- Home

- »

- Clothing, Footwear & Accessories

- »

-

Shoe Care Market Size, Share And Trends Report, 2030GVR Report cover

![Shoe Care Market Size, Share & Trends Report]()

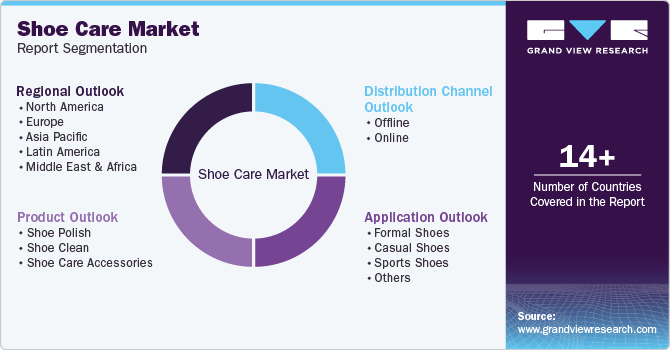

Shoe Care Market Size, Share & Trends Analysis Report By Product (Shoe Polish, Shoe Clean, Shoe Care Accessories), By Application (Formal Shoes, Casual Shoes, Sports Shoes), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-967-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Shoe Care Market Size & Trends

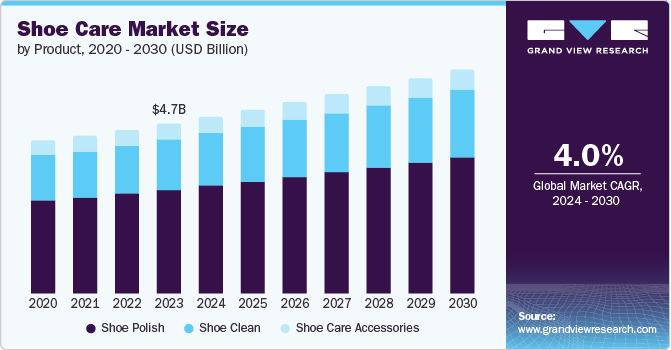

The global shoe care market size was valued at USD 4.74 billion in 2023 and is projected to grow at a CAGR of 4.0% from 2024 to 2030. The growth in the footwear market is attributed to the development of companies focusing on innovation by offering products of different materials and styles. There is a rise in the sneakers market due to the increased adoption of sneaker culture in the sneaker and streetwear community. This community invests in sneakers and uses different shoe care products to improve the longevity of the shoes, helping them have a better resale value for their sneakers.

Rapid urbanization and lifestyle changes have resulted in the adoption of different types of shoe styles. Companies are investing in manufacturing shoes according to the demand by innovating in designs and materials. Different styles of shoes, formal, informal, and athletic, are worn according to the occasion and time. There is an increase in the practice of shoe maintenance among the new generation. Products such as shoe polish, sprays, wax, and brushes are used more frequently. Therefore, this lifestyle change has increased the demand for shoe care products.

An increase in disposable income has increased the demand for premium-quality shoes. This has also increased demand for shoe care products, as shoes made from premium materials require proper care to maintain quality, shape, and color. Customers are willing to invest in these shoe care products as there is an increased sense of belonging to the shoes, especially among the youth generation. Furthermore, the rise in e-commerce has allowed various startups and companies to acquire a more extensive customer base in the shoe care market.

Product Insights

The shoe polish segment dominated the market in 2023, with a share of 61.1% in 2023. The growth is significant as the consumption of shoe polishes is already high in the formal and casual footwear segment. Shoe polish provides shine and wax coating to the shoes. It is also essential for maintaining the longevity of the shoes. With the increase in the population, there is a rise in the workforce that uses formal attires. Shoe polish is an essential product for customers wearing formal attire. Hence, these factors have resulted in the market growth of this segment.

The shoe-cleaning segment is expected to witness a CAGR of 4.4% over the forecast period attributed to the rising use of shoe-cleaning products such as shampoos, soaps, and deodorizers, which companies are investing heavily in marketing. With the rise in the footwear industry, companies are deploying footwear with different materials that require special care to function for a longer duration. Therefore, there is an increased demand for shoe cleaning products that are specially made according to the material of the footwear.

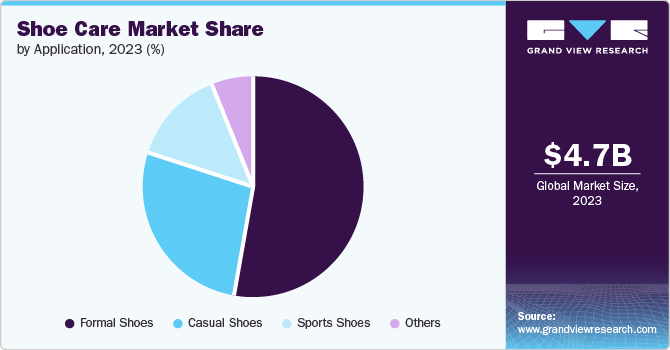

Application Insights

The formal shoes segment dominated the market in 2023, with a share of 52.9%. This growth was attributed to the increase in the workforce around the world, as there is an increase in the working population using formal attire. Shoe care is a necessity among the community that wears formal attire. Clean formal shoes are a necessity when it comes to office or formal occasions. Therefore, there is an increased demand for shoe care products for formal shoes.

The casual shoes segment is expected to witness a CAGR of 4.5% over the forecast period. This market growth is attributed to the rise in the customer base of casual shoes, such as the sneaker community. The youth population is using shoe care products more for maintenance, whether for self-use or reselling. Furthermore, there is a rise in the resale market of casual shoes, especially sneakers, which has resulted in the demand for shoe care products.

Distribution Channel Insights

The offline segment dominated the market in 2023, with a share of 79.8% in 2023 owing to the high presence of footwear stores globally. Footwear stores offer a variety of shoe care products such as polish, wax, deodorant, shampoo, and more. This wide range of product availability has resulted in the growth of this segment. Furthermore, a strong distribution channel among offline stores allows companies to deploy new products quickly. Therefore, these factors are responsible for the market growth of this segment.

The online segment is anticipated to witness a CAGR of 5.8% during the forecast period. The market growth was due to the growth in the e-commerce sector and the rise in startups and companies selling shoe care products. Companies are selling their products through their own websites, social media channels, or e-commerce websites such as Amazon, Flipkart, and more.

Regional Insights

North America dominated the shoe care market with a market share of 33.7% in 2023. This growth has been attributed to the presence of key market players and growth in the region's corporate sector. There is a rise in the population using formal shoes, which has resulted in an increased demand for shoe care products. Furthermore, the growing sneakers community has also helped the market as the sneaker community prioritizes the maintenance of footwear either for personal use or for reselling.

U.S. Shoe Care Market Trends

The U.S. dominated the North American market in 2023. The factors responsible for the market growth in the country are the growth in the number of corporate workforce, as formal shoes worn by the corporate community require utmost care and need to be clean to maintain perfect attire. Furthermore, the growing sneakers community has also fueled market growth, as the community prioritizes the presentation of sneakers and casual shoes.

Europe Shoe Care Market Trends

The Europe shoe care market was identified as a lucrative region in this industry, as it had a market share of 27.4% in 2023. This growth resulted from the presence of key market players and a rise in the awareness of shoe care in the country. Furthermore, the rise in disposable income has increased sales of premium footwear. Therefore, this rise has resulted in the increased demand for shoe care products required to maintain the quality of premium footwear.

The UK shoe care market is expected to grow rapidly due to the rise in awareness regarding footwear care and hygiene. An increase in the population implementing shoe care practices has resulted from urbanization and changes in lifestyle. Furthermore, the increasing sneaker community that focuses on maintaining the quality and condition of footwear has resulted in market growth in this country.

Asia Pacific Shoe Care Market Trends

Asia Pacific had a market share of 23.5% in 2023. This growth is due to the increased use of formal and sports shoes in developing countries such as Japan, India, and China. The presence of key manufacturing companies results in faster and cheaper production of new products that are exported globally. Furthermore, increased investments in marketing campaigns by major companies have also resulted in the positive growth of the market in this region.

China shoe care market held a substantial market share in 2023 due to its developed manufacturing sector and growing corporate sector. Growing awareness of footwear care due to heavy investments in marketing campaigns by key market players has also contributed to the market's growth.

Key Shoe Care Company Insights

Some of the major companies in the shoe care market are S. C. Johnson & Son, Inc.

Caleres Inc., Payless ShoeSource Inc., Shinola, and more. Companies are focusing on offering products that will enhance the appearance and the lifespan of the shoes. Companies are also focusing on implementing innovative formulae in order to offer service to shoes with different materials.

-

Caleres is a footwear company operating various footwear brands including Famous Footwear, Sam Edelman, Allen Edmonds, Naturalizer and more. The company operates around 900 Famous Footwear stores in the U.S.

-

Payless ShoeSource is a multinational discount footwear chain operating in around 30 countries. Their portfolio consists of brands such as Fioni, Comfort Plus, smart fit, and more.

Key Shoe Care Companies:

The following are the leading companies in the shoe care market. These companies collectively hold the largest market share and dictate industry trends.

- S. C. Johnson & Son, Inc.

- Caleres

- Payless ShoeSource Inc.

- Shinola

- Charles Clinkard

- Schuhhaus Klauser GmbH & Co. KG

- Implus

- GRANGERS

- Angelus Shoe Polish

- Griffin Shoe Care

Recent Developments

-

In September 2023, Astromueller AG, a shoe company, announced the acquisition of Schuhhaus Klauser GmbH & Co. KG (Salamander), a 120-year-old European footwear brand. The company aimed to modernize the salamander brand and offer an attractive collection in the modern/comfort domain.

Shoe Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.93 billion

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, South Africa

Key companies profiled

S. C. Johnson & Son, Inc., Caleres, Payless ShoeSource Inc., Shinola, Charles Clinkard, Schuhhaus Klauser GmbH & Co. KG, Implus, GRANGERS, Angelus Shoe Polish, Griffin Shoe Care

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shoe Care Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Shoe Care Market report based on product, application, distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shoe Polis

-

Shoe Clean

-

Shoe Care Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Formal Shoes

-

Casual Shoes

-

Sports Shoes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."