to IVIG, with regulatory submissions planned for 2026.

-

In June 2024, the FDA granted Rystiggo orphan drug designation for an undisclosed rare autoimmune condition, supporting trials for diseases like MOG-AD. This designation offers incentives for development, potentially broadening Rystiggo’s therapeutic scope and addressing critical gaps in rare disease treatment options.

Rozanolixizumab (Rystiggo) Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 547.54 million

Revenue forecast in 2033

USD 1,700.40 million

Growth rate

CAGR of 15.22% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

UCB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rozanolixizumab (Rystiggo) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rozanolixizumab (Rystiggo) market report based on indication, distribution channel and region:

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Generalized Myasthenia Gravis (gMG)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital & Specialty Pharmacies

-

Retail & E‑Commerce

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rozanolixizumab (Rystiggo) market size was estimated at USD 218.61 million in 2024 and is expected to reach USD 547.54 million in 2025.

b. The global rozanolixizumab (Rystiggo) market is projected to grow at a CAGR of 9.02% from 2025 to 2033 to reach USD 1,700.40 million by 2033.

b. Based on indication, gMG accounted for 100% of Rystiggo’s global revenue. The dominance of gMG reflects its relatively higher prevalence among rare neurological disorders, with global estimates suggesting 100–350 cases per million people, translating to a sizable patient population requiring targeted therapies. Other indications are currently in emerging stages, with ongoing clinical development exploring potential expansion into additional autoimmune and neuromuscular conditions.

b. UCB leads the Rozanolixizumab market with Rystiggo, focusing on pipeline expansion, global approvals, and self-administration innovations. Competitors in the autoimmune space, like Roche and Sanofi, may challenge with similar therapies. UCB’s strategy emphasizes partnerships and patient-centric solutions to maintain dominance through 2033.

b. The market is driven by its approval for generalized myasthenia gravis (gMG). Key trends include rising demand for targeted therapies and global regulatory approvals, fueled by potential approvals and increasing healthcare access. Growth is supported by UCB’s innovative approach and emerging pipeline applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.