- Home

- »

- Electronic Devices

- »

-

Self-service Technology Market Size, Share Report 2030GVR Report cover

![Self-service Technology Market Size, Share & Trends Report]()

Self-service Technology Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (ATM, Kiosks, Vending Machines), By Application (Retail, QSR, Banking, Healthcare), By Region, And Segment Forecasts

- Report ID: 978-1-68038-649-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Self-service Technology Market Summary

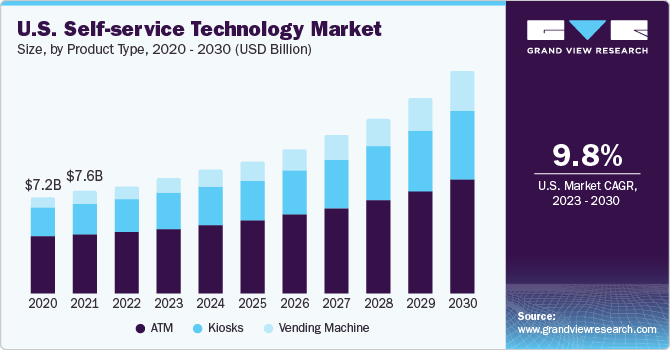

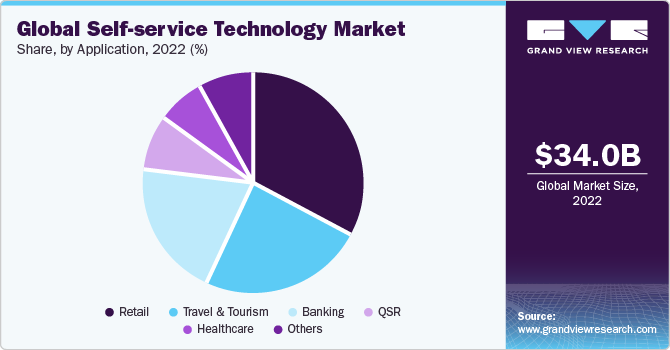

The global self-service technology market size was valued at USD 34.03 billion in 2022 and is projected to reach USD 92.24 billion by 2030, growing at a CAGR of 13.8% from 2023 to 2030. Varied technological advancements, such as remote management and wireless communication, are estimated to facilitate growth.

Key Market Trends & Insights

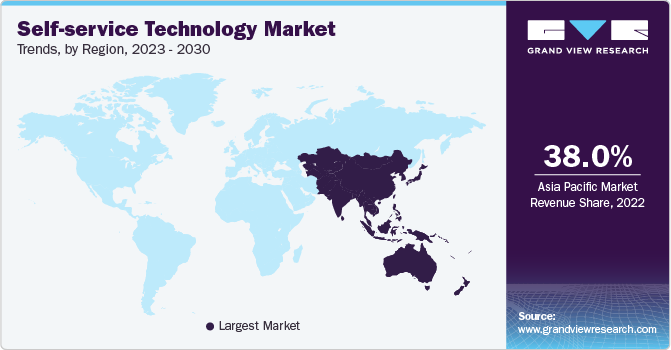

- Asia Pacific accounted for the largest revenue share of 38.0% in 2022.

- The Middle East and Africa are expected to witness significant growth with a CAGR of 15.3% over the forecast period.

- Based on product type, the ATM segment accounted for the largest revenue share of 58.4% in 2022.

- Based on application, the retail segment dominated the self-service technology market with a revenue share of 33.2% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 34.03 billion

- 2030 Projected Market Size: USD 92.24 billion

- CAGR (2023-2030): 13.8%

- Asia Pacific: Largest market in 2022

Integrating biometric security services, including fingerprint recognition, that ensures secured financial transactions is expected to drive the industry growth. These technologies enable customers to produce a service independent of direct service employee involvement.

Increasing demand for self-service machines and automated devices, wireless communication, technology advancements, and remote management are the major factors driving the demand for Self-service Technology (SST). Additionally, the increasing influx of consumers in retail stores and the growing consumption of goods and services purchased in stores play a critical role in the growing demand. The booming retail industry across emerging economies is projected to offer numerous opportunities for growth over the next seven years.

Furthermore, widespread awareness about the benefits of these machines, such as ease of check-in and check-out process, reduction in congestion, and improvement in customer experience across the retail, airport, and banking applications, is estimated to impact the demand positively. Besides urban areas, the manufacturers and service providers are now aiming at rural areas to enhance further self-service technology industry growth. For instance, in 2019, Karnataka Gramin Bank, an India-based rural banking service provider sponsored by Canara Bank of India, deployed mobile ATMs in Ballari, Kalaburagi, and Gulbarga districts of Karnataka.

The energy management and power consumption regulations imposed on different regions may curb demand. The government of various regions restricted the usage of food and beverage vending machines in many places, such as schools and colleges, thereby limiting the demand for these machines. As a result, manufacturers began introducing and promoting energy-conserving vending machines that provide added value benefits and contribute to society. These energy-saving vending machines consume less power and help in energy conservation in comparison to previous models. For instance, the refrigerated vending machines that are certified as ENERGY STAR save approximately 1,000 kWh annually and are 40% more energy efficient.

The growing adoption of mobile devices, connected systems, and digital platforms is revolutionizing customer shopping experiences across digital and physical reality. From convenience stores to food and beverage retail formats, all are increasingly adopting self-service technologies to provide customers with a personalized experience. These intelligent technologies offer enhanced customer support in real-time. Furthermore, the need for workforce optimization and to reduce overhead costs is influencing verticals such as banking, travel and hospitality, retail, and healthcare to adopt automated and intelligent technologies.

The COVID-19 pandemic has radically shifted consumer and business behavior. With the radical change in consumer behavior with increased distancing and stringent regulations, businesses are forced to stop their operations and, thus, limit their spending on opportunistic technologies. Despite the short-term social lockdown impact, the increased demand for groceries, medical supplies, general merchandise, and home improvement among shoppers forced businesses to adopt self-assisted technologies to promote social distancing and zero-touch practices. Furthermore, limited workforce availability due to lockdown and initiation of traveling and transportation has also led to the extensive adoption of self-service checkout systems.

Product Type Insights

The ATM segment accounted for the largest revenue share of 58.4% in 2022. Despite the rise in new avenues of digital transactions, the need for cash among developed and developing economies is encouraging the development of ATM deployments.Furthermore, with the need to reduce operational costs and increase customer satisfaction, banks are rapidly deploying cash-dispensing ATMs and self-service cash recycling machines. Moreover, the demand for small-value transactions among retail consumers is a crucial factor in surging self-service ATM deployments.

The vending machine segment is expected to grow at the fastest CAGR of 17.2% during the forecast period The rising demand for vending machines in the corporate sector is driving the overall market growth. The increasing need to reduce additional costs, space, and queues is the other factor driving the market in commercial spaces. Furthermore, the growing number of commercial projects and corporate offices to provide faster services is also anticipated to contribute towards the adoption of vending machines.

Application Insights

The retail segment dominated the self-service technology market with a revenue share of 33.2% in 2022. The need to provide quality service and improved customer experience encourages retailers to adopt self-service technologies. The most preferred technologies are the kiosks and vending machines. The rising influx in the shopper population and the need to provide a hassle-free experience during checkout further drive retail store applications. The growing adoption of interactive kiosks and self-checkout systems among various retail sectors, such as specialty stores, convenience stores, and supermarkets, are the other factors responsible for the growth of the retail segment.

The Quick Service Restaurant (QSR) segment is expected to register the fastest CAGR of 15.4% over the forecast period. A growing number of QSRs coupled with the increasing consumer orders and the need to reduce counter waiting time with fewer employees is driving the need for self-service systems. Furthermore, the increasing competition among restaurants to provide efficient service while maintaining operational costs is another factor responsible for the market growth. Additionally, the need to provide increased guest satisfaction and order accuracy and improve smarter business is driving the adoption of automated self-service systems among QSRs.

Regional Insights

Asia Pacific accounted for the largest revenue share of 38.0% in 2022 and is expected to grow at the fastest CAGR of 16.4% during the forecast period. The growth is attributed to factors such as the increasing deployment of ATMs, self-service kiosks, and vending machines across the emerging economies in the region that are driving the market. Furthermore, the increasing awareness and rising consumer spending tendencies towards this technology are expected to drive demand across the region. Rising urbanization across countries such as India, China, and Japan with exponential growth in the banking sector has led to a huge demand for such automated machines.

The Middle East and Africa are expected to witness significant growth with a CAGR of 15.3% over the forecast period.The growth of self-service technology in the region is driven by factors such as rapid urbanization, rising disposable incomes, the adoption of mobile internet, government initiatives

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations, to augment their market share. For instance, in February 2020, Hitachi-Omron Terminal Solutions, Corp’s Thailand subsidiary, received an order for ATM deployment, monitoring, and assistance from the Government Savings Bank of Thailand in partnership with Platt Nera International Limited.

Key Self-service Technology Companies:

- AZKOYEN, S.A.

- HYOSUNG TNS

- KIOSK Information Systems.

- HESS Cash Systems

- Crane Company

- Toshiba Tec Corporation.

- Fastcorp Vending LLC

Recent Developments

-

In June 2022, Zello, a voice-first communication platform announced the release of Zello Kiosk, a new product that integrates touchscreen kiosks with the company's industry-leading push-to-talk technology.It enables retail staff to interact effectively so that customers enjoy a positive shopping experience from the time they enter the store.

-

In May 2023, Applova Inc.,a Silicon Valley-based technology company announced a partnership with Samsung to launch a self-service kiosk for restaurants. These kiosk offers contactless ordering and payment, helping restaurants streamline operations, increase sales, and boost profits.

-

In May 2022, the U.S.-based companies, Solvpath LLC., a self-service customer support company, and sticky.io, a subscription management and recurring billing platform providerannounced collaboration. Through this collaboration both companies aim to help e-commerce merchants quickly resolve customer support inquiries using intelligent self-service methods.

Self-service Technology Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.37 billion

Revenue forecast in 2030

USD 92.24 billion

Growth Rate

CAGR of 13.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report Updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

AZKOYEN, S.A.; HYOSUNG TNS; KIOSK Information Systems.; HESS Cash Systems; Crane Company; Toshiba Tec Corporation.; Fastcorp Vending LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & or segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Self-service Technology Market Report Segmentation

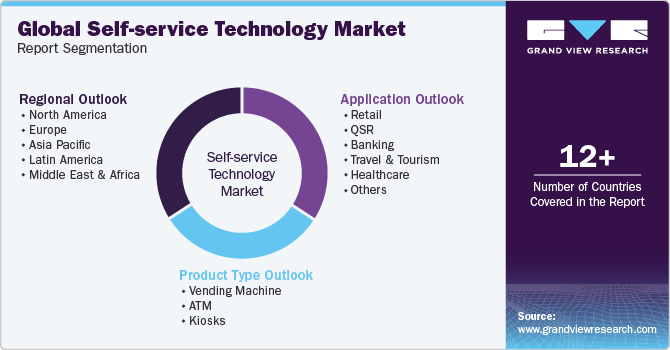

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global self-service technology market based on product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Vending machine

-

ATM

-

Kiosks

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

QSR

-

Banking

-

Travel & tourism

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global self-service technology market size was estimated at USD 34.03 billion in 2022 and is expected to reach USD 37.37 billion in 2023.

b. The global self-service technology market is expected to grow at a compound annual growth rate of 13.8% from 2023 to 2030 to reach USD 92.24 billion by 2030.

b. The ATM segment accounted for the largest revenue share of 58.4% in 2022. Despite the rise in new avenues of digital transactions, the need for cash among developed and developing economies is encouraging the development of ATM deployments.

b. Some key players operating in the self-service technology market include NAZKOYEN, S.A.; HYOSUNG TNS; KIOSK Information Systems.; HESS Cash Systems; Crane Company; Toshiba Tec Corporation.; and Fastcorp Vending LLC amongst others.

b. Key factors that are driving the market growth include Increasing demand for self-service machines and automated devices, wireless communication, technology advancements, and remote management are the major factors driving the demand for Self-service Technology (SST).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.