- Home

- »

- Pharmaceuticals

- »

-

Shingles Vaccine Market Size, Share & Growth Report, 2030GVR Report cover

![Shingles Vaccine Market Size, Share & Trends Report]()

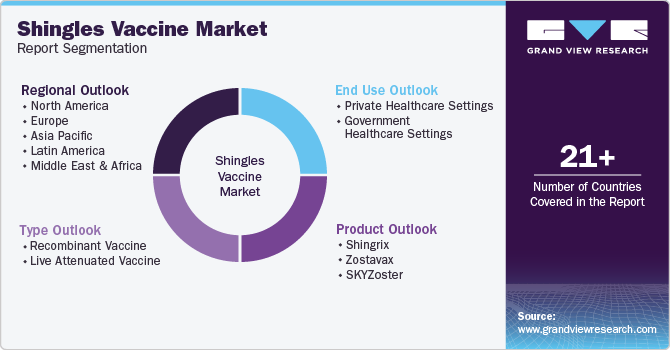

Shingles Vaccine Market Size, Share & Trends Analysis Report By Product (Shingrix, Zostavax), By Type (Recombinant Vaccine), By End-use (Private Healthcare Settings), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-638-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Shingles Vaccine Market Size & Trends

The global shingles vaccine market size was estimated at USD 4.31 billion in 2023 and is projected to grow at a CAGR of 15.34% from 2024 to 2030. The increasing risk of developing shingles, especially in adults aged 60 and above, and improvement in healthcare policies in developed countries are key factors driving market growth. The Centers for Disease Control and Prevention (CDC) estimates that approximately one out of three individuals in the U.S. will develop shingles in their lifetime. Vaccination is the most effective way to protect oneself from shingles, which can lead to severe complications such as long-lasting nerve pain and vision impairment. In March 2021, CDC released guidelines related to shingles vaccination during the COVID-19 pandemic and designated it as an essential preventive care service.

Government regulatory bodies are making increasing recommendations for vaccination against the disease to reduce burden and increase the approval of vaccines to prevent shingles. For instance, U.S. Advisory Committee on Immunization Practices has recommended vaccination against shingles in adults aged 60 and above since 2006 and this recommendation increased awareness about the importance of shingles vaccination.

Including shingles vaccines in national immunization programs plays a significant role in driving market growth. When vaccines are recommended and provided as part of national vaccination schedules, it leads to increased uptake and coverage. For instance, in Australia, vaccination against shingles is funded under the National Immunization Program for adults aged 70 to 79 years, because people in this age group have a higher risk of developing herpes zoster and are expected to benefit the most.

Governments are actively promoting shingles vaccination through awareness programs, free vaccine programs, and other initiatives contributing to market growth. From November 2023, the Australian government is launching a comprehensive vaccination program to provide free Shingrix vaccines to nearly five million people at risk of severe shingles disease. This program includes individuals aged 65 and over, First Nations people aged 50 and over, and those with weakened immune systems.

The cost of shingles vaccination without insurance for one eligible adult is about USD 400, which is a relatively affordable price considering the long-term benefits of immunization. In addition, the disease burden can be reduced by increasing adoption of vaccines, which is a critical factor in the market's growth. The cost-effectiveness of vaccines is a significant factor in the uptake of vaccines globally, with vaccines being generally more cost-effective than treating shingles.

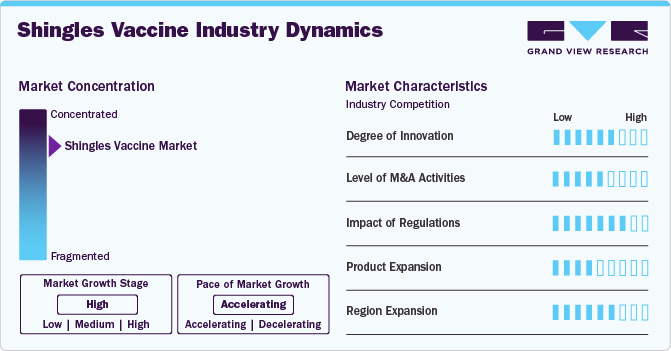

Industry Dynamics

The market is experiencing notable innovation with the introduction of recombinant vaccines such as Shingrix, which offer superior efficacy and safety compared to traditional vaccines, Zostavax. These advancements in vaccine technology are fostering the development of more effective solutions for shingles prevention, contributing to market growth despite the higher cost of these innovative vaccines.

The degree of mergers and acquisitions has been moderate but is expected to increase as the market grows rapidly. As market expands and new players enter the industry, consolidation through mergers and acquisitions becomes a common strategy for companies to strengthen their positions, expand their product portfolios, and enhance their market presence.

Regulatory bodies greatly influence the shingles vaccine market, impacting development to marketing phases. Key regulators include FDA, overseeing vaccine approvals, and the WHO, which sets global standards and provides guidance to ensure vaccines' safety and effectiveness worldwide.

The global shingles vaccine market has relatively few product substitutes. This is primarily due to the unique characteristics and efficacy of the leading vaccines, such as Shingrix and SKYZoster. While other vaccines may be available for preventing shingles, the dominance of Shingrix and SKYZoster, along with their proven efficacy and safety profiles, limits the presence of direct substitutes.

North America and followed by Europe dominated the shingles vaccine market due to their well-established healthcare systems and greater disease awareness. Government support, healthcare policies, awareness efforts, and vaccine technology advancements drive market growth. As more regions prioritize vaccination against shingles to address public health concerns related to herpes zoster, the market is poised for continued growth and expansion globally.

Product Insights

The Shingrix segment held the largest share of 93.77% in 2023 and is anticipated to grow over the forecast period owing to the increasing recommendation and high efficacy of this vaccine compared to other vaccines. The segment’s growth can be attributed to increasing awareness of Shingles and approval of Shingrix vaccines in various regions. In July 2021, U.S. FDA expanded the approval of Shingrix to include immunocompromised adults aged 18 and above who are at risk of shingles due to immunodeficiency or immunosuppression from a known disease or treatment. Shingrix, a non-live vaccine made from recombinant sub-units with an adjuvant, was initially authorized by the FDA in 2017 to prevent shingles in individuals aged 50 and older.

The SkyZoster vaccine is the second largest segment due to its high prescription rate, cost-effectiveness compared to Zostavax, and its inclusion in the immunization programs of some provinces. Additionally, increasing clinical trials of SkyZoster in other countries is expected to lead to its approval in those regions. The reduced availability of live attenuated vaccines, such as Zostavax, for immunocompromised adults has led to the emergence of recombinant vaccines such as SkyZoster. This change is mainly due to the inherent drawbacks of live vaccines in this patient population, highlighting the increasing preference and potential for recombinant vaccine options.

Type Insights

The recombinant vaccines segment held the largest share of 93.77% in 2023 and is anticipated to grow over the forecast period. Recombinant vaccines, especially Shingrix, have been widely adopted in North America and Europe due to their high efficacy and lack of major side effects. Compared to other types of vaccines, recombinant vaccines have demonstrated high efficacy rates in clinical trials. This superior efficacy can drive demand for recombinant shingles vaccines among healthcare providers and patients. Ongoing advancements in biotechnology and genetic engineering have enabled the development of more sophisticated recombinant vaccines with improved immunogenicity and effectiveness.

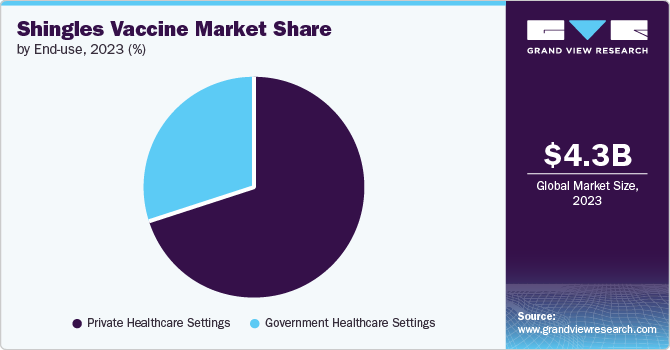

End-use Insights

The private healthcare settings segment held the largest market share of 69% in 2023. Patients often prefer private healthcare settings due to shorter wait times, personalized care, and more comfortable environments. This preference leads patients to seek shingles vaccination services in private healthcare settings, increasing demand in this segment. Private healthcare settings typically offer greater accessibility and availability, including extended hours of operation, flexible appointment scheduling, and convenient locations. The easy access to shingles vaccination services in private settings encourages more individuals to choose these facilities, contributing to their dominance.

The government healthcare settings segment is anticipated to grow significantly over the forecast period due to the increasing adoption of vaccination programs and regulations imposed by governments to ensure public health and disease prevention. Governments may require certain populations to receive vaccinations, such as shingles vaccine, which can significantly increase the demand for vaccines in government healthcare settings as compliance becomes mandatory. Shingles is a painful viral infection with serious health implications, especially for older adults. As governments prioritize public health and disease prevention, promoting shingles vaccination in government healthcare settings becomes a strategic focus to reduce the burden of this disease on healthcare systems. Vaccination programs implemented in government healthcare settings are often cost-effective in long run, making them a viable option for governments to invest in.

Regional Insights

North America shingles vaccine market accounted for 62.58% share in 2023. Government initiatives and immunization programs are crucial in driving the demand for shingles vaccines in North America. Public health agencies often recommend vaccination against shingles for specific age groups or populations, increasing vaccination rates.

U.S. Shingles Vaccine Market Trends

The shingles vaccine market in the U.S. held the largest share in 2023 and is expected to grow rapidly over the forecast period. The U.S. regulatory bodies for shingles vaccines, such as U.S. Food and Drug Administration (FDA), play a significant role in driving the market growth in U.S. region. In addition, insurance coverage for the shingles vaccine under Medicare Part D also plays a crucial role in improving access to the vaccine, thereby supporting market expansion.

Europe Shingles Vaccine Market Trends

In the Europe region, the shingles vaccine market is experiencing significant growth driven by the increasing prevalence of herpes zoster among adults. The demand for shingles vaccines is rising in Europe due to their high efficacy and minimal side effects. Countries in Europe, such as the UK, have included Shingrix in their national shingles vaccination programs, further boosting market growth.

The UK shingles vaccine market is experiencing significant growth due to recent developments. The country became the first in Europe to approve the inclusion of this shingles vaccine in its immunization program. The UK government's recommendation of the shingles vaccine, particularly for individuals aged 70 and above, is expected to spur market growth. The UK's National Health Service (NHS) has also substantially provided access to the shingles vaccine. By offering this vaccine for free to eligible age groups, NHS has ensured that financial barriers do not hinder individuals from receiving this vaccine, thus increasing coverage across the country.

The shingles vaccine market in France is being impacted by the increasing number of cases among adults. With approximately 230,000 reported shingles cases annually in France and a high hospitalization rate due to the illness, there is an urgent need for an effective vaccination strategy. French health authority, Haute Autorité de Santé (HAS), has recommended a new shingles vaccine to reduce the infection rate. French government actively promotes the shingles vaccine through awareness campaigns and public health initiatives. These efforts have resulted in a significant increase in shingles vaccine adoption in France.

Asia Pacific Shingles Vaccine Market Trends

The Asia Pacific shingles vaccine market is anticipated to witness the fastest growth over the forecast period. Increased awareness and education about shingles disease in many countries within the Asia Pacific region have led to better recognition and diagnosis of condition. Public health campaigns and educational programs aimed at healthcare providers and the public contribute to this growing awareness. Government bodies are actively supporting the prevention of shingles through awareness programs, free vaccine programs, and other initiatives.

The shingles vaccine market in Japan is growing significantly after the approval of Shingrix for adults aged 18 and over who are at increased risk of developing shingles. In June 2023, the Japanese Ministry of Health, Labour, and Welfare (MHLW) approved the vaccine for a larger population segment, including individuals with specific underlying diseases or conditions that put them at higher risk. This expanded indication for Shingrix is expected to address a substantial need in Japan, where an estimated 600,000 people develop shingles annually.

The India shingles vaccine market is expected to grow over the forecast period. Efforts to raise awareness about the importance of vaccination, including campaigns focused on preventing diseases such as shingles, can positively impact vaccine uptake rates in India. Educational initiatives targeting healthcare professionals and the general public can enhance understanding and promote vaccination against shingles. For Instance, in February 2024, GlaxoSmithKline (GSK) initiated ‘Project 90’ in India to raise awareness about shingles, a viral infection caused by the varicella-zoster virus, which also causes chickenpox. This project aims to educate the public about disease prevalence and complexities of shingles, emphasizing the importance of early diagnosis and treatment.

Latin America Shingles Vaccine Market Trends

The shingles vaccine market in Latin America is experiencing favorable growth prospects. With the aging population and rising awareness regarding the significance of immunization, there's an expanding interest in shingles vaccines among adult population aged 60 and above. As more people aim to safeguard themselves against the varicella-zoster virus, the region is observing an increase in vaccination rates.

The shingles vaccine market in Brazil is expected to grow over the forecast period due to the high incidence of varicella, highlighted by a 2023 study on an outbreak in Bahia state, which had a notably high incidence rate of 3.0 cases per 100,000. This study found that children under 15 months and those aged 4-6 years were at the highest risk, underscoring the importance of vaccination in these vulnerable groups.

MEA Shingles Vaccine Market Trends

The MEA region is experiencing rapid economic growth, leading to increased healthcare investments and spending. This growth in healthcare infrastructure and spending supports the adoption of shingles vaccines in the region

The shingles vaccine market in Saudi Arabia presents growth opportunities. Commercialization of these vaccines under the UAE's adult vaccination program is a significant market driver. In October 2023, UAE Ministry of Health and Prevention (MoHAP) announced the availability of these herpes zoster (shingles) vaccine as part of country's adult vaccination program. This government initiative to make the shingles vaccine accessible is a key driver. Vaccine launch under the adult vaccination program will increase awareness about the importance of shingles prevention among the population, thereby boosting the demand for this vaccine.

Key Shingles Vaccine Company Insights

Some of the key market players operating in the shingles vaccine market include GlaxoSmithKline plc., Merck & Co., Inc., and SK chemicals. The increasing awareness regarding disease worldwide and public-funded vaccination programs to prevent disease are expected to increase vaccination adoption. These companies are actively involved in developing, producing, and distributing shingles vaccines to meet the growing demand for immunization against shingles.

Key Shingles Vaccine Companies:

The following are the leading companies in the shingles vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- GlaxoSmithKline plc.

- Merck & Co., Inc.

- SK chemicals

- Green Cross Corp

- Geneone Life Science

- Vaccitech

- CanSinoBIO

Recent Developments

-

In October 2023, GSK plc has formed an exclusive partnership with Chongqing Zhifei Biological Products, Ltd. to jointly promote GSK’s shingles vaccine, Shingrix, in China. The initial agreement spans three years with the possibility of extension. Key aim of this collaboration was to enhance the availability of Shingrix in China by leveraging Zhifei’s extensive network comprising more than 30,000 vaccination points.

-

In April 2023, GlaxoSmithKline (GSK) Pharmaceuticals had launched Shingrix in India, a vaccine that protects adults aged 50 and above against shingles and post-herpetic neuralgia.

-

In January 2023, SK Bioscience, a South Korean biotechnology company, received approval for its shingles vaccine, SKYZoster, from the National Pharmaceutical Regulatory Agency (NPRA) in Malaysia. This approval marks the second shingles vaccine developed globally and positions SK Bioscience to enter the Southeast Asian market with a product known for its efficacy and safety.

Shingles Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.78 billion

Revenue forecast in 2030

USD 11.26 billion

Growth rate

CAGR of 15.34% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia UAE; Kuwait

Key companies profiled

GlaxoSmithKline plc.; Merck & Co., Inc.; SK chemicals; Green Cross Corp; Geneone Life Science; Vaccitech; CanSinoBIO

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shingles Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shingles vaccine market report based on product, type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shingrix

-

Zostavax

-

SKYZoster

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Recombinant Vaccine

-

Live Attenuated Vaccine

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Healthcare Settings

-

Government Healthcare Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global shingles vaccine market size was estimated at USD 4.31 billion in 2023 and is expected to reach USD 4.78 billion in 2024

b. The global shingles vaccine market is expected to grow at a compound annual growth rate of 15.34% from 2024 to 2030 to reach USD 11.26 billion by 2030.

b. Shingrix vaccine dominated the shingles vaccine market with a share of 91.86% in 2020. This is attributable to high efficacy and inclusion of the vaccine in national immunization programs of various countries.

b. Some key players operating in the shingles vaccine market include GlaxoSmithKline plc.; Merck & Co., Inc.; and SK chemicals, Green Cross Corp, Geneone Life Science, and Vaccitech.

b. Key factors that are driving the shingles vaccine market growth include increased risk of developing shingles especially in adults aged 60 & above and high adoption of vaccines in developed and developing countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."