- Home

- »

- Medical Devices

- »

-

Semi-Solid Dosage CDMO Market, Industry Report, 2030GVR Report cover

![Semi-Solid Dosage CDMO Market Size, Share & Trends Report]()

Semi-Solid Dosage CDMO Market (2025 - 2030) Size, Share & Trends Analysis Report By Route of Administration (Topical, Transdermal), By Product, By Service, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-477-4

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semi-Solid Dosage CDMO Market Trends

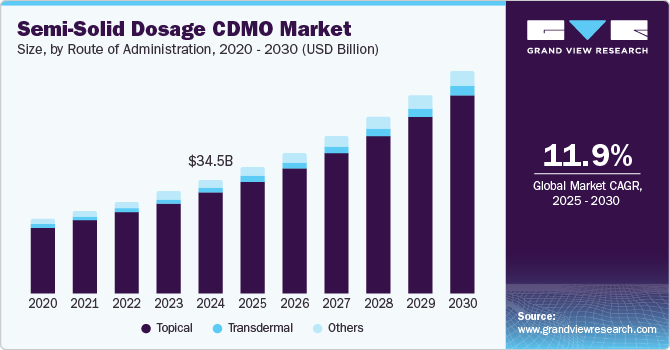

The global semi-solid dosage CDMO market size was estimated at USD 34.5 billion in 2024 and is projected to grow at a CAGR of 11.90% from 2025 to 2030. The global market is projected to expand rapidly due to the growing burden of skin diseases, increasing interest in semi-solid dosage formulations across developed economies, rising research and development investment, and a growing number of contract development and manufacturing organizations (CDMOs).

Furthermore, semi-solid dosage products offer patients a middle ground between traditional solid and liquid formulations. These include creams, gels, ointments, and lotions, among others. These topical formulations ideally need active pharmaceutical ingredients (APIs) dissolved or uniformly dispersed in a suitable base. Developing such products is complex, therefore several pharmaceutical and biopharmaceutical companies ensure efficacy, stability, and patient compliance, creating demand for outsourcing services. CDMO offers efficient and advanced manufacturing techniques, supporting pharmaceutical/biopharmaceutical to expand new products eliminating the requirement for costly equipment & processes while reducing overhead costs associated with managing an in-house team. Thus, the aforementioned factors are further contributing to the semi-solid dosage CDMO industry growth.

Furthermore, pharmaceutical and biopharmaceutical companies are increasingly entering strategic partnerships & collaborations with CDMOs to leverage their specialized capabilities in expertise and production capabilities with high-quality ingredients, accessing new markets, and accelerating product development timelines. Such factors are anticipated to drive the market.

Route of Administration Insights

On the basis of route of administration segment, the market includes topical, transdermal, and others. The topical segment dominated the semi-solid dosage CDMO industry by revenue share of 88.53% in 2024. This growth can be attributed to the growing demand for dermatology to address a diverse array of indications, such as acne vulgaris, infections, wounds to the skin, and eczema, among other indications. Besides, continuous awareness about skincare and the need for high-quality, innovative topical products is expected to support the demand for topical products. Moreover, the advancement of technologies and research in topical products, such as microemulsions and nanoparticles are anticipated to enhance the delivery and effectiveness of active ingredients for better skin penetration and absorptiondue to their higher water content. In addition, increased spending on beauty and cosmetics has led many several companies to introduce a new range of products in the market. This is expected to contribute to the growth of this segment.

The transdermal segment is projected to grow at a lucrative rate during the forecast period. The transdermal segment is expected to be driven by the rising incidence of chronic diseases, growing preference for noninvasive treatments, and increasing emphasis on improved therapeutic outcomes. These transdermal products facilitate the delivery of drugs through the skin (percutaneous absorption).

Product Insights

On the basis of the product segment, the market is segmented to ointments, creams and lotions, pastes, gels, and others. The creams and lotions segment dominated the semi-solid dosage CDMO industry with 42.49% share in 2024. The growing demand for pharmaceutical & cosmetic products, the high prevalence of skin & chronic diseases, the rising popularity of personalized skincare solutions, and the availability of industry experts are key factors anticipated to drive the market in the coming years. In addition, the specialized knowledge and facilities offered by CDMO are anticipated to drive the development of a wide range of topical formulations, including creams and lotions addressing various skin conditions and promoting skin health, ultimately leading to the successful branding of these products. Such factors are anticipated to drive the segment.

The ointments services segment is anticipated to show lucrative growth during the forecast period. The segment is driven by increasing effectiveness in treating infected traumatic skin conditions, ongoing developments in personalizing products, greater use of active ingredients in ointments, and improved expertise in ointment formulation, among other factors. Besides, the unique properties of ointment for sensitive and dry skin conditions have fueled the segment's growth.

Service Insights

On the basis of the service segment, the market is segmented into contract development, and contract manufacturing. The contract manufacturing segment dominated the semi-solid dosage CDMO industry in 2024. This can be attributed to the increasing demand for full-service pharmaceutical/biopharmaceutical contract manufacturing, emerging new semi-solid dosage forms, including creams, & lotions, foams, gels, pastes, ointments, and rising strategic partnerships among companies. In addition, technological advancement, growing formulation outsourcing activities, research and development, and other core competencies, as well as accelerating new product development, further improve segment growth.

The contract development segment is anticipated to show lucrative growth during the forecast period. The segment growth is driven by continuously evolving demand for semi-solid products, increasing burden of diseases, rising investments and growing demand for contract development services. In addition, the services help optimize manufacturer uptime, reliability, and performance.

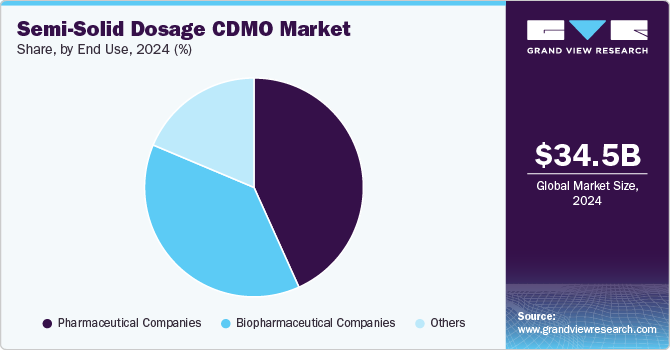

End Use Insights

On the basis of the end use segment, the market is segmented into biopharmaceutical companies, pharmaceutical companies, and others. The pharmaceutical companies segment dominated the semi-solid dosage CDMO industry with 43.26% share in 2024. The high market share is due to the increasing number of small- & medium-sized companies outsourcing their production activities to CDMO manufacturers. Besides, the segment has been experiencing growth due to the discovery of new products, increasing focus on quality & reliability, regulation, affordability, and innovation offered by CDMO, which is anticipated to drive the segment growth. Furthermore, increased efficiency and innovation of various semi-solid products with experienced personnel and advanced technologies drive the segment growth. Such factors are anticipated to drive market growth.

The biopharmaceutical companies’ segment is projected to witness the highest growth rate of 13.09% during forecast period owing to increasing demand for innovative therapies, particularly biologics such as monoclonal antibodies and gene therapies. Moreover, growing investments in research and development are expanding the biopharmaceutical pipeline, is also contributing towards the segment growth.

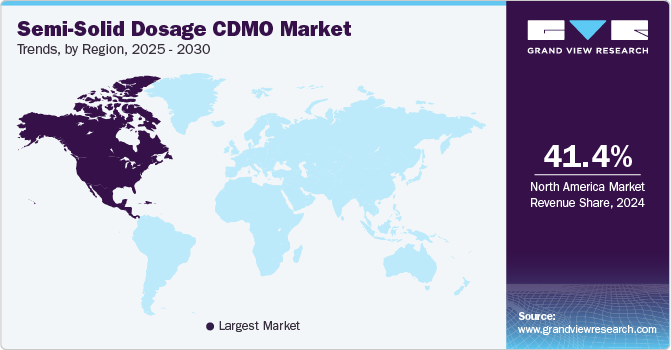

Regional Insights

North America dominated the global market in 2024 with the largest share of 41.37%, owing to growing investments in R&D of new semi-solid products formulations by pharmaceutical and biopharmaceutical companies, increasing skin diseases and innovation in personal care & beauty products. Besides, rising skincare routine awareness among populations is the major factor for the market growth. In addition, the market landscape in the region is influenced by the significant potential to holds business for semi-solid dosage companies in the region. In addition, the presence of established key market players is anticipated to drive market growth.

U.S. Semi-Solid Dosage CDMO Market Trends

The U.S. accounts for the highest share in the semi-solid dosage CDMO market due to rising pharmaceutical and biotechnology companies in this region. Increasing R&D investments and a growing need for semi-solid dosage products drive numerous pharmaceutical biopharmaceutical entities in the U.S. to outsource significant aspects of the product development process.

Europe Semi-Solid Dosage CDMO Market Trends

Europe semi-solid dosage CDMO market is also anticipated to grow due to the presence of various CDMOs in the region, stringent regulatory standards, technological innovation, the prevalence of diseases, growing end-to-end solutions offering semi-solid dosage production, availability of outsourcing services, higher demand for new products, and expanding new facilities. In addition, the emerging R&D activities are rapidly changing market scenarios.

Germany semi-solid dosage CDMOs play a critical role for pharmaceutical and biotechnology manufacturers owing to their expertise & manufacturing capacity, bringing vital products to the market in a shorter time, which has propelled the market demand. Besides, growing interest in natural ingredients-based personal care products is expected to boost the market demand further.

The UK semi-solid dosage CDMO market is driven by R&D initiatives, excellent innovation platforms, and a growing burden of diseases. Moreover, various multinational CDMOs in the country are anticipated to contribute to market growth.

Asia Pacific Semi-Solid Dosage CDMO Market Trends

Asia Pacific semi-solid dosage CDMO market is expected to witness significant growth in the coming years. This growth can be attributed to various factors, such as rising healthcare expenditure, growing demand for dermatology & skincare products, increasing focus on R&D, and growing requirements for outsourcing services. Besides, in recent years, major countries such as China, Japan, and India have also contributed to the semi-solid dosage outsourcing services owing to their expanding CDMO capabilities.

Japan's semi solid dosage CDMOs market is driven by rapid technological advancements, increasing adoption of cutting-edge technologies, high healthcare expenditure and increased semi solid dosage product development. Besides, constant innovation of new semi-solid dosage products is further driving the segment growth.

China semi solid dosage CDMO is driven by increased demand for superior quality semi solid dosage products and ongoing advancements in the pharmaceutical/biopharmaceutical sector are expected to continue driving the growth of the semi solid dosage CDMO market in country.

India is emerging as one of the lucrative markets for semi-solid dosage CDMO owing to low costs, the availability of industry experts, and the growing expansion of facilities in Indian market to meet the growing demand for semi-solid dosage CDMO. Such factors are anticipated to drive the market.

Key Semi-Solid Dosage CDMO Company Insights

The key market players implement several strategic initiatives, such as launches, expansion, acquisitions, agreements, partnerships and collaborations, etc., to increase market presence & gain a competitive edge, fueling the market. For instance, in July 2024, Debut announced the launch of BiotechXBeautyLabs. The lab focuses on formulation development and contract manufacturing, creating biotech products through custom formulations and a selection of clinically backed white label products.

Key Semi-solid Dosage CDMO Companies:

The following are the leading companies in the semi-solid dosage CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- The Lubrizol Corporation

- Cambrex Corporation

- Contract Pharmaceuticals Limited.

- Bora Pharmaceutical

- Ascendia Pharmaceuticals

- Pierre Fabre group

- Piramal Pharma Solutions

- DPT Laboratories, LTD

- LGM Pharma

- Pace Analytical Life Sciences, LLC.

Recent Developments

-

In September 2024, Blue Wolf Capital Partners LLC announced the acquisition of Recipharm pharmaceutical manufacturing facilities in Europe; these facilities focus on producing semi-solid, oral solid, and liquid dosage form pharmaceutical products.

-

In July 2024, MedPharm announced its merger with Tergus Pharma. The combined topical and transepithelial CDMO will operate under MedPharm, establishing an end-to-end CDMO with clinical trial manufacturing and commercial production capabilities.

Semi-Solid Dosage CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 38.42 billion

Revenue forecast in 2030

USD 67.40 billion

Growth rate

CAGR of 11.90% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Route of administration, product, service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

The Lubrizol Corporation; Cambrex Corporation; Contract Pharmaceuticals Limited.; Bora Pharmaceutical; Ascendia Pharmaceuticals; Pierre Fabre group; Piramal Pharma Solutions; DPT Laboratories, LTD;LGM Pharma; Pace Analytical Life Sciences, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Semi-Solid Dosage CDMO Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the semi-solid dosage CDMO market report on the basis of route of administration, product, service, end use, and region:

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Transdermal

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ointments

-

Creams and Lotions

-

Pastes

-

Gels

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Development

-

Contract Manufacturing

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global semi-solid dosage CDMO market size was estimated at USD 34.5 billion in 2024 and is expected to reach USD 38.4 billion in 2025.

b. The global semi-solid dosage CDMO market is expected to grow at a compound annual growth rate of 11.9% from 2025 to 2030 to reach USD 67.4 billion by 2030.

b. Topical segment dominated the semi-solid dosage CDMO market with a share of 88.5% in 2024. This is attributable to growing demand for topical formulations due to their targeted delivery and lower systemic side effects.

b. Some key players operating in the semi-solid dosage CDMO market include The Lubrizol Corporation, Cambrex Corporation, Contract Pharmaceuticals Limited., Bora Pharmaceutical, Ascendia Pharmaceuticals, Pierre Fabre group, Piramal Pharma Solutions, DPT Laboratories, LTD, LGM Pharma, Pace Analytical Life Sciences, LLC.

b. Key factors that are driving the market growth include rising prevalence of skin conditions coupled with aging population. Moreover, increasing shift towards personalized medicines is also contributing towards the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.