- Home

- »

- Network Security

- »

-

Security Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![Security Analytics Market Size, Share & Trends Report]()

Security Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Organization Size (SMEs, Large Enterprises), By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-748-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Analytics Market Summary

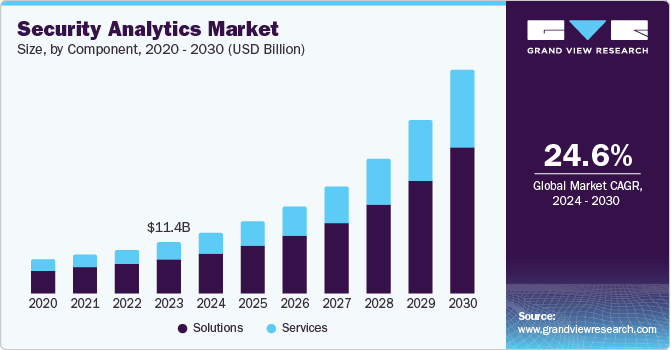

The global security analytics market size was estimated at USD 11.45 billion in 2023 and is projected to reach USD 50.38 billion by 2030, growing at a CAGR of 24.6% from 2024 to 2030. Rapid digital transformation and increasing technology embracement has led to a rising demand for security analytics solutions and services in recent years.

Key Market Trends & Insights

- The North America security analytics market dominated the global market with a revenue share of 39.5% in 2023.

- The analytics market in Asia Pacific security is anticipated to experience the fastest CAGR of 26.8% from 2024 to 2030.

- Based on organization size, the large enterprises segment dominated the global market for security analytics in 2023.

- Based on application, the network security analytics segment held the largest revenue share of the market in 2023.

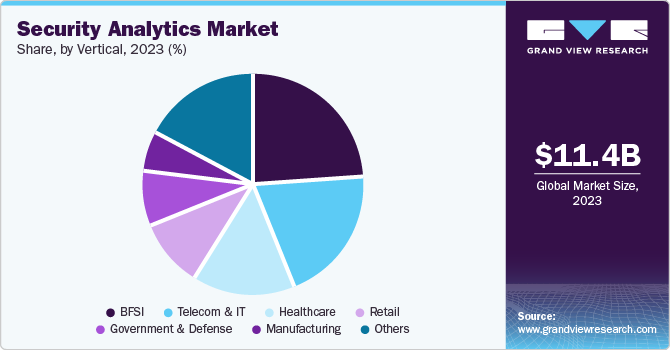

- Based on vertical, the BFSI segment dominated global security analytics market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.45 Billion

- 2030 Projected Market USD 50.38 Billion

- CAGR (2024-2030): 24.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Companies need assistance identifying potential network-based threats, understanding patterns through investigations, generating actionable insights, and preventing future intrusion, data breaches, and data theft incidents.

Security analytics platform assists with technology tools that offer proactive security functions such as detection, monitoring, and analysis of numerous security events, threat patterns, and attacks. Growing incidents related to security threats and cyberattacks primarily influence the demand for the security analytics market. According to the U.S. Federal Bureau of Investigation Internet Crime Report 2023, the Internet Crime Complaint Center received nearly 21,489 complaints of Business Email Compromise (BEC), 2,825 complaints of ransomware, 14,190 complaints of government impersonation, 37,560 of tech and customer support impersonation and more. Nearly 2,412 complaints were received every day in 2023. Critical infrastructure management organizations affected by ransomware attacks recorded 1,193 complaints in 2023. Organizations seek effective security analytics solutions and services to equip networks, systems, infrastructure, and technology utility space with necessary protection capabilities.

In recent years, multiple industry participants have adopted cloud-computing technology for enhanced data storage, remote monitoring, and seamless workflows. This has significantly increased the risk of data breaches, especially in the banking and financial services sectors. Misconfiguration of the cloud facilitates such attacks, which adds to the risks and loss of data. Furthermore, the increasing volume of data generated through digital transactions and interactions between consumers and businesses has increased the demand for enhanced data security.

Component Insights

The solutions segment held the largest revenue share of the global security market and accounted for 67.9% in 2023. This is attributed to increasing demand for security information and event management (SIEM) solutions that can assist organizations in real time security analysis. The security solutions offered by the key market participants ensure the monitoring of organizational networks, identification potential threats, and use of advanced technology tools such as artificial intelligence (AI) to provide real time assistance and response to incidents. Ability of security analytics solutions to profile techniques utilized by threat actors through predictive methodologies has fueled the demand for this segment in recent years.

The services segment is expected to experience fastest CAGR during forecast period. The security analytics services include professional and managed services. The experienced security analytics services offer required tools and technology-backed resolutions to user organizations and provide training for its employees if needed. However, providers continuously oversee managed services and handle the technology tools utilized by the client companies. The use of security analytics services is driven by its cost-effectiveness, lack of trained personnel, reduced liability, and assistance experts provide in ensuring protection from threats from routine business activities.

Organization Size Insights

The large enterprises segment dominated the global market for security analytics in 2023. This segment is driven by the increasing number of threats experienced by large enterprises with complex infrastructures that utilize and function large amounts of data. Large enterprises are equipped with the capacity to invest the necessary funds in the implementation of effective security analytics measures, train their employees as and when needed, and adopt numerous security analytics services for various projects.

The SME segment is projected to experience the fastest CAGR from 2024 to 2030. The growth of this segment is primarily influenced by factors such as rising network-based threats to SEMs, lack of skilled cybersecurity personnel, growing transition to cloud-based platforms, need for cost-effective security assistance, and more. The possibility of data breaches, the use of legacy systems, and the availability of SMEs' specific security analytics solutions and services offered by key players in the market are expected to drive demand for this segment in the coming years.

Application Insights

The network security analytics segment held the largest revenue share of the market in 2023 based on application. Network security analytics solutions help organizations detect threats, improve compliance adherence, protect sensitive data, and maintain security posture. The use of data in high volumes, increasing demand for data security, and rising incidents of network-based cyber-attacks are expected to drive demand for this segment during the forecast period. Some key components of network-based security analytics are threat intelligence, incident response, firewalls, intrusion prevention systems, threat detection, access control, and more.

The endpoint security analytics segment is anticipated to experience the fastest CAGR from 2024 to 2030. This segment is influenced by aspects such as increasing cyber threats, growing adoption of work policies such as Bring your own devices (BYOD), the emergence of technologies such as the Internet of Things, increasing use of cloud computing, rising concerns of data privacy, and increased remote work profiles.

Vertical Insights

The BFSI segment dominated global security analytics market in 2023. This is attributed to many industry data breaches and data theft incidents. The previous incidences have encouraged companies in the BFSI sector to adopt efficient security analytics solutions. The sensitivity of data generated, processed, and utilized by banking and financial services further enhances the need for effective security measures.

The healthcare segment is projected to experience the fastest CAGR of 28.2% from 2024 to 2030. The growth of this segment is mainly influenced by factors such as growing data dependency, the sensitivity of patients' data, the increasing use of IoT or AI-driven systems, the growth in digital transformation activities within the healthcare sector, and the use of advanced technologies such as cloud computing. Risk assessment, incident response, and data security are some of the key areas where the healthcare industry requires enhanced security services.

Regional Insights

North America security analytics market dominated the global market with a revenue share of 39.5% in 2023. This is attributed to rapid digital transformation activities in multiple industries operating in North America, a rise in network-based threats, a large number of cyberattacks, data breaches, and data thefts reported in recent years, the growing dependence on customer data, and the presence of robust information & technology industry in the region. The adoption of advanced technologies such as AI, IoT, cloud computing, and others by numerous industries, including banking and financial services, healthcare, retail, e-commerce, automotive, manufacturing, and others, is expected to fuel the growth of this market in the approaching years.

U.S. Security Analytics Market Trends

The U.S. security analytics market held the regional industry's largest revenue share in 2023. This market is expected to experience rapid growth in demand owing to the rise in cyber-attacks and security threats. States such as California, Texas, Florida, New York, Ohio, and others recorded many complaints about internet-based crimes. According to the U.S. Federal Bureau of Investigation Internet Crime Report 2023, losses of nearly USD 12.5 billion were recorded in 2023. Phishing/Spoofing accounted for the largest complaints count of 298,878 in 2023. The highest number of complaints, i.e., 77,271, was recorded in California, followed by 47,305 in Texas and 41,061 in Florida during 2023.

Europe Security Analytics Market Trends

Europe is identified as a significant region for the global security analytics market in 2023. Rapid growth in digital transformation activities, many startups operating in the information technology sector, growing investments in adopting advanced technology and automation by organizations and governments, and many cyber threats experienced by companies in the region generate demand for this market. The presence of multiple manufacturing industry facilities that are undergoing a transition from traditional processes to “Industry 4.0” enhancements and increasing dependence of the banking and financial services sector on customer data is expected to drive demand for effective security analytics solutions in Europe during the forecast period.

Germany security analytics market is expected to experience significant growth from 2024 to 2030. According to The State of IT Security in Germany, 2023, by the Federal Office for Information Security, Germany recorded an average of two attacks per month on local government and municipal businesses. A quarter of a million new malware variants were found daily, and nearly 775 emails with malware were detected daily. These aspects are expected to drive demand for enhanced security analytics solutions.

Asia Pacific Security Analytics Market Trends

The analytics market in Asia Pacific security is anticipated to experience the fastest CAGR of 26.8% from 2024 to 2030. Growth of this segment is primarily driven by the extra-ordinary pace of digital transformation activities in the region, growing use of data by organizations operating in industries such as retail, healthcare, manufacturing, automotive, and others, increasing cyber-attacks, rising dependency on critical infrastructure management on network-based systems, and more. The presence of economies such as China and India, with lucrative growth in digital transactions between businesses and customers, adds to the need for effective security analytics solutions.

India security analytics market is projected to experience noteworthy growth during forecast period. This market is driven by the increasing use of data-driven systems backed by advanced technologies such as AI, IoT, and others. The presence of multiple outsourcing service provider businesses working for IT and telecom industry participants from North America and Europe in the country also drives the demand for this market.

Key Security Analytics Company Insights

Some of the key companies involved in the security analytics market include LevelBlue, Cisco Systems, Inc., McAfee, LLC, Microsoft, and others. To address the growth in demand and increasing competition, the key market participants are adopting strategies such as innovation, mergers & acquisitions, enhanced research, and more.

-

LevelBlue provides strategic cybersecurity services. Its offerings include On Premises Firewall (PBFW), Network Based Firewall (NBFW), Zero-Trust Network Access (ZTNA), Enterprise Traffic Protector (ETP), Cloud Access Security Broker (CASB), Secure Web Gateway (SWG), Secure Access Service Edge (SASE), Software-Defined Wide Area Networking (SD-WAN), Distributed Denial of Service (DDoS), Web Application and API Protection (WAAP) and more.

-

Fortinet, Inc., a major market participant in cyber security, offers a range of products and services related to network security, unified SASE, security operations, enterprise networking, cloud security, operational technology, and others.

Key Security Analytics Companies:

The following are the leading companies in the security analytics market. These companies collectively hold the largest market share and dictate industry trends.

- LevelBlue

- Broadcom (Symantec)

- Cisco Systems, Inc.

- FireEye, Inc.

- Fortinet, Inc.

- Hewlett Packard Enterprise Development LP

- IBM

- McAfee, LLC

- Microsoft

- Palo Alto Networks

- RSA Security LLC

- Securonix

- Splunk LLC

- Sumo Logic

- Tenable, Inc.

Recent Developments

-

In August 2024, Fortinet, Inc., a prominent cybersecurity company, announced that it had acquired Next DLP, a company that operates in insider risk and data protection. The strategic move is expected to strengthen Fortinet’s position in the integrated DLP and standalone enterprise data loss prevention (DLP) market.

-

In January 2024, McAfee, LLC, a key participant in the online protection industry, unveiled its latest innovation, 'Project Mockingbird. ' This advanced AI-detection capability can assist businesses and individuals in detecting maliciously altered audio in videos. McAfee has provided AI-equipped a combination of behavioral, categorical, and contextual detection models to address growing concerns regarding deep fakes.

Security Analytics market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.49 billion

Revenue Forecast in 2030

USD 50.38 billion

Growth rate

CAGR of 24.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, organizations size, application, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan,China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

LevelBlue; Broadcom (Symantec); Cisco Systems, Inc.; FireEye, Inc.; Fortinet, Inc.; Hewlett Packard Enterprise Development LP; IBM; McAfee, LLC; Microsoft; Palo Alto Networks; RSA Security LLC; Securonix; Splunk LLC; Sumo Logic; Tenable, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Analytics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global security analytics market report based on component, organization size, application, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Services

-

Professional

-

Managed Services

-

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large enterprises

-

SMEs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Web Security Analytics

-

Network Security Analytics

-

Endpoint Security Analytics

-

Application Security Analytics

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Telecom & IT

-

Retail

-

Healthcare

-

Government & Defense

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.