- Home

- »

- Homecare & Decor

- »

-

School Furniture Market Size & Share, Industry Report, 2033GVR Report cover

![School Furniture Market Size, Share & Trends Report]()

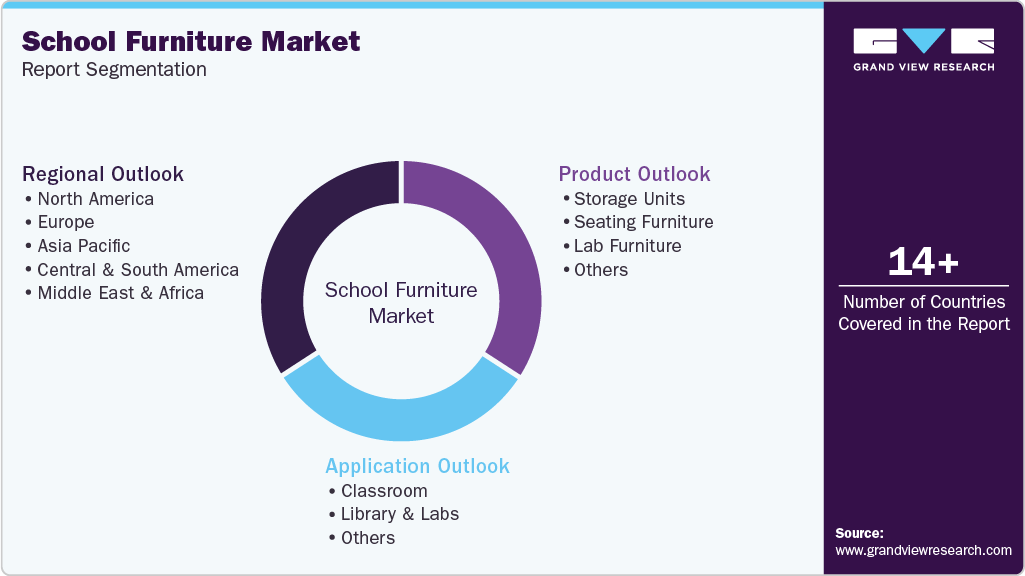

School Furniture Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Seating Furniture, Storage Units, Lab Furniture), By Application (Classroom, Library & Labs), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-099-6

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

School Furniture Market Summary

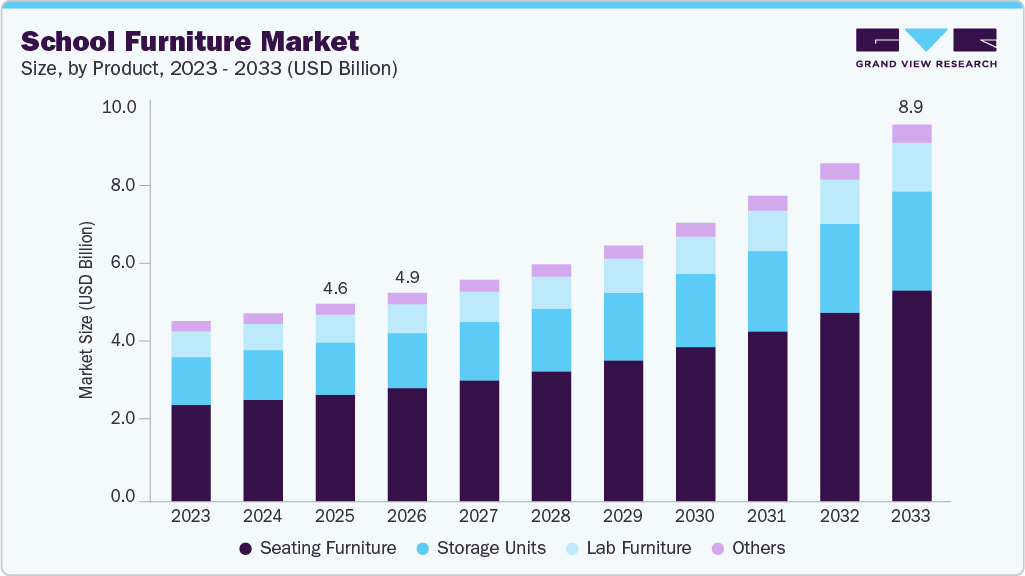

The global school furniture market size was estimated at USD 4.66 billion in 2025 and is projected to reach USD 8.88 billion by 2033, growing at a CAGR of 8.8% from 2026 to 2033. The growing population, education reforms in several countries globally, the rising importance of ergonomic seating for students, and technological advancements to accommodate devices such as laptops and tablets are factors propelling the market growth.

Key Market Trends & Insights

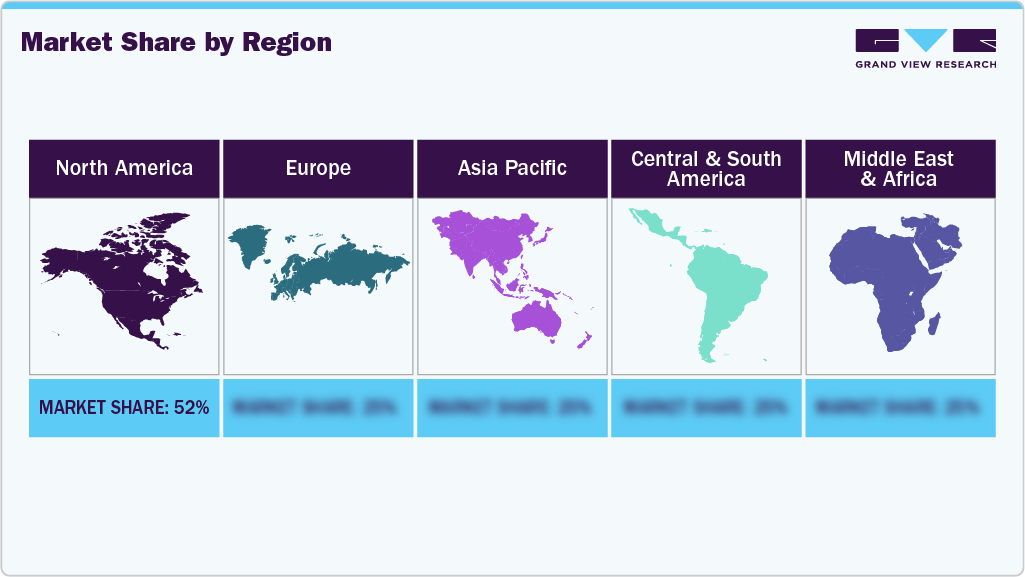

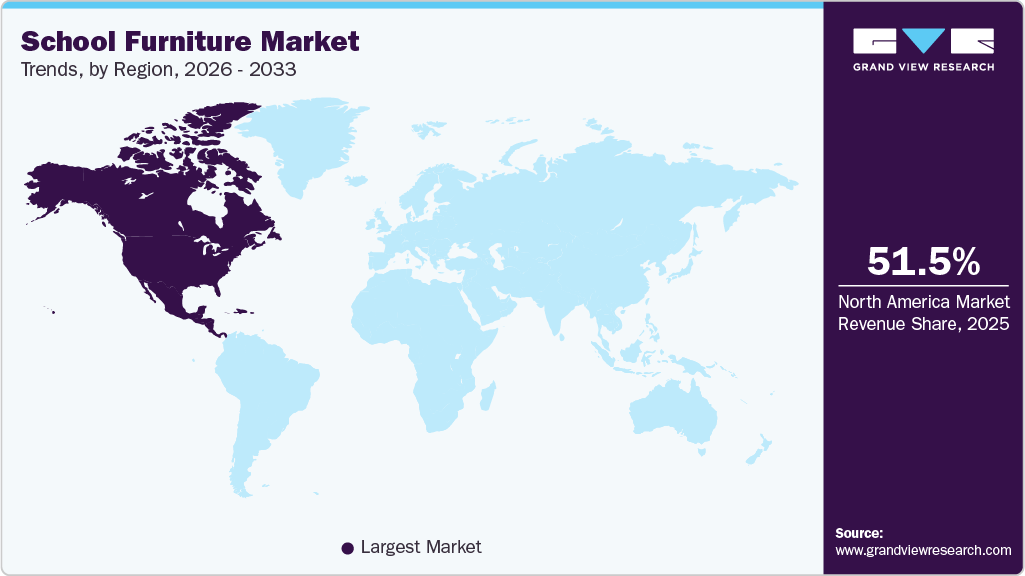

- By region, North America led the market with a share of 51.5% in 2025.

- By product, the seating furniture segment led the market with a share of 54.1% in 2025.

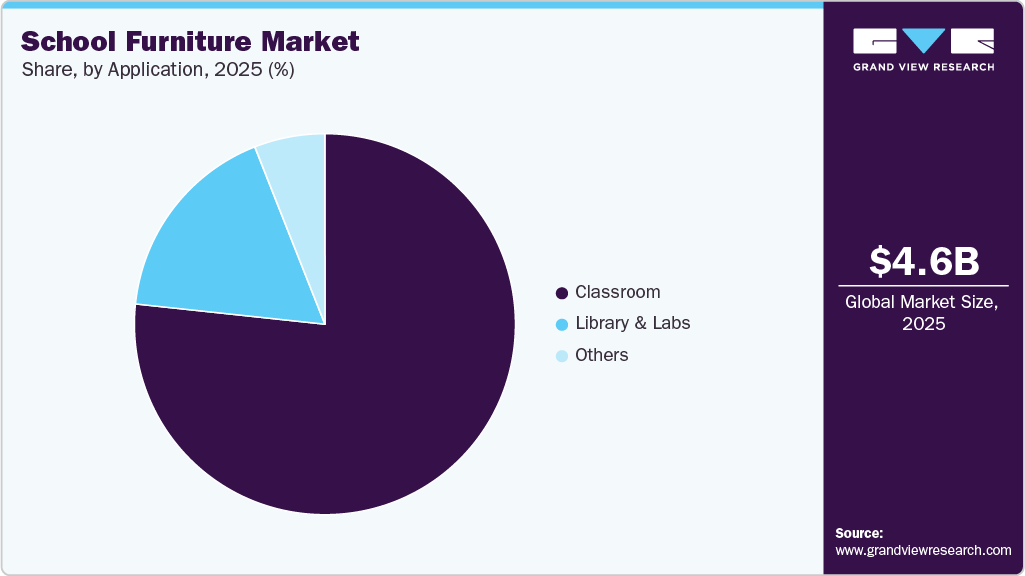

- By application, school furniture for the classroom segment led the market with a share of 77.5% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.66 Billion

- 2033 Projected Market Size: USD 8.88 Billion

- CAGR (2026-2033): 8.8%

- North America: Largest market in 2025

As school enrollments continue to rise and new schools are established, the demand for classroom furniture to accommodate these changes has also increased. Educational institutions are investing in larger, more modern facilities, which necessitate the procurement of new and updated furniture. This growth is especially pronounced in emerging markets, where rapid urbanization is driving the construction of new schools.Another key factor contributing to the rise in demand is the shift toward modern, ergonomic, and technology-friendly furniture. As teaching methodologies evolve, classrooms are becoming more dynamic and collaborative. There is now a greater emphasis on flexible seating arrangements and furniture that support interactive and group-based learning. Modern classrooms require furniture that not only accommodates traditional learning tools but also integrates seamlessly with digital devices such as laptops and tablets. This shift has led to an increase in demand for furniture that is adaptable, ergonomic, and conducive to modern teaching methods.

Additionally, there is a growing focus on student comfort, health, and wellbeing, which has influenced the procurement of furniture. Schools are increasingly prioritizing furniture that promotes good posture, mobility, and overall comfort. Height-adjustable desks, chairs with proper lumbar support, and modular furniture systems are now seen as essential for creating a conducive learning environment. This trend is part of a broader recognition of the importance of student wellbeing in educational outcomes.

Consumer Insights

As the global population continues to rise, more schools are being built to accommodate the growing number of students. According to the United Nations, the global population is projected to increase by nearly 2 billion people over the next 30 years, reaching a potential peak of nearly 10.4 billion in the mid-2080s. The growing population will necessitate the construction of more schools and educational facilities, resulting in an increased demand for furniture to furnish these new facilities. This will drive the market for school furniture as more schools are built.

Government expenditures toward education have a significant impact on the school furniture market. When governments increase their spending on education, schools may have more funding available to invest in new furniture. This can lead to an increase in orders and sales for school furniture manufacturers.

In 2024, U.S. government spending on education reached approximately USD 1.35 trillion across all levels, representing a notable increase from previous years. Out of this, the Department of Education operated with a budget of around $268 billion, or about 4% of total federal spending. Federal appropriations for the Department itself totaled approximately USD 188.6 billion, accounting for roughly 10% of the total national educational spending.

In 2024, government education spending in Europe was about 4.6–4.7% of GDP for the European Union as a whole, representing around €800 billion in annual expenditure. The largest allocations are made to primary and secondary education, typically accounting for around 3.3–3.4% of GDP combined, with tertiary education receiving approximately 0.8% of GDP. Individual country spending as a percentage of GDP varies, with Sweden, Denmark, Belgium, and Finland at the higher end (6–7%), and countries like Ireland, Romania, and Italy at the lower end (less than 4%). For example, Czechia’s public education spending in 2024 accounted for 4.1% of GDP and comprised 14.8% of the state budget.

In the school furniture industry, innovations have increased demand for furniture in schools. Steelcase, Inc., for instance, launched Edvi, a colorful and functional personal storage furniture. The final product is an unjointed structure that is held together by carefully designed fittings and jigs. Due to its cushioned top, the storage container may also feature a movable seating arrangement. Innovative classroom furniture can offer fresh features and functionality that enhance children's learning. For example, furniture that can be easily reconfigured to support various teaching methods can provide greater flexibility and adaptability in the classroom, leading to improved learning outcomes.

There is also a growing awareness of the importance of ergonomic and comfortable school furniture in promoting students' health and wellbeing. According to a blog by Harvard Health Publishing, poor postures can lead to neck pain, back problems, poor balance, headaches, and breathing difficulties. This has led to an increased demand for adjustable desks and chairs, as well as other furniture that promotes good posture and reduces the risk of musculoskeletal disorders.

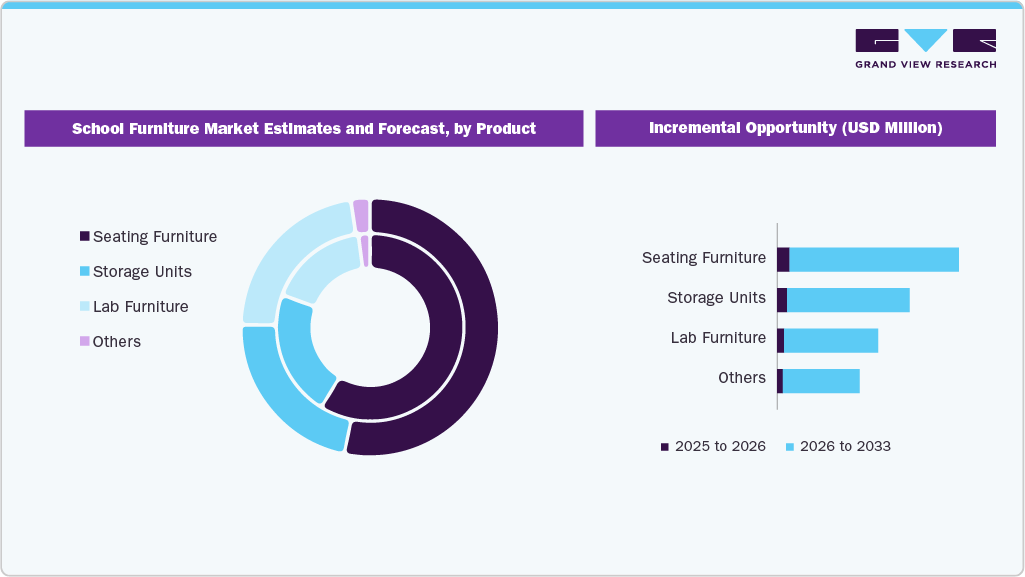

Product Insights

Seating furniture dominated the school furniture market, accounting for a revenue share of over 54.0% in 2025. This position can be attributed to its mass requirement in every educational institution. Such products are essential for creating a comfortable and functional learning environment. Without adequate seating, students may be distracted or uncomfortable, which can affect their ability to learn. Schools typically require a large volume of seating furniture, such as chairs and desks, to furnish their classrooms. The high demand for seating furniture drives ever-growing market growth, making it a dominant segment.

The storage units segment is expected to grow at a CAGR of 9.3% from 2026 to 2033. Several schools globally have been opting for free-standing lockable cubbies and partial-height lockers instead of full-height locker rows to save space and provide a more personalized approach to student storage. Moreover, with the increasing use of technology and educational resources, schools are collecting more materials that require storage. This includes textbooks, laptops, tablets, and other classroom supplies. As a result, schools require more storage units to organize and store these materials.

Application Insights

School furniture for the classroom dominated the school furniture industry with a revenue share of around 77.0% in 2025. Classroom furniture is in high demand due to the large number of classrooms that need to be furnished in schools worldwide. Each classroom requires a variety of furniture, including desks, chairs, whiteboards, and storage units, which contributes to a significant portion of the market. Collaborations, reconfiguration, and ergonomically designed furniture for classrooms are now receiving more attention as a result of rising innovations in the raw materials used to make classroom furniture.

School furniture for library & labs is expected to grow at a CAGR of 8.6% from 2026 to 2033. There is a growing focus on STEM (science, technology, engineering, and math) education in schools. This has led to an increase in the number of labs and classrooms dedicated to these subjects, which will drive demand for specialized furniture designed for these areas. Libraries and labs are places where students can collaborate on projects and research. As a result, furniture that is designed to facilitate collaboration, such as group tables and workstations, is likely to be in high demand.

Regional Insights

North America dominated the school furniture market, accounting for a revenue share of over 51.5% in 2025. Many schools are investing in the upgrade or construction of new facilities, which necessitate the use of modern furniture. There's also a greater focus on student comfort and ergonomics, leading to more demand for furniture that promotes better posture and flexibility. As classrooms become increasingly technology-driven, schools require furniture that can accommodate laptops, tablets, and other digital tools, often featuring features such as charging ports and adjustable desks. These shifts, combined with a focus on creating more collaborative and adaptable learning spaces, are driving the regional market growth.

Europe School Furniture Market Trends:

The school furniture industry in Europe accounted for a share of 24.1% in 2025, driven by increased government investment in educational infrastructure and the modernization of school facilities; a growing focus on creating flexible, collaborative learning environments, which includes the incorporation of movable desks, chairs, and multifunctional spaces; heightened awareness of ergonomics and student wellbeing, resulting in a greater demand for adjustable and comfort-oriented furniture; and an expanding emphasis on sustainability, with educational institutions prioritizing eco-friendly materials and furniture designed for extended durability.

Asia Pacific School Furniture Market Trends

The Asia Pacific school furniture industry is expected to grow at a CAGR of 9.6% from 2026 to 2033. Rapid expansion in educational infrastructure across countries such as India and China, fueled by rising enrolment and government investment in building new schools and upgrading existing ones, is creating strong demand for furniture. Additionally, there is a growing emphasis on ergonomics, comfort, and flexible learning environments: institutions are increasingly seeking desks, chairs, and storage units designed to support modern teaching methods, group work, and digital learning setups, rather than traditional fixed row-and-column layouts.

Central & South America School Furniture Market Trends

The Central & South America school furniture industry is expected to grow at a CAGR of 8.9% from 2026 to 2033. The increasing emphasis on modern learning environments and ergonomic design is driving the demand for upgraded specifications in school furniture. Educational institutions are moving beyond basic utility furniture to prioritize durable, multi-functional, and comfortable solutions that accommodate technology integration and foster collaborative learning spaces. Furthermore, economic growth and a rising middle class in Central & South American countries are facilitating greater investment in private and semi-private education, which often necessitates the use of higher-quality furnishings.

Middle East & Africa School Furniture Market Trends:

The Middle East & Africa school furniture industry is expected to grow at a CAGR of 8.4% from 2026 to 2033. Several factors contribute to this growth, including the rise in student enrolments and the opening of new educational institutions, particularly in countries such as the UAE and Saudi Arabia. Governments in these regions are prioritizing the development of both urban and rural education facilities, which has led to a higher demand for modern and functional school furniture. Additionally, there is a growing emphasis on creating adaptable learning environments, with schools increasingly seeking ergonomic, durable, and modular furniture to accommodate contemporary teaching methods, including digital learning.

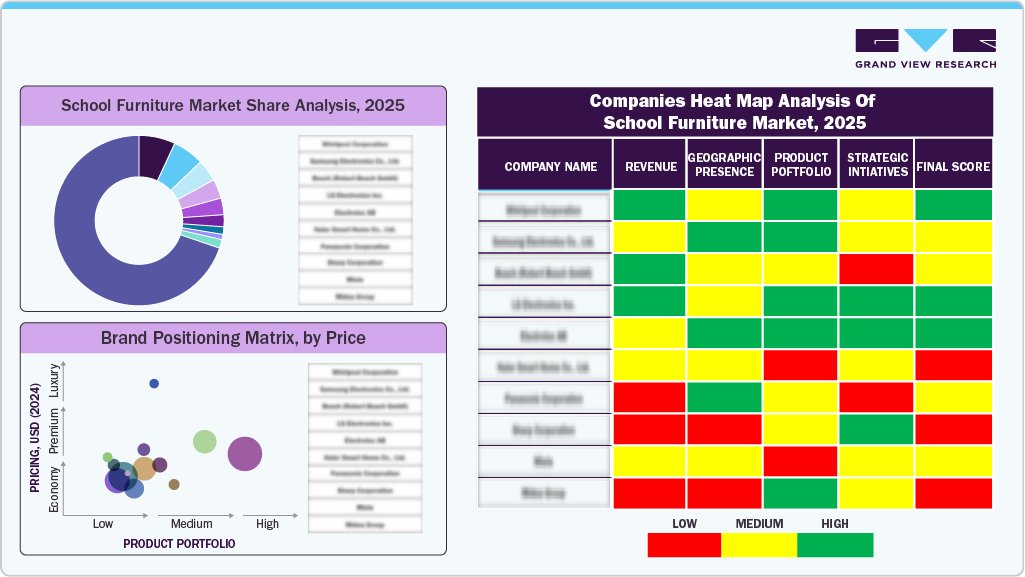

Key School Furniture Company Insights

The market is characterized by the presence of numerous well-established players, along with several small and midsized players. Companies have been focusing on strategies such as product launches, expansions, mergers & acquisitions to compete in the market.

-

In May 2025, Clerkenwell Design Week 2025 showcased a series of product launches centered around innovation, sustainability, and material experimentation. Notable highlights included a foamless sofa, jelly-like stools, and modular designs such as the Bruton Sofa (made with natural materials) and the F300 Chair (a relaunch of Pierre Paulin's classic). Collaborations also featured the Jelly Chair by Jones + Partners for Deadgood, the Plank Desk System by Very Good & Proper and Forpeople, and the Caston Chair by David Irwin, crafted with 3D-knitted sleeves from recycled marine plastic. Artist Alex Chinneck's house sculpture and Arthur Mamou-Mami's 3D-printed water wave installations added artistic flair to the event, which took place in London from May 20 to 22, 2025, highlighting creativity and the use of sustainable materials.

-

In March 2024, Smith System partnered with Landscape Forms to launch OpenSpaces, a new line of highly durable, weather-resistant outdoor school furniture designed for creative student learning environments. The OpenSpaces range comprises tables, seating, benches, stools, recycling systems, and bike racks, all crafted from recycled materials and designed for low maintenance, accessibility, and enhanced collaboration in outdoor educational spaces.

Key School Furniture Companies:

The following are the leading companies in the School Furniture Market. These companies collectively hold the largest Market share and dictate industry trends.

- Fleetwood Group

- Scholar Craft

- VS America, Inc.

- Smith System Mfg. Co

- Knoll, Inc.

- Haworth Inc.

- VITRA INTERNATIONAL AG.

- Virco

- Office Line

- MOBeduc

School Furniture Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.92 billion

Revenue forecast in 2033

USD 8.88 billion

Growth rate

CAGR of 8.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2023

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Fleetwood Group; Scholar Craft; VS America, Inc.; Smith System Mfg. Co; Knoll, Inc.; Haworth Inc.; VITRA INTERNATIONAL AG.; Virco; Office Line; MOBeduc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global School Furniture Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the school furniture market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Storage Units

-

Seating Furniture

-

Lab Furniture

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Classroom

-

Library & Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Seating furniture dominated the market, accounting for over 54% of the share in 2025. This position can be attributed to its mass requirement in every educational institution. Such products are essential for creating a comfortable and functional learning environment. Without adequate seating, students may be distracted or uncomfortable, which can affect their ability to learn. high levels of investment in education, and large number of schools.

b. Some key players operating in the school furniture market include Fleetwood Group; Scholar Craft; VS America, Inc.; Smith System Mfg. Co; Knoll, Inc.; Haworth Inc.; VITRA INTERNATIONAL AG.; Virco; Office Line; MOBeduc.

b. Key factors that are driving the school furniture market growth includes growing population, education reforms in several countries globally, the rising importance of ergonomic seating for students, and technological advancements to accommodate devices such as laptops, tablets.

b. The global school furniture market was estimated at USD 4.66 billion in 2025 and is expected to reach USD 4.92 billion in 2026.

b. The global school furniture market is expected to grow at a compound annual growth rate of 8.8% from 2026 to 2033 to reach USD 8.88 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.