- Home

- »

- Advanced Interior Materials

- »

-

Screening Equipment Market Size, Industry Report, 2033GVR Report cover

![Screening Equipment Market Size, Share & Trends Report]()

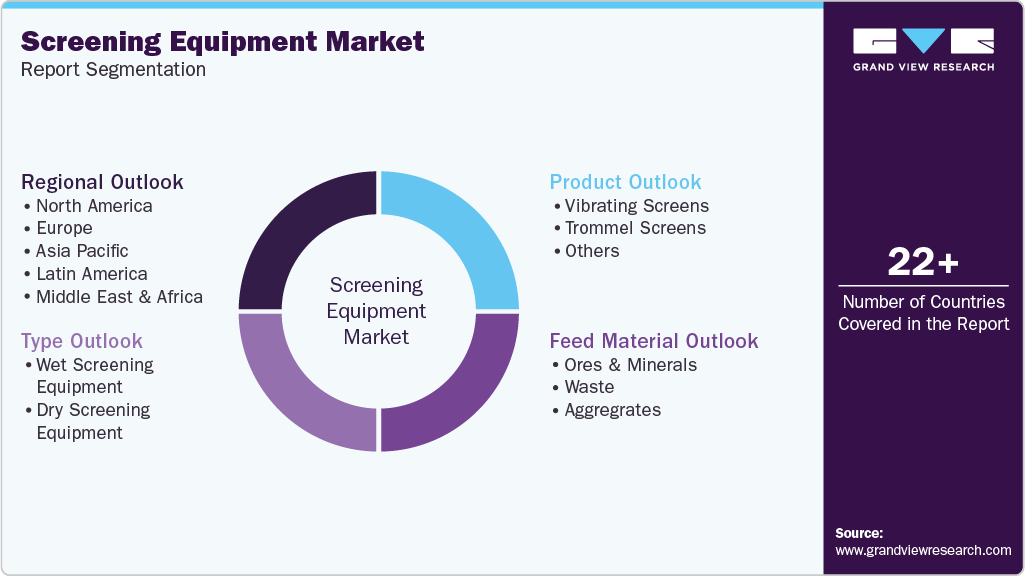

Screening Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Wet Screening Equipment, Dry Screening Equipment), By Product (Vibrating Screens, Trommel Screens), By Feed Material, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-791-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Screening Equipment Market Summary

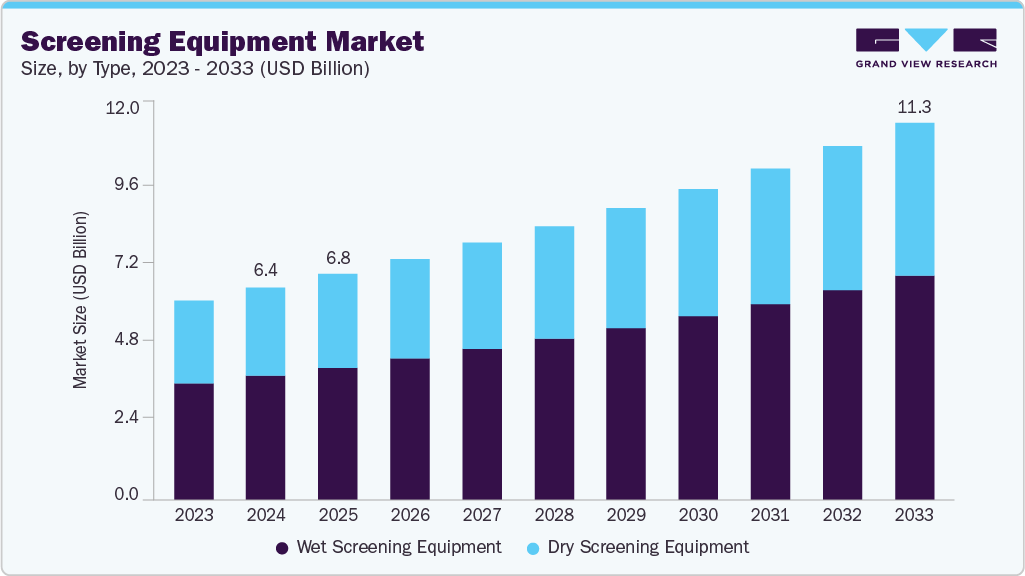

The global screening equipment market size was estimated at USD 6,363.3 million in 2024 and is projected to reach USD 11,286.8 million by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The global screening equipment industry is driven by the rising demand for efficient material separation and size classification across industries such as mining, construction, recycling, and agriculture.

Key Market Trends & Insights

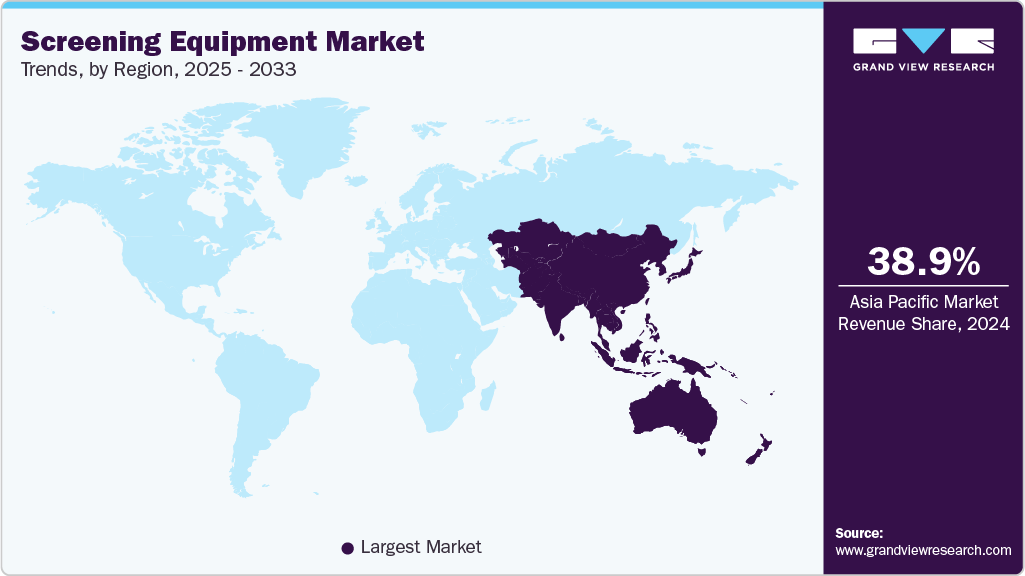

- Asia Pacific dominated the screening equipment market with the largest revenue share of 38.9% in 2024.

- By type, the dry screening equipment segment is expected to grow at the fastest CAGR of 6.3% from 2025 to 2033.

- By product, the trommel screens segment is projected to expand at the fastest CAGR of 6.8% from 2025 to 2033.

- By feed material, the waste segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 6,363.3 Million

- 2033 Projected Market Size: USD 11,286.8 Million

- CAGR (2025-2033): 6.6%

- Asia Pacific: Largest market in 2024

- Asia Pacific: Fastest growing region

Increasing mining and quarrying activities, particularly in developing regions, have significantly boosted the need for advanced screening solutions to handle higher material volumes and improve productivity.

Moreover, the growing adoption of mobile and modular screening units is enhancing operational flexibility and reducing setup time, which further supports market expansion. Technological advancements, including automation, real-time monitoring, and hybrid power systems, are also enabling higher screening accuracy and lower operational costs, strengthening overall market growth.

Market Concentration & Characteristics

The screening equipment industry is moderately concentrated, with several established global players such as Metso Corporation, Sandvik AB, and Terex Corporation among others dominating the industry landscape. These companies hold a strong market presence due to their broad product portfolios, global distribution networks, and focus on customized solutions. However, regional manufacturers also play a vital role, especially in emerging markets, where price competitiveness and localized support influence equipment selection.

The degree of innovation in the screening equipment industry is moderate to high, driven by continuous developments in vibration technology, wear-resistant materials, and digital monitoring systems. Manufacturers are increasingly integrating smart sensors and predictive maintenance features to enhance uptime and operational reliability.

In terms of regulatory impact, environmental and safety standards significantly influence equipment design and manufacturing. Regulations promoting dust suppression, noise reduction, and energy efficiency are pushing manufacturers to adopt cleaner and safer screening technologies. The screening equipment industry also exhibits moderate end-user concentration, with mining, construction, and recycling sectors accounting for the majority of equipment demand due to their continuous need for material sorting and processing efficiency.

Drivers, Opportunities & Restraints

The construction and infrastructure sectors remain major contributors to market growth, driven by large-scale projects and increased urbanization. Demand for high-performance vibrating screens and trommel screens has increased, especially for aggregate processing and waste recycling applications. In addition, stricter environmental regulations promoting sustainable waste management are encouraging the deployment of advanced screening systems capable of efficiently sorting recyclable and non-recyclable materials.

The screening equipment industry presents substantial opportunities driven by rapid industrialization, the shift toward sustainable resource management, and rising investments in infrastructure development. The expansion of the mining and construction sectors in Asia Pacific, Africa, and Latin America is creating new avenues for advanced screening systems capable of handling high throughput with improved accuracy. Moreover, the growing emphasis on circular economy practices has accelerated the demand for mobile and energy-efficient screening solutions that enable material recovery and recycling.

Despite strong demand across industries, the screening equipment industry faces several restraints that could limit short-term growth. High initial investment and maintenance costs associated with large-scale screening systems pose a challenge, particularly for small and medium-sized operators. Equipment downtime and frequent wear of screening media also lead to increased operational expenses, discouraging adoption in cost-sensitive markets. Furthermore, fluctuations in raw material prices and supply chain disruptions can impact equipment production and delivery timelines.

Type Insights

The wet screening equipment segment led the market with the largest revenue share of 58.5% in 2024, due to its effectiveness in handling fine materials, slurries, and high-moisture feeds. Wet screening processes are widely used in mineral processing, sand washing, and ore beneficiation applications where precise particle separation and dust control are critical. The ability of wet screening systems to enhance efficiency and minimize airborne particles makes them ideal for industries prioritizing product quality and environmental compliance.

The dry screening segment is anticipated to grow at the fastest CAGR during the forecast period. The dry screening continues to gain traction in applications where water usage must be minimized, such as aggregate processing, construction material screening, and waste sorting. Dry screens offer lower operating costs and are easier to install in remote or arid regions, making them suitable for portable and mobile setups. Technological improvements in vibration design and screen media materials have enhanced their efficiency and throughput, enabling precise separation even without the use of water.

Product Insights

The vibrating systems segment led the market with the largest revenue share of 70.0% in 2024,due to its versatility, high efficiency, and adaptability across diverse industries such as mining, construction, and recycling. These systems are capable of handling a wide range of materials, from fine powders to large aggregates, with consistent performance. Manufacturers are increasingly integrating multi-deck configurations and digital control systems to improve screening precision and operational monitoring.

The trommel screens segment expected to grow at the fastest CAGR during the forecast period, primarily driven by its increasing adoption in recycling, waste management, and small-scale mineral processing. Trommel screens are valued for their simplicity, durability, and ability to handle sticky or irregular materials effectively. Their rotating drum design allows for consistent material flow and low maintenance requirements, making them ideal for separating organic waste, compost, and aggregates.

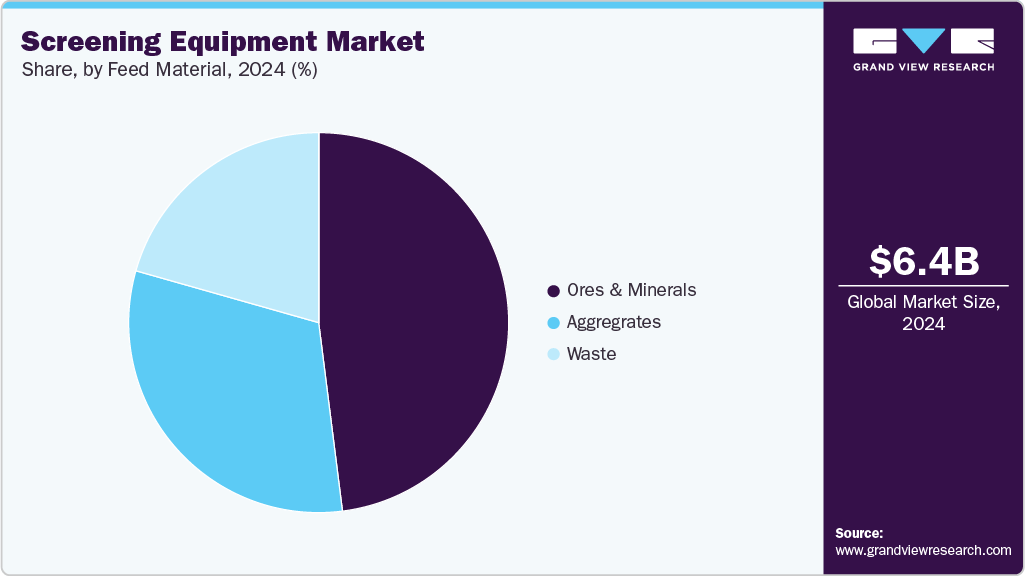

Feed Material Insights

The ores & minerals segment led the market with the largest revenue share of 48.0% in 2024,supported by the mining industry’s continuous need for material classification and size control. Screening systems are essential in ore extraction and processing to ensure product uniformity and optimize downstream operations such as crushing and grinding. The rise in global metal demand and ongoing exploration activities are driving further equipment installations.

The waste segment is anticipated to grow at the fastest CAGR during the forecast period, due to growing emphasis on recycling, landfill reduction, and sustainable resource management. Screening equipment is widely used to separate recyclable materials such as plastics, metals, and organic waste from mixed waste streams. The increasing integration of screening systems into municipal waste treatment and composting facilities is further driving adoption. As countries tighten waste management regulations, demand for efficient, low-emission, and easy-to-maintain screening equipment continues to rise.

Regional Insights

The screening equipment market in North America is witnessing steady growth, driven by strong mining, aggregates, and recycling activities. The region’s focus on sustainable construction practices and material recovery has accelerated the adoption of energy-efficient and mobile screening units. Ongoing infrastructure renovation projects, coupled with advancements in automated screening technologies, further strengthen market demand. Moreover, established industry players and a mature equipment rental ecosystem contribute to stable long-term market performance.

U.S. Screening Equipment Market Trends

The screening equipment market in the U.S. is growing steadily, supported by strong demand from the aggregates, mining, and recycling industries. Ongoing infrastructure modernization and highway construction projects continue to drive adoption of advanced vibrating and mobile screening systems. The country’s emphasis on sustainable material handling and recycling efficiency has encouraged the use of energy-efficient, low-emission screening solutions.

Asia Pacific Screening Equipment Market Trends

Asia Pacific dominated the screening equipment market with the largest revenue share of 38.9% in 2024, owing to rapid industrialization, expanding mining output, and robust infrastructure development in countries such as China, India, and Australia. Government initiatives supporting mineral exploration and urban development projects continue to stimulate equipment demand. The increasing presence of local manufacturers offering cost-effective solutions has also made screening systems more accessible. Furthermore, the shift toward automation and mobile screening plants is enhancing operational flexibility and efficiency across the region.

The screening equipment market in China accounted for the largest market revenue share in Asia Pacific in 2024, supported by extensive mining operations and rapid infrastructure expansion. Local manufacturers are increasingly adopting automation and digital control systems to improve equipment performance and operational safety. The government’s emphasis on industrial modernization and environmental sustainability is also accelerating the shift toward energy-efficient and modular screening solutions. With continuous investment in urbanization and construction, China’s screening equipment industry is poised for robust long-term growth.

The India screening equipment market is expanding rapidly, fueled by major infrastructure and mining projects under national development initiatives. The demand for portable and high-capacity screening systems is growing as industries focus on operational efficiency and cost reduction. The government’s increasing focus on resource recovery and sustainable construction practices has further boosted equipment utilization.

Europe Screening Equipment Market Trends

The screening equipment market in Europe is propelled by stringent environmental regulations and the rapid growth of recycling and waste management operations. The region’s emphasis on circular economy practices has led to widespread adoption of modular and hybrid-powered screening systems. Countries such as Germany, the UK, and France are investing in smart and low-emission equipment to meet sustainability goals. In addition, technological integration and refurbishment of older screening plants are fostering modernization across the region.

The UK screening equipment market is shaped by its growing focus on circular economy initiatives and sustainable construction practices. The increasing volume of recycling operations, particularly in construction and demolition waste, is fostering demand for compact and mobile screening equipment. Government regulations promoting waste reduction and material recovery are also influencing purchasing decisions. Additionally, the shift toward electric and hybrid screening systems aligns with the UK’s broader decarbonization goals, supporting a gradual transition toward cleaner technologies.

The screening equipment market in Germany represents one of Europe’s most technologically advanced screening equipment industry, driven by the country’s strong industrial base and commitment to precision engineering. Continuous infrastructure renewal, along with advancements in recycling processes, sustains demand for high-performance screening units. The integration of automation, real-time monitoring, and digital diagnostics is gaining traction to enhance productivity. Moreover, Germany’s stringent environmental and safety regulations are pushing manufacturers toward more sustainable and durable equipment designs.

Middle East & Africa Screening Equipment Market Trends

The screening equipment market in the Middle East & Africa is expanding gradually, supported by the growth of the mining, construction, and aggregate processing sectors. Rising investments in infrastructure, particularly in the Gulf countries, have bolstered equipment demand. African nations are also witnessing greater exploration activity, driving the need for reliable and heavy-duty screening solutions. Despite logistical and regulatory challenges, the region presents significant long-term potential due to its rich mineral reserves and emerging industrial base.

The Saudi Arabia screening equipment market is witnessing notable growth, driven by the expansion of mining and construction projects under national diversification initiatives. The government’s focus on developing non-oil industries and infrastructure has significantly boosted demand for high-performance screening systems. The growing adoption of mobile and heavy-duty equipment for quarrying and mineral processing reflects a shift toward modernized operations.

Latin America Screening Equipment Market Trends

The screening equipment market in Latin America is growing, primarily driven by the resurgence of the mining and construction sectors in countries such as Brazil, Chile, and Peru. The demand for high-capacity and durable screening equipment is increasing as mining operations expand, and resource extraction intensifies. Ongoing infrastructure and energy projects are also contributing to higher adoption rates. However, challenges such as capital constraints and import dependency in some countries slightly temper the pace of growth.

The Brazil screening equipment market is supported by the resurgence of the mining and construction sectors, with growing demand for advanced screening systems capable of handling diverse materials. Investments in infrastructure and industrial expansion are encouraging the adoption of mobile and modular units. The country’s focus on improving mineral processing efficiency is driving replacement and modernization of existing equipment fleets. Furthermore, increasing collaboration between local and international manufacturers is enhancing product availability and service capabilities across the region.

Key Screening Equipment Company Insights

Some of the key players operating in the market include Metso and Sandvik AB

-

Metso Corporation is a Finland-based industrial company engaged in providing equipment, technology, and services for the mining, aggregates, and metals industries. The company’s operations are organized around delivering solutions for mineral processing, aggregates production, and metal refining. Its portfolio includes crushers, screens, mills, and other material handling systems that support large-scale industrial production processes. Within the screening equipment domain, Metso offers vibrating and mobile screens used across quarrying, mining, and recycling applications. The company operates globally, serving a wide base of industrial and infrastructure-oriented customers.

-

Sandvik AB is a Sweden-based engineering and manufacturing company with a diverse portfolio spanning mining and rock excavation, metal-cutting tools, and advanced materials technology. It designs and produces a range of industrial machinery and tools used in construction, manufacturing, and resource extraction industries. Sandvik’s Rock Processing division provides screening and crushing equipment utilized in aggregate production and mining operations. The company maintains a strong international presence with production and service facilities across major industrial regions, catering to both equipment supply and aftermarket support needs.

Key Screening Equipment Companies:

The following are the leading companies in the global screening equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Terex Corporation

- Metso Outotec

- Sandvik AB

- Vulcan Industries Inc.

- Kleemann GmbH

- Derrick Corporation

- Weir Group PLC

- FLSmidth A/S

- Rubble Master HMH GmbH

- Epiroc

- Astec Industries, Inc.

- McCloskey International

- SMICO

- Derrick Corporation

- Deister Machine Company, Inc.

Recent Developments

-

In October 2025, Sandvik AB, in collaboration with S&R Enterprises, delivered its first QA452e hybrid mobile screen to Southern Africa. The dual-powered unit, combining diesel and electric operation, was quickly sold and deployed for a major dam project in Lesotho. Featuring Sandvik’s advanced “Doublescreen” triple-deck technology, it delivers up to 30% higher screening efficiency and flexibility. The launch aligns with rising regional demand for hybrid solutions amid escalating energy costs, supported by an extended 24-month warranty.

-

In February 2024, Superior Industries introduced a new heavy-duty scalping screen in its Guardian Horizontal Screen lineup. Designed to handle larger feed sizes, this model accommodates up to 18-inch (457mm) material, surpassing the 14-inch (355mm) capacity of its medium-duty predecessor. The screen features a perforated top deck made of 3/4-inch AR steel and a slight slope to facilitate efficient material movement.

Screening Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,774.8 million

Revenue forecast in 2033

USD 11,286.8 million

Growth rate

CAGR of 6.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, feed material, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Terex Corporation; Metso Outotec; Sandvik AB; Vulcan Industries Inc.; Kleemann GmbH; Derrick Corporation; Weir Group PLC; FLSmidth A/S; Rubble Master HMH GmbH; Epiroc; Astec Industries, Inc.; McCloskey International; SMICO; Derrick Corporation; Deister Machine Company, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Screening Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global screening equipment market report based on type, product, feed material, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Wet Screening Equipment

-

Dry Screening Equipment

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vibrating Screens

-

Trommel Screens

-

Others

-

-

Feed Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Ores & Minerals

-

Waste

-

Aggregrates

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global screening equipment market size was estimated at USD 6,363.3 million in 2024 and is expected to be USD 6,774.8 million in 2025.

b. The global screening equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2033 to reach USD 11,286.8 million by 2033.

b. The Asia Pacific market led the market in 2024 accounting for a share of 38.9% in 2024, driven by rapid industrialization, urbanization, and infrastructure development across the region. This expansion is further fueled by increasing demand in sectors such as mining, construction, and agriculture, where efficient material processing and sorting are essential.

b. Some of the key players operating in the global screening equipment market include Terex Corporation, Metso Outotec, Sandvik AB, Vulcan Industries Inc., Kleemann GmbH, Derrick Corporation, Weir Group PLC, FLSmidth A/S, Rubble Master HMH GmbH, Epiroc, Astec Industries, Inc., McCloskey International, SMICO, Derrick Corporation, and Deister Machine Company, Inc.

b. The global screening equipment market is primarily driven by the surge in infrastructure development and urbanization, which increases the demand for efficient material processing in construction projects. Additionally, advancements in automation and the adoption of modular, mobile equipment enhance operational efficiency and flexibility, further propelling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.