- Home

- »

- Medical Devices

- »

-

Sex Toys Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Sex Toys Market Size, Share & Trends Report]()

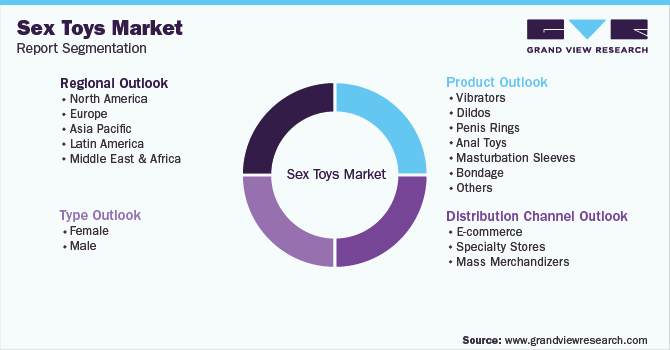

Sex Toys Market Size, Share & Trends Analysis Report By Product (Vibrators, Penis Rings, Anal Toys, Dildos), By Type (Male, Female), By Distribution Channel (E-commerce, Specialty Stores, Mass Merchandizers), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-981-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

The global sex toys market size was valued at USD 32.7 billion in 2022. It is expected to expand at a compound annual growth rate (CAGR) of 8.50% from 2023 to 2030. Increased spending capacities and improved standard of living in developing economies are the factors expected to drive market growth during the forecast period. Novelty adult products are gaining a mainstream position in the sexual wellness industry with their growing popularity among all age groups. Acceptance of the LGBTQ+ community and growing interest among women toward experimenting with sexual wellness products without hesitation is promoting the adoption of such products and hence, driving the market growth. Liberalization, penetration of social media, and the influence of pop culture have resulted in increasing awareness about the importance of sexual health.

Moreover, the nonexistence of manufacturing regulations allows the manufacturers to develop female and male-centric products without any restrictions on reporting the material or chemical used in the products. Manufacturers are thus at liberty to develop many products under the label of novelty toys. Products such as vibrators, dildos, and e-stimulators are widely used by both genders for sexual stimulation.

The increasing popularity of sex toys has been observed worldwide. Women, as well as couples, are experimenting with sex toys such as Bluetooth vibrators, luxury love toys, romantic toys, and automated toys, to enhance the sexual experience while making love or masturbating. Sex toys are also known to have medical benefits. They are helpful in the treatment of menopausal symptoms and neurological conditions such as lack of arousal. In men, toys help tackle sexual problems including premature ejaculation, lack of libido, and erectile dysfunction. Growing adoption of sex toys to treat these issues is likely to contribute to market growth in the coming years.

One of the growing trends in the sex toys industry is the adoption of cutting-edge technology for the development of innovative products. Virtual gadgets, remotely connected devices, robots, immersive entertainment, and augmented reality are factors expected to change the landscape of the market in the coming years. For instance, EXOLOVER PTY LTD. is an Australian startup that develops adult novelty devices using blockchain technology, allowing remote interaction and sharing real-time intimate sensations.

COVID-19 Impact

There was a positive COVID-19 impact on the sex toy market, increased web traffic, and a surge in sales of toys during the initial stage of the pandemic due to social distancing and quarantine. During COVID-19, customers shifted towards app-enabled sex toys and Bluetooth-powered toys, also known as teledildonics, to reduce the exposure to harmful chemicals in sex toys. In addition, the increasing adoption of toys is attributed to couples experimenting with their relationship. Some of the market players are coming up with new toys that use technology to enhance customer experience. For instance, Lovense Lush Bullet Vibrator is a Bluetooth device that can be operated from anywhere. In addition, New Zealand’s Adult toy megastore has tripled its sales during the COVID times, similar growth trends were observed in the UK, Denmark, Columbia, and the U.S.

The sex toys market witnessed an increment of over 26% from 2019 to 2020. As per the earlier projection, the market was expected to be nearly USD 29 billion in 2020. Total and partial lockdowns had resulted in increased sexual activities among individuals and in turn the usage of sex toys such as vibrators, dildos, and massage products. Favorable regulatory changes regarding LGBTQ+ relationships had resulted in a larger use of these products including, penile rings, anal toys, and vibrators. In 2021, the market witnessed a slight decline of nearly 9% as compared to 2020, before resuming its growth trajectory by mid-2022. Improving regulatory structure in Asian countries and increasing acceptance of sex toys as a medium of increasing satisfaction among married couples will continue to boost the growth of sex toys in the coming few years.

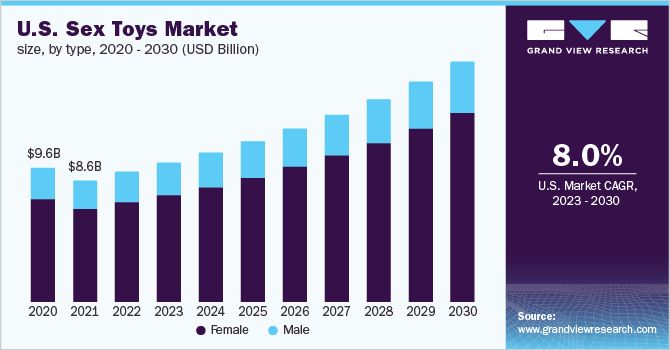

Type Insights

The female segment dominated the market with a revenue share of around 59.56% in 2022 and is expected to register the fastest CAGR of 8.68% during the forecast period. Surpassing the taboo and social stigma, a wide range of women’s products are easily available in the market. Products such as vibrators, dildos, and anal beads are displayed directly in the wellness department. Manufacturers have generally targeted women for manufacturing toys around the female anatomy. The increasing popularity of male sex toys such as penile rings, penis pumps, and penis vibrators is expected the boost the growth of the male sex toys segment. Online retailers, as well as hypermarkets, are stocking sex toys alongside condoms in their wellness segment, providing easy access to men looking to enhance their sexual health.

The COVID-19 pandemic forced people worldwide to stay indoors or self-isolate at home and practice self-care, including self-pleasure. This has led to an increase in the sales of sex toys, especially in developed and developing markets. Sales of products such as personal massagers, vibrators, flashlights, blindfolds, handcuffs, and bondage items have surpassed the estimated sales for the last 3 months compared to 2019. Manufacturers are also introducing various products along with toys for a safer experience for customers, such as personal lubricants, toy cleaning wipes, air pulsing arousers, massagers, and toy cleaners.

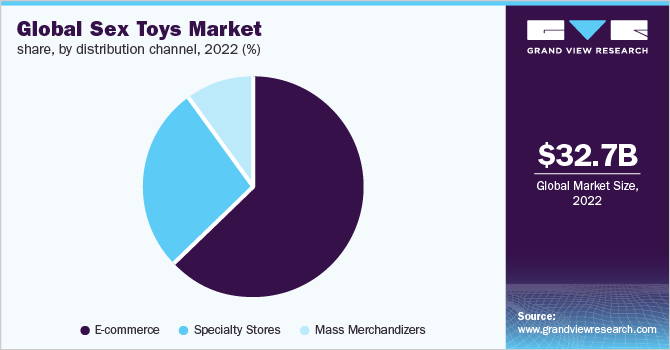

Distribution Channel Insights

The e-commerce platforms and online retailers segment held the largest market share of around 63.09% in 2022 and is expected to register the fastest CAGR of 8.60% during the forecast period. Increasing penetration of the internet and the availability of numerous sex toys on e-commerce platforms are driving the growth of the segment. The anonymity maintained in product delivery is an added advantage for customers opting for online purchases over brick-and-mortar adult stores. Based on the distribution channel, the global sex toys market is segmented into E-commerce, specialty stores, and mass merchandisers.

Online stores and retailers have reported significantly high demand for adult toys, with the worldwide lockdown to combat the COVID-19 pandemic. To fulfill this increasing demand for sex toys during the period of self-quarantine, maintaining an adequate supply is a major challenge for manufacturers, distributors, and retailers. The supply and distribution chain are adversely affected due to the global shutdown of air freights and shipments. This is expected to increase import duties in several countries, which in turn is expected to increase the prices of imported sex toys.

In developing countries, sales of toys have legal concerns and online retailers are often the only source of purchase. According to a survey by Reckitt Benckiser in 2019, around 74% of Indians expressed their interest to explore and try new things sexually. More than 35% of the online orders for sex toys in India are from non-metro & tier 1 cities.

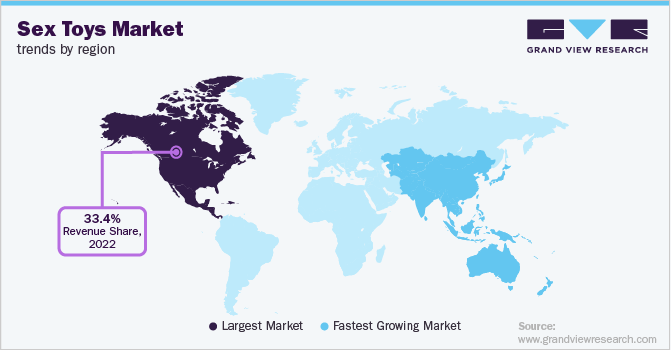

Regional Insights

North America held the largest share of over 33.39% in 2022, owing to the presence of numerous manufacturers and retailers providing easy access to products. According to a survey conducted in the U.S. in 2019, 53% of Americans used sex toys for improving their sexual experience. Social acceptance and liberal sexual lifestyle in the U.S. and Canada, along with the presence of multiple adult stores, are expected to boost demand for adult novelty items during the forecast period. Manufacturers in North America such as Doc Johnson in the U.S. and Cal Exotics in Ontario have experienced increased sales of sex toys in the first quarter of 2020.

European countries, such as Germany, Italy, France, the U.K., Denmark, and Belgium, are leading contributors to the market. Traditional vibrators and dildos are the most popular products in these countries. The presence of some of the leading brands, such as LELO, Lovehoney, Durex, and Fun Factory, which cater to the requirements of the European community, had positioned Europe as the second-largest market in 2021.

Asia Pacific is expected to register the fastest market growth with a CAGR of 9.02% during the forecast period. Reducing social stigma by changing customer perception toward sex and increasing online retailers are expected to drive demand for sex toys in the Asia Pacific. Countries such as Singapore and New Zealand are now catering to the sexual needs of women through the promotion of the sex toys industry.

Key Companies & Market Share Insights

The global market is highly competitive with the presence of global and regional manufacturers. Manufacturers are launching some of the most luxurious and exotic products using advanced technology. For instance, some of the market players are focusing on couple sex toys. In 2021, clitoral stimulators, suction vibrators, wand vibrators, and oral stimulators were trending. Also, Stylecaster introduced an oral sex stimulation toy in 2021.

In March 2020, online sales for PinkCherry’s Womanizer vibrator (produced by WOW Tech Group) increased after a stay-at-home campaign with billboards that read SCREAM YOUR OWN NAME was released at multiple sites. Some of the brands that are high in demand during this pandemic in Canada include Womanizer, Magic Wand Rechargeable, Tenga Egg, Je Joue Uma, Njoy Pure Wand, Fuze, and Pleasure Plug. In July 2019, LifeStyles Healthcare announced the launch of three new intimate accessories under its SKYN brand-SKYN Thrill, SKYN Vibes, and SKYN Shiver.

Marketing strategies used for these products are changing. Manufacturers are working on removing the pornographic image associated with sexual wellness products and rebranding the use of vibrators as a healthy means of improving sex life. Some of the prominent players in the global sex toys market include

-

Church & Dwight Co., Inc.

-

Reckitt Benckiser Group plc

-

LELO

-

LifeStyles Healthcare Pte Ltd

-

Doc Johnson Enterprises

-

Lovehoney Group Ltd

-

BMS Factory

-

PinkCherry

-

Tenga Co., Ltd.

-

Fun Factory

-

We-Vibe

Sex Toys Market Report Scope

Report Attributes

Details

Market size value in 2023

USD 35.2 billion

Revenue forecast in 2030

USD 62.3 billion

Growth Rate

CAGR of 8.50%

Base year for estimation

2022

Historical data

2017 – 2021

Forecast period

2023 – 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea, New Zealand, Brazil; Mexico; Argentina; South Africa

Key companies profiled

Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; LELO; LifeStyles Healthcare Pte Ltd; Doc Johnson Enterprises; Lovehoney Group Ltd; BMS Factory; PinkCherry, Tenga Co., Ltd.; Fun Factory; We-Vibe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global sex toys market report based on type, product, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Female

-

Male

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Vibrators

-

Dildos

-

Penis Rings

-

Anal Toys

-

Masturbation Sleeves

-

Bondage

-

Sex Dolls

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

E-commerce

-

Specialty Stores

-

Mass Merchandizers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sex toys market size was estimated at USD 32.7 billion in 2022 and is expected to reach USD 35.2 billion in 2023.

b. The global sex toys market is expected to grow at a compound annual growth rate of 8.50% from 2023 to 2030 to reach USD 62.3 billion by 2030.

b. North America dominated the sex toys market with a share of 33.3% in 2022. This is attributable to social acceptance and liberal sexual lifestyle in the U.S. along with the presence of multiple adult stores.

b. Some key players operating in the sex toys market Church & Dwight Co., Inc.; Reckitt Benckiser Group plc; LELO; LifeStyles Healthcare Pte Ltd; Doc Johnson Enterprises; Lovehoney Group Ltd; BMS Factory; Tenga Co., Ltd.; Fun Factory; We-Vibe.

b. Key factors that are driving the sex toys market growth include growing demand from customers to enhance sexual experience, liberalization, penetration of social media, and the influence of pop culture is increasing awareness about the importance of sexual health.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."