- Home

- »

- Communication Services

- »

-

SATCOM On The Move Market Size, Industry Report, 2033GVR Report cover

![SATCOM On The Move Market Size, Share & Trends Report Report]()

SATCOM On The Move Market (2025 - 2033) Size, Share & Trends Report Analysis By Platform, By Frequency Band, By End Use (Defense & Military, Government & Public Safety, Commercial Enterprises, Aviation & Maritime), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-724-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

SATCOM On The Move Market Summary

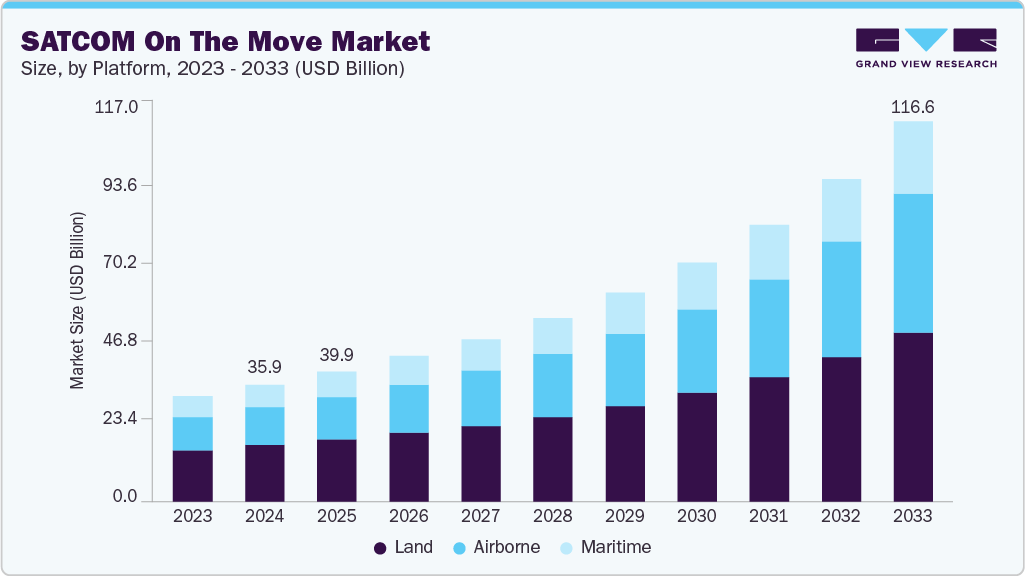

The global SATCOM on the move market size was estimated at USD 35.93 billion in 2024 and is projected to reach USD 116.59 billion in 2033, growing at a CAGR of 14.4% from 2025 to 2033. The satcom on the move (SOTM) market’s growth is primarily driven by the growing demand for uninterrupted and high-speed connectivity across mobile platforms such as military vehicles, ships, aircraft, and commercial fleets.

Key Market Trends & Insights

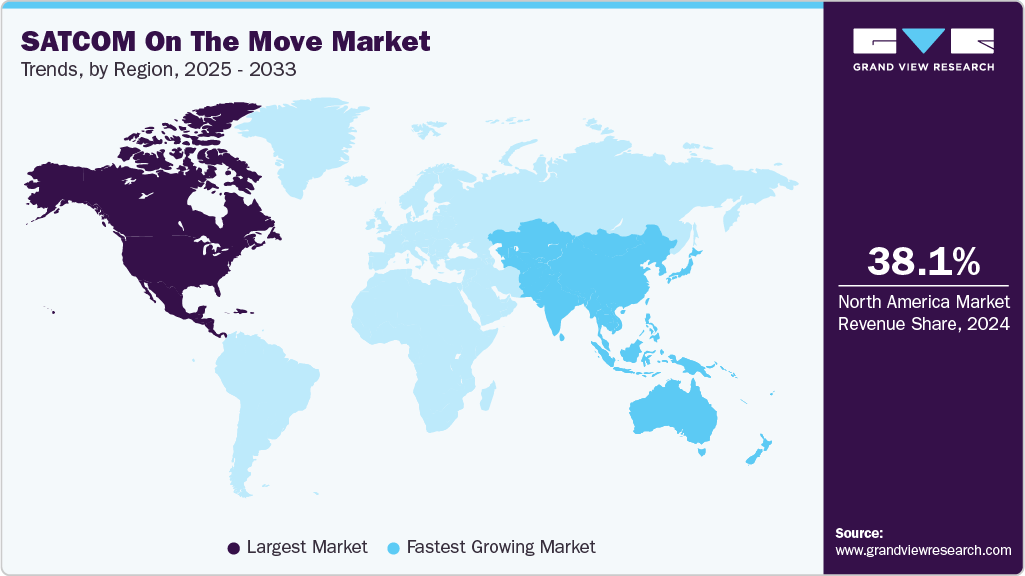

- North America dominated the satcom on the move market with the largest revenue share of 38.13% in 2024.

- The U.S. satcom on the move industry is the largest in North America, driven by a combination of economic scale, advanced infrastructure, and supportive regulatory frameworks.

- By platform, the land segment held the largest revenue share of 46.75% in 2024.

- By frequency band, the Ku-band segment held the largest revenue share of 35.80% in 2024.

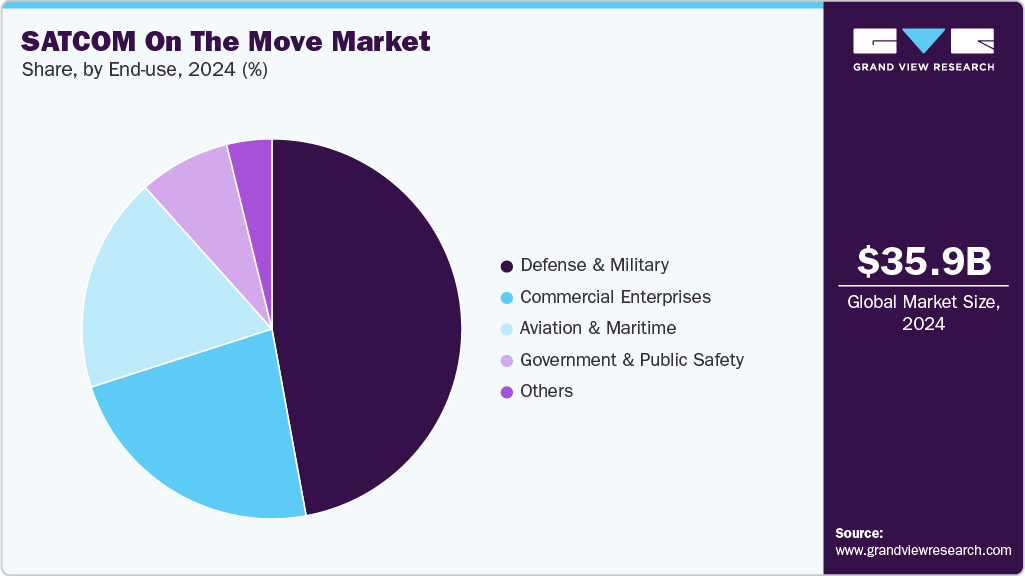

- By end use, the defense & military segment held the largest revenue share of 47.12% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 35.93 Billion

- 2033 Projected Market Size: USD 116.59 Billion

- CAGR (2025-2033): 14.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As real-time communication becomes increasingly critical, especially in remote or hostile environments, SOTM systems enable seamless voice, video, and data transmission while in motion. The rise in global defense and homeland security spending is a key factor contributing to market growth, as governments prioritize advanced communication capabilities to enhance situational awareness, command and control, and secure communication during mobile operations.

Rising defense and homeland security investments are also propelling the growth of the SATCOM on the move industry. Armed forces worldwide are prioritizing secure and mobile communication systems that ensure situational awareness, command coordination, and mission continuity in dynamic operational environments. Governments are deploying SOTM systems in military vehicles, naval fleets, and aircraft to maintain communication links even in hostile or geographically dispersed terrains.

Technological advancements in satellite communications are making SATCOM on the move more viable and cost-effective. The deployment of low-earth orbit (LEO) satellite constellations has significantly reduced latency while enhancing data throughput, making real-time mobile connectivity more efficient. At the same time, compact and lightweight electronically steered antennas (ESA) are replacing traditional bulky mechanical systems, allowing for easier integration across a variety of mobile platforms, including vehicles, ships, and aircraft. These innovations have broadened the applicability of SOTM solutions, enabling high-speed and resilient communication in increasingly mobile and data-intensive operational environments.

The satcom on the move market, despite its growth potential, faces several key restraints that may hinder broader adoption or slow down market expansion across certain regions and sectors. One major challenge is the high initial cost of deployment, including the expense of advanced satellite terminals, integration with mobile platforms, and ongoing subscription or bandwidth fees. These costs can be prohibitive for smaller commercial operators or government agencies with limited budgets, particularly in developing countries.

Platform Insights

The land segment dominated the SATCOM on the move industry with the largest revenue share of 46.75% in 2024. This dominance is primarily attributed to the widespread deployment of SATCOM on the move systems across military ground vehicles, emergency response units, and commercial transportation fleets. In defense, land-based mobile command centers and armored vehicles rely heavily on satellite connectivity to maintain secure communication links in remote or infrastructure-deficient regions. These systems support real-time situational awareness, command coordination, and intelligence sharing in dynamic field environments.

The airborne segment is expected to register the fastest CAGR of 15.8% over the forecast period, driven by its critical role in enabling real-time, high-bandwidth communication for both military and commercial aviation applications. In defense, airborne SATCOM systems provide uninterrupted connectivity for surveillance aircraft, unmanned aerial vehicles (UAVs), and command-and-control platforms operating in remote or contested environments. These systems support mission-critical functions such as live video streaming, target tracking, and secure communications.

Frequency Band Insights

The Ku-band segment dominated the satcom on the move market with a market share of 35.80%. This dominance is largely due to its widespread availability, mature infrastructure, and ability to deliver reliable, high-capacity connectivity for mobile platforms. Ku-band frequencies are well-suited for dynamic environments, offering robust performance in both commercial and defense applications such as in-flight connectivity, maritime communications, and mobile command units.

The Ka-band segment is expected to register the fastest CAGR of 16.3% over the forecast period, driven by its capability to support higher bandwidth and faster data transmission compared to conventional frequency bands, increasing demand for high-throughput applications such as real-time video, broadband internet access, and surveillance across mobile platforms is accelerating the adoption of Ka-band SATCOM solutions in sectors including defense, aviation, maritime, and ground mobility.

End Use Insights

The defense and military segment led the market with the largest revenue share of 47.12% in 2024, supported by the growing need for secure, real-time communication in remote and mobile operational settings. Armed forces worldwide are increasingly deploying SATCOM on the move systems to enable effective command and control, surveillance, and intelligence-sharing capabilities across ground, naval, and airborne platforms. Additionally, the ability of SOTM systems to operate independently of terrestrial networks makes them critical for operations in contested or infrastructure-limited areas.

The commercial enterprises segment is expected to witness the fastest CAGR of 15.7% over the forecast period, fueled by increasing demand for reliable mobile connectivity across industries such as transportation, energy, media, and telecommunications. As organizations expand their operations into remote and mobile environments, the need for uninterrupted data access, voice communication, and real-time monitoring continues to rise. Businesses are increasingly adopting SOTM solutions to support applications such as fleet management, remote asset tracking, live broadcasting, and field operations. The rise in connected commercial vehicles, offshore platforms, and mobile command units is also contributing to this trend.

Regional Insights

The North America SATCOM on the move market dominated with the largest revenue share of 38.13% in 2024, supported by strong defense spending, advanced satellite infrastructure, and widespread adoption of mobile connectivity solutions across both government and commercial sectors. The U.S., in particular, plays a key role due to its significant investments in military modernization programs and its emphasis on enhancing real-time communication capabilities for mobile operations across air, land, and sea.

U.S. SATCOM On The Move Market Trends

The U.S. drives the North America satcom on the move industry through substantial defense investments, robust satellite communication infrastructure, and early adoption of advanced mobile connectivity technologies. The U.S. Department of Defense actively integrates SATCOM solutions across all branches of the military to ensure secure, high-bandwidth communication in mobile and remote operations. This includes deployment on ground vehicles, naval ships, and airborne platforms to support surveillance, reconnaissance, command and control functions.

Asia Pacific SATCOM On The Move Market Trends

The Asia Pacific SATCOM on the move industry is expected to register the fastest CAGR of 16.8% during the forecast period. Many Asia Pacific countries, including China, India, Japan, and South Korea, are significantly increasing their defense budgets to enhance tactical communication capabilities. SOTM systems are being integrated into land vehicles, naval fleets, and UAVs to enable secure, real-time connectivity in remote and contested environments. This is particularly relevant given the region's geopolitical tensions and border security challenges. Additionally, Asia Pacific is home to some of the world’s busiest air routes and maritime trade corridors. Airlines and shipping companies are increasingly adopting SATCOM systems to provide in-flight entertainment, live tracking, and crew communications. This trend is reinforced by growing passenger expectations and international trade expansion.

The China SATCOM on the move market is expected to grow over the forecast period. China’s investment in its domestic satellite infrastructure including the Beidou Navigation Satellite System and multiple high-throughput geostationary and LEO satellites supports the scalability of SOTM services. In parallel, domestic manufacturers are producing cost-competitive electronically steered antennas and mobile terminals, accelerating adoption across both defense and civilian sectors.

The SATCOM on the move market in India is expected to grow during the forecast period. One of the main drivers is India’s defense modernization strategy, which places emphasis on network-centric operations. The Indian Armed Forces are increasingly deploying SOTM systems across armored vehicles, aircraft, and naval vessels to maintain secure communication in remote and high-conflict zones such as Jammu & Kashmir, Ladakh, and the northeastern states. These systems are essential for command and control, ISR (intelligence, surveillance, reconnaissance), and troop mobility, especially in regions lacking reliable terrestrial infrastructure.

Europe SATCOM On The Move Market Trends

The Europe SATCOM on the move industry is experiencing notable growth, driven by several region-specific factors rooted in defense modernization, digital autonomy, and commercial mobility demands. For instance, In December 2024, the European Union advanced its commitment to secure satellite communications through the USD 11.04 billion (EUR 10.6 billion) IRIS² (Infrastructure for Resilience, Interconnectivity and Security by Satellite) constellation program. This initiative is intended to provide high-speed, multi-orbit connectivity for governmental and defense missions while expanding access for commercial applications. It underscores the EU’s strategic priority to reduce reliance on non-European satellite operators and reinforce regional communication sovereignty.

The UK SATCOM on the move market is projected to grow during the forecast period. In the UK, the integration of Low Earth Orbit (LEO) constellations and high-throughput satellites (HTS) is transforming the SATCOM on the move landscape. LEO constellations provide significantly lower latency and faster data transmission compared to traditional geostationary satellites, supporting real-time applications and dependable connectivity in remote and underserved regions. These capabilities are particularly critical for sectors such as transportation, emergency services, energy, and maritime operations.

Key SATCOM On The Move Company Insights

Some of the key players operating in the SATCOM on the move market include L3Harris Technologies, Inc., General Dynamics Mission Systems, Inc., Thales, and Honeywell International Inc. These companies are actively investing in research and development (R&D) to enhance system efficiency, safety, and reliability. Key areas of innovation include the development of compact and lightweight electronically steered antennas (ESA) to replace bulky mechanical systems, integration of multi-orbit satellite connectivity combining GEO, MEO, and LEO networks for lower latency and higher bandwidth, and the adoption of software-defined terminals for improved flexibility and interoperability. In addition, advancements in cybersecurity, artificial intelligence (AI)-driven network management, and ruggedized hardware for challenging environments enable more reliable and secure communications for both defense and commercial mobile applications.

-

L3Harris Technologies, Inc. is an American aerospace and defense company established in 2019 through the merger of L3 Technologies and Harris Corporation. Headquartered in Melbourne, Florida, the company operates through four primary business segments: Integrated Mission Systems, Space and Airborne Systems, Communication Systems, and Aviation Systems. Its offerings include communication, surveillance, electronic, and space-based solutions for government and commercial applications. In the area of SATCOM on the move (SOTM), L3Harris develops compact and rugged terminals for land, maritime, and airborne platforms. These systems operate across GEO, MEO, and LEO satellite networks, enabling mobile connectivity for defense operations, emergency services, and communication in remote areas.

-

Thales Group is a French multinational company headquartered in Paris, specializing in aerospace, defense, electronics, and cybersecurity. The company operates through key business segments including Defence & Security, Aeronautics & Space, and Digital & Cybersecurity. Its offerings include communication, surveillance, electronic, and satellite-based solutions for government and commercial use. The company supplies SATCOM-on-the-Move terminals and modems for land vehicles, naval vessels, and aircraft. These systems integrate electronically steered and stabilized antennas with IP-based modems such as Modem 21 and RuggSAT to deliver secure, wide-bandwidth connectivity over GEO, MEO, and LEO constellations.

Key SATCOM On The Move Companies:

The following are the leading companies in the SATCOM on the move market. These companies collectively hold the largest market share and dictate industry trends.

- L3Harris Technologies, Inc.

- General Dynamics Mission Systems, Inc.

- RTX Corporation

- Thales

- Viasat, Inc.

- EchoStar Corporation

- Honeywell International Inc.

- Gilat Satellite Networks

- Hughes Network Systems, LLC

- Elbit Systems Ltd.

Recent Developments

-

In June 2025, Thales signed a contract with Airbus Defence & Space to supply its AVIATOR 700S safety satcom system for the A400M military transport aircraft, enhancing secure cockpit and passenger data communications via Viasat SB‑S and Inmarsat services. The system improves connectivity, navigation, and surveillance, reduces pilot workload, and aligns with military operational needs, further expanding Thales’s role in the A400M program, where it already provides avionics, flight control, and mission systems.

-

In August 2022, OneWeb and Intelsat entered into a global distribution agreement to provide airlines with an integrated inflight connectivity (IFC) solution that combines coverage from low Earth orbit (LEO) and geostationary (GEO) satellite networks. Under the partnership, Intelsat will distribute OneWeb’s LEO satellite services to airlines worldwide, leveraging its existing experience in IFC operations and GEO satellite infrastructure to support continuous and reliable connectivity during flight.

SATCOM On The Move Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.88 billion

Revenue forecast in 2033

USD 116.59 billion

Growth rate

CAGR of 14.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, frequency band, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

L3Harris Technologies, Inc.; General Dynamics Mission Systems, Inc.; RTX Corporation; Thales; Viasat, Inc.; EchoStar Corporation; Honeywell International Inc.; Gilat Satellite Networks; Hughes Network Systems, LLC; Elbit Systems Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global SATCOM On The Move Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the SATCOM on the move market report based on platform, frequency band, end use, and region:

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Land

-

Airborne

-

Maritime

-

-

Frequency Band Outlook (Revenue, USD Million, 2021 - 2033)

-

L-band

-

Ku-band

-

Ka-band

-

Multi-band

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Defense & Military

-

Government & Public Safety

-

Commercial Enterprises

-

Aviation & Maritime

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global SATCOM on the move Market size was estimated at USD 35.93 billion in 2024 and is expected to reach USD 39.88 bllion by 2025.

b. The global SATCOM on the move market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2033 and is expected to reach USD 116.59 billion by 2033.

b. In the SATCOM on the move market, the defense & military segment dominated the market with a 47.12% share in 2024, primarily driven by the rising demand for secure and reliable communications for real-time mission coordination, surveillance, and intelligence sharing across land, air, and naval platforms.

b. Some of the key players are L3Harris Technologies, Inc.; General Dynamics Mission Systems, Inc.; RTX Corporation; Thales; Viasat, Inc.; EchoStar Corporation; Honeywell International Inc.; Gilat Satellite Networks; Hughes Network Systems, LLC; Elbit Systems Ltd.

b. The market growth can be attributed to the rising adoption of advanced satellite communication technologies for uninterrupted connectivity across mobile platforms, including ground vehicles, aircraft, and naval vessels. Increasing military modernization initiatives, the proliferation of unmanned systems, and the demand for real‑time intelligence, surveillance, and reconnaissance (ISR) capabilities are fueling the need for SATCOM on the move solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.