- Home

- »

- Medical Devices

- »

-

Saudi Arabia Blood Glucose Monitoring Devices Market, Industry Report 2030GVR Report cover

![Saudi Arabia Blood Glucose Monitoring Devices Market Size, Share & Trends Report]()

Saudi Arabia Blood Glucose Monitoring Devices Market Size, Share & Trends Analysis Report By Product (Self-monitoring, Continuous Glucose Monitoring), By End-use (Hospitals, Homecare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-265-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

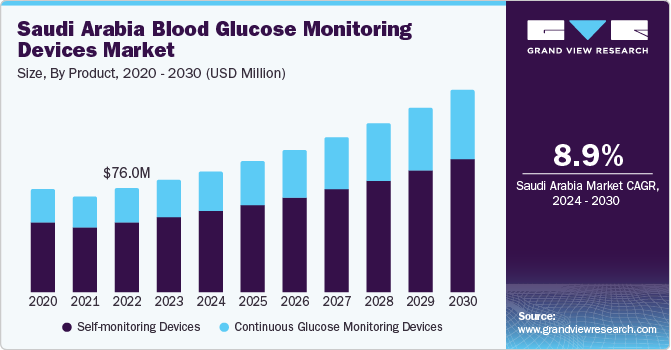

The Saudi Arabia blood glucose monitoring devices market size was estimated at USD 81.97 million in 2023 and is expected to grow at a CAGR of 8.9% from 2024 to 2030. Major factors contributing to market growth are the increasing prevalence of diabetes, advancements in technology, government initiatives, and several demographic factors. For instance, according to the International Diabetes Federation (IDF), approximately 4.27 million people had diabetes in 2021, which is expected to increase to 5.63 million by 2030 and 7.53 million by 2045.

Government efforts targeting enhanced diabetes care and management in Saudi Arabia and expanding healthcare infrastructure are boosting market growth by enabling improved access to diabetes management devices for patients nationwide. For instance, in January 2024, the Minister of Health of Saudi Arabia was presented with a Guinness World Record certificate for the Diabetes Center in Al-Ahsa. This center focuses on providing specialized treatment for Type 1 diabetes patients. The record was attained for organizing the largest simultaneous human gathering dedicated to diabetes awareness and education, with 752 individuals coming together.

Technological advancements have spurred the creation of more precise, user-friendly, and convenient blood glucose monitoring (BGM) devices, which are gaining popularity among healthcare providers and patients. For instance, in August 2023, Nemaura Medical obtained approval from the Saudi Food and Drug Authority (SFDA) for its non-invasive wearable glucose sensor, sugarBEAT. Classified as a Class IIb medical device with a CE mark, this device provides valuable insights through continuous glucose monitoring and analysis of daily glucose trends.

Market Concentration & Characteristics

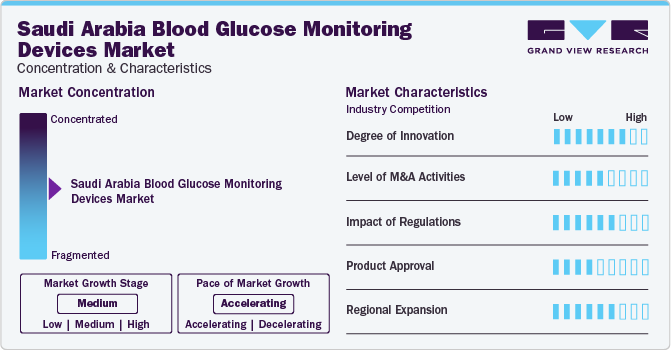

The industry growth stage is high, and the pace of the growth is accelerating. This is fueled by several key factors, including significant innovation within the industry. Continuous advancements in technology within the BGM devices industry are key growth drivers. These technological breakthroughs have resulted in more advanced and effective devices, boasting enhanced accuracy, quicker testing times, and superior user interfaces. Such ongoing innovations fuel industry expansion by addressing the ever-changing requirements of healthcare providers and patients seeking enhanced solutions for managing diabetes more effectively.

Leading industry players consistently enhance their product portfolios to broaden their customer reach and increase their market share. This includes upgrading existing products, considering strategic acquisitions, securing necessary government approvals, and engaging in collaboration initiatives. For instance, in November 2023, Saudi Pharmaceutical Industries and Medical Appliances Corp. (SPIMACO)'s subsidiary, Dammam Pharma Co., formed a strategic alliance agreement with Merck Sharp & Dohme International (MSD) to manufacture type 2 diabetes medications in the Kingdom of Saudi Arabia.

The level of innovation in blood glucose monitoring devices in Saudi Arabia is remarkable, with ongoing advancements aimed at improving their accuracy, user-friendliness, and overall effectiveness. For instance, in January 2024, King Abdullah University of Science and Technology (KAUST) and Saudi health tech firm AmplifAI Health collaborated to develop an innovative diabetes detection system.

Companies manufacturing blood glucose monitoring devices are undertaking merger and acquisition activities. This strategic approach seeks to improve technological capabilities, expand industry reach, and maintain competitiveness. For instance, in April 2022, Medtronic collaborated with GE Healthcare to address the distinct needs and demand for care at ambulatory surgery centers and office-based laboratories. This new alliance allows Customers to access a wide range of products, financial solutions, and service excellence.

Regulations substantially influence the landscape of blood glucose monitoring devices in Saudi Arabia, affecting aspects ranging from product approval to market entry and post-industrial monitoring. The regulatory framework governing medical devices in the country prioritizes the safety, efficacy, and quality of blood glucose monitoring devices while fostering innovation and market competitiveness. The SFDA, Saudi Arabia's regulatory authority, is responsible for overseeing the registration and approval of medical devices, including blood glucose monitoring devices.

Manufacturers launching new products to stay competitive in the market and the growing demand and adoption of blood glucose monitoring devices are important factors driving industry growth.

Expanding the distribution and availability of blood glucose monitoring devices in Saudi Arabia represents a notable opportunity for enhancing diabetes management in the region. Given the rising population and escalating diabetes rates, there is a growing demand for accessible and dependable glucose monitoring solutions.

Product Insights

The self-monitoring device segment held the largest market share of over 67.1% in 2023. Self-monitoring blood glucose (SMBG) devices have been the conventional approach for monitoring blood glucose levels in individuals with diabetes. These devices provide a convenient and accessible way for patients to monitor their glucose levels regularly, whether at home or on the move. The familiarity and simplicity associated with SMBG devices have played a key role in their extensive adoption by healthcare providers and patients.

Continuous glucose monitoring devices is expected to grow at the fastest rate over the forecast period. CGM devices have brought a shift in the way blood glucose is now monitored and treated. Both providers and patients look for more digitally advanced options to manage diabetes and improve virtual care. CGM has numerous advantages over self-monitoring devices, such as convenient & noninvasive methods of blood glucose monitoring, smaller device sizes, more convenient & reliable, timely monitoring of blood glucose levels, closer understanding of lows & highs in tests, and improved care & decision-making.

End-use Insights

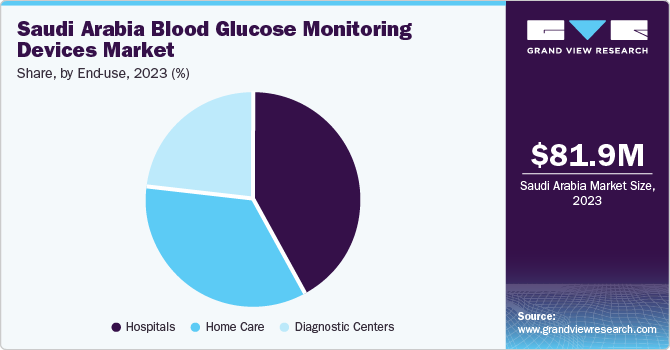

The hospital segment dominated the market with a share of over 41.8% in 2023. The increasing hospital admissions among diabetes patients, who face a threefold higher risk compared to non-diabetic individuals, highlight the urgent requirement for effective glucose monitoring tools within hospital settings. Furthermore, rapid advancements in diabetes technology in recent years have resulted in more sophisticated BGM devices specifically designed for hospital environments.

The home care segment is expected to grow significantly during the forecast period from 2024 to 2030. As BGM devices have become user-friendly, accurate, and accessible, individuals gain the ability to monitor their blood glucose levels conveniently and independently from the comfort of their homes. Furthermore, technological advancements have spurred the development of innovative BGM devices equipped with features like wireless connectivity, cloud-based data storage, and smartphone integration. These capabilities enable effortless data tracking, analysis, and sharing with healthcare providers, thereby facilitating remote monitoring and telemedicine consultations. Consequently, patients receive timely feedback and personalized guidance, enhancing adherence to treatment regimens and improving glycemic control.

Key Saudi Arabia Blood Glucose Monitoring Devices Company Insights

Major players in the market are actively enhancing their product offerings through product upgrades, strategic collaborations, potential acquisitions, and obtaining necessary government approvals to expand their customer base and capture a larger market share. Among the prominent market players are Medtronic plc., Abbott Laboratories, and F. Hoffmann-La Roche Ltd.

Key Saudi Arabia Blood Glucose Monitoring Devices Companies:

- Medtronic plc

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Sanofi

- Novo Nordisk A/S

Recent Developments

-

In May 2023, Medtronic plc revealed its plans to acquire EOFlow Co. Ltd., the maker of the EOPatch device-an entirely disposable, tubeless, and wearable insulin delivery system. The integration of EOFlow into Medtronic's portfolio, alongside its Meal Detection Technology algorithm and advanced continuous glucose monitor (CGM), is expected to bolster the company's ability to cater to a wider spectrum of individuals with diabetes, regardless of their treatment stage or insulin delivery method preferences.

-

In August 2022, Abbott entered a strategic partnership with WW International, Inc. (WeightWatchers). Through this collaboration, both entities will integrate the WeightWatchers weight management program tailored for individuals with diabetes with Abbott's range of FreeStyle Libre products, creating a cohesive mobile experience. This collaboration aims to provide users with valuable knowledge and insights to enhance their dietary habits, lower their blood sugar levels, and ultimately empower them to regain control over their health.

-

In February 2023, Insulet Corporation completed the acquisition of the insulin pump patents from Bigfoot Biomedical (Bigfoot), a company renowned for its expertise in insulin delivery technologies.

Saudi Arabia Blood Glucose Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 88.63 million

Revenue forecast in 2030

USD 148.19 million

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Key companies profiled

Medtronic plc; Abbott Laboratories; F. Hoffmann-La Roche Ltd; Bayer AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Sanofi; Novo Nordisk A/S

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Saudi Arabia Blood Glucose Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the Saudi Arabia blood glucose monitoring devices market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitter & Receiver

-

Insulin Pumps

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Diagnostic Centers

-

Frequently Asked Questions About This Report

b. The Saudi Arabia blood glucose monitoring devices market size was estimated at USD 81.97 million in 2023 and is expected to reach USD 88.63 million in 2024.

b. The Saudi Arabia blood glucose monitoring devices market is expected to grow at a compound annual growth rate of 8.94% from 2024 to 2030 to reach USD 148.19 million by 2030.

b. Self-monitoring device dominated the Saudi Arabia blood glucose monitoring devices market type segment with a share of over 67.1% in 2023.

b. Some key players operating in the Saudi Arabia blood glucose monitoring devices market include Medtronic plc; Abbott Laboratories; F. Hoffmann-La Roche Ltd; Bayer AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Sanofi; Novo Nordisk A/S

b. Key factors that are driving the market growth include the growing prevalence of diabetes, technological advancements and strategic initiatives undertaken by the government.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."