- Home

- »

- Advanced Interior Materials

- »

-

Semiconductor Diffusion Equipment Market Report, 2033GVR Report cover

![Semiconductor Diffusion Equipment Market Size, Share & Trends Report]()

Semiconductor Diffusion Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Vertical Diffusion Systems, Horizontal Diffusion Systems), By Technology (Thermal Diffusion), By End Use, By Wafer Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-679-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2025 - 2033

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semiconductor Diffusion Equipment Market Summary

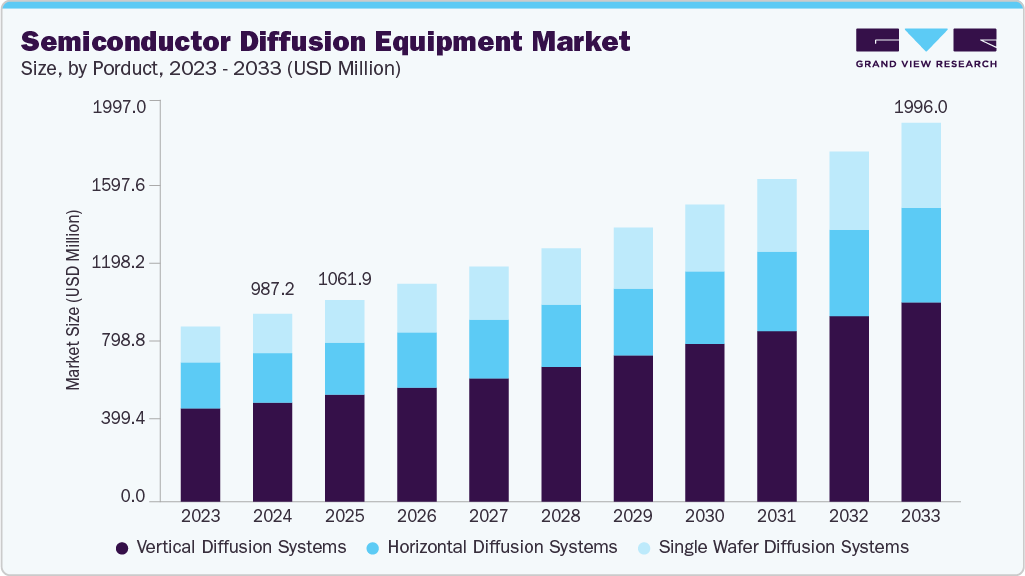

The global semiconductor diffusion equipment market size was estimated at USD 987.2 million in 2024 and is projected to reach USD 1,996.0 million by 2033, growing at a CAGR of 8.2% from 2025 to 2033. Growth is primarily driven by the increasing demand for smaller, faster, and more energy-efficient semiconductor chips, particularly for use in smartphones, AI processors, and high-performance computing devices.

Key Market Trends & Insights

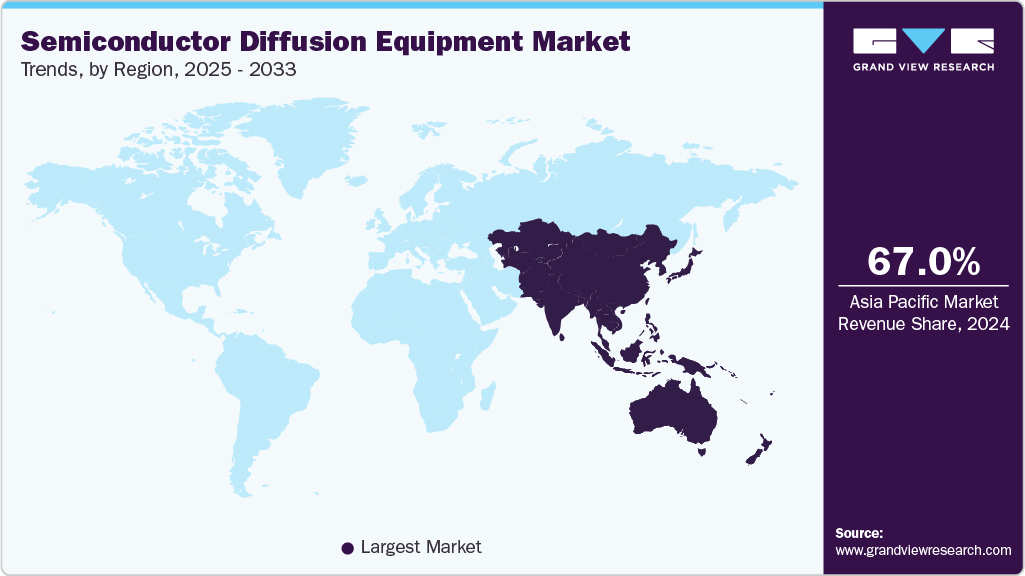

- Asia Pacific dominated the semiconductor diffusion equipment market with the largest revenue share of 67.0% in 2024.

- The semiconductor diffusion equipment market in the U.S. is expected to grow at a substantial CAGR of 6.4% from 2025 to 2033.

- By product, single wafer diffusion systems segment is expected to grow at a considerable CAGR of 8.9% from 2025 to 2033 in terms of revenue.

- By technology, rapid thermal processing (RTP) segment is expected to grow at a considerable CAGR of 9.0% from 2025 to 2033 in terms of revenue.

- By end use, memory manufacturers segment is expected to grow at a considerable CAGR of 9.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 987.2 Million

- 2033 Projected Market Size: USD 1,996.0 Million

- CAGR (2025-2033): 8.2%

- Asia Pacific: Largest market in 2024

As chipmakers transition to advanced process nodes, i.e., below 5nm, the need for highly precise and uniform diffusion processes becomes critical. This is prompting foundries and integrated device manufacturers (IDMs) to invest in next-generation thermal processing technologies, including advanced diffusion furnaces and rapid thermal processing (RTP) systems. Expanding applications of consumer electronics and IoT devices are boosting semiconductor production. Diffusion equipment plays a crucial role in creating integrated circuits required in smart home systems, wearables, and connected appliances. As the number of smart devices grows, so does the need for high-volume, high-yield diffusion tools. This trend significantly supports the global market expansion.

Market Concentration & Characteristics

The global semiconductor diffusion equipment market is moderately concentrated, with a few major players dominating the landscape. These companies hold significant market shares due to advanced technology, strong R&D capabilities, and established customer relationships. High capital investment and technological expertise create barriers for new entrants. As a result, competition is primarily among well-established firms.

The semiconductor diffusion equipment market is characterized by a high degree of innovation, driven by rapid advancements in chip design and manufacturing processes. Companies consistently invest in R&D to develop tools that support smaller nodes and improved efficiency. Innovations in rapid thermal processing and plasma diffusion are particularly significant. Continuous technological upgrades are essential to remain competitive.

The market sees a moderate level of M&A activity as key players seek to strengthen their portfolios and expand global reach. Strategic acquisitions are often aimed at integrating complementary technologies or entering new regional markets. These moves help companies enhance their product offerings and production capabilities. M&A also facilitates faster innovation and cost optimization.

Regulations in this market mainly address environmental standards, export controls, and intellectual property rights. Meeting safety and emission standards is essential, especially in areas with strict environmental laws. Trade restrictions, like export bans, can disrupt global supply chains and technology sharing. Companies need to adjust their operations to navigate these regulatory frameworks effectively.

Drivers, Opportunities & Restraints

The growing demand for advanced semiconductor devices in applications like AI, 5G, and automotive electronics is a key driver of the diffusion equipment market. Technological advancements in wafer processing and miniaturization are fueling equipment upgrades. Expansion of foundries and memory manufacturing facilities further boosts demand. Additionally, increased chip production for consumer electronics supports market growth.

The growing adoption of IoT, edge computing, and wearable devices offers significant growth opportunities. Emerging economies are investing in local semiconductor manufacturing, creating new markets for diffusion equipment. The move toward electric vehicles and smart infrastructure also boosts demand for high-performance chips. Collaborations and innovations in diffusion technologies can unlock additional potential.

High capital investment required for semiconductor equipment limits entry for smaller players. The complexity and precision required in diffusion processes demand advanced engineering, posing technical challenges. Trade restrictions and supply chain disruptions can impact global operations. Additionally, the cyclical nature of the semiconductor industry creates uncertainty in long-term demand.

Product Insights

Vertical diffusion systems segment dominated the market and held a 53.1% share in 2024, thanks to their superior thermal uniformity and space-saving design. They are commonly used in high-volume semiconductor manufacturing, especially for 300mm wafers. These systems provide efficient batch processing and improved contamination control. Their cost-effectiveness and high throughput make them well-suited for large-scale production.

Single wafer diffusion systems are experiencing rapid growth due to increasing demand for advanced node semiconductor devices. They offer precise process control, essential for manufacturing sub-7nm chips. These systems reduce particle contamination and improve yield in low-volume, high-value applications. Their adoption is rising in R&D labs and advanced logic chip production.

Technology Insights

The thermal diffusion segment dominated the market and held a 49.7% share in 2024, thanks to its long-standing use in semiconductor manufacturing and proven reliability in high-volume production. It is commonly used for doping and oxidation processes, especially in traditional and mature node applications. The technology supports batch processing, which boosts throughput and lowers operational costs. Its compatibility with various wafer sizes also contributes to its market leadership.

Rapid Thermal Processing is the fastest growing segment owing to its ability to deliver precise temperature control in short cycle times. It is crucial for fabricating advanced nodes, enabling processes like annealing and oxidation without affecting surrounding materials. RTP systems are essential in advanced chip applications such as FinFETs and 3D architectures. Their efficiency and reduced thermal budget make them increasingly preferred in cutting-edge semiconductor fabs.

Wafer Size Insights

300 mm media segment accounted for a share of 62.0% in 2024. 300 mm wafer size leads the market due to its efficiency in supporting high-volume semiconductor manufacturing. These wafers enable more chips per batch, reducing cost per unit and increasing productivity. Major foundries and IDMs prefer 300 mm wafers for fabricating advanced logic and memory chips. The widespread adoption of automation in 300 mm fabs further strengthens its market position.

The 200 mm wafer segment is expanding rapidly due to its growing use in power devices, analog chips, and MEMS production. These wafers are well-suited for automotive, industrial, and IoT applications where mature nodes are enough. A rise in demand for these end-use products is leading to capacity increases at older 200 mm fabs. Their lower production cost compared to 300 mm wafers also encourages wider adoption.

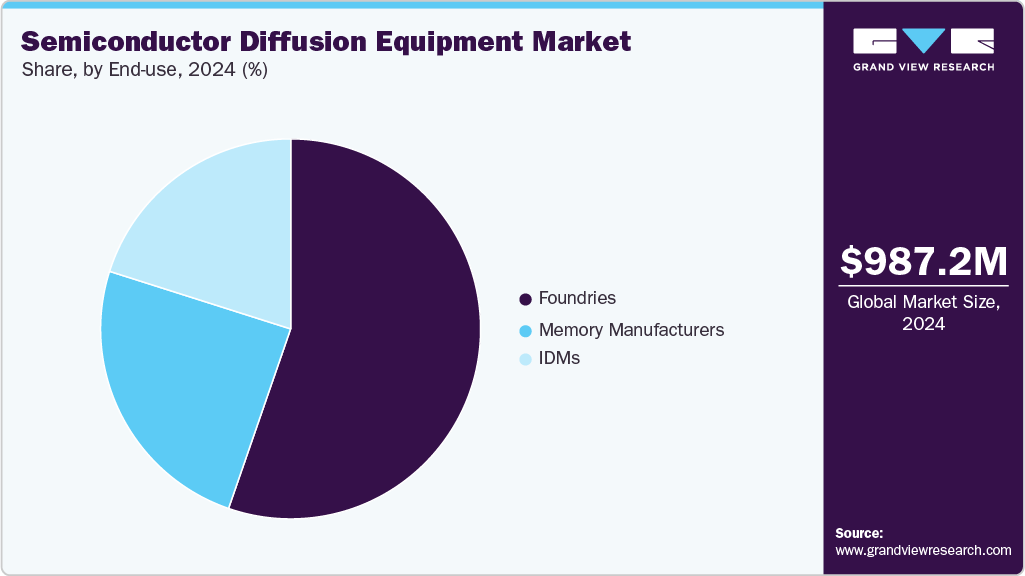

End Use Insights

Foundries segment accounted for a share of 55.3% in 2024 due to their large-scale production capabilities and diverse client base. They invest heavily in advanced diffusion technologies to meet the requirements of various fabless semiconductor companies. Foundries play a central role in high-volume manufacturing of logic and analog chips. Their demand for high-throughput, cost-effective diffusion systems drives consistent market growth.

Memory manufacturers represent the fastest growing segment as demand for DRAM and NAND continues to surge. The expansion of AI, cloud computing, and mobile storage needs is fueling new memory fabrication projects. These manufacturers require advanced diffusion tools for producing high-density and high-performance memory chips. Increasing investment in next-generation memory technologies is accelerating equipment adoption.

Regional Insights

Asia Pacific is the dominating region and accounted for the share of 67.0% in the global semiconductor diffusion equipment market, fueled by the presence of major chip manufacturing hubs like China, Taiwan, South Korea, and Japan. Strong government support, skilled labor, and massive investments in fabs drive regional dominance. The region hosts top foundries and IDMs, ensuring steady demand for advanced equipment. Continued expansion in memory and logic chip production sustains market leadership.

China Semiconductor Diffusion Equipment Market Trends

China is rapidly expanding its semiconductor diffusion equipment market through heavy investment in domestic chip manufacturing. Government initiatives like the "Made in China 2025" plan are driving the development of advanced fabrication facilities. Despite export restrictions, local equipment makers are scaling up to meet internal demand. The push for technological self-reliance is significantly boosting market growth.

India semiconductor diffusion equipment market is growing, fueled by the government's “Semicon India” initiative and increased foreign investment. Plans for new fabrication plants are creating demand for advanced processing tools, including diffusion systems. The rise in domestic electronics and automotive manufacturing is strengthening the need for chip production infrastructure. India’s focus on building a complete semiconductor ecosystem is driving long-term market expansion.

North America Semiconductor Diffusion Equipment Market Trends

North America market for semiconductor diffusion equipment is growing at a significant CAGR of 6.5% in the semiconductor diffusion equipment market, driven by increased investment in domestic semiconductor manufacturing. Initiatives like the CHIPS Act are fueling the construction of new fabs across the U.S. The region’s focus on technological leadership and reduced dependency on imports boosts equipment demand. Strong R&D and the presence of major equipment suppliers enhance growth momentum.

The U.S. dominates the North American semiconductor diffusion equipment market due to strong investments in chip manufacturing and innovation. Government support through the CHIPS and Science Act has accelerated the development of new fabrication plants. Major equipment manufacturers and tech giants headquartered in the U.S. boost local demand. The country’s advanced R&D ecosystem ensures leadership in next-generation diffusion technologies.

Canada is witnessing steady growth in the semiconductor diffusion equipment market, supported by rising interest in domestic chip production. Government initiatives and academic partnerships are fostering semiconductor research and pilot fabrication. Demand is increasing in sectors like telecommunications, automotive, and aerospace. Though still developing, Canada’s strategic focus on high-tech industries supports long-term growth.

Europe Semiconductor Diffusion Equipment Market Trends

Europe is experiencing moderate growth driven by rising investments in semiconductor self-sufficiency and green technologies. Countries like Germany and France are focusing on developing advanced chip fabrication capabilities. The automotive and industrial sectors are major demand drivers for specialized semiconductor devices. EU-backed funding initiatives are further supporting market development.

Germany is experiencing growth in the semiconductor diffusion equipment market due to strong demand from its automotive and industrial electronics sectors. The government is actively supporting semiconductor manufacturing through subsidies and EU funding. Major chipmakers are expanding operations or planning new fabs within the country. Germany’s focus on technological sovereignty and supply chain resilience is driving equipment demand.

The UK is gradually expanding its role in the semiconductor industry, with growing investments in R&D and chip design. While large-scale manufacturing is limited, demand for advanced equipment is rising in research facilities and pilot lines. Government strategies aim to strengthen domestic capabilities in semiconductor innovation. The UK’s focus on high-tech growth supports diffusion equipment market expansion.

Middle East & Africa Semiconductor Diffusion Equipment Market Trends

The Middle East and Africa are emerging markets with growing interest in developing semiconductor capabilities. Regional efforts are focused on diversification from oil dependence through tech-driven industries. While manufacturing infrastructure is limited, demand for electronics and smart technologies is rising. Strategic initiatives may support long-term growth in this region.

Saudi Arabia semiconductor diffusion equipment market is witnessing growth in the semiconductor diffusion equipment market as part of its Vision 2030 strategy to diversify the economy. The government is investing in high-tech sectors, including semiconductors, to reduce reliance on oil. Partnerships with global tech companies are being explored to establish local manufacturing capabilities. These initiatives are gradually increasing demand for advanced equipment like diffusion systems.

Latin America Semiconductor Diffusion Equipment Market Trends

Latin America is gradually expanding its presence in the semiconductor value chain. While manufacturing remains limited, growing demand for electronics and digital infrastructure is increasing regional interest. Governments are exploring partnerships and incentives to attract semiconductor investment. The market is in a nascent stage but shows potential for future growth.

Brazil semiconductor diffusion equipment market is experiencing growth in the semiconductor diffusion equipment market due to rising demand for electronics and government support for tech manufacturing. Initiatives to boost local semiconductor production are attracting investment in fabrication infrastructure. The country’s expanding automotive and consumer electronics sectors drive the need for chipmaking tools. Efforts to strengthen R&D and reduce import dependence further support market development.

Key Semiconductor Diffusion Equipment Company Insights

Some of the key players operating in the market include Expertech, Carlo Gavazzi, and Thermco Systems

-

Expertech specializes in manufacturing advanced thermal processing systems, particularly diffusion and oxidation furnaces. The company focuses on custom-built vertical and horizontal furnace systems designed for research and production environments. Its equipment is widely used in universities, pilot fabs, and specialty semiconductor applications. Expertech is known for supporting legacy wafer sizes and offering flexible process capabilities. The company also provides refurbishment and upgrade services for existing diffusion tools.

-

Carlo Gavazzi designs and manufactures automation components tailored for semiconductor and industrial equipment applications. Its products include sensors, relays, and power monitoring systems integrated into wafer processing and diffusion tools. The company supports semiconductor equipment manufacturers by enhancing safety, process control, and energy efficiency. Carlo Gavazzi’s offerings are optimized for reliability in cleanroom and high-precision environments. It emphasizes modularity and scalability in its automation solutions for fabs and OEMs.

Key Semiconductor Diffusion Equipment Companies:

The following are the leading companies in the semiconductor diffusion equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Expertech

- Carlo Gavazzi

- Thermco Systems

- Bruce Technologies

- Watlow Electric Manufacturing Company.

- ASM International N.V.

- Sunred Electronic Equipment (Wuxi)Co.,Ltd.

- Syn-thermal

- Tempress

- Ohkura Electric Co., Ltd.

- SVCS

- Semicorex Advanced Material Technology Co.,Ltd.

- JTEKT Thermo Systems Corporation

- Tokyo Electron Limited

- Kokusai Electric

Recent Developments

-

In July 2024, Tokyo Electron (TEL) launched the Episode™ 1 and Episode™ 2 DMR single wafer deposition systems and announced the upcoming Episode™ 2 QMR. These platforms address advanced device scaling and 3D stacking needs by supporting a wider range of deposition materials. Episode™ 1 enables complex, multi-step processes with up to eight integrated modules, including tools for reducing contact resistance in logic devices. Episode™ 2 enhances fab productivity through dual-wafer transfer and a compact footprint. This expansion underscores TEL’s strategic focus on next-generation materials and high-efficiency deposition solutions.

-

In October 2023, Watlow has launched ASSURANT HT, a high-temperature heating solution designed for advanced semiconductor processing applications. The system enhances temperature stability and process control in high-temperature environments. It is engineered to support critical steps in diffusion, oxidation, and LPCVD processes. This innovation demonstrates Watlow’s commitment to improving thermal solutions for semiconductor manufacturing.

-

In March 2023, Bristol University successfully produced its first wafer with all transistors functioning, marking a key milestone in its semiconductor research capabilities. The achievement was made possible using Thermco Systems’ diffusion furnace technology. This development validates the university's growing in-house fabrication capabilities. It also highlights Thermco’s role in supporting academic innovation in chip manufacturing.

Semiconductor Diffusion Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,061.9 million

Revenue forecast in 2033

USD 1,996.0 million

Growth rate

CAGR of 8.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, wafer size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Netherlands; Italy; China; Japan; India; Taiwan; South Korea; Brazil; Isreal; South Africa

Key companies profiled

Expertech; Carlo Gavazzi; Thermco Systems; Bruce Technologies; Watlow Electric Manufacturing Company.; ASM International N.V.; Sunred Electronic Equipment(Wuxi)Co.,Ltd.; Syn-thermal; Tempress; Ohkura Electric Co., Ltd.; SVCS; Semicorex Advanced Material Technology Co.,Ltd.; JTEKT Thermo Systems Corporation; Tokyo Electron Limited; Kokusai Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semiconductor Diffusion Equipment Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global semiconductor diffusion equipment market report based on product, technology, wafer size, end use and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Vertical Diffusion Systems

-

Horizontal Diffusion Systems

-

Single Wafer Diffusion Systems

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Thermal Diffusion

-

Plasma Diffusion

-

Rapid Thermal Processing (RTP)

-

-

Wafer Size Outlook (Revenue, USD Million, 2021 - 2033)

-

300 mm

-

200 mm

-

Less Than 200 mm

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Integrated Device Manufacturers (IDMs)

-

Foundries

-

Memory Manufacturers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Isreal

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global semiconductor diffusion equipment market size was estimated at USD 987.2 million in 2024 and is expected to be USD 1,061.9 million in 2025.

b. The global semiconductor diffusion equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.2% from 2025 to 2033 to reach USD 1,996.0 million by 2033.

b. Asia Pacific is the dominating region and accounted for the share of 67.0% in the global semiconductor diffusion equipment market, fueled by the presence of major chip manufacturing hubs like China, Taiwan, South Korea, and Japan. Strong government support, skilled labor, and massive investments in fabs drive regional dominance.

b. Some of the key players operating in the global semiconductor diffusion equipment market include Expertech; Carlo Gavazzi; Thermco Systems; Bruce Technologies; Watlow Electric Manufacturing Company.; ASM International N.V.; Sunred Electronic Equipment (Wuxi)Co.,Ltd.; Syn-thermal; Tempress; Ohkura Electric Co., Ltd.; SVCS; Semicorex Advanced Material Technology Co.,Ltd.; JTEKT Thermo Systems Corporation; Tokyo Electron Limited; Kokusai Electric

b. The global semiconductor diffusion equipment market is driven by rising demand for advanced chips used in AI, 5G, and automotive technologies. Increasing investments in new fabs and next-generation wafer processing are boosting equipment adoption. Additionally, government support for domestic semiconductor production across key regions fuels market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.