- Home

- »

- Pharmaceuticals

- »

-

Schizophrenia Drugs Market Size, Industry Report, 2030GVR Report cover

![Schizophrenia Drugs Market Size, Share & Trends Report]()

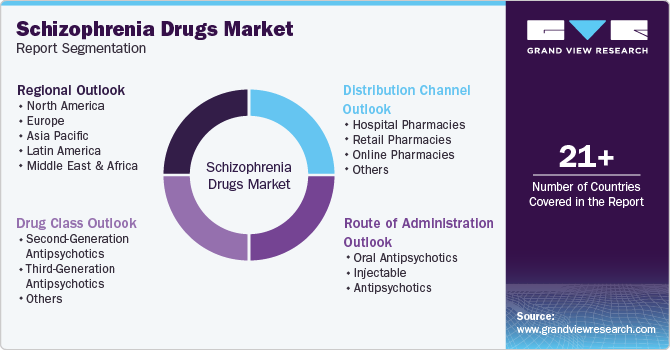

Schizophrenia Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Second- generation Antipsychotics, Third-Generation Antipsychotics), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-222-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Schizophrenia Drugs Market Summary

The global schizophrenia drugs market size was estimated at USD 8.18 billion in 2024 and is projected to reach USD 11.19 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growing demand can be attributed to the rising prevalence of schizophrenia and other related mental health disorders worldwide.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, The U.S. schizophrenia drugs market dominated the North America market in 2024.

- By drug class, the second-generation antipsychotics held the largest revenue share of 73.05% in 2024.

- By route of administration, the injectable antipsychotic segment held the largest share of 67.69% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.18 Billion

- 2030 Projected Market Size: USD 11.19 Billion

- CAGR (2025-2030): 5.6%

- North America: Largest market in 2024

Factors contributing to the growing disease prevalence include genetic, environmental, and socio-economic influences. With growing awareness and advancing diagnostic capabilities, the diagnosis of schizophrenia has increased, further fueling the need for effective and innovative treatment options.

Ongoing advancements in medical research and pharmaceutical technology have significantly enhanced the treatment landscape for schizophrenia. The development of next-generation antipsychotic medications, which offer improved efficacy and reduced adverse effects, has strengthened the role of pharmacological interventions in schizophrenia management. These newer therapies effectively address core symptoms such as hallucinations, delusions, and cognitive dysfunction. For example, in March 2025, the Journal of Clinical Psychopharmacology reported the approval of Cobenfy, a novel non-dopaminergic treatment combining xanomeline and trospium. This formulation offers an alternative mechanism of action while minimizing side effects associated with traditional dopamine-based therapies, thereby expanding the treatment options and market potential.

Government initiatives and private sector investments have improved access to mental health care services, boosting the uptake of schizophrenia medications. Enhanced healthcare coverage, expanded mental health programs, and integrated care models have resulted in increased diagnosis rates and treatment adherence. Furthermore, the gradual reduction in mental health stigma encourages more individuals to seek treatment, reinforcing the demand for antipsychotic drugs. This structural shift highlights a broader societal and institutional focus on mental health management.

Although schizophrenia typically manifests in young adulthood, cases of late-onset schizophrenia among the elderly are gaining recognition. The increasing global aging population contributes to a wider patient base requiring specialized mental health care. According to an October 2023 report by the World Health Organization, approximately 14% of individuals aged 60 years and older experience mental disorders such as depression and anxiety. With the global elderly population projected to reach 1.4 billion by 2030, the need for effective schizophrenia treatments tailored for older adults is expected to grow, thereby driving market demand.

Pipeline Analysis

The schizophrenia drug market is experiencing significant research and development activity, with a strong pipeline of Phase 3 clinical trials focused on introducing innovative therapies. These late-stage candidates reflect growing investment from both established pharmaceutical companies and emerging biotech firms, which underscores the industry's commitment to advancing treatment options. The current pipeline includes diverse approaches, from novel antipsychotic formulations to digital therapeutics. As several of these candidates are projected to launch within the next three to five years, their successful development could significantly expand the therapeutic landscape, improve patient outcomes, and drive future market growth.

The following table highlights key Phase 3 trials.

NCT Number

Company

Phase 3

Estimated Launch

NCT06894212

Otsuka Pharmaceutical Development & Commercialization, Inc.

PHASE3

2028

NCT05838625

Click Therapeutics, Inc.

PHASE3

2025

NCT05304767

Karuna Therapeutics

PHASE3

2026

NCT03817502

Gedeon Richter Plc.

PHASE3

2025

NCT06067984

Click Therapeutics, Inc.

PHASE3

2025

NCT03094429

SyneuRx International (Taiwan) Corp

PHASE2|PHASE3

2026

NCT04578756

AbbVie

PHASE3

2025

NCT05658510

BioXcel Therapeutics Inc

PHASE3

2025

NCT06585787

Karuna Therapeutics

PHASE3

2026

NCT06126224

Karuna Therapeutics

PHASE3

2025

NCT05980949

Karuna Therapeutics

PHASE3

2027

NCT05511363

Karuna Therapeutics

PHASE3

2026

NCT06068465

Tasly Pharmaceutical Group Co., Ltd

PHASE3

2026

Source: Clinical Trial

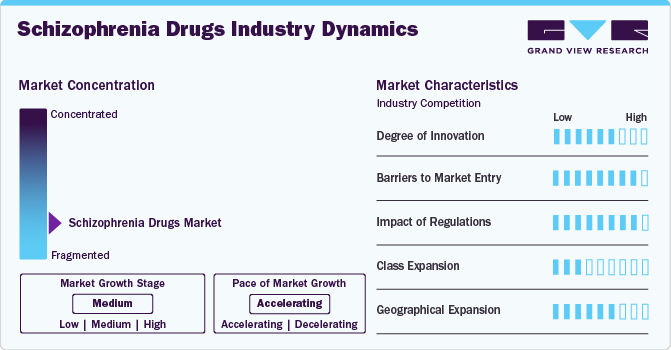

Market Concentration & Characteristics

The degree of innovation is high in the schizophrenia drug market, fueled by a wave of nontraditional drug development and repurposing strategies. For instance, in December 2024, AbbVie, a U.S.-based pharmaceutical company, announced that its investigational drug tavapadon achieved positive topline results in the Phase III TEMPO-2 trial. These advances reflect the industry's dynamic nature, shaping products and services to meet evolving consumer needs.

Several companies participate in mergers and acquisitions to strengthen their market positions. This allows firms to enhance their abilities, broaden their product offerings, and boost proficiency. For instance, in March 2024, Bristol Myers Squibb, located in the U.S., finalized its USD 14 billion purchase of Karuna Therapeutics, augmenting its neuroscience portfolio with KarXT, a possible first-in-class therapy for schizophrenia. This approach allows companies to broaden their research and development capabilities, diversify their product lines, and expedite the introduction of next-generation treatments in the schizophrenia drugs industry.

Regulations in the schizophrenia drug market establish critical standards for safety, efficacy, and accessibility. They govern approval processes, clinical trial protocols, manufacturing quality, labeling, and post-market surveillance. For instance, the FDA's rigorous regulatory framework in the U.S. ensures that new treatments undergo extensive clinical testing to assess safety and efficacy before reaching patients. In September 2024, the FDA issued revised guidelines for the accelerated approval of schizophrenia therapies to address unmet needs, such as cognitive symptoms, streamlining the approval process for innovative therapies such as Ulotaront (SEP-363856). Compliance is vital for companies to introduce and sustain their products. Regulations protect patients by minimizing risks and ensuring accurate information.

The schizophrenia drugs market is experiencing significant product expansion, driven by a focus on developing therapies that address a broader spectrum of symptoms and improve patient outcomes. Advancements in neuroscience have led to the development of novel agents targeting specific neurotransmitter systems, such as Ulotaront, a TAAR1 and 5-HT1A agonist, and Emraclidine, a selective M4 receptor positive allosteric modulator. These treatments aim to address cognitive and negative symptoms, which are often inadequately managed by traditional antipsychotics.

The schizophrenia drugs market in the Asia-Pacific region, particularly in countries like China and India, is experiencing significant growth due to rising awareness of mental health issues, improving healthcare infrastructure, and an aging population more prone to psychiatric disorders. Countries are positioning themselves as key players in the global market, with innovation and affordability becoming key factors driving the competitive landscape.

Drug Class Insights

The second-generation antipsychotics held the largest revenue share of 73.05% in the schizophrenia drugs industry in 2024. Their demand is rising due to better safety and effectiveness compared to first-generation antipsychotics. These newer medications have a lower chance of causing movement-related adverse effects, such as tremors and rigidity, which leads to better patient compliance. Second-generation antipsychotics are also used for conditions like treatment-resistant depression and have long-acting injectable forms that increase their appeal.

The third-generation-antipsychotic segment is expected to grow at the fastest CAGR over the forecast period. The demand for third-generation antipsychotics is growing due to their better clinical benefits compared to older drugs. Medications like aripiprazole and brexpiprazole provide more effective control of schizophrenia symptoms while having fewer severe adverse effects, such as weight gain and movement issues. This enhances patient adherence and quality of life, making these drugs a preferred option for long-term treatment. As healthcare providers and patients increasingly prioritize treatments with better tolerance profiles and better overall outcomes, the demand for these third-generation antipsychotics is expected to rise over the forecast years.

Route Of Administration Insights

The injectable antipsychotic segment held the largest revenue share of 67.69% in 2024. The growing preference for injectable formulations, particularly Long-Acting Injectables (LAIs), is driven by their ability to address common challenges in schizophrenia treatment. LAIs ensure consistent drug release and stable plasma levels, reducing the risk of relapse associated with missed oral doses. This delivery method enhances treatment adherence, as it requires less frequent administration compared to daily oral medications. Additionally, injectable treatments allow healthcare providers to monitor compliance more effectively and make timely adjustments. Increasing awareness of these clinical advantages, coupled with advances in drug delivery technology, continues to strengthen demand for injectable antipsychotics.

The oral antipsychotics segment is anticipated to register significant growth in the schizophrenia drugs market. Oral formulations remain a preferred choice among patients and healthcare providers due to ease of administration and flexible dosing schedules, which support better adherence to treatment plans. The development of safer and more efficacious oral therapies is further driving this preference. In addition, advancements in the understanding of schizophrenia’s neurobiology have facilitated the design of oral antipsychotics that target specific neurotransmitter pathways, enabling more personalized and targeted treatment approaches.

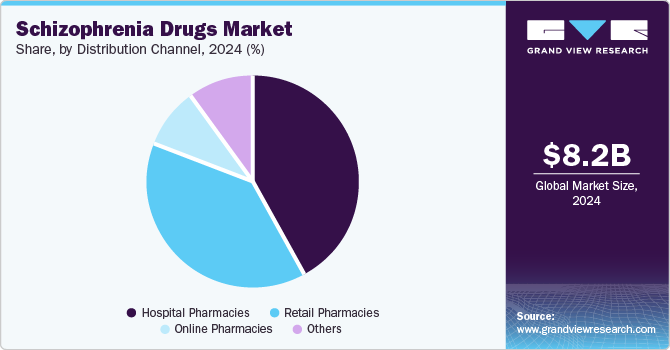

Distribution Channel Insights

The hospital pharmacies segment held the largest market revenue share of 41.80% in 2024. Hospital pharmacies are essential in providing complete patient care by managing complex medication plans and monitoring adverse effects. They have quick access to new drugs and trial medications, making them key distributors of innovative treatments. Integrating hospital pharmacies with other healthcare services enhances the continuity of patient care, resulting in improved outcomes. Moreover, hospitals provide patient education and assistance, enabling patients to comprehend their medications and effectively manage their mental health, which is crucial for addressing conditions such as schizophrenia.

The retail pharmacies segment is expected to grow at a significant CAGR over the forecast period. Retail pharmacies offer easy accessibility and convenience to patients seeking medication, which is crucial for managing chronic conditions like schizophrenia. With the growing prevalence of schizophrenia and the increasing awareness of mental health, more patients are seeking regular treatment, which retail pharmacies can readily provide. Retail pharmacies also offer personalized services, such as patient counseling and medication management, enhancing adherence to prescribed treatments. The trend toward integrating mental health services within community-based settings also supports the role of retail pharmacies as crucial access points for schizophrenia medications, further driving segment demand.

Regional Insights

North America schizophrenia drugs market held the largest revenue share of 38.65% in 2024. This share is attributable to the rising awareness and diagnosis rates of schizophrenia and related mental health disorders. Enhanced mental health screening and awareness campaigns have led to more individuals seeking treatment. In addition, advancements in medical research have resulted in more effective and targeted therapies, encouraging greater adoption of these drugs. The aging population also contributes, as schizophrenia symptoms often manifest in late adolescence or early adulthood, and older adults are increasingly seeking treatment for long-standing conditions. Furthermore, there is a growing emphasis on outpatient care and community-based treatment programs, which rely heavily on pharmaceutical management, thus driving the demand for these medications.

U.S. Schizophrenia Drugs Market Trends

The U.S. schizophrenia drugs market dominated the regional market in 2024. Schizophrenia is becoming increasingly recognized and diagnosed due to improved mental health awareness and better diagnostic tools. This has led to more individuals being identified and treated for the condition. Advancements in pharmacological treatments have resulted in newer, more effective medications with fewer adverse effects, making them more appealing to patients and healthcare providers. According to the Treatment Advocacy Center, in September 2020, 2.8 million adults in the U.S. were estimated to have been suffering from schizophrenia. Approximately 40% remained untreated annually. Researchers focused on genetic, neurotransmitter, and emerging infectious/inflammatory theories for the development of treatments.

Europe Schizophrenia Drugs Market Trends

Europe schizophrenia drugs market has been witnessing notable growth. Increasing recognition and reduction of stigma surrounding mental health problems are prompting more people to opt for treatments. For instance, in June 2023, the European Commission launched a major mental health initiative-Communication on a comprehensive approach to mental health-as part of the EU approach to mental health, providing funds to help EU member states to improve mental health care and prevention. This initiative is focused on prevention, access to quality care, and assisting people to reintegrate into society after recovery. Moreover, progress in pharmaceutical research has resulted in the creation of more efficient and well-tolerated drugs, promoting adherence and sustained treatment and elevating demand.

The UK schizophrenia drugs market is expected to grow rapidly over the forecast period. The UK government's initiatives to prioritize mental health, such as the NHS Long Term Plan, have significantly improved access to mental health services, leading to earlier diagnosis and treatment of schizophrenia. Moreover, the introduction of newer, more effective antipsychotic medications has made treatment more accessible, contributing to the growing demand.

The schizophrenia drugs market in Germany is projected to experience steady growth during the forecast period. The country’s strong healthcare infrastructure and national mental health policies support early diagnosis and continuous treatment of schizophrenia. Germany’s commitment to integrating mental health care into primary care services, along with increasing investments in innovative therapies, contributes to market expansion. Additionally, the availability of advanced antipsychotic drugs and growing awareness around mental health are driving higher treatment uptake.

The France schizophrenia drugs market is expected to grow steadily, supported by the government’s proactive stance on mental health care. National health strategies aimed at reducing psychiatric disorders, coupled with widespread access to healthcare services, are facilitating early intervention and ongoing treatment of schizophrenia. Furthermore, France’s adoption of novel pharmacological therapies and emphasis on community-based mental health services are contributing to increased demand for antipsychotic medications.

Asia Pacific Schizophrenia Drugs Market Trends

Asia Pacific schizophrenia drugs market is expected to grow at the fastest CAGR over the forecast period. The growing demand can be attributed to a combination of factors such as rising disease prevalence, improved healthcare access, government initiatives, increased awareness, and availability of newer treatment options. These factors are shaping a larger and more accessible market for schizophrenia treatments in the region. For instance, the Indian Ministry of Health and Family Welfare launched the updated National Mental Health Policy, focusing on improving access to affordable care, integrating services into primary healthcare, and expanding medication availability.

Japan schizophrenia drugs market is poised for steady growth, supported by a strong healthcare system and comprehensive mental health policies. The government’s ongoing efforts to destigmatize mental illness and promote early intervention have improved diagnosis rates and access to treatment. Aging population trends are also contributing to increased demand, as late-onset schizophrenia becomes more recognized. Additionally, Japan’s investment in pharmaceutical innovation and the adoption of next-generation antipsychotics are expanding treatment options and driving market growth.

The schizophrenia drugs market in China is expected to grow significantly in the forecast period, driven by improved healthcare infrastructure and awareness campaigns undertaken by the Chinese government. In addition, China's rapid urbanization and economic growth have led to lifestyle changes and increased stress levels, contributing to the prevalence of mental health disorders, including schizophrenia. Moreover, China's aging population, which reached 297 million people aged 60 and above in 2023 (21.1% of the total population), is facing an increase in age-related mental health issues, including schizophrenia. This demographic shift resulted in an increased need for enhanced access to healthcare and medications, and there has been notable expansion in medical and senior care facilities, further propelling the demand for schizophrenia medications.

Latin America Schizophrenia Drugs Market Trends

The Latin American schizophrenia drugs market is witnessing gradual but consistent growth, primarily led by Brazil and Argentina. Increasing recognition of mental health as a public health priority is reshaping policy frameworks across the region. Economic constraints and evolving procurement mechanisms are encouraging the adoption of cost-effective generic and biosimilar antipsychotics. Strategic partnerships between local manufacturers and multinational pharmaceutical companies are bolstering production capabilities and aligning with global quality benchmarks, thereby improving treatment accessibility and driving regional market expansion.

Brazil schizophrenia drugs market is expanding, supported by a rising burden of mental health disorders and comprehensive government healthcare initiatives under the SUS (Sistema Único de Saúde). The public sector’s emphasis on integrating mental health into primary care has facilitated broader distribution of antipsychotic therapies. Furthermore, the regulatory environment increasingly favors biosimilars and new chemical entities, supported by local manufacturing incentives and international licensing agreements that enhance treatment availability and affordability.

Middle East & Africa Schizophrenia Drugs Market Trends

The Middle East and Africa represent high-potential, developing markets for schizophrenia drugs, with growth led by Saudi Arabia and the UAE. National healthcare transformation plans, such as Saudi Arabia’s Vision 2030 and the UAE’s focus on healthcare digitization, are enhancing the mental health infrastructure. These reforms are accelerating the integration of advanced psychiatric care, including long-acting injectable antipsychotics. Collaborations between regional distributors and global pharmaceutical firms are expanding access to newer-generation antipsychotic therapies, addressing the underserved treatment population across both urban and rural regions.

Saudi Arabia schizophrenia drugs market is demonstrating significant momentum, driven by rising prevalence of psychiatric disorders and extensive government investment in the biopharmaceutical sector. The country’s healthcare reforms, including universal insurance coverage and mental health initiatives under Vision 2030, are propelling the adoption of advanced therapeutic options. Biosimilar introduction is being facilitated through favorable regulatory pathways and public sector procurement. Additionally, the expansion of digital health platforms and telepsychiatry services is increasing patient access to medication management and continuous care.

Key Schizophrenia Drugs Company Insights

The schizophrenia drugs market is undergoing a transformative phase, driven by advances in neuroscience, evolving treatment paradigms, and increased regulatory support for innovation. In 2024, the industry is witnessing the emergence of next-generation antipsychotics that target novel pathways beyond the traditional dopamine-centric mechanisms. These developments are reshaping therapeutic strategies and expanding the range of pharmacological options available to clinicians.

New entrants and established players are focusing on differentiated formulations, such as long-acting injectables (LAIs), digital therapeutics, and agents that address cognitive and negative symptoms. Companies are increasingly pursuing combination therapies and receptor-specific agents, supported by growing late-stage clinical pipelines. Strategic collaborations between biopharmaceutical firms and digital health platforms are also gaining traction, aimed at improving treatment adherence and outcomes. These innovations are driving a shift toward more patient-centric, effective, and sustainable schizophrenia care solutions globally.

Key Schizophrenia Drugs Companies:

The following are the leading companies in the schizophrenia drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- Bristol-Myers Squibb Company/ Otsuka Holdings Co., Ltd.

- Sumitomo Pharma Co., Ltd.

- Eli Lilly and Company

- Alkermes

- VANDA PHARMACEUTICALS

- AstraZeneca plc

- AbbVie Inc.

- Pfizer Inc.

- H. Lundbeck A/S

Recent Developments

-

In April 2025, CMG Pharmaceutical, a subsidiary of CHA Biotech, received approval from the U.S. Food and Drug Administration (FDA) for Mezofy, an oral film-type formulation of aripiprazole designed for the treatment of schizophrenia in adults and pediatric patients aged 13 years and older. This approval marks a significant achievement for CMG Pharmaceutical, as Mezofy is the first oral aripiprazole film-type medication to receive FDA approval. CMG Pharmaceutical plans to launch Mezofy in the U.S. market in the first half of 2026, with an estimated annual sales target of 100 billion won (approximately $75 million USD) within five years of commercialization.

-

In January 2025, Johnson & Johnson, based in the U.S., acquired Intra-Cellular Therapies to enhance its neuroscience portfolio, expand innovation in mental health treatments, and reinforce its leadership in the biopharmaceutical sector.

-

In April 2024, Vanda Pharmaceuticals received FDA approval in the U.S. to market Fanapt for bipolar I disorder, expanding its psychiatric portfolio 15 years after approval for schizophrenia, reinforcing its market presence.

-

In October 2024, Bristol Myers Squibb received approval from the U.S. Food and Drug Administration (FDA) for Cobenfy (xanomeline/trospium chloride), a novel antipsychotic medication for the treatment of schizophrenia. Unlike traditional antipsychotics that target dopamine receptors, Cobenfy operates through muscarinic receptors, potentially reducing common side effects such as drowsiness, weight gain, and muscle tremors.

Schizophrenia Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.52 billion

Revenue forecast in 2030

USD 11.20 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, route of administration, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Johnson & Johnson Services, Inc.; Bristol-Myers Squibb Company/ Otsuka Holdings Co., Ltd.; Sumitomo Pharma Co., Ltd.; Eli Lilly and Company; Alkermes; VANDA PHARMACEUTICALS; AstraZeneca plc; AbbVie Inc.; Pfizer Inc.; H. Lundbeck A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Schizophrenia Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global schizophrenia drugsmarket report based on drug class, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Second-Generation Antipsychotics

-

Risperdal (Risperidone)

-

Invega (Paliperidone)

-

Zyprexa (Olanzapine)

-

Geodon (Ziprasidone)

-

Seroquel (Quetiapine)

-

Latuda (Lurasidone)

-

Aristada (Aripiprazole Lauroxil)

-

Fanapt (Iloperidone)

-

Saphris (Asenapine)

-

Vraylar (Cariprazine)

-

-

Third-Generation Antipsychotics

-

Abilify (Aripiprazole)

-

Others

-

-

First-Generation Antipsychotics

-

Generics

-

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Antipsychotics

-

Injectable Antipsychotics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.