- Home

- »

- Next Generation Technologies

- »

-

Server Virtualization Market Size, Industry Report, 2033GVR Report cover

![Server Virtualization Market Size, Share & Trends Report]()

Server Virtualization Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Type (Full Virtualization, Para-virtualization, OS-level Virtualization), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-656-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Server Virtualization Market Summary

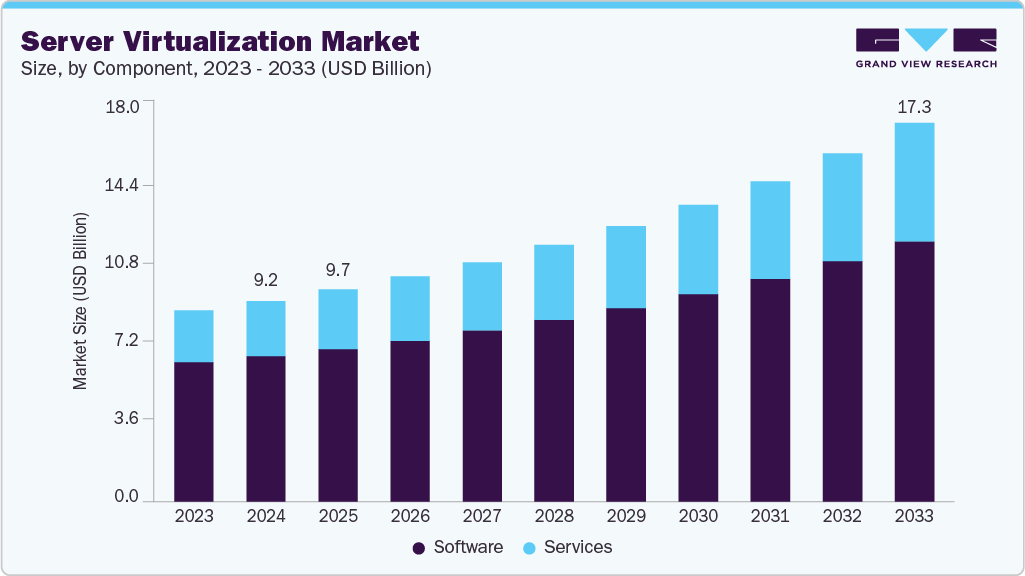

The global server virtualization market size was estimated at USD 9.15 billion in 2024 and is projected to reach USD 17.25 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. Server virtualization reduces the need for multiple physical servers by consolidating workloads onto fewer machines.

Key Market Trends & Insights

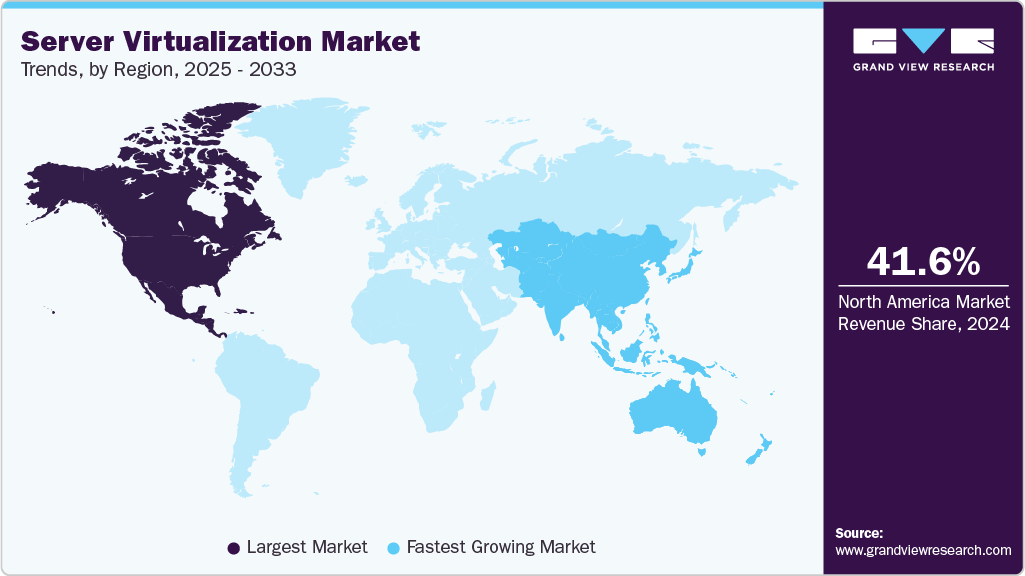

- North America dominated the server virtualization market with the largest revenue share of 41.6% in 2024.

- The server virtualization market in the U.S. held the largest revenue share in North America in 2024.

- By component, the software segment accounted for the largest market revenue share in 2024.

- By type, the full virtualization segment accounted for the largest market revenue share in 2024.

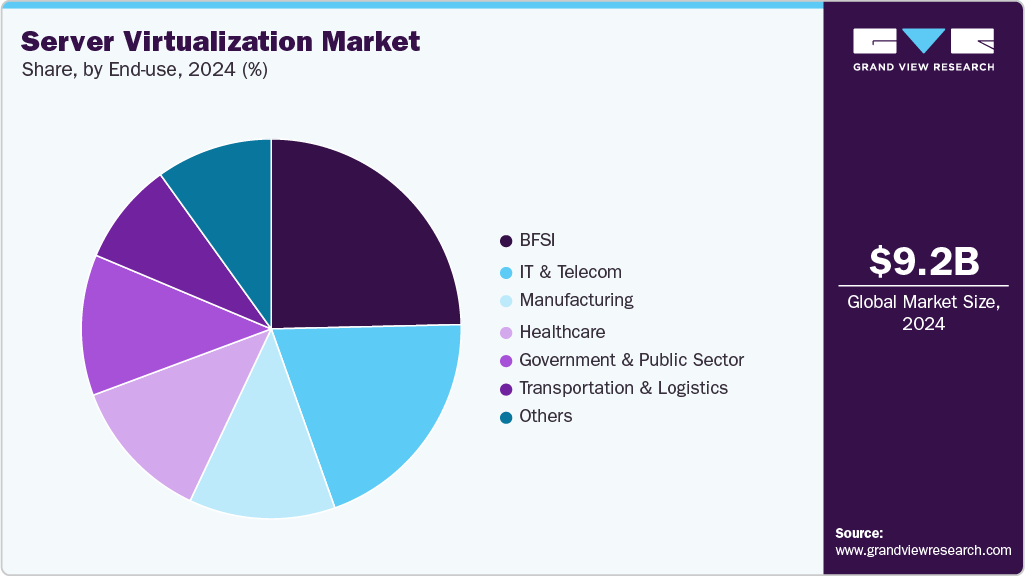

- By end use, the healthcare segment is expected to grow at the fastest CAGR of over 8.0% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 9.15 Billion

- 2033 Projected Market Size: USD 17.25 Billion

- CAGR (2025-2033): 7.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This significantly cuts capital expenses, energy consumption, cooling requirements, and data center space. Organizations benefit from lower operational costs and improved resource efficiency, making virtualization a cost-effective infrastructure optimization strategy. The rapid growth of cloud computing is a major driver of the global server virtualization industry. As more businesses transition to cloud-based operations, the need for server virtualization increases, given its ability to efficiently manage and optimize cloud environments. Virtualization enables cloud providers to maximize the use of physical infrastructure by running multiple virtual machines (VMs) on a single server, enhancing resource allocation and operational efficiency. It also supports the deployment of private, public, and hybrid cloud models, allowing organizations to choose the most suitable approach for their requirements.By simplifying cloud service management, improving scalability, and strengthening availability and disaster recovery, server virtualization delivers clear operational advantages. For enterprises, it helps reduce costs by minimizing reliance on dedicated hardware. Moreover, the growing shift toward multi-cloud and hybrid IT strategies calls for seamless integration between on-premise and cloud environments, which is facilitated by server virtualization effectively. As cloud adoption rises across sectors like finance, healthcare, and e-commerce, virtualization remains essential to unlocking its full value.

Server virtualization enables dynamic allocation and reallocation of compute, storage, and network resources based on real-time workload demands. This elasticity ensures that applications receive the necessary resources during peak usage while conserving them during low activity, optimizing performance and cost. It is particularly valuable in industries with unpredictable or seasonal demands such as retail, finance, or media.

Virtual machines (VMs) can be easily cloned, migrated, or resized without downtime, providing unmatched operational agility.As enterprises shift to hybrid IT models combining on-premise infrastructure with public and private clouds, server virtualization acts as a crucial enabler. It allows seamless workload migration, disaster recovery, and unified management across environments. Virtualization abstracts the hardware layer, making it easier to move workloads between data centers and cloud platforms, thus reducing vendor lock-in. This flexibility supports business continuity, compliance, and optimization of costs across distributed infrastructures.

Server virtualization, while enhancing efficiency, also introduces greater security risks due to increased infrastructure complexity. A single vulnerability in a hypervisor or virtual machine (VM) can potentially compromise the entire virtual environment, impacting multiple systems hosted on the same physical server. One major concern is VM escape, where a malicious VM breaks isolation and gains access to the host or other VMs. Hypervisor attacks target the control layer itself, posing significant threats to system integrity. In addition, inter-VM traffic may bypass traditional network security tools, creating blind spots. These risks are amplified in multi-tenant environments, such as public clouds, where different users share the same underlying infrastructure.

Component Insights

The software segment led the market with the largest revenue share of 72.50% in 2024. The growing adoption of hybrid and multi-cloud strategies is a major driver for the software segment in the server virtualization market. Enterprises are seeking flexibility to deploy workloads across on-premises infrastructure, private clouds, and public cloud platforms like AWS, Azure, and Google Cloud. Virtualization software plays a critical role in enabling this interoperability by abstracting physical hardware and allowing seamless migration, scaling, and management of virtual machines across diverse environments. It ensures consistent performance, security, and control, regardless of the underlying infrastructure. This flexibility empowers organizations to optimize costs, improve resilience, and avoid vendor lock-in while supporting modern digital transformation and business continuity objectives.

The services segment is anticipated to grow at the fastest CAGR of 9.0% during the forecast period. As virtual environments evolve to include hybrid clouds, containers, edge computing, and hyper-converged systems, managing them has become increasingly complex. Organizations now depend on professional services for expert support in designing architectures, planning migrations, and optimizing performance. These services ensure seamless integration across platforms, reduce downtime, and improve operational efficiency, making them essential for businesses aiming to maximize the benefits of their virtualized infrastructure.

Type Insights

The full virtualization segment accounted for the largest market revenue share in 2024. Full virtualization simplifies deployment and management by completely abstracting the underlying hardware, enabling virtual machines (VMs) to run independently of the host system. This abstraction allows IT teams to create standardized, isolated environments regardless of hardware variations, making it easier to deploy and manage applications. With consistent VM behavior across physical servers, on-premise data centers, and cloud platforms, organizations can streamline operations, reduce setup errors, and minimize configuration overhead. It also simplifies lifecycle management tasks such as provisioning, patching, migration, and scaling. As a result, enterprises can reduce administrative burden, increase operational efficiency, and accelerate time-to-value when deploying and maintaining virtualized infrastructure.

The OS-Level virtualization segment is expected to register the fastest CAGR during the forecast period. OS-level virtualization enables containers to share the host operating system kernel, eliminating the need for separate guest OS instances. This makes it far more lightweight than traditional hypervisor-based virtualization, allowing a greater number of workloads to run on a single physical server. Similarly, containers can be launched in seconds, making OS-level virtualization ideal for agile development practices and continuous integration/continuous delivery (CI/CD) pipelines. This speed accelerates application deployment and scaling, supporting faster innovation and time-to-market for businesses.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. Server virtualization in the cloud enhances cost-efficiency by minimizing the need for dedicated physical hardware. It allows multiple virtual machines to run on shared infrastructure, maximizing server utilization and reducing capital and operational expenses. Enterprises benefit from pay-as-you-go pricing models, gaining financial flexibility, while cloud providers improve return on infrastructure investments. In addition, the rapid growth of Infrastructure-as-a-Service (IaaS) platforms like AWS EC2, Microsoft Azure, and Google Compute Engine is a major driver. These platforms rely on hypervisor-based or container-based virtualization to deliver scalable, customizable compute environments. This flexibility supports a wide range of workloads, from basic hosting to complex enterprise applications, fueling ongoing demand for cloud virtualization.

The on-premise segment is expected to grow at the fastest CAGR during the forecast period. Many enterprises rely on legacy systems or custom applications that are difficult to migrate to public cloud platforms due to compatibility or performance issues. On-premise server virtualization allows these organizations to modernize their IT infrastructure without modifying existing software. By virtualizing legacy workloads, businesses can consolidate hardware, improve resource efficiency, and maintain critical application functionality, ensuring continued operations while gradually transitioning to more modern environments.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. Large enterprises manage complex IT infrastructures with extensive applications, users, and geographically dispersed operations. Server virtualization enables centralized management and scalable resource allocation, allowing IT teams to efficiently support high volumes of workloads across various departments and locations. This centralization improves operational control, consistency, and resource utilization. In addition, by consolidating workloads onto fewer physical servers, virtualization significantly reduces the need for hardware, energy, cooling, and physical space. This leads to substantial capital and operational cost savings while enhancing the return on investment. Improved server utilization also lowers total infrastructure overhead, making virtualization a cost-effective solution for large organizations focused on performance, efficiency, and long-term scalability.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period. The availability of open-source and freemium virtualization platforms like Proxmox, KVM, and VirtualBox has significantly lowered entry barriers for SMEs, enabling cost-effective adoption of virtualization. These solutions offer essential features without high upfront costs. In addition, vendors such as Red Hat, Nutanix, and Microsoft provide flexible, subscription-based virtualization models that scale with business needs, allowing SMEs to implement robust virtual environments within limited IT budgets.

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2024. The BFSI sector requires uninterrupted access to critical systems like transaction processing, online banking, trading platforms, and customer service portals, where even minimal downtime can result in significant financial losses and reputational damage. Server virtualization enhances high availability by allowing workloads to be distributed across multiple virtual machines and physical hosts. Features such as live migration enable the seamless transfer of running virtual machines from one server to another without service interruption. In addition, disaster recovery (DR) capabilities such as automated failover, VM snapshots, and backup replication ensure rapid recovery in case of hardware failure, cyberattacks, or data loss. These capabilities help financial institutions maintain continuous service and compliance.

The healthcare segment is expected to grow at the fastest CAGR during the forecast period. Healthcare organizations handle large volumes of data across diverse systems such as EHRs, PACS, and lab databases. Server virtualization allows these systems to be consolidated onto fewer physical servers, streamlining IT infrastructure and reducing complexity. This improves data accessibility and interoperability, enabling seamless information exchange between departments and systems. As a result, healthcare providers can enhance patient care, reduce operational inefficiencies, and support more integrated, data-driven clinical workflows.

Regional Insights

North America dominated the server virtualization market with the largest revenue share of 41.59% 2024. North America’s leadership in cloud adoption across industries fuels demand for server virtualization. Enterprises and cloud service providers (CSPs) use virtualization to build scalable and efficient hybrid cloud environments that integrate on-premise and cloud resources. This approach enhances IT agility, flexibility, and workload portability, enabling organizations to quickly adapt to changing business needs while optimizing infrastructure utilization and ensuring seamless operations across diverse computing environments.

U.S. Server Virtualization Market Trends

The server virtualization market in the U.S. is expected to grow at a significant CAGR from 2025 to 2033. The U.S. is home to major tech and cloud providers like VMware, Microsoft, AWS, Google, and Red Hat, which significantly influence the server virtualization industry. These companies drive continuous innovation, expand virtualization capabilities, and foster a robust ecosystem, accelerating adoption across enterprises seeking scalable and advanced virtual infrastructure solutions.

Europe Server Virtualization Market Trends

The server virtualization market in Europe is expected to grow at a substantial CAGR of 6.9% from 2025 to 2033. European governments and enterprises are rapidly advancing digital transformation through initiatives like the EU Cloud Strategy. These efforts promote cloud-first public services and hybrid IT models, driving demand for scalable virtualization solutions. Server virtualization supports this shift by enabling flexible, secure, and efficient infrastructure across public and private cloud environments.

The UK server virtualization market is expected to grow at a rapid CAGR during the forecast period. Significant investments by hyperscalers like Google and AWS are boosting the UK’s server virtualization market. Google’s USD 1 billion data center in Waltham Cross and AWS’s planned USD 8.5 billion expansion are enhancing cloud infrastructure, driving demand for scalable, virtualized environments to support advanced computing, storage, and enterprise digital transformation initiatives.

The server virtualization market in Germanyheld a substantial market share in 2024. Germany’s emphasis on Industry 4.0, combined with the growing adoption of edge computing and IoT, is driving demand for server virtualization. Manufacturers require virtualized systems on plant floors and edge sites to support low-latency, real-time processing, enabling efficient automation, smart factory operations, and integration of intelligent devices across industrial environments.

Asia Pacific Server Virtualization Market Trends

The server virtualization market in the Asia Pacific is expected to grow at the fastest CAGR of 9.5% from 2025 to 2033. In Asia Pacific, the rapid adoption of cloud and hybrid/multi-cloud strategies is driving demand for scalable virtualization solutions that enable flexible workload management and seamless portability across environments. Simultaneously, a surge in small and medium enterprises (SMEs) embracing affordable virtualization tools such as open-source and subscription-based platforms is boosting market penetration. These trends support broader digital transformation efforts, allowing businesses to optimize IT resources and enhance operational efficiency.

The China server virtualization market held a substantial market share in 2024. China’s government-led digitalization initiatives, such as the “Cloud First” policy, mandate public sectors and state-owned enterprises to adopt domestic cloud platforms like Alibaba Cloud and Huawei Cloud, accelerating virtualization deployment. In addition, the “New Infrastructure” plan prioritizes 5G, AI, and data center development, driving demand for scalable virtualization to support smart cities, industrial IoT, and edge computing, the key components of China’s broader digital economy and modernization strategy.

The server virtualization market in Japanheld a substantial market share in 2024. Japan’s server virtualization market benefits from strong cloud and data center expansion driven by hyperscalers like AWS, Microsoft, and Google expanding in Osaka and Tokyo. Domestic providers such as NTT, SoftBank, and Fujitsu offer localized cloud virtualization solutions. In addition, Japanese enterprises increasingly adopt multi-cloud strategies using platforms like VMware Cloud on AWS and Azure Arc, enabling seamless workload portability, scalability, and integration across diverse cloud and on-premise environments.

The India server virtualization market is growing as SMEs and startups are rapidly adopting affordable VPS and virtualization platforms to support their digital transformation and e-commerce operations. These solutions offer cost-effective scalability, simplified IT management, and improved resource utilization, enabling smaller businesses to compete more effectively in a growing digital economy with limited infrastructure budgets.

Key Server Virtualization Company Insight

The key market players in the global server virtualization industry include VMware, Inc., Microsoft Corporation, Red Hat, Inc., Citrix Systems, Inc., IBM Corporation, Hewlett-Packard Enterprise Company, Cisco Systems, Inc., Dell Technologies, Inc., Huawei Technologies Co., Ltd., Virtuozzo, and Scale Computing. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Server Virtualization Companies:

The following are the leading companies in the server virtualization market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Dell Technologies, Inc.

- Hewlett-Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- Red Hat, Inc.

- Scale Computing

- Virtuozzo

- VMware, Inc.

Recent Development

-

In May 2025, Scale Computing partnered with Arrow Electronics to distribute its edge‑optimized virtualization solutions globally, leveraging Arrow’s expertise in embedded compute and connectivity. This collaboration delivers scalable, resilient infrastructure that reduces downtime by up to 90% and lowers total cost of ownership by 40%, enhancing operational efficiency in edge and on‑prem environments.

-

In March 2025, Citrix announced a partnership with NVIDIA to launch AI virtual workstations, combining Citrix DaaS with NVIDIA RTX Virtual Workstation using vGPU technology. This solution enables enterprises, especially in regulated sectors, to develop securely and prototype AI applications on existing GPU infrastructure, speeding delivery, lowering costs, and protecting proprietary data from public LLM exposure.

-

In January 2025, Red Hat announced the launch of the OpenShift Virtualization Engine, a streamlined edition of OpenShift focused solely on virtual machine management. It simplifies VM deployment with KVM-based virtualization, integrates migration tools, leverages Ansible automation, and supports on-prem and bare-metal cloud environments, offering efficient, scalable, and cost-effective virtualization.

Server Virtualization Market Report Scope

Report Attribute

Details

Revenue value in 2025

USD 9.67 billion

Revenue forecast in 2033

USD 17.25 billion

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, type, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

VMware, Inc.; Microsoft Corporation; Red Hat, Inc.; Citrix Systems, Inc.; IBM Corporation; Hewlett Packard Enterprise Company; Cisco Systems, Inc.; Dell Technologies, Inc.; Huawei Technologies Co., Ltd.; Virtuozzo; Scale Computing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Server Virtualization Market Report Segmentation

This report forecasts Revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global server virtualization market report based on component, type, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Full Virtualization

-

Para-Virtualization

-

OS-Level Virtualization

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

SMEs

-

Large enterprises

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Healthcare

-

Government and Public Sector

-

Transportation and Logistics

-

Manufacturing

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The key market players in the global server virtualization market include VMware, Inc., Microsoft Corporation, Red Hat, Inc., Citrix Systems, Inc., IBM Corporation, Hewlett Packard Enterprise Company, Cisco Systems, Inc., Dell Technologies, Inc., Huawei Technologies Co., Ltd., Virtuozzo, and Scale Computing.

b. Server virtualization reduces the need for multiple physical servers by consolidating workloads onto fewer machines. This significantly cuts capital expenses, energy consumption, cooling requirements, and data center space. Organizations benefit from lower operational costs and improved resource efficiency, making virtualization a cost-effective infrastructure optimization strategy.

b. The global server virtualization market size was estimated at USD 9.15 billion in 2024 and is expected to reach USD 9.67 billion in 2025.

b. The global server virtualization market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033 to reach USD 17.25 billion by 2033.

b. The software segment accounted for a market share of over 72.5% in 2024. The growing adoption of hybrid and multi-cloud strategies is a major driver for the software segment in the server virtualization market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.