- Home

- »

- Advanced Interior Materials

- »

-

Sand Blasting Machines Market Size & Share Report, 2030GVR Report cover

![Sand Blasting Machines Market Size, Share & Trends Report]()

Sand Blasting Machines Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Stationary, Portable), By Operation (Manual, Automatic), By Blasting Type (Dry, Wet), By End-use (Oil & Gas, Marine), By Region, And Segment Forecasts

- Report ID: 978-1-68038-257-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sand Blasting Machines Market Summary

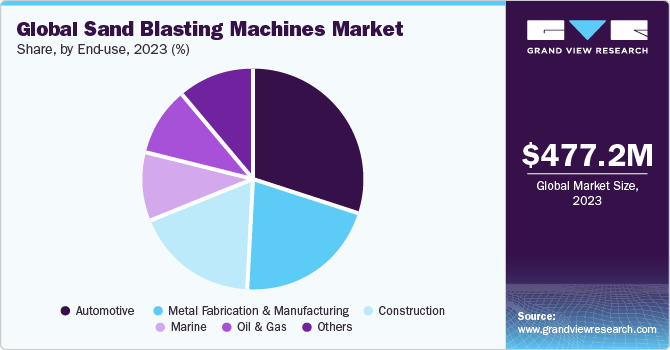

The global sand blasting machines market size was estimated at USD 477.2 million in 2023 and is projected to reach USD 638.7 million by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The growth of the construction industry and expansion of metropolitan areas in various regions are fueling the need for sand-blasting machines.

Key Market Trends & Insights

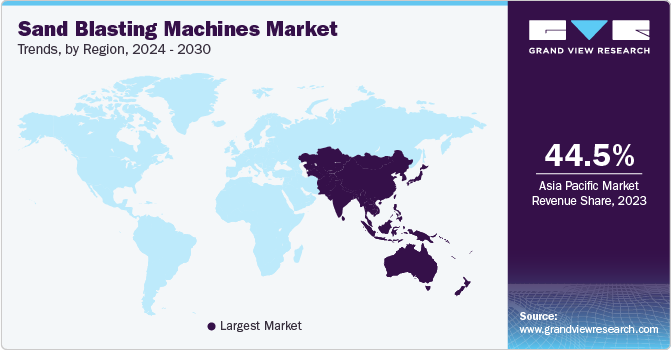

- The Asia Pacific led the market and accounted for over 44.5% share of the total revenue in 2023.

- The North America is expected to demonstrate strong growth during the forecast period.

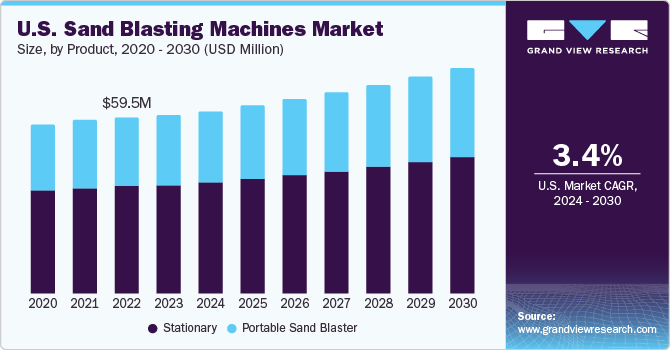

- Based on product, the stationary segment dominated the industry and accounted for a revenue share of 65.5% in 2023.

- Based on operation, the automatic segment is anticipated to grow at a CAGR of 4.5% from 2024 to 2030.

- Based on blasting type, the dry sand segment is anticipated to grow at a CAGR of 4.0% from 2024 to 2030.

- Based on end-use, the automotive segment is anticipated to grow at a CAGR of 4.0% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 477.2 Million

- 2030 Projected Market Size: USD 638.7 Million

- CAGR (2024-2030): 4.3%

- Asia Pacific: Largest market in 2023

Rapid urbanization, industrial development, and government investments in infrastructure projects are contributing to the construction sector's expansion. Sand-blasting machines play a crucial role in the construction industry, primarily during the final phases of finishing, refining, and achieving smooth surfaces. A rise in demand from the automotive construction and manufacturing sectors is the driving force for market growth.

The introduction of novel products and ongoing research and development efforts are anticipated to be catalysts for market expansion in the years ahead. Company innovations are primarily concentrated on enhancing the productivity, reliability, and cost-effectiveness of their products. In addition, the potential for growth in end-use industries like marine, construction, and petrochemicals is expected to present significant opportunities for the market. Environmental regulations and workplace safety standards impact the type of sand blasting machines used in the U.S., leading to the adoption of more environmentally friendly and safer equipment. In addition, the U.S. market is influenced by the growth of various industries, including automotive, aerospace, construction, manufacturing, and marine, which rely on these machines for surface preparation, cleaning, and finishing.

Conversely, the market is anticipated to face certain limitations due to regulatory factors. Various government agencies, such as the USDA, FDA, and EPA, are actively working on crafting regulations and standards aimed at encouraging the production of environmentally friendly sand blasting machines worldwide. Increased environmental concerns, particularly concerning issues like wastewater disposal and noise emissions from these machines, are projected to drive the implementation of more stringent regulations during the forecast period. The growing need to eliminate dust, rust, paint, and other surface contaminants from various objects, such as machinery, cars, and buildings, are poised to drive product adoption. These machines are equipped to efficiently remove such pollutants.

Furthermore, growing investments in robotic sand-blasting machine technology are expected to have a favorable impact on market growth. The U.S. boasts an extensive infrastructure network and numerous national monuments that have aged over the decades and are in dire need of restoration. The rising focus on repairing & preserving these monuments is expected to drive product demand. Large-scale projects involving the cleaning & refurbishment of structures, such as bridges, dams, and other critical infrastructure, are set to contribute to growth. In addition, the availability of contract firms offering sand blasting services for residential applications, including the cleaning of rusty pipes, roads, terraces, and the removal of fireplace deposits, is propelling market expansion in this region.

Product Insights

Stationary product segment dominated the industry and accounted for a revenue share of 65.5% in 2023. Stationary sand-blasters are often favored for heavy-duty industrial and commercial applications where large, fixed workpieces or structures need to be treated. This includes tasks like cleaning large metal structures, tanks, and buildings, where a stationary setup provides efficiency and precision. In addition, industries involved in large-scale surface preparation, such as shipbuilding, steel manufacturing, and bridge construction, prefer stationary sand blasters due to their capacity to handle extensive workpieces efficiently.

The portable product segment is anticipated to grow at a CAGR of 3.5% from 2024 to 2030. Manufacturers have been working on improving the usability of portable sand-blasters, making them more user-friendly. This has expanded their market, attracting a broader customer base, including those with limited sand blasting experience. In addition, increasing environmental regulations have pushed companies to invest in more environmentally friendly sand-blasting technologies. Portable sand blasters that offer options for dust containment, recycling abrasive materials, and reducing environmental impact are becoming more popular.

Operation Insights

Automatic segment is anticipated to grow at a CAGR of 4.5% from 2024 to 2030. Automatic sand blasting machines are often faster than manual alternatives, leading to reduced project lead times and faster completion of tasks. Moreover, increasing demand for automation in manufacturing and surface preparation products across various industries drives the adoption of automatic sand blasting machines.

Semi-automatic sand blasting machines offer a balance between manual and fully automatic operation, making them versatile for a wide range of tasks. Operators can have control over the product while benefiting from automation. In addition, semi-automatic sand blasters offer a balance between cost-effectiveness and efficiency, making them attractive to businesses that need consistent results without the high investment of fully automatic systems.

Blasting Type Insights

Demand for the dry sand-blasting type segment is anticipated to grow at a CAGR of 4.0% from 2024 to 2030. Dry sand-blasting is often more efficient and faster than wet sand blasting as there is no need to deal with the added weight and disposal of water. This can lead to increased productivity in various industries. Furthermore, ongoing developments in abrasive materials, such as the introduction of eco-friendly and high-performance abrasives, enhance the effectiveness of dry sand-blasting.

Wet sand-blasting produces less dust pollution compared to dry sand-blasting, making it an environmentally friendly option. It is often used in environmentally sensitive areas or locations where dust control is crucial. Moreover, industries and projects that need to comply with strict environmental regulations often opt for wet sand-blasting due to its reduced environmental impact and dust emissions.

End-use Insights

The automotive end-use segment is anticipated to grow at a CAGR of 4.0% from 2024 to 2030. Automotive manufacturers and repair shops use sand-blasting machines to prepare vehicle surfaces for painting. This is crucial for achieving a high-quality finish and ensuring paint adhesion. The automotive end-use segment benefits from the versatility, efficiency, and precision of sand-blasting machines, which are essential for maintaining the appearance, safety, and performance of vehicles. The need for high-quality surface preparation, refurbishment, and customization in the automotive sector drives the demand for these machines.

Sand-blasting machines are used for surface preparation in the construction industry, especially in tasks like cleaning, paint removal, rust removal, and texturing. This is essential for achieving smooth, clean, and properly prepared surfaces for coatings and finishes. Furthermore, construction projects often involve the restoration and maintenance of aging structures, historical buildings, and monuments. Sand-blasting is employed to remove contaminants, graffiti, and damaged coatings while preserving the original architecture.

Regional Insights

Asia Pacific led the market and accounted for over 44.5% share of the total revenue in 2023. The swift urbanization in emerging countries across Asia Pacific has led to a notable surge in construction activities. For instance, in India, the infrastructure sector alone constitutes half of the construction endeavors, while the other half encompasses industrial operations, residential and commercial development, and similar endeavors. In addition, numerous governments in the region have introduced a multitude of initiatives aimed at enhancing urban infrastructure. These collective endeavors and advancements are driving the region’s expansion.

North America is expected to demonstrate strong growth during the forecast period. This projection is underpinned by the presence of substantial infrastructure and historical monuments that have aged over the decades and now require urgent restoration. The growing focus on the repair and preservation of these landmarks is generating a high product demand for. Notably, extensive cleaning and refurbishment initiatives for structures like bridges, dams, and other critical infrastructure are contributing to the expansion for companies operating in this sector. Furthermore, the availability of contract firms offering sand blasting services for residential applications, encompassing tasks like cleaning corroded pipes, road surfaces, terraces, and removing fireplace deposits, is further propelling regional market growth.

Key Companies & Market Share Insights

The global industry is highly fragmented, with numerous small- to large-scale manufacturers and suppliers competing for market share. This fragmentation offers a wide selection of equipment, and customization choices to buyers while catering to specific industry needs. To meet the rising demand from a diverse range of industries, key players are pursuing business growth through strategies, such as mergers & acquisitions, establishment of new manufacturing facilities, and geographic expansion initiatives.

For instance, in March 2023, BlastOne acquired VertiDrive B.V. Through this acquisition, BlastOne improved customer assistance and delivered creative solutions for automating their painting and blasting processes. BlastOne's capacity to serve a wide range of industries were enhanced by the integration of VertiDrive's robotics technology, including shipbuilding, ship refurbishment, chemical industries, heavy fabrication, and infrastructure.

Key Sand Blasting Machine Companies:

- Clemco Industries Corporation

- Norton Sandblasting Equipment

- Graco Inc.

- Airblast B.V.

- Sinto Group

- Surface Blasting Systems, LLC

- Guyson Corporation

- Fratelli Pezza

- Hangzhou Color Powder Coating Equipment Co., Ltd.

- Beijing Coowor Network Technology Co., Ltd.

- Hangzhou Huashengtong Machinery Equipment Co., Ltd.

- Axxiom Manufacturing, Inc.

- Micro Blaster’s

- MMLJ, Inc.

- CONIEX SA

Sand Blasting Machines Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 494.8 million

Revenue forecast in 2030

USD 638.7 million

Growth rate

CAGR of 4.3 % from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, operation, blasting type, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentine; South Africa; UAE; Saudi Arabia

Key companies profiled

Clemco Industries Corp.; Norton Sandblasting Equipment; Graco Inc.; Airblast B.V.; Sinto Group; Surface Blasting Systems, LLC; Guyson Corporation; Fratelli Pezza; Hangzhou Color Powder Coating Equipment Co., Ltd.; Beijing Coowor Network Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sand Blasting Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sand blasting machines market report based on product, operation, blasting type, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Sand Blaster

-

Stationary

-

-

Operation Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Semi-automatic

-

Automatic

-

-

Blasting Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Sand Blasting

-

Wet Sand Blasting

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Marine

-

Oil & Gas

-

Metal Fabrication & Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Frequently Asked Questions About This Report

b. The sand blasting machine market size was estimated at USD 477.2 million in 2023 and is expected to reach USD 494.8 million in 2024.

b. The sand blasting machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 and reach USD 638.7 million by 2030.

b. Asia Pacific dominated the sand blasting machine market and accounted 44.5% of the market share in 2023. The swift urbanization in emerging countries across the Asia Pacific region has led to a notable surge in construction activities.

b. Some of the key players operating in the sand blasting machine market include Clemco Industries Corporation, Norton Sandblasting Equipment, Graco Inc., Airblas, B.V.,Sinto Group, Surface Blasting Systems, LLC, among others.

b. The key factors that are driving the sand blasting machine market include the growth of various industries, such as automotive, aerospace, construction, and manufacturing, creates a demand for surface preparation and cleaning equipment like sand blasting machines. Moreover, infrastructure projects like bridges, highways, and buildings often require sand blasting to remove rust, corrosion, and old coatings. This drives demand for sand blasting equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.