- Home

- »

- Automotive & Transportation

- »

-

Secure Logistics Market Size & Share, Industry Report, 2030GVR Report cover

![Secure Logistics Market Size, Share & Trends Report]()

Secure Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Static, Mobile), By Mode Of Transport (Road, Rail, Air), By Application (Cash Management, Diamonds, Jewelry & Precious Metals, Manufacturing), By End-use (Retailers, Government), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-322-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Secure Logistics Market Summary

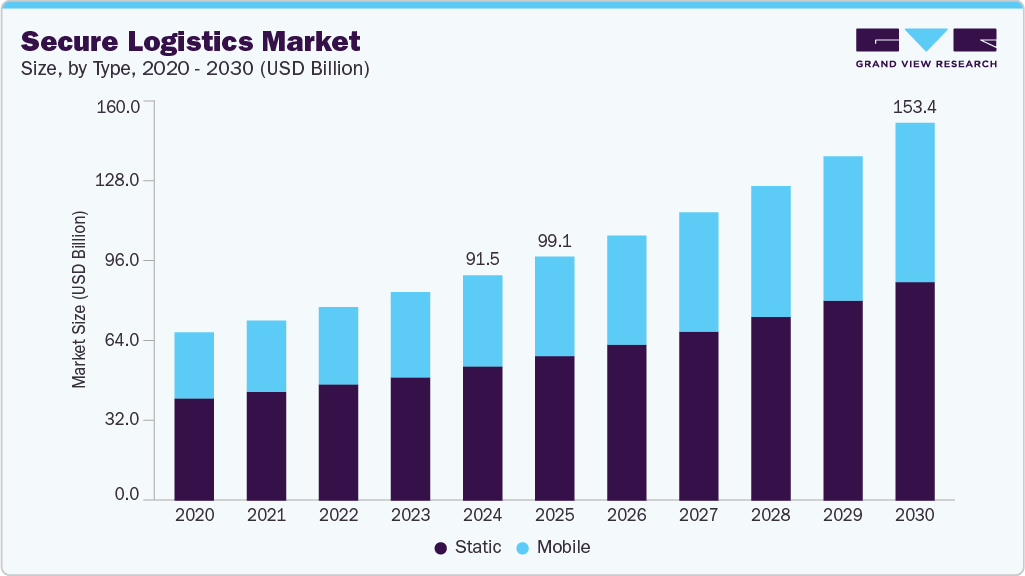

The global secure logistics market size was estimated at USD 91.51 billion in 2024 and is projected to reach USD 153.44 billion by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The industry is witnessing steady growth globally, driven by the rising need for safe and efficient transportation of valuable assets, cash, and confidential documents across various industries.

Key Market Trends & Insights

- Europe secure logistics market accounted for a 41.6% share of the overall market in 2024.

- The UK secure logistics industry is expected to grow rapidly in the coming years, driven by high-value financial operations, retail activity, and the presence of major multinational banks and security firms.

- By type, the static segment accounted for the largest share of 59.5% in 2024.

- By mode of transport, the road segment held the largest market share in 2024.

- By application, the cash management segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 91.51 Billion

- 2030 Projected Market Size: USD 153.44 Billion

- CAGR (2025-2030): 9.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Increasing cash circulation, expansion of banking and ATM networks, and the growing movement of high-value goods such as jewelry, electronics, and pharmaceuticals are fueling demand for professional secure logistics services. Technological advancements are transforming the secure logistics landscape through the integration of IoT, telematics, AI, and blockchain solutions. Modern armored fleets are now equipped with GPS-enabled tracking systems, biometric authentication, and electronic locking mechanisms that enhance transparency and real-time control over asset movement. Advanced analytics and AI-driven route optimization tools are helping logistics providers improve efficiency and reduce operational costs.

Growing demand for secure logistics services has attracted significant private and institutional investments in infrastructure, fleet modernization, and technology integration. Leading providers are expanding their networks of cash processing centers, armored vehicles, and high-security vaults to meet increasing customer needs. Venture capital and private equity firms are also investing in tech-driven security companies that offer integrated logistics and digital monitoring solutions. Furthermore, strategic partnerships between banks, logistics firms, and fintech players are driving innovation in cash management and secure delivery services. These investments are improving service capacity and accelerating the digital transformation of the global industry.

The industry operates under a highly regulated framework, with strict compliance requirements related to safety, insurance, and asset custody. Governments and central banks mandate standardized procedures for cash handling, armored transport specifications, and personnel background checks to prevent theft, fraud, and money laundering. International standards such as ISO certifications and regional security mandates ensure consistency and accountability across service providers.

Despite strong growth potential, the market faces several challenges. High operational costs, including vehicle maintenance, fuel expenses, and insurance premiums, put pressure on profit margins for service providers. The growing shift toward digital and cashless payment ecosystems in developed markets also reduces dependence on traditional cash-in-transit operations. In addition, rising security threats, labor shortages, and the need for continuous staff training increase the cost and complexity of operations.

Type Insights

The static segment accounted for the largest share of 59.5% in 2024. The expansion of banking networks, ATMs, and organized retail outlets in emerging markets has created a broader base for static secure logistics operations. Financial institutions increasingly rely on third-party security providers to operate cash management centers and regional vaults, which help in the efficient and centralized handling of funds. Similarly, retail chains require overnight secure storage and same-day cash collection services to safeguard earnings, thereby expanding opportunities for static security solutions.

The mobile segment is expected to grow at the fastest CAGR during the forecast period. Rapid growth of e-commerce and omnichannel retail has created much larger volumes of high-value, time-sensitive shipments that require secure on-the-move handling. Merchants and marketplaces increasingly demand same-day/next-day fulfilment and secure doorstep delivery for electronics, pharmaceuticals, and luxury goods, which in turn pushes providers to expand mobile secure logistics (armored couriers, secure rapid-response teams, locked mobile lockers) to meet demand while protecting goods and cash flows.

Mode Of Transport Insights

The road segment held the dominating share in the market in 2024. The road segment remains the backbone of secure logistics due to its flexibility, last-mile reach, and cost-effectiveness. The expansion of retail, e-commerce, and banking networks across urban and semi-urban regions has significantly boosted demand for armored vehicles, cash-in-transit vans, and secured courier fleets. Businesses handling cash, valuables, jewelry, or sensitive documents prefer road transport for its ability to provide door-to-door secure delivery and frequent route scheduling.

The air segment is expected to grow at the fastest CAGR during the forecast period. The air segment of secure logistics is growing rapidly as companies prioritize speed, safety, and international reach. High-value items such as diamonds, luxury watches, financial instruments, artworks, and critical medical supplies increasingly rely on air freight due to the need for quick, controlled delivery. Secure air logistics providers collaborate with airlines and airport authorities to manage secure cargo holds, armed escorts, and sealed containers. This makes air transport indispensable for time-critical, long-distance, and international deliveries.

Application Insights

The cash management segment dominated the market in 2024. The cash management segment is expanding rapidly as banks, retail chains, and financial institutions increasingly outsource their cash handling and transportation operations to specialized secure logistics providers. Despite the rise in digital payments, cash remains a critical medium of exchange in many economies, particularly in emerging markets. Businesses rely on professional secure logistics firms to handle cash pickup, counting, sorting, and delivery to central vaults or bank branches. The need for reliability, transparency, and efficiency in cash operations is driving sustained growth in this segment.

The manufacturing segment is projected to grow at the fastest CAGR over the forecast period. In the manufacturing segment, secure logistics services are vital for the movement of high-value raw materials, components, tools, and finished goods. Industries such as electronics, automotive, defense, and precision engineering require secure transportation to prevent theft, tampering, or industrial espionage. As manufacturing supply chains become more globalized and complex, the need for controlled, monitored, and insured logistics services has intensified, fueling segment growth.

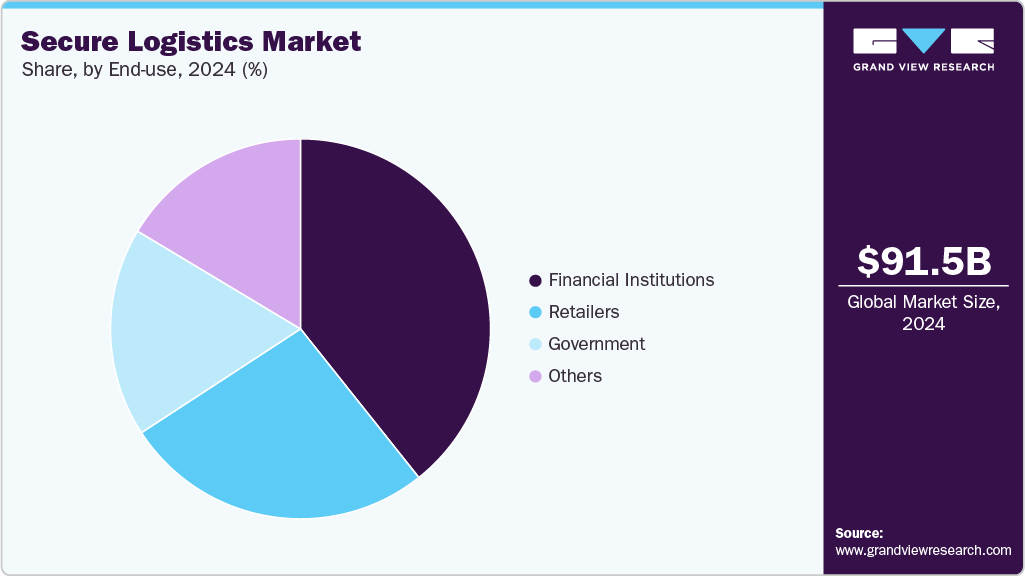

End-use Insights

The financial institutions segment dominated the market in 2024. Financial institutions continue to expand ATM and cash deposit machine networks to improve accessibility and customer service. Each of these endpoints requires regular cash replenishment, collection, and monitoring, creating consistent demand for cash-in-transit (CIT) and cash management services. The integration of real-time tracking systems, armored vehicles, and tamper-proof containers ensures secure and transparent handling of funds, reinforcing banks’ reliance on secure logistics providers and supporting segment growth.

The government segment is expected to register the fastest CAGR over the forecast period. Government agencies, including central banks and treasuries, frequently manage the movement of currency, bullion reserves, and other national assets. Secure logistics firms with armored fleets, trained personnel, and specialized storage infrastructure play a vital role in ensuring the safe and compliant transfer of these assets between mints, central repositories, and commercial banks. As economies grow and cash demand increases, government reliance on professional secure logistics partners also strengthens.

Regional Insights

The secure logistics market in Europe held the largest share of 41.6% in 2024. Stringent regulatory frameworks and the modernization of financial infrastructure support the growth in the region. Countries within the European Union are emphasizing standardized cash handling procedures, cross-border security protocols, and armored transport certifications.

The UK secure logistics industry is expected to grow rapidly in the coming years, driven by high-value financial operations, retail activity, and the presence of major multinational banks and security firms. The sector benefits from strong regulatory oversight by financial authorities, ensuring high standards in cash management and asset protection.

North America Secure Logistics Industry Trends

North America secure logistics market held a significant share in 2024. The region benefits from a mature financial ecosystem and extensive retail networks that demand reliable cash management and high-value goods transport services. Growing adoption of digital tracking systems, armored fleets, and integrated security software is further driving operational efficiency.

U.S. Secure Logistics Market Trends

The secure logistics market in the U.S. held a dominant position in 2024, driven by robust demand from financial institutions, government agencies, and the retail sector. High cash circulation in industries such as gaming, hospitality, and quick-service restaurants sustains the need for professional cash-in-transit and vaulting services.

Asia Pacific Secure Logistics Market Trends

The secure logistics market in Asia Pacific is expected to grow at the fastest CAGR of 12.4% over the forecast period. The market in the region is experiencing robust growth due to rapid economic expansion, urbanization, and the rise of cash-intensive sectors such as retail, manufacturing, and banking. Emerging economies across the region are witnessing strong demand for cash management, ATM replenishment, and high-value goods transport.

Japan secure logistics industry is expected to grow rapidly in the coming years due to a highly developed financial sector and a strong emphasis on operational precision, safety, and compliance. Despite being a technologically advanced and increasingly cashless society, a substantial volume of cash transactions persists, necessitating efficient and secure cash-handling services.

The secure logistics industry in Indiaheld a substantial market share in 2024 due to rising cash circulation, banking network expansion, and the growth of organized retail. The country’s large ATM base and increasing number of bank branches continue to fuel demand for cash-in-transit and cash processing services.

Key Secure Logistics Company Insights

Key players operating in the secure logistics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key companies in the secure logistics market include Brink’s Incorporated, CargoGuard,CMS Info Systems (CMS), G4S Limited, GardaWorld, and others.

-

GardaWorld is the world’s largest privately owned integrated security and cash logistics company, offering comprehensive secure logistics services worldwide. With over 132,000 employees operating in more than 45 countries, GardaWorld provides end-to-end secure transport and logistics solutions, including armored cash transport, physical security services, vehicle and asset tracking, crisis management, and risk consulting. GardaWorld serves a broad client base, including financial institutions, retailers, and governments, emphasizing operational excellence, innovation, and security compliance.

-

Brink's Incorporated is a secure logistics and cash management solutions provider. It provides comprehensive, secure logistics services for valuable assets, including cash, precious metals, diamonds, jewelry, and sensitive documents. Brink's operates a vast network with armored transport vehicles, bonded warehouses, custom clearance expertise, and advanced cargo telemetry to monitor shipments' location, temperature, and humidity in real time. Their offerings include end-to-end management of pickup, transit, and delivery, all-risk insurance coverage, risk consulting, and secure storage and vaulting facilities worldwide. Brink's serves a diverse client base, including banks, retailers, governments, and private enterprises, ensuring product integrity and security throughout the supply chain with a focus on innovation, operational excellence, and compliance.

Key Secure Logistics Companies:

The following are the leading companies in the secure logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Brink’s Incorporated

- CargoGuard

- CMS Info Systems (CMS)

- G4S Limited

- GardaWorld

- Allied Universal

- Loomis AB

- Maltacourt

- Securitas AB

- Prosegur

Recent Developments

- In February 2024, GardaWorld was announced as a formal endorsed business partner by the Canadian Institute of Traffic and Transportation (CITT), becoming the first security provider to achieve this status. This endorsement recognizes GardaWorld’s leadership in providing sophisticated security services tailored to the increasingly complex needs of logistics and transportation industries, including physical security, mobile security, and advanced systems. The partnership with CITT reflects GardaWorld’s commitment to supporting the protection of people, freight, and logistics assets in an environment where security demands are becoming more intricate.

Secure Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 99.09 billion

Revenue forecast in 2030

USD 153.44 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of transport, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Brink’s Incorporated; CargoGuard; CMS Info Systems (CMS); G4S Limited; GardaWorld; Allied Universal; Loomis AB; Maltacourt; Securitas AB; Prosegur

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Secure Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global secure logistics market report based on type, mode of transport, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Static

-

Mobile

-

-

Mode of Transport Outlook (Revenue, USD Million, 2018 - 2030)

-

Road

-

Rail

-

Air

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cash Management

-

Diamonds, Jewelry & Precious Metals

-

Manufacturing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Financial Institutions

-

Retailers

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global secure logistics market size was estimated at USD 91.51 billion in 2024 and is expected to reach USD 99.09 billion in 2025.

b. The global secure logistics market is expected to grow at a compound annual growth rate of 9.1% from 2025 to 2030 to reach USD 153.44 billion by 2030.

b. Europe dominated the secure logistics market with a share of 41.6% in 2024. This is attributable to the increasing penetration of ATMs, coupled with the growing use of ATMs in the region.

b. Some key players operating in the secure logistics market include Brink’s Incorporated; CargoGuard; CMS Info Systems (CMS); G4S Limited; GardaWorld; Allied Universal; Loomis AB; Maltacourt; Securitas AB; Prosegur.

b. Key factors that are driving the secure logistics market growth include the increasing money circulation across the globe, rising security concerns among corporate and banks have increased the requirement for secure movement and management services for currency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.