- Home

- »

- Next Generation Technologies

- »

-

Service Integration & Management Market Size Report, 2030GVR Report cover

![Service Integration And Management Market Size, Share & Trends Report]()

Service Integration And Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Organization Size (Large Enterprises, SMEs), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-362-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

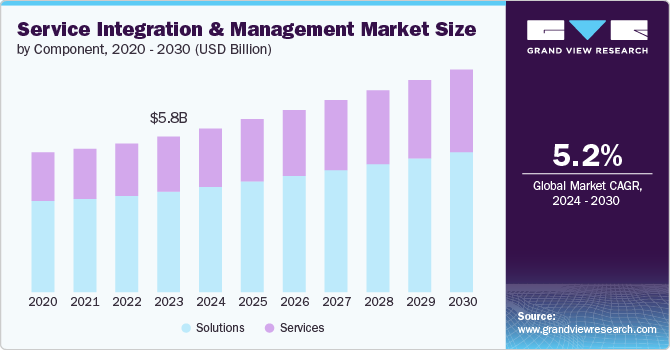

The global service integration and management market size was valued at USD 5.81 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. This growth is driven by the increasing complexity of IT environments, necessitating efficient management of multiple service providers. Organizations seek enhanced service quality and customer satisfaction, leveraging service integration and management (SIAM) to streamline service delivery. The adoption of multi-supplier ecosystems and the need for cost optimization further boost SIAM's demand, as it helps in better resource utilization and cost-effective service management. Additionally, digital transformation initiatives and stringent regulatory compliance requirements drive the need for robust, integrated service management solutions.

The rise in outsourcing and managed services, along with the proliferation of cloud computing, drives the need for coordinated management through SIAM. The adoption of advanced technologies such as AI, ML, and automation enhances SIAM's capabilities, making it engaging for managing diverse IT environments. As companies prioritize business agility and flexibility, SIAM helps them adapt quickly and manage dynamic IT landscapes effectively. Additionally, organizations are focusing on governance and risk management, with SIAM providing the necessary frameworks for robust oversight and risk mitigation.

The increasing number of strategic partnerships and collaborations among IT service providers necessitates a SIAM approach to manage complex relationships and ensure seamless service delivery. The expansion of digital services and platforms across industries requires integrated service management for consistent and efficient delivery, driving SIAM adoption. Customer-centric service delivery models also require a unified management approach to ensure a seamless customer experience. Furthermore, organizations emphasize service innovation and continuous improvement, with SIAM enabling structured management and continual enhancement of service delivery processes.

Component Insights

The solutions segment led the market and accounted for over 64% of the global revenue in 2023, driven by comprehensive offerings that include business and technology solutions. Business solutions focus on strategic planning, governance, compliance, and aligning IT services with business objectives, while technology solutions leverage automation, AI, ML, and cloud computing to manage complex IT environments efficiently. The high customization and flexibility of SIAM solutions across various industries enhance service delivery quality and governance. Additionally, SIAM solutions support digital transformation efforts by ensuring cohesive service management, thus driving their adoption and market growth.

The services segment is poised for significant growth due to the rising demand for expertise and consulting, as organizations need tailored strategies and best practices to implement and manage SIAM frameworks. Continuous support and maintenance services are essential for adapting to changes and resolving issues, while training and development services build the necessary skills for managing new structures. The complexity of integrating multiple service providers drives the need for specialized implementation services, and customization of SIAM services to meet unique organizational needs further fuels demand. Additionally, managed SIAM services allow organizations to outsource framework management, focusing on core activities.

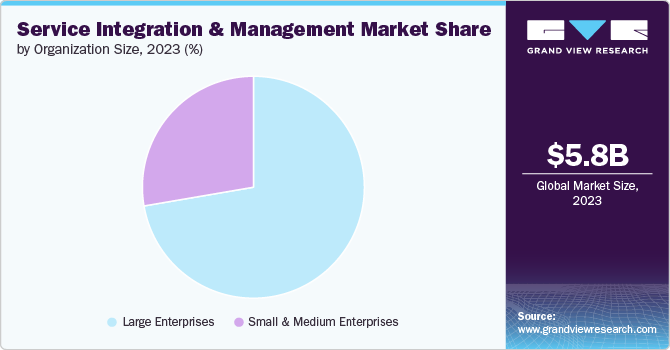

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023 due to their complex IT environments, extensive scale of operations, and the strategic importance of IT in their business strategies. SIAM provides a structured approach to managing multiple service providers and ensures consistency and efficiency across various regions and business units. With higher IT budgets, these enterprises invest in comprehensive SIAM solutions to meet stringent regulatory and compliance requirements, prioritize governance and risk management, and improve service quality and customer satisfaction. The need for agility and flexibility to adapt to market changes, coupled with digital transformation initiatives and global operations, further drives large enterprises to adopt SIAM frameworks.

The Small & Medium Enterprises (SMEs) segment is poised for significant growth in the SIAM market as SMEs are increasingly adopting IT services to boost operational efficiency and competitiveness, necessitating structured management and integration through SIAM. Despite their smaller scale compared to large enterprises, SMEs face growing complexity in their IT ecosystems, including multiple service providers and cloud solutions, which SIAM helps unify and manage efficiently. SIAM offers cost-effective solutions that streamline IT service management, leading to substantial savings and improved operational efficiencies for SMEs. Moreover, as SMEs embark on digital transformation journeys, SIAM supports these initiatives by integrating digital services and enabling agile development, thereby enhancing innovation and speeding up time-to-market.

Vertical Insights

The IT & telecom segment accounted for the largest market revenue share in 2023, driven by its highly complex IT environments and heavy reliance on IT services. SIAM plays a vital role in managing this complexity by ensuring seamless integration and coordination across diverse systems, applications, and service providers. For IT & Telecom companies, rapid innovation and flexibility are essential, and SIAM facilitates the adoption of new technologies, supports agile development, and enhances global operational standards. Moreover, SIAM helps these organizations prioritize customer experience by aligning IT services with business objectives, improving service quality, and maintaining high levels of reliability and security.

The manufacturing segment is poised for significant growth in the SIAM market, driven by the increasing complexity of IT systems within modern manufacturing processes. SIAM offers a structured approach to integrate and manage interconnected systems such as ERP, MES, IoT devices, and supply chain management, enhancing operational efficiency and supporting cost reduction efforts. Embracing digital transformation initiatives such as Industry 4.0 and smart manufacturing, SIAM facilitates the adoption of advanced technologies like AI, ML, and automation, enabling real-time data analysis and process optimization. Manufacturers benefit from SIAM's ability to manage global supply chains effectively, ensure regulatory compliance, improve quality management practices, and leverage IoT and big data analytics for enhanced decision-making.

Regional Insights

North America service integration and management market held a significant share of over 35% in 2023, driven by its advanced IT infrastructure and widespread adoption of digital technologies such as cloud computing and big data analytics. The region benefits from a robust ecosystem of leading IT service providers and technology vendors specializing in IT management and integration services, supporting the deployment of sophisticated SIAM solutions tailored to diverse industry needs. North American businesses, mainly in finance, healthcare, telecommunications, and manufacturing, lead in digital transformation efforts, fueling the demand for integrated service management solutions such as SIAM.

U.S. Service Integration And Management Market Trends

The service integration and management (SIAM) market in the U.S. is poised for substantial growth. The country leads in cloud adoption, prompting increased demand for SIAM to manage hybrid IT environments effectively. U.S. businesses are also prioritizing digital transformation to enhance agility and competitiveness, with SIAM playing a crucial role in integrating digital technologies and optimizing IT service delivery. Complex IT ecosystems and stringent regulatory compliance requirements further emphasize the need for SIAM frameworks to ensure seamless service delivery, operational efficiency, and regulatory adherence across diverse sectors.

Europe Service Integration And Management Market Trends

The service integration and management (SIAM) market in Europe is growing as the region's stringent GDPR necessitates robust IT governance and risk management, supporting demand for SIAM frameworks. European companies with multinational operations benefit from SIAM's ability to streamline IT service management across diverse geographic locations. Moreover, as European industries pursue digital transformation initiatives, SIAM supports the integration of digital technologies, enhances service quality, and improves operational efficiencies.

Asia Pacific Service Integration And Management Market Trends

The service integration and management (SIAM) market in Asia Pacific is poised for significant growth driven by rapid digital transformation across countries such as China, India, Japan, and Southeast Asia. Organizations in the region are embracing cloud computing, big data analytics, IoT, and AI to enhance operational efficiency and customer experiences. SIAM plays a vital role in integrating these technologies into IT service management frameworks, supporting agile and scalable operations. Asia Pacific enterprises benefit from SIAM's structured approach to managing complex IT environments, ensuring seamless integration and standardized processes across hybrid IT architectures.

Key Service Integration And Management Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in April 2024, Accenture acquired CLIMB CO., LTD., a technology services provider based in Japan. CLIMB CO., LTD. specializes in system integration, IT infrastructure management, and operations. This acquisition enhances Accenture's capabilities in Japan, mainly in helping global organizations navigate technology changes. CLIMB CO., LTD's expertise will accelerate application and infrastructure modernization services, specifically benefiting financial institutions and government agencies aiming for digital transformation.

Key Service Integration And Management Companies:

The following are the leading companies in the service integration and management market. These companies collectively hold the largest market share and dictate industry trends.

- Atos SE

- CGI Inc

- DXC Technology Company

- Fujitsu

- HCL Technologies Limited

- IBM Corporation

- Infosys Limited

- LTIMindtree Limited

- TATA Consultancy Services Limited

- Wipro

Recent Developments

-

In May 2024, Accenture acquired OPENSTREAM HOLDINGS CO., LTD to bolster its capabilities in advancing clients' data-driven business reinvention. The acquisition aims to enhance Accenture's offerings in system and application modernization and to support the adoption of cloud, data analytics, AI, and IoT technologies. OPENSTREAM HOLDINGS CO., LTD brings a robust client portfolio and automation solutions spanning the entire product value chain, from manufacturing to logistics and procurement and after-sales service, further strengthening Accenture's business and service capabilities.

-

In May 2024, Cloud21 Limited, a digital healthcare consulting and technology services company, acquired BDS Connected Solutions to enhance its IT integration and support services. This acquisition aims to expand Cloud21 Limited's managed services offerings, focusing on optimizing technology infrastructure and enhancing staff experience in health and care IT operations.

-

In May 2024, BigID launched an integration of its data security posture management with ServiceNow's security posture control. This collaboration aims to streamline security, operational efficiency, and compliance for joint customers. The integration enhances vulnerability identification and prioritization, providing a unified view of IT assets and associated data. This integration accelerates workflows, improves time-to-value, and enhances trust in CMDB data accuracy and consistency.

Service Integration And Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.12 billion

Revenue forecast in 2030

USD 8.31 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, organization size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Atos SE; CGI Inc; DXC Technology Company; Fujitsu; HCL Technologies Limited; IBM Corporation; Infosys Limited; LTIMindtree Limited; TATA Consultancy Services Limited; Wipro

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Service Integration And Management (SIAM) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global service integration and management (SIAM) market report based on component, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Business Solutions

-

Governance, Risk, & Control

-

Contract Management

-

Procurement

-

Auditing & Invoicing

-

Technology Solutions

-

Application

-

Application Development

-

Application Testing

-

Application Lifecycle Management

-

Infrastructure

-

Data Center

-

Network

-

Security

-

Others

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

IT & Telecommunication

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare & Life Sciences

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global service integration and management market size was estimated at USD 5.81 billion in 2023 and is expected to reach USD 6.12 billion in 2024.

b. The global service integration and management market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 8.31 billion by 2030.

b. North America dominated the market in 2023, accounting for over 35% share of the global revenue, driven by its advanced IT infrastructure and widespread adoption of digital technologies such as cloud computing and big data analytics.

b. Some key players operating in the service integration and management market include Atos SE; CGI Inc; DXC Technology Company; Fujitsu; HCL Technologies Limited; IBM Corporation; Infosys Limited; LTIMindtree Limited; TATA Consultancy Services Limited; Wipro

b. Key factors driving the service integration and management market growth include increasing adoption of service management platforms and increasing preference for multi-vendor outsourcing

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.