- Home

- »

- Beauty & Personal Care

- »

-

Setting Spray Market Size, Share And Trends Report, 2030GVR Report cover

![Setting Spray Market Size, Share & Trends Report]()

Setting Spray Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Oil-control, Waterproof), By End-use (Professional, Personal), By Distribution Channel (Supermarket & Hypermarket, Specialty Retail Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-156-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Setting Spray Market Size & Trends

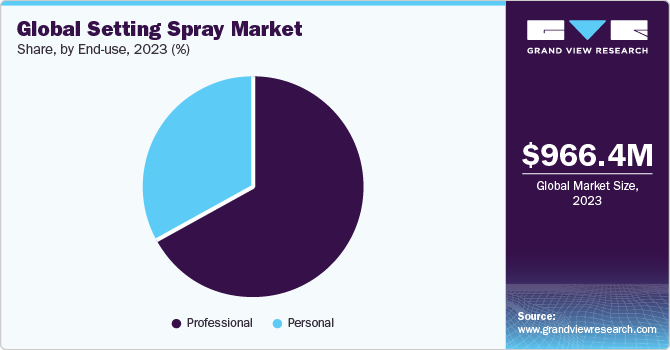

The global setting spray market size was valued at USD 966.4 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.6% from 2024 to 2030. There is an increasing demand, due to the desire for makeup that remains fresh, smudge-proof, and long-lasting, regardless of the occasion, climate, or environmental factors. Consumers are looking for solutions that keep their makeup looking flawless and intact throughout the day and night. The beauty and cosmetics industry's continuous expansion and innovation have opened up new avenues for setting sprays. Consumers are increasingly interested in products that not only enhance their makeup but also contribute to overall skin health. Many individuals who regularly wear makeup seek formulations that offer skincare benefits, such as hydration and protection. Hence, the market is experiencing growth due to products like hydrating setting sprays and those with SPF content, which cater to consumer demands.

The increasing influence of social media is a significant driver of the market. These platforms play a crucial role in endorsing brands and providing makeup tutorials. They offer product reviews and application tips, helping consumers make informed decisions based on their skin type, the occasion, and brand preference. According to Zippia in 2023, 37% of shoppers typically found out about new cosmetics brands or products through social media ads. About 33% found out via recommendations and comments made on social media platforms. Also, a 2021 Segmenta blog article highlighted that 22% of the U.S. women use apps to try on makeup, reflecting the shift toward online beauty shopping.

Also, beauty brands have invested in virtual and augmented reality technology to enhance the online shopping experience, particularly for younger consumers aged 13-25. Sephora and YouCam are among the popular choices for virtual makeup tools, with YouCam being favored by the younger demographic. A significant opportunity for the market is expected to emerge in the near future as a result of the global trend toward organic and vegan cosmetics goods. Consumers' preference for organic cosmetics over products with chemical bases is supported by growing knowledge about these goods and their beneficial effects on skin, which is further fueling the market's expansion. Companies like Urban Decay are offering a range of vegan setting sprays with different contents like SPF protection, hydration and more.

End-use Insights

The professional segment dominated the market with a share of 67% in 2023. In film, television, and photography, where high-definition cameras and intense lighting are the norm, makeup must withstand close inspection. Professional setting sprays guarantee flawless makeup even in these demanding conditions. They also cut down on the need for constant touch-ups. Industry professionals adopt these products for their ability to maintain a polished look over an extended period.

The personal end-use segment is anticipated to grow at a CAGR of 8.4% during the forecast period. Beauty influencers and online makeup tutorials play a vital role in educating consumers about the advantages and popular product reviews of setting sprays. They provide step-by-step guidance on application techniques, showcase the products' effectiveness, and contribute to the growing popularity of these beauty essentials for personal use.

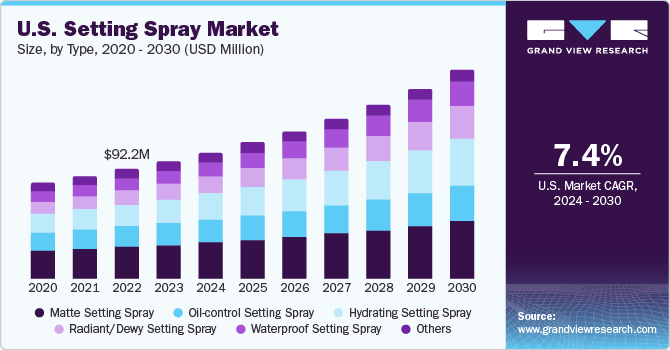

Type Insights

Matte setting spray dominated the market with a share of around 26.4% in 2023. Matte setting spray is favored for its ability to manage skin shine and excess oil, resulting in a desirable matte finish, particularly appealing to individuals with oily skin. Furthermore, it effectively sets makeup, extending its longevity and preventing smudging. The market includes innovative companies like Amorus USA, which introduces attractive products like their cucumber-scented formula in the Mist & Lock setting spray, contributing to a competitive marketplace and heightened consumer demand.

Radiant/Dewy setting spray is estimated to grow at a CAGR of 10.0% during the forecast period from 2024 to 2030. Radiant setting sprays often feature hydrating components like glycerin, hyaluronic acid, and botanical extracts. It helps to maintain skin moisture, preventing makeup from appearing dry or cakey. Particularly valuable in hot, humid climates, it is a favorite choice for events, photoshoots, and weddings, ensuring flawless, radiant makeup even under intense lighting and high-definition cameras.

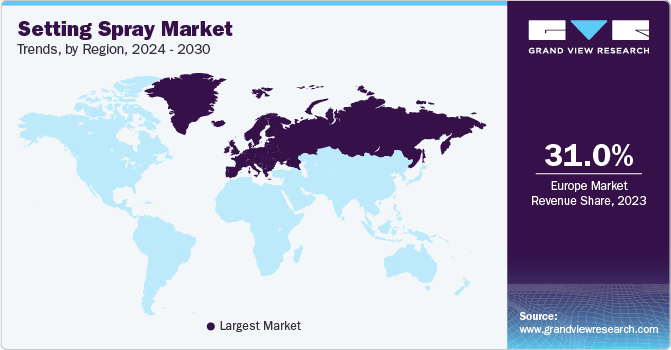

Regional Insights

Europe dominated the market in 2023 with a share of about 31.0%. By attracting external investments, developing intangible assets like brands, and investing in research and development, the cosmetics and personal care industry is enhancing the competitiveness of the European economy for future prosperity. Also, according to Personal Care Association of Europe, as of 2022, most of Europe's 500 million consumers use cosmetics daily, valuing health and self-esteem, while the strong presence of brands in Europe drives the cosmetics market, including setting sprays.

Asia Pacific is expected to witness a CAGR of 9.5% from 2024 to 2030. Increased consumer spending on cosmetics and personal care products, coupled with the appeal of premium cosmetic brands among celebrities, is fueling commercialization. Additionally, the growing industrial sector benefits from rising per capita incomes in emerging countries like India, Singapore, South Korea, Japan, etc., contributing to increased sales. Furthermore, the personal care industry in emerging nations is poised for significant growth during the projection period, offering substantial market potential.

Distribution Channel Insights

Supermarkets and hypermarkets held a majority market share of about 31.6% in 2023. These offline channels feature well-known brands that align with regional consumer preferences, aiding shoppers in making informed choices. These stores offer a diverse selection of products from various brands and price ranges, occasionally featuring attractive deals, contributing to increased product adoption through this retail channel.

The online channel segment is set to grow at a CAGR of about 9.1%. The growth of the e-commerce industry in emerging markets is a significant catalyst for market expansion. China and India, in particular, are witnessing a surge in online cosmetic product like setting spray browsing and shopping. Additionally, the industry is expected to thrive as prominent e-commerce companies establish stronger ties with cosmetics producers in developing economies. Furthermore, the increasing global popularity of e-commerce platforms and the widespread adoption of smartphones are projected to open up numerous opportunities in the near future.

Key Companies & Market Share Insights

The market for setting spray is increasingly competitive with presence of both large and small-scale manufacturers. Prominent players have been adopting strategies such as merger & acquisitions, partnerships, product launches, innovation, and promotions to stay competitive in the markets.

Key Setting Spray Companies:

- Rare Beauty

- e.l.f Cosmetics, Inc.

- Urban Decay

- Swiss Beauty

- L'Oréal

- Sugar Cosmetics

- Lakme Cosmetics (Unilever)

- Faces Canada

- Charlotte Tillbury Cosmetics

- Anastasia Beverly Hills

Recent Developments

-

In July 2022 - L'Oréal partnered with Nasscom, a non-profit association of the Indian IT-BPM industry. The partnership focuses on developing and deploying technologies in L'Oréal's business operations. The partnership would support L'Oréal in consumer evaluations, personalization, product development, etc.

-

In January 2021, E.L.F Cosmetics partnered with Nykaa, an India-based consumer technology platform. The partnership aims at introducing E.L.F Cosmetics' products and strengthening its market presence in India.

Setting Spray Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.04 billion

Revenue forecast in 2030

USD 1.73 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

Rare Beauty; e.l.f Cosmetics, Inc.; Urban Decay; Swiss Beauty; L'Oréal; Sugar Cosmetics; Lakme Cosmetics (Unilever); Faces Canada; Charlotte Tillbury Cosmetics; Anastasia Beverly Hills

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Setting Spray Market Report Segmentation

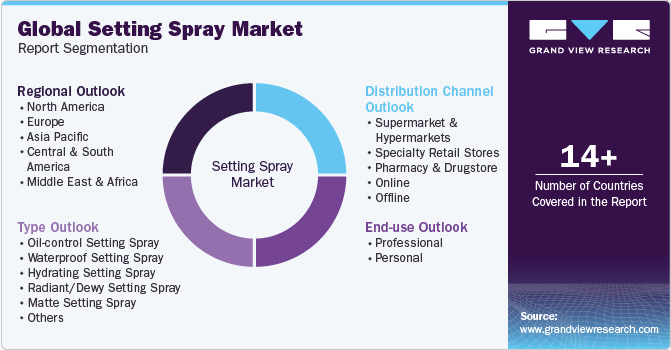

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global setting spray market report based on type, end-use, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-control Setting Spray

-

Waterproof Setting Spray

-

Hydrating Setting Spray

-

Radiant/Dewy Setting Spray

-

Matte Setting Spray

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional

-

Personal

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket and Hypermarkets

-

Specialty Retail Stores

-

Pharmacy & Drugstore

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global setting spray market was estimated at USD 966.4 million in 2023 and is expected to reach USD 1.04 billion in 2024.

b. The global setting spray market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 1.73 billion by 2030.

b. Europe dominated the setting spray market with a share of around 31% in 2023. This is owing to the people are moving toward a healthy lifestyle and are thinking of a sustainable environment, thus preferring cosmetics made from organic and plant-based ingredients,

b. Some of the key players operating in the cosmetics market include Rare Beauty, e.l.f Cosmetics, Inc., Urban Decay, Swiss Beauty, L'Oréal, Sugar Cosmetics, Lakme Cosmetics (Unilever), Faces Canada, Charlotte Tillbury Cosmetics, Anastasia Beverly Hills.

b. Key factors that are driving the setting spray market growth include the rising awareness of chemical-free cosmetics and the rising popularity of personalized and long-lasting skincare products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.