- Home

- »

- Medical Devices

- »

-

Scanning Electron Microscopes Market Size Report, 2030GVR Report cover

![Scanning Electron Microscopes Market Size, Share & Trends Report]()

Scanning Electron Microscopes Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Life Science, Nanotechnology, Material Science, Semiconductors), By Region (APAC, North America), And Segment Forecasts

- Report ID: 978-1-68038-516-8

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Scanning Electron Microscopes Market Summary

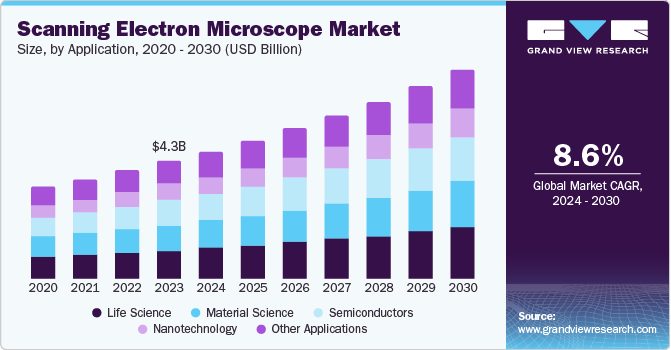

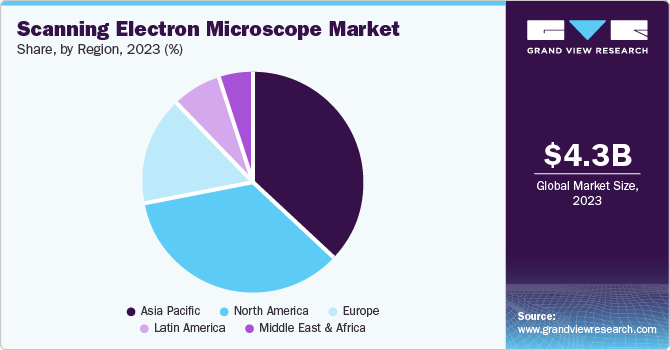

The global scanning electron microscopes market size was estimated at USD 4.34 billion in 2023 and is projected to reach USD 7.73 billion by 2030, growing at a CAGR of 8.6% from 2024 to 2030. Increasing demand for nanotechnology-based research and a consequent rise in funding are driving the market growth.

Key Market Trends & Insights

- Asia Pacific scanning electron microscopes market dominated the global industry and held the largest revenue share of 37.6% in 2023.

- China scanning electron microscopes accounted for the largest revenue share in 2023.

- Based on application, the life science segment held the largest share of 24.7% in 2023.

- In terms of application, the nanotechnology segment is expected to experience a significant CAGR of 9.0% from 2024 to 2030.

- On the basis of application, material science held a significant share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.34 billion

- 2030 Projected Market Size: USD 7.73 billion

- CAGR (2024-2030): 8.6%

- Asia Pacific: Largest market in 2023

Furthermore, growing product application in the electronics, semiconductor, and pharmaceutical industries is expected to drive the market in the coming years. In addition, improvements in the resolution power and features like attachment of other devices, such as energy x-ray dispersion spectrometer, are expected to propel market growth during the forecast period.

A key reason for the success of Scanning Electron Microscopes (SEMs) is that they are widely used by small- to medium-scale pharmaceutical companies and R&D institutes. They provide researchers and quality assurance personnel with data regarding surface morphology and properties, such as chemical analysis, topography, fractography, and others. For example, the Zeiss Gemini 500 is a high-resolution Field Emission Scanning Electron Microscope (FE-SEM) that delivers nanoscale imaging from 100 mm diameter wafers down to small pieces. It has excellent resolution and image quality at high and low accelerating voltages.

As nanotechnology has applications in most of the areas of material sciences, semiconductors, and life sciences, which substantially affect the economy of any nation, it promotes corporate enterprises & government organizations to support Research & Development (R&D) via public funding. The global market is observing higher growth owing to various driving factors, such as it is one of the most vital devices to analyze nanomaterials at the microscopic scale in medical devices, pharmaceutical industries, and numerous industry verticals.

Semiconductor device manufacturing requires microscopes for procedures, such as coating, failure analysis, lithography, and detection. Growth of the semiconductor industry at a rapid pace in nations, such China and India, due to the outsourcing of electric equipment manufacturing is a major driver of the SEMs market.

Growing global focus on R&D for applications, such as material sciences, neurosciences, life sciences, semiconductor and nanotechnology industry, would increase the adoption rate for automated & advanced microscopes, such as analytical electron microscope, SEMs and scanning probe microscope. These microscopes provide imaging resolution as high as 0.1 nm, required for precision manufacturing industries.

These applications are sub-segments of the semiconductor industry, which is recently gaining enormous demand in the market. According to Moore’s law, the semiconductor industry is constantly moving towards the miniaturization of transistor chips. These trends of miniaturization of transistor chips requiring advanced microscopes, such as TEM, SEM, and SPM, for analytical and quality assurance purposes will provide great market potential over the next seven years.

The rise in advancement of nanotechnology is majorly driving the expansion of the SEM market. The growing demand for compact, and efficient products at lower prices, along with the increasing demand for product miniaturization has propelled the development of nanotechnology in multiple industries. In addition, the use of electron microscopes allows the development of three-dimensional images in a variety of industries.

The advancement of technology in SEMs allows the data generation in digital form, thereby speeding up the operation of instruments. Furthermore, it reduces the steps in the preparation of sample.

However, the market is restricted by high excise taxes and custom duty on medical goods along with the high cost of modern digital electronic microscopes. Furthermore, a scarcity of highly skilled labor resources capable of handling SMEs effectively constitutes a challenge to the market's expansion.

There is a huge potential for scanning electron microscopes in the healthcare domain. The integration of additional devices such as energy x-ray dispersion spectrometer with electron microscopes is expected to increase the resolution power and other features. This is expected to further propel the market growth.

Application Insights & Trends

The life science segment held the largest share of 24.7% in 2023. SEM is a powerful technique used in life science research to visualize biological samples with high resolution and three-dimensional detail. Unlike traditional light microscopes, SEM uses high-energy electrons instead of visible light to scan the specimen’s surface and create magnified images. This method allows researchers to explore intricate cellular structures, microorganisms, and other biological features in unprecedented detail. The additional advantages provided by the advanced SEMs in life science applications are expected to generate greater demand for the segment in the approaching years.

The nanotechnology segment is expected to experience a significant CAGR of 9.0% from 2024 to 2030. Nanotechnology plays a vital role in enhancing the capabilities of SEMs. It generates improved resolution, sample preparation techniques, nanoparticle characterization, surface topography, and chemical composition mapping. SEMs operate in a vacuum, making them suitable for non-living specimens. Nanotechnology enhances SEM’s capabilities, bridging the gap between macro and Nano worlds. These factors are projected to drive growth for this segment.

Material science held a significant share in 2023. SEM has emerged as one of the prominent characterization instruments for materials sciences. SEMs are used in materials science for quality control, research, and failure analysis. In modern materials science, investigation & research on nanofibers & nanotubes, high mesoporous architecture, temperature superconductors, and alloy strength, significantly depend on the use of SEMs.

Regional Insights & Trends

Asia Pacific scanning electron microscopes market dominated the global industry and held the largest revenue share of 37.6% in 2023. The rapid growth of the semiconductor industry in countries such as India and China has fueled the demand for SEMs. Often, a defect review SEM is adopted to examine the defect identified on the semiconductor wafer. Increasing research and development efforts in application industries such as semiconductors, material science and life sciences are expected to drive growth for this industry in the approaching years. In addition, the presence of major market participants is also contributing to the growth.

China Scanning Electron Microscopes Market Trends

China scanning electron microscopes accounted for the largest revenue share in 2023. This is primarily due to enhancements in infrastructure related to the education industry, growing investments in research activities, and an increasing number of global companies entering the region for cost-effective operations.

North America Scanning Electron Microscopes Market Trends

Electron microscopes market in North America held a significant revenue share in 2023. This market is primarily driven by factors such as continuous growth experience by the scientific research industry, unceasing technology advancements, and an increase in industrial applications. North America hosts numerous research institutes, pharmaceutical companies, and quality assurance personnel who rely on SEMs for surface morphology analysis, chemical analysis, and more. The region’s focus on cutting-edge technologies, including nanotechnology, fuels demand for advanced microscopes like SEMs.Research-based activities in the life sciences, biotechnology, and pharmaceutical industries are an integral part of the innovation system in North American countries and this is expected to boost the demand for SEMs in the region over the forecast period.

U.S. Scanning Electron Microscopes Market Trends

The U.S. scanning electron microscopes market dominated the regional market with revenue share of 90.8% in 2023. This is attributed to the extensive adoption of SEMs by multiple businesses and institutes for a wide range of applications such as basic research, quality assurance and product line enhancements. In the U.S., industries such as metal, batteries, semiconductors, polymers and biotech are customers for this product.

Europe Scanning Electron Microscopes Market Trends

Europe was identified as one of the significant regions in 2023. This market is driven by aspects such as increasing accessibility and availability of SEMs in the region, growth in adoption of new and advanced SEMs by businesses, and growing emphasis on research and development activities. In addition, increasing investments in R&D are contributing to the budding market. For instance, in March 2024, VTT Technical Research Centre of Finland, a state-owned non-profit organization working in research technology, started using a new Focused Ion Beam (FIB) Scanning Electron Microscope. This investment has enhanced its capacity and has brought down the time spent during design to market by one-tenth.

Germany scanning electron market is expected to experience a lucrative growth rate during the forecast period. This is attributed to the growing adoption of SEMs, the presence of multiple research facilities in the country, enhancing research infrastructure coupled with rising investments and the presence of global market participants.

Key Scanning Electron Microscopes Company Insights

Some of the key companies operating in the scanning electronic microscopes market are Bruker Corp., Thermo Fisher Scientific, and others. Due to an overwhelming response and growing demand, companies have been adopting strategies such as improved investments in R&D, new product launches, collaborations, partnerships, and innovation.

- Hitachi High-Technologies, manufacturer of a diverse range of instruments, provides multiple SEM products for various industries. Its offerings are equipped with innovative technology such as signal detection systems and electron optics.

Key Scanning Electron Microscopes Companies:

The following are the leading companies in the scanning electron microscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Bruker

- Thermo Fisher Scientific

- Hitachi High-Tech Corporation

- JEOL Ltd.

- Leica Microsystems

- Nanoscience Instruments, Inc.

- Nikon Corporation

- Olympus Corporation

- ZEISS

Recent Developments

-

In May 2024, Hitachi High Tech Corporation, one of the key market participants, introduced high-resolution Schottky scanning electron microscopes, namely SU3800SE and SU3900SE. They provide highly efficient and accurate observation of heavy and large specimens at nano level.

-

In May 2024, JEOL Ltd., an innovation and technology organization serving the global scientific technology industry, launched its new product, an electron microscope JEM-120i. The company has marketed it as compact, expandable and easy to use product.

-

In June 2022, Bruker, an American manufacturer of scientific instruments announced remarkable advancements in multi-omic tissue imaging and highly multiplexed spatial proteomics at large fields of view. Moreover, key enhancements were introduced for mass spectrometry imaging MALDI HiPLEX-IHC following a strategic partnership of Bruker’s with AmberGen.

-

In July 2021, Thermo Fisher Scientific launched Thermo Scientific Phenom Pharos G2 Desktop Field Emission Gun - Scanning Electron Microscope (FEG-SEM). This product helped to distinguish the shape, size, and chemical content of a broad spectrum of nanoparticles at high resolution.

-

In December 2021, Thermo Fisher Scientific Inc. announced the acquisition of PPD, Inc. for USD 17.4 billion. The acquisition of PPD will allow Thermo Fisher to offer a full range of clinical development services.

Scanning Electron Microscopes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.71 billion

Revenue forecast in 2030

USD 7.73 billion

Growth rate

CAGR of 8.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Applications, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Brazil; Mexico; South Africa; Australia; Thailand; Argentina; Saudi Arabia; UAE; Kuwait

Key companies profiled

Bruker; Thermo Fisher Scientific; Hitachi High-Tech Corporation; JEOL Ltd.; Leica Microsystems; Nanoscience Instruments, Inc.; Nikon Corporation; Olympus Corporation; ZEISS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Scanning Electron Microscopes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global scanning electron microscopes market report based on application and region:

-

Applications Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Science

-

Nanotechnology

-

Life Science

-

Semiconductors

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.