- Home

- »

- Homecare & Decor

- »

-

Sauna Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Sauna Market Size, Share & Trends Report]()

Sauna Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Traditional Sauna, Infrared Sauna, Electric Sauna), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-389-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Sauna Market Summary

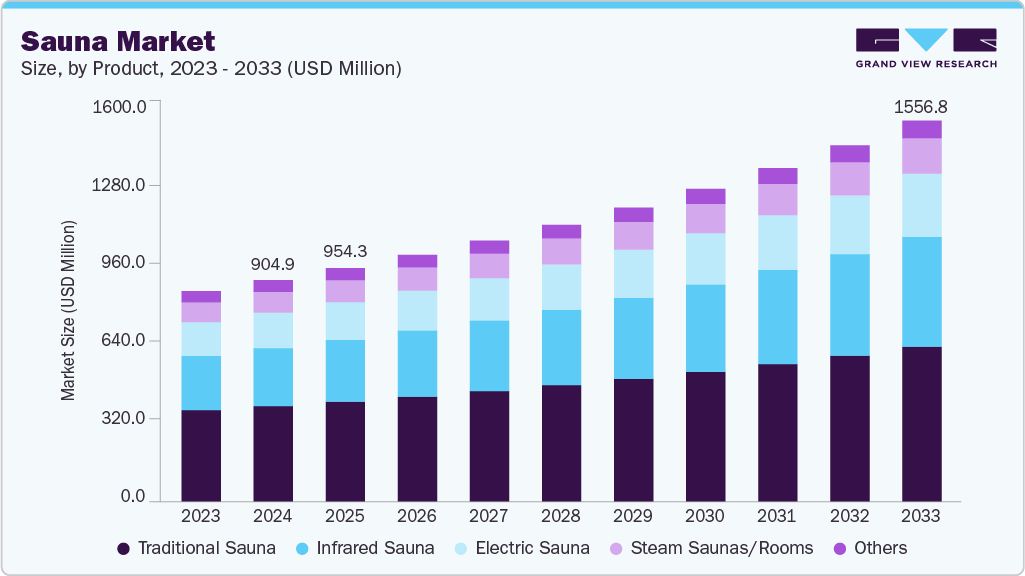

The global sauna market size was estimated at USD 904.9 million in 2024 and is projected to reach USD 1,556.8 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The global demand for saunas is experiencing a significant upsurge, driven by several key factors that underscore the convergence of wellness trends, technological advancements, and evolving consumer preferences.

Key Market Trends & Insights

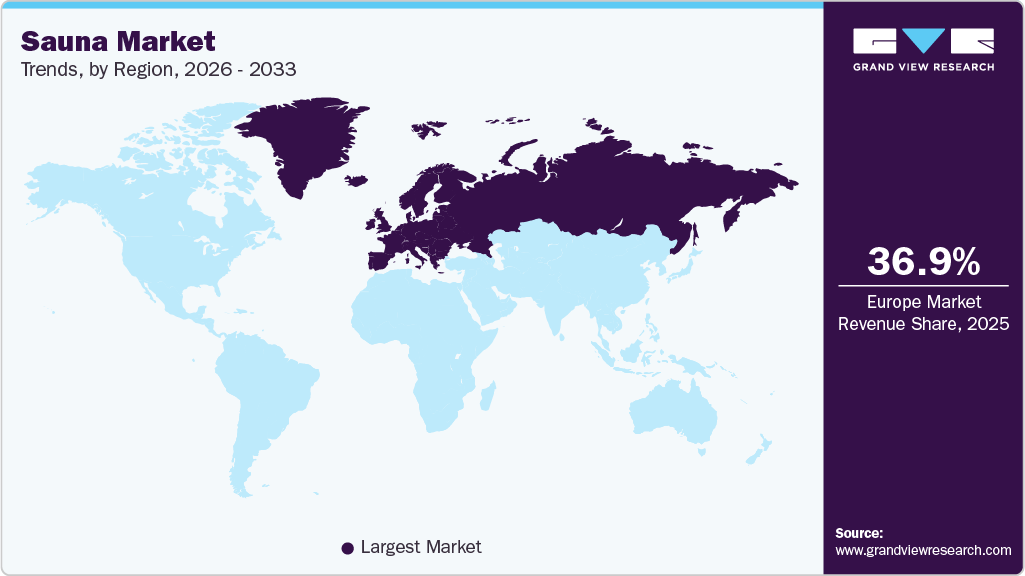

- Europe sauna industry accounted for a share of 36.82% in the year 2024.

- The sauna industry in the U.S. is expected to grow at a CAGR of 5.3% from 2025 to 2033.

- By product, the traditional sauna held the largest market share of 43.06% in 2024.

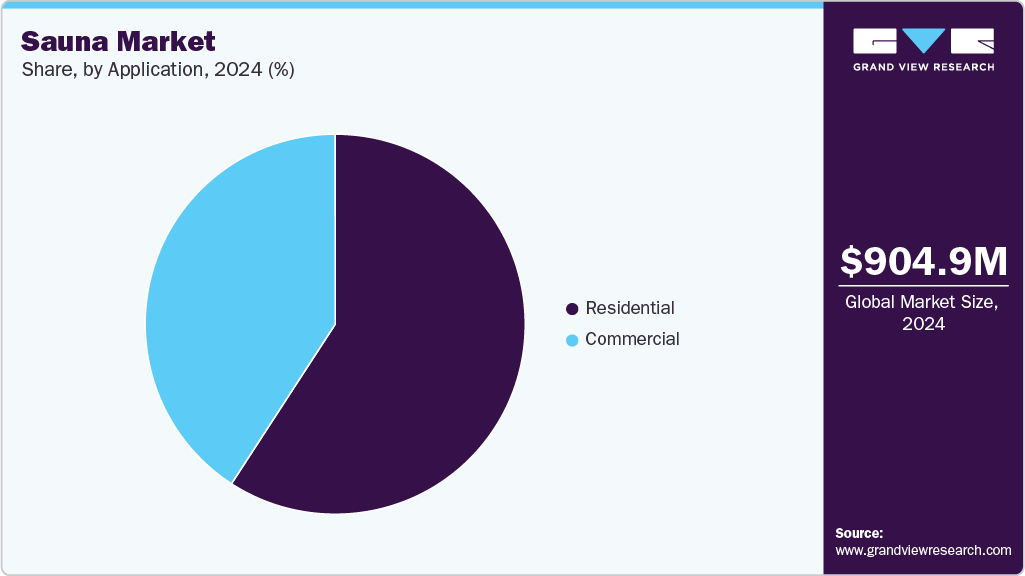

- By application, the residential segment held the largest market share of 59.17% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 904.9 Million

- 2033 Projected Market Size: USD 1,556.8 Million

- CAGR (2025-2033): 6.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Modern consumers are increasingly prioritizing holistic health approaches, which include stress reduction, detoxification, and overall well-being. Saunas, renowned for their benefits in promoting relaxation, improving cardiovascular health, and aiding muscle recovery, are becoming a staple in both personal and commercial wellness routines. This heightened awareness of health benefits is propelling demand in various segments, including residential, hospitality, and fitness industries.Technological innovations in sauna design and functionality are also playing a crucial role in expanding market reach. The development of advanced heating technologies, such as infrared and hybrid systems, has broadened the appeal of saunas by offering more efficient, customizable, and energy-saving solutions. These innovations cater to diverse consumer needs, from traditional high-heat enthusiasts to those seeking gentler, therapeutic heat experiences. Enhanced digital controls and smart home integrations are further driving adoption, making saunas more user-friendly and accessible, thus increasing their appeal across different demographics.

The hospitality sector's adoption of wellness amenities, including saunas, is another significant contributor to the global market growth. Hotels, resorts, and luxury accommodations are increasingly incorporating saunas into their wellness offerings to attract health-conscious travelers. This trend is particularly pronounced in high-end and boutique hotels where personalized wellness experiences are a key differentiator. By providing state-of-the-art sauna facilities, these establishments enhance their service portfolio, thereby boosting occupancy rates and customer satisfaction.

According to the statistics published by Finland Toolbox, sauna usage in the country is deeply ingrained in the culture, with 90% of the population engaging in sauna sessions at least once weekly, and 40% participating multiple times per week. This consistent usage not only promotes a culture of wellness and relaxation but also enhances global awareness and adoption of sauna experiences. The cultural prevalence of sauna usage stimulates innovation in sauna technologies and services, catering to varied consumer preferences and expanding market opportunities worldwide.

The expanding urbanization and rising disposable incomes in emerging markets are fostering a new consumer base for saunas. In regions such as Asia-Pacific and Latin America, the burgeoning middle class is showing an increased propensity for lifestyle and wellness products. The growing popularity of home wellness installations, including saunas, reflects this trend, as consumers seek to replicate spa-like experiences within their homes. This shift is driving manufacturers to innovate and offer cost-effective, space-efficient sauna solutions suitable for urban living environments.

To fortify their global presence, manufacturers and key players in the sauna industry are strategically forming partnerships and acquiring technology-integrated firms to bolster supply chain resilience. For instance, in September 2023, Harvia Plc completed the acquisition of Phoenix El-Mec srl, a renowned manufacturer of electromechanical timers used in sauna heaters. Phoenix El-Mec has served as a trusted supplier to Harvia for an extended period. This acquisition is aimed at enhancing supply chain robustness and ensuring the uninterrupted availability of critical components for Harvia's sauna heater production. By securing critical components through internal capabilities, companies can meet growing market demand more effectively, thereby fostering greater consumer confidence and market expansion opportunities globally.

Consumer Insights for the Sauna Market

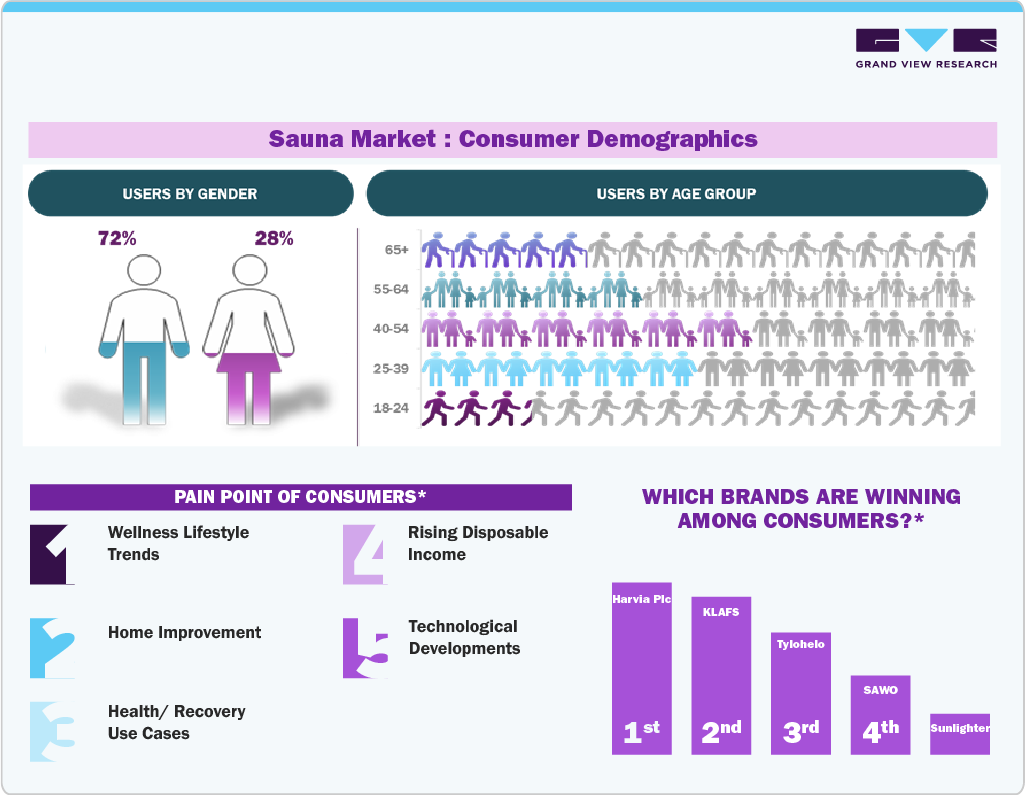

Sauna user demographics exhibit clear heterogeneity by both age and gender across geographies. Evidence from Nordic health and population studies indicates a strong tradition of regular sauna bathing among middle-aged and older adults, with participation rates often higher among men in countries such as Finland and Sweden; for example, some Nordic studies report a greater proportion of male sauna bathers relative to female bathers when measured by monthly frequency. Conversely, survey data from North America suggest a different profile in which female respondents-particularly those in the 30-45 age band-represent a substantial share of the sauna-using population. Across studies, the modal user tends to be in middle adulthood (roughly 30-65 years), with lower relative usage reported at the extremes of age (young adults under 25 and the very elderly), though older cohorts continue to engage with sauna bathing in many markets.

These findings underscore that gender balances and age distributions are market- and culture-specific rather than globally uniform, and that sampling frameworks and study objectives (health outcomes versus consumer behaviour) materially affect reported splits. Consequently, any go-to-market segmentation, product positioning, or communications strategy should be informed by regionally representative consumer research rather than extrapolation from Nordic or single-country surveys. Where precise age × gender matrices are required for commercial decision-making, bespoke primary research or aggregation of nationally representative datasets is recommended, since published studies frequently differ in definitions of “sauna user” (e.g., ≥once/month versus ≥twice/week) and in age cohort boundaries.

Product Insights

The traditional sauna accounted for a market share of 43.06% in 2024. The demand for traditional saunas is surging due to a combination of factors, including increased awareness of their health benefits, cultural influence, and the rising trend of wellness tourism. Traditional saunas offer a unique and authentic experience that promotes relaxation, detoxification, and improved circulation, which appeals to health-conscious consumers. In addition, the integration of traditional saunas in luxury hotels, spas, and wellness centers as premium amenities enhances their market appeal. Growing disposable incomes and a heightened focus on holistic wellness practices are further driving the adoption of traditional saunas in both residential and commercial settings worldwide.

The demand for infrared saunas is projected to grow at a CAGR of 7.5% over the forecast period of 2025 to 2033. The demand for these products is growing on account of their perceived health benefits, energy efficiency, and user-friendly design. Infrared saunas operate at lower temperatures than traditional saunas, making them more comfortable for a wider range of users while still offering benefits such as improved circulation, pain relief, and detoxification. Their relatively lower operating costs and easier installation process appeal to both residential consumers and commercial establishments. Key players operating in the market are launching new products that cater to this trend. For instance, in September 2024, Effegibi, an Italian wellness brand, launched new sauna models in 2023, including the Aladdin sauna and the versatile Natural modular cubicle, which was offered in configurations as a sauna, hammam, or infrared sauna. In addition, the growing trend towards personalized health and wellness solutions has led to increased adoption of infrared saunas in home settings, fitness centers, and wellness spas, further driving market growth.

Application Insights

The demand for saunas in the residential sector held a market share of 59.17% in 2024. The growth is driven by heightened consumer focus on health, wellness, and home-based relaxation solutions. As awareness of the benefits of regular sauna use, such as improved cardiovascular health, stress reduction, and detoxification, grows, more homeowners are investing in saunas to enhance their wellness routines. In addition, advancements in technology have led to more compact, affordable, and user-friendly sauna models, such as infrared and hybrid saunas, which cater to varying space and budget constraints. The rising trend of home remodeling and the desire for personal relaxation spaces further contribute to the increased adoption of residential saunas. Enhanced marketing and the availability of customizable options also play a significant role in driving consumer demand.

The demand for saunas in the commercial sector is projected to grow at a CAGR of 6.9% over the forecast period from 2025 to 2033. In the commercial segment, the rising demand for saunas is driven by the growing emphasis on wellness and luxury amenities in various business establishments. Gyms, spas, hotels, and wellness centers are increasingly incorporating saunas to offer a comprehensive range of relaxation and therapeutic services that attract and retain clients. The integration of saunas enhances the value proposition of these facilities, catering to the evolving expectations of consumers who seek high-quality, holistic wellness experiences during their leisure time or while traveling.

The commercial and institutional sectors are recognizing the benefits of saunas in promoting employee well-being and productivity. Corporate wellness programs are increasingly incorporating saunas to enhance workplace health initiatives, reduce stress, and improve overall employee satisfaction. Similarly, sports complexes and rehabilitation centers utilize saunas for their therapeutic benefits, aiding in physical recovery and performance enhancement. This institutional adoption underscores the versatility and broad applicability of saunas, contributing to their sustained demand across diverse market segments globally.

Regional Insights

The sauna industry in North America held a 28.23% market share of the global revenue in 2024. As consumers increasingly prioritize health and relaxation, saunas are being integrated into home wellness spaces and commercial establishments, such as gyms and spas. The rise of wellness trends, coupled with growing disposable incomes and a culture that values health-oriented investments, is driving this demand. In addition, the availability of innovative and space-efficient sauna designs, such as infrared saunas that offer convenience and health benefits, is expanding the market's appeal to both residential and commercial consumers across the region.

U.S. Sauna Market Trends

The sauna industry in the U.S. is expected to grow at a CAGR of 5.3% from 2025 to 2033. The increasing awareness of the therapeutic benefits of sauna use, including stress relief, improved circulation, and detoxification, is driving consumer interest. Moreover, the integration of saunas into luxury home renovations and high-end real estate projects is contributing to market growth. The U.S. market is also witnessing a rise in commercial installations in fitness centers, hotels, and spas, where saunas are valued as premium amenities that enhance the overall customer experience and attract health-conscious consumers.

Asia Pacific Sauna Market Trends

The Asia Pacific sauna industry is projected to grow at a CAGR of 7.6% from 2025 to 2033. The region's expanding wellness industry, including spas and fitness centers, is adopting saunas to cater to the rising consumer preference for comprehensive wellness experiences. In addition, the introduction of compact and affordable sauna models is making them accessible to a broader audience, contributing to market growth across diverse countries in the Asia Pacific region.

Europe Sauna Market Trends

Europe sauna industry accounted for a share of 36.82% in the year 2024. Sauna use is an integral part of daily life in many European countries, such as Finland and Sweden, where saunas are deeply embedded in the culture. According to UNESCO Intangible Cultural Heritage, Finland, with a population of 5.5 million, boasts 3.3 million saunas, ensuring widespread accessibility for all residents. This extensive sauna infrastructure underscores the deep cultural significance of saunas in Finnish daily life and highlights their integration into the nation's lifestyle. The market benefits from a longstanding tradition of sauna use, combined with increasing consumer awareness of the health benefits of regular sauna sessions. In addition, the European wellness trend is driving innovations in sauna technology and design, enhancing the appeal of traditional and modern sauna solutions across residential and commercial sectors.

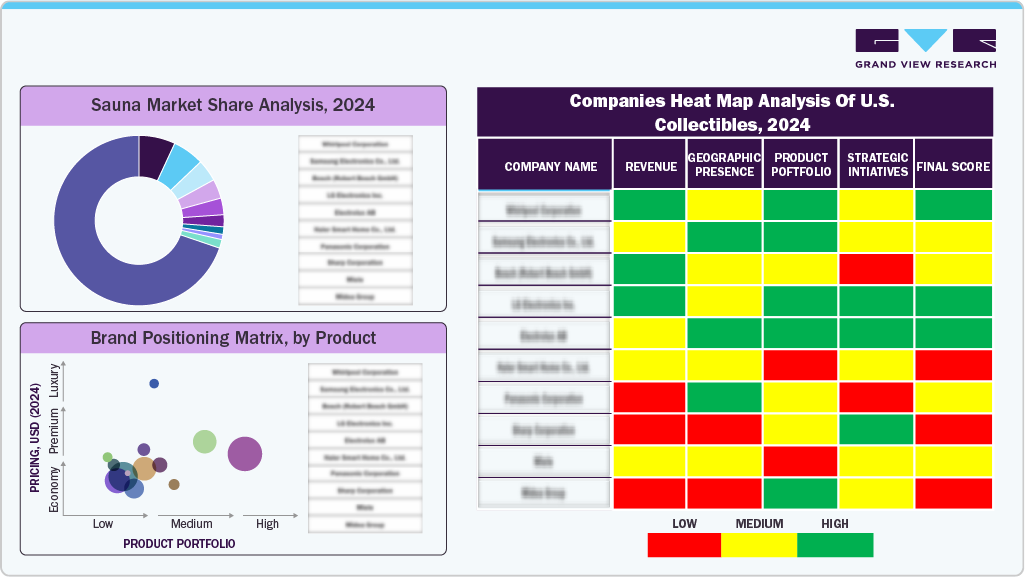

Key Sauna Company Insights

The competitive landscape of the sauna industry is characterized by a diverse and dynamic array of players vying for market share across multiple segments, including traditional, infrared, and steam saunas. Leading global manufacturers, such as Harvia Group, TyloHelo, and KLAFS, dominate the market with their extensive product portfolios, innovative technologies, and strong distribution networks. These industry leaders invest significantly in research and development to introduce cutting-edge designs and improve user experience, thereby maintaining their competitive edge.

In addition, regional players and niche manufacturers contribute to market fragmentation by offering specialized or customized solutions, catering to specific consumer preferences and regional demands. The market is further influenced by trends such as increased consumer focus on wellness, advancements in sauna technology, and the growing integration of saunas into residential and commercial wellness facilities. Competitive strategies include enhancing product differentiation, expanding market presence through strategic acquisitions, and leveraging digital marketing to capture a broader consumer base.

Key Sauna Companies:

The following are the leading companies in the sauna market. These companies collectively hold the largest market share and dictate industry trends.

- Harvia Group

- KLAFS GmbH

- SAUNATEC

- TyloHelo Group

- Sauna360 Inc. (Masco Corporation)

- HUUM

- Syracuse Sauna King

- Effegibi

- Nordic Sauna

- Saunacore

Recent Developments

-

In September 2025, Harvia plc announced the launch of its new control panel, the Fenix, alongside an upgraded mobile application, MyHarvia, which together aimed to deliver a more intuitive and connected sauna experience. The Fenix system incorporated smart learning features and predefined heating profiles, while the MyHarvia app provided remote control, usage statistics, and over-the-air updates. The company indicated that existing Harvia Xenio users could upgrade to Fenix via a simple plug-and-play installation rather than a full system replacement. These innovations were made available through Harvia’s global reseller network, encompassing Europe, North America, and other international markets.

-

In February 2025, KLAFS announced that it had expanded its U.S. portfolio by launching its first outdoor sauna, named TARAS. The new model featured sustainably sourced timber, full-glass front and back walls, triple-pane weather-resistant construction, and a freestanding heater with smart features. It was positioned to join the company’s existing indoor sauna series (ARISO, VALORA, S11) under Kohler Co.’s luxury wellness offerings. The brand emphasised that TARAS seamlessly blended premium design and performance to deliver a high-end wellness experience suitable for outdoor environments.

-

In July 2024, Harvia Plc completed the acquisition of 100% of the shares in ThermaSol Steam Bath LLC, a leading U.S. manufacturer of premium steam showers and steam rooms. This strategic acquisition enhances Harvia Group's sauna portfolio by expanding its presence in the high-value steam segment. The move bolsters Harvia’s market position in the U.S., further solidifying its leadership as a global provider of comprehensive sauna solutions.

-

In March 2023, Harvia Plc, one of the leading sauna manufacturers, and Bergman Ltd. entered into a joint venture to establish Harvia Japan Ltd., thereby strengthening their longstanding collaboration. The joint venture focused on advancing the sales and marketing of Harvia’s sauna and spa products within the Japanese market. The new entity was projected to achieve full operational status by the first half of 2024.

Sauna Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 954.3 million

Revenue forecast in 2033

USD 1,556.8 million

Growth rate

CAGR of 6.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Harvia Group; KLAFS GmbH; SAUNATEC; TyloHelo Group; Sauna360 Inc. (Masco Corporation); HUUM; Syracuse Sauna King; Effegibi; Nordic Sauna; Saunacore

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sauna Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global sauna market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Traditional Sauna

-

Infrared Sauna

-

Electric Sauna

-

Steam Saunas/Rooms

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Wellness Centers/Gyms/Spas

-

Hotels/Hospitality

-

Hospitals/Medical Centers

-

Institutional

-

Others (Public Bathhouses and Community Centers, etc.)

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sauna market was estimated at USD 904.9 million in 2024 and is expected to reach USD 954.3 million in 2025.

b. The global sauna market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 1,556.8 million by 2030.

b. Europe dominated the sauna market, with a share of over 36.82% in 2024. The regional market's growth is driven by rising inclinations toward health and relaxation, growing disposable incomes, and a culture that values health-oriented investments.

b. Some of the key players in the sauna market include Harvia Group, KLAFS GmbH, SAUNATEC, TyloHelo Group, Sauna360 Inc. (Masco Corporation), HUUM, Syracuse Sauna King, Effegibi, Nordic Sauna, and Saunacore.

b. Key factors driving the sauna market growth are the increasing use of saunas due to their benefits in promoting relaxation, improving cardiovascular health, and aiding muscle recovery and the development of advanced heating technologies, such as infrared and hybrid systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.