- Home

- »

- Organic Chemicals

- »

-

Semiconductor Chemicals Market Size, Industry Report 2033GVR Report cover

![Semiconductor Chemicals Market Size, Share & Trends Report]()

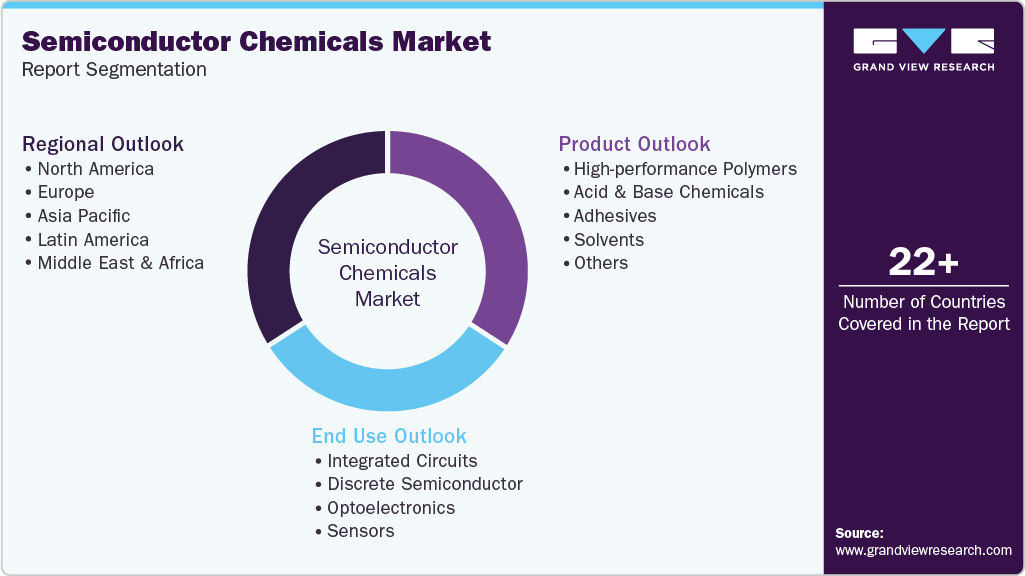

Semiconductor Chemicals Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (High Performance Polymers, Acid & Base Chemicals), By End Use (Integrated Circuits, Discrete Semiconductor, Optoelectronics, Sensors), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-268-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Chemicals Market Summary

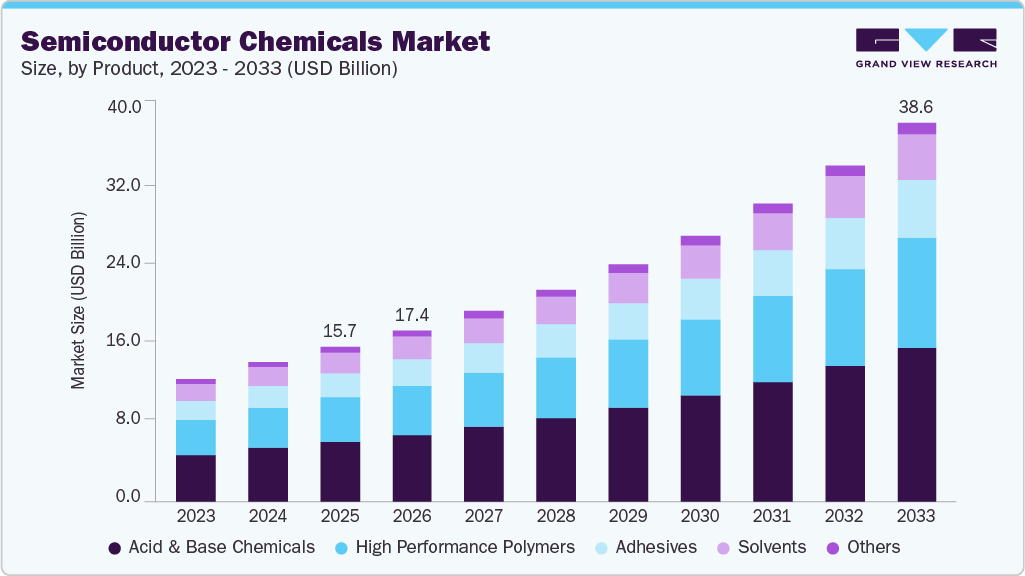

The global semiconductor chemicals market size was estimated at USD 15,758.3 million in 2025 and is projected to reach USD 38,595.0 million by 2033, growing at a CAGR of 12.0% from 2026 to 2033. The growth can be attributed to the rapid expansion of the semiconductor industry, fueled by growing demand for advanced electronic devices, IoT applications, and high-performance computing.

Key Market Trends & Insights

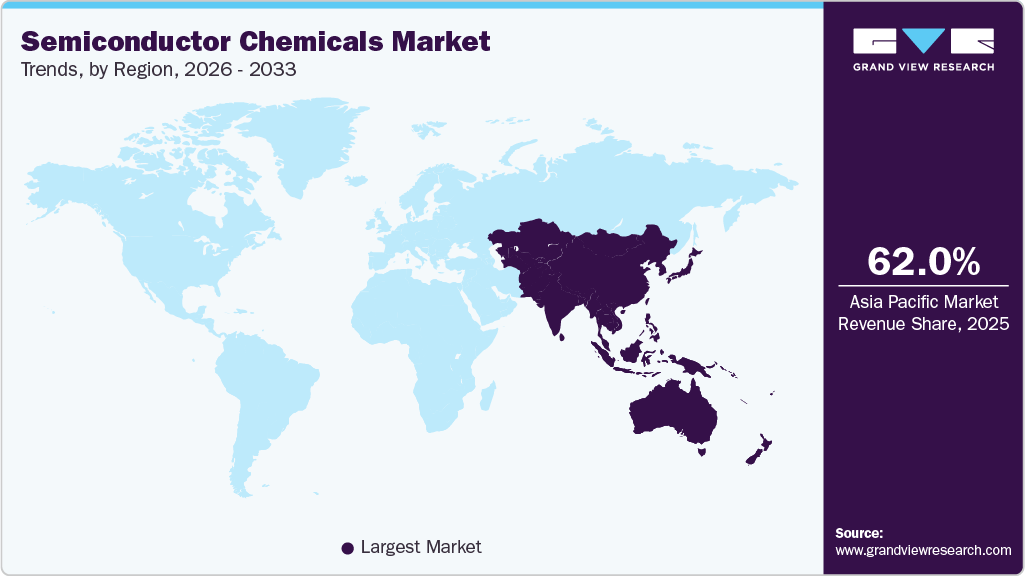

- Asia Pacific dominated the market with the largest revenue share of 62.0% in 2025.

- The market in China is expected to grow at a significant CAGR of 12.2% from 2026 to 2033.

- By Product, acid & base chemicals segment held the largest revenue share of 38.9% in 2025.

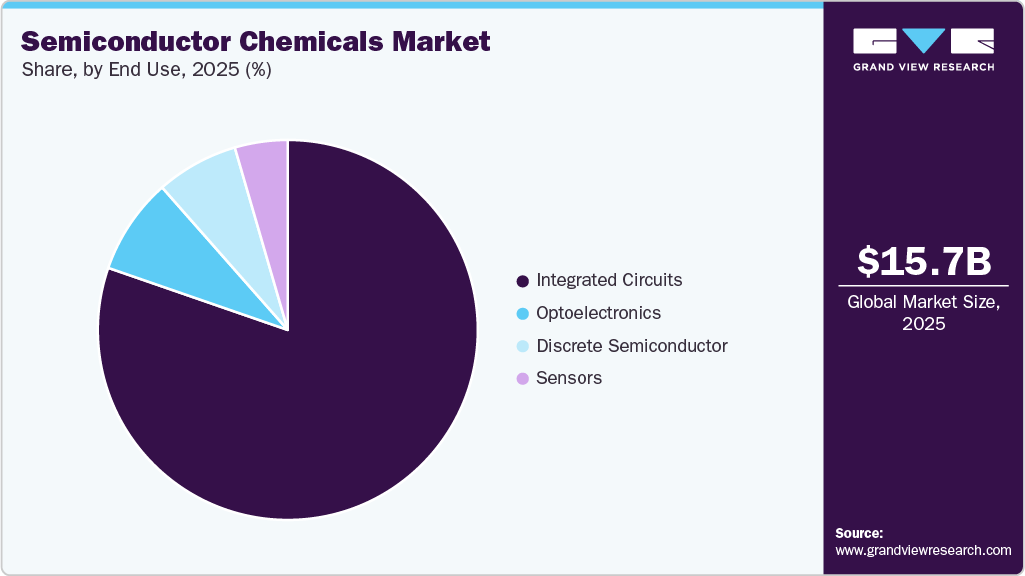

- By End use, integrated circuits segment held the largest revenue share of 80.3% in 2025 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 15,758.3 Million

- 2033 Projected Market Size: USD 38,595.0 Million

- CAGR (2026-2033): 12.0%

- Asia Pacific: Largest market in 2025

This surge in chip production is increasing the need for specialized chemicals that ensure precision, yield, and reliability in semiconductor manufacturing processes.Increasing adoption of cutting-edge technologies such as AI, 5G, and electric vehicles is driving demand for high-purity semiconductor chemicals, as manufacturers require advanced materials to support complex chip designs and higher production efficiency.

The growing trend of semiconductor manufacturing reshoring and expansion of fabrication facilities globally presents a significant growth opportunity for chemical suppliers to cater to rising local demand with customized and high-performance solutions.

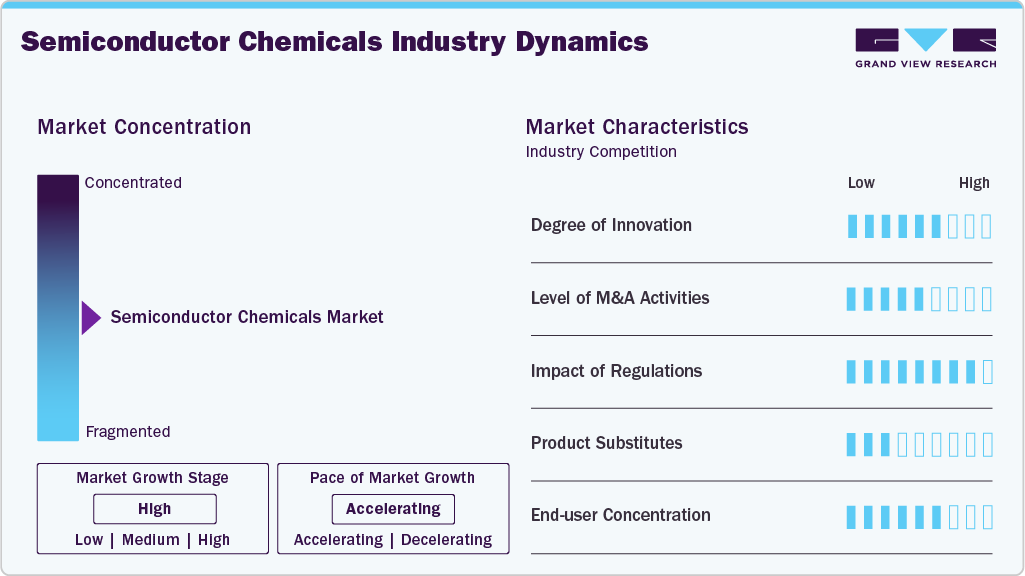

Market Concentration & Characteristics

The semiconductor chemicals market is moderately concentrated, with a few global players dominating due to their strong technological expertise, established supply chains, and high entry barriers. Key manufacturers leverage scale, quality certifications, and long-term contracts with semiconductor fabs to maintain market leadership.

The market is highly specialized and technology-driven, characterized by stringent quality standards, continuous innovation, and critical dependence on R&D. Suppliers focus on high-purity, performance-critical chemicals, with demand closely tied to semiconductor production cycles and emerging applications such as AI, 5G, and EVs.

Product Insights

The acid and base chemicals segment held the largest revenue share of 38.9% in 2025, due to its critical role in etching, cleaning, and wafer fabrication processes. Strong demand from established semiconductor manufacturing hubs and consistent usage in high-volume chip production sustain its market leadership.

The high-performance polymers segment is witnessing a significant CAGR of 12.1% from 2026 to 2033, as advanced semiconductor devices require specialized materials for dielectric layers, encapsulation, and insulating applications. Increasing adoption of miniaturized and high-speed chips is driving the need for these polymers, creating strong growth potential in this segment.

End Use Insights

The integrated circuits segment accounted for the largest revenue share of 80.3% in 2025, driven by the continuous growth of consumer electronics, computing, and automotive applications. High-volume IC production requires large-scale, high-purity chemical supply, reinforcing this segment’s market leadership.

The optoelectronics segment is experiencing a substantial CAGR of 11.7% over the forecast period, due to rising demand for photonic devices, LEDs, and optical sensors in communication and industrial applications. Increasing adoption of advanced optoelectronic components is fueling the need for specialized chemicals tailored to precision fabrication processes.

Regional Insights

The Asia Pacific dominated the market with a revenue share of 62.0% in 2025, due to its dominance in global semiconductor manufacturing. The presence of large-scale fabs in countries such as China, Taiwan, South Korea, and Japan creates sustained demand for high-purity chemicals to support mass production and advanced node development.

China holds 29.7% market share of Asia Pacific semiconductor chemicals market in 2025.Semiconductor chemicals market in China is driven by aggressive capacity expansion and efforts to localize semiconductor supply chains. Strong domestic chip production initiatives are increasing demand for locally sourced and high-purity process chemicals.

North America Semiconductor Chemicals Market Trends

North America accounted for 19.9% of the global market in 2025, driven by strategic investments in domestic semiconductor manufacturing and R&D. Government-backed initiatives and expansion of advanced fabs are increasing demand for specialized and high-performance chemicals to support next-generation chip technologies.

U.S. Semiconductor Chemicals Market Trends

The U.S. market is driven by renewed investments in advanced semiconductor fabs and innovation-focused manufacturing. Rising production of logic and memory chips is boosting demand for specialty chemicals that support high precision and yield optimization.

Europe Semiconductor Chemicals Market Trends

In Europe, the market is driven by rising investments in automotive semiconductors and industrial electronics. Strong focus on technology sovereignty and expansion of regional semiconductor capacity is supporting steady demand for process-critical chemicals.

Semiconductor chemicals market in Germany is driven by strong demand from automotive electronics and industrial automation sectors. The country’s focus on high-quality manufacturing and advanced semiconductor applications supports consistent demand for performance-driven chemical solutions.

Latin America Semiconductor Chemicals Market Trends

Latin America’s growth is driven by increasing semiconductor assembly, testing, and electronics manufacturing activities. Gradual expansion of the regional electronics supply chain is creating emerging demand for semiconductor chemicals, particularly for back-end processes.

Middle East & Africa Semiconductor Chemicals Market Trends

The semiconductor chemicals market in the Middle East & Africa is driven by early-stage investments in high-tech manufacturing and diversification initiatives. Government-led industrial development programs are encouraging the establishment of semiconductor-related facilities, supporting niche chemical demand.

Key Semiconductor Chemicals Company Insights

Key players, such as Taiwan Semiconductor Integrated Circuits Co. Ltd., BASF SE, Eastman Chemical Company, FUJIFILM Corp., Honeywell International Inc., Linde PL, Solvay, VWR International, LLC, Entegris, and SK Inc., are dominating the market.

-

Taiwan Semiconductor Integrated Circuits Co. Ltd. is a global leader in advanced semiconductor manufacturing, playing a critical role in driving demand for high-purity and process-critical semiconductor chemicals. The company’s focus on leading-edge nodes, high production volumes, and continuous technology innovation strengthens long-term partnerships with chemical suppliers to ensure yield optimization, process stability, and supply chain reliability.

-

BASF SE is a key participant in the semiconductor chemicals market, leveraging its strong R&D capabilities and broad specialty chemicals portfolio. The company supports semiconductor manufacturers with advanced, high-purity chemical solutions tailored for wafer fabrication and processing, positioning BASF as a strategic supplier aligned with evolving technology and sustainability requirements in the semiconductor industry.

Key Semiconductor Chemicals Companies:

The following are the leading companies in the semiconductor chemicals market. These companies collectively hold the largest Market share and dictate industry trends.

- Taiwan Semiconductor Integrated Circuits Company Ltd.

- BASF SE

- Eastman Chemical Company

- FUJIFILM Corporation

- Honeywell International Inc.

- Linde PLC

- Solvay

- VWR International, LLC.

- Entegris

- SK Inc.

Recent Developments

-

In November 2025, FUJIFILM Corporation completed a new development and evaluation building at its Shizuoka factory to accelerate advanced semiconductor materials development, including photoresists and process chemicals tailored for next-generation chips.

-

In October 2025, BASF SE announced the construction of a state-of-the-art electronic grade ammonium hydroxide plant in Ludwigshafen, Germany, aimed at supporting wafer cleaning and etch processes in semiconductor manufacturing. This expansion strengthens local supply chain resilience for advanced chip fabs in Europe.

Semiconductor Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 17,460.2 million

Revenue forecast in 2033

USD 38,595.0 million

Growth rate

CAGR of 12.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea, Taiwan; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Taiwan Semiconductor Integrated Circuits Co. Ltd.; BASF SE; Eastman Chemical Company; FUJIFILM Corp.; Honeywell International Inc.; Linde PLC; Solvay; VWR International, LLC; Entegris; SK Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global semiconductor chemicals market report based on product, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

High-performance Polymers

-

Acid & Base Chemicals

-

Adhesives

-

Solvents

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Integrated Circuits

-

Discrete Semiconductor

-

Optoelectronics

-

Sensors

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global semiconductor chemicals market size was estimated at USD 15,758.3 million in 2025 and is expected to reach USD 17,460.2 million in 2026.

b. The global semiconductor chemicals market is expected to grow at a compound annual growth rate of 12.0% from 2026 to 2033 to reach USD 38,595.0 million by 2033.

b. The acid and base chemicals segment held the largest revenue share of 38.9% in 2025, due to its critical role in etching, cleaning, and wafer fabrication processes. Strong demand from established semiconductor manufacturing hubs and consistent usage in high-volume chip production sustain its market leadership.

b. Key players, such as Taiwan Semiconductor Integrated Circuits Co. Ltd.; BASF SE; Eastman Chemical Company; FUJIFILM Corp.; Honeywell International Inc.; Linde PL; Solvay; VWR International, LLC; Entegris; SK Inc. are dominating the market.

b. Market is driven by the rapid expansion of the semiconductor industry, fueled by growing demand for advanced electronic devices, IoT applications, and high-performance computing. This surge in chip production is increasing the need for specialized chemicals that ensure precision, yield, and reliability in semiconductor manufacturing processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.